Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 Dezember 2024 - 2:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a

-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

December 2024

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check

mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Table of Contents

Items:

OTHER NEWS

Subject:

Disclosure under the Indian Listing Regulations

IBN

ICICI Bank Limited

(the ‘Bank’) Report on Form 6-K

The Bank has made

the below announcement to the Indian Stock exchanges:

The Board of Directors

of ICICI Bank Limited (“the Bank”), at its meeting held today, approved a proposal for sale of 19% stake held in ICICI Merchant

Services Private Limited (“IMSPL” or “the Company”), an associate of the Bank, subject to receipt of requisite

approvals. Consequent to the completion of this transaction, IMSPL will cease to be an associate of the Bank.

Pursuant to Regulation

30 read with para A of part A of Schedule III of the SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015, as amended,

read with SEBI Master Circular dated November 11, 2024, we wish to provide the following disclosure:

| a. |

The amount and percentage of the turnover or revenue or income and net worth contributed by such unit or division or undertaking or subsidiary or associate company of the listed entity during the last financial year |

Name of associate

company: ICICI Merchant Services Private Limited

Revenue from

operations during FY2024:

₹ 4.75

billion

Net worth of

the Company at March 31, 2024:

₹ 6.45

billion |

| b. |

Date on which the agreement for sale has been entered into |

Will

be executed before June 30, 2025 |

| c. |

The expected date of completion of sale/disposal |

By

June 30, 2025 |

| d. |

Consideration received from such sale/disposal |

In

the range of ₹ 1.60 -1.90 billion |

| e. |

Brief details of buyers and whether any of the buyers belongs to promoter/ promoter group/ group companies. If yes, details thereof |

First Data Holdings 1 (Netherlands) BV, a global leader in electronic commerce and payment services. The buyer does not belong to promoter/ promoter group/ group companies. |

| f. |

Whether the transaction would fall within related party transaction? If yes, whether the same is done at “arm’s length” |

This transaction does not constitute a related party transaction. |

| g. |

Whether the sale, lease or disposal of the undertaking is outside Scheme of Arrangements? If yes, details of the same including compliance with regulation 37A of LODR Regulations |

Not applicable |

| h. |

Additionally, in case of a slump sale, indicative disclosure provided for amalgamation/ merger, shall be disclosed by the listed entity with respect to such slump sale |

Not applicable |

The Board meeting commenced at 09:30 a.m. and concluded at 01:40 p.m.

We request you to

take note of the above.

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India. |

Tel.: 022- 4008 8900

Email:companysecretary@icicibank.com

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012 |

Regd. Office: ICICI Bank Tower, Near

Chakli Circle,

Old Padra Road, Vadodara 390007. India |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

| |

|

For

ICICI Bank Limited |

| |

|

|

| |

|

|

| Date: |

December

13, 2024 |

|

By: |

/s/ Vivek

Ranjan |

| |

|

|

|

Name: |

Vivek

Ranjan |

| |

|

|

|

Title: |

Assistant General Manager |

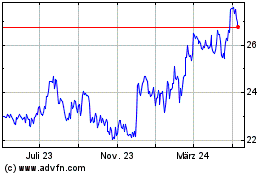

Icici Bank (NYSE:IBN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

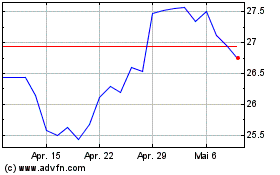

Icici Bank (NYSE:IBN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024