Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 November 2024 - 9:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-33153

Endeavour

Silver Corp.

(Translation of registrant's name into English)

#1130-609

Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

¨ Form 40-F x

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Endeavour Silver Corp. |

| |

|

(Registrant) |

| |

|

|

| |

|

|

| Date: November 20, 2024 |

|

/s/ Dan Dickson |

| |

|

Dan Dickson |

| |

|

CEO |

| |

|

|

EXHIBIT INDEX

Incorporated by Reference

Exhibit 99.1 to

this Form 6-K of Endeavour Silver Corp. (the “Company”) is hereby incorporated by reference as an exhibit to the Registration

Statement on Form F-10 (File No. 333-272755) of the Company, as amended or supplemented.

Exhibit 99.1

Endeavour Silver Corp.

Treasury Offering of

Common Shares

November 20,

2024

The Common Shares will be offered by way of

a prospectus supplement in each of the provinces of Canada, except Quebec, and in the United States. A final base shelf prospectus containing

important information relating to the securities described in this document has been filed with the securities regulatory authorities

in each of the provinces of Canada, except Quebec, and a corresponding registration statement on Form F-10 has been filed with the

U.S. Securities and Exchange Commission (the “SEC”). A copy of the final base shelf prospectus, any amendment to the final

base shelf prospectus and any applicable shelf prospectus supplement that has been filed is required to be delivered with this document.

Copies of the final base shelf prospectus, any applicable shelf prospectus supplement, and the registration statement may be obtained

from BMO Nesbitt Burns Inc. for which contact details are provided below. You may also get these documents for free by visiting SEDAR+

at www.sedarplus.ca or EDGAR on the SEC website at www.sec.gov.

This document does not provide full disclosure

of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any

applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before

making an investment decision.

Terms and Conditions

| Issuer: |

Endeavour Silver Corp. (“Endeavour Silver” or the “Company”). |

| |

|

| Offering: |

Treasury offering of 15,825,000 common shares (“Common Shares”) |

| |

|

| Offering Price: |

US$4.60 per Common Share |

| |

|

| Issue Amount: |

US$72,795,000 |

| |

|

| Over-Allotment Option: |

The Company has granted the Underwriters an option, exercisable, in whole or in part, at any time

until and including 30 days following the closing of the Offering, to

purchase up to an additional 10% of the Offering at the Offering Price to cover over-allotments, if any. |

| |

|

| Use of Proceeds: |

The net proceeds of the offering will be used for general working capital and the advancement of

the Pitarrilla Project. |

| |

|

| Form of Offering: |

Bought deal by way of a prospectus supplement in each of the provinces of Canada,

except Quebec. Registered public offering pursuant to the multijurisdictional disclosure system in the United States. |

|

|

| |

|

| Listing: |

An application will be made to list the Common Shares on the Toronto Stock Exchange (the “TSX”)

and on the New York Stock Exchange (the “NYSE”). The existing common shares are listed on the TSX under the symbol “EDR”

and on the NYSE under the symbol “EXK”. |

| |

|

| Eligibility: |

Eligible for RRSPs, RRIFs, RESPs, TFSAs, RDSPs, FHSAs, and DPSPs. |

| |

|

| Sole Bookrunner: |

BMO Capital Markets |

| |

|

| Commission: |

5.0% |

| |

|

| Closing: |

November 27, 2024 |

The issuer, any underwriter or any dealer

participating in the offering will arrange to send you the base shelf prospectus, any applicable shelf prospectus supplement or the registration

statement or you may request the copies in Canada from BMO Nesbitt Burns Inc. by mail at Brampton Distribution Centre c/o The Data Group

of Companies, 9195 Torbram Road, Brampton, ON, L6S 6H2, by telephone at 905-791-3151 Ext 4312, or by email at torbramwarehouse@datagroup.ca

and in the United States from BMO Capital Markets Corp., Attn: Equity Syndicate Department, 151 W 42nd Street, 32nd Floor, New York,

NY 10036, or by email at bmoprospectus@bmo.com.

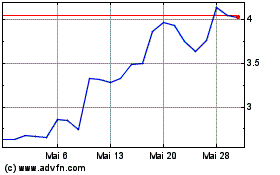

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

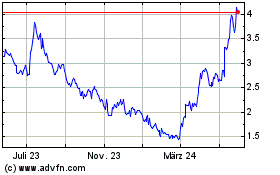

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024