UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission file number: 001-34936

Noah Holdings Limited

1226 South Shenbin Road

Shanghai 201107

People’s Republic of China

+86 (21) 8035-8292

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Noah Holdings Limited |

| |

|

|

| |

By: |

/s/ Qing Pan |

| |

|

Name: Qing Pan |

| |

|

Title: Chief Financial Officer |

Date: September 21, 2023

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited

and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to

its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon

the whole or any part of the contents of this announcement.

Noah

Holdings

Noah

Holdings Private Wealth and Asset Management Limited

諾亞控股私人財富資產管理有限公司

(Incorporated

in the Cayman Islands with limited liability under the name Noah Holdings Limited and carrying on business in Hong Kong as Noah Holdings

Private Wealth and Asset Management Limited)

(Stock

Code: 6686)

GRANT

OF SHARE OPTIONS AND

RESTRICTED

SHARE UNITS

This announcement is made pursuant to

Rules 17.06A, 17.06B and 17.06C of the Hong Kong Listing Rules. The Board hereby announces that on September 20, 2023 (U.S. Eastern Time),

the Company granted Options to subscribe for an aggregate of 25,000 Shares (represented by 50,000 ADSs) to three Grantees and RSUs involving

an aggregate of 5,000 Shares (represented by 10,000 ADSs) to one Grantee under the 2022 Share Incentive Plan.

GRANT OF SHARE OPTIONS UNDER THE 2022 SHARE INCENTIVE PLAN

On the Date of Grant, the Company granted

Options to subscribe for an aggregate of 25,000 Shares (represented by 50,000 ADSs) to three Grantees in accordance with the terms of

the 2022 Share Incentive Plan.

Details of the Grant of Options

Details of the grant of Options are as follows:

| Date of Grant: |

|

September 20, 2023 (U.S. Eastern Time) |

| |

|

|

| Number of Grantees: |

|

3 |

| |

|

|

| Type of Grantees: |

|

Employee Participants |

| |

|

|

| Number of the Options granted

(in ADSs): |

|

50,000 |

| |

|

|

| Number of underlying Shares

pursuant to the Options granted: |

|

25,000 Shares |

| |

|

|

| Number of new ADSs to be subscribed

upon exercise of the Options granted: |

|

50,000 ADSs |

| |

|

|

| Consideration for the Options

granted: |

|

Nil |

| Exercise

price of the Options granted: |

|

US$12.75 per

ADS (approximately HK$199.46 per Share), which represents the highest of: |

| |

|

|

| |

|

(i) |

the closing price of ADSs

of US$12.27 per ADS (approximately HK$191.95 per Share) on the Date of Grant; and |

| |

|

|

| |

|

(ii) |

the average

closing price of the ADSs of US$12.75 per ADS (approximately HK$199.46 per Share) for the five business days immediately preceding

the Date of Grant. |

| |

|

|

| Closing

price of the ADSs on the Date of Grant: |

|

US$12.27 per

ADS (approximately HK$191.95 per Share) |

| |

|

|

| Exercise

period of the Options: |

|

Subject to

the vesting period set out below, the exercise period of the Options shall be ten years from the Date of Grant, and the Options shall

lapse at the expiry of the exercise period or earlier if the employment relationship has been terminated prior to the expiry of the

exercise period. |

| |

|

|

| Vesting period: |

|

Subject to

the Grantee’s continued employment relationship with the Group on the vesting dates, the Options granted shall vest as follows: |

| |

|

|

| |

|

· |

25% shall vest on the first

anniversary of the Date of Grant; and |

| |

|

|

| |

|

· |

75% shall vest in 36 equal

monthly installments (with each installment vesting at the end of each month) following the first anniversary of the Date of Grant.

|

| |

|

|

| Performance

target(s) and/or clawback mechanism: |

|

There are no

performance targets attached to the grant of Options. |

| |

|

|

| |

|

If the Committee

determines that a Grantee has (i) used for profit or disclosed to unauthorized persons, confidential or trade secrets of the Company

or its subsidiaries; (ii) breached any contract with or violated any fiduciary obligation to the Company or its subsidiaries; or

(iii) engaged in any conduct which the Committee determines is injurious to Company or its subsidiaries, the Committee may cause

such Grantee to forfeit his or her outstanding awards under the 2022 Share Incentive Plan, subject to certain limitations set forth

in the 2022 Share Incentive Plan. |

| |

|

|

| |

|

If the Grantee’s

employment terminates, (i) any portion of the Options granted yet unvested on such termination date shall be immediately forfeited

and automatically lapse without action on the part of the Grantee and be of no further force and effect; and (ii) any portion of

the Options vested yet unexercised on such termination date shall be immediately forfeited and automatically lapse upon the expiry

of 30 days from such termination date without action on the part of the Grantee and be of no further force and effect if the Grantee

fails to exercise his/her Options within 30 days from such termination date. |

| Financial

assistance: |

|

The Group will

not provide any financial assistance to any Grantee to facilitate the purchase of Shares under the 2022 Share Incentive Plan. |

The

grant of Options is subject to the terms and conditions of the 2022 Share Incentive Plan and form of award agreement covering the grants.

GRANT OF RESTRICTED SHARE UNITS UNDER THE 2022 SHARE INCENTIVE

PLAN

On the Date of Grant, the Company granted RSUs

involving an aggregate of 5,000 Shares (represented by 10,000 ADSs) to one Grantee in accordance with the terms of the 2022 Share Incentive

Plan.

Details of the Grant of RSUs

Details

of the grant of RSUs are as follows:

| Date of Grant: |

|

September 20,

2023 (U.S. Eastern Time) |

| |

|

|

| Number of Grantee: |

|

1 |

| |

|

|

| Type of Grantee: |

|

Employee Participant |

| |

|

|

| Number

of the RSUs granted (in ADSs): |

|

10,000 |

| |

|

|

| Number

of underlying Shares pursuant to the RSUs granted: |

|

5,000 Shares |

| |

|

|

| Number

of new ADSs to be acquired upon vesting of the RSUs granted: |

|

10,000 ADSs |

| |

|

|

| Consideration

for the RSUs granted: |

|

Nil |

| |

|

|

| Closing

price of the ADSs on the Date of Grant: |

|

US$12.27 per

ADS (approximately HK$191.95 per Share) |

| |

|

|

| Vesting period: |

|

Subject to

the Grantee’s continued employment relationship with the Group on the vesting dates, the RSUs granted shall vest as follows: |

| |

|

|

| |

|

· |

25% shall vest on the first anniversary of the Date

of Grant; and |

| |

|

|

| |

|

· |

75% shall vest in 36 equal monthly

installments (with each installment vesting at the end of each month) following the first anniversary of the Date of Grant. |

| |

|

|

| Performance target(s) and/or clawback mechanism: |

|

There are no

performance targets attached to the grant of RSUs. |

| |

|

If

the Committee determines that a Grantee has (i) used for profit or disclosed to unauthorized persons, confidential or trade secrets

of the Company or its subsidiaries; (ii) breached any contract with or violated any fiduciary obligation to the Company or its subsidiaries;

or (iii) engaged in any conduct which the Committee determines is injurious to Company or its subsidiaries, the Committee may cause

such Grantee to forfeit his or her outstanding awards under the 2022 Share Incentive Plan, subject to certain limitations set forth

in the 2022 Share Incentive Plan. |

| |

|

|

| |

|

If the Grantee’s employment

terminates, any portion of the RSUs granted yet unvested on such termination date shall be immediately forfeited and automatically

lapse without action on the part of the Grantee and be of no further force and effect. |

The grant of RSUs is subject to the terms and

conditions of the 2022 Share Incentive Plan and form of award agreement covering the grants.

REASONS FOR AND BENEFITS OF THE GRANT OF OPTIONS

The grant of Options and RSUs is to (i) recognize

the contributions made to the Group by the Grantees; (ii) encourage, motivate and retain the Grantees, whose contributions are beneficial

to the continual operation, development and long-term growth of the Group; and (iii) closely align the interests and benefits of and

risk sharing among the Shareholders, the Company and the Grantees in order to maximize the motivation of the employees. The grant recognizes

their past contributions to the Group’s business performance and aims to secure their long-term support and commitment to the Group

which are vital to the future development of the Group. The Company believes that the grant of Options and RSUs serves as important incentives

to motivate them to bring a higher return to the Company.

HONG KONG LISTING RULES IMPLICATIONS

To the best of the Directors’ knowledge,

information and belief having made all reasonable enquiries, the Grantees above are Employee Participants of the Group. As of the date

of this announcement, none of the Grantees above is (i) a Director, or a chief executive, or a senior manager, or a substantial shareholder

of the Company, or an associate of any of them; (ii) a participant with options and awards granted and to be granted exceeding the 1%

individual limit under Rule 17.03D of the Hong Kong Listing Rules; or (iii) a related entity participant or service provider with options

and awards granted and to be granted exceeding 0.1% of the total issued Shares in any 12-month period up to and including the Date of

Grant.

NUMBER OF SHARES AVAILABLE FOR FUTURE GRANT

As of the date of this announcement, after the

grant of Options and RSUs, 2,970,000 underlying Shares will be available for future grants under the Scheme Mandate Limit, and 60,000

underlying Shares will be available for future grants under the Service Provider Sublimit.

DEFINITIONS

| “2022 Share Incentive Plan” |

|

the 2022 share

incentive plan adopted on the annual general meeting held on December 16, 2022 with effect from December 23, 2022 and filed with

the United States Securities and Exchange Commission on December 23, 2022 |

| |

|

|

| “ADSs” |

|

American Depositary Shares

(two ADSs representing one Share) |

| |

|

|

| “associate(s)” |

|

has the meaning ascribed

to it in the Hong Kong Listing Rules |

| |

|

|

| “Board” |

|

the board of the Directors |

| |

|

|

| “Committee” |

|

a committee of one or more

members of the Board to whom the Board has delegated its authority (as applicable) to administer the 2022 Share Incentive Plan |

| |

|

|

| “Company” |

|

Noah Holdings Limited,

an exempted company with limited liability incorporated in the Cayman Islands on June 29, 2007, carrying on business in Hong Kong

as “Noah Holdings Private Wealth and Asset Management Limited (諾亞控股私人財富資產

管理有限公司)” and listed on The Stock Exchange of Hong Kong Limited (Stock Code:

6686) and the New York Stock Exchange (Ticker Symbol: NOAH) |

| |

|

|

| “Date of Grant” “ |

|

September 20, 2023 (U.S.

Eastern Time) |

| |

|

|

| Director(s)” |

|

the director(s) of the

Company |

| |

|

|

| “Employee Participant(s)” |

|

has the meaning ascribed

thereto in Chapter 17 of the Hong Kong Listing Rules |

| |

|

|

| “Grantee(s)” |

|

the Employee Participant(s)

of the Group who were granted Options and/or RSUs in accordance with the 2022 Share Incentive Plan on the Date of Grant |

| |

|

|

| “Group” |

|

the Company, its subsidiaries

and consolidated affiliated entities from time to time |

| |

|

|

| “HK$” |

|

Hong Kong dollars, the

lawful currency of Hong Kong |

| |

|

|

| “Hong Kong” |

|

Hong Kong Special Administrative

Region of the People’s Republic of China |

| |

|

|

| “Hong Kong Listing Rules” |

|

the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited |

| |

|

|

| “Option(s)” |

|

share option(s) entitling

the Grantee(s) to subscribe for or purchase a specified number of Shares (including in the form of ADSs) upon payment of the exercise

price which are granted pursuant to the 2022 Share Incentive Plan |

| “related entity participant” |

|

has the meaning

ascribed thereto in Chapter 17 of the Hong Kong Listing Rules |

| |

|

|

| “RSU(s)” |

|

restricted share unit(s)

entitling the Grantee(s) to acquire Shares subject to the satisfaction of specified vesting condition which are granted under the

2022 Share Incentive Plan |

| |

|

|

| “Scheme Mandate Limit” |

|

the limit on grant(s) of

share option(s) and/or award(s) over new Shares under all share schemes of the Company approved by the Shareholders on the annual

general meeting held on December 16, 2022, which shall not exceed 3,000,000 Shares |

| |

|

|

| “service provider(s)” |

|

has the meaning ascribed

thereto in Chapter 17 of the Hong Kong Listing Rules and as set out under the 2022 Share Incentive Plan |

| |

|

|

| “Service Provider Sublimit” |

|

a sublimit under the Scheme

Mandate Limit for share option(s) and/or award(s) over new Shares under all share schemes of the Company granted to the service providers,

which shall not exceed 60,000 Shares |

| |

|

|

| “Share(s)” |

|

ordinary share(s) of par

value of US$0.0005 each in the share capital of the Company |

| |

|

|

| “Shareholder(s)” |

|

the holder(s) of the Share(s),

and where the context requires, ADSs |

| |

|

|

| “subsidiary(ies)” |

|

has the meaning ascribed

to it in the Hong Kong Listing Rules |

| |

|

|

| “substantial shareholder” |

|

has the meaning ascribed

to it in the Hong Kong Listing Rules |

| |

|

|

| “U.S.” |

|

the United States |

| |

|

|

| “US$” |

|

United States dollars,

the lawful currency of the United States |

| |

|

|

| “%” |

|

per cent |

For the purpose of this announcement and for

illustrative purpose only, conversions of US$ to HK$ are based on the exchange rate of US$1.00 = HK$7.8220. No representation is made

that any amounts in HK$ or US$ can be or could have been converted at the relevant dates at the above rate or at any other rates or at

all.

| |

By

Order of the Board |

| |

Noah

Holdings Private Wealth and Asset Management Limited |

| |

Jingbo

Wang |

| |

Chairwoman

of the Board |

Hong Kong, September 21, 2023

As of the date of this announcement, the Board

comprises Ms. Jingbo Wang, the chairwoman, and Mr. Zhe Yin as Directors; Ms. Chia-Yue Chang, Mr. Kai Wang and Mr. Boquan He as non-executive

Directors; and Dr. Zhiwu Chen, Ms. Cynthia Jinhong Meng, Ms. May Yihong Wu and Mr. Jinbo Yao as independent Directors.

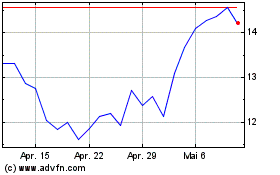

Noah (NYSE:NOAH)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

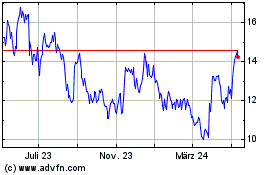

Noah (NYSE:NOAH)

Historical Stock Chart

Von Mai 2023 bis Mai 2024