0001501134FALSE00015011342023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2023

| | |

| Invitae Corporation |

| (Exact name of the registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-36847 | | 27-1701898 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. employer |

| incorporation or organization) | | File Number) | | identification number) |

1400 16th Street, San Francisco, California 94103

(Address of principal executive offices, including zip code)

(415) 374-7782

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.0001 par value per share | | NVTA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

As previously disclosed, Invitae Corporation (the “Company”) is exploring a number of options, including, but not limited to, raising capital, asset sales, business and research and development refocusing efforts, capital expenditure and operating expense reductions, and addressing its debt obligations. In connection therewith, on December 8, 2023, the Company obtained the consent of the holder (the “Consenting Holder”) of the requisite aggregate principal amount of its 4.5% Series A Convertible Senior Secured Notes due 2028 (“Series A Notes”) and 4.5% Series B Convertible Senior Secured Notes due 2028 (the “Series B Notes” and together with the Series A Notes, the “Notes”) issued under that certain indenture (as amended, supplemented or otherwise modified from time to time, the “Indenture”), dated as of March 7, 2023, among the Company, subsidiaries of the Company party thereto as guarantors and U.S. Bank Trust Company, National Association, as trustee (the “Trustee”) and collateral agent (the “Collateral Agent”) to make certain modifications to the Indenture.

The second supplemental indenture to the Indenture dated as of December 8, 2023 (the “Second Supplemental Indenture”), between the Company and the Trustee and Collateral Agent, among other things, (i) added an ability of the Company and its subsidiaries to dispose of certain assets and business lines, (ii) amended certain terms of the covenants of the Indenture, which amendments substantially reduce the ability of the Company and its subsidiaries to incur indebtedness and liens, make restricted payments and investments, and to dispose of assets and properties, and (iii) requires the Company to enter into a transaction support agreement with the Consenting Holder on terms mutually reasonably agreeable to Company and the Consenting Holder. As consideration for providing the Company with the requisite consent to enter into the Second Supplemental Indenture, the Company paid a fee of $2.1 million to the Consenting Holder.

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On December 7, 2023, the Board of Directors (the “Board”) of the Company approved an increase to the size of the Board to nine directors and appointed Ms. Jill Frizzley to fill the new directorship, effective immediately. Ms. Frizzley joins the Board as a Class III director, with a term expiring at the Company’s 2025 annual meeting of stockholders. The Board determined that Ms. Frizzley is independent within the meaning of the New York Stock Exchange’s listing rules. Ms. Frizzley has also been appointed as a member of the Special Committee of the Board.

Ms. Frizzley currently serves as the president of Wildrose Partners LLC, an independent consulting company providing governance and related advisory services to corporations, a position she has held since June 2019. From 2016 through May 2019, Ms. Frizzley served as Counsel at the law firm of Weil, Gotshal & Manges LLP. Ms. Frizzley has served as a director on numerous public and private boards of directors. Currently, Ms. Frizzley has served as a director for Proterra Inc., since August 2023 and iMedia Brands, Inc., since April 2023. She previously served on the boards of directors for the following public companies in the last five years: Virgin Orbit Holdings, Inc., Surgalign Holdings, Inc., Avaya Holdings Corporation, Hudson Technologies, Inc. and Vivus, Inc. Ms. Frizzley holds a BSc degree from the University of Alberta and an LLB degree from the University of Toronto Faculty of Law.

In connection with the appointment of Ms. Frizzley to the Board, Ms. Frizzley and the Company entered into an engagement agreement (the “Engagement Agreement”), pursuant to which Ms. Frizzley agreed to serve as a director on the Board. The Engagement Agreement provides for a fixed monthly cash fee of $40,000, which is payable in advance monthly. The foregoing summary of the Engagement Agreement is not complete and is qualified in its entirety by reference to the full text of the agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated in this Item 5.02 by reference.

Other than as described above, Ms. Frizzley does not have any direct or indirect material interests in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K, and there are no arrangements or understandings between any of Ms. Frizzley and any other persons pursuant to which she was appointed to the Board.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 11, 2023

| | | | | | | | |

| | |

| INVITAE CORPORATION |

| |

| By: | | /s/ Thomas R. Brida |

| Name: | | Thomas R. Brida |

| Title: | | General Counsel |

ENGAGEMENT AGREEMENT

THIS ENGAGEMENT AGREEMENT (the “Agreement”) is made as of December 7, 2023, by and between Invitae Corporation (the “Company”), and Jill Frizzley (“Director”).

BACKGROUND

WHEREAS, Director has no prior or current affiliation, material business, or relationship, direct or indirect, with the Company or its affiliates, or its equity holders (other than the Advisor Agreement (as defined below)), and therefore, is capable of being an independent and disinterested director of the Company.

WHEREAS, the Company desires and has requested that Director serve as an independent and disinterested director of the Company.

WHEREAS, pursuant to that certain engagement agreement between the Company and Director dated October 23, 2023 (the “Advisor Agreement”), Director was appointed as an independent advisor to the Company with the option to serve as an independent and disinterested director of the Company upon execution of a subsequent mutual agreement.

WHEREAS, the Company and Director are entering into this Agreement to induce Director to serve as an independent and disinterested director of the Company and to set forth certain understandings between the parties.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual agreements and promises contained herein, and other good and valuable consideration, the adequacy and sufficiency of which are hereby acknowledged, Company and Director hereby agree as follows:

1. DUTIES. Director agrees to (i) serve as an independent and disinterested member of the Board of Directors of the Company (the “Board of Directors”) to be available to perform the duties consistent with the position of director pursuant to the Company’s organizational documents (all as amended from time to time, the “Organizational Documents”) and the laws of such organizational documents; (ii) serve as a member of the Board of Directors of any of the Company’s subsidiaries (each a “Subsidiary Board of Directors”), as may be requested from time to time by the Board of Directors; and (iii) serve as a member of one or more committees of the Board of Directors or a Subsidiary Board of Directors as may be requested from time to time by the Company or a majority of the Board of Directors and for which she is qualified to serve. Director agrees to devote as much time as is reasonably necessary to perform completely the duties as an independent and disinterested director of the Company. The Company acknowledges that Director currently holds other positions (“Other Employment”) and agrees that Director may maintain such positions; provided that such Other Employment shall not materially interfere with Director’s obligations under this Agreement. By execution of this Agreement, Director agrees to serve as a director of the Company until her successor is duly elected and qualified or until the expiration or termination of this Agreement or her earlier death, incapacitation, resignation or removal.

2. TERM. The term of this Agreement shall continue until such time as Director resigns or is removed at any time, with or without cause, in accordance with and

to the extent permitted by the Organizational Documents, in which event this Agreement shall terminate as of the date of such resignation or removal, except as specifically provided herein.

3. COMPENSATION. For all services to be rendered by Director hereunder, and so long as Director has not been removed as an independent director of the Company, the Company agrees to pay, or to cause one or more of its subsidiaries to pay, Director a monthly fee of $40,000 for each month, pro rated for the first month only, payable upon execution of this Agreement and payable in advance each month on or before the first day of each month thereafter.

4. EXPENSES. In addition to the compensation provided in Section 3 hereof, the Company will reimburse or will cause one or more of its subsidiaries to reimburse Director for reasonable and documented out-of-pocket expenses incurred in good faith in the performance of Director’s duties for the Company. Such payments shall be made by the Company or one or more of its subsidiaries upon submission by the Director of a statement itemizing the expenses incurred. Such statements shall be accompanied by sufficient documentation to support the expenditures. Without limiting the indemnification provisions contained herein, any individual expense reimbursable by the Company under this section may not exceed $2,500 without the Company’s written consent, by e-mail or otherwise (not to be unreasonably withheld).

5. CONFIDENTIALITY. The Company and Director each acknowledge that in order for Director to perform her duties as an independent and disinterested director of the Company, Director shall necessarily be obtaining access to certain confidential information concerning the Company and its affiliates, including, but not limited to business methods, information systems, financial data and strategic plans which are unique assets of the Company or its affiliates (whether or not marked as confidential or proprietary, “Confidential Information”). Director covenants that she shall not, either directly or indirectly, in any manner, utilize or disclose to any person, firm, corporation, association or other entity any Confidential Information, except (i) as required by law, (ii) pursuant to a subpoena or order issued by a court, governmental body, agency or official, or (iii) to the extent such information (A) is generally known to the public, (B) was known to Director prior to its disclosure to Director by the Company, (C) was obtained by Director from a third party which, to Director’s knowledge, was not prohibited from disclosing such information to Director pursuant to any contractual, legal or fiduciary obligation, or (D) was independently derived by Director without any use of Confidential Information. Director shall provide notice to the Company as is reasonably practicable prior to any disclosure under (i) or (ii) above and shall cooperate with the Company to limit disclosure of Confidential Information to the extent reasonably practicable. This Section 5 shall continue in effect after Director has ceased acting as an independent and disinterested director of the Company.

6. INDEMNIFICATION.

(a) Certain Definitions. For purposes of this Section 6, the term:

“Applicable Law” means the laws of the State of Delaware.

“Expenses” means all expenses, liabilities and losses (including, without limitation, attorneys’ fees, retainers, expert and witness fees, disbursements and expenses of counsel, judgments, fines, excise taxes or penalties and amounts paid or to be paid in settlement) actually and reasonably incurred or suffered by Director or on Director’s behalf in connection with a Proceeding.

“Proceeding” means any threatened, pending, actual or completed action, suit, inquiry or proceeding, whether civil, criminal, administrative or investigative, whether public or private, and, including any such threatened, pending, actual or completed action, suit, inquiry or proceeding by or in the right of the Company or any of its subsidiaries (collectively, the “Companies”).

(b) Indemnification. In the event that Director was or is made a party or is threatened to be made a party to or is involved (including, without limitation, as a witness) in any Proceeding by reason of the fact that Director or a person of whom Director is the legal representative of is or was an independent and disinterested director of any of the Companies (whether before or after the date hereof) and, whether the basis of such Proceeding is alleged action in an official capacity as an independent and disinterested director or in any other capacity while serving as an independent and disinterested director of any of the Companies, the Companies shall, jointly and severally, indemnify and hold harmless Director to the fullest extent authorized by Applicable Law or any other applicable law or rule, but no less than to the extent set forth herein, against all Expenses; provided, however, that the Companies shall indemnify Director only if Director did not engage in fraud, gross negligence or willful misconduct and, in the case of criminal Proceedings, Director had no reasonable cause to believe her conduct was unlawful; and provided, further, that the Companies shall, jointly and severally, indemnify Director in connection with a Proceeding (or claim or part thereof) initiated by Director only if (i) such Proceeding is a suit or other action seeking to enforce Director’s right to advancement of expenses and/or indemnification under this Agreement or (ii) such Proceeding (or claim or part thereof) was authorized by the Board of Directors or a Subsidiary Board of Directors.

(c) Presumptions. In the event that, under Applicable Law, the entitlement of Director to be indemnified hereunder shall depend upon whether Director shall have acted in good faith and in a manner Director reasonably believed to be in or not opposed to the best interests of the Companies and with respect to criminal Proceedings, had no reasonable cause to believe Director’s conduct was unlawful, or shall have acted in accordance with some other defined standard of conduct, or whether fees and disbursements of counsel and other costs and amounts are reasonable, the burden of proof of establishing that Director has not acted in accordance with such standard and that such costs and amounts are unreasonable shall rest with the Companies, and Director shall be presumed to have acted in accordance with such standard, such costs and amounts shall be conclusively presumed to be reasonable and Director shall be entitled to indemnification unless, and only unless, based upon clear and convincing evidence, it shall be determined by a court of competent jurisdiction (after exhaustion or expiration of the time for filing of all appeals) that Director has not met such standard or, with respect to the amount of indemnification, that such costs and amounts are not reasonable (in which case Director shall be indemnified to the extent such costs and amounts are determined by such court to be reasonable).

In addition, and without in any way limiting the provisions of this Section 6(c), Director shall be deemed to have acted in good faith and in a manner Director reasonably believed to be in or not opposed to the best interests of the Companies or, with respect to any criminal Proceeding to have had no reasonable cause to believe Director’s conduct was unlawful, if Director’s action is based on (i) information supplied to Director by the officers of the Companies in the course of her duties, (ii) the advice of legal counsel for Director or for the Companies or (iii) information or records given or reports made to the Companies by an independent certified public accountant, an appraiser, a financial advisor, an investment banker or other expert selected with reasonable care by the Companies.

The provisions of this Section 6(c) shall not be deemed to be exclusive or to limit in any way the circumstances in which a person may be deemed to have met the applicable standard of conduct, if applicable, under Applicable Law.

(d) Indemnification When Wholly or Partly Successful. Without limiting the scope of indemnification provided in Section 6(b), to the extent that Director is a party to and is successful, on the merits or otherwise, in any Proceeding, Director shall be indemnified to the maximum extent permitted by Applicable Law against all Expenses. If Director is not wholly successful in a Proceeding but is successful, on the merits or otherwise, as to one or more but less than all claims, issues or matters in such Proceeding, the Companies shall, jointly and severally, indemnify Director against all Expenses actually and reasonably incurred by Director and on her behalf in connection with each successfully resolved claim, issue or matter, and shall otherwise indemnify Director to the extent required by Section 6(b). All Expenses shall be presumed to be have been incurred with respect to successfully resolved claims, issues and matters unless, and only unless, based upon clear and convincing evidence (with the burden of proof being on the Companies), it shall be determined by a court of competent jurisdiction (after exhaustion or expiration of the time for filing of all appeals) that a portion of such Expenses were incurred with respect to unsuccessfully resolved claims, issues or matters. For purposes of this Section 6(d) and without limitation, the termination of any claim, issue or matter in any Proceeding by dismissal, with or without prejudice, shall be deemed to be a successful result as to such claim, issue or matter.

(e) Suit to Recover Indemnification. If a claim under Section 6(b) or Section 6(h) of this Agreement is not paid in full by the Companies within thirty days after a written claim has been received by the Companies, Director may at any time thereafter bring suit against the Companies to recover the unpaid amount of the claim. It shall be a defense to any such suit (other than a suit brought to enforce a claim for expenses incurred in defending any Proceeding in advance of its final disposition where the required undertaking has been tendered to the Companies) that Director has not met the standards of conduct, if applicable, which make it permissible under Applicable Law for the Companies to indemnify Director for the amount claimed, but the burden of proving such defense and its applicability shall be on the Companies and may be met only by clear and convincing evidence. Neither the failure of the Companies (including their directors (or equivalent) or equity holders) to have made a determination prior to the commencement of such suit that indemnification of Director is proper in the circumstances because Director has met the standard of conduct, if applicable, under Applicable Law, nor an actual determination by the Companies (including their directors (or equivalent) or equity holders) that Director has not met such applicable standard of conduct, shall be a defense to the suit or create a presumption that Director has not met the applicable standard of conduct. The expenses incurred by Director in bringing such suit (whether or not Director is successful) shall be paid by the Companies unless a court of competent jurisdiction determines that each of the material assertions made by Director in such suit was not made in good faith and was frivolous.

(f) Rights Not Exclusive; Rights Continue. The right to indemnification and the payment of expenses incurred in defending any Proceeding in advance of its final disposition conferred in this Agreement shall not be exclusive of, or limit in any manner whatsoever, any other right which Director may have or hereafter acquire under any statute, provision of the Organizational Documents, agreement, vote of equity holders or otherwise. The indemnification, expense advancement and other rights of Director herein shall continue after Director ceases to be an independent and disinterested director of the Company for so long as Director may be subject to any possible claim for which Director would be entitled to indemnification under this

Agreement or otherwise as a matter of law, and shall not be amended, modified, terminated, revoked or otherwise altered without Director’s prior written consent.

(g) Insurance. The Company or one of its affiliates (which, in the case of an affiliate, shall include coverage of directors of the Company) shall maintain insurance to protect the Company and any manager, director or trustee of the Company against any expense, liability or loss, and such insurance shall cover Director to at least the same extent as any other director of the Company; provided that the Company shall maintain insurance in form substantially similar to, and in amount not less than, the insurance maintained by the Company as of the date hereof. Director shall have the right to receive a copy of any policy for such insurance upon request.

(h) Advancement of Defense Costs. Notwithstanding anything in the Organizational Documents to the contrary, the Company shall also promptly pay Director the expenses actually and reasonably incurred in defending any Proceeding in advance of its final disposition without requiring any preliminary determination of the ultimate entitlement of Director to indemnification; provided, however, the payment of such expenses so incurred by Director in advance of the final disposition of any Proceeding shall be made only upon delivery to the Company of an unsecured undertaking in the form attached hereto as Exhibit A by or on behalf of Director, to repay (without interest) all amounts so advanced if it shall ultimately be determined that Director is not entitled to be indemnified under this Agreement.

(i) Subrogation. In the event of payment under this Agreement, the Company shall be subrogated to the extent of such payment to all of the rights of recovery of Director, who shall, at the Company’s expense, execute all papers required and take all action necessary to secure such rights, including the execution of such documents necessary to enable the Company effectively to bring suit to enforce such rights.

(j) No Duplication of Payments. The Company shall not be liable under this Agreement to make any payment in connection with any Proceeding against Director to the extent Director has otherwise actually received payment (under any insurance policy, contract, agreement, the Organizational Documents, or otherwise) of the amounts otherwise indemnifiable hereunder.

(k) Contribution. If the indemnification provided in Section 6(b) and the advancement provided in Section 6(h) should under Applicable Law be unenforceable or insufficient to hold Director harmless in respect of any and all Expenses with respect to any Proceeding, then the Companies shall, subject to the provisions of this Section 6(k) and for purposes of this Section 6(k) only, upon written notice from Director, be treated as if they were parties who are or were threatened to be made parties to such Proceeding (if not already parties), and the Companies shall contribute to Director the amount of Expenses incurred by Director in such proportion as is appropriate to reflect the relative benefits accruing to the Companies and all of their directors, trustees, managers, officers, employees and agents (other than Director) treated as one entity on the one hand, and Director on the other, which arose out of the event(s) underlying such Proceeding, and the relative fault of the Companies and all of their directors, trustees, managers, officers, employees and agents (other than Director) treated as one entity on the one hand, and Director on the other, in connection with such event(s), as well as any other relevant equitable considerations.

No provision of this Section 6(k) shall (i) operate to create a right of contribution in favor of Director if it is judicially determined that, with respect to any Proceeding, Director engaged in willful misconduct or gross negligence or (ii) limit Director’s rights to

indemnification and advancement of Expenses, whether under this Agreement or otherwise.

The Companies hereby waive any right of contribution from Director for Expenses incurred by the Companies with respect to any Proceeding in which the Companies are or are threatened to be made a party; provided, however, this waiver by the Companies shall not be effective should a court of competent jurisdiction finally determine that Director engaged in fraud, will misconduct, or gross negligence which gave rise to such Expenses incurred by the Companies. The Companies shall not enter into any settlement of any Proceeding in which the Companies are jointly liable with Director (or would be if joined in such Proceeding) unless such settlement provides for a full and final release of all claims asserted against Director and does not contain an admission of wrongdoing by Director.

(l) Specific Limitations to Indemnification. Notwithstanding anything in this Agreement to the contrary, the Corporation shall not be obligated under this Agreement to make any payment to Director with respect to any Proceeding (and Director hereby waives and relinquishes any right under this Agreement or the Organizational Documents): (i) to the extent that payment is actually made to Director under any insurance policy, or is made to Director by the Corporation or an affiliate otherwise than pursuant to this Agreement. Notwithstanding the availability of such insurance, Director also may claim indemnification from the Corporation pursuant to this Agreement by assigning to the Corporation any claims under such insurance to the extent Director is paid by the Corporation; (ii) provided there has been no change in control of the Corporation in connection with Proceedings settled without the Corporation’s consent, which consent, however, shall not be unreasonably withheld; (iii) or an accounting of profits made from the purchase or sale by Director of securities of the Corporation within the meaning of section 16(b) of the Securities Exchange Act of 1934, as amended, or similar provisions of any state statutory or common law; or (iv) to the extent it would be otherwise prohibited by law, if so established by a judgment or other final adjudication adverse to Director.

7. INFORMATION. The Company shall provide Director with financial, operational and legal information as reasonably requested, and shall make its management, advisors and counsel available to discuss the business and operations of the Company upon Director’s reasonable request. To the best of the Company’s knowledge, the information with respect to the Company will be true and correct in all material respects and will not contain any material misstatement of fact or omit to state any material fact necessary to make the statements contained therein not misleading. The Company shall advise Director of any material event or change in the business, affairs, condition (financial or otherwise) or prospects of the Company that occurs during the term of this Agreement.

8. EFFECT OF WAIVER. The waiver by either party of the breach of any provision of this Agreement shall not operate as or be construed as a waiver of any subsequent breach thereof.

9. GOVERNING LAW. This Agreement shall be interpreted in accordance with, and the rights of the parties hereto shall be determined by, the laws of the state of Delaware without reference to its conflicts of laws principles.

10. ASSIGNMENT. The rights and benefits of the Company under this Agreement shall not be transferable except by operation of law without Director’s consent, and all the covenants and agreements hereunder shall insure to the benefit of, and be enforceable by or against, its successors and assigns. The Company shall not affect any proposed sale, exchange, dividend or other distribution or liquidation of all or

substantially all of its assets or any significant recapitalization or reclassification of its outstanding securities that does not explicitly or by operation of law provide for the assumption of the obligations of the Company set forth herein without Director’s consent pursuant to the Organizational Documents. The duties and obligations of Director under this Agreement are personal and therefore Director may not assign any right or duty under this Agreement without the prior written consent of the Company.

11. BINDING EFFECT; SUCCESSORS AND ASSIGNS. This Agreement shall be binding upon and inure to the benefit of and be enforceable by each of the parties hereto and their respective successors, assigns (including any direct or indirect successor by purchase, merger, consolidation or otherwise to all or substantially all of the business or assets of the Company), heirs and personal legal representatives. The Company shall require and cause any successor (whether direct or indirect, and whether by purchase, merger, consolidation or otherwise) to all, substantially all, or a substantial part, of the business or assets of the Company, by written agreement in form and substance reasonably satisfactory to Director, expressly to assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform if no such succession had taken place.

12. DISCLOSURE. Director may, at her option and expense and after announcement of any transaction or following the end of the term of this Agreement, publicize her role for the Company (which may include the reproduction of the logo of the Company and a hyperlink to the website of the Company) in her marketing materials or other advertising materials as she may choose, stating that she has acted as a director of the Company, provided, that the Company’s prior written consent of such publication is obtained before the Director publicizes her role for the Company in any marketing or other advertising materials.

13. SEVERABILITY; HEADINGS. If any provision of this Agreement is held by a court of competent jurisdiction to be invalid as applied to any fact or circumstance, it shall be modified by the minimum amount necessary to render it valid, and any such invalidity shall not affect any other provision, or the same provision as applied to any other fact or circumstance. The headings used in this Agreement are for convenience only and shall not be construed to limit or define the scope of any Section or provision.

14. COUNTERPARTS; AMENDMENT. This Agreement may be executed in one or more counterparts, each of which shall be considered one and the same agreement. No amendment to this Agreement shall be effective unless in writing signed by each of the parties hereto.

[Signature page follows]

The parties hereto have caused this Agreement to be effective as of the date ascribed above.

INVITAE CORPORATION

By: /s/ Thomas R. Brida

Name: Thomas R. Brida

Title: General Counsel

Director

By: /s/ Jill Frizzley

Name: Jill Frizzley

EXHIBIT A

FORM OF UNDERTAKING

Undertaking to Repay

The undersigned hereby acknowledges her undertaking to repay any amounts advanced to her by Invitae Corporation or one or more of its subsidiaries under Section 6(i) of the Engagement Agreement between her and Invitae Corporation (the “Agreement”) in connection with [insert description of proceeding] (the “Proceeding”), if it is ultimately determined that she is not entitled to be indemnified with respect to the Proceeding under the Agreement.

Dated _________ __________________

Signature

__________________

Name: Jill Frizzley

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

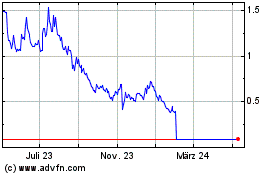

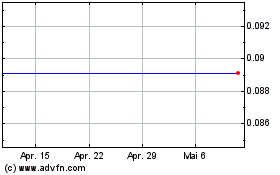

Invitae (NYSE:NVTA)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Invitae (NYSE:NVTA)

Historical Stock Chart

Von Mai 2023 bis Mai 2024