Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-274004

PROSPECTUS

SUPPLEMENT

(To Prospectus

Dated August 29, 2023)

20,227,736

American Depositary Shares

Representing

40,455,472 Ordinary Shares

We

have entered into an “at the market offering” sales agreement (the “Sales Agreement”) with RBC Capital Markets,

LLC and Berenberg Capital Markets LLC, which we refer to as the sales agents, relating to our American Depositary Shares, or ADSs, each

representing two ordinary shares, with no par value, offered through this prospectus supplement pursuant to a continuous offering program.

In accordance with the terms of the Sales Agreement, under this prospectus supplement, we will offer and sell 20,227,736 ADSs from time

to time through the sales agents.

The

ADSs are listed on the New York Stock Exchange, or NYSE, under the symbol “JMIA.” On August 5, 2024, the closing sale price

of the ADSs was $10.59 per ADS.

Sales

of ADSs under this prospectus supplement will be made by any method permitted that is deemed to be an “at the market offering”

as defined in Rule 415(a)(4) of the Securities Act of 1933, as amended, or the Securities Act, including sales made directly on or through

the NYSE, the existing trading market for the ADSs, to or through a market maker other than on an exchange or otherwise, in negotiated

transactions at market prices prevailing at the time of sale or at prices related to the prevailing market prices, and/or other method

permitted by law. The sales agents will act as our agents using commercially reasonable efforts consistent with each of their normal

trading and sales practices. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The

sales agents will be entitled to compensation under the terms of the Sales Agreement at a combined commission rate of up to 3.00% of

the gross sales price of any ADSs sold by the sales agents under the Sales Agreement. See “Plan of Distribution” beginning

on page S-26 for additional information regarding the compensation to be paid to the sales agents.

In

connection with the sale of the ADSs on our behalf, the sales agents may be deemed to be “underwriter(s)” within the meaning

of the Securities Act, and the compensation paid to the sales agents will be deemed to be underwriting commissions or discounts. We have

also agreed to provide indemnification and contribution to the sales agents with respect to certain liabilities, including liabilities

under the Securities Act.

Investing

in our securities involves risks. See “Risk Factors” beginning on page S-6 of this prospectus supplement, on page 6 of the

accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

on the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offence.

|

RBC

Capital Markets |

Berenberg |

|

Prospectus

Supplement dated August 6, 2024

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

or any free writing prospectus that we have authorized for use in connection with this offering. Neither we nor the sales agents have

authorized anyone to provide you with information different from that contained in this prospectus supplement, the accompanying prospectus

or any free writing prospectus we have authorized for use in connection with this offering. If anyone provides you with different or

inconsistent information, you should not rely on it. We and the sales agents take no responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. The information contained in, or incorporated by reference

into, this prospectus supplement, the accompanying prospectus, and any free writing prospectus we have authorized for use in connection

with this offering is accurate only as of the date of each such document. Our business, financial condition, results of operations and

prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents

incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized

for use in connection with this offering in their entirety before making an investment decision. You should also read and consider the

information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where You Can

Find More Information” and “Incorporation of Certain Documents by Reference.” These documents contain important information

that you should consider when making your investment decision.

We

are offering to sell, and seeking offers to buy, our ordinary shares only in jurisdictions where offers and sales are permitted. The

distribution of this prospectus supplement, the accompanying prospectus or any free writing prospectus we have authorized for use in

connection with this offering and the offering of the ordinary shares in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus supplement, the accompanying prospectus or any free writing prospectus

we have authorized for use in connection with this offering must inform themselves about, and observe any restrictions relating to, the

offering of the ordinary shares and the distribution of this prospectus supplement, the accompanying prospectus and any free writing

prospectus we have authorized for use in connection with this offering outside the United States. This prospectus supplement, the accompanying

prospectus and any free writing prospectus we have authorized for use in connection with this offering do not constitute, and may not

be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement,

the accompanying prospectus or any such free writing prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

About

this Prospectus Supplement

On

August 15, 2023, we filed with the Securities and Exchange Commission, or SEC, a registration statement on Form F-3 (File No. 333-274004)

utilizing a shelf registration process relating to the securities described in this prospectus supplement, which registration statement

was declared effective on August 29, 2023. Under this shelf registration process, we may, from time to time, sell up to an

aggregate of 20,227,736 ADSs, representing up to an aggregate of 40,455,472 ordinary shares.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus. The second part, the accompanying prospectus, gives more general information, some of which

may not apply to this offering. Generally, when we refer to this prospectus, we are referring to the combined document consisting of

this prospectus supplement and the accompanying prospectus.

In

this prospectus supplement, as permitted by law, we “incorporate by reference” information from other documents that we file

with the SEC. This means that we can disclose important information to you by referring to those documents. The information incorporated

by reference is considered to be a part of this prospectus supplement and the accompanying prospectus, and should be read with the same

care. When we make future filings with the SEC to update the information contained in documents that have been incorporated by reference,

the information included or incorporated by reference in this prospectus supplement is considered to be automatically updated and superseded.

If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the

information contained in this prospectus supplement. However, if any statement in this prospectus supplement or the accompanying prospectus

is inconsistent with a statement in another document having a later date (including a document incorporated by reference in the accompanying

prospectus), the statement in the document having the later date modifies or supersedes the earlier statement. You should read this prospectus

supplement, the accompanying prospectus, the documents incorporated by reference herein and therein and any free writing prospectus that

we have authorized for use in connection with this offering, in their entirety before making an investment decision.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the prospectus supplement or the accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate

only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing

the current state of our affairs.

References

in this prospectus supplement to “we,” “us”, “our”, “Jumia” and the “Company”

refer to Jumia Technologies AG and its consolidated subsidiaries, as applicable.

Information

Regarding Forward-Looking Statements

This

prospectus supplement and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section

27A of the Securities Act and Section 21E of the Exchange Act that relate to our current expectations and views of future events. These

statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under Item

3. “Key Information—D. Risk Factors” in our then-current Annual Report on Form 20-F, which may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the

forward-looking statements.

In

some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “may,”

“will,” “expect,” “estimate,” “could,” “should,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,”

“continue,” “is/are likely to” or other similar expressions. These forward-looking statements are based on estimates

and assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks

and uncertainties. These statements constitute forward-looking statements within the meaning of Section 27A of the Securities Act, and

Section 21E of the Exchange Act. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of their dates. Forward-looking statements contained in this prospectus supplement include, but are not limited to, statements about:

| ● | our

future business and financial performance, including our revenue, operating expenses and

our ability to maintain profitability and our future business and operating results; |

| ● | our

strategies, plan, objectives and goals; and |

| ● | our

expectations regarding the development of our industry, internet penetration, market size

and the competitive environment in which we operate. |

These

forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these

forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual

outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including,

without limitation, the risk factors set forth in Item 3. “Key Information-D. Risk Factors” in our Annual Report on Form

20-F for the year ended December 31, 2023, including the following:

| ● | we

have incurred significant losses since inception and there is no guarantee that we will achieve

or sustain profitability in the future; |

| ● | we

rely on external financing and may not be able to raise necessary additional capital on economically

acceptable terms or at all; |

| ● | our

markets pose significant operational challenges that require us to expend substantial financial

resources; |

| ● | many

of our countries of operation are, or have been, characterized by political instability or

changes in regulatory or other government policies; |

| ● | our

business may be materially and adversely affected by an economic slowdown in any region of

Africa; |

| ● | currency

volatility and inflation may materially adversely affect our business; |

| ● | exchange

controls may restrict the ability of our subsidiaries to convert or transfer sums in foreign

currencies; |

| ● | uncertainties

with respect to the legal system in certain African markets could adversely affect us; |

| ● | if

our operation of JumiaPay were found to be in violation of applicable laws or regulations,

or if JumiaPay is found to be engaged in an unauthorized banking or financial business, we

could be subject to fines or other sanctions, forced to cease doing business in certain countries,

or forced to change our business practices; |

| ● | our

business may be materially and adversely affected by violent crime or terrorism or acts of

war in any region of Africa; |

| ● | growth

of our business depends on an increase in internet penetration in Africa and other external

factors, some of which are beyond our control; |

| ● | we

face competition, which may intensify; |

| ● | we

may be unable to adapt to changes in our industry or successfully launch and monetize new

and innovative technologies, as a result of which our growth and profitability could be adversely

affected; |

| ● | we

may not be able to maintain our existing partnerships, strategic alliances or other business

relationships or enter into new ones. We may have limited control over such relationships,

and these relationships may not provide the anticipated benefits; |

| ● | we

may fail to maintain or grow the size of our customer base or the level of engagement of

our customers; |

| ● | sellers

set their own prices and decide which goods they make available on our marketplace, which

could affect our ability to respond to customer preferences and trends; |

| ● | we

use third-party carriers as part of our fulfillment process, giving us limited control over

the fulfillment process and exposing us to challenges should we need to replace carriers; |

| ● | we

may experience malfunctions or disruptions of our technology systems; |

| ● | we

may experience security breaches and disruptions due to hacking, viruses, fraud, malicious

attacks and other circumstances; and |

| ● | we

conduct a substantial amount of our business in foreign currencies, which heightens our exposure

to the risk of exchange rate fluctuations. |

The

forward-looking statements made or incorporated by reference in this prospectus supplement and the accompanying prospectus relate only

to events or information as of the date on which the statements are made in this prospectus supplement. Except as required by law, we

undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events

or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this

prospectus supplement and the accompanying prospectus, the documents incorporated by reference herein and the documents that we reference

herein and have filed as exhibits to the registration statement, of which this prospectus supplement is a part, completely and with the

understanding that our actual future results or performance may be materially different from what we expect.

Prospectus

Supplement Summary

This

summary highlights selected material information contained elsewhere or incorporated by reference in this prospectus supplement and the

accompanying prospectus. This summary may not contain all the information that you should consider before investing in our securities.

You should read this summary together with the entire prospectus supplement and the accompanying prospectus carefully, including the

“Risk Factors” sections contained in this prospectus supplement, the accompanying prospectus and the documents that are incorporated

herein and therein by reference, including the “Risk Factors” section of the Annual Report on Form 20-F for the year ended

December 31, 2023, any financial statements in such documents and the notes to those financial statements, and in any free writing prospectus

that we have authorized for use in connection with this offering, before making an investment decision. This prospectus supplement may

add to, update or change information contained in or incorporated by reference in the accompanying prospectus.

References

in this prospectus supplement to “we,” “us”, “our”, “Jumia” and the “Company”

refer to Jumia Technologies AG (formerly Africa Internet Holding GmbH) and its consolidated subsidiaries, as applicable.

Our

Business

We

are the leading pan-African e-commerce platform. Our platform consists of our marketplace, which connects sellers with customers, our

logistics service, which enables the shipment and delivery of packages from sellers to customers, and our payment service, JumiaPay,

which, together with its network of licensed payment service providers and other partners, facilitates transactions among participants

active on our platform in selected markets.

We

are active in three regions in Africa, which consist of 11 countries that together accounted for almost 70% of Africa’s GDP of

€2.9 trillion in 2023, according to estimates by the International Monetary Fund. Though still nascent, we believe that e-commerce

in Africa is well positioned to grow.

Our employees were based

in 16 countries, and 36% of our employees were female and 64% were male as of December 31, 2023. As of the same date, approximately 56%

of our workforce consisted of marketplace operations and management employees followed by logistics employees at 36%.

We

intend to benefit from the expected growth of e-commerce in Africa through the investments that we have made and the extensive local

expertise that we have developed since our founding in 2012. Through our operations, we have developed a deep understanding of the economic,

technical, geographic and cultural complexities that are unique to Africa, and which vary from country to country. We believe that our

deep understanding has enabled us to create solutions that address the needs and preferences of our sellers and customers in the most

comprehensive and efficient way. We possess extensive local knowledge of the logistics and payment landscapes in the markets in which

we operate, which we consider to be a key component of the success of our company. In addition, we take full advantage of the mobile-centric

aspects of the African market, having adopted a “mobile-first” approach in our product development and marketing efforts,

which allows us to expand the audience for our goods and services, increase engagement and conversion and reduce our customer acquisition

costs.

On

our marketplace, a large and diverse group of over 64 thousand sellers offer goods across a wide range of categories, such

as phones, electronics, home & living, fashion, beauty and other, including fast-moving consumer goods to customers (i.e., consumers,

retailers, distributors and other local buyers). In connection with our marketplace offering, we also engage in corporate sales, where

we sell physical goods to local and regional retailers, distributors and other corporate buyers. On our JumiaPay app, we offer a number

of digital lifestyle services including utility bills payment, airtime recharge, gaming and entertainment, transport ticketing as well

as financial services such as micro-loans, insurance or savings products. We had 5.7 million “Annual Active Customers”

within the 12-month period preceding December 31, 2023, which we define as unique

customers that placed an order for a product or a service on our platform within this period, irrespective of cancellations or returns.

We believe that the number and quality of sellers on our marketplace, and the breadth of their respective offerings, attract more

customers to our platform, increasing traffic and orders, which in turn attracts even more sellers to Jumia, creating powerful network

effects. Our marketplace operates with limited inventory risk, as the goods sold via our marketplace are predominantly sold by third-party

sellers, meaning the cost and risk of inventory remains with the seller. In 2023, over 80% of the items sold on our marketplace

were offered by third-party sellers.

Our

logistics service, Jumia Logistics, facilitates the delivery of goods in a convenient and reliable way. It consists of a large network

of leased warehouses, pick-up stations for customers and drop-off locations for sellers and a significant number of local third-party

logistics service providers, whom we integrate and manage through our proprietary technology, data and processes. In certain cities,

where we believe it is beneficial to enhance our logistics service, we also operate our own last-mile fleet.

Our

payment service, JumiaPay, has been designed to facilitate cashless online transactions between participants on our platform. JumiaPay

encompasses a number of functionalities positioning African customers, who have traditionally relied on cash, to transact in a cash-less

manner. JumiaPay, with its network of licensed payment service providers and other partners, provides digital payment processing on our

platform allowing for a fast and secure payment experience at checkout. JumiaPay also has a dedicated payment app, the JumiaPay app,

through which we offer customers a number of digital lifestyle services from a broad range of third-party service providers. As of December 31,

2023, one or more JumiaPay services were available in nine markets: Egypt, Ghana, Ivory Coast, Kenya, Morocco, Nigeria, Tunisia, Uganda

and Algeria. In line with our strategic focus on adding value to our ecosystem, we have deliberately rationalized the range of digital

services offered on the JumiaPay app and scaled back some of our marketing initiatives which impacted negatively the JumiaPay performance

in 2023. Our strategic focus is now on cultivating a customer base with greater long-term value. The number of JumiaPay Transactions

reached 8.4 million in 2023 compared to 9.7 million in 2022. Total Payment Volume (“TPV”) reached $192.2 million in

2023, a decrease of 25% compared to 2022.

Our

operations benefit from a uniform technology platform coupled with coordinated local presence. Our unified, scalable technology platform

has been developed by our technology and data team, which is predominantly located in Portugal and Egypt. This technology platform covers

all relevant aspects of our operations, from data management, business intelligence, traffic optimization and customer engagement to

infrastructure, logistics and payments. We constantly collect and analyze data to help us optimize our operations, make our customer

experience more personal and relevant, and enable us, selected sellers and logistics partners to make informed real-time decisions. Our

local teams in each of our countries of operations have access to, and may benefit from, the centralized data collection and analytics

and are empowered to use the insights gained from our platform in order to take action locally.

Trust is critical in Africa,

where people traditionally rely on face-to-face interaction to transact business. We believe that our targeted marketing efforts and consistent

focus on delivering a high-quality seller and customer experience have helped us to build a strong reputation and create a leading brand

that customers and sellers recognize and trust. Our brand is well known by customers and sellers and is among the most recognizable in

our regions of operation. For example, Jumia was a leading online marketplace in Africa as of 2023, based on number of monthly visits,

according to Statista. In addition, in 2021, Jumia topped the list in the online retail sector in Egypt.

We

remain committed to taking the business to profitability, through a combination of fundamentals-led growth, enhanced cost discipline

and balanced monetization. Navigating a very challenging macroeconomic backdrop in 2023, we have implemented several initiatives focused

on enhancing our financial performance and building a more robust foundation for our e-commerce operations. This involved discontinuing

business activities with limited growth potential, optimizing marketing spend, and streamlining our organization. While these changes

impacted our performance in 2023, they were deemed necessary to ensure long-term sustainability and success in a complex and evolving

economic landscape.

Annual

Active Customers reached 5.7 million in 2023, a decrease of 22% compared to 2022. Orders reached 21.3 million in 2023, a decrease

of 22% compared to 2022. GMV reached $749.8 million in 2023, a decrease of 20% compared to 2022. In terms of financial indicators, we

made significant progress in 2023. Our Adjusted EBITDA loss for 2023 decreased by 68% from $182.1 million to $58.2 million, steadily

improving quarter after quarter. Our Loss before Income tax from continuing operations for 2023 decreased by 52% from $206.2 million

to $98.6 million.

Selected

Risks Associated with our Business, Operations and Financial Position

Our

business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” in our Annual Report

on Form 20-F for the year ended December 31, 2023. You should read these risks before you invest in the ADSs. We may be unable, for many

reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business

include, but are not limited to, the following:

| ● | we

have incurred significant losses since inception and there is no guarantee that we will achieve

or sustain profitability in the future; |

| ● | we

rely on external financing and may not be able to raise necessary additional capital on economically

acceptable terms or at all; |

| ● | our

markets pose significant operational challenges that require us to expend substantial financial

resources; |

| ● | many

of our countries of operation are, or have been, characterized by political instability or

changes in regulatory or other government policies; |

| ● | our

business may be materially and adversely affected by an economic slowdown in any region of

Africa; |

| ● | currency

volatility and inflation may materially adversely affect our business; |

| ● | exchange

controls may restrict the ability of our subsidiaries to convert or transfer sums in foreign

currencies; |

| ● | uncertainties

with respect to the legal system in certain African markets could adversely affect us; |

| ● | if

our operation of JumiaPay were found to be in violation of applicable laws or regulations,

or if JumiaPay is found to be engaged in an unauthorized banking or financial business, we

could be subject to fines or other sanctions, forced to cease doing business in certain countries,

or forced to change our business practices; |

| ● | our

business may be materially and adversely affected by violent crime or terrorism or acts of

war in any region of Africa; |

| ● | growth

of our business depends on an increase in internet penetration in Africa and other external

factors, some of which are beyond our control; |

| ● | we

face competition, which may intensify; |

| ● | we

may be unable to adapt to changes in our industry or successfully launch and monetize new

and innovative technologies, as a result of which our growth and profitability could be adversely

affected; |

| ● | we

may not be able to maintain our existing partnerships, strategic alliances or other business

relationships or enter into new ones. We may have limited control over such relationships,

and these relationships may not provide the anticipated benefits; |

| ● | we

may fail to maintain or grow the size of our customer base or the level of engagement of

our customers; |

| ● | sellers

set their own prices and decide which goods they make available on our marketplace, which

could affect our ability to respond to customer preferences and trends; |

| ● | we

use third-party carriers as part of our fulfillment process, giving us limited control over

the fulfillment process and exposing us to challenges should we need to replace carriers; |

| ● | we

may experience malfunctions or disruptions of our technology systems; |

| ● | we

may experience security breaches and disruptions due to hacking, viruses, fraud, malicious

attacks and other circumstances; |

| ● | we

conduct a substantial amount of our business in foreign currencies, which heightens our exposure

to the risk of exchange rate fluctuations. |

Corporate

Information

Our

legal name is Jumia Technologies AG. We were incorporated on June 26, 2012 as a limited liability

company (Gesellschaft mit beschränkter Haftung) under German law and registered

with the commercial register (Handelsregister) of the local court (Amtsgericht) in Berlin Charlottenburg, Germany, on July

4, 2012. On December 17 and 18, 2018, our shareholders resolved upon the change of our legal form into a German stock corporation (Aktiengesellschaft)

and the change of our company name to Jumia Technologies AG. The change of our legal form and company name became effective upon registration

with the commercial register (Handelsregister) of the local court (Amtsgericht)

in Berlin Charlottenburg, Germany, on January 31, 2019. The legal effect of the conversion of the limited liability company (Gesellschaft

mit beschränkter Haftung) with the company name Africa Internet Holding GmbH under German law is limited to the change

in the legal form. Africa Internet Holding GmbH was neither dissolved nor wound up, but continues its existence as the same legal entity

with a new legal form and name. Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue,

Suite 204, Newark, Delaware 19711.

Our

principal executive offices are located at Skalitzer Straße 104,

10997 Berlin, Germany. Our telephone number is +49 (30) 398 20 34 54 and our website is www.jumia.com. The information on, or accessible

through, our website or any other website referenced herein is not incorporated by reference into this prospectus supplement, is not

considered a part of this prospectus supplement and should not be relied upon with respect to this offering.

The

Offering

|

Securities

offered by us: |

20,227,736

ADSs representing 40,455,472 ordinary shares. |

| American Depositary Shares: |

Each American depositary

share (“ADS”), which may be evidenced by an American Depositary Receipt (“ADR”), represents two of our ordinary

shares. |

| As an ADS holder,

we will not treat you as one of our shareholders. The depositary, The Bank of New York Mellon, will be the holder of the ordinary

shares underlying the ADSs. You will have rights as provided in the deposit agreement. You may surrender the ADSs and withdraw the

underlying ordinary shares as provided, and pursuant to the limitations set forth in, the deposit agreement. The depositary will

charge you fees for, among other things, any such surrender for the purpose of withdrawal. As described in the deposit agreement,

we may amend or terminate the deposit agreement without your consent. If you continue to hold the ADSs, you agree to be bound by

the terms of the deposit agreement then in effect. To better understand the terms of the ADSs, you should carefully read the “Description

of American Depositary Shares” section in the accompanying prospectus. You should also read the deposit agreement, which is

an exhibit to the registration statement to which this prospectus supplement relates. |

| Depositary: |

The Bank of New York

Mellon. |

| Distribution: |

Sales of ADSs under

this prospectus supplement will be made by any method permitted that is deemed to be an “at the market offering” as defined

in Rule 415(a)(4) of the Securities Act of 1933, as amended, or the Securities Act, including sales made directly on or through the

NYSE, the existing trading market for the ADSs, to or through a market maker other than on an exchange or otherwise, in negotiated

transactions at market prices prevailing at the time of sale or at prices related to the prevailing market prices, and/or other method

permitted by law. |

| Use of proceeds: |

We intend to use the

net proceeds from the offering to help support our continued efforts around customer acquisition, expansion of our supplier base

and overall assortment, scaling our logistics network and improving our marketing and vendor technology as well as for general corporate

purposes. See “Use of Proceeds” on page S-11 of this prospectus supplement. |

| Dividend policy: |

We have not paid any

dividends on our ordinary shares since our inception, and we currently intend to retain any future earnings to finance the growth

and development of our business. Therefore, we do not anticipate that we will declare or pay any cash dividends in the foreseeable

future. Except as required by law, any future determination to pay cash dividends will be at the discretion of our management board

and supervisory board and will be dependent upon our financial condition, results of operations, capital requirements, and other

factors our management board and supervisory board deem relevant. See “Dividend Policy” in our Annual Report on Form

20-F for the year ended December 31, 2023. |

| Trading market: |

The ADSs are listed

on the New York Stock Exchange, or NYSE, under the symbol “JMIA.” |

Risk

Factors

An

investment in the ADSs involves a high degree of risk. Before deciding whether to invest in the ADSs, you should consider carefully the

risks described below as well as those discussed under Item 3. “Key Information—D. Risk Factors” contained in

our Annual Report on Form 20-F for the year ended December 31, 2023, as filed with the SEC on March 28, 2024, which is incorporated

by reference in the prospectus supplement and the accompanying prospectus, in their entirety, together with other information in this

prospectus supplement, the accompanying prospectus, the information and documents incorporated by reference herein and therein, and in

any free writing prospectus that we have authorized for use in connection with this offering. The risks and uncertainties previously

described and discussed below are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we

currently see as immaterial, may also harm our business and financial condition. If any of these risks actually occur, our business,

financial condition, results of operation or cash flow could be adversely affected. This could cause the trading price of our ordinary

shares to decline, resulting in a loss of all or part of your investment.

Risks

Related to Our Securities and this Offering

It

is not possible to predict the aggregate proceeds resulting from sales made under the Sales Agreement.

While

the number of ADSs that will be sold by the sales agents is fixed, the price per ADS sold pursuant to the Sales Agreement will fluctuate

over time. Accordingly, it is not currently possible to predict the aggregate proceeds to be raised in connection with sales under the

Sales Agreement.

The

ADSs offered hereby will be sold in an “at-the-market offering” and investors who buy ADSs at different times will likely

pay different prices.

Investors

who purchase ADSs in this offering at different times will likely pay different prices, and accordingly may experience different levels

of dilution and different outcomes in their investment results. In addition, there is no maximum sales price for ADSs to be sold in this

offering. Investors may experience a decline in the value of the ADSs they purchase in this offering as a result of sales made at prices

lower than the prices they paid.

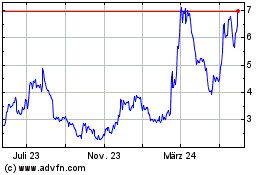

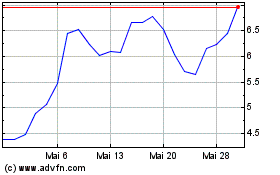

The

price of the ADSs has been and may in the future be volatile.

The

market price of the ADSs has fluctuated in the past, and may fluctuate substantially in the future, due to the materialization of any

of the risks included in or incorporated by reference in the prospectus supplement and the accompanying prospectus as well as a variety

of factors, many of which are beyond our control, including:

| ● | our

operating and financial results failing to meet the expectations of securities analysts or

investors; |

| ● | changes

in financial estimates or recommendations by securities analysts; |

| ● | material

announcements by us or our competitors; |

| ● | new

regulatory pronouncements and changes in regulatory guidelines, including with respect to

taxation; |

| ● | public

sales of a substantial number of ADSs; and |

| ● | fluctuations

in trading volume. |

Future

offerings of debt or equity securities by us could adversely affect the market price of the ADSs, and future issuances of equity securities

could lead to a substantial dilution of our shareholders.

We

may require additional capital in the future to finance our business operations and growth. We may seek to raise such capital through

the issuance of additional ADSs or debt securities with conversion rights (e.g., convertible bonds and option rights). An issuance of

additional ADSs or debt securities with conversion rights could potentially reduce the market price of the ADSs and we currently cannot

predict the amounts and terms of such future offerings.

If

such offerings of equity or debt securities with conversion rights are made without granting subscription rights to our existing shareholders,

these offerings would dilute the economic and voting rights of our existing shareholders. In addition, such dilution may arise from the

acquisition or investments in companies in exchange, fully or in part, for newly issued ADSs, options granted to our business partners

or from the exercise of stock options by our employees in the context of existing or future stock option programs or the issuance of

ADSs to employees in the context of existing or future employee participation programs.

Any

future issuance of ADSs could reduce the market price of the ADSs and dilute the holdings of existing shareholders.

Investors

may have difficulty enforcing civil liabilities against us or the members of our management and supervisory boards.

We

are incorporated in Germany and conduct substantially all of our operations in Africa through our subsidiaries. Certain members of our

management board and supervisory board are non-residents of the United States. The majority of our assets and the assets of half of the

members of our management board and supervisory board are located outside the United States. As a result, it may not be possible, or

may be very difficult, to serve process on company representatives or the company in the United States, or to enforce judgments obtained

in U.S. courts against company representatives or the company based on civil liability provisions of the securities laws of the United

States.

There

is no treaty between the United States and Germany for the mutual recognition and enforcement of judgments (other than arbitration awards)

in civil and commercial matters. Therefore, a final judgment for the payment of money rendered by any federal or state court in the United

States based on civil liability, whether or not predicated solely upon the U.S. federal securities laws, would not be enforceable in

Germany unless the underlying claim is re-litigated before a German court of competent jurisdiction.

Based

on the foregoing, there can be no assurance that U.S. investors will be able to enforce any judgments obtained in U.S. courts in civil

and commercial matters, including judgments under the U.S. federal securities laws, against us, members of our management board and supervisory

board, or our senior management. In addition, there is doubt as to whether a German court would impose civil liability on us, the members

of our management and supervisory board or our senior management in an original action predicated solely upon the U.S. federal securities

laws brought in a court of competent jurisdiction in Germany against us or such members, respectively.

Holders

of the ADSs may be subject to limitations on transfer of their ADSs.

The

ADSs are transferable on the books of the depositary. However, the depositary may close its transfer books at any time or from time to

time when it deems expedient in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer

or register transfers of ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary

deems it advisable to do so because of any requirement of law or of any government or governmental body, or under any provision of the

deposit agreement, or for any other reason.

The

exercise of voting rights of holders of the ADSs is limited by the terms of the deposit agreement.

For

so long as holders of the ADSs do not convert their ADSs into ordinary shares, they may not attend our shareholder’s meetings and

may exercise their voting rights with respect to the ordinary shares underlying their ADSs only in accordance with the provisions of

the deposit agreement. Upon receipt of voting instructions from a holder of the ADSs in the manner set forth in the deposit agreement,

the depositary for the ADSs will endeavor to vote such holder’s underlying ordinary shares in accordance with these instructions.

Under our articles of association, the minimum notice period required for convening a shareholders’ meeting corresponds to the

statutory minimum period, which is currently 36 days. When a shareholders’ meeting is convened, a holder of the ADSs may not receive

sufficient notice of a shareholders’ meeting to permit such holder to withdraw its ordinary shares to allow the holder to cast

its vote with respect to any specific matter at the meeting. In addition, the depositary and its agents may not be able to send voting

instructions to a holder of the ADSs or carry out such holder’s voting instructions in a timely manner. We will make all reasonable

efforts to cause the depositary to extend voting rights to a holder of the ADSs in a timely manner, but such holder may not receive the

voting materials in time to ensure that such holder can instruct the depositary to vote its shares. Furthermore, the depositary and its

agents will not be responsible for any failure to carry out any instructions to vote, for the manner in which any vote is cast or for

the effect of any such vote. As a result, a holder of the ADSs may not be able to exercise its right to vote and may lack recourse if

the ordinary shares are not voted as requested by such holder.

The

rights of shareholders in companies subject to German corporate law differ in material respects from the rights of shareholders of corporations

incorporated in the United States.

We

are a stock corporation (Aktiengesellschaft) incorporated under German law. Our corporate affairs are governed by our articles

of association and by the laws governing stock corporations incorporated in Germany. The rights of shareholders and the responsibilities

of members of our management board and supervisory board may be different from the rights and obligations of shareholders in companies

governed by the laws of U.S. jurisdictions and the management or directors of those corporations. In the performance of their duties,

our management board and supervisory board are required by German law to consider the interests of our company, its shareholders, its

employees and other stakeholders. It is possible that some of these parties will have interests that are different from, or in addition

to, your interests as an ADS holder.

German

and European insolvency laws are substantially different from U.S. insolvency laws and may offer our shareholders less protection than

they would have under U.S. insolvency laws.

As

a company with its registered office in Germany, we are subject to German insolvency laws in the event any insolvency proceedings are

initiated against us including, among other things, Regulation (EU) 2015/848 of the European Parliament and of the Council of May 20,

2015 on insolvency proceedings. Should courts in another European country determine that the insolvency laws of that country apply to

us in accordance with and subject to such EU regulations, the courts in that country could have jurisdiction over the insolvency proceedings

initiated against us. Insolvency laws in Germany or the relevant other European country, if any, may offer our shareholders less protection

than they would have under U.S. insolvency laws and make it more difficult for our shareholders to recover the amount they could expect

to recover in a liquidation under U.S. insolvency laws.

As

we are a foreign private issuer and intend to follow certain home country corporate governance practices, holders of the ADSs may not

have the same protections afforded to shareholders of companies that are subject to all NYSE corporate governance requirements.

As

a foreign private issuer, we have the option to follow certain home country corporate governance practices rather than those of the NYSE,

provided that we disclose the requirements we are not following and describe the home country practices we are following. The standards

applicable to us are considerably different than the standards applied to domestic U.S. issuers. For instance, we are not required to:

| ● | have

a majority of the board be independent (although all of the members of the audit committee

must be independent under the Exchange Act); |

| ● | have

a compensation committee or a nominating or corporate governance committee consisting entirely

of independent directors; or |

| ● | have

regularly scheduled executive sessions with only independent directors. |

We

have relied on and intend to continue to rely on some of these exemptions. For more information, please see our Form 20-F for the year

ended December 31, 2023. As a result, holders of the ADSs may not have the same protections afforded to shareholders of companies that

are subject to all NYSE corporate governance requirements.

The

interpretation of the treatment of ADSs by the German tax authorities is subject to change.

The specific treatment of ADSs under German tax law is based on administrative

guidance by the fiscal authorities, which are not codified law and are subject to change. Tax authorities may modify their interpretation

and the current treatment of ADSs may change, as the circular issued by the German Federal Ministry of Finance (BMF-Schreiben),

dated May 21, 2019, reference number IV C 1-S 1980-1/16/10010 :001, as amended from time to time, shows. According to this circular, ADSs

are not treated as capital participation (Kapitalbeteiligung) within the meaning of Section 2 para. 8 of the Investment Tax Code

(Investmentsteuergesetz), whereas according to the more general circular issued by the German Federal Ministry of Finance on ADSs,

they should rather be treated as the underlying stocks themselves in principle (Federal Ministry of Finance, circular dated May 24, 2013,

reference number IV C 1-S 2204/12/10003, as amended by the circular dated December 18, 2018, reference number IV C 1-S 2204/12/10003).

Such changes in the interpretation by the fiscal authorities may have adverse effects on the taxation of investors.

We

may become a passive foreign investment company (“PFIC”), which could result in adverse United States federal income tax

consequences to United States investors.

We

believe we were not a PFIC in the prior taxable year and do not expect to become a PFIC in the current taxable year or the foreseeable

future. However, the determination of whether or not we are a PFIC is made on an annual basis and will depend on the composition of our

income and assets from time to time. Specifically, we will be classified as a PFIC for United States federal income tax purposes if either:

(1) 75% or more of our gross income in a taxable year is passive income, or (2) the average percentage of our assets by value in a taxable

year which produce or are held for the production of passive income (which includes cash) is at least 50%. It is therefore possible that

we could become a PFIC in a future taxable year. In addition, our current expectation regarding our PFIC status is based in part upon

the value of our goodwill which is based on the market value for our shares and ADSs, and in part on the rate at which our cash and cash

equivalents are spent. Accordingly, we could become a PFIC in the future if there is a substantial decline in the value of our shares

and ADSs or we spend our cash or cash equivalents at a slower rate than expected.

If

we are or were to become a PFIC, such characterization could result in adverse United States federal income tax consequences to a holder

of the ADSs if such holder is a United States investor. For example, if we are a PFIC, our United States investors will become subject

to increased tax liabilities under United States federal income tax laws and regulations and will become subject to burdensome reporting

requirements. We cannot assure that we will not be a PFIC for our current taxable year or any future taxable year.

We

have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have considerable discretion in the application of the net proceeds from this offering and could spend the proceeds in

ways that do not improve our results of operations or enhance the value of the ADSs. Shareholders may not be able to assess whether the

proceeds are being used appropriately. We have not quantified or allocated any specific portion or range of the net proceeds to us for

any particular purpose. The failure by our management to apply these funds effectively could result in financial losses that could have

a material adverse effect on our business and cause the price of the ADSs to decline. See “Use of Proceeds.”

Capitalization

The

table below sets forth our cash and cash equivalents as well as our capitalization as of June 30, 2024 on an actual basis. While the

sales agents will sell all shares, represented by ADSs, subscribed for in the relevant capital increase, the price per ADSs sold in this

offering will likely vary. Accordingly, the actual total public offering amount, commissions and proceeds to us are not determinable

at this time and no capitalization information adjusted for the effects of the offering is presented.

The

information set forth in the following table should be read in conjunction with, and is qualified in its entirety by, reference to our

unaudited financial statements, including our interim consolidated financial statements, and the notes thereto incorporated

by reference into this prospectus supplement and the accompanying prospectus, and to our audited financial statements contained in our Form 20-F for the year ended December 31, 2023, incorporated by reference into this prospectus.

| | |

As

of

June 30,

2024 | |

| | |

Actual | |

| | |

(in thousands

of U.S.$) | |

| | |

| |

| Cash and cash equivalents | |

| 45,057 | |

| | |

| | |

| Non-current borrowings | |

| 5,524 | |

| Current borrowings | |

| 2,725 | |

| Share capital | |

| 239,163 | |

| Share premium | |

| 1,736,469 | |

| Other reserves | |

| 177,358 | |

| Accumulated losses | |

| (2,127,440 | ) |

| Equity attributable to the equity holders of

the Company(1) | |

| 25,550 | |

| Total capitalization and

indebtedness | |

| 33,799 | |

| (1) | Excludes

negative $513 thousand of equity attributable to non-controlling interests. |

Use

of Proceeds

We

intend to sell 20,227,736 ADSs during the course of the offering described in this prospectus supplement. The amount of proceeds from

this offering will depend upon the market price at which the ADSs are sold. While the sales agents will sell all shares, represented

by ADSs, subscribed for in the relevant capital increase, the price per ADSs sold in this offering will likely vary. Accordingly, the

actual total public offering amount, commissions and proceeds to us are not determinable at this time.

We

intend to use the net proceeds from the offering to help support our continued efforts around customer acquisition, expansion of our

supplier base and overall assortment, scaling our logistics network and improving our marketing and vendor technology as well as for

general corporate purposes.

The

amount of what, and timing of when, we actually spend for these purposes may vary significantly and will depend on a number of factors,

including our future revenue and cash generated by operations and other factors described in the “Risk Factors” sections

contained in this prospectus supplement and in our Annual Report on Form 20-F for the year ended December 31, 2023. Accordingly, we will

have broad discretion in deploying the net proceeds from this offering.

Dilution

If

you invest in the ADSs, your ownership interest will be diluted to the extent of the difference between the price per ADS you pay in

this offering and the as adjusted net tangible book value per ADS immediately after the completion of this offering. As of June 30, 2024,

we had a net tangible book value of $25.0 million, corresponding to a net tangible book value of $0.24 per ADS. Net tangible book value

per ADS represents the amount of our total assets less our total liabilities, divided by 204,470,178 ordinary shares, the total number

of our ordinary shares outstanding as of June 30, 2024, and multiplying such amount by two, as one ADS represents two ordinary shares.

After

giving effect to the assumed issuance and sale of 20,227,736 ADSs (representing an aggregate of 40,455,472 ordinary shares) at an assumed

offering price of $10.59 per ADS (the last reported sale price of the ADSs on the NYSE on August 5, 2024) and after deducting the

discounts and commissions and estimated expenses payable by us, our as adjusted net tangible book value as of June 30, 2024 would have

been $230.3 million, representing $1.88 per ADS. This represents an immediate increase in net tangible book value of $1.64

per ADS to existing shareholders and an immediate dilution in net tangible book value of $8.71 per ADS to new investors purchasing

ADSs in this offering. Dilution for this purpose represents the difference between the assumed offering price per ADS of $10.59 and

the adjusted net tangible book value of $1.88 per ADS to investors participating in this offering.

The

following table illustrates this dilution to new investors participating in the offering:

| | |

| (in

$) | |

| Assumed

public offering price per ADS | |

| 10.59 | |

| Net tangible book

value per ADS as of June 30, 2024 | |

| 0.24 | |

| Increase

per ADS attributable to new investors purchasing ADSs in this offering | |

| 1.64 | |

| As

adjusted net tangible book value per ADS after giving effect to this offering | |

| 1.88 | |

| Dilution

per ADS to new investors | |

| 8.71 | |

The

above discussion and table are based on our actual ordinary shares outstanding as of June 30, 2024 and exclude 2,359,673 ADSs (4,719,346

ordinary shares) covered by awards available for issuance under our virtual restricted stock unit plans as of June 30, 2024.

In

addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of such securities may result in further dilution to our shareholders.

Material

Tax Considerations

German

Taxation

The

following discussion addresses certain German tax consequences of acquiring, owning or disposing of the ADSs. With the exception of the

subsection “German Taxation of Holders of ADSs—Taxation of Holders Tax Resident in Germany” below, which provides an

overview of dividend taxation to holders that are residents of Germany, this discussion applies only to U.S. treaty beneficiaries (defined

below) that acquire ADSs in the offering. The discussion does not purport to be a comprehensive description of all the tax considerations

that may be relevant to a German tax resident or a U.S. treaty beneficiary (defined below) acquiring ADSs. In particular, this discussion

does not address tax considerations applicable to certain types of U.S. treaty beneficiaries (defined below) that may be subject to special

treatment under the German tax laws, such as companies of the finance or insurance sector.

This

discussion is based on domestic German tax laws, including, but not limited to, circulars issued by German tax authorities, which are

not binding on the German courts, and the Treaty (defined below). It is based upon tax laws in effect at the time of filing of this prospectus.

These laws are subject to change, possibly with retroactive effect. There is no assurance that German tax authorities will not challenge

one or more of the tax consequences described in this discussion. There is no assurance that German tax authorities will not challenge

one or more of the tax consequences described in this discussion. In addition, this discussion is based upon the assumption that each

obligation in the deposit agreement and any related agreement will be performed in accordance with its terms. It does not purport to

be a comprehensive or exhaustive description of all German tax considerations that may be of relevance in the context of acquiring, owning

and disposing of ADSs.

The

tax information presented in this section is not a substitute for tax advice. Prospective holders of ADSs should consult their own tax

advisors regarding the German tax consequences of the purchase, ownership, disposition, donation or inheritance of ADSs in light of their

particular circumstances, including the effect of any state, local, or other foreign or domestic laws or changes in tax law or interpretation.

The same applies with respect to the rules governing the refund of any German dividend withholding tax (Kapitalertragsteuer) withheld.

Only an individual tax consultation can appropriately account for the particular tax situation of each investor.

The

Company does not assume any responsibility for withholding tax at source.

German

Taxation of Holders of ADSs

General

Based

on the circular issued by the German Federal Ministry of Finance (BMF-Schreiben), dated May 24, 2013, reference number IV C 1-S 2204/12/10003,

as amended by the circular dated December 18, 2018, reference number IV C 1-S 2204/12/10003, in respect of the taxation of American Depositary

Receipts (“ADRs”) on domestic shares (jointly the “ADR Tax Circular”), for German tax purposes, the ADSs represent

a beneficial ownership interest in the underlying shares of the Company and should qualify as the ADRs for the purpose of the ADR Tax

Circular even though it has to be noted that the ADR Tax Circular does not explicitly address ADSs. If the ADSs qualify as the ADRs under

the ADR Tax Circular, dividends would accordingly be attributable to holders of the ADSs for tax purposes, and not to the legal owner

of the ordinary shares (i.e., the financial institution on behalf of which the ordinary shares are stored at a domestic depository for

the ADS holders). Furthermore, holders of the ADSs should be treated as beneficial owners of the capital of the Company with respect

to capital gains (see below in section “German Taxation of Capital Gains of the U.S. Treaty Beneficiaries of the ADSs”).

However, investors should note that circulars published by the German tax authorities (including the ADR Tax Circular) are not binding

on German courts, including German tax courts, and it is unclear whether a German court would follow the ADR Tax Circular in determining

the German tax treatment of the ADSs. For the purpose of this German tax section, it is assumed that the ADSs qualify as the ADRs within

the meaning of the ADR Tax Circular.

Taxation

of Holders Not Tax Resident in Germany

The

following discussion describes material German tax consequences for a holder that is a U.S. treaty beneficiary of acquiring, owning and

disposing of the ADSs. For purposes of this discussion, a “U.S. treaty beneficiary” is a resident of the United States for

purposes of the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation

and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes as of June 4, 2008 (Abkommen

zwischen der Bundesrepublik Deutschland und den Vereinigten Staaten von Amerika zur Vermeidung der Doppelbesteuerung und zur Verhinderung

der Steuerverkürzung auf dem Gebiet der Steuern vom Einkommen und vom Vermögen und einiger anderer Steuern in der Fassung vom

4. Juni 2008) (the “Treaty”), who is fully eligible for benefits under the Treaty.

A

holder will be a U.S. treaty beneficiary entitled to full Treaty benefits in respect of the ADSs if it is, inter alia:

| ● | the

beneficial owner of the ADSs (and the dividends paid with respect thereto); |

| ● | a

U.S. holder (as defined below); |

| ● | not

also a resident of Germany for German tax purposes; and |

| ● | not

subject to the limitation on benefits restrictions (i.e., anti-treaty shopping article of

the Treaty or German domestic rules) that applies in certain circumstances. |

Special

rules apply to pension funds and certain other tax-exempt investors.

This

discussion does not address the treatment of ADSs that are (i) held in connection with a permanent establishment or fixed base through

which a U.S. treaty beneficiary carries on business or performs personal services in Germany or (ii) part of business assets for which

a permanent representative in Germany has been appointed.

General

Rules for the Taxation of Holders Not Tax Resident in Germany

Non-German

resident holders of ADSs are subject to German taxation with respect to certain German source income (beschränkte Steuerpflicht).

According to the ADR Tax Circular, income from the shares should be attributed to the holder of the ADSs for German tax purposes. As

a consequence, income from the ADSs should be treated as German source income (dividend distributions of a corporate with a statutory

seat and/or its place of central management in Germany). However, the repayment of capital contributions (Einlagenrückgewähr)

for tax purposes is considered as reduction of the acquisition costs of the respective shares rather than as dividend payment (subject

to proper tax declaration by the Company in accordance with German tax law).

The

full amount of a dividend distributed by the Company to a non-German resident holder which does not maintain a permanent establishment

or other taxable presence in Germany, to which the ADSs are attributable, is subject to (final) German withholding tax at a 25% rate plus a solidarity surcharge (Solidaritätszuschlag)

of 5.5% on the amount of withholding tax (amounting in total to a rate of 26.375%) and church tax (Kirchensteuer), if applicable.

The relevant dividend is deemed to be received for German tax purposes at the payout date as determined by the Company’s general

shareholders’ meeting, or if such date is not specified, the day after such general shareholders’ meeting. The amount of

the relevant taxable income is based on the gross amount in Euro; any expenses and costs related to such taxable income in principle

should not reduce the taxable income.

The

solidarity surcharge (Solidaritätszuschlag) has been abolished or reduced for certain German taxpayers, depending on their

amount of payable income tax. The new rules apply from the beginning of the assessment period for the fiscal year ending December 31,

2021. Pursuant to the new law, the solidarity surcharge remains in place for purposes of withholding tax, the flat rate income tax on

capital income regime and corporate income tax. Prospective holders of ADSs are advised to monitor future developments closely, also in relation to a potential

abolishment of the German flat rate income tax on capital

income (Abgeltungsteuer), which has been discussed in the past.

German

withholding tax on capital income (Kapitalertragsteuer) is withheld and remitted to the competent German tax authorities by

(i) the German dividend disbursing agent (i.e., a German credit institution, financial services institution or securities institute

(each including the German branch of a foreign enterprise, but excluding a foreign branch of a German enterprise)

(each as defined in the German Banking Act (Kreditwesengesetz) or German Securities Institute Act (Wertpapierinstitutsgesetz) that holds or administers the underlying shares in custody

and (a) disburses or credits the dividend income from the underlying shares, (b) disburses or credits the dividend income from the

underlying shares on delivery of the dividend coupons or (c) disburses such dividend income to a foreign agent or (ii) the central

securities depository (Wertpapiersammelbank) in terms of the German Depositary Act (Depotgesetz) holding the

underlying shares in a collective deposit, if such central securities depository disburses the dividend income from the underlying

shares to a foreign agent, regardless of whether a holder must report the dividend for tax purposes and regardless of whether or not

a holder is a resident of Germany.

Pursuant

to the provisions of the Treaty, the German withholding tax may not exceed 15% of the gross dividends collected by U.S. treaty

beneficiaries. The excess of the total withholding tax, including the solidarity surcharge, over the maximum rate of withholding tax

permitted by the Treaty is refunded to U.S. treaty beneficiaries upon application (subject to presenting a proper German withholding

tax certificate which can only be issued if the company has confirmed in writing to the German depositary the number of ADSs issued

and that all of the ADSs issued at the issuance date were covered by an equivalent number of German shares deposited with the German

depositary (circular by the German Federal Ministry of Finance, dated December 18, 2018, reference number IV C 1-S 2204/12/10003, as

amended by the circular dated December 18, 2018, reference number IV C 1-S 2204/12/10003)). For example, for a declared

dividend in the amount of €100, a U.S. treaty beneficiary initially receives €73.625 (€100 minus the 26.375%

withholding tax including solidarity surcharge). The U.S. treaty beneficiary is entitled to a partial withholding tax refund from

the German tax authorities in the amount of €11.375 of the gross dividend (of €100). As a result, the U.S. treaty

beneficiary ultimately receives a total of €85 (85% of the declared dividend) following the refund of the excess withholding.

However, investors should note that it is unclear how the German tax authorities will apply the refund process to dividends on the

ADSs with respect to non-German resident holders of the ADSs. Further, such refund is subject to the German anti-avoidance treaty

shopping rule (as described below in section “—Withholding Tax Refund for U.S. Treaty Beneficiaries”).

A

reduced permitted German withholding tax rate of 5% would apply according to the Treaty provisions, if the U.S. treaty beneficiary is

a corporation and holds directly at least 10% of the voting shares of the dividend paying company.

German

Taxation of Capital Gains of the U.S. Treaty Beneficiaries of the ADSs

Capital

gains from the disposition of the ADSs realized by a non-German tax resident holder who does not maintain a permanent establishment or

other taxable presence in Germany, to which the ADSs are attributable, will be treated as German source income and be subject to German (corporate) income tax if such holder

at any time during the five years preceding the disposition, directly or indirectly, owned 1% or more of the Company’s share capital

(or other equity related instruments, as specified by law), irrespective of whether through the ADSs or shares of the Company. If such

holder had acquired the ADSs without consideration, the previous owner’s holding period and quota would be taken into account when

calculating the above holding period and the participation threshold.

However,

U.S. treaty beneficiaries are eligible for treaty benefits under the Treaty (as described above in the section “—General

Rules for the Taxation of Holders Not Tax Resident in Germany “. Pursuant to the Treaty, U.S. treaty beneficiaries are not subject

to German tax with any capital gain derived from the sale of the ADSs, even under the circumstances described in the preceding paragraph

and therefore should not be taxed on capital gains from the disposition of the ADSs.

German statutory law requires

a German disbursing agent to levy withholding tax on capital gains from the sale of ADSs or other securities held in a custody account

in Germany. With regard to the German taxation of capital gains, German disbursing agent means a German credit institution, a financial

services institution or securities institute (each including the German branch of a foreign enterprise, but excluding a foreign branch

of a German enterprise) (each as defined in the German Banking Act (Kreditwesengesetz) or German Securities Institute Act (Wertpapierinstitutsgesetz)

that holds the ADSs in custody or administers the ADSs for the investor or conducts sales or other dispositions and disburses or credits

the income from the ADSs to the holder of the ADSs. It should be noted that the German statutory law does not explicitly condition the

obligation to withhold taxes on capital gains being subject to taxation in Germany under German statutory law or on an applicable income

tax treaty permitting Germany to tax such capital gains.

However, a circular issued

by the German Federal Ministry of Finance, dated May 19, 2022, reference number IV C 1-S 2252/19/10003 :009, as amended from time to time,

provides that German taxes on capital gains need not be withheld when the holder of the custody account is not a resident of Germany for

tax purposes and the income is not subject to German taxation. The circular further states that there is no obligation to withhold such

tax even if the non-German resident holder owns 1% or more of the share capital of a German company. While circulars issued by the German

Federal Ministry of Finance are in principle only binding on the German tax authorities but not on the German courts, in practice, the

disbursing agents nevertheless typically rely on guidance contained in such circulars. Therefore, a disbursing agent is expected not to

withhold tax on capital gains derived by a U.S. treaty beneficiary from the disposition of ADSs held in a custody account in Germany,

unless the holder of the ADSs does not provide evidence on its tax status as non-German tax resident. In any other case, the U.S. treaty

beneficiary may be entitled to claim a refund of the withholding tax from the German tax authorities under the Treaty, as described below

in the section “—Withholding Tax Refund for U.S. Treaty Beneficiaries.”

Withholding

Tax Refund for U.S. Treaty Beneficiaries

U.S. treaty beneficiaries are

generally eligible for treaty benefits under the Treaty, as described above in Section “—Taxation of Holders Not Tax Resident

in Germany.” Accordingly, U.S. treaty beneficiaries are in general entitled to claim a refund of the portion of the otherwise applicable

26.375% German withholding tax (corporate income tax including solidarity surcharge) on dividends that exceeds the applicable Treaty rate

(subject to presenting a proper German withholding tax certificate). However, in respect of dividends, refund described in the preceding

paragraph is only possible if, due to special rules on the restriction of withholding tax credit, the following three cumulative requirements

are met: (i) the holder must qualify as beneficial owner of the ADSs for an uninterrupted minimum holding period of 45 days within a period

starting 45 days prior to and ending 45 days after the due date of the dividends, (ii) the holder has to bear at least 70% of the change

in value risk related to the ADSs during the minimum holding period as described under (i) of this paragraph and has not entered into

(acting by itself or through a related party) hedging transactions which lower the change in value risk by more than 30%, and (iii) the

holder must not be obliged to fully or largely compensate directly or indirectly the dividends to third parties. If these requirements

are not met, then for a shareholder not being tax resident in Germany who applied for a full or partial refund of the withholding tax

pursuant to a double taxation treaty, no refund is available. This restriction generally does only apply, if (i) the tax on the dividends

underlying the refund application is below 15% of the gross amount of the dividends pursuant to a double taxation treaty and (ii) the

holder does not directly own 10% or more in the shares of the company and is subject to income taxes in its state of residence, without

being tax-exempt. The restriction of the withholding tax credit does not apply if the holder has beneficially owned the ADSs for at least

one uninterrupted year until receipt (Zufluss) of the dividends. In addition to the aforementioned restrictions, in particular,

pursuant to a decree published by the German Federal Ministry of Finance dated July 9, 2021, reference number IV C 1-S 2252/19/10035 :014,