false

0001518621

0001518621

2023-08-16

2023-08-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 16, 2023

Orchid Island Capital, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

001-35236

|

27-3269228

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

3305 Flamingo Drive, Vero Beach, Florida 32963

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code (772) 231-1400

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Trading symbol:

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.01 per share

|

ORC

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On August 16, 2023, Orchid Island Capital, Inc. (the "Company") announced that the Board of Directors of the Company declared a dividend for the month of August 2023 of $0.16 per share of the Company’s common stock, to be paid on September 27, 2023 to holders of record on August 31, 2023, with an ex-dividend date of August 30, 2023. In addition, the Company announced certain details of its RMBS portfolio as of July 31, 2023 as well as certain other information regarding the Company. A copy of the Company’s press release announcing the dividend and the other information regarding the Company is attached hereto as Exhibit 99.1 and incorporated herein by this reference.

Caution About Forward-Looking Statements.

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including, but not limited to, statements about the Company’s distributions. These forward-looking statements are based upon the Company’s present expectations, but the Company cannot assure investors that actual results will not vary from the expectations contained in the forward-looking statements. Investors should not place undue reliance upon forward looking statements. For further discussion of the factors that could affect outcomes, please refer to the “Risk Factors” section of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 16, 2023

|

|

ORCHID ISLAND CAPITAL, INC. |

| |

|

| |

|

| |

By:

|

/s/ Robert E. Cauley

|

| |

|

Robert E. Cauley

|

| |

|

Chairman and Chief Executive Officer

|

ORCHID ISLAND CAPITAL ANNOUNCES

AUGUST 2023 MONTHLY DIVIDEND AND

JULY 31, 2023 RMBS PORTFOLIO CHARACTERISTICS

Vero Beach, Fla., August 16, 2023 - Orchid Island Capital, Inc. (the “Company”) (NYSE: ORC) announced today that the Board of Directors of the Company declared a monthly cash dividend for the month of August 2023. The dividend of $0.16 per share will be paid September 27, 2023 to holders of record of the Company’s common stock on August 31, 2023, with an ex-dividend date of August 30, 2023. The Company plans on announcing its next common stock dividend on September 11, 2023.

The Company intends to make regular monthly cash distributions to its holders of common stock. In order to qualify as a real estate investment trust (“REIT”), the Company must distribute annually to its stockholders an amount at least equal to 90% of its REIT taxable income, determined without regard to the deduction for dividends paid and excluding any net capital gain. The Company will be subject to income tax on taxable income that is not distributed and to an excise tax to the extent that a certain percentage of its taxable income is not distributed by specified dates. The Company has not established a minimum distribution payment level and is not assured of its ability to make distributions to stockholders in the future.

As of August 16, 2023, the Company had 47,086,727 shares of common stock outstanding. As of July 31, 2023 and June 30, 2023, the Company had 43,896,709 shares of common stock outstanding.

RMBS Portfolio Characteristics

Details of the RMBS portfolio as of July 31, 2023 are presented below. These figures are preliminary and subject to change. The information contained herein is an intra-quarter update created by the Company based upon information that the Company believes is accurate:

| |

●

|

RMBS Valuation Characteristics

|

| |

●

|

Investment Company Act of 1940 (Whole Pool) Test Results

|

| |

●

|

Repurchase Agreement Exposure by Counterparty

|

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty finance company that invests on a leveraged basis in Agency RMBS. Our investment strategy focuses on, and our portfolio consists of, two categories of Agency RMBS: (i) traditional pass-through Agency RMBS, such as mortgage pass-through certificates and collateralized mortgage obligations issued by Fannie Mae, Freddie Mac or Ginnie Mae, and (ii) structured Agency RMBS. The Company is managed by Bimini Advisors, LLC, a registered investment adviser with the Securities and Exchange Commission.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements include, but are not limited to, statements about the Company’s distributions. These forward-looking statements are based upon Orchid Island Capital, Inc.’s present expectations, but these statements are not guaranteed to occur. Investors should not place undue reliance upon forward-looking statements. For further discussion of the factors that could affect outcomes, please refer to the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

RMBS Valuation Characteristics |

|

($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized |

|

|

May 23 - |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jul-23 |

|

|

Jul-23 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net |

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

CPR |

|

|

CPR |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

|

|

|

|

|

|

|

|

Average |

|

|

(1-Month) |

|

|

(3-Month) |

|

|

Modeled Interest |

|

| |

|

Current |

|

|

Fair |

|

|

% of |

|

|

Current |

|

|

Average |

|

|

|

|

|

|

|

|

|

|

Maturity |

|

|

(Reported |

|

|

(Reported |

|

|

Rate Sensitivity (1) |

|

Type |

|

Face |

|

|

Value |

|

|

Portfolio |

|

|

Price |

|

|

Coupon |

|

|

GWAC |

|

|

Age |

|

|

(Months) |

|

|

in Aug) |

|

|

in Aug) |

|

|

(-50 BPS) |

|

|

(+50 BPS) |

|

Fixed Rate RMBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15yr 4.0 |

|

$ |

380 |

|

|

$ |

369 |

|

|

|

0.01 |

% |

|

$ |

97.24 |

|

|

|

4.00 |

% |

|

|

4.54 |

% |

|

|

63 |

|

|

|

115 |

|

|

|

0.8 |

% |

|

|

0.8 |

% |

|

$ |

6 |

|

|

$ |

(6 |

) |

15yr 5.0 TBA |

|

|

100,000 |

|

|

|

99,328 |

|

|

|

2.25 |

% |

|

|

99.33 |

|

|

|

5.00 |

% |

|

|

5.67 |

% |

|

|

9 |

|

|

|

167 |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

1,319 |

|

|

|

(1,477 |

) |

15yr Total |

|

|

100,380 |

|

|

|

99,697 |

|

|

|

2.25 |

% |

|

|

99.32 |

|

|

|

5.00 |

% |

|

|

5.66 |

% |

|

|

9 |

|

|

|

167 |

|

|

|

0.8 |

% |

|

|

0.8 |

% |

|

|

1,325 |

|

|

|

(1,483 |

) |

30yr 3.0 |

|

|

2,456,873 |

|

|

|

2,165,855 |

|

|

|

48.97 |

% |

|

|

88.15 |

|

|

|

3.00 |

% |

|

|

3.44 |

% |

|

|

27 |

|

|

|

329 |

|

|

|

5.8 |

% |

|

|

5.9 |

% |

|

|

70,845 |

|

|

|

(71,926 |

) |

30yr 3.5 |

|

|

202,264 |

|

|

|

186,816 |

|

|

|

4.22 |

% |

|

|

92.36 |

|

|

|

3.50 |

% |

|

|

4.04 |

% |

|

|

41 |

|

|

|

309 |

|

|

|

7.7 |

% |

|

|

7.5 |

% |

|

|

5,286 |

|

|

|

(5,330 |

) |

30yr 4.0 |

|

|

577,027 |

|

|

|

540,268 |

|

|

|

12.22 |

% |

|

|

93.63 |

|

|

|

4.00 |

% |

|

|

4.78 |

% |

|

|

18 |

|

|

|

340 |

|

|

|

4.4 |

% |

|

|

6.7 |

% |

|

|

13,860 |

|

|

|

(14,839 |

) |

30yr 4.5 |

|

|

353,488 |

|

|

|

339,212 |

|

|

|

7.67 |

% |

|

|

95.96 |

|

|

|

4.50 |

% |

|

|

5.45 |

% |

|

|

13 |

|

|

|

346 |

|

|

|

6.3 |

% |

|

|

6.1 |

% |

|

|

6,771 |

|

|

|

(7,594 |

) |

30yr 5.0 |

|

|

569,299 |

|

|

|

557,442 |

|

|

|

12.60 |

% |

|

|

97.92 |

|

|

|

5.00 |

% |

|

|

5.93 |

% |

|

|

11 |

|

|

|

348 |

|

|

|

5.9 |

% |

|

|

5.3 |

% |

|

|

10,244 |

|

|

|

(11,803 |

) |

30yr 5.5 |

|

|

278,178 |

|

|

|

278,213 |

|

|

|

6.29 |

% |

|

|

100.01 |

|

|

|

5.50 |

% |

|

|

6.43 |

% |

|

|

4 |

|

|

|

356 |

|

|

|

5.8 |

% |

|

|

0.0 |

% |

|

|

4,386 |

|

|

|

(5,244 |

) |

30yr 6.0 |

|

|

234,058 |

|

|

|

236,801 |

|

|

|

5.35 |

% |

|

|

101.17 |

|

|

|

6.00 |

% |

|

|

7.01 |

% |

|

|

5 |

|

|

|

352 |

|

|

|

5.8 |

% |

|

|

0.0 |

% |

|

|

2,886 |

|

|

|

(3,481 |

) |

30yr Total |

|

|

4,671,187 |

|

|

|

4,304,607 |

|

|

|

97.33 |

% |

|

|

92.15 |

|

|

|

3.80 |

% |

|

|

4.44 |

% |

|

|

21 |

|

|

|

336 |

|

|

|

5.8 |

% |

|

|

6.0 |

% |

|

|

114,278 |

|

|

|

(120,217 |

) |

Total Pass Through RMBS |

|

|

4,771,567 |

|

|

|

4,404,304 |

|

|

|

99.58 |

% |

|

|

92.30 |

|

|

|

3.83 |

% |

|

|

4.47 |

% |

|

|

21 |

|

|

|

332 |

|

|

|

5.8 |

% |

|

|

6.0 |

% |

|

|

115,604 |

|

|

|

(121,698 |

) |

Structured RMBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IO 20yr 4.0 |

|

|

9,512 |

|

|

|

1,016 |

|

|

|

0.02 |

% |

|

|

10.68 |

|

|

|

4.00 |

% |

|

|

4.57 |

% |

|

|

139 |

|

|

|

94 |

|

|

|

6.4 |

% |

|

|

8.9 |

% |

|

|

6 |

|

|

|

(6 |

) |

IO 30yr 3.0 |

|

|

3,013 |

|

|

|

365 |

|

|

|

0.01 |

% |

|

|

12.12 |

|

|

|

3.00 |

% |

|

|

3.64 |

% |

|

|

102 |

|

|

|

247 |

|

|

|

0.6 |

% |

|

|

7.3 |

% |

|

|

1 |

|

|

|

(3 |

) |

IO 30yr 4.0 |

|

|

85,317 |

|

|

|

15,826 |

|

|

|

0.36 |

% |

|

|

18.55 |

|

|

|

4.00 |

% |

|

|

4.60 |

% |

|

|

107 |

|

|

|

244 |

|

|

|

7.1 |

% |

|

|

8.1 |

% |

|

|

(306 |

) |

|

|

216 |

|

IO 30yr 4.5 |

|

|

3,663 |

|

|

|

684 |

|

|

|

0.02 |

% |

|

|

18.67 |

|

|

|

4.50 |

% |

|

|

4.99 |

% |

|

|

157 |

|

|

|

189 |

|

|

|

7.6 |

% |

|

|

7.9 |

% |

|

|

(5 |

) |

|

|

1 |

|

IO 30yr 5.0 |

|

|

2,012 |

|

|

|

401 |

|

|

|

0.01 |

% |

|

|

19.94 |

|

|

|

5.00 |

% |

|

|

5.36 |

% |

|

|

157 |

|

|

|

191 |

|

|

|

9.6 |

% |

|

|

8.3 |

% |

|

|

(6 |

) |

|

|

4 |

|

IO Total |

|

|

103,517 |

|

|

|

18,292 |

|

|

|

0.41 |

% |

|

|

17.67 |

|

|

|

4.01 |

% |

|

|

4.60 |

% |

|

|

113 |

|

|

|

227 |

|

|

|

7.0 |

% |

|

|

8.1 |

% |

|

|

(310 |

) |

|

|

212 |

|

IIO 30yr 4.0 |

|

|

29,096 |

|

|

|

310 |

|

|

|

0.01 |

% |

|

|

1.07 |

|

|

|

0.00 |

% |

|

|

4.40 |

% |

|

|

70 |

|

|

|

279 |

|

|

|

0.4 |

% |

|

|

1.4 |

% |

|

|

83 |

|

|

|

(70 |

) |

Total Structured RMBS |

|

|

132,613 |

|

|

|

18,602 |

|

|

|

0.42 |

% |

|

|

14.03 |

|

|

|

3.13 |

% |

|

|

4.55 |

% |

|

|

103 |

|

|

|

239 |

|

|

|

5.5 |

% |

|

|

6.7 |

% |

|

|

(227 |

) |

|

|

141 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Mortgage Assets |

|

$ |

4,904,180 |

|

|

$ |

4,422,906 |

|

|

|

100.00 |

% |

|

|

|

|

|

|

3.81 |

% |

|

|

4.47 |

% |

|

|

23 |

|

|

|

329 |

|

|

|

5.8 |

% |

|

|

6.0 |

% |

|

$ |

115,377 |

|

|

$ |

(121,557 |

) |

| |

|

Average |

|

Hedge |

|

Modeled Interest |

|

| |

|

Notional |

|

Period |

|

Rate Sensitivity (1) |

|

Hedge |

|

Balance |

|

End |

|

(-50 BPS) |

|

|

(+50 BPS) |

|

5-Year Treasury Future(2) |

|

$ |

(471,500 |

) |

Sep-23 |

|

$ |

(9,715 |

) |

|

$ |

9,421 |

|

10-Year Treasury Future(3) |

|

|

(285,000 |

) |

Sep-23 |

|

|

(9,340 |

) |

|

|

9,116 |

|

10-Year Ultra Treasury Future(4) |

|

|

(244,200 |

) |

Sep-23 |

|

|

(11,530 |

) |

|

|

10,991 |

|

Swaps |

|

|

(2,326,500 |

) |

Nov-29 |

|

|

(60,418 |

) |

|

|

58,123 |

|

TBA |

|

|

(350,000 |

) |

Aug-23 |

|

|

(10,175 |

) |

|

|

10,463 |

|

Swaptions |

|

|

(200,000 |

) |

Feb-24 |

|

|

(1,087 |

) |

|

|

1,100 |

|

Hedge Total |

|

$ |

(3,877,200 |

) |

|

|

$ |

(102,265 |

) |

|

$ |

99,214 |

|

Rate Shock Grand Total |

|

|

|

|

|

|

$ |

13,112 |

|

|

$ |

(22,343 |

) |

|

(1)

|

Modeled results from Citigroup Global Markets Inc. Yield Book. Interest rate shocks assume instantaneous parallel shifts and horizon prices are calculated assuming constant SOFR option-adjusted spreads. These results are for illustrative purposes only and actual results may differ materially.

|

RMBS Assets by Agency |

|

|

|

|

|

|

|

|

($ in thousands) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Percentage |

|

| |

|

Fair |

|

|

of |

|

Asset Category |

|

Value |

|

|

Portfolio |

|

As of July 31, 2023 |

|

|

|

|

|

|

|

|

Fannie Mae |

|

$ |

2,962,563 |

|

|

|

67.0 |

% |

Freddie Mac |

|

|

1,460,343 |

|

|

|

33.0 |

% |

Total Mortgage Assets |

|

$ |

4,422,906 |

|

|

|

100.0 |

% |

Investment Company Act of 1940 Whole Pool Test |

|

($ in thousands) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Percentage |

|

| |

|

Fair |

|

|

of |

|

Asset Category |

|

Value |

|

|

Portfolio |

|

As of July 31, 2023 |

|

|

|

|

|

|

|

|

Non-Whole Pool Assets |

|

$ |

147,773 |

|

|

|

3.3 |

% |

Whole Pool Assets |

|

|

4,275,133 |

|

|

|

96.7 |

% |

Total Mortgage Assets |

|

$ |

4,422,906 |

|

|

|

100.0 |

% |

Borrowings By Counterparty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Weighted |

|

|

Weighted |

|

|

| |

|

|

|

|

|

% of |

|

|

Average |

|

|

Average |

|

|

| |

|

Total |

|

|

Total |

|

|

Repo |

|

|

Maturity |

|

Longest |

As of July 31, 2023 |

|

Borrowings |

|

|

Debt |

|

|

Rate |

|

|

in Days |

|

Maturity |

ASL Capital Markets Inc. |

|

$ |

334,517 |

|

|

|

8.1 |

% |

|

|

5.36% |

|

|

|

31 |

|

9/29/2023 |

J.P. Morgan Securities LLC |

|

|

332,029 |

|

|

|

8.0 |

% |

|

|

5.36% |

|

|

|

15 |

|

8/23/2023 |

Mitsubishi UFJ Securities (USA), Inc |

|

|

326,977 |

|

|

|

7.9 |

% |

|

|

5.45% |

|

|

|

46 |

|

9/29/2023 |

RBC Capital Markets, LLC |

|

|

304,569 |

|

|

|

7.4 |

% |

|

|

5.36% |

|

|

|

15 |

|

8/17/2023 |

Citigroup Global Markets Inc |

|

|

303,009 |

|

|

|

7.3 |

% |

|

|

5.45% |

|

|

|

29 |

|

8/31/2023 |

Mirae Asset Securities (USA) Inc. |

|

|

295,469 |

|

|

|

7.1 |

% |

|

|

5.45% |

|

|

|

47 |

|

12/22/2023 |

Wells Fargo Bank, N.A. |

|

|

276,180 |

|

|

|

6.7 |

% |

|

|

5.43% |

|

|

|

42 |

|

9/28/2023 |

Daiwa Securities America Inc. |

|

|

241,127 |

|

|

|

5.8 |

% |

|

|

5.36% |

|

|

|

17 |

|

8/17/2023 |

Marex Capital Markets Inc. |

|

|

225,680 |

|

|

|

5.5 |

% |

|

|

5.43% |

|

|

|

62 |

|

10/5/2023 |

ING Financial Markets LLC |

|

|

222,891 |

|

|

|

5.4 |

% |

|

|

5.47% |

|

|

|

52 |

|

9/21/2023 |

Cantor Fitzgerald & Co |

|

|

214,935 |

|

|

|

5.2 |

% |

|

|

5.37% |

|

|

|

16 |

|

8/16/2023 |

ABN AMRO Bank N.V. |

|

|

214,073 |

|

|

|

5.2 |

% |

|

|

5.35% |

|

|

|

14 |

|

8/14/2023 |

Banco Santander SA |

|

|

189,783 |

|

|

|

4.6 |

% |

|

|

5.43% |

|

|

|

47 |

|

10/5/2023 |

Merrill Lynch, Pierce, Fenner & Smith |

|

|

185,312 |

|

|

|

4.5 |

% |

|

|

5.37% |

|

|

|

15 |

|

8/25/2023 |

StoneX Financial Inc. |

|

|

173,222 |

|

|

|

4.2 |

% |

|

|

5.37% |

|

|

|

25 |

|

9/15/2023 |

South Street Securities, LLC |

|

|

117,859 |

|

|

|

2.8 |

% |

|

|

5.36% |

|

|

|

57 |

|

9/29/2023 |

Goldman, Sachs & Co |

|

|

88,297 |

|

|

|

2.1 |

% |

|

|

5.37% |

|

|

|

14 |

|

8/24/2023 |

Bank of Montreal |

|

|

74,003 |

|

|

|

1.8 |

% |

|

|

5.37% |

|

|

|

17 |

|

8/17/2023 |

Lucid Cash Fund USG LLC |

|

|

11,070 |

|

|

|

0.3 |

% |

|

|

5.41% |

|

|

|

17 |

|

8/17/2023 |

Lucid Prime Fund, LLC |

|

|

8,967 |

|

|

|

0.2 |

% |

|

|

5.41% |

|

|

|

17 |

|

8/17/2023 |

Total Borrowings |

|

$ |

4,139,969 |

|

|

|

100.0 |

% |

|

|

5.40% |

|

|

|

32 |

|

12/22/2023 |

Contact:

Orchid Island Capital, Inc.

Robert E. Cauley

3305 Flamingo Drive, Vero Beach, Florida 32963

Telephone: (772) 231-1400

v3.23.2

Document And Entity Information

|

Aug. 16, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Orchid Island Capital, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 16, 2023

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

001-35236

|

| Entity, Tax Identification Number |

27-3269228

|

| Entity, Address, Address Line One |

3305 Flamingo Drive

|

| Entity, Address, City or Town |

Vero Beach

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

32963

|

| City Area Code |

772

|

| Local Phone Number |

231-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ORC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001518621

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

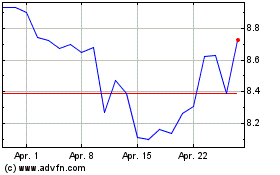

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024