Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

19 Juli 2023 - 4:36PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

July 19, 2023

Commission File Number 001-36761

Kenon Holdings Ltd.

1 Temasek Avenue #37-02B

Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-201716) OF

KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH REGISTRATION STATEMENT.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

| |

KENON HOLDINGS LTD.

|

|

| |

|

|

|

|

Date: July 19, 2023

|

By:

|

/s/ Robert L. Rosen

|

|

| |

|

Name: Robert L. Rosen

|

|

| |

|

Title: Chief Executive Officer

|

|

| |

|

|

|

Exhibit 99.1

OPC Energy Ltd., a Subsidiary of Kenon Holdings Ltd., Announces that the Israel Electric Corporation

has Cancelled the Tender for the Eshkol Acquisition

Singapore, July 19, 2023. Kenon

Holdings Ltd.’s (NYSE: KEN, TASE: KEN) (“Kenon”) subsidiary OPC Energy Ltd. (“OPC”) previously announced on June 18, 2023 that a third party was declared the winning bidder for the acquisition of the “Eshkol” power plant (“Tender”), with an offer of NIS 12.4 billion (approximately $3.5 billion) and that the special-purpose corporation owned equally by OPC Power Plants Ltd. (an 80% subsidiary of OPC) and a corporation held by the Noy

Fund was declared the second qualifier, with an offer of NIS 7.1 billion (approximately $2.0 billion). OPC has announced on July 19, 2023 that the Israel Electric Corporation (“IEC”) has cancelled the Tender and has decided to conduct a new competitive procedure between the bidders who participated in the Tender (and which, according to a report published by the IEC, will include a

minimum bid price of NIS 9 billion (approximately $2.5 billion)), in accordance with the terms and dates that will be referred to in the Tender documents.

OPC announced that it objects to the cancellation of the Tender and to the competitive procedure decided by the IEC, and that it

believes these steps are unlawful. OPC also announced that in the opinion of OPC and its legal advisors, since the winning bidder in the Tender (a corporation controlled by Dalia Energy Companies Ltd.) failed to meet its obligation to realize its

winning bid in accordance with its original bid as submitted as part of the Tender, the IEC is required to declare the second qualifier (the special-purpose corporation owned equally by OPC Power Plants Ltd. and a corporation held by the Noy Fund) as

the winner in the Tender. OPC has announced that it intends to contact the IEC in connection with its decision, and in the event its request is not answered, OPC intends to appeal to judicial courts.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include statements with respect to the tender, the IEC announcement of the cancellation of the tender, OPC’s objections and the steps it intends to take, and other non-historical statements. These forward-looking

statements are based on current expectations or beliefs, and are subject to uncertainty and changes in circumstances. These forward-looking statements are subject to a number of risks and uncertainties, which could cause the actual results to differ

materially from those indicated in these forward-looking statements. Such risks include the risks related to the Tender, the IEC announcement of the cancellation of the tender, OPC’s objections and the steps it intends to take, including an appeal to

the judicial courts, and including those set forth under the heading “Risk Factors” in Kenon’s most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Except as required by law, Kenon undertakes no obligation to

update these forward-looking statements, whether as a result of new information, future events, or otherwise.

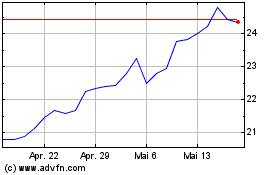

Kenon (NYSE:KEN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

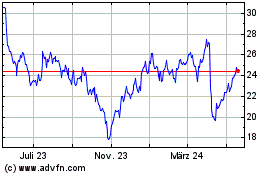

Kenon (NYSE:KEN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024