Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

01 Juni 2023 - 12:05PM

Edgar (US Regulatory)

The following is a summary of the terms of the notes offered by the preliminary pricing supplement hyperlinked below. Summary of Terms Issuer: JPMorgan Chase Financial Company LLC Guarantor: JPMorgan Chase & Co. Minimum Denomination: $1,000 Reference Stocks: Common stock of Tesla, Inc., common stock of NVIDIA Corporation, and Class A common stock of Alphabet Inc. Pricing Date: June 30, 2023 Final Review Date: June 30, 2026 Maturity Date: July 6, 2026 Review Dates: Quarterly Contingent Interest Rate: At least 12.00%* per annum, payable quarterly at a rate of at least 3.00%* Interest Barrier: With respect to each Reference Stock, an amount that represents 85.00% of its Initial Value CUSIP: 48133XFR2 Preliminary Pricing Supplement: http://sp.jpmorgan.com/document/cusip/48133XFR2/doctype/Product_Termsheet/document.pdf Estimated Value: The estimated value of the notes, when the terms of the notes are set, will not be less than $900.00 per $1,000 principal amount note. For information about the estimated value of the notes, which likely will be lower than the price you paid for the notes, please see the hyperlink above. Automatic Call If the closing price of one share of each Reference Stock on any Review Date (other than the first, second, third and final R evi ew Dates) is greater than or equal to its Initial Value, the notes will be automatically called for a cash payment, for each $1,000 princi pal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to that Review Date, payable on the applicable Call Settlement Date. No further payments will be made on the notes. Payment at Maturity If the notes have not been automatically called, you will receive a cash payment at maturity, for each $1,000 principal amoun t n ote, equal to (a) $1,000 plus (b) the Contingent Interest Payment, if any, applicable to the final Review Date. You are entitled to repayment of principal in full at maturity, subject to the credit risks of JPMorgan Financial and JPMorga n C hase & Co. Capitalized terms used but not defined herein shall have the meanings set forth in the preliminary pricing supplement. Any payment on the notes is subject to the credit risk of JPMorgan Chase Financial Company LLC, as issuer of the notes, and t he credit risk of JPMorgan Chase & Co., as guarantor of the notes. Hypothetical Payment at Maturity J.P. Morgan Structured Investments | 1 800 576 3529 | jpm_structured_inv e stments@jpmorgan.com 3yNC1y TSLA/ NVDA / GOOGL Auto Callable Contingent Interest Notes North America Structured Investments Payment At Maturity (assuming 12.00% per annum Contingent Interest Rate) Least Performing Stock Return $1,030.00 60.00% $1,030.00 40.00% $1,030.00 20.00% $1,030.00 10.00% $1,030.00 5.00% $1,030.00 0.00% $1,030.00 - 5.00% $1,030.00 - 15.00% $1,000.00 - 15.01% $1,000.00 - 20.00% $1,000.00 - 30.00% $1,000.00 - 40.00% $1,000.00 - 60.00% $1,000.00 - 80.00% $1,000.00 - 100.00% This table does not demonstrate how your interest payments can vary over the term of your notes. Contingent Interest *If the notes have not been automatically called and the closing price of one share of each Reference Stock on any Review Date is greater than or equal to its Interest Barrier, you will receive on the applicable Interest Payment Date for each $1,000 principal amount note a Contingent Interest Payment equal to at least $30.00 (equivalent to an interest rate of at least 12.00% per annum, payable at a rate of at least 3.00% per quarter). The hypothetical payments on the notes shown above apply only if you hold the notes for their entire term or until automatically called. These hypotheticals do not reflect fees or expenses that would be associated with any sale in the secondary market. If these fees and expenses were included, the hypothetical payments shown above would likely be lower.

J.P. Morgan Structured Investments | 1 800 576 3529 | jpm_structured_investments@jpmorgan.com Selected Risks • The notes may not pay more than the principal amount at maturity. • The notes do not guarantee the payment of interest and may not pay interest at all. • Any payment on the notes is subject to the credit risks of JPMorgan Chase Financial Company LLC and JPMorgan Chase & Co. Therefore the value of the notes prior to maturity will be subject to changes in the market’s view of the creditworthiness of JPMorgan Chase Financial Company LLC or JPMorgan Chase & Co. • The appreciation potential of the notes is limited to the sum of any Contingent Interest Payments that may be paid over the term of the notes. • You are exposed to the risk of decline in the price of one share of each Reference Stock. • Whether a Contingent Interest Payment will be payable and whether the notes will be automatically called will be determined by the Least Performing Reference Stock. • The automatic call feature may force a potential early exit. • No dividend payments or voting rights. • The anti - dilution protection for each Reference Stock is limited and may be discretionary. • As a finance subsidiary, JPMorgan Chase Financial Company LLC has no independent operations and has limited assets. Selected Risks (continued) • The estimated value of the notes will be lower than the original issue price (price to public) of the notes. • The estimated value of the notes is determined by reference to an internal funding rate. • The estimated value of the notes does not represent future values and may differ from others’ estimates. • The value of the notes, which may be reflected in customer account statements, may be higher than the then current estimated value of the notes for a limited time period. • Lack of liquidity: J.P. Morgan Securities LLC (who we refer to as JPMS) intends to offer to purchase the notes in the secondary market but is not required to do so. The price, if any, at which JPMS will be willing to purchase notes from you in the secondary market, if at all, may result in a significant loss of your principal. • Potential conflicts: We and our affiliates play a variety of roles in connection with the issuance of notes, including acting as calculation agent and hedging our obligations under the notes, and making the assumptions used to determine the pricing of the notes and the estimated value of the notes when the terms of the notes are set. It is possible that such hedging or other trading activities of J.P. Morgan or its affiliates could result in substantial returns for J.P. Morgan and its affiliates while the value of the notes decline. • The tax consequences of the notes may be uncertain. You should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the notes. Additional Information SEC Legend: JPMorgan Chase Financial Company LLC and JPMorgan Chase & Co. have filed a registration statement (including a pr osp ectus) with the SEC for any offerings to which these materials relate. Before you invest, you should read the prospectus in that registration statement and the other documents relating to this offering that JPM organ Chase Financial Company LLC and JPMorgan Chase & Co. has filed with the SEC for more complete information about JPMorgan Chase Financial Company LLC and JPMorgan Chase & Co. and this offering. You may get the se documents without cost by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, JPMorgan Chase Financial Company LLC and JPMorgan Chase & Co., any agent or any dealer participat ing in the this offering will arrange to send you the prospectus and each prospectus supplement as well as any product supplement, underlying supplement and preliminary pricing supplement if you so request by c all ing toll - free 1 - 866 - 535 - 9248. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion o f U .S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with JPMorgan Cha se & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax - related penalties. Investment suitability must be determined individually for each investor, and the financial instruments described herein may not be suitable for all investors. This information is not intended to provide and should not be relied upon as providing accounting, legal, regulatory or tax advice. Investors should consult with their own advisers as to the se matters. This material is not a product of J.P. Morgan Research Departments. Free Writing Prospectus Filed Pursuant to Rule 433, Registration Statement Nos. 333 - 270004 and 333 - 270004 - 01 North America Structured Investments The risks identified above are not exhaustive. Please see “Risk Factors” in the prospectus supplement and the applicable prod uct supplement and “Selected Risk Considerations” in the applicable preliminary pricing supplement for additional information. 3yNC1y TSLA/ NVDA / GOOGL Auto Callable Contingent Interest Notes

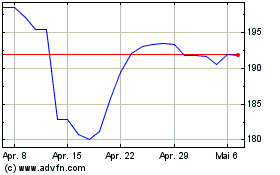

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

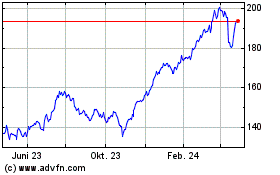

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Mai 2023 bis Mai 2024