SECURITIES

AND EXCHANGE COMMISSION

Washington

DC 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

OF

THE

SECURITIES EXCHANGE ACT OF 1934

For 21

February 2023

InterContinental Hotels Group PLC

(Registrant's

name)

Broadwater

Park, Denham, Buckinghamshire, UB9 5HJ, United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F

Form 40-F

Indicate

by check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes

No

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): Not

applicable

EXHIBIT

INDEX

|

99.1

|

Final Results dated

21 February 2023

|

Exhibit

No: 99.1

InterContinental Hotels Group PLC

Full Year Results to 31 December 2022

21 February 2023

|

|

Reported

|

|

Underlying1

|

|

|

2022

|

2021

|

% change

|

|

% change

|

|

|

REPORTABLE SEGMENTS1:

|

|

|

|

|

|

|

|

Revenue1

|

$1,843m

|

$1,390m

|

+33%

|

|

+39%

|

|

|

Revenue from fee

business1

|

$1,449m

|

$1,153m

|

+26%

|

|

+28%

|

|

|

Operating

profit1

|

$828m

|

$534m

|

+55%

|

|

+53%

|

|

|

Fee margin1

|

56.2%

|

49.6%

|

+6.6%pts

|

|

|

|

|

Adjusted

EPS1

|

282.3¢

|

147.0¢

|

+92%

|

|

KEY METRICS:

|

|

GROUP RESULTS:

|

|

|

|

|

● $25.8bn total gross revenue1

|

|

Total revenue

|

$3,892m

|

$2,907m

|

+34%

|

|

+33%

vs 2021, (8)% vs 2019

|

|

Operating profit

|

$628m

|

$494m

|

+27%

|

|

● +37%

global FY RevPAR1

|

|

Basic EPS

|

207.2¢

|

145.4¢

|

+43%

|

|

vs

2021, (3.3)% vs 2019

|

|

Total dividend per share

|

138.4¢

|

85.9¢

|

+61%

|

|

● +26%

global Q4 RevPAR1

|

|

Net

debt1

|

$1,851m

|

$1,881m

|

(2)%

|

|

vs

2021, +4.1% vs 2019

|

1.

Definitions

for non-GAAP measures can be found in the 'Use of key performance

measures and non-GAAP measures' section, along with reconciliations

of these measures to the most directly comparable line items within

the Financial Statements.

|

●

|

Further significant improvement in trading: sequential improvement

each quarter in global RevPAR vs 2019

|

|

●

|

Strongest recovery in Americas, with RevPAR +3.3% vs 2019 (Q4

+9.0%); EMEAA improving to (7.5)% (Q4 +8.8%); Greater China (38)%

(Q4 (42)%) due to the scale of travel restrictions that were still

in place

|

|

●

|

Average daily rate +18% vs 2021, +8% vs 2019; occupancy +9%pts vs

2021, (7)%pts vs 2019

|

|

●

|

Iberostar Beachfront Resorts agreement signed in November 2022,

with first 12.4k rooms added to IHG's system in December 2022;

continue to explore further opportunities with Exclusive Partners

to drive additional system growth

|

|

●

|

Gross system growth +5.6% YOY; adjusted net system size growth of

+4.3% YOY

|

|

●

|

Opened and added 49.4k rooms (269

hotels); global

estate now at 912k rooms (6,164 hotels)

|

|

●

|

Signed 80.3k rooms (467 hotels); global pipeline now at 281k rooms

(1,859 hotels), +3.9% YOY

|

|

●

|

Fee margin of 56.2%, +6.6%pts vs 2021 (+2.1%pts vs 2019's

54.1%)

|

|

●

|

Operating profit from reportable segments of $828m, +55% vs 2021;

this was held back by $17m adverse currency impact and included $5m

of costs related to Iberostar agreement

|

|

●

|

Reported operating profit of $628m, after $105m System Fund

reported loss and $95m net exceptional charges

|

|

●

|

Net cash from operating activities of $646m (2021: $636m), with

adjusted free cash flow1 of

$565m (2021: $571m); net debt movement includes $482m share

buybacks, $233m dividends and a $230m net foreign exchange

benefit

|

|

●

|

Adjusted EBITDA1 of

$896m, +42% vs 2021; net debt:adjusted EBITDA ratio reduced to

2.1x

|

|

●

|

Final dividend of 94.5¢ proposed, +10% vs 2021, resulting in a

total dividend for the year of 138.4¢

|

|

●

|

Share buyback programme to return an additional $750m of surplus

capital in 2023

|

Keith Barr, Chief Executive Officer, IHG Hotels & Resorts,

said:

"In 2022 we saw demand return strongly in most of our markets,

pushing Group RevPAR back close to 2019 levels and fee margin

ahead. It's particularly pleasing that in the second half of the

year we exceeded 2019 levels for both RevPAR and profitability.

Looking to 2023, while there are economic uncertainties, we expect

continued strong leisure demand in many markets, alongside further

return of business and group travel and the ongoing reopening of

China.

Our strategy over the last five years has significantly

strengthened our brand portfolio and seen substantial investment to

innovate our technology and distribution platforms. Our recent

agreement with Iberostar adds our 18th brand

and substantially increases our resort and all-inclusive presence,

and we continue to explore further new opportunities like this for

additional growth through exclusive partners. Meanwhile, the other

six brands we have added since 2017 already contribute more than

10% of our pipeline, and our Luxury & Lifestyle portfolio is

now 13% of our system size and 20% of our pipeline as we increase

our exposure to higher fee income segments.

In total, we signed 467 hotels in 2022 and opened 269, which led to

net system growth of over 4%. The further 1,800 hotels in our

pipeline represents future growth of over 30% of today's system

size. The Holiday Inn Brand Family, with its global leadership

position, delivered around a third of our hotel signings and half

of openings.

IHG's enterprise platform strength helps our hotel owners capture

demand and grow their business, with enterprise contribution

increasing in 2022 to represent 77% of their total room revenue.

Critical to this was the launch of our new mobile app during the

year, which has led to mobile now accounting for more than half of

all digital bookings, while the transformation of our IHG One

Rewards programme has delivered significant improvements in both

enrolments and loyalty contribution. Alongside substantial

investments in revenue-generating technology platforms to support

future growth, we have also continued to invest in our internal

systems to maintain the health of the business, and in capabilities

to help IHG and our hotel owners meet our 2030 Journey to Tomorrow

responsible business commitments.

IHG's overarching ambition is to deliver industry-leading growth in

our scale, enterprise platform and performance, doing so

sustainably for all stakeholders including our hotel owners, guests

and society as a whole. We are a stronger and more resilient

company than ever before, and we are proud of the advancements made

in each of our strategic priorities. Reflecting the confidence we

have in continued growth and the highly cash generative nature of

our business, the Board is pleased to be recommending a 10%

increase in the final dividend in respect of 2022 and to announce a

further share buyback programme to return an additional $750m to

shareholders in 2023."

For further information, please contact:

Investor

Relations: Stuart

Ford (+44 (0)7823 828 739); Aleksandar Milenkovic (+44 (0)7469 905

720);Joe

Simpson (+44 (0)7976 862 072)

Media Relations: Amy

Shields (+44 (0)7881 035 550); Claire Scicluna (+44 (0)7776 778

808)

Presentation for analysts and institutional

shareholders:

A conference call and webcast presented by Keith Barr, Chief

Executive Officer, and Paul Edgecliffe-Johnson, Chief Financial

Officer and Group Head of Strategy, will commence at 9:30am (London

time) on 21 February 2023 and can be accessed at www.ihgplc.com/en/investors/results-and-presentations or

directly on https://www.investis-live.com/ihg/63c5626aaeebb912002bff90/egad

Analysts and institutional shareholders wishing to ask questions

should use the following dial-in details for a Q&A

facility:

|

UK:

|

0800 640 6441

|

|

UK local:

|

0203 936 2999

|

|

US:

|

+1 855 979 6654

|

|

US local:

|

+1 646 664 1960

|

|

All other locations:

|

+44 203 936 2999

|

|

Passcode:

|

63 05 76

|

An archived webcast of the presentation is expected to be available

later on the day of the results and will remain available for the

foreseeable future, accessed at www.ihgplc.com/en/investors/results-and-presentations.

An audio replay will also be available for 7 days using the

following details:

|

UK:

|

0203 936 3001

|

|

US:

|

+1 845 709 8569

|

|

All other locations:

|

+44 203 936 3001

|

|

Passcode:

|

92 39 56

|

Website:

The full release and supplementary data will be available on our

website from 7:00am (London time) on 21 February. The web address

is www.ihgplc.com/en/investors/results-and-presentations.

About IHG Hotels & Resorts:

IHG Hotels & Resorts [LON:IHG,

NYSE:IHG (ADRs)] is a global hospitality company, with a purpose to

provide True Hospitality for Good.

With a family of 18 hotel brands and IHG

One Rewards, one of the world's

largest hotel loyalty programmes, IHG has over 6,000 open hotels in

more than 100 countries, and more than 1,800 in the development

pipeline.

- Luxury &

Lifestyle: Six

Senses Hotels Resorts Spas, Regent

Hotels & Resorts, InterContinental

Hotels & Resorts, Vignette

Collection, Kimpton

Hotels & Restaurants, Hotel

Indigo

-

Premium: voco

hotels, HUALUXE

Hotels & Resorts, Crowne

Plaza Hotels & Resorts, EVEN

Hotels

-

Essentials: Holiday

Inn Hotels & Resorts, Holiday

Inn Express, avid

hotels

- Suites: Atwell

Suites, Staybridge

Suites, Holiday

Inn Club Vacations, Candlewood

Suites

-

Exclusive

Partners: Iberostar

Beachfront Resorts

InterContinental Hotels Group PLC is the Group's holding company

and is incorporated and registered in England and Wales.

Approximately 325,000 people work across IHG's hotels and corporate

offices globally.

Visit us online for more about our hotels

and reservations and IHG

One Rewards. To

download the new IHG One Rewards app, visit the Apple

App or Google

Play stores.

For our latest news, visit our Newsroom and

follow us on LinkedIn, Facebook and Twitter.

Cautionary note regarding forward-looking statements:

This announcement contains certain forward-looking statements as

defined under United States law (Section 21E of the Securities

Exchange Act of 1934) and otherwise. These forward-looking

statements can be identified by the fact that they do not relate

only to historical or current facts. Forward-looking statements

often use words such as 'anticipate', 'target', 'expect',

'estimate', 'intend', 'plan', 'goal', 'believe' or other words of

similar meaning. These statements are based on assumptions and

assessments made by InterContinental Hotels Group PLC's management

in light of their experience and their perception of historical

trends, current conditions, expected future developments and other

factors they believe to be appropriate. By their nature,

forward-looking statements are inherently predictive, speculative

and involve risk and uncertainty. There are a number of factors

that could cause actual results and developments to differ

materially from those expressed in or implied by, such

forward-looking statements. The main factors that could affect the

business and the financial results are described in the 'Risk

Factors' section in the current InterContinental Hotels Group PLC's

Annual report and Form 20-F filed with the United States Securities

and Exchange Commission.

Attractive long-term growth drivers

Hotel industry demand characteristics exhibit both resiliency and

structural growth

|

●

|

The industry has previously demonstrated relative resiliency during

economic downturns, particularly in recurring essential business

travel and in chainscales such as upper midscale, which is where

IHG is weighted. Through the pandemic, a sustained level of demand

was shown, followed by a rapid recovery.

|

|

●

|

While the economic outlook has some continued challenges and

uncertainties, current conditions, including employment, consumer

savings and business activity levels, remain supportive to the

industry.

|

|

●

|

Consumer surveys have indicated travel to be among the most

resilient of discretionary spending areas, while business surveys

have indicated a continued return of travel activity and the

potential for greater hotel use to support hybrid and flexible

working arrangements.

|

|

●

|

Historically, industry revenue has outpaced global economic growth

in 18 out of 23 years between 2000 and 2022, with a CAGR of +3.3%

(versus +2.8% CAGR for GDP). Prior to the pandemic, there had been

10 consecutive years of RevPAR outperforming global economic

growth.

|

|

●

|

Reflecting the strength of demand recovery, Oxford Economics expect

global hotel room nights consumed to be back above 2019 levels by

2024 and growth at a CAGR of +6% from 2022 through to 2032. The US

market alone is forecast to increase from 2.1 billion to 2.8

billion room nights over this time period, and China to be even

faster at an +11% CAGR.

|

The need for additional hotel supply remains an enduring industry

characteristic

|

●

|

In the short term, Covid restrictions challenged the ability to

complete and open new build hotels, with this being an ongoing

issue in Greater China through 2022. Other markets have also seen

the temporary impact on the industry from costs and availability of

construction crews and materials, and the macro-economic outlook

affecting the availability and cost of real estate

financing.

|

|

●

|

Longer-term, and in addition to the industry's RevPAR growth,

further new hotel supply will still be needed to satisfy the

demands of growing populations, rising middle classes and the

inherent desire to travel to physically interact and for new

experiences.

|

|

●

|

Global hotel room net new supply growth has been at a CAGR of 2.0%

over the 10 years from 2012 to 2022, and was 1.2% in the US,

according to STR; their forecasts of the industry pipeline indicate

similar new supply growth rates into the future.

|

|

●

|

Global leading hotel brands are expected to continue their

long-term trend of taking market share. In periods when developers

are adding less new supply, leading branded players can also

accelerate conversion opportunities.

|

Key trends in recent trading

Strong return of demand

|

●

|

As Covid-related travel restrictions have lifted, demand has

swiftly recovered; IHG's group RevPAR exceeded 2019 levels each

month from July onwards; by Q4, group RevPAR was 4% ahead of 2019

levels, with the Americas and EMEAA both 9% ahead, offsetting

Greater China at (42)% due to restrictions still being in place in

that market.

|

|

●

|

Leisure travel has seen the earliest pattern of recovery, followed

by the growing return of business and group travel.

|

|

●

|

The US, our single largest country market, is amongst the most

recovered, and other geographic markets are expected to exhibit

similar drivers of recovery; by Q4, the revenue performance by

category in IHG's US estate was:

|

|

|

○

|

Leisure 16% ahead of 2019, reflecting 2% more room nights and rate

14% ahead;

|

|

|

○

|

Business 5% ahead of 2019, reflecting 2% fewer room nights and rate

7% ahead; and

|

|

|

○

|

Groups 7% behind 2019, reflecting 13% fewer room nights and rate 7%

ahead.

|

|

|

|

|

|

Sustained volume and pricing improvements

|

●

|

By Q4, IHG's group RevPAR of 4% ahead of 2019 levels reflected

occupancy (5)%pts behind and ADR up +13%; the Americas is the most

recovered region, with occupancy just (1.5)%pts below 2019 and ADR

+11.7% ahead.

|

|

●

|

Leisure bookings were generally strong throughout 2022; there have

been no clear signs of consumer price resistance or cooling of

leisure demand in the most recent months of trading, and industry

commentators are expecting a backdrop of still some pent-up desire

to resume travel for leisure purposes, as well as the benefit in

2023 of China travel restrictions lifting.

|

|

●

|

The recovery in business demand is expected to continue, with

progress in the US indicating the potential elsewhere; our

corporate rate negotiations for 2023 are expected to support

further increases in ADR.

|

|

●

|

Groups & Meetings are also expected to see continued recovery

in 2023.

|

|

●

|

The overall industry has been experiencing both the opportunity and

the need for higher room rates, given the return of demand and

inflation pressures; sustainability of these is anticipated in

industry forecasts:

|

|

|

○

|

STR forecast US industry RevPAR to be 12% ahead of 2019 levels in

2023 and 25% ahead by 2025;

|

|

|

○

|

this assumes broadly flat ADR in real terms, with growth driven by

nominal ADR; and

|

|

|

○

|

occupancy for the US industry is forecast by STR to be restored to

over 96% of 2019 levels in 2023, and to be fully recovered by

2025.

|

|

●

|

Our industry has relatively limited forward visibility in most

parts of the demand mix due to typically short booking windows, and

shorter term reductions in demand could reoccur; however, the

industry is also characterised by an ability to rapidly adjust

prices according to the demand and inflationary environment, and by

long-term structural growth drivers in both demand and the need for

additional new hotel supply.

|

|

|

|

|

|

IHG strongly positioned to drive growth and shareholder

value

IHG sees a continuation of its strong track record of driving

growth and shareholder value through our:

|

●

|

Asset light, fee-based, predominantly franchised model, which has

high barriers to entry in an industry that provides long-term

structural growth characteristics in both demand (RevPAR) and new

supply (system growth); reflecting IHG's success in capturing

growth, ahead of the temporary disruption caused by Covid, in the

decade through to 2019 IHG delivered:

|

|

|

○

|

+3.9% average annual growth in RevPAR, and

|

|

|

○

|

+3.2% average annual growth in net system size.

|

|

●

|

Chainscale and geographic diversification, with exposure to a mix

of resilient and high growth market segments.

|

|

●

|

Well-invested portfolio that includes market leading brands, and an

enterprise platform through which our hotel owners leverage IHG's

scale, distribution channels, leading technology and loyalty

programmes.

|

|

●

|

Existing system of over 6,000 hotels that will grow fee income

through long term, sustainable RevPAR expansion.

|

|

●

|

Pipeline of over 1,800 further hotels that will deliver multi-year

growth in system size.

|

|

●

|

Efficient cost base, with a proven track record of leveraging this

to increase margins whilst investing appropriately to support

future growth, and benefiting from a model where fee income is

largely linked to hotel revenues; over the decade through to 2019,

IHG has delivered:

|

|

|

○

|

~130bps average annual improvement in fee margin, and

|

|

|

○

|

+11.4% CAGR in Adjusted EPS.

|

|

●

|

Strong cash generation, from which to further invest in our brands

and enterprise platform to optimise growth, fund a sustainably

growing dividend and return excess funds to shareholders; since

2003, IHG has returned over $14bn in total to IHG's shareholders,

consisting of:

|

|

|

○

|

$2.6bn through ordinary dividends (representing a CAGR of +11.0%

through to 2019), and

|

|

|

○

|

$11.7bn via additional returns to shareholders.

|

|

|

|

|

|

In 2022, IHG has achieved RevPAR back close to 2019 levels and

ahead in the second half, delivered adjusted net system size growth

above the long-run average, expanded the fee margin to 210bps above

the prior peak, and restored the ordinary dividend along with

resuming the return of additional surplus capital to shareholders

through buybacks.

Capital allocation: growing the ordinary dividend and returning

surplus capital through buybacks

IHG's asset-light business model is highly cash generative through

the cycle and enables us to invest in our brands and strengthen our

enterprise platform. We have a disciplined approach to capital

allocation which ensures that the business is appropriately

invested in, whilst looking to maintain an efficient and

conservative balance sheet.

The Board's perspectives on the uses of cash generated by the

business are unchanged: ensuring the business is investing to

optimise growth that will drive long-term shareholder value

creation, funding a sustainably growing dividend, and then

returning surplus capital to shareholders, whilst targeting our

leverage ratio within a range of 2.5-3.0x net debt:adjusted EBITDA

to maintain an investment grade credit rating.

The Board is proposing a final dividend of 94.5¢ in respect of

2022, which is growth of +10% on 2021. An interim dividend of

43.9¢ was resumed and paid in October 2022. The total dividend

for the year would therefore be 138.4¢, representing an

increase of +61% on 2021 as no interim dividend was paid in the

prior year. The ex-dividend date is Thursday 30 March 2023 and the

Record date is Friday 31 March. Subject to shareholder approval at

the AGM on Friday 5 May, the dividend will be paid on Tuesday 16

May.

The proposed total dividend for 2022 is covered 2.0x by Adjusted

EPS. Over the coming years the Board aims to see dividend cover

revert to around the prior level that has averaged 2.3x in the

2012-2019 period.

The dividend payments for 2022 will have returned close to $250m to

IHG's shareholders. An additional $500m of surplus capital was

returned to shareholders through a share buyback programme that

concluded in January 2023. This repurchased 9,272,994 shares at an

average price of £46.57 per share, and reduced the total

number of voting rights in the Company by 5.0%.

A new share buyback programme will commence immediately, targeted

to return $750m over the course of 2023. With the further

improvement in profitability and strong cash generation achieved in

2022, IHG's net debt:adjusted EBITDA ratio reduced to 2.1x at 31

December 2022. With adjusted EBITDA of $896m in 2022, this new

buyback programme to return another $750m of surplus capital to

shareholders would increase pro forma leverage by 0.8x and

therefore resets it on this basis towards the upper end of our

target range of 2.5-3.0x.

The Board expects IHG's business model to continue its strong

long-term track record of generating substantial capacity to enable

our investment plans that drive growth, to fund a sustainably

growing ordinary dividend, and to return surplus capital to our

shareholders.

System size and pipeline progress

Openings and signings progress in 2022 reflects IHG's strong

portfolio of brands and the overall enterprise platform that we

provide to hotel owners, together with the long-term attractiveness

of the markets we operate in:

|

●

|

Global system of 912k rooms (6,164 hotels) at 31 December 2022,

weighted 68% across midscale segments and 32% across upscale and

luxury

|

|

●

|

Gross growth +5.6% YOY; 49.4k rooms (269 hotels) opened, of which

12.4k (33 hotels) added through the Iberostar agreement; adjusted

gross growth, excluding Iberostar, of +4.2%

|

|

●

|

Removal of 18.1k rooms (96 hotels); includes the impact of ceasing

all operations in Russia, resulting in the removal of 6.5k rooms

(28 hotels), equivalent to 0.7% of IHG's global system

|

|

●

|

Underlying removal rate -1.3% YOY, lower than the historical

average underlying rate of ~1.5%a;

fewer removals in Americas includes the effect of the 2021 Holiday

Inn and Crowne Plaza review

|

|

●

|

Net system size growth +4.3%b YOY

on an adjusted basis for Russia; net growth +2.9% excluding

Iberostar

|

|

●

|

Global pipeline of 281k rooms (1,859 hotels), representing 31% of

current system size; pipeline growth +3.9% YOY and broadly flat on

the 283k pipeline at the end of 2019

|

|

●

|

Signed 80.3k rooms (467 hotels), +17% YOY; Q4 signings of 36.4k

rooms, or 17.9k excluding Iberostar

|

|

●

|

Signings mix drives pipeline to be weighted 54% across midscale

segments and 46% across upscale and luxury

|

|

●

|

Conversions have continued to grow in importance, representing

around a quarter of signings and a third of openings in 2022

(excluding Iberostar)

|

|

●

|

More than 40% of the global pipeline is under construction, broadly

in line with prior years

|

System and pipeline summary of movements in 2022 and total closing

position (rooms):

|

|

System

|

Pipeline

|

|

Openings

|

Removals

|

Net

|

Total

|

YOY%

|

Adjusted YOY%b

|

Signings

|

Total

|

|

Group

|

49,443

|

(18,143)

|

31,300

|

911,627

|

+3.6%

|

+4.3%

|

80,338

|

281,468

|

|

Americas

|

20,568

|

(4,161)

|

16,407

|

515,496

|

+3.3%

|

+3.3%

|

32,464

|

100,319

|

|

EMEAA

|

16,211

|

(10,747)

|

5,464

|

229,664

|

+2.4%

|

+5.5%

|

25,847

|

83,410

|

|

G. China

|

12,664

|

(3,235)

|

9,429

|

166,467

|

+6.0%

|

+6.0%

|

22,027

|

97,739

|

a For

the years 2016-19, the total removal rate was 2.2-2.3% in each

year, which included elevated removals of Holiday Inn and Crowne

Plaza properties in those years; the underlying removal rate of

~1.5% reflects that across all other brands.

b Adjusted

for the removal of 6.5k rooms (28 hotels) in Russia, following

IHG's announcements regarding ceasing all operations in that

country in Q2 2022; this adjustment increases net growth by 0.7%

for the Group and by 3.1% for EMEAA. Net system size growth

includes the addition of the 12.4k rooms (33 hotels) added through

the Iberostar agreement, 9.0k rooms (23 hotels) of which are in

Americas, 3.4k rooms (10 hotels) in EMEAA; Adjusted net growth

excluding Iberostar would have been 1.4% lower at +2.9% for the

Group, 1.8% lower at +1.5% for Americas and 1.6% lower at +3.9% for

EMEAA.

The regional performance reviews provide further detail of the

system and pipeline by region, and further analysis by brand and by

ownership type.

Updates on our strategic priorities

Our four strategic priorities put the expanded brand portfolio we

have built in recent years at the heart of our business, and our

owners and guests at the heart of our thinking. Our priorities

recognise the crucial role of a sophisticated, well-invested

digital approach, ensure we meet our growing responsibility to care

for and invest in our people, and make a positive difference to our

communities and planet.

In 2022, we have increased our level of investment spending to meet

these priorities, including further development of our portfolio

and individual brands, the critical step of transforming our

loyalty programme, and strengthening our digital channels. We have

also invested in the resiliency and flexibility of our core

revenue-generating technology platforms to support future growth,

alongside enhancing our core HR systems and in capabilities that

will help IHG and our hotel owners meet our Journey to Tomorrow

responsible business commitments.

We continue to place strong emphasis on how we best utilise our own

cost investment resources, together with those of the System Fund,

to help strengthen our enterprise, capture demand and capitalise on

significant opportunities for growth. In 2021, fee business cost

savings of $75m were achieved and have been sustained in 2022. As

intended, the additional temporary reductions in the 2021 cost base

of $25m were redeployed in 2022. While there continues to be

pressure to the underlying level of cost inflation in our overheads

base, IHG has a strong long-term track record of driving

incremental efficiencies and scale advantage in its cost base to

help offset these, and delivering productivity gains to further

support our hotel owners, at the same time as continuing to invest

in each of our strategic priorities.

1. Build loved and trusted brands

We continue to invest in all our brands, enhancing design, service

and quality and increasing their scale. We also take opportunities

to add additional brands to our portfolio to offer wider choice to

guests and loyalty members and provide more owners access to the

power of IHG's enterprise platform. Highlights in 2022

included:

Continued growth of our most established brands.

|

●

|

Our InterContinental brand

opened six hotels, growing to 207 across more than 60 countries. A

pipeline of 90 hotels and resorts represents growth equivalent to

over 30% of current system size.

|

|

●

|

Holiday Inn Express grew

to 3,091 hotels, with a presence in more than 50 countries. Despite

its already market-leading global scale, there is a pipeline for

over 20% further growth. Holiday Inn Express achieved 110 signings

in the year, while our established extended stay

brands Candlewood

Suites and Staybridge

Suites added over 70

more.

|

Strengthening Holiday Inn and Crowne Plaza. Our

review in 2021 addressed the consistency and quality of the estates

for these two brands, resulting in the removal of 151 hotels or 10%

of their combined estate, and owners committing to improvements in

83 hotels.

|

●

|

Two-thirds of the Americas Holiday Inn estate and three-quarters of

the Crowne Plaza estate will have been updated by 2025 as a result

of the review and our ongoing progress. Contributing to this, a

further 20 Crowne Plaza and 50 Holiday Inn properties are expected

to have renovations completed in 2023. Recently renovated hotels

for both brands are showing strong performance metrics across

occupancy, room rate, revenue market share and guest satisfaction

scores.

|

|

●

|

Both brands have pipelines equivalent to 20% or more of their

current system size and to drive performance and growth we continue

to evolve key elements such as designs of the latest hotel formats

and food & beverage services, including Holiday Inn's new

premium breakfast buffet and streamlined all-day dining

menus.

|

Driving more conversions to our brands. Conversions

have continued to grow in importance, with 96 signings and

83 openings in 2022, representing around a quarter and third

respectively (excluding Iberostar). Converting to IHG brands

reflects the growing demand for access to our enterprise platform,

including our revenue-generating systems, marketing and loyalty

programmes to support performance, increase efficiencies and drive

returns for owners.

|

●

|

Our upscale conversion brand voco recently achieved the milestone of 100 open

and pipeline hotels. As momentum builds, there were 14 hotels

opened and 23 signings for the brand in the year. Achieving top

guest satisfaction scores versus equivalent competing brands, there

are already voco properties open in 18 countries and the pipeline

will add a further 14, including the first in India, Thailand,

Japan and Indonesia. In 2022 the brand was recognised as the

World's Leading Premium Hotel Brand at the World Travel

Awards.

|

|

●

|

Vignette Collection, our Luxury

& Lifestyle conversion brand which launched in August 2021, had

secured its first 17 properties by the end of 2022, running

ahead of our expectations. The first two Vignette properties in the

Americas region were signed in the second half of the year, while

in early 2023 the first signings in China, Japan and Germany were

achieved, which will lead to the brand's initial presence in more

than a dozen countries.

|

Excellent progress in growing our Luxury & Lifestyle

presence. We

have grown this category to 13% of IHG's system size and 20% of our

pipeline, which is approaching twice the size it was five years

earlier. In addition to the progress made at both InterContinental

and Vignette, other highlights included:

|

●

|

Our Regent brand saw its flagship Regent Hong Kong

reopen towards the end of the year and another key opening was an

all-suites-and-villas property in Phu Quoc (Vietnam). Two further

signings in Shanghai and Shenzhen Bay take the combined open and

pipeline to 19 hotels, up from nine at acquisition in 2018. In

2023, the Carlton Cannes, one of the world's most iconic hotels,

will reopen as a Regent after a two-year redevelopment, becoming a

flagship property within a new generation of Regent hotels and

reflecting our ambition to grow the brand across

Europe.

|

|

●

|

Kimpton continued

to grow both in the US and internationally, with four openings

including Australia's first for the brand in Sydney and a second in

Greater China. A strong year of 10 signings increased the pipeline

to 41 properties, representing growth of more than 50% on the 76

hotels already open for the brand.

|

|

●

|

Six Senses marked

an excellent year with eight signings, taking its pipeline to 38

properties, which would triple today's existing system. Building on

a strong presence across EMEAA, the brand's pipeline now includes

six hotels in the Americas and four in China.

|

|

●

|

Hotel Indigo achieved

18 openings in the year to reach 143 properties across more than 20

countries. Signings continued to be very strong too, with 30 in the

year taking the pipeline to 20k rooms, which would double the

existing system size.

|

First Atwell Suites openings and the rapid scale of

avid.

|

●

|

The first two Atwell

Suites properties opened

in the year - a prototype new-build at Denver Airport and an

adaptive re-use at Miami Brickell, while 11 more signings for this

new extended stay brand grew the pipeline to 30

properties.

|

|

●

|

In Q1 2023 we will have reached 60 open properties for

our avid hotels brand, which recently had a first opening in

Canada to add to those in the US and Mexico. There are more than

140 properties in the pipeline, as we continue to develop avid

hotels to be our next brand of scale. Open hotels are showing guest

satisfaction and revenue share ahead of competing brands. Eight

avid properties have also now sold, which also helps to demonstrate

the strong return on investment that owners can achieve from the

brand.

|

Growing our brand portfolio further through Exclusive

Partners. Adding

Exclusive Partners demonstrates the strengths and attractiveness of

IHG's enterprise platform, particularly in regard to providing

brands and hotels with access to our advanced technology and our

distribution channels. For IHG, these commercial agreements will

drive additional system growth and high quality fee streams, while

providing more choice for our owners, guests and loyalty members,

as strongly evidenced with our first Exclusive Partner,

Iberostar:

|

●

|

Announced in November 2022, the long-term commercial agreement with

Iberostar Hotels & Resorts for resort and all-inclusive hotels

added Iberostar Beachfront Resorts as an 18th brand

to IHG's portfolio and brings up to 70 hotels (24.3k rooms) into

our system, of which 33 (12.4k rooms) of these were added to IHG's

system by the end of the year. There are 27 of the 70 hotels that

require additional approvals from third parties in order to join

IHG.

|

|

●

|

The agreement significantly increases and broadens IHG's resort

footprint, providing guests with an increased choice of

destinations. Iberostar is positioned among the top resort brands

in the world, successfully developing a leading presence in

beachfront and all-inclusive properties in the Caribbean, Americas,

Southern Europe and North America over many decades.

|

|

●

|

The Iberostar properties gain access to IHG's enterprise platform,

including to our distribution channels and to

IHG One Rewards, which can drive large volumes of demand

to hotels from the more than 115 million members of the loyalty

programme.

|

|

●

|

Under this new type of agreement for Exclusive Partners to leverage

the scale and strengths of our platform, IHG receives marketing,

distribution, technology and other fees in a manner similar to our

existing asset light model. For the initial up to 70 hotels, by

2027, annual revenue recognised within IHG's fee business is

expected to be in excess of $40m, with a broadly similar amount

additionally recognised within System Fund revenues. Fees per key

are expected to exceed IHG's prior average by more than

10%.

|

|

●

|

In 2022, there were $5m of costs incurred by IHG in relation to the

initial stages of the agreement. In 2023, IHG is investing in

further integration costs, the net impact of which on operating

profit from reportable segments is expected to be $10-15m. The

Iberostar agreement is then expected to turn to a positive

contribution in 2024, before ramping up significantly from 2025

with the final step up in the fee structure and the expected shift

in distribution channel mix that IHG is expected to deliver for the

Iberostar hotels.

|

|

●

|

IHG's pipeline also includes five Iberostar Beachfront Resorts

properties that are expected to be built and opened in future

years. This pipeline, along with IHG's fee income, will further

increase as IHG and Iberostar work together to grow the brand's

footprint through the long-term commercial agreement.

|

2. Customer centric in all we do

Delivering True Hospitality for Good means creating seamless and

tailored guest experiences that generate increased demand and build

loyalty, whilst delivering high returns for our owners in

responsible and sustainable ways.

Transforming loyalty

Our loyalty programme is critical to our business and future

growth, with 2022 seeing the welcome return to over half our room

nights being driven by loyalty members. We now have more than 115

million members in the programme. Loyalty members stay in our

hotels more often, typically spend 20% more than non-members and

are estimated to be 9x more likely to book direct, which is our

most profitable channel for owners.

In 2022 we launched our transformed loyalty programme, IHG One

Rewards, to offer industry-leading value, richer benefits and

greater choice for members to enhance their stays, alongside

attracting a next-generation of travellers. The enhanced rewards

include free breakfast for Diamond Elite members and the ability

for guests to choose the rewards that matter to them most through

the introduction of Milestone Rewards. Achievements

include:

|

●

|

Global loyalty contribution had already returned to 2019 levels by

the end of 2022, with a significant increase in contribution in the

months following launch, which also saw a step up in member Guest

Love scores.

|

|

●

|

Enrolments in 2022 were up 27% year-on-year and 12.2 million more

loyalty members have been added.

|

|

●

|

11% more points were redeemed in 2022 compared to 2019, with a 16%

increase in reward nights booked.

|

|

●

|

Engagement with Milestone Rewards has exceeded our expectations,

with over one million rewards chosen.

|

|

●

|

Relaunched US co-brand credit cards with new benefits have driven a

60% increase in new accounts and a 17% lift in spend

year-on-year.

|

|

●

|

The launch of our largest marketing campaign in more than a decade,

Guest How You Guest, has lifted awareness and brand favourability

measures and helped drive more revenue to our hotels for our

owners.

|

|

●

|

In 2022, IHG One Rewards won awards including Best Hotel Loyalty

Enhancement from The Points Guy and Best Hotel Rewards Program from

Global Traveler.

|

We have also further strengthened our relationship with Mr &

Mrs Smith and expanded the benefits to our IHG One Rewards members.

The fourth quarter of 2022 saw the largest number of properties

loaded since initial launch, and there are now 687 properties live;

these are not part of IHG's system size, but as a loyalty

partnership provide IHG One Rewards members an even wider selection

of luxury and lifestyle hotels to indulge in while they earn and

redeem points.

Lowering costs and driving efficiencies for our owners

With 2022 continuing to see supply chain issues and increasing

supply cost pressures, together with labour shortages, our owners

around the world rely heavily on IHG to help them run an efficient

business. We have continued to expand the benefits for owners of

being part of the IHG system, whilst also improving guest

experience.

|

●

|

We have further expanded the scale and reach of our procurement

solutions for operating supplies and equipment. Around 4,100 hotels

in the Americas region now participate in our F&B purchasing

programme, with nearly 20% growth in the number of hotels joining

in the US alone. These programmes support menu optimisation, help

owners mitigate inflationary pressures and achieve absolute

savings. Hotels in Latin America that recently joined IHG's buying

programme saw savings of up to 13%, whilst in the UK, smaller owner

groups onboarded in 2022 saw typical savings of 7-15% on food costs

and 10-15% on beverage costs.

|

|

●

|

We are also helping owners to lower construction and refurbishment

costs. For example, our first Hotel Procurement Service pilots that

have now expanded to Japan, Australasia and the Pacific have

demonstrated savings of 11-35% on various goods and services for

owners during their hotel build and opening phases.

|

|

●

|

In Greater China, we have connected owners to specialist financiers

for them to provide a Supply Chain Financing programme that offers

deferred payment plans at competitive interest rates for owners'

purchases of hotel building materials.

|

|

●

|

In our latest formats, the construction costs per key for

Candlewood Suites, Staybridge Suites and Atwell Suites have reduced

by 3-5% through further Furniture, Fixtures & Equipment

savings.

|

|

●

|

During 2022 we unveiled the latest evolution of our upscale EVEN

Hotels brand through an updated design, refreshed restaurant and

integrated wellness experience. Developed in collaboration with

franchisees, this format will be more efficient to build and

operate, supporting the brand's future growth in more

markets.

|

|

●

|

To mitigate energy cost increases, in the US we assist owners to

make their properties more energy efficient and secure related tax

deductions. We have also launched a community solar offering

initially for hotels in the US state of Maryland, whilst in the UK

and Germany all our managed hotels are now supplied through green

energy tariffs. We continue to develop further programmes to use

IHG's combined scale to help owner groups access low carbon

projects and lower-cost energy.

|

|

●

|

The rollout of our next-generation payments system, FreedomPay, is

expected to be complete in all US and Canada hotels by the end

2023, adding more guest payment options and lowering costs for

owners.

|

3. Create digital advantage

Our digital-first approach drives a higher percentage of direct

bookings to our hotels, helps meet evolving guest expectations,

creates cost efficiencies and delivers data and insights to

optimise revenue management decisions. Developments in 2022

included:

|

●

|

Next generation IHG mobile app. Mobile

is our fastest-growing revenue channel. Amongst many enhancements,

our new app launched in 2022 offers streamlined booking and allows

guests to check-in faster. It also powers IHG One Rewards by

providing members with seamless access to their loyalty benefits,

including the ability to choose and redeem Milestone Rewards and

showcase loyalty benefits pre-stay. Other improvements include

filtering by room attributes, enriched maps functionality, and in

Q4 alone a further 60+ enhancements were made to the booking

process. The improvements to the app are supporting further

increases in direct bookings, loyalty engagement and incremental

spend during stays. Since its launch, reservation flow conversion

rate is up two percentage points versus 2019, revenue driven by our

mobile app for the Americas and EMEAA regions has been at 30%

higher levels than 2019, and a further shift in preference for

mobile device usage has seen it now account for 58% of all digital

bookings.

|

|

|

|

|

●

|

Improved booking experience. Newly

designed webpages that combine rooms and rates choices have

contributed to increases in booking conversion of up to one

percentage point and revenue uplift of up to 3%. This new web

experience has also driven a ~30% increase in web enrolments to our

IHG One Rewards programme.

|

|

|

|

|

●

|

New websites for individual brands. Rolling

out new sites for our InterContinental and Hotel Indigo brands has

followed the success of those for Kimpton, Holiday Inn and Holiday

Inn Express. New templates are elevating the brands and providing

guests with significantly enhanced content and

functionality.

|

|

|

|

|

●

|

Stay enhancements and attribute pricing. We

have progressed with testing across more brands how we best drive

the cross-sell of non-room extras and the up-sell of rooms, which

enable owners to generate maximum value from the unique attributes

of their inventory. Leveraging the GRS capabilities, our pilots are

presenting upsells of room types and rooms views, for example, and

we will be scaling these across more of the estate in

2023.

|

|

|

|

|

●

|

Digitising more areas of customer experience. As

part of a wide range of investments to enhance the customer contact

experience whilst driving greater cost efficiency and effectiveness

for our owners, we achieved 20% of customer contacts going through

digital channels by the end of 2022, compared to just 4% at the

start. Growth in AI capabilities has also increased end-to-end

self-service from 12% to 17%.

|

4. Care for our people, communities and

planet

With hotels in thousands of communities all over the world, our

business and brands touch the lives of millions of people every day

and are united by a purpose of True Hospitality for Good. Our

actions are shaped by a culture of strong governance, clear

policies and a series of ambitious commitments for our people,

communities and planet set out in our Journey to Tomorrow 2030

responsible business plan, which launched in 2021. We are making

substantial investments in systems and capabilities to help IHG and

our hotel owners meet these commitments. Developments in 2022

included:

People

Creating a culture where everyone feels valued and able to thrive

is a vital part of our ability to attract, develop and retain a

more diverse range of talent with different experiences and

backgrounds. We

are making investments in multiple areas to achieve

this:

|

●

|

Overall employee engagement increased to 86% (+1% on 2021), placing

IHG as a Global Best Employer by Kincentric.

|

|

●

|

We continue to make progress on our commitment to increase ethnic

minority leadership representation at a corporate level, aiming to

increase this in the US from 20% in 2022 to 26% by 2025 and in the

UK from 6% in 2022 to 20% by 2027.

|

|

●

|

Reflecting a focus on gender balance among our leaders, the

proportion of female corporate leaders increased to 34% and IHG is

one of the few large global businesses to have a gender-balanced

all-employee population (58% female).

|

|

●

|

We celebrated more colleagues graduating from our RISE programme,

which aims to increase the number of women in General Manager and

other senior positions in our managed hotels.

|

|

●

|

We have launched enhanced core HR and learning and development

platforms, alongside tools and resources around

wellbeing.

|

Communities

IHG is proud to be at the heart of thousands of communities around

the world, and as part of delivering our purpose of True

Hospitality for Good we focus on making a positive impact through

three areas: skills building, disaster relief and tackling food

poverty:

|

●

|

Our free virtual learning platform, the IHG Skills Academy, was

translated into eight additional languages in 2022 to broaden the

global reach of the IHG Academy programme, which has now trained

more than 98,000 people.

|

|

●

|

Further programmes were set up to help students historically

impacted by discrimination, poverty and other work barriers,

including with Historically Black Colleges and Universities (HBCUs)

in the US.

|

|

●

|

As we seek to advance human rights through our business activities,

we launched minimum core requirements for responsible labour

practices for all IHG managed, owned and leased hotels globally,

which further supports the implementation of IHG's Human Rights

Policy at hotel level.

|

|

●

|

We have implemented new responsible procurement digital tools and

solutions, with more than 18,000 e-learning training sessions

delivered to colleagues; supporting both our people and communities

focus, we introduced our Supplier Diversity programme, EPIC

(Engaging Partnerships through Inclusion and Collaboration), whilst

through leveraging further partnerships we have gained exposure to

additional diverse business entities and doubled our qualified

diverse spending in the US on the prior year.

|

|

●

|

IHG supported 10 relief efforts around the globe during the year,

working closely with our long-term partners such as CARE

International and the International Federation of Red Cross and Red

Crescent Societies (IFRC).

|

|

●

|

In response to the war in Ukraine and the humanitarian crisis it

has caused, IHG made significant donations to some of our charity

partners and worked with our hotel owners in other countries to

shelter and recruit refugees. We have also teamed up with Tent

Partnership to provide refugees in the US with skills and

jobs.

|

Planet

As part of our Journey to Tomorrow commitments, our 2030

science-based target is to reduce by 46% from the 2019 baseline

year our absolute Scope 1 and 2 Greenhouse Gas (GHG) emissions as

well as our Scope 3 GHG emissions covering both our Fuel and Energy

Related Activities (FERA) and franchise estate. Notable progress in

2022 including:

|

●

|

A 3.4% absolute reduction in GHG emissions as defined above, or a

5.8% decrease on an occupied room basis compared to our 2019

baseline levels, achieved in a year when our hotels were also

highly focused on recovering from the pandemic and restoring

growth.

|

|

●

|

The rollout of our Hotel Energy Reduction Opportunities (HERO) tool

and training, which gives owners bespoke sustainability

recommendations, costs and savings based upon their hotel's

individual data and characteristics.

|

|

●

|

We continue to roll-out centralised data collection across our

business to make it easier for our hotels to understand and measure

their environmental impacts, identify areas for reduction and track

progress. At no additional cost to hotels, this data is also

helping them to answer requests for proposals when they bid for

corporate contracts.

|

|

●

|

New hotel energy metrics and brand standards as part of our

strategy to decarbonise the existing estate, with targets tailored

for every hotel by region, brand and climate zone. Mandated

requirements have initially focused on those that provide the most

impact for the lowest cost, with paybacks of less than five years

for hotel owners.

|

|

●

|

Our latest design work for Holiday Inn Express in the US draws upon

our analysis to develop new-build hotels that operate at very low

or zero-carbon. The guide sets out the measures needed, cost

impacts and returns on investment for hotel owners compared to

current builds.

|

|

●

|

To tackle waste, we secured a bulk bathroom amenities global

collaboration to replace bathroom miniatures for more than 4,000

hotels, saving at least 850 tonnes of plastic annually in the

Americas region alone and providing hotels with savings of 10-30%

versus previous costs.

|

|

●

|

Our global food waste e-learning modules launched in 13 languages,

based around the UN's "prevent, donate, divert" plan, whilst our

work with food waste specialist Winnow to install assessment

technology at 20 hotels in the Middle East is delivering an average

reduction of 68% in the cost of food waste.

|

|

●

|

A baseline dataset on water risks for all hotels has been

completed, which will inform our future strategy and reporting as

we adopt the Sustainability Accounting Standards Board (SASB)

framework. Our global risk mapping on biodiversity was also

finalised in the year to establish the baseline dataset for this

critical area.

|

|

●

|

Among our strong ratings across ESG indices, surveys and reports,

we are proud to have been listed in the S&P Dow Jones

Sustainability World Index and Europe Index for the sixth

consecutive year, to receive a AA rating from MSCI, to be ranked

'best-in-class' in the ISS Environmental Quality Score and Social

Quality Score, and in the Workforce Disclosure Initiative (WDI) to

have increased our score to 81% in 2022 which strongly outperformed

the sector average of 66%.

|

Summary of financial performance

INCOME STATEMENT SUMMARY

|

|

12 months ended 31 December

|

|

|

|

|

|

|

|

2022

|

2021

|

%

|

|

|

$m

|

$m

|

change

|

|

Revenue

|

|

|

|

|

Americas

|

1,005

|

774

|

29.8

|

|

EMEAA

|

552

|

303

|

82.2

|

|

Greater China

|

87

|

116

|

(25.0)

|

|

Central

|

199

|

197

|

1.0

|

|

|

_____

|

_____

|

_____

|

|

Revenue from reportable segmentsa

|

1,843

|

1,390

|

32.6

|

|

|

|

|

|

|

System Fund revenues

|

1,217

|

928

|

31.1

|

|

Reimbursement of costs

|

832

|

589

|

41.3

|

|

|

_____

|

_____

|

_____

|

|

Total revenue

|

3,892

|

2,907

|

33.9

|

|

|

_____

|

_____

|

_____

|

|

Operating profit/(loss)

|

|

|

|

|

Americas

|

761

|

559

|

36.1

|

|

EMEAA

|

152

|

5

|

NMb

|

|

Greater China

|

23

|

58

|

(60.3)

|

|

Central

|

(108)

|

(88)

|

22.7

|

|

|

_____

|

_____

|

_____

|

|

Operating profit from reportable segmentsa

|

828

|

534

|

55.1

|

|

Analysed as:

|

|

|

|

|

Fee Business excluding Central

|

917

|

658

|

39.4

|

|

Owned, leased and managed lease

|

19

|

(36)

|

NMb

|

|

Central

|

(108)

|

(88)

|

22.7

|

|

|

|

|

|

|

System Fund result

|

(105)

|

(11)

|

854.5

|

|

|

____

|

____

|

____

|

|

Operating profit before exceptional items

|

723

|

523

|

38.2

|

|

Operating exceptional items

|

(95)

|

(29)

|

227.6

|

|

|

____

|

____

|

____

|

|

Operating profit

|

628

|

494

|

27.1

|

|

|

|

|

|

|

Net financial expenses

|

(96)

|

(139)

|

(30.9)

|

|

Analysed as:

|

|

|

|

|

Adjusted interest expensea

|

(122)

|

(142)

|

(14.1)

|

|

System Fund interest

|

16

|

3

|

433.3

|

|

Foreign exchange gains

|

10

|

-

|

-

|

|

|

|

|

|

|

Fair value gains on contingent purchase consideration

|

8

|

6

|

33.3

|

|

|

____

|

____

|

____

|

|

Profit before tax

|

540

|

361

|

49.6

|

|

|

|

|

|

|

Tax

|

(164)

|

(96)

|

70.8

|

|

Analysed as;

|

|

|

|

|

Tax before exceptional items, foreign

exchange gains and System Funda

Tax on foreign exchange gains

|

(194)

4

|

(125)

-

|

55.2

-

|

|

Tax on exceptional items and exceptional tax

|

26

|

29

|

(10.3)

|

|

|

____

|

____

|

____

|

|

Profit for the year

|

376

|

265

|

41.9

|

|

|

|

|

|

|

Adjusted earningsc

|

511

|

269

|

90.0

|

|

|

|

|

|

|

Basic weighted average number of ordinary shares

(millions)

|

181

|

183

|

(1.1)

|

|

|

____

|

____

|

____

|

|

Earnings per ordinary share

|

|

|

|

|

|

Basic

|

207.2¢

|

145.4¢

|

42.5

|

|

|

Adjusteda

|

282.3¢

|

147.0¢

|

92.1

|

|

|

|

|

|

|

|

Dividend per share

|

138.4¢

|

85.9¢

|

61.1

|

|

|

|

|

|

|

|

Average US dollar to sterling exchange rate

|

$1: £0.81

|

$1: £0.73

|

11.0

|

|

|

|

|

|

a. Definitions

for non-GAAP measures can be found in the 'Use of key performance

measures and non-GAAP measures' section along with reconciliations

of these measures to the most directly comparable line items within

the Financial Statements.

b. Percentage

change considered not meaningful, such as where a positive balance

in the latest period is comparable to a negative or zero balance in

the prior period.

c. Adjusted

earnings as used within adjusted earnings per share, a non-GAAP

measure.

Revenue

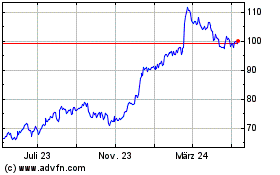

Trading improved in each quarter of 2022, with Group comparable

RevPARa exceeding

pre-pandemic levels in the third and fourth quarters alongside the

continued lifting of Covid-related travel restrictions. Both the

Americas and EMEAA saw strong sequential improvement, and full year

RevPARa exceeded

pre-pandemic levels in the US and UK. Trading continued to be

driven by strong leisure demand, which was supported by improvement

in both corporate and group bookings in the second half of the

year. Greater China remained impacted by localised travel

restrictions for much of the year.

Group comparable RevPARa improved

year-on-year by 60.8% in the first quarter, then grew 43.9% in the

second quarter, 27.8% in the third quarter, 25.6% in the fourth

quarter and 36.6% in the full year. When compared to the

pre-pandemic levels of 2019, Group comparable

RevPARa declined

17.7% in the first quarter and 4.5% in the second quarter, then

grew 2.7% in the third quarter and 4.1% in the fourth quarter, with

the full year 3.3% below 2019. Overall, average daily rate

strengthened to 8.2% ahead of 2019 and occupancy continued to

recover to 7.4%pts below 2019 levels.

Our other key driver of revenue, net system size, increased by 3.6%

year-on-year to 911.6k rooms, impacted by the removal of 6.5k rooms

in the first half of the year relating to the ceasing of operations

in Russia. Adjusting for this, net system size increased

4.3%.

Total revenue increased by $985m (33.9%) to $3,892m, including a

$243m increase in cost reimbursement revenue. Revenue from

reportable segmentsb increased

by $453m (32.6%) to $1,843m, driven by the improved trading

conditions. Underlying revenueb increased

by $509m to $1,817m, with underlying fee revenueb increasing

by $317m. Owned, leased and managed lease revenue increased by

$157m.

Operating profit and margin

Operating profit improved by $134m from $494m to $628m, including a

$66m increase in charges from operating exceptional items and a

$94m increase in the reported System Fund loss.

Operating profit from reportable segmentsb increased

by $294m (55.1%) to $828m, with fee business operating profit

increasing by $239m (41.9%) to $809m, due to the improvement in

trading which drove a $41m increase in incentive management fees to

$103m. Owned, leased and managed lease operating profit improved

from a $36m loss to a $19m profit on continued growth in Americas

and EMEAA. Underlying operating profitb increased

by $282m (52.5%) to $819m.

Fee marginb increased

by 6.6%pts over the prior year (2.1%pts above 2019) to 56.2%,

benefitting from the improvement in trading and ongoing disciplined

cost management, including sustaining $75m of the cost savings

achieved in 2021.

The impact of the movement in average USD exchange rates for 2021

compared to 2022 netted to a nil impact on operating profit from

reportable segmentsb when

calculated as restating 2021 figures at 2022 exchange rates, but

negatively impacted operating profit from reportable

segmentsb by

$17m when applying 2021 rates to 2022 figures. This difference is

due to high growth in non-US dollar markets in 2022, meaning that

2022 operating profit from reportable segmentsb would

be $17m higher if foreign exchange rates had remained constant with

2021.

If the average exchange rate during January 2023 had existed

throughout 2022, the 2022 operating profit from reportable

segmentsb would

have been $9m lower.

System Fund

The Group operates a System Fund to collect and administer cash

assessments from hotel owners for the specific purpose of use in

marketing, reservations, and the Group's loyalty programme, IHG One

Rewards. The System Fund also benefits from proceeds from the sale

of loyalty points under third-party co-branding arrangements. The

Fund is not managed to generate a surplus or deficit for IHG over

the longer term but is managed for the benefit of hotels in the IHG

System with the objective of driving revenues for the hotels in the

System.

The growth in the IHG One Rewards programme means that, although

assessments are received from hotels up front when a member earns

points, more revenue is deferred each year than is recognised

in the System Fund. This can lead to accounting losses

in the System Fund each year as the deferred revenue balance grows

which do not necessarily reflect the Fund's cash position and the

Group's capacity to invest.

In the year to 31 December 2022, System Fund revenues increased

$289m (31.1%) to $1,217m, primarily driven by the continued

recovery in travel demand yielding higher assessment

revenues.

The reported System Fund loss increased by $94m to $105m,

reflecting increased investments in consumer marketing, loyalty and

direct channels, largely driven by the re-launch of the Group's

loyalty program and higher levels of Reward Night redemptions,

which offset the increase in assessment income.

a.

Comparable

RevPAR includes the impact of hotels temporarily closed as a result

of Covid-19.

b. Definitions

for non-GAAP measures can be found in the 'Use of key performance

measures and non-GAAP measures' section along with reconciliations

of these measures to the most directly comparable line items within

the Financial Statements.

Reimbursement of costs

Cost reimbursement revenue represents reimbursements of expenses

incurred on behalf of managed and franchised properties and

relates, predominantly, to payroll costs at managed properties

where we are the employer. As we record cost reimbursements based

upon costs incurred with no added mark up, this revenue and related

expenses have no impact on either our operating profit or net

profit for the year. In the year to 31 December 2022, reimbursable

revenue increased by $243m (41.3%) to $832m. Over 90% of the

increase was in the US and Canada reflecting the overall recovery

in trading conditions.

Operating exceptional items

Operating exceptional items totalled a charge of $95m, driven by

the following items:

|

●

|

the costs and impairment charges of ceasing operations in Russia

($17m);

|

|

●

|

commercial litigation and disputes ($28m);

|

|

●

|

impairment reversals ($22m) reflecting improved trading conditions

in both the Americas and EMEAA regions;

|

|

●

|

impairment charges ($12m) relating to one hotel in the EMEAA

region;

|

|

●

|

shares of losses from the Barclay associate ($60m) arising from an

allocation of expenses in excess of the Group's percentage

share.

|

Further information on exceptional items can be found in note 5 to

the Financial Statements.

Net financial expenses

Net financial expenses decreased to $96m from $139m. Adjusted

interesta,

which excludes exceptional finance expenses and foreign exchange

gains and adds back interest relating to the System Fund, decreased

by $20m to an expense of $122m. The decrease in adjusted

interesta was

primarily driven by favourable impacts of FX rates on the sterling

bonds and an increase in interest received on deposits, offset by

an increase in interest payable to the System

Fund.

Financial expenses include $82m (2021: $91m) of total interest

costs on public bonds, which are fixed rate debt. Interest expense

on lease liabilities was $29m (2021: $29m).

Fair value gains on contingent purchase consideration

Contingent purchase consideration arose on the acquisition of

Regent. The gain of $8m (2021: $6m of which $1m related to Regent

and $5m to contingent consideration no longer payable) relates to a

favourable movement in the bond rates used in the valuation. The

total contingent purchase consideration liability at 31 December

2022 is $65m (31 December 2021: $73m).

Taxation

The effective rate of tax on profit before exceptional items,

foreign exchange gains and System Fund was 27% (2021: 31%); this

was lower than 2021 largely due to the improved profit base. An

overall $26m tax credit ($33m current tax credit and a $7m deferred

tax charge) arose in respect of exceptional items (2021: $29m

credit). Net tax paid in 2022 totalled $211m (2021: $86m); the 2021

comparative included $15m of tax refunds, of which there were none

in 2022. The Group continued to recognise significant deferred tax

assets of $109m (2021: $127m) in the UK in respect of revenue

losses and other temporary differences. Further information on tax

can be found in note 6 to the Financial Statements.

Earnings per share

The Group's basic earnings per ordinary share is 207.2¢ (2021:

145.4¢). Adjusted earnings per ordinary

sharea increased

by 135.3¢ to 282.3¢.

Dividends and returns

The Board is proposing a final dividend of 94.5¢ in respect of

2022, which is growth of 10% on 2021. An interim dividend of

43.9¢ was resumed and paid in October 2022. The total dividend

for the year would therefore be 138.4¢, representing an

increase of 61% as no interim dividend was paid in 2021. The

ex-dividend date is Thursday 30 March 2023 and the Record Date is

Friday 31 March. The corresponding dividend amount in Pence