Form 8-K - Current report

08 September 2023 - 11:17PM

Edgar (US Regulatory)

EAGLE MATERIALS INC false 0000918646 0000918646 2023-09-08 2023-09-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 8, 2023

Eagle Materials Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

1-12984 |

|

75-2520779 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 5960 Berkshire Ln., Suite 900 Dallas, Texas |

|

|

|

75225 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (214) 432-2000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

EXP |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

Eagle Materials Inc., a Delaware corporation (“Eagle”), has prepared presentation materials that will be used by management in investor presentations beginning in September 2023. The presentation materials are being furnished with this report as Exhibit 99.1 and are incorporated herein by reference. Pursuant to the rules of the Securities and Exchange Commission, the information contained in this report (including the exhibits) shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing by Eagle under such Act or the Securities Act of 1933, as amended.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Investor Presentation |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| EAGLE MATERIALS INC. |

|

|

| By: |

|

/s/ Matt Newby |

|

|

Matt Newby |

|

|

Executive Vice President, General Counsel and Secretary |

Date: September 8, 2023

Exhibit 99.1

Company Overview Evolution and Outlook Fiscal Year 2024 Investor Presentation

Forward Looking Statements This presentation contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context of the statement and

generally arise when the Company is discussing its beliefs, estimates or expectations as to future events. These statements are not historical facts or guarantees of future performance but instead represent only the Company’s belief at the time

the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside the Company’s control. Actual results and outcomes may differ materially from what is expressed or

forecast in such forward-looking statements. The principal risks and uncertainties that may affect the Company’s actual performance include the following: the cyclical and seasonal nature of the Company’s businesses; fluctuations in public

infrastructure expenditures; adverse weather conditions; the fact that our products are commodities and that prices for our products are subject to material fluctuation due to market conditions and other factors beyond our control; the availability

and fluctuations in the cost of raw materials; changes in the costs of energy, including, without limitation, natural gas, coal and oil, and the nature of our obligations to counterparties under energy supply contracts, such as those related to

market conditions (for example, spot market prices), governmental orders and other matters; changes in the cost and availability of transportation; unexpected operational difficulties, including unexpected maintenance costs, equipment downtime and

interruption of production; material nonpayment or non-performance by any of our key customers; inability to timely execute announced capacity expansions; difficulties and delays in the development of new

business lines; governmental regulation and changes in governmental and public policy (including, without limitation, climate change and other environmental regulation); possible outcomes of pending or future litigation or arbitration proceedings;

changes in economic conditions or the nature or level of activity in any one or more of the markets or industries in which the Company or its customers are engaged; severe weather conditions (such as winter storms, tornados and hurricanes) and their

effects on our facilities, operations and contractual arrangements with third parties; competition; cyber-attacks or data security breaches; increases in capacity in the gypsum wallboard and cement industries; changes in the demand for residential

housing construction or commercial construction or construction projects undertaken by state or local governments; the availability of acquisitions or other growth opportunities that meet our financial return standards and fit our strategic focus;

risks related to pursuit of acquisitions, joint ventures and other transactions or the execution or implementation of such transactions, including the integration of operations acquired by the Company; general economic conditions, including

inflation and recessionary conditions; and changes in interest rates and the resulting effects on the Company and demand for our products. For example, increases in interest rates, decreases in demand for construction materials or increases in the

cost of energy (including, without limitation, natural gas, coal and oil) or the cost of our raw materials could affect the revenue and operating earnings of our operations. In addition, changes in national or regional economic conditions and levels

of infrastructure and construction spending could also adversely affect the Company’s result of operations. Finally, any forward-looking statements made by the Company are subject to the risks and impacts associated with natural disasters,

pandemics or other unforeseen events, including, without limitation, the COVID-19 pandemic and responses thereto designed to contain its spread and mitigate its public health effects, as well as their impact

on economic conditions, capital and financial markets. These and other factors are described in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023 and subsequent

quarterly and annual reports upon filing. These reports are filed with the Securities and Exchange Commission. All forward-looking statements made herein are made as of the date hereof, and the risk that actual results will differ materially from

expectations expressed herein will increase with the passage of time. The Company undertakes no duty to update any forward-looking statement to reflect future events or changes in the Company’s expectations.

Eagle Materials Company Overview â–ª Founded in 1963 as a subsidiary of Centex Corp.

â–ª Completed the IPO in 1994 and stock began trading on the NYSE â–ª In 2004, Centex spun off Centex Construction Products which became Eagle Materials Inc. (NYSE: EXP) â–ª Two primary business lines:

Portland cement and gypsum wallboard â–ª Basic building products used in construction: primarily in infrastructure, residential, repair and remodel, and to a lesser degree non-residential

â–ª Well-recognized as a low-cost producer through cycles â–ª 100% of revenues are generated within the US â–ª Geographically diverse across the US heartland and

sunbelt with 70 production facilities â–ª No one customer accounts for more than 10% of revenue; top 10 customers represent approximately 30% Revenue (FYE March 31, $ in millions) $2,148 $1,862 $1,623 FY21 FY22 FY23 Adjusted

EBITDA1 & Margin (FYE March 31, $ in millions) $782 $657 $571 35% 35% 36% FY21 FY22 FY23 1 Adjusted EBITDA from Continuing Operations and Adjusted EBITDA from Continuing Operations Margin are non-GAAP

measures; Margin is calculated as Adjusted EBITDA from Continuing Operations divided by Revenue; see appendix for reconciliation

Who We Are We Manufacture Necessities Not Luxuries • Our two major product lines are Portland cement

(“Heavy” materials) and gypsum wallboard (“Light” materials), today proportionately 50/50 • Both building products have essential roles in the growth and renewal of America • We strategically operate with limited

vertical integration, e.g., meaning distribution and ready-mix concrete • We own virtually all our raw material and enjoy relative self-sufficiency with many decades of supply that is highly proximate to

our production facilities Operating Earnings + DD&A by Segment for FYE Mar-23 ($ in millions) Gypsum Wallboard $374 46% Recycled Paperboard 5% $40 4% Concrete and Aggregates 45% $36 Cement $360

Eagle Materials: Financial Evolution In Millions, Annual at March

Year-End Revenue $2,387 Heavy $579 Light 2011 2023 (Trough) Through investments and acquisitions, we’ve grown from a balanced sales contribution between our businesses a decade ago

to a greater Heavy materials contribution today Operating Earnings + DD&A $810 $109 2011 2023 (Trough) Our operating earnings + DD&A have continued to show a balanced earnings contribution across our Heavy and Light materials businesses

“Heavy” materials includes cement, concrete and aggregates, cement intersegment revenue as well as our proportionate share of JV “Light” materials includes wallboard and paperboard and paperboard intersegment revenue

Comparative on Peer Profit Margins Pre-Tax Margin % (Latest Fiscal

Year) 30.0 27.4 20.0 17.7 17.8 14.1 15.0 10.8 10.0 – Eagle Heavy Peers Light Peers

Pre-Tax Margin % (10-Year Average)1 30.0 21.0 20.0 14.1 11.5 8.9 9.6 10.0

1.7 – Eagle Heavy Peers Light Peers EBITDA Margin % (Latest Fiscal Year) 40.0 33.7 30.0 28.0 23.1

23.7 19.0 20.0 14.0 10.0 – Eagle Heavy Peers Light Peers EBITDA Margin % (10-Year Average)1 40.0

29.5 30.0 24.3 24.7 20.0 17.8 18.2 11.4 10.0 – Eagle Heavy Peers Light Peers Source: Factset; EBITDA Margin % is a non-GAAP measure. Note: Heavy Peers include VMC, MLM, SUM, and ACA. “Light Peers” represents median of Light materials peers. Light Peers include SSD, DOOR, PGTI, JHX, OC, JELD, AWI, and LPX. 1 Represents

average of available data when 10 years of data is unavailable.

Comparative on Peer Return on Capital Return on Equity % (Latest Fiscal Year) 40.0

39.8 30.2 30.0 20.0 14.3 11.8 12.5 8.8 10.0 – Eagle Heavy Peers Light Peers Return on Equity % (10-Year Average)1 40.0 30.0 21.4 20.0 16.0 10.5 8.4 10.0

6.5 2.7 – Eagle Heavy Peers Light Peers Return on Invested Capital % (Latest Fiscal Year) 30.0 21.0 20.0

16.6 9.1 10.0 7.1 7.8 5.3 – Eagle Heavy Peers Light Peers Return on Invested Capital %

(10-Year Average)1 30.0 20.0 12.5 9.6 10.0 6.8 5.5 5.7 1.5 – Eagle

Heavy Peers Light Peers Source: Factset. Note: Heavy Peers include VMC, MLM, SUM, and ACA. “Light Peers” represents median of Light materials peers. Light Peers include SSD, DOOR, PGTI, JHX, OC, JELD, AWI, and LPX. 1 Represents average of

available data when 10 years of data is unavailable.

Comparative on Peer Cash Flow Metrics Free Cash Flow Yield % (Latest Fiscal Year) 10.0

8.0 7.9 6.5 6.0 4.0 2.4 2.3 2.0 1.4 0.5 – Eagle Heavy Peers

Light Peers Free Cash Flow Yield % (10-Year Average)1 10.0 8.0 6.3 5.9 6.0 4.4 4.0 3.5

2.8 2.0 2.0 – Eagle Heavy Peers Light Peers Free Cash Flow Conversion % (Latest Fiscal Year) 70.0 60.0 59.6 50.0

44.9 40.0 31.7 30.0 29.6 20.0 11.6 10.0 3.8 – Eagle Heavy Peers Light Peers Free Cash Flow Conversion % (10-Year Average)1 70.0 63.7 60.0 51.4 50.0 40.0 35.6 35.8 30.0

29.9 18.1 20.0 10.0 – Eagle Heavy Peers Light Peers Source: Factset. Note: Heavy Peers include VMC, MLM, SUM, and ACA. “Light Peers”

represents median of Light materials peers. Light Peers include SSD, DOOR, PGTI, JHX, OC, JELD, AWI, and LPX. 1 Represents average of available data when 10 years of data is unavailable.

End-Use Applications US Building Code and Specification Driven Cement

is the essential binding material in concrete which has • Unrivaled strength, durability, longevity and resilience • Energy efficiency • Doesn’t burn, rust or rot • Malleable at the jobsite • Few practical cement

substitutes, and some substitutes have diminishing availability, e.g., fly ash • Provides comparable if not superior performance in terms of embodied carbon, resilience, safety, and climate adaptability when compared with other building

materials Concrete is the most used building material in the world, and one that is critical for sustainable development US End-Use Cement Segments Wallboard Applications Applications Residential Construction

~30% ~80% and Repair and Remodeling Infrastructure, ~50% Roads and ~0% Bridges Non- ~20% Residential ~20% Construction The water molecule imbedded in gypsum wallboard chemistry provides an inherent fire

resistance benefit that is essential in meeting US construction specifications There are few practical substitutes, and wallboard is not generally imported to the US from offshore

Cement US Heartland System Strategic Geographic Focus, Manufacturing Away from US Coastlines (Imports) Plants

and Capacities1 (ST2 thousands) Texas Lehigh (50%) 720 Illinois Cement 1,100 Mountain Cement 800 Nevada Cement 550 Central Plains Kansas City 1,300 Central Plains Tulsa 900 Fairborn Cement 980 Kosmos Cement 1,800 8,150 1 Represents cement grinding

production capacity; generally, a plant’s cement grinding production capacity is greater than its clinker production capacity 2 One short ton equals 2,000 pounds Eagle Cement Plants Eagle Cement Terminals

US Cement Consumption and Clinker Capacity Million Metric Tons 120,000 US Clinker Capacity 100,000 80,000

60,000 40,000 20,000 0 2017 2018 2019 2020 2021 2022 Public Residential Nonresidential Other New capacity — and capacity expansion — is constrained due to regulation (NESHAP) Imports will be required again to meet demand Source: Portland

Cement Association

Gypsum Wallboard and Paperboard System US Sunbelt Strategic Geographic Focus West of Mississippi River Natural

Gypsum Gypsum, CO East of Mississippi River 700 MMSF Synthetic Gypsum Duke, OK 1,300 MMSF Albuquerque, NM Georgetown, SC 425 MMSF 900 MMSF Bernalillo, NM Lawton, OK 550 MMSF 390,000 tons paperboard Total Wallboard Design

Capacity ~ 4 Billion SF

Gypsum Wallboard US Demand is Closely Linked with Housing 1400 48 New Home Sales (000) 1200 42 Wallboard

Shipments (BSF) 36 1000 30 800 24 600 18 400 12 200 6 0 0 1980 1985 1990 1995 2000 2005 2010 2015 2020 Source: Census Bureau, Gypsum Association

Eagle Materials Strategy Since 2010 Strategy and Investment Directions Heavy Side Cement and Con/Agg Light Side

Wallboard and Paperboard Growth • Cement • Aggregates Improvement • Brownfield paper expansion Results ✓ Tripled Cement capacity through acquisitions ✓ Achieved scale materiality ✓ Largest US-only player ✓ Bolt-on aggregates acquisitions ✓ Remained profitable each year throughout the deepest and longest construction recession in US history ✓

Benchmark margin performance ✓ Benchmark customer satisfaction ✓ Benchmark safety performance ✓ Secure raw materials for 40 years+ ✓ Improved paper capabilities, increasing capacity from 270,000 tons to 390,000+

Macroeconomic Fundamentals Future Determinants of Profitability Favorable for Eagle Businesses Heavy

Side Winning US Heartland Strategy, Different Than International + Supply + Demand + Substitutes + Structure + Sustainability + Imports + Logistics Light

Side Reasons Why Future Cycles May Be More Favorable Than Past

Eagle Materials Capital Allocation $3.0 Billion Over the Last Five Years â–ª Capital Allocation

Priorities Remain Unchanged — Investments in Profitable Strategic Growth Opportunities — Investments to Maintain and Improve Existing Assets — Return of Cash to Shareholders through Share Repurchases and Dividends Light-Side

Improvement Heavy-Side Growth and Improvement Share Repurchases and Dividends â–ª 38% Heavy-Side Growth and Improvement (e.g., Acquisitions) â–ª 55% Return of Cash to

Shareholders â–ª 7% Light-Side Improvement (e.g., Paperboard Expansion) Note: Includes Fiscal year 2019, 2020, 2021, 2022 and 2023; excludes divested business units

Well-Managed Capital Structure Net Debt/Adj. EBITDA Below 2x (with Exception of Temporary Increase For the

Kosmos Acquisition) Kosmos Acquisition 3.1x Plan was implemented to quickly reduce leverage post-acquisition 1.5x 1.5x 1.5x 1.4x 1.4x 1.3x 1.3x 1.3x FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 Net Debt and Adjusted EBITDA are non-GAAP measures; see appendix for reconciliation

Environmental CO2 Measurement and Disclosure Notwithstanding our growth in cement (we grew our asset base 3x

over recent years) … … we have continued to make significant progress in reducing our per unit CO2 emissions – on our journey to value chain carbon neutrality Note:

Year-to-year variations are heavily influenced by acquisitions, integration activities, divestitures and interval operating postures – e.g., the largest acquisition

in company history, Kosmos Cement, occurred in 2020 CO2e/ton cementitious product CO2e as reported 0.86 0.84 0.82 0.80 0.78 0.76 0.74 0.72 2011 2022 Note: Eagle Materials CO2 intensity history and methodology has been independently reviewed and

verified by a third-party environmental consultancy (SLR Consulting, headquartered in the UK). Data includes our Texas Lehigh plant that is a JV.

CO2e/ton Cementitious Product, CO2e as reported Progress, 2030 Goals and Longer-Term Aspirations Phase 1 Phase

2 Phase 3 0.9 0.8 0.7 0.6 Product Mix Shift to 100% Limestone 0.5 Cement for all 0.4 construction grades, and Process in conjunction with 0.3 Optimization related actions implies a 0.2 20% Reduction in CO2 0.1 per ton from the 2011 Baseline 0 2010

2020 2030 Net Zero Aspiration: With the development and commercialization of key technologies, e.g., • Carbon capture, transport, use, and storage • Clean hydrogen production and delivery 2040 2050

Appendix

Adjusted EBITDA Reconciliation $ in millions, Fiscal Year Ending March 31 FY 21 FY 22 FY 23 Net Earnings,

as reported $ 339 $ 374 $ 462 (Earnings) from Discontinued Operations (5) – –Income Tax Expense 90 101 127 Interest Expense 44 31 35 Depreciation, Depletion and Amortization 129 129 139 EBITDA from Continuing Operations $ 597 $ 635 $ 762

Gain on Sale of Businesses (52) – –Business Development Costs1 7 – –Purchase Accounting2 4 – 2 Loss on Early Retirement of Senior Notes – 8 –Stock-based Compensation3 15 14 17 Adjusted EBITDA from Continuing

Operations $ 571 $ 657 $ 782 We present Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) from Continuing Operations and Adjusted EBITDA from Continuing Operations to provide more consistent comparison of operating performance

from period to period. EBITDA from Continuing Operations is a non-GAAP financial measure that provides supplemental information regarding the operating performance of our business without regard to financing

methods, capital structures or historical cost basis. Adjusted EBITDA from Continuing Operations is also a non-GAAP financial measure that excludes the impact from

non-routine items, such as purchase accounting (Non-routine Items) and stock-based compensation. Management uses EBITDA from Continuing Operations and Adjusted EBITDA

from Continuing Operations as alternative bases for comparing the operating performance of Eagle from period to period and for purposes of its budgeting and planning processes. Adjusted EBITDA from Continuing Operations may not be comparable to

similarly titled measures of other companies because other companies may not calculate Adjusted EBITDA from Continuing Operations in the same manner. Neither EBITDA from Continuing Operations nor Adjusted EBITDA from Continuing Operations should be

considered in isolation or as an alternative to net income, cash flow from operations or any other measure of financial performance in accordance with GAAP. The table beside shows the calculation of EBITDA from Continuing Operations and Adjusted

EBITDA from Continuing Operations and reconciles them to net earnings in accordance with GAAP for the fiscal years ended March 31, 2023, 2022 and 2021. 1 Represents non-routine

expenses associated with acquisitions and other strategic transactions. 2 Represents the cost impact of the fair value markup of acquired inventory. 3 The increase in stock-based compensation is due to the retirement of two senior executives during

the first quarter of fiscal 2023.

Net Debt to Adjusted EBITDA Reconciliation $ in millions, Fiscal Year Ending March 31 FY 21 FY 22 FY 23

Total debt, excluding debt issuance costs $ 1,015 $ 950 $ 1,100 Cash and cash equivalents 264 19 15 Net Debt $ 751 $ 931 $ 1,084 Adjusted EBITDA from Continuing Operations $ 571 $ 657 $ 782 Net Debt to Adjusted EBITDA from Continuing Operations 1.3x

1.4x 1.4x GAAP does not define “Net Debt” and it should not be considered as an alternative to cash flow or liquidity measures defined by GAAP. We define Net Debt as total debt minus cash and cash equivalents to indicate the amount of

total debt that would remain if the Company applied the cash and cash equivalents held by it to the payment of outstanding debt. The Company also uses “Net Debt to Adjusted EBITDA from Continuing Operations,” which it defines as Net Debt

divided by Adjusted EBITDA from Continuing Operations, as a metric of its current leverage position. We present this metric for the convenience of the investment community and rating agencies who use such metrics in their analysis, and for investors

who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

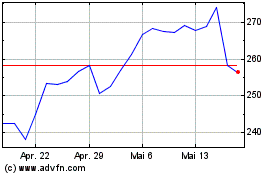

Eagle Materials (NYSE:EXP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

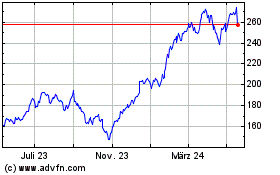

Eagle Materials (NYSE:EXP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024