0001839175

false

0001839175

2023-11-30

2023-11-30

0001839175

MBAC:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemableWarrantMember

2023-11-30

2023-11-30

0001839175

MBAC:ClassCommonStockParValue0.0001PerShareMember

2023-11-30

2023-11-30

0001839175

MBAC:PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-11-30

2023-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13

OR 15(d)

OF THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

earliest event reported): November 30, 2023

M3-BRIGADE ACQUISITION

II CORP.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-40162 |

|

86-1359752 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

1700 Broadway, 19th

Floor

New York, New York 10019

(Address of principal executive

offices, including zip code)

(212) 202-2200

(Registrant’s telephone

number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one share of Class A common stock and one-third of one redeemable warrant |

|

MBAC.U |

|

New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

MBAC |

|

New York Stock Exchange |

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

MBAC.WS |

|

New York Stock Exchange |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

As previously reported, on

March 7, 2023, the stockholders of M3-Brigade Acquisition II Corp. (the “Company”) approved an amendment to the

Company’s certificate of incorporation in order to extend the date by which the Company must consummate a business combination from

March 8, 2023 to December 8, 2023 (the “Extension Date”).

On November 29, 2023, the

Company’s board of directors (the “Board”) determined that the Company would be unlikely to consummate a business combination

by the Extension Date. Accordingly, the Company will (i) cease all operations except for the purpose of winding up, (ii) as

promptly as possible, redeem the shares of the Company’s Class A common stock, par value $0.0001 per share (the “Class

A Common Stock”), that were included in the units issued in the Company’s initial public offering (the “Public Shares”)

at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on

the funds held in the Trust Account and not released to the Company to pay its taxes (less up to $100,000 of interest to pay dissolution

expenses), divided by the number of outstanding Public Shares, which redemption will completely extinguish rights of the holders of the

Public Shares as stockholders (including the right to receive further liquidating distributions, if any), subject to applicable law (the

“Redemption”), and (iii) as promptly as reasonably possible following the Redemption, subject to the approval of the

Company’s remaining stockholders, dissolve and liquidate, subject in each case to its obligations under Delaware law to provide

for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions

with respect to the Company’s warrants, which will expire worthless.

The Company’s sponsor

has agreed to waive its redemption rights with respect to monies held in the Trust Account with respect to its shares of the Company’s

Class B common stock, par value $0.0001 per share.

In order to provide for the

disbursement of funds from the Trust Account, the Company has instructed Continental Stock Transfer & Trust Company (“Continental”),

as its trustee, to take all necessary actions to effect the Redemption. The proceeds thereof, less $100,000 of interest to pay dissolution

expenses and net of taxes payable, will be held in a trust operating account while awaiting disbursement to the holders of the Public

Shares. The Company expects to redeem all of the outstanding Public Shares for an estimated redemption price of approximately $10.60

per share (the “Redemption Amount”). All other costs and expenses associated with implementing the dissolution will be funded

from proceeds held outside of the Trust Account. Record holders of Public Shares will receive their pro rata portion of the proceeds of

the Trust Account by delivering their Public Shares to Continental, the Company’s transfer agent. Beneficial owners of Public Shares

held in “street name,” however, will not need to take any action in order to receive the Redemption Amount. The Redemption

Amount is expected to be paid out by December 13, 2023.

The Company expects that

the New York Stock Exchange will file a Form 25 with the United States Securities and Exchange Commission (the “Commission”)

to delist the Company’s securities after the last day of trading on December 8, 2023. The Company thereafter intends to file

a Form 15 with the Commission to suspend its reporting obligations under Sections 13 and 15(d) of the Exchange Act.

On November 30, 2023, the

Company issued a press release announcing the Redemption, dissolution and liquidation. A copy of the press release is attached as Exhibit 99.1

and incorporated herein by reference.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

M3-BRIGADE ACQUISITION II CORP. |

| |

|

|

| Date: December 4, 2023 |

By: |

/s/ Mohsin Y. Meghji |

| |

|

Name: |

Mohsin Y. Meghji |

| |

|

Title: |

Chairman and Chief Executive Officer |

Exhibit 99.1

M3-Brigade Acquisition II Corp. Announces Redemption

of Class A Common Stock

New York, NY, November 30, 2023 (PR NEWSWIRE) – M3-Brigade Acquisition

II Corp., a Delaware corporation (the “Company”) (NYSE: MBAC) which is a special purpose acquisition company, today announced

that it has determined to redeem all of its outstanding Class A common stock, par value $0.0001 per share, previously issued to the public

(the “Public Shares”), with such redemption anticipated to be effective on or about December 13, 2023, because the Company

will not consummate an initial business combination within the time period required by its amended and restated certificate of incorporation

(the “Charter”), filed with the U.S. Securities and Exchange Commission (the “Commission”) on March 10, 2021.

The Company expects the last day of trading of its Public Shares, units and warrants to be on or about December 8, 2023.

On March 7, 2023, the Company held an extraordinary general meeting of

shareholders of the Company (the “Extension Meeting”) to amend the Articles to extend the date by which the Company has to

consummate a business combination from March 8, 2023 to December 8, 2023. The shareholders of the Company approved such extension at the

Extension Meeting.

Pursuant to the Company’s Charter, if the Company has not completed

an initial business combination by December 8, 2023, the Company will (i) cease all operations except for the purpose of winding up, (ii)

as promptly as reasonably possible but not more than ten business days thereafter subject to lawfully available funds therefor, redeem

100% of the issued and outstanding Public Shares at a per-share price, payable in cash, equal to the quotient obtained by dividing (A)

the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the Trust Account (which interest

shall be net of taxes payable and up to $100,000 of interest to pay dissolution expenses), by (B) the total number of then outstanding

Public Shares, which redemption will completely extinguish rights of the holders of Public Shares (including the right to receive further

liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption,

subject to the approval of the remaining stockholders and the Company’s board of directors, in accordance with applicable law, dissolve

and liquidate, subject in each case to the Company’s obligations under Delaware law to provide for claims of creditors and other

requirements of applicable law.

The per-share redemption price for the Public Shares is expected to be

approximately $10.60 (the “Redemption Amount”). In accordance with the terms of the related trust agreement, the Company expects

to retain a portion of the interest earned on the funds deposited in the trust account to pay the Company’s tax obligations and

$100,000 of dissolution expenses.

As of the close of business on the redemption date, the Public Shares will

be deemed to no longer be outstanding and will represent only the right to receive the Redemption Amount for each such Public Share.

The Redemption Amount will be payable to the holders of the Public Shares

upon presentation of their respective stock or unit certificates or other delivery of their shares or units to the Company’s transfer

agent, Continental Stock Transfer & Trust Company. Beneficial owners of Public Shares held in “street name,” however,

will not need to take any action in order to receive the Redemption Amount.

There will be no redemption rights or liquidating distributions with respect

to the Company’s warrants, which will expire worthless.

Following the last day of trading of the Company's Public Shares, units

and warrants, the Company expects that the New York Stock Exchange will file a Form 25 with the Commission to delist its securities. The

Company thereafter expects to file a Form 15 with the Commission to terminate the registration of its securities under the Securities

Exchange Act of 1934, as amended.

About M3-Brigade Acquisition II Corp.

MBAC is a special purpose acquisition corporation formed for the purpose

of effecting a merger, stock purchase or similar business combination with one or more businesses. MBAC is led by key executives of M3

Partners, LP, a leading financial advisory services firm that specializes in assisting companies at inflection points in their growth

cycle, and Brigade Capital Management, LP, a leading global investment advisor that was founded in 2006 to specialize in credit-focused

investment strategies and has approximately $30 billion in assets under management.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements relating to the estimated per-share redemption price and timing for redemptions and delisting of the Company’s

securities. When used in this press release, the words “could,” “should,” “will,” “may,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,”

the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words. These forward-looking statements involve many risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by such statements, including. These forward-looking statements speak only

as of the date of the foregoing communication, and the Company expressly disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statement contained herein to reflect any change in its expectations with regard thereto or any change

in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of the Company,

including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, for risks and uncertainties related to the Company’s

business which may affect the statements made in this communication.

Contact:

M3-Brigade Acquisition II Corp.

c/o M3 Partners, LP

1700 Broadway

19th Floor

New York, NY 10019

www.m3-brigade.com

Investor Relations

Kristin Celauro (212) 202-2223

v3.23.3

Cover

|

Nov. 30, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 30, 2023

|

| Entity File Number |

001-40162

|

| Entity Registrant Name |

M3-BRIGADE ACQUISITION

II CORP.

|

| Entity Central Index Key |

0001839175

|

| Entity Tax Identification Number |

86-1359752

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1700 Broadway

|

| Entity Address, Address Line Two |

19th

Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

(212)

|

| Local Phone Number |

202-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock and one-third of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A common stock and one-third of one redeemable warrant

|

| Trading Symbol |

MBAC.U

|

| Security Exchange Name |

NYSE

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

MBAC

|

| Security Exchange Name |

NYSE

|

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

MBAC.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBAC_UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBAC_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MBAC_PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

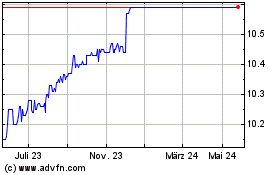

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024