Current Report Filing (8-k)

09 September 2022 - 11:13PM

Edgar (US Regulatory)

00014825120001496264false 0001482512 2022-09-08 2022-09-08 0001482512 hpp:HudsonPacificPropertiesLpMember 2022-09-08 2022-09-08 0001482512 us-gaap:CommonStockMember 2022-09-08 2022-09-08 0001482512 us-gaap:CumulativePreferredStockMember 2022-09-08 2022-09-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2022 (September 8, 2022)

Hudson Pacific Properties, Inc.

Hudson Pacific Properties, L.P.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

|

Hudson Pacific Properties, Inc. |

|

|

|

|

|

|

Hudson Pacific Properties, L.P. |

|

Maryland |

|

|

|

|

| |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

11601 Wilshire Blvd., Ninth Floor Los Angeles, California |

|

90025 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (310)

445-5700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

|

|

Registrant |

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Hudson Pacific Properties, Inc. |

|

Common Stock, $0.01 par value |

|

HPP |

|

New York Stock Exchange |

Hudson Pacific Properties, Inc. |

|

4.750% Series C Cumulative Redeemable Preferred Stock |

|

HPP Pr C |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

| |

|

|

| Hudson Pacific Properties, Inc. |

|

☐ |

| |

|

| Hudson Pacific Properties, L.P. |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| |

|

|

| Hudson Pacific Properties, Inc. |

|

☐ |

| |

|

| Hudson Pacific Properties, L.P. |

|

☐ |

On September 8, 2022, Hudson Pacific Properties, L.P. and Hudson Pacific Properties, Inc. entered into an underwriting agreement with Wells Fargo Securities, LLC and BofA Securities, Inc., as representatives of the several underwriters named therein, with respect to an underwritten public offering of $350,000,000 aggregate principal amount of Hudson Pacific Properties, L.P.’s 5.950% Senior Notes due 2028 (the “Notes”), which are to be fully and unconditionally guaranteed by Hudson Pacific Properties, Inc.

The closing of the sale of the Notes is expected to occur on September 15, 2022, subject to the satisfaction of customary closing conditions. The Notes will be issued pursuant to a base indenture, dated as of October 2, 2017, by and among Hudson Pacific Properties, L.P., as issuer, Hudson Pacific Properties, Inc., as guarantor, and U.S. Bank Trust Company, National Association, as successor in interest to U.S. Bank National Association, as trustee, to be supplemented by a fourth supplemental indenture, to be dated as of the closing date, which will be filed with the Securities and Exchange Commission on a subsequent Current Report on Form

8-K.

The Notes are being offered pursuant to an effective shelf registration statement filed with the Securities and Exchange Commission on April 28, 2021 (Registration Nos.

333-255579

and

a base prospectus, dated April 28, 2021, included as part of the registration statement, and a prospectus supplement, dated September 8, 2022, filed with the Securities and Exchange Commission pursuant to Rule 424(b) under the Securities Act of 1933, as amended.

The foregoing description of the underwriting agreement is qualified in its entirety by the underwriting agreement attached as Exhibit 1.1 to this Current Report on Form

8-K

and incorporated herein by reference.

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused

this

report

to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 9, 2022

|

|

|

Hudson Pacific Properties, Inc. |

|

|

| By: |

|

/s/ Mark T. Lammas |

| |

|

Mark T. Lammas |

| |

|

President |

|

Hudson Pacific Properties, L.P. |

|

|

| By: |

|

Hudson Pacific Properties, Inc. |

| |

|

Its General Partner |

|

|

| By: |

|

/s/ Mark T. Lammas |

| |

|

Mark T. Lammas |

| |

|

President |

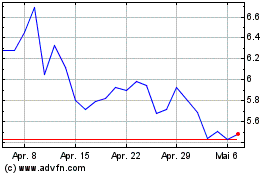

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

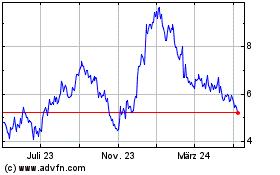

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024