0000071829false00000718292024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-02960 | 72-1123385 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 9320 Lakeside Boulevard, | Suite 100 | |

| The Woodlands, | Texas | 77381 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (281) 362-6800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | NR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Newpark Resources, Inc. (the “Company”) issued a press release announcing financial information for the three and nine months ended September 30, 2024. The press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K and the information in the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Use of Non-GAAP Financial Information

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include Adjusted Income (Loss) from Continuing Operations, Adjusted Income (Loss) from Continuing Operations Per Common Share, earnings before interest, taxes, depreciation and amortization (“EBITDA”) from Continuing Operations, Adjusted EBITDA from Continuing Operations, Free Cash Flow, and Adjusted EBITDA Margin from Continuing Operations.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and liquidity with that of other companies in our industry. Management uses these measures to evaluate our operating performance, liquidity and capital structure. In addition, our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. Applicable reconciliations to the nearest GAAP financial measure of each non-GAAP financial measure are included in the attached Exhibit 99.1.

Item 8.01 Other Events.

On October 29, 2024, the Company detected a ransomware cybersecurity incident (“Incident”) in which an unauthorized third party gained access to certain of the Company’s internal information systems. Upon detection, the Company activated its cybersecurity response plan and launched an investigation internally with the support of external advisors to assess and to contain the threat.

The incident has caused disruptions and limitation of access to certain of the Company’s information systems and business applications supporting aspects of the Company’s operations and corporate functions, including financial and operating reporting systems. However, the Company’s manufacturing and field operations have continued in all material respects utilizing established downtime procedures.

The full scope of the costs and related impacts of the Incident, including any future impact on our financial condition and results of operations, has not yet been determined. Based on the Company's current knowledge of the facts and circumstances related to this incident, the Company believes that this incident is not reasonably likely to materially impact the Company's financial conditions or results of operations. Should any of the relevant facts and circumstances substantively change, the Company will make any required disclosures.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NEWPARK RESOURCES, INC. |

| | | (Registrant) |

| | | | |

| Date: | November 7, 2024 | By: | /s/ Gregg S. Piontek |

| | | Gregg S. Piontek |

| | | | Senior Vice President and Chief Financial Officer |

| | | | (Principal Financial Officer) |

Exhibit 99.1

NEWPARK RESOURCES REPORTS THIRD QUARTER 2024 RESULTS

THE WOODLANDS, Texas – November 7, 2024 – Newpark Resources, Inc. (NYSE: NR) (“Newpark” or the “Company”) today announced results for the third quarter ended September 30, 2024.

On September 13, 2024, the Company completed the sale of its equity interests in substantially all of the Company’s Fluids Systems segment. The results of the Fluids Systems segment are reported in discontinued operations for all periods.

THIRD QUARTER 2024 RESULTS

•Revenue of $44.2 million

•Operating income from continuing operations of $1.2 million

•Income from continuing operations of $14.9 million, which includes a $14.6 million tax benefit; Adjusted Income from Continuing Operations of $0.3 million

•Adjusted EBITDA from Continuing Operations of $7.5 million

•Adjusted EBITDA Margin from Continuing Operations of 17.0%

•$70 million of initial cash proceeds from the sale of Fluids Systems; net deferred consideration and note receivable of $18 million as of September 30, 2024

•Total cash of $43 million and debt of $14 million as of September 30, 2024

| | | | | | | | | | | | | | | | | | | | |

| Third Quarter | | | |

| (In millions) | 2024 | | 2023 | | Change | |

| Revenues | $ | 44.2 | | | $ | 57.3 | | | $ | (13.1) | | |

| Operating income from continuing operations | $ | 1.2 | | | $ | 6.3 | | | $ | (5.1) | | |

| Net cash provided by operating activities | $ | 2.8 | | | $ | 27.0 | | | $ | (24.2) | | |

| Free Cash Flow | $ | (5.6) | | | $ | 22.9 | | | $ | (28.5) | | |

| Industrial Solutions Segment | | | | | | |

| Revenues | $ | 44.2 | | | $ | 57.3 | | | $ | (13.1) | | |

| Operating income | $ | 7.3 | | | $ | 14.3 | | | $ | (7.0) | | |

| Adjusted EBITDA | $ | 12.5 | | | $ | 19.7 | | | $ | (7.2) | | |

| Operating margin (%) | 16.5 | % | | 25.0 | % | | -850 | bps |

| Adjusted EBITDA margin (%) | 28.3 | % | | 34.4 | % | | -610 | bps |

MANAGEMENT COMMENTARY

“Our third quarter performance was impacted by a combination of certain key customers shifting their priorities from scheduled transmission projects to renewable generation projects, unfavorable weather conditions, and an extended unplanned maintenance event at our Louisiana manufacturing facility,” stated Matthew Lanigan, President and CEO of Newpark. “In total, the seasonal pullback in rental revenues and six-weeks of facility maintenance impacted third quarter Adjusted EBITDA by nearly $5 million,” continued Lanigan. “The facility has been operating at normal production levels since the start of the fourth quarter.”

“Following the more pronounced seasonal effects, customer activity rebounded sharply as we exited the third quarter,” continued Lanigan. “October set a new monthly record for rental volume, putting us on pace for very strong fourth quarter rental revenues.”

“Our disciplined, return-driven approach to capital allocation remains central to our value creation thesis,” stated Lanigan. “We intend to prioritize organic investment in rental fleet, while returning capital to shareholders through our programmatic share repurchase program. With the Fluids divestiture completed,

we have begun simplifying our business structure and streamlining our support structure around a core site access solutions offering and expect to remain opportunistic acquirors of complementary assets that further enhance our customer value proposition, expand our addressable market, and further support our strategic focus on profitable growth.”

“We remain highly constructive on both the near and longer-term outlook for our business,” continued Lanigan. “Entering 2025, our entire organization is solely focused on the significant market opportunity we see in site access solutions. From multi-billion-dollar investment programs focused on high-grading the United States’ aging electricity grid, to the exponential growth in advanced computing data centers, our platform is uniquely equipped to support next-generation investments in our nation’s infrastructure.”

BUSINESS UPDATE

Newpark is engaged in a multi-year business transformation plan designed to drive organic commercial growth within targeted, higher-margin product and rental markets; improve asset optimization and organizational efficiency; and pursue a capital allocation strategy that prioritizes investments in opportunities with superior return profiles, together with a programmatic return of capital program.

The third quarter of 2024 was highlighted by the following:

•Completed Fluids Systems sale. On September 13, 2024, we completed the sale of the equity interests in substantially all of the Company’s Fluids Systems segment to SCF Partners, a leading private equity firm serving the global energy industry. The sale marks an important strategic milestone for our Company as we focus on growing our scale as a leading, pure-play specialty rental and services business in the global worksite access and critical infrastructure markets.

•Strong balance sheet management. We ended the third quarter of 2024 with total cash of $43 million, total debt of $14 million, and available liquidity under our ABL credit facility of $56 million. Additionally, we have $18 million of net deferred consideration and note receivable from the Fluids Systems sale as of September 30, 2024.

•Summer seasonality in Industrial Solutions segment, but momentum heading into Q4. Industrial Solutions revenue from specialty rental and services decreased to $32 million for the third quarter of 2024, driven by higher summer seasonality impacts as compared to historical experience, caused by key customers shifting their priorities from scheduled transmission projects to renewable generation projects and exceptionally hot and dry weather, particularly in the southern U.S. Revenues from product sales decreased to $12 million for the third quarter of 2024, reflecting typical quarterly fluctuations in order and delivery timing. Following the more pronounced seasonal slowdown in customer projects in the third quarter of 2024, we expect revenues to meaningfully improve in the fourth quarter of 2024, benefitting from higher customer rental project activity and product sales.

•Robust return of capital program. In February 2024, the Board of Directors increased the authorization for repurchases of common stock up to $50.0 million. No share repurchases were made in the first nine months of 2024, due to trading blackout restrictions associated with the Fluids Systems sale process that was completed in September 2024.

FINANCIAL PERFORMANCE

In the third quarter of 2024, Newpark generated income from continuing operations of $14.9 million, or $0.17 per diluted share, on total revenue of $44.2 million, compared to income from continuing operations of $2.7 million, or $0.03 per diluted share, on total revenue of $57.3 million, in the prior year period. Income from continuing operations for the third quarter of 2024 includes an income tax benefit of $14.6 million primarily reflecting the release of valuation allowances on U.S. net operating losses and other tax credit carryforwards following the sale of the Fluids Systems business. The Company reported Adjusted

EBITDA from Continuing Operations of $7.5 million in the third quarter 2024, or 17.0% of total revenue, compared to $12.0 million, or 21.0% of total revenue, in the third quarter 2023.

Industrial Solutions segment operating income was $7.3 million in the third quarter of 2024, compared to $14.3 million in the prior year period. Corporate office expenses were $6.1 million in the third quarter 2024, compared to $8.1 million in the prior year period.

BALANCE SHEET AND LIQUIDITY

As of September 30, 2024, Newpark had total cash of $43 million, total debt of $14 million, and available liquidity under our U.S. ABL credit facility of $56 million. Additionally, we have $18 million of net deferred consideration and note receivable from the Fluids Systems sale as of September 30, 2024.

Newpark generated $3 million of operating cash flow in the third quarter 2024, which includes $6 million usage associated with an increase in net working capital within the Fluids Systems business. Capital investments used $8 million, net, primarily funding the expansion of the mat rental fleet to support the October 2024 surge in rental demand. The Company also used $36 million of cash to reduce debt.

FINANCIAL GUIDANCE

The following forward-looking guidance reflects the Company’s current expectations and beliefs as of November 7, 2024 and is subject to change. The following statements apply only as of the date of this disclosure and are expressly qualified in their entirety by the cautionary statements included elsewhere in this document.

For the full year 2024, Newpark currently anticipates the following:

•Industrial Solutions segment revenue in a range of $217 million to $223 million

•Industrial Solutions segment Adjusted EBITDA in a range of $77 million to $81 million

•Total Industrial Solutions capital expenditures in a range of $33 million to $35 million

THIRD QUARTER 2024 RESULTS CONFERENCE CALL

A conference call will be held Friday, November 8, 2024 at 9:30 a.m. ET to review the Company’s financial results and conduct a question-and-answer session.

A webcast of the conference call will be available in the Investor Relations section of the Company’s website at www.newpark.com. Individuals can also participate by teleconference dial-in. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software.

To participate in the live teleconference:

| | | | | |

Domestic Live: | 800-274-8461 |

International Live: | 203-518-9814 |

Conference ID: | NRQ324 |

To listen to a replay of the teleconference, which subsequently will be available through November 15, 2024:

| | | | | |

Domestic Replay: | 877-710-5302 |

International Replay: | 402-220-1605 |

ABOUT NEWPARK RESOURCES

Newpark Resources, Inc. is a site access solutions company that manufactures, sells, and rents industry-leading sustainable composite matting products, along with a full suite of services, including planning, logistics, and remediation. As a geographically diversified company, we deliver superior quality and reliability across critical infrastructure markets, including electrical transmission & distribution, oil and gas exploration, pipeline, renewable energy, petrochemical, construction, and other industries. For more information, visit our website at www.newpark.com.

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical facts are forward-looking statements. Words such as “will,” “may,” “could,” “would,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying them. These statements are not guarantees that our expectations will prove to be correct and involve a number of risks, uncertainties, and assumptions. Many factors, including those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by Newpark, particularly its

Annual Report on Form 10-K, and its Quarterly Reports on Form 10-Q, as well as others, could cause actual plans or results to differ materially from those expressed in, or implied by, these statements. These risk factors include, but are not limited to, risks related to our focus on growth of our Industrial Solutions business; the expected benefits from the recently completed sale of our Fluids Systems business; economic and market conditions that may impact our customers’ future spending; the ongoing conflicts in Europe and the Middle East; operating hazards present in the industries in which our customers operate; our contracts that can be terminated or downsized by our customers without penalty; our product offering and market expansion; our ability to attract, retain, and develop qualified leaders, key employees, and skilled personnel; expanding our services in the utilities sector, which may require unionized labor; the price and availability of raw materials; inflation; capital investments and any future business acquisitions; market competition; technological developments and intellectual property; severe weather, natural disasters, and seasonality; public health crises, epidemics, and pandemics; our cost and continued availability of borrowed funds, including noncompliance with debt covenants; environmental laws and regulations; legal compliance; the inherent limitations of insurance coverage; income taxes; cybersecurity incidents or business system disruptions; activist stockholders that may attempt to effect changes at our Company or acquire control over our Company; share repurchases; and our amended and restated bylaws, which could limit our stockholders’ ability to obtain what such stockholders believe to be a favorable judicial forum for disputes with us or our directors, officers or other employees. We assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities laws. Newpark's filings with the Securities and Exchange Commission can be obtained at no charge at www.sec.gov, as well as through our website at www.newpark.com.

IR CONTACT

Noel Ryan or Paul Bartolai

Investors@Newpark.com

Newpark Resources, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (In thousands, except per share data) | September 30,

2024 | | June 30, 2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Revenues | $ | 44,207 | | | $ | 66,791 | | | $ | 57,262 | | | $ | 159,965 | | | $ | 161,193 | |

| Cost of revenues | 32,067 | | | 41,966 | | | 37,602 | | | 105,358 | | | 104,528 | |

| Selling, general and administrative expenses | 11,005 | | | 12,750 | | | 13,910 | | | 35,335 | | | 40,834 | |

| Other operating (income) loss, net | (99) | | | (432) | | | (523) | | | (1,435) | | | (1,032) | |

| Operating income from continuing operations | 1,234 | | | 12,507 | | | 6,273 | | | 20,707 | | | 16,863 | |

| | | | | | | | | |

| Foreign currency exchange (gain) loss | (562) | | | 487 | | | 514 | | | 170 | | | (172) | |

| Interest expense, net | 943 | | | 909 | | | 1,017 | | | 2,612 | | | 3,154 | |

| Income from continuing operations before income taxes | 853 | | | 11,111 | | | 4,742 | | | 17,925 | | | 13,881 | |

| | | | | | | | | |

Provision (benefit) for income taxes from continuing operations (1) | (14,016) | | | 2,483 | | | 2,062 | | | (9,626) | | | 4,900 | |

| Income from continuing operations | 14,869 | | | 8,628 | | | 2,680 | | | 27,551 | | | 8,981 | |

| | | | | | | | | |

| Discontinued operations: | | | | | | | | | |

| Income from discontinued operations before income taxes | 629 | | | 264 | | | 6,923 | | | 5,072 | | | 9,353 | |

| Loss on sale of discontinued operations before income taxes | (195,729) | | | — | | | — | | | (195,729) | | | — | |

| Provision (benefit) for income taxes from discontinued operations | (5,933) | | | 852 | | | 1,933 | | | (4,141) | | | 3,342 | |

| Income (loss) from discontinued operations | (189,167) | | | (588) | | | 4,990 | | | (186,516) | | | 6,011 | |

| | | | | | | | | |

| Net income (loss) | $ | (174,298) | | | $ | 8,040 | | | $ | 7,670 | | | $ | (158,965) | | | $ | 14,992 | |

| | | | | | | | | |

| Income (loss) per common share - basic: | | | | | | | | | |

| Income from continuing operations | $ | 0.17 | | | $ | 0.10 | | | $ | 0.03 | | | $ | 0.32 | | | $ | 0.10 | |

| Income (loss) from discontinued operations | (2.19) | | | (0.01) | | | 0.06 | | | (2.18) | | | 0.07 | |

| Net income (loss) | $ | (2.02) | | | $ | 0.09 | | | $ | 0.09 | | | $ | (1.86) | | | $ | 0.17 | |

| | | | | | | | | |

| Income (loss) per common share - diluted: | | | | | | | | | |

| Income from continuing operations | $ | 0.17 | | | $ | 0.10 | | | $ | 0.03 | | | $ | 0.32 | | | $ | 0.10 | |

| Income (loss) from discontinued operations | (2.16) | | | (0.01) | | | 0.06 | | | (2.13) | | | 0.07 | |

| Net income (loss) | $ | (1.99) | | | $ | 0.09 | | | $ | 0.09 | | | $ | (1.82) | | | $ | 0.17 | |

| | | | | | | | | |

| Weighted average shares: | | | | | | | | | |

| Basic | 86,377 | | | 85,473 | | | 86,310 | | | 85,619 | | | 86,873 | |

| Diluted | 87,490 | | | 87,626 | | | 88,034 | | | 87,453 | | | 88,683 | |

(1) Provision (benefit) for income taxes from continuing operations for the three and nine months ended September 30, 2024 includes an income tax benefit of $14.6 million primarily reflecting the release of valuation allowances on U.S. net operating losses and other tax credit carryforwards following the sale of the Fluids Systems business.

Newpark Resources, Inc.

Operating Segment Results

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (In thousands) | September 30,

2024 | | June 30, 2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Revenues | | | | | | | | | |

| Rental and service revenues | $ | 32,408 | | | $ | 36,396 | | | $ | 38,065 | | | $ | 103,985 | | | $ | 114,374 | |

| Product sales revenues | 11,799 | | | 30,395 | | | 19,197 | | | 55,980 | | | 46,819 | |

| Total revenues (Industrial Solutions) | $ | 44,207 | | | $ | 66,791 | | | $ | 57,262 | | | $ | 159,965 | | | $ | 161,193 | |

| | | | | | | | | |

| Operating income (loss) from continuing operations | | | | | | | | | |

| Industrial Solutions | $ | 7,286 | | | $ | 19,392 | | | $ | 14,336 | | | $ | 39,614 | | | $ | 41,593 | |

| Corporate office | (6,052) | | | (6,885) | | | (8,063) | | | (18,907) | | | (24,730) | |

| Total operating income from continuing operations | $ | 1,234 | | | $ | 12,507 | | | $ | 6,273 | | | $ | 20,707 | | | $ | 16,863 | |

| | | | | | | | | |

| Segment operating margin | | | | | | | | | |

| Industrial Solutions | 16.5 | % | | 29.0 | % | | 25.0 | % | | 24.8 | % | | 25.8 | % |

Newpark Resources, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (In thousands, except share data) | September 30,

2024 | | December 31, 2023 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 42,907 | | | $ | 789 | |

Receivables, net (1) | 54,561 | | | 42,818 | |

| Inventories | 14,910 | | | 18,606 | |

| Prepaid expenses and other current assets | 4,596 | | | 4,690 | |

| Current assets of discontinued operations | — | | | 290,321 | |

| Total current assets | 116,974 | | | 357,224 | |

| | | |

| Property, plant and equipment, net | 179,690 | | | 165,544 | |

| Operating lease assets | 10,481 | | | 11,192 | |

| Goodwill | 47,461 | | | 47,283 | |

| Other intangible assets, net | 10,864 | | | 12,461 | |

| Deferred tax assets | 17,519 | | | 1,367 | |

| Other assets | 6,617 | | | 1,582 | |

| Noncurrent assets of discontinued operations | — | | | 45,683 | |

| Total assets | $ | 389,606 | | | $ | 642,336 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current debt | $ | 8,457 | | | $ | 6,319 | |

| Accounts payable | 19,130 | | | 16,345 | |

| Accrued liabilities | 23,572 | | | 21,026 | |

| Current liabilities of discontinued operations | — | | | 92,594 | |

| Total current liabilities | 51,159 | | | 136,284 | |

| | | |

| Long-term debt, less current portion | 5,506 | | | 55,710 | |

| Noncurrent operating lease liabilities | 9,957 | | | 10,713 | |

| Deferred tax liabilities | 1,209 | | | 3,697 | |

| Other noncurrent liabilities | 5,321 | | | 4,191 | |

| Noncurrent liabilities of discontinued operations | — | | | 16,377 | |

| Total liabilities | 73,152 | | | 226,972 | |

| | | |

| Common stock, $0.01 par value (200,000,000 shares authorized and 111,669,464 and 111,669,464 shares issued, respectively) | 1,117 | | | 1,117 | |

| Paid-in capital | 632,165 | | | 639,645 | |

| Accumulated other comprehensive loss | (2,766) | | | (62,839) | |

| Retained earnings (deficit) | (148,161) | | | 10,773 | |

| Treasury stock, at cost (25,172,166 and 26,471,738 shares, respectively) | (165,901) | | | (173,332) | |

| Total stockholders’ equity | 316,454 | | | 415,364 | |

| Total liabilities and stockholders’ equity | $ | 389,606 | | | $ | 642,336 | |

(1) Receivables, net as of September 30, 2024, includes $20.0 million for estimated deferred consideration related to the sale of the Fluids Systems business.

Newpark Resources, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (In thousands) | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (158,965) | | | $ | 14,992 | |

| Adjustments to reconcile net income (loss) to net cash provided by operations: | | | |

| Loss on divestitures | 195,729 | | | — | |

| Impairments and other non-cash charges | — | | | 2,816 | |

| Depreciation and amortization | 21,804 | | | 23,507 | |

| Stock-based compensation expense | 4,119 | | | 4,967 | |

| Provision for deferred income taxes | (22,290) | | | (1,031) | |

| Credit loss expense | 998 | | | 827 | |

| Gain on sale of assets | (2,412) | | | (2,176) | |

| Gain on insurance recovery | (874) | | | — | |

| Amortization of original issue discount and debt issuance costs | 885 | | | 409 | |

| Change in assets and liabilities: | | | |

| (Increase) decrease in receivables | (13,734) | | | 33,917 | |

| (Increase) decrease in inventories | 9,481 | | | (2,160) | |

| Increase in other assets | (1,027) | | | (2,133) | |

| Increase (decrease) in accounts payable | 12,498 | | | (11,179) | |

| Increase (decrease) in accrued liabilities and other | (3,916) | | | 1,086 | |

| Net cash provided by operating activities | 42,296 | | | 63,842 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (29,940) | | | (20,134) | |

| Proceeds from divestitures, net of cash disposed | 48,499 | | | 19,355 | |

| Proceeds from sale of property, plant and equipment | 3,188 | | | 2,952 | |

| Proceeds from insurance property claim | 1,385 | | | — | |

| Net cash provided by investing activities | 23,132 | | | 2,173 | |

| | | |

| Cash flows from financing activities: | | | |

| Borrowings on lines of credit | 177,541 | | | 198,486 | |

| Payments on lines of credit | (224,292) | | | (229,657) | |

| Debt issuance costs | (50) | | | — | |

| Purchases of treasury stock | (4,504) | | | (28,226) | |

| Proceeds from employee stock plans | 17 | | | 179 | |

| Other financing activities | (9,538) | | | (2,950) | |

| Net cash used in financing activities | (60,826) | | | (62,168) | |

| | | |

| Effect of exchange rate changes on cash | (119) | | | (504) | |

| | | |

| Net increase in cash, cash equivalents, and restricted cash | 4,483 | | | 3,343 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 38,901 | | | 25,061 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 43,384 | | | $ | 28,404 | |

Newpark Resources, Inc.

Non-GAAP Reconciliations

(Unaudited)

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include Adjusted Income (Loss) from Continuing Operations, Adjusted Income (Loss) from Continuing Operations Per Common Share, earnings before interest, taxes, depreciation and amortization (“EBITDA”) from Continuing Operations, Adjusted EBITDA from Continuing Operations, Free Cash Flow, and Adjusted EBITDA Margin from Continuing Operations.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and liquidity with that of other companies in our industry. Management uses these measures to evaluate our operating performance, liquidity and capital structure. In addition, our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP.

Adjusted Income (Loss) from Continuing Operations and Adjusted Income (Loss) from Continuing Operations Per Common Share

The following tables reconcile the Company’s income (loss) from continuing operations and income (loss) from continuing operations per common share calculated in accordance with GAAP to the non-GAAP financial measures of Adjusted Net Income (Loss) from Continuing Operations and Adjusted Net Income (Loss) from Continuing Operations Per Common Share:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | Nine Months Ended |

| (In thousands) | September 30,

2024 | | June 30, 2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Income from continuing operations (GAAP) | $ | 14,869 | | | $ | 8,628 | | | $ | 2,680 | | | $ | 27,551 | | | $ | 8,981 | |

| Gain on insurance recovery | — | | | — | | | — | | | (67) | | | — | |

| Gain on legal settlement | — | | | — | | | — | | | (550) | | | — | |

| Severance costs | 113 | | | 175 | | | 466 | | | 921 | | | 1,487 | |

| Tax on adjustments | (24) | | | (37) | | | (98) | | | (64) | | | (312) | |

Unusual tax items (1) | (14,617) | | | — | | | — | | | (14,617) | | | — | |

| Adjusted Income from Continuing Operations (non-GAAP) | $ | 341 | | | $ | 8,766 | | | $ | 3,048 | | | $ | 13,174 | | | $ | 10,156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Income from Continuing Operations (non-GAAP) | $ | 341 | | | $ | 8,766 | | | $ | 3,048 | | | $ | 13,174 | | | $ | 10,156 | |

| | | | | | | | | |

| Weighted average common shares outstanding - basic | 86,377 | | | 85,473 | | | 86,310 | | | 85,619 | | | 86,873 | |

| Dilutive effect of stock options and restricted stock awards | 1,113 | | | 2,153 | | | 1,724 | | | 1,834 | | | 1,810 | |

| Weighted average common shares outstanding - diluted | 87,490 | | | 87,626 | | | 88,034 | | | 87,453 | | | 88,683 | |

| | | | | | | | | |

| Adjusted Income from Continuing Operations Per Common Share - Diluted (non-GAAP): | $ | — | | | $ | 0.10 | | | $ | 0.03 | | | $ | 0.15 | | | $ | 0.11 | |

(1) Unusual tax items primarily reflects the release of valuation allowances on U.S. net operating losses and other tax credit carryforwards that are now expected to be realized following the sale of the Fluids Systems business.

Newpark Resources, Inc.

Non-GAAP Reconciliations (Continued)

(Unaudited)

EBITDA from Continuing Operations, Adjusted EBITDA from Continuing Operations, and Adjusted EBITDA Margin from Continuing Operations

The following table reconciles the Company’s income (loss) from continuing operations calculated in accordance with GAAP to the non-GAAP financial measures of EBITDA from Continuing Operations, Adjusted EBITDA from Continuing Operations, and Adjusted EBITDA Margin from Continuing Operations:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | Nine Months Ended |

| (In thousands) | September 30,

2024 | | June 30, 2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Revenues | $ | 44,207 | | | $ | 66,791 | | | $ | 57,262 | | | $ | 159,965 | | | $ | 161,193 | |

| Income from continuing operations (GAAP) | $ | 14,869 | | | $ | 8,628 | | | $ | 2,680 | | | $ | 27,551 | | | $ | 8,981 | |

| Interest expense, net | 943 | | | 909 | | | 1,017 | | | 2,612 | | | 3,154 | |

| Provision (benefit) for income taxes | (14,016) | | | 2,483 | | | 2,062 | | | (9,626) | | | 4,900 | |

| Depreciation and amortization | 5,592 | | | 5,674 | | | 5,821 | | | 16,932 | | | 17,688 | |

| EBITDA from Continuing Operations (non-GAAP) | 7,388 | | | 17,694 | | | 11,580 | | | 37,469 | | | 34,723 | |

| Gain on insurance recovery | — | | | — | | — | | | (67) | | | — | |

| Gain on legal settlement | — | | | — | | — | | | (550) | | | — | |

| Severance costs | 113 | | | 175 | | 466 | | | 921 | | | 1,487 | |

| Adjusted EBITDA from Continuing Operations (non-GAAP) | $ | 7,501 | | | $ | 17,869 | | | $ | 12,046 | | | $ | 37,773 | | | $ | 36,210 | |

| Adjusted EBITDA Margin from Continuing Operations (non-GAAP) | 17.0 | % | | 26.8 | % | | 21.0 | % | | 23.6 | % | | 22.5 | % |

Free Cash Flow

The following table reconciles the Company’s net cash provided by operating activities calculated in accordance with GAAP to the non-GAAP financial measure of Free Cash Flow:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | Nine Months Ended |

| (In thousands) | September 30,

2024 | | June 30, 2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Net cash provided by operating activities (GAAP) | $ | 2,765 | | | 27,581 | | | $ | 26,994 | | | $ | 42,296 | | | $ | 63,842 | |

| Capital expenditures | (9,472) | | | (6,586) | | | (4,787) | | | (29,940) | | | (20,134) | |

| Proceeds from sale of property, plant and equipment | 1,146 | | | 899 | | | 648 | | | 3,188 | | | 2,952 | |

| Free Cash Flow (non-GAAP) | $ | (5,561) | | | $ | 21,894 | | | $ | 22,855 | | | $ | 15,544 | | | $ | 46,660 | |

Newpark Resources, Inc.

Non-GAAP Reconciliations (Continued)

(Unaudited)

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

The following tables reconcile the Company’s segment operating income calculated in accordance with GAAP to the non-GAAP financial measures of EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Industrial Solutions | Three Months Ended | | Nine Months Ended |

| (In thousands) | September 30,

2024 | | June 30, 2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Revenues | $ | 44,207 | | | $ | 66,791 | | | $ | 57,262 | | | $ | 159,965 | | | $ | 161,193 | |

| Operating income (GAAP) | 7,286 | | | $ | 19,392 | | | $ | 14,336 | | | $ | 39,614 | | | $ | 41,593 | |

| Depreciation and amortization | 5,155 | | | 5,215 | | | 5,224 | | | 15,551 | | | 15,758 | |

| EBITDA (non-GAAP) | 12,441 | | | 24,607 | | | 19,560 | | | 55,165 | | | 57,351 | |

| Gain on insurance recovery | — | | | — | | — | | | (67) | | | — | |

| Gain on legal settlement | — | | | — | | — | | | (550) | | | — | |

| Severance costs | 49 | | | 175 | | 162 | | | 742 | | | 254 | |

| Adjusted EBITDA (non-GAAP) | $ | 12,490 | | | $ | 24,782 | | | $ | 19,722 | | | $ | 55,290 | | | $ | 57,605 | |

| Operating Margin (GAAP) | 16.5 | % | | 29.0 | % | | 25.0 | % | | 24.8 | % | | 25.8 | % |

| Adjusted EBITDA Margin (non-GAAP) | 28.3 | % | | 37.1 | % | | 34.4 | % | | 34.6 | % | | 35.7 | % |

Newpark Resources, Inc.

Non-GAAP Reconciliations (Continued)

(Unaudited)

Trailing Twelve Months (“TTM”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended | | TTM |

| (In thousands) | December 31,

2023 | | March 31,

2024 | | June 30,

2024 | | September 30,

2024 | | September 30,

2024 |

| Revenues | $ | 46,455 | | $ | 48,967 | | $ | 66,791 | | $ | 44,207 | | | $ | 206,420 | |

| Income from Continuing Operations (GAAP) | $ | 5,168 | | $ | 4,054 | | $ | 8,628 | | $ | 14,869 | | | $ | 32,719 | |

| Interest expense, net | 953 | | 760 | | 909 | | 943 | | | 3,565 | |

| Provision (benefit) for income taxes | 673 | | 1,907 | | 2,483 | | (14,016) | | | (8,953) | |

| Depreciation and amortization | 5,908 | | 5,666 | | 5,674 | | 5,592 | | | 22,840 | |

| EBITDA from Continuing Operations (non-GAAP) | 12,702 | | | 12,387 | | | 17,694 | | | 7,388 | | | 50,171 | |

| Gain on insurance recovery | — | | (67) | | — | | — | | | (67) | |

| Gain on legal settlement | — | | (550) | | — | | — | | | (550) | |

| Severance costs | — | | 633 | | 175 | | 113 | | | 921 | |

| Adjusted EBITDA from Continuing Operations (non-GAAP) | $ | 12,702 | | | $ | 12,403 | | | $ | 17,869 | | | $ | 7,501 | | | $ | 50,475 | |

| Adjusted EBITDA Margin from Continuing Operations (non-GAAP) | 27.3 | % | | 25.3 | % | | 26.8 | % | | 17.0 | % | | 24.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Industrial Solutions | Three Months Ended | | TTM |

| (In thousands) | December 31,

2023 | | March 31,

2024 | | June 30,

2024 | | September 30,

2024 | | September 30,

2024 |

| Revenues | $ | 46,455 | | $ | 48,967 | | $ | 66,791 | | $ | 44,207 | | | $ | 206,420 | |

| Operating income (GAAP) | $ | 11,415 | | $ | 12,936 | | $ | 19,392 | | $ | 7,286 | | | $ | 51,029 | |

| Depreciation and amortization | 5,350 | | 5,181 | | 5,215 | | 5,155 | | | 20,901 | |

| EBITDA (non-GAAP) | 16,765 | | | 18,117 | | | 24,607 | | | 12,441 | | | 71,930 | |

| Gain on insurance recovery | — | | (67) | | — | | — | | | (67) | |

| Gain on legal settlement | — | | (550) | | — | | — | | | (550) | |

| Severance costs | — | | 518 | | 175 | | 49 | | | 742 | |

| Adjusted EBITDA (non-GAAP) | $ | 16,765 | | | $ | 18,018 | | | $ | 24,782 | | | $ | 12,490 | | | $ | 72,055 | |

| Operating Margin (GAAP) | 24.6 | % | | 26.4 | % | | 29.0 | % | | 16.5 | % | | 24.7 | % |

| Adjusted EBITDA Margin (non-GAAP) | 36.1 | % | | 36.8 | % | | 37.1 | % | | 28.3 | % | | 34.9 | % |

###

v3.24.3

Cover Page

|

Oct. 29, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0000071829

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity Registrant Name |

Newpark Resources, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-02960

|

| Entity Tax Identification Number |

72-1123385

|

| Entity Address, Address Line One |

9320 Lakeside Boulevard,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77381

|

| City Area Code |

281

|

| Local Phone Number |

362-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

NR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

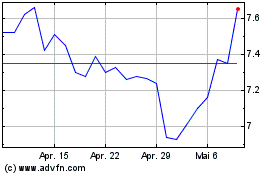

Newpark Resources (NYSE:NR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Newpark Resources (NYSE:NR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024