000006788709/282024Q1false28,753,7503,202,563☒51,28051,280425,148425,148826,170826,170http://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#Liabilitieshttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#Liabilitieshttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpense00000678872023-10-012023-12-300000067887us-gaap:CommonClassAMember2023-10-012023-12-300000067887us-gaap:CommonClassBMember2023-10-012023-12-300000067887us-gaap:CommonClassAMember2024-01-22xbrli:shares0000067887us-gaap:CommonClassBMember2024-01-22iso4217:USD00000678872022-10-022022-12-31iso4217:USDxbrli:shares00000678872023-12-3000000678872023-09-300000067887us-gaap:CommonClassAMember2023-12-300000067887us-gaap:CommonClassAMember2023-09-300000067887us-gaap:CommonClassBMember2023-12-300000067887us-gaap:CommonClassBMember2023-09-300000067887us-gaap:CommonStockMember2023-12-300000067887us-gaap:CommonStockMember2022-12-310000067887us-gaap:AdditionalPaidInCapitalMember2023-09-300000067887us-gaap:AdditionalPaidInCapitalMember2022-10-010000067887us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-300000067887us-gaap:AdditionalPaidInCapitalMember2022-10-022022-12-310000067887us-gaap:AdditionalPaidInCapitalMember2023-12-300000067887us-gaap:AdditionalPaidInCapitalMember2022-12-310000067887us-gaap:RetainedEarningsMember2023-09-300000067887us-gaap:RetainedEarningsMember2022-10-010000067887us-gaap:RetainedEarningsMember2023-10-012023-12-300000067887us-gaap:RetainedEarningsMember2022-10-022022-12-310000067887us-gaap:RetainedEarningsMember2023-12-300000067887us-gaap:RetainedEarningsMember2022-12-310000067887us-gaap:TreasuryStockCommonMember2023-09-300000067887us-gaap:TreasuryStockCommonMember2022-10-010000067887us-gaap:TreasuryStockCommonMember2023-10-012023-12-300000067887us-gaap:TreasuryStockCommonMember2022-10-022022-12-310000067887us-gaap:TreasuryStockCommonMember2023-12-300000067887us-gaap:TreasuryStockCommonMember2022-12-310000067887us-gaap:TrustForBenefitOfEmployeesMember2023-09-300000067887us-gaap:TrustForBenefitOfEmployeesMember2022-10-010000067887us-gaap:TrustForBenefitOfEmployeesMember2023-10-012023-12-300000067887us-gaap:TrustForBenefitOfEmployeesMember2022-10-022022-12-310000067887us-gaap:TrustForBenefitOfEmployeesMember2023-12-300000067887us-gaap:TrustForBenefitOfEmployeesMember2022-12-310000067887mog:SupplementalRetirementPlanTrustMember2023-09-300000067887mog:SupplementalRetirementPlanTrustMember2022-10-010000067887mog:SupplementalRetirementPlanTrustMember2023-10-012023-12-300000067887mog:SupplementalRetirementPlanTrustMember2022-10-022022-12-310000067887mog:SupplementalRetirementPlanTrustMember2023-12-300000067887mog:SupplementalRetirementPlanTrustMember2022-12-310000067887us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000067887us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-010000067887us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012023-12-300000067887us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-022022-12-310000067887us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-300000067887us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100000678872022-12-310000067887us-gaap:CommonClassAMember2022-10-010000067887us-gaap:CommonClassAMember2022-10-022022-12-310000067887us-gaap:CommonClassAMember2022-12-310000067887us-gaap:CommonClassBMember2022-10-010000067887us-gaap:CommonClassBMember2022-10-022022-12-310000067887us-gaap:CommonClassBMember2022-12-310000067887us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-09-300000067887us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2022-10-010000067887us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-10-012023-12-300000067887us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2022-10-022022-12-310000067887us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-12-300000067887us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2022-12-310000067887us-gaap:CommonClassBMemberus-gaap:TreasuryStockCommonMember2023-09-300000067887us-gaap:CommonClassBMemberus-gaap:TreasuryStockCommonMember2022-10-010000067887us-gaap:CommonClassBMemberus-gaap:TreasuryStockCommonMember2023-10-012023-12-300000067887us-gaap:CommonClassBMemberus-gaap:TreasuryStockCommonMember2022-10-022022-12-310000067887us-gaap:CommonClassBMemberus-gaap:TreasuryStockCommonMember2023-12-300000067887us-gaap:CommonClassBMemberus-gaap:TreasuryStockCommonMember2022-12-310000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassAMember2023-12-300000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassAMember2022-12-310000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassBMember2023-09-300000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassBMember2022-10-010000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassBMember2023-10-012023-12-300000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassBMember2022-10-022022-12-310000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassBMember2023-12-300000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassBMember2022-12-310000067887mog:SupplementalRetirementPlanTrustMemberus-gaap:CommonClassBMember2023-12-300000067887mog:SupplementalRetirementPlanTrustMemberus-gaap:CommonClassBMember2022-12-310000067887us-gaap:CommonStockMember2023-09-300000067887us-gaap:CommonStockMember2022-10-010000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassAMember2023-09-300000067887us-gaap:TrustForBenefitOfEmployeesMemberus-gaap:CommonClassAMember2022-10-010000067887mog:SupplementalRetirementPlanTrustMemberus-gaap:CommonClassBMember2023-09-300000067887mog:SupplementalRetirementPlanTrustMemberus-gaap:CommonClassBMember2022-10-0100000678872022-10-010000067887srt:MinimumMember2023-10-012023-12-300000067887srt:MaximumMember2023-10-012023-12-30xbrli:pure00000678872024-01-012023-12-300000067887mog:DCLMembermog:MilitaryAircraftMember2023-10-202023-10-200000067887mog:DCLMembermog:MilitaryAircraftMember2023-10-200000067887mog:TriTechMembermog:IndustrialMember2022-09-302022-09-300000067887mog:NavAidsSaleMembermog:MilitaryAircraftMember2021-12-032021-12-0300000678872023-12-130000067887us-gaap:AssetPledgedAsCollateralMember2023-12-300000067887mog:SpaceAndDefenseMember2023-09-300000067887mog:MilitaryAircraftMember2023-09-300000067887mog:CommercialAircraftMember2023-09-300000067887mog:IndustrialMember2023-09-300000067887mog:SpaceAndDefenseMember2023-10-012023-12-300000067887mog:MilitaryAircraftMember2023-10-012023-12-300000067887mog:CommercialAircraftMember2023-10-012023-12-300000067887mog:IndustrialMember2023-10-012023-12-300000067887mog:SpaceAndDefenseMember2023-12-300000067887mog:MilitaryAircraftMember2023-12-300000067887mog:CommercialAircraftMember2023-12-300000067887mog:IndustrialMember2023-12-300000067887us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-300000067887us-gaap:CustomerRelatedIntangibleAssetsMember2023-09-300000067887us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-300000067887us-gaap:TechnologyBasedIntangibleAssetsMember2023-09-300000067887us-gaap:CustomerContractsMember2023-12-300000067887us-gaap:CustomerContractsMember2023-09-300000067887us-gaap:MarketingRelatedIntangibleAssetsMember2023-12-300000067887us-gaap:MarketingRelatedIntangibleAssetsMember2023-09-300000067887us-gaap:OtherIntangibleAssetsMember2023-12-300000067887us-gaap:OtherIntangibleAssetsMember2023-09-300000067887mog:MoogAircraftServicesAsiaMemberus-gaap:OtherAssetsMember2023-12-300000067887mog:MoogAircraftServicesAsiaMemberus-gaap:OtherAssetsMember2023-09-300000067887us-gaap:OtherAssetsMembermog:NOVILLCMember2023-12-300000067887us-gaap:OtherAssetsMembermog:NOVILLCMember2023-09-300000067887us-gaap:OtherAssetsMembermog:SuffolkTechnologiesFund1LPMember2023-12-300000067887us-gaap:OtherAssetsMembermog:SuffolkTechnologiesFund1LPMember2023-09-300000067887us-gaap:OtherAssetsMember2023-12-300000067887us-gaap:OtherAssetsMember2023-09-300000067887us-gaap:OtherNonoperatingIncomeExpenseMember2023-10-012023-12-300000067887us-gaap:OtherNonoperatingIncomeExpenseMember2022-10-022022-12-310000067887mog:MoogAircraftServicesAsiaMembermog:CommercialAircraftMember2023-12-300000067887mog:SpaceAndDefenseMembermog:NOVILLCMember2023-12-300000067887mog:SuffolkTechnologiesFund1LPMembermog:IndustrialMember2023-10-012023-12-300000067887mog:IndustrialMembermog:HybridMotionSolutionsMember2023-12-300000067887us-gaap:OtherAssetsMembermog:IndustrialMembermog:HybridMotionSolutionsMember2023-12-300000067887us-gaap:RevolvingCreditFacilityMember2023-12-300000067887us-gaap:RevolvingCreditFacilityMember2023-09-300000067887mog:SECTRevolvingCreditFacilityMember2023-12-300000067887mog:SECTRevolvingCreditFacilityMember2023-09-300000067887us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-12-300000067887us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-10-012023-12-300000067887us-gaap:LineOfCreditMembermog:SECTRevolvingCreditFacilityMember2023-12-300000067887mog:SeniorNotes425Memberus-gaap:SeniorNotesMember2023-12-300000067887us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-12-300000067887us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-300000067887us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-300000067887us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-12-300000067887us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-10-012023-12-300000067887us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2022-10-022022-12-310000067887us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentAssetsMember2023-12-300000067887us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentAssetsMember2023-09-300000067887us-gaap:OtherCurrentLiabilitiesMemberus-gaap:ForeignExchangeContractMember2023-12-300000067887us-gaap:OtherCurrentLiabilitiesMemberus-gaap:ForeignExchangeContractMember2023-09-300000067887us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentAssetsMember2023-12-300000067887us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentAssetsMember2023-09-300000067887us-gaap:FairValueInputsLevel2Memberus-gaap:AssetsTotalMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-300000067887us-gaap:FairValueInputsLevel2Memberus-gaap:AssetsTotalMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300000067887us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-300000067887us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2023-09-300000067887us-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-300000067887us-gaap:FairValueInputsLevel3Memberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300000067887us-gaap:FairValueMeasurementsRecurringMemberus-gaap:LiabilitiesTotalMember2023-12-300000067887us-gaap:FairValueMeasurementsRecurringMemberus-gaap:LiabilitiesTotalMember2023-09-300000067887us-gaap:FairValueInputsLevel3Member2023-09-300000067887us-gaap:FairValueInputsLevel3Member2022-10-010000067887us-gaap:FairValueInputsLevel3Member2023-10-012023-12-300000067887us-gaap:FairValueInputsLevel3Member2022-10-022022-12-310000067887us-gaap:FairValueInputsLevel3Member2023-12-300000067887us-gaap:FairValueInputsLevel3Member2022-12-310000067887us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-300000067887mog:A2023PlanMember2023-12-300000067887mog:SpaceAndDefenseMembermog:A2023PlanMember2023-10-012023-12-300000067887mog:MilitaryAircraftMembermog:A2023PlanMember2023-10-012023-12-300000067887mog:A2023PlanMembermog:IndustrialMember2023-10-012023-12-300000067887mog:A2023PlanMember2023-10-012023-12-300000067887mog:A2022PlanMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887mog:A2022PlanMembermog:MilitaryAircraftMember2023-10-012023-12-300000067887mog:A2022PlanMembermog:IndustrialMember2023-10-012023-12-300000067887mog:A2022PlanMember2023-10-012023-12-300000067887mog:A2018PlanMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887mog:A2018PlanMembermog:MilitaryAircraftMember2023-10-012023-12-300000067887mog:A2018PlanMembermog:IndustrialMember2023-10-012023-12-300000067887mog:A2018PlanMember2023-10-012023-12-300000067887mog:A2022PlanMember2023-12-300000067887mog:A2020PlanMember2023-12-300000067887mog:A2018PlanMember2023-12-300000067887country:US2023-10-012023-12-300000067887country:US2022-10-022022-12-310000067887us-gaap:ForeignPlanMember2023-10-012023-12-300000067887us-gaap:ForeignPlanMember2022-10-022022-12-310000067887us-gaap:PensionPlansDefinedBenefitMember2023-10-012023-12-300000067887us-gaap:PensionPlansDefinedBenefitMember2022-10-022022-12-310000067887country:USus-gaap:PensionPlansDefinedBenefitMember2023-10-012023-12-300000067887country:USus-gaap:PensionPlansDefinedBenefitMember2022-10-022022-12-310000067887us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-10-012023-12-300000067887us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-022022-12-310000067887us-gaap:AccumulatedTranslationAdjustmentMember2023-09-300000067887us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-09-300000067887us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-09-300000067887us-gaap:AccumulatedTranslationAdjustmentMember2023-10-012023-12-300000067887us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-10-012023-12-300000067887us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-10-012023-12-300000067887us-gaap:AccumulatedTranslationAdjustmentMember2023-12-300000067887us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-300000067887us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-300000067887us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2023-10-012023-12-300000067887us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2022-10-022022-12-310000067887us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2023-10-012023-12-300000067887us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2022-10-022022-12-310000067887us-gaap:ForeignExchangeContractMember2023-10-012023-12-300000067887us-gaap:ForeignExchangeContractMember2022-10-022022-12-310000067887mog:SpaceMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887mog:SpaceMembermog:SpaceAndDefenseMember2022-10-022022-12-310000067887mog:DefenseMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887mog:DefenseMembermog:SpaceAndDefenseMember2022-10-022022-12-310000067887mog:SpaceAndDefenseMember2022-10-022022-12-310000067887mog:MilitaryAircraftMembermog:OriginalEquipmentManufacturersMember2023-10-012023-12-300000067887mog:MilitaryAircraftMembermog:OriginalEquipmentManufacturersMember2022-10-022022-12-310000067887mog:AftermarketMembermog:MilitaryAircraftMember2023-10-012023-12-300000067887mog:AftermarketMembermog:MilitaryAircraftMember2022-10-022022-12-310000067887mog:MilitaryAircraftMember2022-10-022022-12-310000067887mog:OriginalEquipmentManufacturersMembermog:CommercialAircraftMember2023-10-012023-12-300000067887mog:OriginalEquipmentManufacturersMembermog:CommercialAircraftMember2022-10-022022-12-310000067887mog:AftermarketMembermog:CommercialAircraftMember2023-10-012023-12-300000067887mog:AftermarketMembermog:CommercialAircraftMember2022-10-022022-12-310000067887mog:CommercialAircraftMember2022-10-022022-12-310000067887mog:EnergyMembermog:IndustrialMember2023-10-012023-12-300000067887mog:EnergyMembermog:IndustrialMember2022-10-022022-12-310000067887mog:IndustrialMembermog:IndustrialAutomationMember2023-10-012023-12-300000067887mog:IndustrialMembermog:IndustrialAutomationMember2022-10-022022-12-310000067887mog:SimulationandTestMembermog:IndustrialMember2023-10-012023-12-300000067887mog:SimulationandTestMembermog:IndustrialMember2022-10-022022-12-310000067887mog:MedicalMembermog:IndustrialMember2023-10-012023-12-300000067887mog:MedicalMembermog:IndustrialMember2022-10-022022-12-310000067887mog:IndustrialMember2022-10-022022-12-310000067887mog:SpaceAndDefenseMembermog:CommercialCustomerMember2023-10-012023-12-300000067887mog:SpaceAndDefenseMembermog:CommercialCustomerMember2022-10-022022-12-310000067887mog:U.S.GovernmentCustomerMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887mog:U.S.GovernmentCustomerMembermog:SpaceAndDefenseMember2022-10-022022-12-310000067887mog:SpaceAndDefenseMemberus-gaap:OtherCustomerMember2023-10-012023-12-300000067887mog:SpaceAndDefenseMemberus-gaap:OtherCustomerMember2022-10-022022-12-310000067887mog:U.S.GovernmentCustomerMembermog:MilitaryAircraftMember2023-10-012023-12-300000067887mog:U.S.GovernmentCustomerMembermog:MilitaryAircraftMember2022-10-022022-12-310000067887mog:MilitaryAircraftMemberus-gaap:OtherCustomerMember2023-10-012023-12-300000067887mog:MilitaryAircraftMemberus-gaap:OtherCustomerMember2022-10-022022-12-310000067887mog:CommercialAircraftMembermog:CommercialCustomerMember2023-10-012023-12-300000067887mog:CommercialAircraftMembermog:CommercialCustomerMember2022-10-022022-12-310000067887mog:CommercialAircraftMemberus-gaap:OtherCustomerMember2023-10-012023-12-300000067887mog:CommercialAircraftMemberus-gaap:OtherCustomerMember2022-10-022022-12-310000067887mog:CommercialCustomerMembermog:IndustrialMember2023-10-012023-12-300000067887mog:CommercialCustomerMembermog:IndustrialMember2022-10-022022-12-310000067887mog:U.S.GovernmentCustomerMembermog:IndustrialMember2023-10-012023-12-300000067887mog:U.S.GovernmentCustomerMembermog:IndustrialMember2022-10-022022-12-310000067887mog:IndustrialMemberus-gaap:OtherCustomerMember2023-10-012023-12-300000067887mog:IndustrialMemberus-gaap:OtherCustomerMember2022-10-022022-12-310000067887mog:CommercialCustomerMember2023-10-012023-12-300000067887mog:CommercialCustomerMember2022-10-022022-12-310000067887mog:U.S.GovernmentCustomerMember2023-10-012023-12-300000067887mog:U.S.GovernmentCustomerMember2022-10-022022-12-310000067887us-gaap:OtherCustomerMember2023-10-012023-12-300000067887us-gaap:OtherCustomerMember2022-10-022022-12-310000067887us-gaap:TransferredOverTimeMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887us-gaap:TransferredOverTimeMembermog:SpaceAndDefenseMember2022-10-022022-12-310000067887us-gaap:TransferredAtPointInTimeMembermog:SpaceAndDefenseMember2023-10-012023-12-300000067887us-gaap:TransferredAtPointInTimeMembermog:SpaceAndDefenseMember2022-10-022022-12-310000067887us-gaap:TransferredOverTimeMembermog:MilitaryAircraftMember2023-10-012023-12-300000067887us-gaap:TransferredOverTimeMembermog:MilitaryAircraftMember2022-10-022022-12-310000067887us-gaap:TransferredAtPointInTimeMembermog:MilitaryAircraftMember2023-10-012023-12-300000067887us-gaap:TransferredAtPointInTimeMembermog:MilitaryAircraftMember2022-10-022022-12-310000067887us-gaap:TransferredOverTimeMembermog:CommercialAircraftMember2023-10-012023-12-300000067887us-gaap:TransferredOverTimeMembermog:CommercialAircraftMember2022-10-022022-12-310000067887us-gaap:TransferredAtPointInTimeMembermog:CommercialAircraftMember2023-10-012023-12-300000067887us-gaap:TransferredAtPointInTimeMembermog:CommercialAircraftMember2022-10-022022-12-310000067887us-gaap:TransferredOverTimeMembermog:IndustrialMember2023-10-012023-12-300000067887us-gaap:TransferredOverTimeMembermog:IndustrialMember2022-10-022022-12-310000067887us-gaap:TransferredAtPointInTimeMembermog:IndustrialMember2023-10-012023-12-300000067887us-gaap:TransferredAtPointInTimeMembermog:IndustrialMember2022-10-022022-12-310000067887us-gaap:TransferredOverTimeMember2023-10-012023-12-300000067887us-gaap:TransferredOverTimeMember2022-10-022022-12-310000067887us-gaap:TransferredAtPointInTimeMember2023-10-012023-12-300000067887us-gaap:TransferredAtPointInTimeMember2022-10-022022-12-310000067887us-gaap:BankingMembermog:FinancingForPurchasesAndLeaseTransactionsMember2023-10-012023-12-300000067887us-gaap:BankingMembermog:FinancingForPurchasesAndLeaseTransactionsMember2022-10-022022-12-310000067887us-gaap:ObligationsMemberus-gaap:BankingMember2023-10-012023-12-300000067887us-gaap:DepositsMemberus-gaap:BankingMember2023-10-012023-12-300000067887us-gaap:BankingMember2023-12-300000067887us-gaap:SubsequentEventMember2024-01-252024-01-250000067887us-gaap:SubsequentEventMember2024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission file number 1-05129

MOOG Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| New York | | 16-0757636 | |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| |

| 400 Jamison Road | East Aurora, | New York | 14052-0018 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(716) 652-2000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

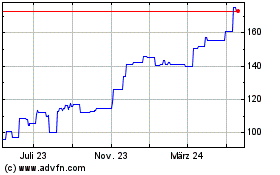

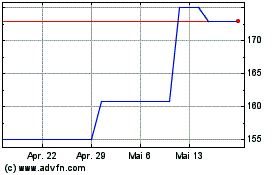

| Class A common stock | MOG.A | New York Stock Exchange |

| Class B common stock | MOG.B | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of each class of common stock as of January 22, 2024 was:

Class A common stock, 28,753,750 shares

Class B common stock, 3,202,563 shares

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

PART I FINANCIAL INFORMATION

Item 1. Financial Statements

Consolidated Condensed Statements of Earnings

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| (dollars in thousands, except share and per share data) | | | | | | December 30,

2023 | | December 31,

2022 |

| Net sales | | | | | | $ | 856,850 | | | $ | 760,103 | |

| Cost of sales | | | | | | 623,651 | | | 556,417 | |

| | | | | | | | |

| Gross profit | | | | | | 233,199 | | | 203,686 | |

| Research and development | | | | | | 30,579 | | | 23,862 | |

| Selling, general and administrative | | | | | | 118,725 | | | 113,165 | |

| Interest | | | | | | 16,694 | | | 13,132 | |

| | | | | | | | |

| Restructuring | | | | | | 1,889 | | | 1,078 | |

| | | | | | | | |

| Gain on sale of buildings | | | | | | — | | | (9,503) | |

| Other | | | | | | 2,701 | | | 1,651 | |

| Earnings before income taxes | | | | | | 62,611 | | | 60,301 | |

| Income taxes | | | | | | 14,799 | | | 14,285 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net earnings | | | | | | $ | 47,812 | | | $ | 46,016 | |

| | | | | | | | |

| Net earnings per share | | | | | | | | |

| Basic | | | | | | $ | 1.50 | | | $ | 1.45 | |

| Diluted | | | | | | $ | 1.48 | | | $ | 1.44 | |

| | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | | | | | 31,902,101 | | | 31,746,001 | |

| Diluted | | | | | | 32,249,313 | | | 31,874,718 | |

| See accompanying Notes to Consolidated Condensed Financial Statements. |

Consolidated Condensed Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| (dollars in thousands) | | | | | | December 30,

2023 | | December 31,

2022 |

| Net earnings | | | | | | $ | 47,812 | | | $ | 46,016 | |

| Other comprehensive income ("OCI"), net of tax: | | | | | | | | |

| Foreign currency translation adjustment | | | | | | 31,013 | | | 50,735 | |

| Retirement liability adjustment | | | | | | 1,678 | | | 1,199 | |

| Change in accumulated loss on derivatives | | | | | | 318 | | | 1,919 | |

| Other comprehensive income, net of tax | | | | | | 33,009 | | | 53,853 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Comprehensive income | | | | | | $ | 80,821 | | | $ | 99,869 | |

| See accompanying Notes to Consolidated Condensed Financial Statements. |

Consolidated Condensed Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | |

| (dollars in thousands) | | December 30,

2023 | | September 30,

2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 126,398 | | | $ | 68,959 | |

| Restricted cash | | 430 | | | 185 | |

| Receivables, net | | 381,609 | | | 434,723 | |

| Unbilled receivables | | 760,561 | | | 706,601 | |

| Inventories, net | | 788,040 | | | 724,002 | |

| Prepaid expenses and other current assets | | 59,577 | | | 50,862 | |

| Total current assets | | 2,116,615 | | | 1,985,332 | |

| Property, plant and equipment, net | | 842,682 | | | 814,696 | |

| Operating lease right-of-use assets | | 59,489 | | | 56,067 | |

| Goodwill | | 833,413 | | | 821,301 | |

| Intangible assets, net | | 72,663 | | | 71,637 | |

| Deferred income taxes | | 9,284 | | | 8,749 | |

| Other assets | | 53,809 | | | 50,254 | |

| Total assets | | $ | 3,987,955 | | | $ | 3,808,036 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| Current liabilities | | | | |

| | | | |

| | | | |

| Accounts payable | | $ | 261,155 | | | $ | 264,573 | |

| Accrued compensation | | 64,099 | | | 111,154 | |

| Contract advances and progress billings | | 445,706 | | | 377,977 | |

| | | | |

| Accrued liabilities and other | | 238,871 | | | 211,769 | |

| Total current liabilities | | 1,009,831 | | | 965,473 | |

| Long-term debt, excluding current installments | | 920,103 | | | 863,092 | |

| Long-term pension and retirement obligations | | 160,825 | | | 157,455 | |

| Deferred income taxes | | 35,214 | | | 37,626 | |

| Other long-term liabilities | | 154,765 | | | 148,303 | |

| Total liabilities | | 2,280,738 | | | 2,171,949 | |

| | | | |

| | | | |

| Shareholders’ equity | | | | |

| Common stock - Class A | | 43,826 | | | 43,822 | |

| Common stock - Class B | | 7,454 | | | 7,458 | |

| Additional paid-in capital | | 673,261 | | | 608,270 | |

| Retained earnings | | 2,536,172 | | | 2,496,979 | |

| Treasury shares | | (1,065,654) | | | (1,057,938) | |

| Stock Employee Compensation Trust | | (146,373) | | | (114,769) | |

| Supplemental Retirement Plan Trust | | (119,869) | | | (93,126) | |

| Accumulated other comprehensive loss | | (221,600) | | | (254,609) | |

| Total shareholders’ equity | | 1,707,217 | | | 1,636,087 | |

| | | | |

| | | | |

| Total liabilities and shareholders’ equity | | $ | 3,987,955 | | | $ | 3,808,036 | |

| See accompanying Notes to Consolidated Condensed Financial Statements. | | | | |

Consolidated Condensed Statements of Shareholders' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended |

| (dollars in thousands) | | | | | | December 30,

2023 | | December 31,

2022 |

| COMMON STOCK | | | | | | | | |

| Beginning and end of period | | | | | | $ | 51,280 | | | $ | 51,280 | |

| ADDITIONAL PAID-IN CAPITAL | | | | | | | | |

| Beginning of period | | | | | | 608,270 | | | 516,123 | |

| Issuance of treasury shares | | | | | | 2,160 | | | 2,228 | |

| Equity-based compensation expense | | | | | | 3,454 | | | 2,443 | |

| | | | | | | | |

| Adjustment to market - SECT and SERP | | | | | | 59,377 | | | 29,717 | |

| End of period | | | | | | 673,261 | | | 550,511 | |

| RETAINED EARNINGS | | | | | | | | |

| Beginning of period | | | | | | 2,496,979 | | | 2,360,055 | |

| Net earnings | | | | | | 47,812 | | | 46,016 | |

Dividends (1) | | | | | | (8,619) | | | (8,257) | |

| | | | | | | | |

| | | | | | | | |

| End of period | | | | | | 2,536,172 | | | 2,397,814 | |

| TREASURY SHARES AT COST | | | | | | | | |

| Beginning of period | | | | | | (1,057,938) | | | (1,047,012) | |

| | | | | | | | |

| Class A and B shares issued related to compensation | | | | | | 995 | | | 1,724 | |

| Class A and B shares purchased | | | | | | (8,711) | | | (10,447) | |

| End of period | | | | | | (1,065,654) | | | (1,055,735) | |

| STOCK EMPLOYEE COMPENSATION TRUST ("SECT") | | | | | | | | |

| Beginning of period | | | | | | (114,769) | | | (73,602) | |

| Issuance of shares | | | | | | 5,001 | | | 2,561 | |

| Purchase of shares | | | | | | (3,971) | | | (1,753) | |

| Adjustment to market | | | | | | (32,634) | | | (16,895) | |

| End of period | | | | | | (146,373) | | | (89,689) | |

| SUPPLEMENTAL RETIREMENT PLAN ("SERP") TRUST | | | | | | | | |

| Beginning of period | | | | | | (93,126) | | | (58,989) | |

| | | | | | | | |

| | | | | | | | |

| Adjustment to market | | | | | | (26,743) | | | (12,822) | |

| End of period | | | | | | (119,869) | | | (71,811) | |

| ACCUMULATED OTHER COMPREHENSIVE LOSS | | | | | | | | |

| Beginning of period | | | | | | (254,609) | | | (311,042) | |

| Other comprehensive income | | | | | | 33,009 | | | 53,853 | |

| | | | | | | | |

| End of period | | | | | | (221,600) | | | (257,189) | |

| TOTAL SHAREHOLDERS’ EQUITY | | | | | | $ | 1,707,217 | | | $ | 1,525,181 | |

| See accompanying Notes to Consolidated Condensed Financial Statements. |

(1) Cash dividends were $0.27 per share for the three months ended December 30, 2023 and $0.26 per share for three months ended December 31, 2022.

Consolidated Condensed Statements of Shareholders’ Equity, Shares

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended |

| (share data) | | | | | | December 30,

2023 | | December 31,

2022 |

| COMMON STOCK - CLASS A | | | | | | | | |

| Beginning of period | | | | | | 43,822,344 | | | 43,806,835 | |

| Conversion of Class B to Class A | | | | | | 3,573 | | | — | |

| End of period | | | | | | 43,825,917 | | | 43,806,835 | |

| COMMON STOCK - CLASS B | | | | | | | | |

| Beginning of period | | | | | | 7,457,369 | | | 7,472,878 | |

| Conversion of Class B to Class A | | | | | | (3,573) | | | — | |

| End of period | | | | | | 7,453,796 | | | 7,472,878 | |

| TREASURY SHARES - CLASS A COMMON STOCK | | | | | | | | |

| Beginning of period | | | | | | (14,657,897) | | | (14,614,444) | |

| | | | | | | | |

| Class A shares issued related to compensation | | | | | | 18,411 | | | 35,550 | |

| Class A shares purchased | | | | | | (7,533) | | | (87,614) | |

| End of period | | | | | | (14,647,019) | | | (14,666,508) | |

| TREASURY SHARES - CLASS B COMMON STOCK | | | | | | | | |

| Beginning of period | | | | | | (2,896,845) | | | (3,020,291) | |

| Class B shares issued related to compensation | | | | | | 64,263 | | | 72,740 | |

| Class B shares purchased | | | | | | (59,112) | | | (44,350) | |

| End of period | | | | | | (2,891,694) | | | (2,991,901) | |

| SECT - CLASS A COMMON STOCK | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Beginning and end of period | | | | | | (425,148) | | | (425,148) | |

| SECT - CLASS B COMMON STOCK | | | | | | | | |

| Beginning of period | | | | | | (592,128) | | | (611,942) | |

| Issuance of shares | | | | | | 37,308 | | | 30,069 | |

| Purchase of shares | | | | | | (29,780) | | | (20,727) | |

| End of period | | | | | | (584,600) | | | (602,600) | |

| SERP - CLASS B COMMON STOCK | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Beginning and end of period | | | | | | (826,170) | | | (826,170) | |

| See accompanying Notes to Consolidated Condensed Financial Statements. |

Consolidated Condensed Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| (dollars in thousands) | | December 30,

2023 | | December 31,

2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net earnings | | $ | 47,812 | | | $ | 46,016 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | |

| Depreciation | | 20,927 | | | 18,392 | |

| Amortization | | 2,720 | | | 2,992 | |

| Deferred income taxes | | (4,547) | | | (1,342) | |

| Equity-based compensation expense | | 4,165 | | | 2,974 | |

| | | | |

| | | | |

| Gain on sale of buildings | | — | | | (9,503) | |

| | | | |

| Other | | (2,478) | | | 1,145 | |

| Changes in assets and liabilities providing (using) cash: | | | | |

| Receivables | | 58,887 | | | (27,387) | |

| Unbilled receivables | | (51,015) | | | (26,570) | |

| Inventories | | (46,852) | | | (44,435) | |

| Accounts payable | | (5,752) | | | (9,679) | |

| Contract advances and progress billings | | 64,171 | | | 72,889 | |

| Accrued expenses | | (31,814) | | | (35,186) | |

| Accrued income taxes | | 12,324 | | | 12,632 | |

| Net pension and post retirement liabilities | | 2,957 | | | 3,988 | |

| Other assets and liabilities | | (11,114) | | | 1,157 | |

| Net cash provided by operating activities | | 60,391 | | | 8,083 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Acquisitions of businesses, net of cash acquired | | (5,212) | | | — | |

| Purchase of property, plant and equipment | | (37,416) | | | (30,125) | |

| Net proceeds from businesses sold | | — | | | 1,124 | |

| Net proceeds from buildings sold | | — | | | 7,432 | |

| Other investing transactions | | (479) | | | (3,724) | |

| Net cash used by investing activities | | (43,107) | | | (25,293) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| | | | |

| Proceeds from revolving lines of credit | | 279,500 | | | 241,000 | |

| Payments on revolving lines of credit | | (223,000) | | | (160,300) | |

| | | | |

| Payments on long-term debt | | — | | | (93) | |

| | | | |

| | | | |

| | | | |

| Payments on finance lease obligations | | (1,286) | | | (884) | |

| Payment of dividends | | (8,619) | | | (8,257) | |

| Proceeds from sale of treasury stock | | 581 | | | 1,869 | |

| Purchase of outstanding shares for treasury | | (8,711) | | | (12,721) | |

| Proceeds from sale of stock held by SECT | | 5,001 | | | 2,561 | |

| Purchase of stock held by SECT | | (4,561) | | | (1,753) | |

| | | | |

| | | | |

| | | | |

| Other financing transactions | | — | | | (2,026) | |

| Net cash provided by financing activities | | 38,905 | | | 59,396 | |

| Effect of exchange rate changes on cash | | 1,495 | | | 4,492 | |

| Increase in cash, cash equivalents and restricted cash | | 57,684 | | | 46,678 | |

| Cash, cash equivalents and restricted cash at beginning of period | | 69,144 | | | 117,328 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 126,828 | | | $ | 164,006 | |

| | | | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | | |

| | | | |

| | | | |

| Treasury shares issued as compensation | | $ | 2,574 | | | $ | 1,532 | |

| Assets acquired through lease financing | | 7,845 | | | 5,970 | |

| See accompanying Notes to Consolidated Condensed Financial Statements. |

Notes to Consolidated Condensed Financial Statements

Three Months Ended December 30, 2023

(Unaudited)

(dollars in thousands, except per share data)

Note 1 - Basis of Presentation

The accompanying unaudited consolidated condensed financial statements have been prepared by management in accordance with U.S. generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, all adjustments consisting of normal recurring adjustments considered necessary for the fair presentation of results for the interim period have been included. The results of operations for the three months ended December 30, 2023 are not necessarily indicative of the results expected for the full year. The accompanying unaudited consolidated condensed financial statements should be read in conjunction with the financial statements and notes thereto included in our Form 10-K for the fiscal year ended September 30, 2023. All references to years in these financial statements are to fiscal years.

Effective October 1, 2023, we made changes to our segment reporting structure that resulted in four reporting segments. Our former Aircraft Controls segment has been separated into Military Aircraft and Commercial Aircraft. The Goodwill, Restructuring and Segment footnotes have been restated to reflect this change.

Reclassifications

Certain prior year amounts have been reclassified to conform to current year's presentation.

Recent Accounting Pronouncements Adopted

There have been no new accounting pronouncements adopted for the three months ended December 30, 2023.

Recent Accounting Pronouncements Not Yet Adopted

| | | | | | | | | | | | | | |

| Standard | | Description | | Financial Statement Effect or Other Significant Matters |

ASU no. 2023-07 Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures | | This standard requires disclosure of significant segment expenses that are regularly provided to the chief operating decision maker (“CODM”) and included within each reported measure of segment profit or loss. The amendments also require disclosure of all other segment items by reportable segment and a description of its composition. Additionally, the amendments require disclosure of the title and position of the CODM and an explanation of how the CODM uses the reported measures of segment profit or loss in assessing segment performance and deciding how to allocate resources. The provisions of the standard are effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The amendment requires retrospective application to all prior periods presented in the financial statements. | | We are currently reviewing the guidance and evaluating the impact on our financial statements and related disclosures. |

Planned date of adoption:

FY 2025 |

ASU no. 2023-09 Income Taxes (Topic 740): Improvements to Income Tax Disclosures

| | This standard expands annual income tax disclosures to require specific categories in the rate reconciliation table to be disclosed using both percentages and reporting currency amounts and requires additional information for reconciling items that meet a quantitative threshold. Additionally, the amendment requires disclosure of income taxes paid by jurisdiction. The provisions of the standard are effective for annual periods beginning after December 15, 2024. Early adoption is permitted. The amendments should be applied on a prospective basis. Retrospective application is permitted. | | We are currently reviewing the guidance and evaluating the impact on our financial statements and related disclosures. |

Planned date of adoption:

FY 2026 |

We consider the applicability and impact of all Accounting Standard Updates ("ASU"). ASUs not listed above were assessed and determined to be either not applicable, or had or are expected to have an immaterial impact on our financial statements and related disclosures.

Note 2 - Revenue from Contracts with Customers

We recognize revenue from contracts with customers using the five-step model prescribed in ASC 606. The first step is identifying the contract. The identification of a contract with a customer requires an assessment of each party’s rights and obligations regarding the products or services to be transferred, including an evaluation of termination clauses and presently enforceable rights and obligations. Each party’s rights and obligations and the associated terms and conditions are typically determined in purchase orders. For sales that are governed by master supply agreements under which provisions define specific program requirements, purchase orders are issued under these agreements to reflect presently enforceable rights and obligations for the units of products and services being purchased.

Contracts are sometimes modified to account for changes in contract specifications and requirements. When this occurs, we assess the modification as prescribed in ASC 606 and determine whether the existing contract needs to be modified (and revenue cumulatively caught up), whether the existing contract needs to be terminated and a new contract needs to be created, or whether the existing contract remains and a new contract needs to be created. This is determined based on the rights and obligations within the modification as well as the associated transaction price.

The next step is identifying the performance obligations. A performance obligation is a promise to transfer goods or services to a customer that is distinct in the context of the contract, as defined by ASC 606. We identify a performance obligation for each promise in a contract to transfer a distinct good or service to the customer. As part of our assessment, we consider all goods and/or services promised in the contract, regardless of whether they are explicitly stated or implied by customary business practices. The products and services in our contracts are typically not distinct from one another due to their complexity and reliance on each other or, in many cases, we provide a significant integration service. Accordingly, many of our contracts are accounted for as one performance obligation. In limited cases, our contracts have more than one distinct performance obligation, which occurs when we perform activities that are not highly complex or interrelated or involve different product life cycles. Warranties are provided on certain contracts, but do not typically provide for services beyond standard assurances and are therefore not distinct performance obligations under ASC 606.

The third step is determining the transaction price, which represents the amount of consideration we expect to be entitled to receive from a customer in exchange for providing the goods or services. There are times when this consideration is variable, for example a volume discount, and must be estimated. Sales, use, value-added, and excise taxes are excluded from the transaction price, where applicable.

The fourth step is allocating the transaction price. The transaction price must be allocated to the performance obligations identified in the contract based on relative stand-alone selling prices when available, or an estimate for each distinct good or service in the contract when standalone prices are not available. Our contracts with customers generally require payment under normal commercial terms after delivery. Payment terms are typically within 30 to 60 days of delivery. The timing of satisfaction of our performance obligations does not significantly vary from the typical timing of payment.

The final step is the recognition of revenue. We recognize revenue as the performance obligations are satisfied. ASC 606 provides guidance to help determine if we are satisfying the performance obligation at a point in time or over time. In determining when performance obligations are satisfied, we consider factors such as contract terms, payment terms and whether there is an alternative use of the product or service. In essence, we recognize revenue when, or as control of, the promised goods or services transfer to the customer.

Revenue is recognized using either the over time or point in time method. The over-time method of revenue recognition is predominantly used in Space and Defense, Military Aircraft and Commercial Aircraft. We use this method for U.S. Government contracts and repair and overhaul arrangements as we are creating or enhancing assets that the customer controls as the assets are being created or enhanced. In addition, many of our large commercial contracts qualify for over-time accounting as our performance does not create an asset with an alternative use and we have an enforceable right to payment for performance completed to date. Our over-time contracts are primarily firm fixed price.

Revenue recognized at the point in time control is transferred to the customer is used most frequently in Industrial. We use this method for commercial contracts in which the asset being created has an alternative use. We determine the point in time control transfers to the customer by weighing the five indicators provided by ASC 606 - the entity has a present right to payment; the customer has legal title; the customer has physical possession; the customer has significant risks and rewards of ownership; and the customer has accepted the asset. When control has transferred to the customer, profit is generated as cost of sales is recorded and as revenue is recognized. Inventory costs include all product manufacturing costs such as direct material, direct labor, other direct costs and indirect overhead cost allocations. Shipping and handling costs are considered costs to fulfill a contract and not considered performance obligations. They are included in cost of sales as incurred.

Revenue is recognized over time on contracts using the cost-to-cost method of accounting as work progresses toward completion as determined by the ratio of cumulative costs incurred to date to estimated total contract costs at completion, multiplied by the total estimated contract revenue, less cumulative revenue recognized in prior periods. We believe that cumulative costs incurred to date as a percentage of estimated total contract costs at completion is an appropriate measure of progress toward satisfaction of performance obligations as this measure most accurately depicts the progress of our work and transfer of control to our customers. Changes in estimates affecting sales, costs and profits are recognized in the period in which the change becomes known using the cumulative catch-up method of accounting, resulting in the cumulative effect of changes reflected in the period. Estimates are reviewed and updated quarterly for substantially all contracts. For the three months ended December 30, 2023 and December 31, 2022 we recognized lower revenue of $95 and $4,300, respectively, for adjustments made to performance obligations satisfied (or partially satisfied) in previous periods.

Contract costs include only allocable, allowable and reasonable costs which are included in cost of sales when incurred. For applicable U.S. Government contracts, contract costs are determined in accordance with the Federal Acquisition Regulations and the related Cost Accounting Standards. The nature of these costs includes development engineering costs and product manufacturing costs such as direct material, direct labor, other direct costs and indirect overhead costs. Contract profit is recorded as a result of the revenue recognized less costs incurred in any reporting period. Variable consideration and contract modifications, such as performance incentives, penalties, contract claims or change orders are considered in estimating revenues, costs and profits when they can be reliably estimated and realization is considered probable. Revenue recognized on contracts for unresolved claims or unapproved contract change orders was not material for the three months ended December 30, 2023.

As of December 30, 2023, we had contract reserves of $54,553. For contracts with anticipated losses at completion, a provision for the entire amount of the estimated remaining loss is charged against income in the period in which the loss becomes known. Contract losses are determined considering all direct and indirect contract costs, exclusive of any selling, general or administrative cost allocations that are treated as period expenses. Loss reserves are more common on firm fixed-price contracts that involve, to varying degrees, the design and development of new and unique controls or control systems to meet the customers’ specifications. In accordance with ASC 606, we calculate contract losses at the contract level, versus the performance obligation level. Recall reserves are recorded when additional work is needed on completed products for them to meet contract specifications. Contract-related loss reserves are recorded for the additional work needed on completed and delivered products in order for them to meet contract specifications.

Contract Assets and Liabilities

Unbilled receivables (contract assets) primarily represent revenues recognized for performance obligations that have been satisfied but for which amounts have not been billed. Unbilled receivables are classified as current assets and in accordance with industry practice, include amounts that may be billed and collected beyond one year due to the long term nature of our contracts.

Contract advances and progress billings (contract liabilities) relate to payments received from customers in advance of the satisfaction of performance obligations for a contract (contract advances) and when billings are in excess of revenue recognized (progress billings). These amounts are recorded as contract liabilities until such obligations are satisfied, either over-time as costs are incurred or at a point when deliveries are made. We do not consider contract advances and progress billings to be significant financing components as the intent of these payments in advance are for reasons other than providing a significant financing benefit and are customary in our industry.

For contracts recognized using the cost-to-cost method, the amount of unbilled receivables or contract advances and progress billings is determined for each contract to determine the contract asset or contract liability position at the end of each reporting period.

Total contract assets and contract liabilities are as follows:

| | | | | | | | | | | | | | |

| | December 30,

2023 | | September 30, 2023 |

| Unbilled receivables | | $ | 760,561 | | | $ | 706,601 | |

| Contract advances and progress billings | | 445,706 | | | 377,977 | |

| Net contract assets | | $ | 314,855 | | | $ | 328,624 | |

The increase in contract assets reflects the net impact of additional unbilled revenues recorded in excess of revenue recognized during the period. The increase in contract liabilities reflects the net impact of additional deferred revenues recorded in excess of revenue recognized during the period. For the three months ended December 30, 2023, we recognized $97,705 of revenue, that was included in the contract liability balance at the beginning of the year.

Remaining Performance Obligations

As of December 30, 2023, the aggregate amount of the transaction price allocated to the performance obligations that are unsatisfied (or partially unsatisfied) was $5,300,000. We expect to recognize approximately 47% of that amount as sales over the next twelve months and the balance thereafter.

Disaggregation of Revenue

See Note 20 - Segments, for disclosures related to disaggregation of revenue.

Note 3 - Acquisitions and Divestitures

Acquisitions

On October 20, 2023, we acquired Data Collection Limited ("DCL") based in Auckland, New Zealand for a purchase price, net of acquired cash, of $5,882, consisting of $5,212 in cash and a working capital adjustment to be paid of approximately $670. DCL specializes in manufacturing and operating pavement surveying equipment and providing innovative solutions for measuring and managing pavements. This operation is included in our Military Aircraft segment. The purchase price allocation is subject to adjustments as we obtain additional information for our estimates during the measurement period.

Divestitures

On September 30, 2022, we sold a sonar business based in the United Kingdom previously included in our Industrial segment. We have cumulatively received net proceeds of $13,075 and recorded a loss of $15,246, net of transaction costs. The transaction is subject to adjustments associated with amounts currently held in escrow.

On December 3, 2021, we sold the assets of our Navigation Aids ("NAVAIDS") business based in Salt Lake City, Utah previously included in our Military Aircraft segment to Thales USA Inc. We have cumulatively received net proceeds of $36,550 and recorded a gain of $15,242, net of transaction costs. The transaction is subject to adjustments associated with amounts currently held in escrow.

Note 4 - Receivables

Receivables consist of:

| | | | | | | | | | | | | | | |

| | December 30,

2023 | | September 30,

2023 | |

| Accounts receivable | | $ | 369,853 | | | $ | 426,804 | | |

| | | | | |

| | | | | |

| | | | | |

| Other | | 15,467 | | | 11,929 | | |

| Less allowance for credit losses | | (3,711) | | | (4,010) | | |

| Receivables, net | | $ | 381,609 | | | $ | 434,723 | | |

On December 13, 2023, Moog Receivables LLC (the "Receivables Subsidiary"), a wholly owned bankruptcy remote special purpose subsidiary of Moog Inc. (the "Company"), as seller, the Company, as master servicer, Wells Fargo Bank, N.A., as administrative agent (the "Agent") and certain purchasers (collectively, the "Purchasers") entered into the Third Amendment to the Amended and Restated Receivables Purchase Agreement (the "RPA"). The RPA amendment increased the capacity from $100,000 to $125,000 and extended the maturity date from November 4, 2024 to December 11, 2026. The RPA is subject to customary termination events related to transactions of this type.

Under the RPA, the Receivables Subsidiary may sell receivables to the Purchasers in amounts up to a $125,000 limit. The receivables will be sold to the Purchasers in consideration for the Purchasers making payments of cash, which is referred to as "capital" for purposes of the RPA, to the Receivables Subsidiary in accordance with the terms of the RPA. The Receivables Subsidiary may sell receivables to the Purchasers so long as certain conditions are satisfied, including that, at any date of determination, the aggregate capital paid to the Receivables Subsidiary does not exceed a "capital coverage amount", equal to an adjusted net receivables pool balance minus a required reserve. Each Purchaser's share of capital accrues yield at a variable rate plus an applicable margin.

The parties intend that the conveyance of receivables to the Agent, for the ratable benefit of the Purchasers will constitute a purchase and sale of receivables and not a pledge for security. The Receivables Subsidiary has guaranteed to each Purchaser and Agent the prompt payment of sold receivables, and to secure the prompt payment and performance of such guaranteed obligations, the Receivables Subsidiary has granted a security interest to the Agent, for the benefit of the Purchasers, in all assets of the Receivables Subsidiary. The assets of the Receivables Subsidiary are not available to pay our creditors or any affiliate thereof. In our capacity as master servicer under the RPA, we are responsible for administering and collecting receivables and have made customary representations, warranties, covenants and indemnities. We also provided a performance guarantee for the benefit of the Purchaser.

The proceeds of the RPA are classified as operating activities in our Consolidated Condensed Statements of Cash Flows. Cash received from collections of sold receivables is used by the Receivables Subsidiary to fund additional purchases of receivables on a revolving basis or to return all or any portion of outstanding capital of the Purchaser. Subsequent collections on the pledged receivables, which have not been sold, will be classified as operating cash flows at the time of collection. Total receivables sold and cash collections under the RPA were $148,827 and $123,827 for the three months ended December 30, 2023, respectively. The fair value of the sold receivables approximated book value due to their credit quality and short-term nature, and as a result, no gain or loss on sale of receivables was recorded.

As of December 30, 2023, the amount sold to the Purchasers was $125,000, which was derecognized from the Consolidated Condensed Balance Sheets. As collateral against sold receivables, the Receivables Subsidiary maintains a certain level of unsold receivables, which was $583,838 at December 30, 2023.

The allowance for credit losses is based on our assessment of the collectability of customer accounts. The allowance is determined by considering factors such as historical experience, credit quality, age of the accounts receivable, current economic conditions and reasonable forecasted financial information that may affect a customer’s ability to pay.

Note 5 - Inventories

Inventories, net of reserves, consist of:

| | | | | | | | | | | | | | |

| | December 30,

2023 | | September 30,

2023 |

| Raw materials and purchased parts | | $ | 292,483 | | | $ | 270,305 | |

| Work in progress | | 405,599 | | | 368,277 | |

| Finished goods | | 89,958 | | | 85,420 | |

| Inventories, net | | $ | 788,040 | | | $ | 724,002 | |

There are no material inventoried costs relating to over-time contracts where revenue is accounted for using the cost-to-cost method of accounting as of December 30, 2023 and September 30, 2023.

Note 6 - Property, Plant and Equipment

Property, plant and equipment consists of:

| | | | | | | | | | | | | | | | |

| | December 30,

2023 | | September 30,

2023 | | |

| Land | | $ | 32,107 | | | $ | 31,417 | | | |

| Buildings and improvements | | 672,924 | | | 646,079 | | | |

| Machinery and equipment | | 849,330 | | | 827,257 | | | |

| Computer equipment and software | | 228,926 | | | 228,284 | | | |

| Property, plant and equipment, at cost | | 1,783,287 | | | 1,733,037 | | | |

| Less accumulated depreciation and amortization | | (940,605) | | | (918,341) | | | |

| Property, plant and equipment, net | | $ | 842,682 | | | $ | 814,696 | | | |

Note 7 - Leases

We lease certain manufacturing facilities, office space and machinery and equipment globally. At inception we evaluate whether a contractual arrangement contains a lease. Specifically, we consider whether we control the underlying asset and have the right to obtain substantially all the economic benefits or outputs from the asset. If the contractual arrangement contains a lease, we then determine the classification of the lease, operating or finance, using the classification criteria described in ASC 842. We then determine the term of the lease based on terms and conditions of the contractual arrangement, including whether the options to extend or terminate the lease are reasonably certain to be exercised. We have elected to not separate lease components from non-lease components, such as common area maintenance charges and instead, account for the lease and non-lease components as a single component.

Our lease right-of-use ("ROU") assets represent our right to use an underlying asset for the lease term and our lease liabilities represent our obligation to make lease payments. Operating lease ROU assets are included in Operating lease right-of-use assets and operating lease liabilities are included in Accrued liabilities and other and Other long-term liabilities on the Consolidated Condensed Balance Sheets. Finance lease ROU assets are included in Property, plant and equipment and finance lease liabilities are included in Accrued liabilities and other, and Other long-term liabilities on the Consolidated Condensed Balance Sheets. Operating lease cost is included in Cost of sales and Selling, general and administrative on the Consolidated Condensed Statements of Earnings. Finance lease cost is included in Cost of sales, Selling, general and administrative and Interest on the Consolidated Condensed Statements of Earnings.

The ROU assets and lease liabilities for both operating and finance leases are recognized as of the commencement date at the net present value of the fixed minimum lease payments over the term of the lease, using the discount rate described below. Variable lease payments are recorded in the period in which the obligation for the payment is incurred. Variable lease payments based on an index or rate are initially measured using the index or rate as of the commencement date of the lease and included in the fixed minimum lease payments. For short-term leases that have a term of 12 months or less as of the commencement date, we do not recognize a ROU asset or lease liability on our balance sheet; we recognize expense as the lease payments are made over the lease term.

The discount rate used to calculate the present value of our leases is the rate implicit in the lease. If the information necessary to determine the rate implicit in the lease is not available, we use our incremental borrowing rate for collateralized debt, which is determined using our credit rating and other information available as of the lease commencement date.

The components of lease expense were as follows:

| | | | | | | | | | |

| | Three Months Ended |

| | December 30,

2023 | December 31,

2022 |

| Operating lease cost | | | $ | 6,970 | | $ | 7,395 | |

| | | | |

| Finance lease cost: | | | | |

| Amortization of right-of-use assets | | | $ | 1,826 | | $ | 972 | |

| Interest on lease liabilities | | | 1,232 | | 364 | |

| Total finance lease cost | | | $ | 3,058 | | $ | 1,336 | |

Supplemental cash flow information related to leases was as follows:

| | | | | | | | |

| Three Months Ended |

December 30,

2023 | December 31,

2022 |

| Cash paid for amounts included in the measurement of lease liabilities: | | |

| Operating cash flow for operating leases | $ | 7,151 | | $ | 7,531 | |

| Operating cash flow for finance leases | 1,232 | | 364 | |

| Financing cash flow for finance leases | 1,286 | | 884 | |

| Assets obtained in exchange for lease obligations: | | |

| Operating leases | $ | 5,717 | | $ | 1,086 | |

| Finance leases | 2,128 | | 4,884 | |

Supplemental balance sheet information related to leases was as follows:

| | | | | | | | |

| December 30,

2023 | September 30,

2023 |

| Operating Leases: | | |

| Operating lease right-of-use assets | $ | 59,489 | | $ | 56,067 | |

| | |

| Accrued liabilities and other | $ | 11,687 | | $ | 11,283 | |

| Other long-term liabilities | 59,306 | | 56,398 | |

| Total operating lease liabilities | $ | 70,993 | | $ | 67,681 | |

| | |

| Finance Leases: | | |

| Property, plant, and equipment, at cost | $ | 89,862 | | $ | 85,324 | |

| Accumulated depreciation | (13,256) | | (10,913) | |

| Property, plant, and equipment, net | $ | 76,606 | | $ | 74,411 | |

| | |

| Accrued liabilities and other | $ | 5,968 | | $ | 5,621 | |

| Other long-term liabilities | 73,661 | | 71,225 | |

| Total finance lease liabilities | $ | 79,629 | | $ | 76,846 | |

| | |

| Weighted average remaining lease term in years: | | |

| Operating leases | 6.7 | 6.9 |

| Finance leases | 23.0 | 23.1 |

| | |

| Weighted average discount rates: | | |

| Operating leases | 5.2 | % | 5.0 | % |

| Finance leases | 6.5 | % | 6.5 | % |

Maturities of lease liabilities were as follows:

| | | | | | | | | | | | | | |

| | | December 30, 2023 |

| | Operating Leases | | Finance Leases |

| 2024 | | $ | 11,378 | | | $ | 7,749 | |

| 2025 | | 13,772 | | | 10,150 | |

| 2026 | | 13,093 | | | 9,866 | |

| 2027 | | 11,804 | | | 9,112 | |

| 2028 | | 9,708 | | | 8,113 | |

| Thereafter | | 24,359 | | | 139,269 | |

| Total lease payments | | 84,114 | | | 184,259 | |

| Less: imputed interest | | (13,121) | | | (104,630) | |

| Total | | $ | 70,993 | | | $ | 79,629 | |

Note 8 - Goodwill and Intangible Assets

Effective October 1, 2023, we made a change to our reporting structure to separate our former Aircraft Controls operating segment into two operating segments, Military Aircraft and Commercial Aircraft, which also represent reporting units for purposes of assessing goodwill. We performed an impairment test consistent with the rules set forth under ASC 350, “Intangibles—Goodwill and Other,” by performing a quantitative analysis on the former reporting unit. Following this test, the Company reassigned the goodwill from the former Aircraft Controls reporting unit to its new reporting units using a relative fair value allocation approach. We then performed quantitative goodwill impairment tests on each of the new reporting units. Quantitative testing requires a comparison of the fair value of a reporting unit to its carrying value. We principally use the discounted cash flow method to estimate the fair value of a reporting unit. The discounted cash flow method incorporates various assumptions, the most significant being projected cash flows (inclusive of projected revenue growth rates and operating margins), the terminal growth rate and the discount rate. Management projects revenue growth rates, operating margins and cash flows based on each reporting unit's current business, expected developments and operational strategies typically over a five-year period. If the carrying value of the reporting unit exceeds its fair value, goodwill is considered impaired and an impairment loss must be measured. The results of our quantitative assessments showed the fair value of the two new reporting units, Military Aircraft and Commercial Aircraft, exceeded their carrying value; and therefore, goodwill was not impaired.

The changes in the carrying amount of goodwill are as follows:

| | | | | | | | | | | | | | | | | |

| Space and

Defense | Military Aircraft | Commercial Aircraft | Industrial | Total |

| Balance at September 30, 2023 | $ | 259,475 | | $ | 111,276 | | $ | 92,612 | | $ | 357,938 | | $ | 821,301 | |

| Acquisition | — | | 2,689 | | — | | — | | 2,689 | |

| | | | | |

| | | | | |

| Foreign currency translation | (473) | | 2,390 | | — | | 7,506 | | 9,423 | |

| Balance at December 30, 2023 | $ | 259,002 | | $ | 116,355 | | $ | 92,612 | | $ | 365,444 | | $ | 833,413 | |

Goodwill in our Space and Defense segment is net of a $4,800 accumulated impairment loss at December 30, 2023. Goodwill in our Medical Devices reporting unit, included in our Industrial segment, is net of a $38,200 accumulated impairment loss at December 30, 2023.

The components of intangible assets are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | December 30, 2023 | | September 30, 2023 |

| | | Weighted-

Average

Life (years) | | Gross Carrying

Amount | | Accumulated

Amortization | | Gross Carrying

Amount | | Accumulated

Amortization |

| Customer-related | | 11 | | $ | 134,739 | | | $ | (95,943) | | | $ | 133,269 | | | $ | (93,648) | |

| Technology-related | | 9 | | 71,978 | | | (57,381) | | | 69,242 | | | (56,106) | |

| Program-related | | 23 | | 38,566 | | | (22,751) | | | 37,465 | | | (21,672) | |

| Marketing-related | | 8 | | 22,644 | | | (19,386) | | | 21,890 | | | (18,995) | |

| Other | | 10 | | 1,842 | | | (1,645) | | | 1,773 | | | (1,581) | |

| Intangible assets | | 12 | | $ | 269,769 | | | $ | (197,106) | | | $ | 263,639 | | | $ | (192,002) | |

All acquired intangible assets other than goodwill are being amortized. Customer-related intangible assets primarily consist of customer relationships. Technology-related intangible assets primarily consist of technology, patents, intellectual property and software. Program-related intangible assets consist of long-term programs represented by current contracts and probable follow on work. Marketing-related intangible assets primarily consist of trademarks, trade names and non-compete agreements.

Amortization of acquired intangible assets is as follows:

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | December 30, 2023 | | December 31, 2022 |

| Acquired intangible asset amortization | | | | | $ | 2,725 | | | $ | 2,987 | |

Based on acquired intangible assets recorded at December 30, 2023, amortization is estimated to be approximately:

| | | | | | | | | | | | | | | | | |

| 2024 | 2025 | 2026 | 2027 | 2028 |

| Estimated future amortization of acquired intangible assets | $ | 10,900 | | $ | 9,800 | | $ | 9,600 | | $ | 8,300 | | $ | 7,500 | |

Note 9 - Equity Method Investments and Joint Ventures

Investments and operating results in which we do not have a controlling interest, however we do have the ability to exercise significant influence over operations, are accounted for using the equity method of accounting. Net investment balances for equity method investments and joint ventures are included as Other assets in the Consolidated Condensed Balance Sheets and consist of:

| | | | | | | | | | | | | | | |

| | | | | December 30, 2023 | | September 30, 2023 |

| Moog Aircraft Service Asia | | | | | $ | 1,511 | | | $ | 1,302 | |

| NOVI LLC | | | | | 325 | | | 325 |

| Suffolk Technologies Fund 1, L.P. | | | | | 1,257 | | | 1,180 | |

| Net investment balance | | | | | $ | 3,093 | | | $ | 2,807 | |

Losses from equity method investments and joint ventures were $67 and $204 for three months ended December 30, 2023 and December 31, 2022, respectively and are included in Other in the Consolidated Condensed Statements of Earnings.

Moog Aircraft Services Asia ("MASA") is a joint venture included in our Commercial Aircraft segment in which we currently hold a 51% ownership share. MASA is intended to provide maintenance, repair and overhaul services for our manufactured flight control systems.

We hold a 20% ownership interest in NOVI LLC ("NOVI") that is included in our Space and Defense segment. NOVI specializes in applying machine learning algorithms to space situational awareness.

Suffolk Technologies Fund 1, L.P., is a limited partnership included in our Industrial segment that invests in startups to transform the construction, real estate and property maintenance industries in the U.S. We have a remaining on-call capital commitment of up to $6,295.

Hybrid Motion Solutions (“HMS”) is a joint venture in our Industrial segment in which we hold a 50% ownership interest. HMS specializes in hydrostatic servo drives and leverages synergies to enter new markets. The joint venture focuses on research and development, design and assembly as well as service. Our share of cumulative losses to date has exceeded our initial investment, and as such, we had no net investment balance recorded as of December 30, 2023.

Investments in, and the operating results of, entities in which we do not have a controlling financial interest or the ability to exercise significant influence over the operations are accounted for using the cost method of accounting. As of December 30, 2023 we had cost method investments of $9,875, which are included as Other assets in the Consolidated Condensed Balance Sheets.

Note 10 - Indebtedness

We maintain short-term line of credit facilities with banks throughout the world that are principally demand lines subject to revision by the banks.

Long-term debt consists of:

| | | | | | | | | | | | | | |

| | December 30,

2023 | | September 30,

2023 |

| U.S. revolving credit facility | | $ | 423,000 | | | $ | 334,500 | |

| SECT revolving credit facility | | 1,000 | | | 33,000 | |

| Senior notes 4.25% | | 500,000 | | | 500,000 | |

| | | | |

| | | | |

| Senior debt | | 924,000 | | | 867,500 | |

| Less deferred debt issuance cost | | (3,897) | | | (4,408) | |

| | | | |

| Long-term debt | | $ | 920,103 | | | $ | 863,092 | |

Our U.S. revolving credit facility, which matures on October 27, 2027, has a capacity of $1,100,000 and provides an expansion option, which permits us to request an increase of up to $400,000 to the credit facility upon satisfaction of certain conditions. Interest on the majority of our outstanding borrowings is principally based on SOFR plus the applicable margin. The credit facility is secured by substantially all of our U.S. assets. The loan agreement contains various covenants which, among others, specify interest coverage and maximum leverage. We are in compliance with all covenants.

The SECT has a revolving credit facility with a borrowing capacity of $35,000, maturing on October 26, 2025. Interest is based on SOFR plus an applicable margin. A commitment fee is also charged based on a percentage of the unused amounts available and is not material.

We have $500,000 aggregate principal amount of 4.25% senior notes due December 15, 2027 with interest paid semiannually on June 15 and December 15 of each year. The senior notes are unsecured obligations, guaranteed on a senior unsecured basis by certain subsidiaries and contain normal incurrence-based covenants and limitations such as the ability to incur additional indebtedness, pay dividends, make other restricted payments and investments, create liens and certain corporate acts such as mergers and consolidations. We are in compliance with all covenants.

Note 11 - Other Accrued Liabilities

Other accrued liabilities consists of:

| | | | | | | | | | | | | | |

| | December 30,

2023 | | September 30, 2023 |

| Employee benefits | | $ | 57,677 | | | $ | 47,653 | |

| Contract reserves | | 54,553 | | | 45,257 | |

| Warranty accrual | | 24,096 | | | 22,939 | |

| Accrued income taxes | | 42,011 | | | 29,631 | |

| Other | | 60,534 | | | 66,289 | |

| Other accrued liabilities | | $ | 238,871 | | | $ | 211,769 | |

In the ordinary course of business, we warrant our products against defects in design, materials and workmanship typically over periods ranging from twelve to sixty months. We determine warranty reserves needed by product line based on historical experience and current facts and circumstances. Activity in the warranty accrual is summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | | | | | | | | | | | | | | | |

| | | | | | December 30,

2023 | | December 31,

2022 | | | | | | | | | | | | | | | | |

| Warranty accrual at beginning of period | | | | | | $ | 22,939 | | | $ | 23,072 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Warranties issued during current period | | | | | | 3,319 | | | 1,958 | | | | | | | | | | | | | | | | | |

| Adjustments to pre-existing warranties | | | | | | (526) | | | (214) | | | | | | | | | | | | | | | | | |

| Reductions for settling warranties | | | | | | (1,876) | | | (2,805) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation | | | | | | 240 | | | 418 | | | | | | | | | | | | | | | | | |

| Warranty accrual at end of period | | | | | | $ | 24,096 | | | $ | 22,429 | | | | | | | | | | | | | | | | | |

Note 12 - Derivative Financial Instruments

We principally use derivative financial instruments to manage foreign exchange risk related to foreign operations and foreign currency transactions and interest rate risk associated with long-term debt. We enter into derivative financial instruments with a number of major financial institutions to minimize counterparty credit risk.

Derivatives designated as hedging instruments

We use foreign currency contracts as cash flow hedges to effectively fix the exchange rates on future payments and revenue. To mitigate exposure in movements between various currencies, including the Philippine peso, we had outstanding foreign currency contracts with notional amounts of $2,792 at December 30, 2023. These contracts mature at various times through March 1, 2024.