Table of Contents

As filed with the Securities and Exchange Commission on December 20, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NexPoint Real Estate Finance, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

84-2178264

|

|

(State or other jurisdiction of

Incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

300 Crescent Court, Suite 700

Dallas, Texas 75201

(214) 276-6300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian Mitts

Chief Financial Officer, Executive VP-Finance, Secretary and Treasurer

300 Crescent Court, Suite 700

Dallas, Texas 75201

(214) 276-6300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Charles T. Haag

Justin S. Reinus

Winston & Strawn LLP

2121 N. Pearl Street

Suite 900

Dallas, Texas 75201

(214) 453-6500

Approximate date of commencement of proposed sale to the public: From time to time on or after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☑ Smaller reporting company ☑ Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 20, 2023

PROSPECTUS

$750,000,000

NexPoint Real Estate Finance, Inc.

Common Stock

Preferred Stock

Warrants

Debt

NexPoint Real Estate Finance, Inc., a Maryland corporation, from time to time, may offer to sell up to an aggregate of $750,000,000 of common stock, preferred stock, warrants and debt securities in one or more primary offerings. The preferred stock, warrants and debt securities may be convertible into, or exercisable or exchangeable for, our common stock or our preferred stock.

We may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. This prospectus describes some of the general terms that may apply to these securities. The specific terms of any securities to be offered, including the specific plan of distribution for any such securities, will be described in a supplement to this prospectus. Prospectus supplements may also add, update or change information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest.

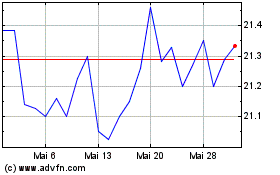

Shares of our common stock are listed on the New York Stock Exchange (the “NYSE”) under the symbol “NREF” and shares of our 8.50% Series A Cumulative Redeemable Preferred Stock (“Series A Preferred Stock”) are listed on the NYSE under the symbol “NREF-PRA.” On December 19, 2023, the last reported sales price for our common stock on the NYSE was $15.41 per share and the last reported sales price for our Series A Preferred Stock on the NYSE was $21.10 per share. As of the date of this prospectus, other than our common stock and Series A Preferred Stock, none of the securities that we may offer by this prospectus is listed on any national securities exchange or automated quotation system.

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and are subject to reduced public company reporting requirements. Investing in our securities involves a high degree of risk. You should read carefully the section entitled “Risk Factors” on page 2 herein and the “Risk Factors” section contained in the applicable prospectus supplement and in the documents incorporated by reference in this prospectus.

This prospectus may not be used to offer to sell any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf process, we may from time to time sell any combination of the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities that we may offer. Each time we sell securities, we will provide a prospectus supplement that contains specific information about the terms of that offering. This prospectus may not be used to consummate sales of securities unless it is accompanied by a prospectus supplement. The prospectus supplement may add information to this prospectus or update or change information in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement. You should carefully read this prospectus and any prospectus supplement together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

You should rely only on the information contained in, or incorporated by reference into, this prospectus, in any accompanying prospectus supplement or in any free writing prospectus filed by us with the SEC. We have not authorized anyone to provide you with different or additional information. We are not offering to sell or soliciting any offer to buy any securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information in this prospectus, any prospectus supplement or any free writing prospectus is accurate only as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless the context otherwise indicates, the terms “NREF,” the “Company,” “we,” “us” and “our” as used in this prospectus refer to NexPoint Real Estate Finance, Inc. and its consolidated subsidiaries. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the context otherwise requires.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus, any prospectus supplement or free writing prospectus and the documents incorporated herein and therein by reference may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. In particular, statements relating to our liquidity and capital resources, our performance and results of operations contain forward-looking statements. Furthermore, all of the statements regarding future financial performance are forward-looking statements. We caution investors that any forward-looking statements presented in this prospectus, any prospectus supplement or free writing prospectus and the documents incorporated herein or therein are based on management’s then-current beliefs and assumptions made by, and information currently available to, management. When used, the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “target,” “estimate,” “project,” “should,” “will,” “seek,” “would,” “result,” the negative version of these words and similar expressions that do not relate solely to historical matters are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We caution you therefore against relying on any of these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance, liquidity or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

| |

●

|

Our loans and investments expose us to risks similar to and associated with debt-oriented real estate investments generally;

|

| |

●

|

Commercial real estate-related investments that are secured, directly or indirectly, by real property are subject to delinquency, foreclosure and loss, which could result in losses to us;

|

| |

●

|

Fluctuations in interest rate and credit spreads could reduce our ability to generate income on our loans and other investments, which could lead to a significant decrease in our results of operations, cash flows and the market value of our investments;

|

| |

●

|

Risks associated with the ownership of real estate;

|

| |

●

|

Our loans and investments are concentrated in terms of type of interest, geography, asset types and sponsors and may continue to be so in the future;

|

| |

●

|

We have a substantial amount of indebtedness which may limit our financial and operating activities and may adversely affect our ability to incur additional debt to fund future needs;

|

| |

●

|

We have limited operating history as a standalone company and may not be able to operate our business successfully, find suitable investments, or generate sufficient revenue to make or sustain distributions to our stockholders;

|

| |

●

|

We may not replicate the historical results achieved by other entities managed or sponsored by affiliates of NexPoint Advisors, L.P. (our “Sponsor”), members of the management team of NexPoint Real Estate Advisors VII, L.P. (our “Manager”) or their affiliates;

|

| |

●

|

We are dependent upon our Manager and its affiliates to conduct our day-to-day operations; thus, adverse changes in their financial health or our relationship with them could cause our operations to suffer;

|

| |

●

|

Our Manager and its affiliates face conflicts of interest, including significant conflicts created by our Manager’s compensation arrangements with us, including compensation which may be required to be paid to our Manager if our management agreement is terminated, which could result in decisions that are not in the best interests of our stockholders;

|

| |

●

|

We pay substantial fees and expenses to our Manager and its affiliates, which payments increase the risk that you will not earn a profit on your investment;

|

| |

●

|

If we fail to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes, cash available for distributions to be paid to our stockholders could decrease materially, which would limit our ability to make distributions to our stockholders;

|

| |

●

|

Risks associated with the current COVID-19 pandemic, including unpredictable variants and the future outbreak of other highly infectious or contagious diseases;

|

| |

●

|

Risks associated with the Highland Capital Management, L.P. bankruptcy, including related litigation and potential conflicts of interest;

|

| |

●

|

Risks associated with a single material weakness that was identified in our review of internal control over financial reporting and the determination that our internal control over financial reporting and disclosure controls and procedures were therefore not effective as of December 31, 2022; and

|

| |

●

|

Any other risks included under Part I, Item 1A, “Risk Factors,” of our Annual Report on Form 10-K filed with the SEC on March 31, 2023.

|

We urge you to carefully consider these risks and review the additional disclosures we make concerning risks and other factors that may materially affect the outcome of our forward-looking statements and our future business and operating results, including those made in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future, including subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and in any prospectus supplement or free writing prospectus. We caution you that any forward-looking statements made in this prospectus, any prospectus supplement or free writing prospectus and the documents incorporated herein and therein by reference are not guarantees of future performance, events or results, and you should not place undue reliance on these forward-looking statements, which speak only as of their respective dates. Except as required by law, we expressly disclaim any obligation to publicly update or revise any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any statement is based.

NEXPOINT REAL ESTATE FINANCE, INC.

NexPoint Real Estate Finance, Inc. (the “Company”, “we”, “our”) is a commercial mortgage REIT focused on originating, structuring and investing in first-lien mortgage loans, mezzanine loans, preferred equity and common stock, as well as multifamily CMBS securitizations. Substantially all of the Company’s business is conducted through NexPoint Real Estate Finance Operating Partnership, L.P. (the “OP”), the Company’s operating partnership. As of the date hereof, the Company holds approximately 83.82% of the common limited partnership units in the OP (“OP Units”) which represents 100% of the Class A OP Units, and the OP owns 100% of the common limited partnership units of its subsidiary partnerships. The OP also directly owns all of the membership interests of a limited liability company through which it owns a portfolio of mezzanine loans. NexPoint Real Estate Finance Operating Partnership GP, LLC is the sole general partner of the OP. In addition to OP Units, as of the date hereof, the Company holds all of the issued and outstanding 8.50% Series A Cumulative Redeemable Preferred Units (liquidation preference $25.00 per unit) in our OP (the “Series A Preferred Units”). The Series A Preferred Units have economic terms that are substantially the same as the terms of our 8.50% Series A Cumulative Redeemable Preferred Stock (the “Series A Preferred Stock”). The Series A Preferred Units rank senior, as to distributions and upon liquidation, to OP Units. As of the date hereof, the Company holds all of the issued and outstanding 9.00% Series B Cumulative Redeemable Preferred Units (liquidation preference $25.00 per unit) in our OP (the “Series B Preferred Units”). The Series B Preferred Units have economic terms that are substantially the same as the terms of our 9.00% Series B Cumulative Redeemable Preferred Stock (the “Series B Preferred Stock”). The Series B Preferred Units rank, as to distributions and upon liquidation, senior to OP Units and pari passu with Series A Preferred Units.

The Company’s primary investment objective is to generate attractive, risk-adjusted returns for stockholders over the long term. The Company intends to achieve this objective primarily by originating, structuring and investing in our target assets. The Company concentrates on investments in real estate sectors where its senior management team has operating expertise, including, among others, in the multifamily, single-family rental properties, self-storage, life science, hospitality and office sectors predominantly in the top 50 metropolitan statistical areas. In addition, the Company targets lending or investing in properties that are stabilized or have a “light transitional” business plan, meaning a property that requires limited deferred funding to support leasing or ramp-up of operations and for which most capital expenditures are for value-add improvements. Through active portfolio management the Company seeks to take advantage of market opportunities to achieve a superior portfolio risk-mix that delivers attractive total returns.

The Company is externally managed by the Manager through a management agreement by and between the Company and the Manager, dated February 6, 2020, as amended on July 17, 2020 and November 3, 2021, that expires on February 6, 2024 and is automatically renewed for successive one-year terms thereafter unless earlier terminated. The Manager conducts substantially all of the Company’s operations and provides asset management services for the Company’s real estate investments. All of the Company’s investment decisions are made by the Manager, subject to general oversight by the Manager’s investment committee and the Company’s Board of Directors (the “Board”). The Manager is wholly owned by the Company’s Sponsor.

The Company is a Maryland corporation that was incorporated on June 7, 2019 and has elected to be treated as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), commencing with our taxable year ended December 31, 2020.

The Company’s principal executive offices are located at 300 Crescent Court, Suite 700, Dallas, Texas 75201. The Company’s telephone number is (214) 276-6300. The Company maintains a website located at http://nref.nexpoint.com. The information contained on or that can be accessed through our website is not incorporated into and does not constitute a part of this prospectus or any other report or document we file with or furnish to the SEC.

RISK FACTORS

Investing in our securities involves significant risks. You should consider the specific risks described in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC, before making an investment decision. Each of the risks described in these documents could materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a partial or complete loss of your investment. See “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

USE OF PROCEEDS

We intend to use the net proceeds from the sale of any securities offered by us under this prospectus as set forth in the applicable prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

The following description summarizes the material provisions of the common stock and preferred stock we may offer. This description is not complete and is subject to, and is qualified in its entirety by reference to, our charter and our bylaws and applicable provisions of Maryland law. The specific terms of any series of preferred stock will be described in the applicable prospectus supplement. Any series of preferred stock we issue will be governed by our charter, including the articles supplementary related to that series. We will file the articles supplementary with the State Department of Assessments and Taxation of Maryland and the SEC and incorporate it by reference as an exhibit to our registration statement at or before the time we issue any preferred stock of that series of authorized preferred stock.

Authorized Stock

Our authorized stock consists of 500,000,000 shares of common stock, par value $0.01 per share, and 100,000,000 shares of preferred stock, par value $0.01 per share, 11,300,000 of which have been classified as shares of Series A Preferred Stock and 16,000,000 shares of which have been classified as shares of Series B Preferred Stock. As of September 30, 2023, 17,518,900 shares of our common stock were issued, 17,231,913 shares of our common stock were outstanding, 2,000,000 shares of our Series A Preferred Stock were issued, 1,645,000 shares of our Series A Preferred Stock were outstanding and 0 shares of our Series B Preferred Stock were issued and outstanding. All the outstanding shares of our common stock, Series A Preferred Stock and Series B Preferred Stock are fully paid and nonassessable.

Our Board may, without stockholder approval, amend our charter from time to time to increase or decrease the aggregate number of authorized shares of stock or the number of authorized shares of stock of any class or series. Under the MGCL, our stockholders generally are not liable for our debts or obligations solely as a result of their status as stockholders.

Common Stock

Subject to the preferential rights, if any, of holders of any other class or series of our stock and to the provisions of our charter relating to the restrictions on ownership and transfer of our stock, the holders of shares of our common stock are entitled to receive dividends and other distributions on such shares of stock when, as and if authorized by our Board and declared by us out of assets legally available for distribution to our stockholders and will be entitled to share ratably in our net assets legally available for distribution to our stockholders in the event of our liquidation, dissolution or winding up after payment of or adequate provision for all of our known debts and liabilities.

Subject to the provisions of our charter regarding the restrictions on ownership and transfer of our stock and except as may be otherwise specified in the terms of any class or series of common stock, each outstanding share of common stock entitles the holder to one vote on all matters submitted to a vote of stockholders, including the election of directors, and, except as may be provided with respect to any other class or series of our stock, the holders of shares of our common stock will possess the exclusive voting power. There is no cumulative voting in the election of directors. Consequently, the holders of a majority of the outstanding shares of our common stock can elect all of the directors then standing for election, and the holders of the remaining shares will not be able to elect any directors. Directors will be elected by a plurality of all of the votes cast in the election of directors.

Holders of shares of our common stock have no preference, conversion, exchange, sinking fund, redemption or appraisal rights and have no preemptive rights to subscribe for any securities of our Company. Subject to the provisions of our charter regarding the restrictions on ownership and transfer of our stock, shares of our common stock will have equal distribution, liquidation and other rights.

Under the MGCL, a Maryland corporation generally cannot dissolve, amend its charter, merge or consolidate with, or convert into, another entity, sell all or substantially all of its assets or engage in a statutory share exchange unless the action is advised by our Board and approved by the affirmative vote of stockholders entitled to cast at least two-thirds of the votes entitled to be cast on the matter, unless a lesser percentage (but not less than a majority of all of the votes entitled to be cast on the matter) is specified in the corporation’s charter. Our charter provides that these actions must be approved by a majority of all of the votes entitled to be cast on the matter.

The MGCL also permits a corporation to transfer all or substantially all of its assets without the approval of its stockholders to an entity owned, directly or indirectly, by the corporation.

Preferred Stock

Under our charter, our Board may from time to time establish and cause us to issue one or more classes or series of preferred stock and set the terms, preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends or other distributions, qualifications, or terms or conditions of redemption of such classes or series. Accordingly, our Board, without stockholder approval, may issue preferred stock with voting, conversion or other rights that could adversely affect the voting power and other rights of the holders of our common stock. Preferred stock could be issued quickly with terms calculated to delay or prevent a change of control or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock, may adversely affect the voting and other rights of the holders of our common stock, and could have the effect of delaying, deferring or preventing a change of control of our Company or other corporate action. Preferred stock offered hereby, upon issuance against full payment of the purchase price therefor, will be fully paid and nonassessable.

The prospectus supplement relating to a particular class or series of preferred stock offered will describe the specific terms thereof, including, where applicable:

| |

•

|

the title, designation, number of shares and stated value of the preferred stock;

|

| |

•

|

the price at which the preferred stock will be issued;

|

| |

•

|

the dividend rates, if any (or method of calculation), whether that rate is fixed or variable or both, and the dates on which dividends will be payable, whether those dividends will be cumulative or noncumulative and, if cumulative, the dates from which dividends will begin to cumulate;

|

| |

•

|

the dates on which the preferred stock will be subject to redemption and the applicable redemption prices;

|

| |

•

|

any redemption or sinking fund provisions;

|

| |

•

|

the convertibility or exchangeability of the preferred stock;

|

| |

•

|

if other than United States dollars, the currency or currencies (including composite currencies) in which the preferred stock is denominated and/or in which payments will or may be payable;

|

| |

•

|

the method by which amounts in respect of the preferred stock may be calculated and any commodities, currencies or indices, or the value, rate or price relevant to that calculation;

|

| |

•

|

the place where dividends and other payments on the preferred stock are payable and the identity of the transfer agent, registrar and dividend disbursement agent for the preferred stock;

|

| |

•

|

any listing of the preferred stock on any securities exchange; and

|

| |

•

|

any additional dividend, liquidation, redemption, preemption, sinking fund, voting and other rights, preferences, privileges, limitations and restrictions.

|

The federal income tax consequences and special considerations applicable to any class or series of preferred stock will be generally described in the prospectus supplement related thereto.

Description of Series A Preferred Stock

The Series A Preferred Stock generally provides for the following rights, preferences and obligations:

| |

•

|

Ranking. Our Series A Preferred Stock ranks, with respect to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up:

|

| |

•

|

senior to our common stock and any class or series of our capital stock expressly designated as ranking junior to the Series A Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up;

|

| |

•

|

on parity with any class or series of our capital stock expressly designated as ranking on parity with the Series A Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up;

|

| |

•

|

junior to any class or series of our capital stock expressly designated as ranking senior to the Series A Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up; and

|

| |

•

|

effectively junior to all of our existing and future indebtedness (including indebtedness convertible into our common stock or preferred stock) and to the indebtedness of our existing and future subsidiaries.

|

| |

•

|

Dividend Rights. The shares of our Series A Preferred Stock accrue a cumulative cash dividend at an annual rate of 8.50% on the $25.00 per share liquidation preference, equivalent to a fixed annual amount of $2.125 per annum.

|

| |

•

|

Liquidation Rights. Upon any voluntary or involuntary liquidation, dissolution or winding up of our company, the holders of our Series A Preferred Stock are entitled to be paid out of our assets legally available for distribution to our stockholders a liquidation preference in cash or property, at fair market value as determined by our Board, of $25.00 per share, plus an amount equal to all accrued and unpaid dividends (whether or not declared) to, but not including, the date of payment, before any payment or distribution will be made to holders of any shares of junior stock, including our common stock.

|

| |

•

|

Redemption Provisions. The shares of our Series A Preferred Stock are not redeemable prior to July 24, 2025, except in certain limited circumstances. On and after July 24, 2025, the shares of Series A Preferred Stock may be redeemed for cash at our option, in whole or from time to time in part, upon not less than 30 days’ nor more than 60 days’ written notice, by paying $25.00 per share plus an amount equal to all accrued and unpaid dividends (whether or not declared) to, but not including, the date of redemption. The Series A Preferred Stock has no stated maturity and will not be subject to any sinking fund or mandatory redemption provisions, except in limited circumstances. Unless full cumulative distributions for all past dividend periods on all shares of Series A Preferred Stock are declared and paid or set apart for payment, the Company will not redeem or purchase any shares of Series A Preferred Stock, nor will it set aside assets for a sinking fund for the redemption of the same, except by conversion into or exchange for shares of junior stock. Notwithstanding the foregoing, the Company may redeem or purchase shares of Series A Preferred Stock to ensure that it continues to meet the requirements for qualification as a REIT pursuant to Article VII of its charter or otherwise and a purchase or acquisition of shares of Series A Preferred Stock may be completed pursuant to a purchase or exchange offer made on the same terms to all holders.

|

| |

•

|

Voting Rights. Holders of Series A Preferred Stock generally have no voting rights. Whenever dividends on the Series A Preferred Stock shall be in arrears for six or more quarterly periods, whether or not consecutive, the number of directors then constituting the Board shall be increased by two, if not already increased by reason of similar types of provisions with respect to another series of Parity Stock (as defined below), and the holders of Series A Preferred Stock (voting together as a single class with the holders of all other series of preferred stock ranking on a parity with the Series A Preferred Stock as to dividends or upon liquidation (“Parity Stock”), upon which like voting rights have been conferred and are exercisable) will be entitled to vote for the election of a total of two directors, if not already elected by the holders of Parity Stock by reason of similar types of provisions with respect to preferred stock directors, at a special meeting of the stockholders called by the holders of record of at least 33% of the Series A Preferred Stock or the holders of 33% of any other series of Parity Stock so in arrears (unless such request is received less than 90 days before the date fixed for the next annual or special meeting of stockholders or, if the request is received less than 90 days prior to the next annual meeting of stockholders, at the next annual meeting of stockholders or, at our sole discretion, a separate special meeting of stockholders to be held no later than 90 days after our receipt of such request), and at each subsequent annual meeting until all dividends accumulated on the Series A Preferred Stock for the past dividend periods and the then-current dividend period have been paid in full. In addition, the issuance of shares of senior stock or certain changes to the terms of the Series A Preferred Stock that would be materially adverse to the rights of holders of Series A Preferred Stock cannot be made without the affirmative vote of holders of at least two-thirds of the outstanding shares of Series A Preferred Stock and all other classes or series of our Parity Stock upon which like voting rights have been conferred and are exercisable, voting together as a single class.

|

| |

•

|

Conversion and Preemptive Rights. Except in connection with certain changes in control of the Company as described below, shares of our Series A Preferred Stock are not convertible or exchangeable for any of our other securities or property. Holders of our Series A Preferred Stock have no preemptive rights to subscribe for any securities of the Company. The following describes the conversion rights of holders of our Series A Preferred Stock upon certain changes of control:

|

| |

•

|

Except to the extent that we have elected to exercise our optional redemption right or our special optional redemption right by providing a notice of redemption prior to the date the shares of Series A Preferred Stock are to be converted (the “Change of Control Conversion Date”), beginning on the first anniversary of the first date on which any shares of Series A Preferred Stock are issued, upon the occurrence of a Change of Control (as defined below), each holder of Series A Preferred Stock will have the right to convert some or all of the Series A Preferred Stock held by such holder (the “Change of Control Conversion Right”) on the Change of Control Conversion Date into a number of shares of our common stock per share of Series A Preferred Stock to be converted equal to the lesser of:

|

| |

•

|

the quotient obtained by dividing (i) the sum of the $25.00 liquidation preference plus the amount of any accrued and unpaid dividends (whether or not declared) to, but not including, the Change of Control Conversion Date (unless the Change of Control Conversion Date is after a record date for a Series A Preferred Stock dividend payment and prior to the corresponding Series A Preferred Stock dividend payment date, in which case no additional amount for such accrued and unpaid dividend will be included in this sum) by (ii) the Common Stock Price (as defined below); and

|

| |

•

|

3.2982, subject to certain adjustments;

|

subject, in each case, to provisions for the receipt of alternative consideration upon conversion as described in the articles supplementary setting forth the terms of the Series A Preferred Stock.

| |

•

|

If we have provided a redemption notice with respect to some or all of the Series A Preferred Stock, holders of any Series A Preferred Stock that we have called for redemption will not be permitted to exercise their Change of Control Conversion Right in respect of any of their shares of Series A Preferred Stock that have been called for redemption, and any Series A Preferred Stock subsequently called for redemption that has been tendered for conversion will be redeemed on the applicable date of redemption instead of converted on the Change of Control Conversion Date.

|

| |

•

|

Except as provided above in connection with a Change of Control, the Series A Preferred Stock is not convertible into or exchangeable for any other securities or property.

|

| |

•

|

The “Common Stock Price” will be: (i) the amount of cash consideration per share of common stock, if the consideration to be received in the Change of Control by the holders of shares of our common stock is solely cash; and (ii) the average of the closing prices for shares of our common stock on the New York Stock Exchange (the “NYSE”) for the ten consecutive trading days immediately preceding, but not including, the effective date of the Change of Control, if the consideration to be received in the Change of Control by the holders of shares of our common stock is other than solely cash.

|

| |

•

|

A “Change of Control” is when, after the original issuance of the Series A Preferred Stock, the following have occurred and are continuing:

|

| |

•

|

the acquisition by any person, including any syndicate or group deemed to be a “person” under Section 13(d)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”), other than a Permitted Holder, of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series of purchases, mergers or other acquisition transactions of shares of our capital stock entitling that person to exercise more than 50% of the total voting power of all shares of our capital stock entitled to vote generally in elections of directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition); and

|

| |

•

|

following the closing of any transaction referred to in the bullet point above, neither we nor the acquiring or surviving entity has a class of common securities (or American depository receipts representing such common securities) listed on the NYSE, the NYSE American or NASDAQ, or listed or quoted on an exchange or quotation system that is a successor to the NYSE, the NYSE American or NASDAQ.

|

For purposes of the definition of Change of Control, a Permitted Holder includes the Manager and its affiliates.

For additional information regarding our Series A Preferred Stock, see our Registration Statement on Form 8-A filed with the SEC on July 20, 2020. See “Where You Can Find More Information.”

Description of Series B Preferred Stock

The Series B Preferred Stock generally provides for the following rights, preferences and obligations:

| |

•

|

Ranking. Our Series B Preferred Stock ranks, with respect to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up:

|

| |

•

|

senior to our common stock and any class or series of our capital stock expressly designated as ranking junior to the Series B Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up;

|

| |

•

|

on parity with our Series A Preferred Stock and any class or series of our capital stock expressly designated as ranking on parity with the Series B Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up;

|

| |

•

|

junior to any class or series of our capital stock expressly designated as ranking senior to the Series B Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up; and

|

| |

•

|

effectively junior to all of our existing and future indebtedness (including indebtedness convertible into our common stock or preferred stock) and to the indebtedness of our existing and future subsidiaries.

|

| |

•

|

Dividend Rights. The shares of our Series B Preferred Stock accrue a cumulative cash dividend at an annual rate of 9.00% on the $25.00 per share liquidation preference.

|

| |

•

|

Liquidation Rights. Upon any voluntary or involuntary liquidation, dissolution or winding up of our company, before any payment or distribution will be made to holders of our common stock or any other class or series of capital stock ranking junior to our shares of Series B Preferred Stock, the holders of our Series B Preferred Stock are entitled to be paid out of our assets legally available for distribution to our stockholders a liquidation preference in cash or property, at fair market value as determined by our Board, of $25.00 per share, subject to appropriate adjustment in relation to any recapitalizations, stock dividends, stock splits, stock combination, reclassifications or other similar events which affect the Series B Preferred Stock (the “liquidation preference”), plus an amount equal to all accrued and unpaid dividends to, but not including, the date of payment, pari passu with the holders of shares of our Series A Preferred Stock and any other class or series of our capital stock ranking on parity with the Series B Preferred Stock as to the liquidation preference and/or accrued but unpaid dividends they are entitled to receive.

|

| |

•

|

Redemption Provisions. The shares of our Series B Preferred Stock are not redeemable by the holders thereof prior to the first day of the month following the date of original issuance. On the first day of the month following the date of original issuance, subject to certain redemption limits, holders will have the right to require us to redeem shares of Series B Preferred Stock at a redemption price equal to the liquidation preference less a redemption fee calculated thereon, plus an amount equal to all accrued and unpaid cash dividends to, but not including, the date of redemption. The redemption fee will be equal to:

|

| |

•

|

Beginning on the first day of the month following the date of original issuance of the shares to be redeemed: 12% of the liquidation preference

|

| |

•

|

Beginning on the first day of the month following the first anniversary of the date of original issuance of the shares to be redeemed: 9% of the liquidation preference

|

| |

•

|

Beginning on the first day of the month following the second anniversary of the date of original issuance of the shares to be redeemed: 6% of the liquidation preference

|

| |

•

|

Beginning on the first day of the month following the third anniversary of the date of original issuance of the shares to be redeemed: 3% of the liquidation preference

|

| |

•

|

Beginning on the first day of the month following the fourth anniversary of the date of original issuance of the shares to be redeemed: 0% of the liquidation preference.

|

In addition, subject to certain restrictions, we will redeem upon notice from the holder shares of Series B Preferred Stock, beginning on the first day of the month following the first anniversary of the date of original issuance of such shares, held by a natural person upon his or her death or upon his or her suffering a qualifying disability, including shares held through a revocable grantor trust, or an IRA or other retirement or profit-sharing plan, where such notice is from (a) in the case of the death of a holder, the holder’s estate, the recipient of such shares through bequest or inheritance, or, with respect to shares held through a revocable grantor trust, the trustee of such trust, who will have the sole ability to give notice on behalf of the trust, or (b) in the case of the disability of a holder, the holder or the holder’s legal representative. If spouses are joint registered holders of shares of Series B Preferred Stock, the notice to redeem such shares may be given upon the death or qualifying disability of either spouse. We must receive such notice within one year after the death or qualifying disability of the holder, but no sooner than the first day of the month following the first anniversary of the date of original issuance of such shares. If the holder is not a natural person, such as a trust (other than a revocable grantor trust) or a partnership, corporation or similar legal entity, the right of redemption upon the death or qualifying disability of a beneficiary of such trust or the holder of an ownership interest in such partnership, corporation or similar legal entity will be subject to the approval of our board of directors in its sole discretion. Beginning on the first day of the month following the first anniversary of the date of original issuance of the shares of Series B Preferred Stock to be redeemed, we will redeem such shares at a redemption price equal to 95% of the liquidation preference, and beginning on the first day of the month following the second anniversary of the date of original issuance of the shares of Series B Preferred Stock to be redeemed, we will redeem such shares at a redemption price equal to 100% of the liquidation preference, in each case, plus an amount equal to accrued but unpaid cash dividends thereon, if any, to but not including the date of redemption.

Also, beginning on the first day of the month following the second anniversary of the date of original issuance of the shares of Series B Preferred Stock to be redeemed, we will have the right (but not the obligation) to redeem all or some portion of outstanding shares of Series B Preferred Stock at a redemption price equal to 100% of the liquidation preference, plus an amount equal to accrued but unpaid cash dividends thereon, if any, to but not including the date of redemption.

For so long as our common stock is listed or admitted to trading on the NYSE or another national securities exchange or automated quotation system, we have the right, in our sole discretion, to pay the redemption price in cash or in equal value of shares of our common stock, based on the closing price per share of our common stock for the single trading day prior to the date of redemption. Any such redemption may be made conditional on such factors as may be determined by our board of directors and as set forth in the notice of redemption.

| |

•

|

Voting Rights. Holders of Series B Preferred Stock generally have no voting rights. The authorization or creation of, or increase in the number of shares of stock ranking senior to the Series B Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up cannot be made without the affirmative vote of holders of at least two-thirds of the outstanding shares of Series A Preferred Stock, Series B Preferred Stock and all other classes or series of our preferred stock upon which like voting rights have been conferred and are exercisable, voting together as a single class. In addition, we may not amend, alter or repeal the provisions of our charter (including the articles supplementary establishing the Series B Preferred Stock), whether by merger, consolidation, conversion or otherwise, in each case in such a way that would materially and adversely affect any right, preference, privilege or voting power of the Series B Preferred Stock or the holders thereof without the affirmative vote of the holders of at least two-thirds of the outstanding shares of Series B Preferred Stock at the time (voting as a separate class).

|

| |

•

|

Preemptive Rights. Holders of our Series B Preferred Stock have no preemptive rights to subscribe for any securities of the Company.

|

| |

•

|

Change of Control. Upon certain changes of control (as defined in the terms of the Series B Preferred Stock) the Company will have the right (but not the obligation) to redeem all or some portion of outstanding shares of Series B Preferred Stock, on a date specified by the Company no later than 120 days after the first date on which such change of control occurred, in cash at a redemption price equal to 100% of the liquidation preference, plus an amount equal to accrued but unpaid cash dividends thereon, if any, to but not including the date of redemption. Any such redemption may be made conditional on such factors as may be determined by the Board and as set forth in the notice of redemption.

|

For additional information regarding our Series B Preferred Stock, see the Prospectus Supplement filed with the SEC on November 2, 2023. See “Where You Can Find More Information.”

Power to Increase or Decrease Authorized Shares of Stock, Reclassify Unissued Shares of Stock and Issue Additional Shares of Common and Preferred Stock

Our charter authorizes our Board, with the approval of a majority of our Board and without stockholder approval, to amend our charter to increase or decrease the aggregate number of shares of stock or the number of shares of any class or series of stock that we are authorized to issue. In addition, our charter authorizes our Board to authorize the issuance from time to time of shares of our common and preferred stock.

Our charter also authorizes our Board to classify and reclassify any unissued shares of our common or preferred stock into other classes or series of stock, including one or more classes or series of stock that have priority over our common stock with respect to voting rights, distributions or upon liquidation, and authorize us to issue the newly classified shares. Prior to the issuance of shares of each new class or series, our Board is required by the MGCL and by our charter to set, subject to the provisions of our charter regarding the restrictions on ownership and transfer of our stock, the preferences, conversion and other rights, voting powers, restrictions, limitations as to distributions, qualifications and terms and conditions of redemption for each class or series. Therefore, although our Board does not currently intend to do so, it could authorize the issuance of shares of common or preferred stock with terms and conditions that could have the effect of delaying, deferring or preventing a change in control or other transaction that might involve a premium price for shares of our common stock or otherwise be in the best interest of our stockholders.

We believe that the power of our Board to approve amendments to our charter to increase or decrease the number of authorized shares of stock, to authorize us to issue additional authorized but unissued shares of common or preferred stock and to classify or reclassify unissued shares of common or preferred stock and thereafter to authorize us to issue such classified or reclassified shares of stock will provide us with increased flexibility in structuring possible future financings and acquisitions and in meeting other needs that might arise.

Restrictions on Ownership and Transfer

In order for us to qualify as a REIT under the Code, shares of our stock must be owned by 100 or more persons during at least 335 days of a taxable year of 12 months (other than the first year for which an election to qualify as a REIT has been made) or during a proportionate part of a shorter taxable year. Also, not more than 50% of the value of the outstanding shares of our stock may be owned, directly or indirectly, by five or fewer individuals (as defined in the Code to include certain entities such as private foundations) during the last half of a taxable year (other than the first year for which an election to be a REIT has been made). To qualify as a REIT, we must satisfy other requirements as well.

Our charter contains restrictions on the ownership and transfer of our stock. The relevant sections of our charter provide that, subject to the exceptions described below, no person or entity may own, or be deemed to own, beneficially or by virtue of the applicable constructive ownership provisions of the Code, more than 6.2%, in value or in number of shares, whichever is more restrictive, of the outstanding shares of our common stock (the “common stock ownership limit”), or 6.2% in value of the outstanding shares of all classes or series of our stock (the “aggregate stock ownership limit”).

We refer to the common stock ownership limit and the aggregate stock ownership limit collectively as the “ownership limits.” We refer to the person or entity that, but for operation of the ownership limits or another restriction on ownership and transfer of our stock as described below, would beneficially own or constructively own shares of our stock in violation of such limits or restrictions and, if appropriate in the context, a person or entity that would have been the record owner of such shares of our stock as a “prohibited owner.”

The constructive ownership rules under the Code are complex and may cause shares of stock owned beneficially or constructively by a group of related individuals and/or entities to be owned beneficially or constructively by one individual or entity. As a result, the acquisition of less than 6.2%, in value or in number of shares, whichever is more restrictive, of the outstanding shares of our common stock, or less than 6.2% in value of the outstanding shares of all classes and series of our stock (or the acquisition by an individual or entity of an interest in an entity that owns, beneficially or constructively, shares of our stock), could, nevertheless, cause that individual or entity, or another individual or entity, to own beneficially or constructively shares of our stock in excess of the ownership limits.

Our Board, in its sole discretion, may exempt, prospectively or retroactively, a particular stockholder from the ownership limits or establish a different limit on ownership, or the excepted holder limit, if our Board determines that:

| |

●

|

no individual’s beneficial or constructive ownership of our stock will result in our being “closely held” under Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year), or otherwise result in our failing to qualify as a REIT or result in our failing to qualify as a “domestically controlled qualified investment entity” within the meaning of Section 897(h) of the Code; and

|

| |

●

|

such stockholder does not and will not own, actually or constructively, an interest in a tenant of ours (or a tenant of any entity owned or controlled by us) that would cause us to own, actually or constructively, more than a 9.9% interest (as set forth in Section 856(d)(2)(B) of the Code) in such tenant (or our Board determines that revenue derived from such tenant will not affect our ability to qualify as a REIT).

|

Our charter provides that any violation or attempted violation of any such representations or undertakings will result in such stockholder’s shares of stock being automatically transferred to a charitable trust. As a condition of granting the waiver or establishing the excepted holder limit, our Board may require an opinion of counsel or a ruling from the Internal Revenue Service (the “IRS”), in either case in form and substance satisfactory to our Board, in its sole discretion, in order to determine or ensure our status as a REIT and such representations and undertakings from the person requesting the exception as our Board may require in its sole discretion to make the determinations above. Our Board may impose such conditions or restrictions as it deems appropriate in connection with granting such a waiver or establishing an excepted holder limit. Our Board has granted waivers from the ownership limits applicable to holders of our common stock to James Dondero and his affiliates and others and may grant additional waivers in the future. These waivers will be subject to certain initial and ongoing conditions designed to preserve our status as a REIT.

In connection with granting a waiver of the ownership limits or creating an excepted holder limit or at any other time, our Board may from time to time increase or decrease the common stock ownership limit, the aggregate stock ownership limit or both, for all other persons, unless, after giving effect to such increase, five or fewer individuals could beneficially own, in the aggregate, more than 49.9% in value of our outstanding stock or we would otherwise fail to qualify as a REIT. A reduced ownership limit will not apply to any person or entity whose percentage ownership of our common stock or our stock of all classes and series, as applicable, is, at the effective time of such reduction, in excess of such decreased ownership limit until such time as such person’s or entity’s percentage ownership of our common stock or our stock of all classes and series, as applicable, equals or falls below the decreased ownership limit, but any further acquisition of shares of our common stock or stock of all other classes or series, as applicable, will violate the decreased ownership limit.

Our charter further prohibits:

| |

●

|

any person from beneficially or constructively owning, applying certain attribution rules of the Code, shares of our stock that would result in our being “closely held” under Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise cause us to fail to qualify as a REIT;

|

| |

●

|

any person from transferring shares of our stock if the transfer would result in shares of our stock being beneficially owned by fewer than 100 persons (determined under the principles of Section 856(a)(5) of the Code); and

|

| |

●

|

any person from beneficially or constructively owning shares of our stock to the extent such ownership would result in our failing to qualify as a “domestically controlled qualified investment entity” within the meaning of Section 897(h) of the Code.

|

Our charter provides that any person who acquires or attempts or intends to acquire beneficial or constructive ownership of shares of our stock that will or may violate the ownership limits or any of the other restrictions on ownership and transfer of our stock described above, or who would have owned shares of our stock transferred to the trust as described below, must immediately give notice to us of such event or, in the case of an attempted or proposed transaction, give us at least 15 days’ prior written notice and provide us with such other information as we may request in order to determine the effect of such transfer on our status as a REIT. The foregoing restrictions on ownership and transfer of our stock will not apply if our Board determines that it is no longer in our best interest to attempt to qualify, or to continue to qualify, as a REIT or that compliance with the restrictions and limits on ownership and transfer of our stock described above is no longer required in order for us to qualify as a REIT.

Our charter further provides that, if any transfer of shares of our stock would result in shares of our stock being beneficially owned by fewer than 100 persons, the transfer will be null and void and the intended transferee will acquire no rights in the shares. In addition, our charter provides that, if any purported transfer of shares of our stock or any other event would otherwise result in any person violating the ownership limits or an excepted holder limit established by our Board, or in our being “closely held” under Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise failing to qualify as a REIT or as a “domestically controlled qualified investment entity” within the meaning of Section 897(h)(4)(B) of the Code, then that number of shares (rounded up to the nearest whole share) that would cause the violation will be automatically transferred to, and held by, a trust for the exclusive benefit of one or more charitable organizations selected by us, and the intended transferee or other prohibited owner will acquire no rights in the shares. The automatic transfer will be effective as of the close of business on the business day prior to the date of the violative transfer or other event that results in a transfer to the trust. If the transfer to the trust as described above would not be automatically effective for any reason to prevent violation of the applicable ownership limits or our being “closely held” under Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or our otherwise failing to qualify as a REIT or as a “domestically controlled qualified investment entity,” then our charter provides that the transfer of the shares will be null and void and the intended transferee will acquire no rights in such shares.

Shares of our stock held in the trust will be issued and outstanding shares. Our charter provides that the prohibited owner will not benefit economically from ownership of any shares of our stock held in the trust and will have no rights to distributions and no rights to vote or other rights attributable to the shares of our stock held in the trust. The trustee of the trust will exercise all voting rights and receive all distributions with respect to shares held in the trust for the exclusive benefit of the charitable beneficiary of the trust. Any distribution made before we discover that the shares have been transferred to a trust as described above must be repaid by the recipient to the trustee upon demand. Subject to Maryland law, effective as of the date that the shares have been transferred to the trust, our charter provides that the trustee will have the authority to rescind as void any vote cast by a prohibited owner before our discovery that the shares have been transferred to the trust and to recast the vote in accordance with the desires of the trustee acting for the benefit of the charitable beneficiary of the trust. However, if we have already taken irreversible corporate action, then the trustee may not rescind and recast the vote.

Shares of our stock transferred to the trustee are deemed offered for sale to us, or our designee, at a price per share equal to the lesser of (a) the price paid by the prohibited owner for the shares (or, in the case of a devise or gift, the market price at the time of such devise or gift) and (b) the market price on the date we accept, or our designee, accepts such offer. We may reduce the amount so payable to the trustee by the amount of any distribution that we made to the prohibited owner before we discovered that the shares had been automatically transferred to the trust and that are then owed by the prohibited owner to the trustee as described above, and we may pay the amount of any such reduction to the trustee for distribution to the charitable beneficiary. We have the right to accept such offer until the trustee has sold the shares of our stock held in the trust as discussed below. Upon a sale to us, our charter provides that the interest of the charitable beneficiary in the shares sold terminates, and the trustee must distribute the net proceeds of the sale to the prohibited owner and must distribute any distributions held by the trustee with respect to such shares to the charitable beneficiary.

If we do not buy the shares, the trustee must, within 20 days of receiving notice from us of the transfer of shares to the trust, sell the shares to a person or entity designated by the trustee who could own the shares without violating the ownership limits or the other restrictions on ownership and transfer of our stock. After the sale of the shares, our charter provides that the interest of the charitable beneficiary in the shares transferred to the trust will terminate and the trustee must distribute to the prohibited owner an amount equal to the lesser of (a) the price paid by the prohibited owner for the shares (or, if the prohibited owner did not give value for the shares in connection with the event causing the shares to be held in the trust (for example, in the case of a gift, devise or other such transaction), the market price of the shares on the day of the event causing the shares to be held in the trust) and (b) the sales proceeds (net of any commissions and other expenses of sale) received by the trust for the shares. The trustee may reduce the amount payable to the prohibited owner by the amount of any distribution that we paid to the prohibited owner before we discovered that the shares had been automatically transferred to the trust and that are then owed by the prohibited owner to the trustee as described above. Any net sales proceeds in excess of the amount payable to the prohibited owner must be paid immediately to the charitable beneficiary, together with any distributions thereon. In addition, if, prior to the discovery by us that shares of stock have been transferred to a trust, such shares of stock are sold by a prohibited owner, then our charter provides that such shares will be deemed to have been sold on behalf of the trust and, to the extent that the prohibited owner received an amount for, or in respect of, such shares that exceeds the amount that such prohibited owner was entitled to receive, such excess amount will be paid to the trustee upon demand. Our charter provides that the prohibited owner has no rights in the shares held by the trustee.

In addition, if our Board determines in good faith that a transfer or other event has occurred that would violate the restrictions on ownership and transfer of our stock described above, our Board may take such action as it deems advisable to refuse to give effect to or to prevent such transfer, including, but not limited to, causing us to redeem shares of our stock, refusing to give effect to the transfer on our books or instituting proceedings to enjoin the transfer.

Our charter provides that every owner of 5% or more (or such lower percentage as required by the Code or the regulations promulgated thereunder) of our stock, within 30 days after the end of each taxable year, must give us written notice stating the stockholder’s name and address, the number of shares of each class and series of our stock that the stockholder beneficially owns and a description of the manner in which the shares are held. Each such owner must provide to us in writing such additional information as we may request in order to determine the effect, if any, of the stockholder’s beneficial ownership on our status as a REIT and to ensure compliance with the ownership limits. In addition, our charter provides that any person or entity that is a beneficial owner or constructive owner of shares of our stock and any person or entity (including the stockholder of record) who is holding shares of our stock for a beneficial owner or constructive owner must, on request, provide to us such information as we may request in good faith in order to determine our status as a REIT and to comply with the requirements of any taxing authority or governmental authority or to determine such compliance and to ensure compliance with the ownership limits.

Any certificates representing shares of our stock will bear a legend referring to the restrictions on ownership and transfer of our stock described above.

These restrictions on ownership and transfer of our stock will not apply if our Board determines that it is no longer in our best interest to attempt to qualify, or to continue to qualify, as a REIT or that compliance is no longer required in order for us to qualify as a REIT.

The restrictions on ownership and transfer of our stock described above, including in Article VII of our charter, could delay, defer or prevent a transaction or a change in control that might involve a premium price for our common stock or otherwise be in the best interest of our stockholders.

Listing

Our common stock is listed on the NYSE under the symbol “NREF.” The Series A Preferred Stock is listed on the NYSE under the symbol “NREF PRA.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock, Series A Preferred Stock and Series B Preferred Stock is Equiniti Trust Company, LLC.

DESCRIPTION OF WARRANTS

We may offer warrants for the purchase of common stock or preferred stock. We may issue warrants independently or together with any offered securities. The warrants may be attached to or separate from those offered securities. We will issue the warrants under one or more warrant agreements to be entered into between us and a warrant agent to be named in the applicable prospectus supplement. The warrant agent will act solely as our agent in connection with the warrants and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

While the terms we have summarized below will generally apply to any future warrants we may offer under a prospectus supplement, we will describe the particular terms of any warrants that we may offer in more detail in the applicable prospectus supplement. The description in the applicable prospectus supplement of any warrants we offer may differ from the description provided below and does not purport to be complete and is subject to and qualified in its entirety by reference to the provisions of the applicable warrant agreement and warrant certificate, which will be filed with the SEC if we offer warrants. You should read the applicable warrant certificate, the applicable warrant agreement and any applicable prospectus supplement in their entirety.

General

The prospectus supplement relating to any warrants that we may offer will contain the specific terms of the warrants. These terms may include the following:

| |

•

|

the title of the warrants;

|

| |

•

|

the price or prices at which the warrants will be issued;

|

| |

•

|

the designation, amount and terms of the securities for which the warrants are exercisable;

|

| |

•

|

the designation and terms of the other securities, if any, with which the warrants are to be issued and the number of warrants issued with each other security;

|

| |

•

|

the aggregate number of warrants offered;

|

| |

•

|

any provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of the warrants;

|

| |

•

|

the price or prices at which the securities purchasable upon exercise of the warrants may be purchased;

|

| |

•

|

any provisions providing for changes to or adjustments in the exercise price;

|

| |

•

|

if applicable, the date on and after which the warrants and the securities purchasable upon exercise of the warrants will be separately transferable;

|

| |

•

|

a discussion of any material U.S. federal income tax considerations applicable to the holding and/or exercise of the warrants;

|

| |

•

|

the date on which the right to exercise the warrants will commence, and the date on which the right will expire;

|

| |

•

|

the maximum or minimum number of warrants that may be exercised at any time;

|

| |

•

|

if the warrants are subject to redemption or call, the material terms thereof;

|

| |

•

|

information with respect to book-entry procedures, if any; and

|

| |

•

|

any other terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants.

|

Exercise of Warrants

Each warrant will entitle the holder of the warrant to purchase for cash the amount of common stock or preferred stock at the exercise price stated or determinable in the applicable prospectus supplement for the warrants. Warrants may be exercised at any time up to the close of business on the expiration date shown in the applicable prospectus supplement, unless otherwise specified in such prospectus supplement.

After the close of business on the expiration date, unexercised warrants will become void. Warrants may be exercised as described in the applicable prospectus supplement. When the warrant holder makes the payment and properly completes and signs the warrant certificate at the corporate trust office of the warrant agent or any other office indicated in the prospectus supplement, we will, as soon as possible, forward the common stock or preferred stock that the warrant holder has purchased. If the warrant holder exercises the warrant for less than all of the warrants represented by the warrant certificate, we will issue a new warrant certificate for the remaining warrants.

Amendments and Supplements to the Warrant Agreements

We may amend or supplement a warrant agreement without the consent of the holders of the applicable warrants to cure ambiguities in the warrant agreement, to cure or correct a defective provision in the warrant agreement, or to provide for other matters under the warrant agreement that we and the warrant agent deem necessary or desirable, so long as, in each case, such amendments or supplements do not materially adversely affect the interests of the holders of the warrants.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information we may include in any applicable prospectus supplements and in any related free writing prospectuses, summarizes the material terms and provisions of the debt securities that we may offer under this prospectus. While the terms summarized below will apply generally to any debt securities that we may offer, we will describe the particular terms of any debt securities in more detail in the applicable prospectus supplement. The terms of any debt securities offered under a prospectus supplement may differ from the terms described below.

We may issue debt securities from time to time in one or more distinct series. The debt securities will be senior debt securities and will be issued under an Indenture, dated April 13, 2021, by and between the Company and UMB Bank, National Association (the “trustee”) as such indenture may be amended and supplemented from time to time. The indenture is filed as an exhibit to the registration statement of which this prospectus is a part. The indenture is qualified under the Trust Indenture Act of 1939. As of the date hereof, the Company had an aggregate principal amount of $180 million of its 5.75% Senior Notes due 2026 outstanding.