UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM 11-K

___________________________________________

(Mark One)

ý ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission File Number: 1-5129

___________________________________________

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

MOOG INC. EMPLOYEE STOCK PURCHASE PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

MOOG INC.

EAST AURORA, NEW YORK 14052-0018

MOOG INC. EMPLOYEE STOCK PURCHASE PLAN

FINANCIAL STATEMENTS

TABLE OF CONTENTS

| | | | | |

| |

Report of Independent Registered Public Accounting Firm | 1 | |

| |

Financial Statements: | |

| Statements of Net Assets Available for Benefits | 2 | |

Statements of Changes in Net Assets Available for Benefits | 3 | |

Notes to Financial Statements | 4-5 |

Exhibit Index | 6 | |

| Signature | 7 | |

| |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Administrative Committee, Plan Administrator, and Plan Participants of

Moog Inc. Employee Stock Purchase Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Moog Inc. Employee Stock Purchase Plan (the Plan) as of September 30, 2023 and 2022, the related statements of changes in net assets available for benefits for the years ended September 30, 2023, 2022, and 2021 and the related notes to the financial statements (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of September 30, 2023 and 2022, and the changes in net assets available for benefits for the years ended September 30, 2023, 2022, and 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with auditing standards of the PCAOB and in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ Freed Maxick CPAs, P.C.

We have served as the Plan's auditor since 2017.

Buffalo, New York

December 20, 2023

MOOG INC. EMPLOYEE STOCK PURCHASE PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | |

| September 30, 2023 | September 30, 2022 |

| Assets: | | |

| Cash | $ | 3,095,360 | | $ | 3,087,910 | |

| Total assets | 3,095,360 | | 3,087,910 | |

| | |

| Liabilities: | | |

| Payable to participants | 3,095,360 | | 3,087,910 | |

| Total liabilities | 3,095,360 | | 3,087,910 | |

| | |

| Net assets available for benefits | $ | — | | $ | — | |

| | |

| See accompanying Notes to Financial Statements. | | |

MOOG INC. EMPLOYEE STOCK PURCHASE PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | | | | |

| Year Ended |

| September 30, 2023 | September 30, 2022 | September 30, 2021 |

| Additions: | | | |

| Employee contributions | $ | 11,048,042 | | $ | 9,961,043 | | $ | 8,665,105 | |

| Total additions | 11,048,042 | | 9,961,043 | | 8,665,105 | |

| | | |

| Deductions: | | | |

| Cost of shares purchased | 11,040,592 | | 9,448,157 | | 8,289,385 | |

| Payable to participants | 3,095,360 | | 3,087,910 | | 2,575,024 | |

| Prior year contributions used for current year share purchases | (3,087,910) | | (2,575,024) | | (2,199,304) | |

| Total deductions | 11,048,042 | | 9,961,043 | | 8,665,105 | |

| | | |

| Net increase (decrease) | — | | — | | — | |

| | | |

| Net assets available for benefits at beginning of period | — | | — | | — | |

| Net assets available for benefits at end of period | $ | — | | $ | — | | $ | — | |

| | | |

| See accompanying Notes to Financial Statements. | | | |

MOOG INC. EMPLOYEE STOCK PURCHASE PLAN

NOTES TO FINANCIAL STATEMENTS

1. Description of Plan

The following is a brief description of the Moog Inc. Employee Stock Purchase Plan (the "Plan") and is provided for general information purposes only. Participants should refer to the Plan Document and the Prospectus for complete information.

General

On February 15, 2017, Moog Inc.’s (the “Company’s”) shareholders approved the Moog Inc. Employee Stock Purchase Plan. The Plan is administered by the Executive Compensation Committee of the Board of Directors (the "Committee") and is intended to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code of 1986, as amended, pursuant to which the Plan is not subject to taxation. The Plan is not subject to any provisions of the Employee Retirement Income Security Act of 1974, as amended, and is not qualified under Section 401 of the Internal Revenue Code of 1986, as amended. The Company believes that the Plan has been operated in accordance with the Code and therefore no provision for income taxes has been reflected in the accompanying financial statements.

Eligibility

An employee of a Moog Inc. entity, that provides services in the United States, Germany and the United Kingdom is eligible to participate in the Plan if employed for at least 20 hours per week and more than five months in any calendar year or at the discretion of the Committee.

Employees owning shares representing 5% or more of the total combined voting power or value of all classes of Company stock are not permitted to purchase any shares of Company common stock under the Plan.

The initial offering period under the Plan began on September 1, 2017 and ended on December 31, 2017. After the initial offering period, all subsequent offering periods are a six-month period beginning on January 1st and July 1st of each year (the “Offering Period”). Each eligible employee may enroll in the Plan during the open enrollment period, which is typically the month prior to the start of an Offering Period.

Contributions

Plan participants may contribute from 1% to 15% of the participant’s compensation, as defined in the Plan, through payroll deductions during the Offering Period. Participants may increase, decrease or suspend their withholding percentage during the enrollment period, effective for the next offering period. The Company holds contributions until the end of the Offering Period at which point the Company issues shares for the contributions received. In accordance with the Plan, the Company has no obligation to segregate employee payroll deductions from any other funds of the Company or to hold funds representing the same pending application of such amount to the purchase of shares at the end of each Offering Period.

Any contribution amount remaining after the purchase of whole shares of common stock at the end of an Offering Period is held in the participant's account for the share purchase in the following offering period.

1. Description of Plan (continued)

Share Purchases

The Plan has reserved 2,000,000 shares of the Company's common stock for issuance. The Committee shall designate whether the participant may purchase shares in the form of Class A common stock or Class B common stock prior to the beginning of the Offering Period. The Plan has issued Class B common stock for all offering periods.

The Plan allows for qualified employees to purchase the Company's common stock at a discounted price. The maximum discounted purchase price of a share of the Company's common stock is 85% of the fair market value at the lower of the beginning or the end of the semi-annual Offering Period. The Plan purchases only whole shares of the Company's common stock. Additionally, participants are prohibited from purchases of shares with an aggregate fair market value in excess of $25,000 in any one calendar year.

The maximum aggregate number of shares subject to issuance in accordance with the Plan is 2,000,000 shares. There were 155,704, 139,121 and 141,647 shares of the Company's common stock purchased during the period ended September 30, 2023, September 30, 2022 and September 30, 2021, respectively. Under the Plan, 1,310,543 shares remain reserved for future issue as of September 30, 2023.

Participant Withdrawals

Participants may choose to withdraw from the Plan by providing notice at least 30 business days prior to the last pay period of the Offering Period. Participants who terminate their employment with the Company are not eligible to continue participation in the Plan. Upon withdrawal, termination from employment or death, any contributions credited to the participant's account will be returned to the participant, by the Company. Refunds from participant withdrawals have not been significant.

Plan Administration

All expenses for Plan administration are paid by the Company and are not reflected in the accompanying financial statements.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements are presented on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

3. Plan Amendments and Termination

The Board of Directors or the Committee may amend, suspend or terminate the Plan at any time and for any reason. If outstanding offering periods are terminated prior to expiration, all amounts credited to participant accounts that have not been used to purchase shares of the Company's common stock, will be returned to the participants.

4. Plan Assets

The Plan's cash is maintained by the Company on behalf of the Plan.

EXHIBIT INDEX

SIGNATURE

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | MOOG INC. EMPLOYEE STOCK PURCHASE PLAN |

| | | |

| Date: December 20, 2023 | | /s/ Paul Wilkinson |

| | | Paul Wilkinson |

| | | Plan Administrator |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (No. 333-218546) on Form S-8 of Moog Inc. of our report dated December 20, 2023 relating to our audit of the financial statements of Moog Inc. Employee Stock Purchase Plan, which appears in this Annual Report on Form 11-K of the Moog Inc. Employee Stock Purchase Plan for the year ended September 30, 2023.

/s/ FREED MAXICK, CPAs, PC

Buffalo, New York

December 20, 2023

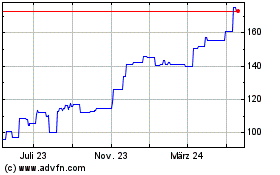

Moog (NYSE:MOG.B)

Historical Stock Chart

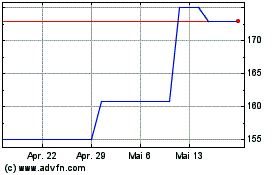

Von Mär 2024 bis Apr 2024

Moog (NYSE:MOG.B)

Historical Stock Chart

Von Apr 2023 bis Apr 2024