0001489393False00014893932024-11-012024-11-010001489393country:GB2024-11-012024-11-010001489393country:NL2024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K/A

____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2024

____________________________________________

LYONDELLBASELL INDUSTRIES N.V.

(Exact name of registrant as specified in its charter)

____________________________________________ | | | | | | | | |

| Netherlands | 001-34726 | 98-0646235 |

(State or other jurisdiction

of incorporation) | (Commission

file number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1221 McKinney St., | | 4th Floor, One Vine Street | | | | |

| Suite 300 | | London | | Delftseplein 27E | |

| Houston, Texas | | W1J0AH | | 3013AA | Rotterdam | |

| USA | 77010 | | United Kingdom | | Netherlands | |

(Address of principal executive offices) (Zip code) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (713) | 309-7200 | | +44 (0) | 207 | 220 2600 | | +31 (0) | 10 | 2755 500 | |

(Registrant’s telephone numbers, including area codes)

(Former name or former address, if changed since last report)

_____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange On Which Registered |

| Ordinary Shares, €0.04 Par Value | | LYB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Conditions.

Explanatory Note

On November 1, 2024, LyondellBasell Industries N.V. (the “Company”) issued a press release and filed a Form 8-K announcing earnings results for the quarter ended September 30, 2024, and provided a supplemental discussion of segment results. The revised segment results discussion is furnished herewith as Exhibit 99.2 and includes a correction to a clerical error in our disclosure regarding the number of shares repurchased, and reflects that the Company repurchased approximately 438 thousand shares during the third quarter 2024.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

| Exhibit Number | | Description |

| | |

| | |

| | |

| 99.2 | | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, hereunto duly authorized. | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | LYONDELLBASELL INDUSTRIES N.V. |

| | | |

| Date: | November 1, 2024 | | | | |

| | | | By: | /s/ Chukwuemeka A. Oyolu |

| | | | | |

| | | | | Chukwuemeka A. Oyolu |

| | | | | Senior Vice President, |

| | | | | Chief Accounting Officer and Investor Relations |

| | | | | (Principal Accounting Officer) |

LYONDELLBASELL BUSINESS RESULTS DISCUSSION BY REPORTING SEGMENT

LyondellBasell manages operations through six operating segments: 1) Olefins and Polyolefins-Americas; 2) Olefins and Polyolefins-Europe, Asia and International; 3) Intermediates and Derivatives; 4) Advanced Polymer Solutions; 5) Refining; and 6) Technology.

This information should be read in conjunction with our Earnings Release for the period ended September 30, 2024, including the forward-looking statements and information related to financial measures.

Olefins & Polyolefins-Americas (O&P-Americas) - Our O&P-Americas segment produces and markets olefins & co-products, polyethylene and polypropylene.

Table 1 - O&P-Americas Financial Overview | | | | | | | | | | | | | | | | | |

| Millions of U.S. dollars | Three Months Ended | Nine Months Ended |

September 30,

2024 | June 30,

2024 | September 30,

2023 | September 30,

2024 | September 30,

2023 |

| Operating income | $596 | $519 | $326 | $1,471 | $1,221 |

| EBITDA | 758 | | 670 | | 479 | | 1,949 | | 1,699 | |

| Identified items: Impairment | — | | — | | 25 | | — | | 25 | |

| EBITDA excluding identified items | $758 | $670 | $504 | $1,949 | $1,724 |

Three months ended September 30, 2024 versus three months ended June 30, 2024 - EBITDA increased $88 million versus the second quarter 2024. Compared to the prior period, olefins results increased approximately $140 million driven by higher ethylene margins due to industry cracker downtime and lower ethane feedstock costs. The company's ethylene crackers operated at about 95% of capacity with the raw materials being 75% ethane and 20% other natural gas liquids. Combined polyolefins results decreased approximately $50 million driven by lower polymer margins due to increased monomer costs. Equity income increased by approximately $5 million.

Three months ended September 30, 2024 versus three months ended September 30, 2023 - EBITDA increased $279 million versus the third quarter 2023 or $254 million, excluding an impairment of $25 million in the third quarter of 2023. Olefins results increased approximately $280 million driven by higher ethylene margins due to industry cracker downtime and lower ethane feedstock costs. Combined polyolefin results decreased approximately $5 million due to lower polypropylene margins driven by higher propylene monomer costs.

Olefins & Polyolefins-Europe, Asia, International (O&P-EAI) - Our O&P-EAI segment produces and markets olefins & co-products, polyethylene and polypropylene.

Table 2 - O&P-EAI Financial Overview | | | | | | | | | | | | | | | | | |

| Millions of U.S. dollars | Three Months Ended | Nine Months Ended |

September 30,

2024 | June 30,

2024 | September 30,

2023 | September 30,

2024 | September 30,

2023 |

| Operating income (loss) | $39 | $30 | $(95) | $58 | $(20) |

| EBITDA | 81 | 70 | (45) | 165 | 116 |

| | | | | |

| | | | | |

Three months ended September 30, 2024 versus three months ended June 30, 2024 - EBITDA increased $11 million versus the second quarter 2024. Compared to the prior period, olefins results decreased approximately $5 million due to lower volumes from planned downtime mostly offset by lower feedstock costs. The company's ethylene crackers operated at approximately 75% of capacity with about 40% of the raw materials derived from non-naphtha feedstocks. Combined polyolefins results increased approximately $10 million compared to the prior period due to moderately higher margins.

Three months ended September 30, 2024 versus three months ended September 30, 2023 - EBITDA increased $126 million versus the third quarter 2023. Compared to the prior period, olefins results increased approximately $50 million due to increased margins driven by higher ethylene prices partially offset by higher feedstock costs. Combined polyolefins results increased approximately $95 million due to higher polyolefin product pricing in Europe. Joint venture equity income decreased approximately $15 million due to weaker margins in Asia.

Intermediates & Derivatives (I&D) - Our I&D segment produces and markets Propylene Oxide & Derivatives, Oxyfuels & Related Products and Intermediate Chemicals, such as styrene monomer and acetyls.

Table 3 - I&D Financial Overview | | | | | | | | | | | | | | | | | |

| Millions of U.S. dollars | Three Months Ended | Nine Months Ended |

September 30,

2024 | June 30,

2024 | September 30,

2023 | September 30,

2024 | September 30,

2023 |

| Operating income | $210 | $392 | $611 | $814 | $1,292 |

| EBITDA | 317 | 794 | 708 | 1,423 | 1,606 |

| Identified items: Gain on sale of business | — | (293) | — | (293) | — |

| | | | | |

| EBITDA excluding identified items | 317 | 501 | 708 | 1,130 | 1,606 |

Three months ended September 30, 2024 versus three months ended June 30, 2024 - EBITDA decreased $477 million compared to the second quarter 2024 or $184 million excluding a gain on the sale of our Ethylene Oxide and Derivatives business of $293 million in the second quarter of 2024. Compared to the prior period, Propylene Oxide & Derivatives results decreased approximately $30 million due to lower volumes driven by planned and unplanned downtime and lower export margins. Intermediate Chemicals results decreased approximately $10 million primarily due to lower styrene margins. Oxyfuels & Related Products results decreased approximately $120 million driven by significantly lower margins as gasoline crack spreads declined.

Three months ended September 30, 2024 versus three months ended September 30, 2023 - EBITDA decreased $391 million versus the third quarter 2023. Compared to the prior period, Propylene Oxide & Derivatives results decreased approximately $35 million due to lower derivatives and export margins. Intermediate Chemicals results increased approximately $15 million driven by higher methanol volumes and margins with higher product pricing and lower natural gas feedstock costs. Oxyfuels & Related Products results decreased approximately $375 million as margins were significantly compressed, especially relative to third quarter 2023 which benefited from unplanned industry downtime.

Advanced Polymer Solutions (APS) - Our Advanced Polymer Solutions segment produces and markets Compounding & Solutions, such as polypropylene compounds, engineered plastics, masterbatches, engineered composites, colors and powders.

Table 4 - Advanced Polymer Solutions Financial Overview | | | | | | | | | | | | | | | | | |

| Millions of U.S. dollars | Three Months Ended | Nine Months Ended |

September 30,

2024 | June 30,

2024 | September 30,

2023 | September 30,

2024 | September 30,

2023 |

| Operating (loss) income | $(5) | $15 | $(6) | $23 | $(244) |

| EBITDA | 19 | 40 | 18 | 94 | (174) |

| Identified items: Goodwill impairment | — | — | — | — | 252 |

| EBITDA excluding identified items | 19 | 40 | 18 | 94 | 78 |

Three months ended September 30, 2024 versus three months ended June 30, 2024 - Compared to the second quarter 2024, EBITDA decreased $21 million due to significantly lower automotive demand in Europe pressuring margins and volumes.

Three months ended September 30, 2024 versus three months ended September 30, 2023 - Compared to the third quarter 2023, EBITDA increased $1 million, driven by slightly higher margins.

Refining - Our Refining segment produces and markets gasoline and distillates, including diesel fuel, heating oil and jet fuel.

Table 5 - Refining Financial Overview | | | | | | | | | | | | | | | | | |

| Millions of U.S. dollars | Three Months Ended | Nine Months Ended |

September 30,

2024 | June 30,

2024 | September 30,

2023 | September 30,

2024 | September 30,

2023 |

| Operating (loss) income | $(92) | $(57) | $51 | $(125) | $234 |

| EBITDA | (60) | (7) | 76 | (12) | 369 |

| Identified items: Refinery exit costs | 37 | 22 | 29 | 75 | 165 |

| | | | | |

| EBITDA excluding identified items | (23) | 15 | 105 | 63 | 534 |

Three months ended September 30, 2024 versus three months ended June 30, 2024 - Relative to the second quarter 2024, EBITDA decreased $53 million, or $38 million excluding third quarter 2024 exit costs of $37 million and second quarter 2024 exit costs of $22 million. Compared to the prior period, volumes were lower due to unplanned downtime. Margins declined in the third quarter 2024 as the Maya 2-1-1 industry crack spread decreased by $3 per barrel to $26 per barrel driven by lower gasoline crack spreads due to weaker demand and high industry operating rates. The Houston Refinery operated at an average crude throughput of 240,000 barrels per day which corresponds to a utilization rate of 90%.

Three months ended September 30, 2024 versus three months ended September 30, 2023 - Relative to the third quarter 2023, EBITDA decreased $136 million, or $128 million excluding third quarter 2024 exit costs of $37 million and third quarter 2023 exit costs of $29 million. Compared to the prior period, margins decreased with the Maya 2-1-1 industry crack spread decreasing approximately $15 per barrel driven by a lower gasoline and distillate cracks due to lower demand and high industry operating rates compared to the prior year. Third quarter 2024 results saw mark-to-market benefit from our commodity distillate hedging program compared to the prior period. Crude throughput decreased by approximately 8,000 barrels per day due to unplanned downtime during third quarter 2024.

Technology - Our Technology segment develops and licenses chemical and polyolefin process technologies and manufactures and sells polyolefin catalysts.

Table 6 - Technology Financial Overview | | | | | | | | | | | | | | | | | |

| Millions of U.S. dollars | Three Months Ended | Nine Months Ended |

September 30,

2024 | June 30,

2024 | September 30,

2023 | September 30,

2024 | September 30,

2023 |

| Operating income | $59 | $72 | $134 | $240 | $265 |

| EBITDA | 69 | 84 | 146 | 271 | 298 |

| | | | | |

| | | | | |

Three months ended September 30, 2024 versus three months ended June 30, 2024 - EBITDA decreased $15 million compared to the prior period as licensing revenues moderated and catalyst demand remained stable.

Three months ended September 30, 2024 versus three months ended September 30, 2023 - EBITDA decreased $77 million relative to the third quarter 2023. Licensing and catalyst revenue decreased compared to the prior period which benefited from higher contract revenue milestones and strong catalyst margins and volume.

Capital Spending and Cash Balances

Capital expenditures, including sustaining maintenance and profit-generating growth projects, were $368 million during the third quarter 2024. At the end of the quarter, cash and liquid investment balances were $2.6 billion, which includes cash and cash equivalents, restricted cash and short-term investments. There were 325 million common shares outstanding as of September 30, 2024. The company paid dividends of $437 million and repurchased approximately 438 thousand shares during the third quarter 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 7 - Reconciliation of EBITDA to EBITDA Excluding Identified Items by Segment |

| Three Months Ended | | Nine Months Ended |

| Millions of U.S. dollars | September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| EBITDA: | | | | | | | | | |

| Olefins & Polyolefins - Americas | $ | 758 | | | $ | 670 | | | $ | 479 | | | $ | 1,949 | | | $ | 1,699 | |

| Olefins & Polyolefins - EAI | 81 | | | 70 | | | (45) | | | 165 | | | 116 | |

| Intermediates & Derivatives | 317 | | | 794 | | | 708 | | | 1,423 | | | 1,606 | |

| Advanced Polymer Solutions | 19 | | | 40 | | | 18 | | | 94 | | | (174) | |

| Refining | (60) | | | (7) | | | 76 | | | (12) | | | 369 | |

| Technology | 69 | | | 84 | | | 146 | | | 271 | | | 298 | |

| Other | (10) | | | (7) | | | (26) | | | (25) | | | (44) | |

| EBITDA | $ | 1,174 | | | $ | 1,644 | | | $ | 1,356 | | | $ | 3,865 | | | $ | 3,870 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Identified items(a): | | | | | | | | | |

| less: Gain on sale of business: | | | | | | | | | |

| Intermediates & Derivatives | $ | — | | | $ | (293) | | | $ | — | | | $ | (293) | | | $ | — | |

| add: Impairments: | | | | | | | | | |

| Olefins & Polyolefins - Americas | — | | | — | | | 25 | | | — | | | 25 | |

| | | | | | | | | |

| | | | | | | | | |

| Advanced Polymer Solutions | — | | | — | | | — | | | — | | | 252 | |

| | | | | | | | | |

| add: Refinery exit costs: | | | | | | | | | |

| Refining | 37 | | | 22 | | | 29 | | | 75 | | | 165 | |

| Total Identified items: | $ | 37 | | | $ | (271) | | | $ | 54 | | | $ | (218) | | | $ | 442 | |

| | | | | | | | | |

| EBITDA excluding Identified items: | | | | | | | | | |

| Olefins & Polyolefins - Americas | $ | 758 | | | $ | 670 | | | $ | 504 | | | $ | 1,949 | | | $ | 1,724 | |

| Olefins & Polyolefins - EAI | 81 | | | 70 | | | (45) | | | 165 | | | 116 | |

| Intermediates & Derivatives | 317 | | | 501 | | | 708 | | | 1,130 | | | 1,606 | |

| Advanced Polymer Solutions | 19 | | | 40 | | | 18 | | | 94 | | | 78 | |

| Refining | (23) | | | 15 | | | 105 | | | 63 | | | 534 | |

| Technology | 69 | | | 84 | | | 146 | | | 271 | | | 298 | |

| Other | (10) | | | (7) | | | (26) | | | (25) | | | (44) | |

| EBITDA excluding Identified items | $ | 1,211 | | | $ | 1,373 | | | $ | 1,410 | | | $ | 3,647 | | | $ | 4,312 | |

| | | | | | | | | |

|

(a) “Identified items” include adjustments for lower of cost or market (“LCM”), gain on sale of business, impairments in excess of $10 million in aggregate for the period and refinery exit costs.

v3.24.3

Document and Entity Information Document

|

Nov. 01, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity Registrant Name |

LYONDELLBASELL INDUSTRIES N.V.

|

| Entity Incorporation, State or Country Code |

P7

|

| Entity File Number |

001-34726

|

| Entity Tax Identification Number |

98-0646235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, €0.04 Par Value

|

| Trading Symbol |

LYB

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001489393

|

| Amendment Flag |

false

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

1221 McKinney St.

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

77010

|

| City Area Code |

(713)

|

| Local Phone Number |

309-7200

|

| United Kingdom |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

4th Floor, One Vine Street

|

| Entity Address, City or Town |

London

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

W1J0AH

|

| Country Region |

+44 (0)

|

| City Area Code |

207

|

| Local Phone Number |

220 2600

|

| Netherlands |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

Delftseplein 27E

|

| Entity Address, City or Town |

Rotterdam

|

| Entity Address, Country |

NL

|

| Entity Address, Postal Zip Code |

3013AA

|

| Country Region |

+31 (0)

|

| City Area Code |

10

|

| Local Phone Number |

2755 500

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityAddressesAddressTypeAxis=country_GB |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityAddressesAddressTypeAxis=country_NL |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

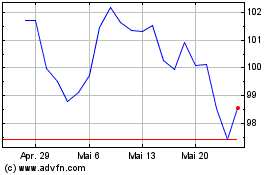

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024