UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 20, 2024 (February 19, 2024)

HEXCEL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-8472 | 94-1109521 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| Two Stamford Plaza 281 Tresser Boulevard Stamford, Connecticut 06901-3238 |

(Address of principal executive offices, including

zip code)

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

| Common Stock, par value $0.01 | HXL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure.

On February 20, 2024, following a previously announced

Investor Day conference in New York, New York, which was also webcast live (“Investor Day”), Hexcel Corporation (the “Company”)

announced its financial outlook for the three-year period 2024 to 2026 and the authorization of an additional share repurchase program.

A copy of the press release dated February 20, 2024

is being furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in its entirety. The Investor

Day supporting slide deck and a replay of the webcast is available on the investor relations webpage of the Company’s website at www.Hexcel.com.

The information contained in this Item 7.01 of this

Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) and shall not be incorporated by reference into any filing under the

Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set

forth by specific reference in such a filing.

Section 8 – Other Events

Item 8.01 Other Events.

On February 19, 2024, the Board of Directors of the

Company (the “Board”) approved an additional $300 million authorization to purchase shares of its common stock, $0.01 par

value per share (the “Common Stock”), under a new share repurchase program (the “Share Repurchase Program”). This

amount is in addition to the amount that currently remains available for repurchases under the prior share repurchase program approved

by the Board in May 2018. The purchases of such shares under the Share Repurchase Program are anticipated to be made in open market transactions,

block transactions, privately negotiated purchase transactions or other purchase techniques at the discretion of management based upon

consideration of market, business, legal, accounting, and other factors. In addition, the Company may establish one or more trading plans

pursuant to Rule 10b5-1 under the Exchange Act, or enter into arrangements with brokers or other third parties for accelerated purchases

of Common Stock. There is no guarantee as to the exact number of shares of Common Stock that the Company may repurchase under the Share

Purchase Program.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HEXCEL CORPORATION |

| |

|

|

| Date: February 20, 2024 |

By: |

/s/ Gail E. Lehman |

| |

|

Gail E. Lehman |

| |

|

Executive Vice President, General Counsel & Secretary |

false

0000717605

0000717605

2024-02-19

2024-02-19

Exhibit 99.1

Hexcel Corporation

Two Stamford Plaza | 281 Tresser Blvd., 16th Floor

Stamford, CT 06901 USA

www.hexcel.com

|

|

NEWS

RELEASE

Hexcel Provides Financial Outlook

STAMFORD,

Conn., February 20, 2024 – Hexcel Corporation (NYSE: HXL), a global leader in advanced

lightweight composites technology, announced today its longer-term financial outlook during the Company’s Investor Day held

in New York City.

Chairman, CEO and President Nick Stanage said: “Hexcel

is benefitting from both cyclical growth as aircraft production rates increase to support strong demand, and from secular growth

reflecting our advanced composite technology value proposition as lightweighting supports fuel efficiency and emissions reduction.

We are forecasting strong sales growth over the next three years, and we expect robust earnings expansion as we leverage our global

manufacturing footprint. We are entering a period of strong cash generation, which will support continued investment in operational

excellence and organic growth, the potential for strategic acquisitions, and returning cash to stockholders.”

Outlook

For the three-year period 2024 to 2026:

| · | Total Sales to grow at a compounded annual growth rate (CAGR) of 10%-12% |

| |

o | Commercial

Aerospace | 12%-16% CAGR |

|

| |

o | Space & Defense | 5%-10% CAGR |

|

| |

o | Industrial | 3%-6% CAGR |

|

| · | Adjusted Diluted Earnings Per Share* to grow at greater than a 25% CAGR |

| · | Capital Expenditures of less than $100 million per year during this three-year

period |

Cumulatively for the three-year period 2024

to 2026:

| · | Adjusted EBITDA* greater than $1.5 billion |

| · | Free Cash Flow* greater than $800 million |

Share repurchase update:

| · | Approximately $65 million in Hexcel stock purchased year to date through

Feb 16 |

| · | Board of Directors approved an additional $300 million share repurchase

program |

Mr. Stanage continued, “We have the right team in place,

our innovation is a powerful competitive advantage, our long-term customer relationships are broad and deep, and our markets are

growing - all of which support continued and compelling value creation for our stockholders.”

As previously disclosed, the management audio presentation was

webcast live and a supporting slide deck is available on the investor relations webpage of the Hexcel website at www.Hexcel.com.

A replay will be available on the investor relations webpage of the Hexcel website.

2 | HEXCEL

CORPORATION

*Non-GAAP Measures

Adjusted diluted earnings per share, adjusted earnings before

interest, taxes, depreciation and amortization, and free cash flow (defined as cash provided by operating activities less cash

payments for capital expenditures) are non-GAAP measures. Management believes that adjusted diluted earnings per share, EBITDA

and free cash flow are meaningful to investors because they provide a view of Hexcel with respect to ongoing operating results

excluding special items. Special items represent significant charges or credits that are important to an understanding of Hexcel’s

overall operating results in the periods presented. Non-GAAP measurements are not recognized in accordance with generally accepted

accounting principles and should not be viewed as an alternative to GAAP measures of performance. The

Company is not providing a quantitative reconciliation of our non-GAAP outlook or targets to the corresponding GAAP information

because the GAAP measures that we exclude from our non-GAAP outlook and targets are difficult to predict and are primarily dependent

on future uncertainties.

Disclaimer on Forward Looking Statements

This news release contains certain statements that constitute

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements

that are not of historical fact constitute “forward-looking statements” and accordingly, involve estimates, assumptions,

forecasts, judgments and uncertainties. There are a number of factors that could cause actual results or outcomes to differ materially

from those addressed in the forward-looking statements. Such factors are detailed in the Forward Looking Statements and Risk Factors

sections of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Securities

and Exchange Commission. We do not undertake an obligation to update our forward-looking statements to reflect future events.

*****

About

Hexcel

Hexcel

Corporation is a global leader in advanced lightweight composites technology. We propel the future of flight, energy

generation, transportation, and recreation through excellence in providing innovative high-performance material solutions that

are lighter, stronger and tougher, helping to create a better world for us all. Our broad and unrivaled product range includes

carbon fiber, specialty reinforcements, prepregs and other fiber-reinforced matrix materials, honeycomb, resins, engineered core

and composite structures for use in commercial aerospace, space and defense, and industrial applications.

Contact

Kurt

Goddard | Vice President Investor Relations | Kurt.Goddard@Hexcel.com | +1 (203) 352-6826

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

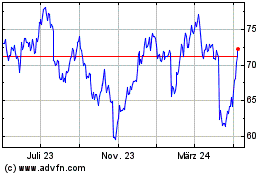

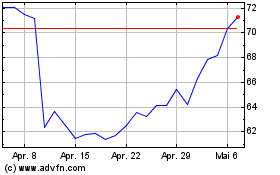

Hexcel (NYSE:HXL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Hexcel (NYSE:HXL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024