- Q1 2023 GAAP diluted EPS of $0.50 compared to Q1 2022 GAAP

diluted EPS of $0.21.

- Q1 2023 adjusted diluted EPS of $0.50, compared to Q1 2022

adjusted diluted EPS of $0.22.

- Q1 2023 Sales were $458 million, an increase of 17.2% over

Q1 2022 sales of $391 million (18.0% increase in constant

currency).

- Full year 2023 guidance is reaffirmed.

See Table C for reconciliation of GAAP and non-GAAP operating

income, net income, earnings per share and operating cash flow to

free cash flow. Free cash flow is cash from operations less capital

expenditures.

Hexcel Corporation (NYSE: HXL):

Summary of Results from

Operations

Quarters Ended

March 31,

(In millions, except per share data)

2023

2022

% Change

Net Sales

$

457.7

$

390.6

17.2

%

Net sales change in constant currency

18.0

%

Operating Income

62.8

30.1

108.6

%

Net Income

42.7

17.8

139.9

%

Diluted net income per common share

$

0.50

$

0.21

138.1

%

Non-GAAP measures for year-over-year

comparison (Table C)

Adjusted Operating Income

$

63.0

$

31.1

102.6

%

As a % of sales

13.8

%

8.0

%

Adjusted Net Income

42.9

18.6

130.6

%

Adjusted diluted net income per share

$

0.50

$

0.22

127.3

%

Hexcel Corporation (NYSE: HXL) today reported first quarter 2023

results including net sales of $458 million and adjusted diluted

EPS of $0.50 per share.

Chairman, CEO and President Nick Stanage said, “Our relentless

focus on execution and growing demand drove an 18% increase in

sales, and we delivered adjusted operating income that was more

than double the same period last year. The margin expansion

reflects strong operating leverage from higher production levels as

our key markets grow. Hexcel is well-positioned to benefit from the

multi-year production ramps our aerospace customers have announced,

as well as growth in other markets – all of which will lead to

significant cash generation and expanding shareholder value.”

Mr. Stanage continued, “Innovating the next generation of

advanced lightweight composite materials is at the heart of who we

are and what we do, so it was a pleasure last month to welcome many

customers and partners to join us at the grand opening of our new

Center of Research & Technology Excellence in Salt Lake City,

Utah. This state-of-the-art facility will allow us to expand our

research and broaden our technology portfolio. It will provide an

even stronger platform for us to collaborate with our customers on

the latest developments in lightweight sustainable solutions, to

create a better world for us all.”

Markets

Sales in the first quarter of 2023 were $457.7 million compared

to $390.6 million in the first quarter of 2022.

Commercial Aerospace (62% of YTD Sales)

- Commercial Aerospace sales of $284.5 million increased 30.0%

(30.0% in constant currency) for the first quarter of 2023 compared

to the first quarter of 2022 led by growth in the Airbus A350 and

A320neo programs. Other Commercial Aerospace increased 23.5% for

the first quarter of 2023 compared to the first quarter of 2022 on

expanding business jet demand.

Space & Defense (28% of YTD Sales)

- Space & Defense sales of $126.2 million increased 6.8%

(7.6% in constant currency) for the quarter as compared to the

first quarter of 2022 with growth across a number of platforms

globally, including fixed-wing aircraft and both military and

civilian rotorcraft.

Industrial (10% of YTD Sales)

- Total Industrial sales of $47.0 million in the first quarter of

2023 decreased 12.1% (9.1% in constant currency) compared to the

first quarter of 2022, due to lower wind energy sales that were

partially offset by sales growth in recreation, automotive and

other industrial markets.

Consolidated Operations

Gross margin for the first quarter of 2023 was 27.9% compared to

22.2% in first quarter of 2022 with the improvement driven by

strong production volume leverage, and also reflecting a favorable

sales mix, favorable absorption and a beneficial foreign exchange

impact. As a percentage of sales, selling, general and

administrative and R&T expenses for the first quarter of 2023

were 14.1% compared to 14.2% for the first quarter of 2022.

Adjusted operating income in the first quarter of 2023 was $63.0

million or 13.8% of sales, compared to $31.1 million, or 8.0% of

sales in 2022. The impact of exchange rates on operating income as

a percentage of sales was favorable by approximately 80 basis

points in the first quarter of 2023 compared to Q1 2022.

Cash and other

- The first quarter 2023 tax expense was $11.7 million compared

to a tax expense of $4.7 million for the first quarter of

2022.

- Net cash used for operating activities in the first quarter of

2023 was $23.4 million, compared to a use of $19.0 million for the

first quarter of 2022. Working capital increased to support higher

sales and was a cash use of $104.0 million in the first quarter of

2023 compared to a use of $74.3 million in the first quarter of

2022. Capital expenditures on a cash basis were $18.1 million for

the first quarter of 2023. Free cash flow was ($41.5) million in

the first quarter of 2023 compared to ($39.9) million in the first

quarter of 2022. Free cash flow is defined as cash generated from

operating activities less cash paid for capital expenditures.

Capital expenditures on an accrual basis were $16.8 million for the

first quarter of 2023 compared to $11.1 million for the first

quarter of 2022.

- The Company did not repurchase any common stock during the

first quarter of 2023 and the remaining authorization under the

share repurchase program on March 31, 2023, was $217 million.

- As announced today, the Board of Directors declared a quarterly

dividend of $0.125 per share payable to stockholders of record as

of May 5, 2023, with a payment date of May 12, 2023.

2023 Guidance

(unchanged)

- Sales of $1.725 billion to $1.825 billion

- Adjusted diluted earnings per share of $1.70 to $1.90

- Free cash flow greater than $140 million

- Accrual basis capital expenditures of approximately $90

million

- Underlying effective tax rate is estimated to be 23%

Hexcel will host a conference call at 10:00 a.m. ET, on April

25, 2023, to discuss first quarter 2023 results. The event will be

webcast via the Investor Relations webpage at www.Hexcel.com. The

event can also be accessed by dialing +1 (646) 960-0452. The

conference ID is 3428143. Replays of the call will be available on

the website.

About Hexcel

Hexcel Corporation is a global leader in advanced lightweight

composites technology. We propel the future of flight, energy

generation, transportation, and recreation through excellence in

providing innovative high-performance material solutions that are

lighter, stronger and tougher, helping to create a better world for

us all. Our broad and unrivaled product range includes carbon

fiber, specialty reinforcements, prepregs and other

fiber-reinforced matrix materials, honeycomb, resins, engineered

core and composite structures for use in commercial aerospace,

space and defense, and industrial applications.

Disclaimer on Forward Looking Statements

This news release contains statements that are forward looking

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements relating to the estimates and

expectations based on aircraft production rates provided by Airbus,

Boeing and others; the revenues we may generate from an aircraft

model or program; the impact of the push-out in deliveries of the

Airbus and Boeing backlog and the impact of delays in the startup

or ramp-up of new aircraft programs or the final Hexcel composite

material content once the design and material selection have been

completed; expectations with regard to regulatory clearances or the

build rate of the Boeing 737 MAX or Boeing 787 and the related

impact on our revenues; expectations with regard to raw material

cost and availability; expectations of composite content on new

commercial aircraft programs and our share of those requirements;

expectations regarding revenues from space and defense

applications, including whether certain programs might be curtailed

or discontinued; expectations regarding sales for wind energy,

recreation, automotive and other industrial applications;

expectations regarding working capital trends and expenditures and

inventory levels; expectations as to the level of capital

expenditures and timing of completion of capacity expansions and

qualification of new products; expectations regarding our ability

to improve and maintain margins; expectations regarding the sale of

certain of our assets; projections regarding our tax rate;

expectations with regard to the continued impact of the conflict

between Russia and Ukraine; expectations regarding our strategic

initiatives and other goals, including, but not limited to, our

sustainability goals; expectations regarding the outcome of legal

matters or the impact of changes in laws or regulations or

government policies; expectations with regard to cybersecurity

measures taken to protect confidential and proprietary information

and the anticipated impact of the above factors and various market

risks on our expectations of financial results for 2023 and beyond.

Actual results may differ materially from the results anticipated

in the forward looking statements due to a variety of factors,

including but not limited to the extent of the impact of the

conflict between Russia and Ukraine and the ongoing market recovery

following the COVID-19 pandemic, including continued disruption in

global financial markets and supply chains, and labor shortages,;

reductions in sales to any significant customers, particularly

Airbus or Boeing, including related to the timing of pending

regulatory clearances for the Boeing 737 MAX and the Boeing 787 or

other geopolitical events or conditions; our ability to effectively

adjust production and inventory levels to align with customer

demand; our ability to effectively motivate, retain and hire the

necessary workforce; availability and cost of raw materials,

including the impact of supply shortages and inflation; supply

chain disruptions, which may be exacerbated by the conflict between

Russia and Ukraine; our ability to successfully implement or

realize our business strategies, plans, goals and objectives of

management, including our sustainability goals and any

restructuring or alignment activities in which we may engage;

changes in sales mix; changes in current pricing and cost levels,

including cost inflation, as well as increasing energy prices

resulting from the conflict between Russia and Ukraine; changes in

aerospace delivery rates; changes in government defense procurement

budgets; changes in military aerospace program technology; timely

new product development or introduction; industry capacity;

increased competition; inability to install, staff and qualify

necessary capacity or complete capacity expansions to meet customer

demand; cybersecurity-related risks including the potential impact

of breaches or intrusions; currency exchange rate fluctuations;

changes in political, social and economic conditions, including,

but not limited to, the effect of change in global trade policies,

such as sanctions imposed as a result of the conflict between

Russia and Ukraine; work stoppages or other labor disruptions; our

ability to successfully complete any strategic acquisitions,

investments or dispositions; compliance with environmental, health,

safety and other related laws and regulations, including those

related to climate change; the effects of natural disasters or

other severe weather events, which may be worsened by the impact of

climate change, and other severe catastrophic events, including any

public health crisis; the potential impact of environmental, social

and governance matters; and the unexpected outcome of legal matters

or impact of changes in laws or regulations. Additional risk

factors are described in our filings with the Securities and

Exchange Commission. We do not undertake an obligation to update

our forward-looking statements to reflect future events.

Hexcel Corporation and

Subsidiaries

Condensed Consolidated Statements of

Operations

Unaudited

Quarters Ended

March 31,

(In millions, except per share data)

2023

2022

Net sales

$

457.7

$

390.6

Cost of sales

330.0

303.9

Gross margin

127.7

86.7

% Gross Margin

27.9

%

22.2

%

Selling, general and administrative

expenses

50.8

44.7

Research and technology expenses

13.9

10.9

Other operating expense

0.2

1.0

Operating income

62.8

30.1

Interest expense, net

9.4

9.1

Income before income taxes, and equity in

earnings of affiliated companies

53.4

21.0

Income tax expense

11.7

4.7

Income before equity in earnings of

affiliated companies

41.7

16.3

Equity in earnings from affiliated

companies

1.0

1.5

Net income

$

42.7

$

17.8

Basic net income per common share:

$

0.50

$

0.21

Diluted net income per common share:

$

0.50

$

0.21

Weighted-average common shares:

Basic

84.6

84.3

Diluted

85.5

84.9

Hexcel Corporation and

Subsidiaries

Condensed Consolidated Balance

Sheets

Unaudited

March 31,

December 31,

(In millions)

2023

2022

Assets

Cash and cash equivalents

$

105.7

$

112.0

Accounts receivable, net

265.3

222.7

Inventories, net

354.6

319.3

Contract assets

28.6

32.0

Prepaid expenses and other current

assets

44.2

38.9

Assets held for sale

9.5

9.5

Total current assets

807.9

734.4

Property, plant and equipment

3,116.1

3,087.9

Less accumulated depreciation

(1,465.4

)

(1,430.1

)

Net property, plant and equipment

1,650.7

1,657.8

Goodwill and other intangible assets,

net

255.2

256.0

Investments in affiliated companies

52.7

47.6

Other assets

140.8

141.5

Total assets

$

2,907.3

$

2,837.3

Liabilities and Stockholders'

Equity

Liabilities:

Short-term borrowings

$

0.2

$

0.2

Accounts payable

122.0

155.5

Accrued compensation and benefits

61.0

69.6

Accrued liabilities

106.9

104.5

Total current liabilities

290.1

329.8

Long-term debt

768.5

723.3

Retirement obligations

44.3

42.7

Other non-current liabilities

182.2

187.3

Total liabilities

$

1,285.1

$

1,283.1

Stockholders' equity:

Common stock, $0.01 par value, 200.0

shares authorized, 110.6 shares issued at March 31, 2023 and 110.4

shares issued at December 31, 2022

$

1.1

$

1.1

Additional paid-in capital

920.8

905.0

Retained earnings

2,137.2

2,104.9

Accumulated other comprehensive loss

(152.1

)

(174.4

)

2,907.0

2,836.6

Less – Treasury stock, at cost, 26.2

shares at March 31, 2023 and 26.2 shares at December 31, 2022

(1,284.8

)

(1,282.4

)

Total stockholders' equity

1,622.2

1,554.2

Total liabilities and stockholders'

equity

$

2,907.3

$

2,837.3

Hexcel Corporation and

Subsidiaries

Condensed Consolidated Statements of

Cash Flows

Unaudited

Quarters Ended

March 31,

(In millions)

2023

2022

Cash flows from operating

activities

Net income

$

42.7

$

17.8

Reconciliation to net cash used for

operating activities:

Depreciation and amortization

30.7

32.2

Amortization related to financing

0.1

0.3

Deferred income taxes

(2.1

)

(1.8

)

Equity in earnings from affiliated

companies

(1.0

)

(1.5

)

Stock-based compensation

12.9

10.4

Restructuring expenses, net of

payments

(2.1

)

(5.0

)

Impairment of assets

1.7

-

Changes in assets and liabilities:

Increase in accounts receivable

(40.5

)

(54.7

)

Increase in inventories

(32.6

)

(24.4

)

Decrease (increase) in prepaid expenses

and other current assets

0.1

(8.6

)

(Decrease) increase in accounts

payable/accrued liabilities

(31.0

)

13.4

Other - net

(2.3

)

2.9

Net cash used for operating activities

(a)

(23.4

)

(19.0

)

Cash flows from investing

activities

Capital expenditures (b)

(18.1

)

(20.9

)

Net cash used for investing activities

(18.1

)

(20.9

)

Cash flows from financing

activities

Borrowings from senior unsecured credit

facilities

65.0

35.0

Net repayments from senior unsecured

credit facilities

(20.0

)

-

Repayment of finance lease obligation and

other debt, net

(0.1

)

(0.3

)

Dividends paid

(10.5

)

(8.5

)

Activity under stock plans

0.4

(0.3

)

Net cash provided by financing

activities

34.8

25.9

Effect of exchange rate changes on cash

and cash equivalents

0.4

(0.9

)

Net decrease in cash and cash

equivalents

(6.3

)

(14.9

)

Cash and cash equivalents at beginning of

period

112.0

127.7

Cash and cash equivalents at end of

period

$

105.7

$

112.8

Supplemental data:

Free Cash Flow (a)+(b)

$

(41.5

)

$

(39.9

)

Accrual basis additions to property, plant

and equipment

$

16.8

$

11.1

Hexcel Corporation and

Subsidiaries

Net Sales to Third-Party Customers by

Market

Quarters Ended March 31, 2023 and

2022

Unaudited

Table A

(In millions)

As Reported

Constant Currency (a)

B/(W)

FX

B/(W)

Market

2023

2022

%

Effect (b)

2022

%

Commercial Aerospace

$

284.5

$

218.9

30.0

$

(0.1

)

$

218.8

30.0

Space & Defense

126.2

118.2

6.8

(0.9

)

117.3

7.6

Industrial

47.0

53.5

(12.1

)

(1.8

)

51.7

(9.1

)

Consolidated Total

$

457.7

$

390.6

17.2

$

(2.8

)

$

387.8

18.0

Consolidated % of Net Sales

%

%

%

Commercial Aerospace

62.2

56.0

56.4

Space & Defense

27.6

30.3

30.2

Industrial

10.2

13.7

13.4

Consolidated Total

100.0

100.0

100.0

(a)

To assist in the analysis of the Company’s

net sales trend, total net sales and sales by market for the

quarter ended March 31, 2022 have been estimated using the same

U.S. dollar, British pound and Euro exchange rates as applied for

the respective period in 2023 and are referred to as “constant

currency” sales.

(b)

FX effect is the estimated impact on “as

reported” net sales due to changes in foreign currency exchange

rates.

Hexcel Corporation and

Subsidiaries

Segment Information

Unaudited

Table B

(In millions)

Composite Materials

Engineered Products

Corporate & Other

(a)

Total

First Quarter 2023

Net sales to external customers

$

378.2

$

79.5

$

-

$

457.7

Intersegment sales

19.3

1.0

(20.3

)

-

Total sales

397.5

80.5

(20.3

)

457.7

Other operating expense

0.2

-

-

0.2

Operating income (loss)

73.2

12.0

(22.4

)

62.8

% Operating margin

18.4

%

14.9

%

13.7

%

Depreciation and amortization

27.2

3.5

-

30.7

Stock-based compensation expense

3.1

0.8

9.0

12.9

Accrual based additions to capital

expenditures

13.1

3.7

-

16.8

First Quarter 2022

Net sales to external customers

$

313.8

$

76.8

$

-

$

390.6

Intersegment sales

16.5

0.3

(16.8

)

-

Total sales

330.3

77.1

(16.8

)

390.6

Other operating expense

0.9

0.1

-

1.0

Operating income

42.6

10.6

(23.1

)

30.1

% Operating margin

12.9

%

13.7

%

7.7

%

Depreciation and amortization

28.6

3.6

-

32.2

Stock-based compensation expense

2.6

0.7

7.1

10.4

Accrual based additions to capital

expenditures

10.1

1.0

-

11.1

(a)

Hexcel does not allocate corporate

expenses to the operating segments.

Hexcel Corporation and

Subsidiaries

Reconciliation of GAAP to Non-GAAP

Operating Income Net Income, EPS and Operating Cash Flow to Free

Cash Flow

Table C

Unaudited

Quarters Ended

March 31,

(In millions)

2023

2022

GAAP operating income

$

62.8

$

30.1

Other operating expense (a)

0.2

1.0

Non-GAAP operating income

$

63.0

$

31.1

Unaudited

Quarters Ended March 31,

2023

2022

(In millions, except per diluted share

data)

Net Income

EPS

Net Income

EPS

GAAP

$

42.7

$

0.50

$

17.8

$

0.21

Other operating expense, net of tax

(a)

0.2

0.00

0.8

0.01

Non-GAAP

$

42.9

$

0.50

$

18.6

$

0.22

Unaudited

Quarters Ended March 31,

(In millions)

2023

2022

Net cash used for operating activities

$

(23.4

)

$

(19.0

)

Less: Capital expenditures

(18.1

)

(20.9

)

Free cash flow (non-GAAP)

$

(41.5

)

$

(39.9

)

(a)

The quarters ended March 31, 2023 and 2022

included restructuring costs.

NOTE: Management believes that

adjusted operating income, adjusted net income, adjusted diluted

net income per share and free cash flow, which are non-GAAP

measures, are meaningful to investors because they provide a view

of Hexcel with respect to the underlying operating results

excluding special items. Special items represent significant

charges or credits that are important to an understanding of

Hexcel’s overall operating results in the periods presented.

Non-GAAP measurements are not recognized in accordance with

generally accepted accounting principles and should not be viewed

as an alternative to GAAP measures of performance.

Hexcel Corporation and

Subsidiaries

Schedule of Total Debt, Net of

Cash

Table D

Unaudited

March 31,

December 31,

March 31,

(In millions)

2023

2022

2022

Current portion finance lease

$

0.2

$

0.2

$

0.7

Total current debt

0.2

0.2

0.7

Senior unsecured credit facility

70.0

25.0

160.0

4.7% senior notes due 2025

300.0

300.0

300.0

3.95% senior notes due 2027

400.0

400.0

400.0

Senior notes original issue discounts

(0.9

)

(0.9

)

(1.1

)

Senior notes deferred financing costs

(2.0

)

(2.2

)

(2.7

)

Other debt

1.4

1.4

1.3

Total long-term debt

768.5

723.3

857.5

Total Debt

768.7

723.5

858.2

Less: Cash and cash equivalents

(105.7

)

(112.0

)

(112.8

)

Total debt, net of cash

$

663.0

$

611.5

$

745.4

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230424005720/en/

Kurt Goddard | Vice President Investor Relations |

Kurt.Goddard@Hexcel.com | +1 (203)-352-6826

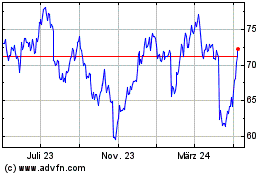

Hexcel (NYSE:HXL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

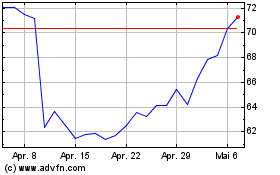

Hexcel (NYSE:HXL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024