false

0001821825

0001821825

2024-11-05

2024-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date

of earliest event reported): November 5, 2024

Organon

& Co.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-40235 |

|

46-4838035 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| incorporation) |

|

| |

|

| |

|

|

|

|

30

Hudson Street, Floor

33,

Jersey City,

NJ |

|

|

|

07302 |

| (Address and principal executive offices) |

|

|

|

(Zip Code) |

| Registrant’s telephone number, including area code: (551)

430-6900 |

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of

each class |

|

Trading

Symbol(s) |

|

Name of

each exchange on which

registered |

| Common

Stock, par value $0.01 per share |

|

OGN |

|

NYSE |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On November 5, 2024, Organon & Co. (“Organon”

or the “Company”) issued a press release announcing that the U.S. Food and Drug Administration (the “FDA”)

extended by three months the target action date of its review of the supplemental New Drug Application for VTAMA® (tapinarof) cream,

1% as a treatment for atopic dermatitis in adults and children two years of age and older. The new target date is March 12, 2025, revised

from the original target action date of December 12, 2024. The FDA has not raised any concerns regarding the safety and efficacy of VTAMA

nor have they raised any concerns regarding the approvability of this indication.

A copy of the press release is included as Exhibit 99.1 to this report

and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, this Current Report on Form 8-K

includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995, including, but not limited to, statements about management’s expectations regarding Organon’s recent

acquisition of Dermavant Sciences Ltd. (“Dermavant”) and potential regulatory approval from the FDA for the use of

VTAMA® in the treatment of atopic dermatitis (including the expected timeframe thereof). Forward-looking statements may be identified

by words such as “target,” “outlook,” “expects,” “will,” “outlook,” “intends,”

“anticipates,” “plans,” “believes,” “seeks,” “estimates,” or words of similar

meaning. These statements are based upon the current beliefs and expectations of Organon’s management and are subject to significant

risks and uncertainties. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ

materially from those set forth in the forward-looking statements. Risks and uncertainties include, but are not limited to, those relating

to the FDA regulatory approval process, including the uncertainty of FDA approval or any extension of time to receive such approval;

difficulties implementing or executing on Organon’s acquisition strategy, including the recent acquisition of Dermavant, or any

other failure to recognize the benefits of such acquisitions; recent Supreme Court decisions and other developments impacting regulatory

agencies and their rule making, including related financial market reactions; and the impact of the 2024 United States presidential

election and any resulting public policy changes affecting health care decisions, including changes in financial outcomes resulting from

candidate positions on healthcare topics and the possible impact on related laws, regulations and policies following the election. Organon

undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found

in Organon’s filings with the Securities and Exchange Commission (“SEC”), including Organon’s most recent Annual

Report on Form 10-K and subsequent SEC filings.

The information in this Item 7.01, including Exhibit 99.2 attached

hereto, is considered to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange

Act or otherwise subject to liability under that Section. The information in this Current Report shall not be incorporated by reference

into any filing or other document pursuant to the Securities Act or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing or document. The Company Information Presentation contains forward-looking statements regarding the Company

and includes a cautionary statement identifying important factors that could cause actual results to differ materially from those anticipated.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

Organon &

Co. |

| |

|

| |

By: |

/s/

Matthew Walsh |

| |

|

Name: |

Matthew Walsh |

| |

|

Title: |

Chief Financial Officer |

Dated: November 5, 2024

Exhibit 99.1

News Release

| Media Contacts: |

Felicia Bisaro |

Investor Contacts: |

Jennifer Halchak |

| |

(646) 703-1807 |

|

(201) 275-2711 |

| |

|

|

|

| |

Kim Hamilton |

|

|

| |

(908) 391-0131 |

|

|

Update on FDA

Review of VTAMA® (tapinarof) Cream, 1% for the Treatment of Atopic Dermatitis in Adults and Children 2 Years of Age and

Older

JERSEY CITY, N.J., November 5,

2024 – Organon (NYSE: OGN), a global healthcare company with a mission to improve the health of women throughout their lives, today

announced that the U.S. Food and Drug Administration (FDA) extended

by three months the target action date of its review of the supplemental New Drug Application

(sNDA) for VTAMA® (tapinarof) cream, 1% as a treatment for atopic dermatitis (AD)

in adults and children two years of age and older. The new target date is March 12, 2025, revised from the original target

action date of December 12, 2024. The FDA has not raised any concerns regarding the safety and efficacy of VTAMA nor have they raised

any concerns regarding the approvability of this indication.

As part of its review process, the FDA

requested the final datasets and clinical study report from the long-term extension study for VTAMA. After receiving the datasets, the

FDA determined that the additional information requested constitutes a major amendment to the sNDA resulting in a standard three-month

extension to the original target action date.

“Organon remains confident in

the robust efficacy and safety data package that has been submitted to the agency to support the review of VTAMA for atopic dermatitis

and we are committed to working with the FDA ensure the agency has all the information it needs for its review,” said Juan Camilo

Arjona Ferreira, MD, Head of Research & Development at Organon.

With an assumed

PDUFA date of March 12, 2025, the company expects that revenue contribution for VTAMA for the full year 2025 will be approximately

$125 million and that the transaction will result in an approximate 75 basis point headwind to Adjusted EBITDA margin in 2025. This is

an update to the company's prior commentary, provided during its third quarter earnings call held on October 31, 2024. The company

will provide a more detailed outlook for 2025 expected consolidated financial performance, including revenue growth and expense optimization

plans, in February 2025 when it reports full year 2024 results.

About Atopic Dermatitis

Atopic dermatitis

(AD), commonly referred to as eczema, is one of the most common inflammatory skin diseases, affects over 26 million people in the U.S.

alone and up to 10% of adults worldwide. AD occurs most frequently in children, affecting up to 20% worldwide. The disease results in

itchy, red, swollen, and cracked skin, often affecting the folds of the arms, back of the knees, hands, face, and neck. Itching is an

especially bothersome symptom in AD, and tends to worsen at night, disturbing sleep and causing fatigue, which in children can lead to

inattention at school. People with AD may also experience social and emotional distress due to the visibility and discomfort of the disease.

About VTAMA®

(tapinarof) cream, 1%

VTAMA cream

is a non-steroidal once-daily topical treatment. The safety and effectiveness of VTAMA cream was evaluated in randomized, double-blind,

vehicle-controlled trials, PSOARING-1 and 2 for plaque psoriasis. The safety and efficacy of VTAMA for the treatment of atopic dermatitis

was also evaluated in ADORING-1 and ADORING-2 Phase III clinical studies and is currently under review by the FDA.

Important Safety Information

Indication: VTAMA® (tapinarof)

cream, 1% is an aryl hydrocarbon receptor agonist indicated for the topical treatment of plaque psoriasis in adults. VTAMA cream is for

use on the skin (topical) only. Do not use VTAMA cream in your eyes, mouth, or vagina. Adverse Events: The most

common adverse reactions (incidence ≥ 1%) in subjects treated with VTAMA cream were folliculitis (red raised bumps around the hair

pores), nasopharyngitis (pain or swelling in the nose and throat), contact dermatitis (skin rash or irritation, including itching and

redness, peeling, burning, or stinging), headache, pruritus (itching), and influenza (flu).

You are encouraged to report negative

side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch or

call 1-800-FDA-1088.

See full Prescribing

Information and Patient Information.

About Organon

Organon is an independent global

healthcare company with a mission to help improve the health of women throughout their lives. Organon’s diverse portfolio offers

more than 60 medicines and products in women’s health, biosimilars, and a large franchise of established medicines across a range

of therapeutic areas. In addition to Organon’s current products, the company invests in innovative solutions and research to drive

future growth opportunities in women’s health and biosimilars. In addition, Organon is pursuing opportunities to collaborate with

biopharmaceutical partners and innovators looking to commercialize their products by leveraging its scale and agile presence in fast

growing international markets.

Organon has geographic

scope with significant reach, world-class commercial capabilities, and approximately 10,000 employees with headquarters located in Jersey

City, New Jersey.

For more information,

visit http://www.organon.com and connect with us on LinkedIn, Instagram, X (formerly known as Twitter)

and Facebook.

Cautionary Note Regarding

Forward-Looking Statements and Non-GAAP Information

Except for historical

information, this press release includes “forward-looking statements” within the meaning of the safe harbor provisions of

the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements

about management’s expectations regarding Organon’s recent acquisition of Dermavant Sciences Ltd. (“Dermavant”)

and potential regulatory approval from the FDA for the use of VTAMA® in the treatment of atopic dermatitis (including the expected

timeframe thereof). Forward-looking statements may be identified by words such as “targets,” “foresees,” “outlook,”

“expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,”

“estimates,” “will” or words of similar meaning. These statements are based upon the current beliefs and expectations

of Organon’s management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or risks

or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements. Risks and

uncertainties include, but are not limited to, those relating to the FDA regulatory approval process, including the uncertainty of FDA

approval or any extension of time to receive such approval; difficulties implementing or executing on Organon’s acquisition strategy,

including the recent acquisition of Dermavant, or any other failure to recognize the benefits of such acquisitions; recent Supreme Court

decisions and other developments impacting regulatory agencies and their rule making, including related financial market reactions;

and the impact of the 2024 United States presidential election and any resulting public policy changes affecting health care decisions,

including changes in financial outcomes resulting from candidate positions on healthcare topics and the possible impact on related laws,

regulations and policies following the election. Organon undertakes no obligation to publicly update any forward-looking statement, whether

as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those

described in the forward-looking statements can be found in Organon’s filings with the Securities and Exchange Commission (“SEC”),

including Organon’s most recent Annual Report on Form 10-K and subsequent SEC filings.

References and links to websites have

been provided for convenience, and the information contained on any such website is not a part of, or incorporated by reference into,

this press release. Organon is not responsible for the contents of third-party websites.

Adjusted EBITDA is a “non-GAAP

financial measure.” For additional information about the company’s use of non-GAAP financial measures, please refer to the

company’s press release regarding its results for the quarter ended September 30, 2024, issued on October 31, 2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

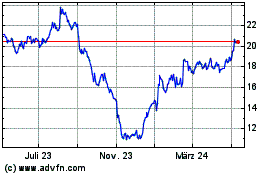

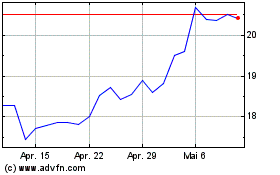

Organon (NYSE:OGN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Organon (NYSE:OGN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025