– Net Income Per Fully Diluted Share of

$0.08 –

– Core FFO Per Fully Diluted Share of $0.26

–

– Signed 304,000 Rentable Square Feet of

Leases –

– Closed on $143 Million of Previously

Announced $195 Million Retail Acquisition in Williamsburg, Brooklyn

–

– Announces Agreement to Acquire Additional

Retail Asset on North 6th Street Williamsburg, Brooklyn–

– Over $0.9 Billion of Liquidity, No

Floating Rate Debt Exposure –

– 2024 FFO Guidance Raised –

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of modernized, amenitized,

and well-located office, retail, and multifamily assets. ESRT’s

flagship Empire State Building, the “World's Most Famous Building,”

features its iconic Observatory that was declared the #1 Attraction

in the World – and the #1 Attraction in the U.S. for the third

consecutive year– in Tripadvisor’s 2024 Travelers’ Choice Awards:

Best of the Best Things to Do. The Company is the recognized leader

in energy efficiency and indoor environmental quality. Today the

Company reported its operational and financial results for the

third quarter 2024. All per share amounts are on a fully diluted

basis, where applicable.

Third Quarter and Recent Highlights

- Net Income of $0.08 per share.

- Core Funds From Operations (“Core FFO”) of $0.26 per share,

compared to $0.25 per share in the third quarter 2023. Third

quarter 2024 Core FFO included $0.02 per share of lease termination

fee income.

- Same-Store Property Cash Net Operating Income (“NOI”) increased

5.2% year-over-year, excluding the $0.02 per share of lease

termination fees, primarily driven by higher revenues from cash

rent commencement inclusive of a net increase of approximately $1.7

million from non-recurring revenue items in the comparable periods,

which was partially offset by increases in operating expenses. When

adjusted for the non-recurring items, SS Cash NOI increased by

approximately 2.6%.

- Manhattan office portfolio leased rate increased by 30bps

sequentially and 170bps year-over-year to 93.6%. The total

commercial portfolio is 93.0% leased as of September 30, 2024.

Manhattan office occupancy increased by 40bps sequentially and

140bps year-over-year to 89.2%. The total commercial portfolio is

88.8% occupied as of September 30, 2024.

- Signed approximately 304,000 rentable square feet of new,

renewal and expansion leases. In our Manhattan office portfolio,

blended leasing spreads were +2.6%. This is the 13th consecutive

quarter of positive leasing spreads.

- Empire State Building Observatory generated $29.7 million of

NOI, a 5.6% increase year-over-year.

- Closed on $143 million of the previously announced $195 million

acquisition of prime retail assets on North 6th Street in

Williamsburg, Brooklyn. The balance is expected to close in the 4th

quarter of 2024.

- Entered into an agreement to acquire an additional retail asset

located on North 6th Street in Williamsburg, Brooklyn, for

approximately $30 million.

- Achieved the highest possible GRESB 5 Star Rating for the fifth

consecutive year with a score of 93. ESRT’s overall score ranked

first among all listed companies in the Americas for the second

year in a row and first in the most competitive peer group within

the U.S.

Property Operations

As of September 30, 2024, the Company’s property portfolio

contained 7.8 million rentable square feet of office space, 0.7

million rentable square feet of retail space and 732 residential

units, which were occupied and leased as shown below.

September 30, 20241

June 30,

20241

September 30, 2023

Percent occupied:

Total commercial portfolio

88.8%

88.5%

87.0%

Total office

88.6%

88.2%

86.7%

Manhattan office

89.2%

88.8%

87.8%

Total retail

91.1%

92.3%

90.4%

Percent leased (includes signed leases

not commenced):

Total commercial portfolio

93.0%

92.6%

90.5%

Total office

92.9%

92.5%

90.5%

Manhattan office

93.6%

93.3%

91.9%

Total retail

94.0%

93.5%

91.5%

Total multifamily portfolio

96.8%

97.9%

97.1%

1 Occupancy and leased percentages for

June 30 and September 30, 2024 exclude First Stamford Place.

Leasing

The tables that follow summarize leasing activity for the three

months ended September 30, 2024. During this period, the Company

signed 31 leases that totaled 304,210 square feet. Within the

Manhattan office portfolio, the Company signed 25 office leases

that totaled 289,329 square feet.

Total Portfolio

Total Portfolio

Total Leases

Executed

Total square

footage executed

Average cash rent psf

– leases executed

Previously escalated

cash rents psf

% of new cash rent

over/ under previously escalated rents

Office

26

291,418

70.11

68.34

2.6 %

Retail

5

12,792

203.88

332.35

(38.7) %

Total Overall

31

304,210

75.74

79.44

(4.7) %

Manhattan Office Portfolio

Manhattan Office

Portfolio

Total Leases

Executed

Total square

footage executed

Average cash rent psf

– leases executed

Previously escalated

cash rents psf

% of new cash rent over

/ under previously escalated rents

New Office

12

130,688

66.07

63.21

4.5 %

Renewal Office

13

158,641

73.11

72.24

1.2 %

Total Office

25

289,329

69.93

68.16

2.6 %

Leasing Activity Highlights

- An 11-year 26,782 square foot expansion lease with Hecker Fink

LLP at the Empire State Building.

- An 11-year 24,503 square foot new lease with Dynadmic

Corporation at 1350 Broadway.

- An 11-year 24,209 square foot new lease with Bloomsbury

Publishing at 1359 Broadway.

Observatory Results

In the third quarter, Observatory revenue was $39.4 million, and

expenses were $9.7 million. Observatory NOI was $29.7 million, a

5.6% increase year-over-year. Year-to-date, Observatory NOI was

$71.0 million, a 5.7% increase year-over-year.

Balance Sheet

The Company had $0.9 billion of total liquidity as of September

30, 2024, which was comprised of $422 million of cash, plus $500

million available under its revolving credit facility. At September

30, 2024, the Company had total debt outstanding of approximately

$2.3 billion, no floating rate debt exposure, and a weighted

average interest rate of 4.27%. At September 30, 2024, the

Company’s ratio of net debt to adjusted EBITDA was 5.2x.

Portfolio Transaction Activity

In the third quarter, the Company closed on $143 million of the

previously announced $195 million all-cash acquisition of prime

retail assets on North 6th Street in Williamsburg Brooklyn, with

the balance expected to close in the fourth quarter of 2024. In

aggregate, the assets comprise approximately 81,000 square feet of

retail space that is 90% leased with a weighted average lease term

of 7.4 years. Current tenants include Hermes, Nike, Santander Work

Café, The North Face, Everlane, Warby Parker, DS Durga, Buck Mason,

Chanel, Byredo, and Google. As previously noted, this transaction

is consistent with the Company’s strategy to recycle capital and

balance sheet capacity from non-core suburban assets into strong

NYC assets.

In the third quarter, the Company entered into an agreement to

acquire an additional retail asset on North 6th Street in

Williamsburg, Brooklyn for approximately $30 million. Due to

confidentiality requirements, more details on this transaction will

be disclosed upon closing expected to occur in mid-2025.

Share Repurchase

The stock repurchase program began in March 2020, and through

October 18, 2024 approximately $293.7 million has been repurchased

at a weighted average price of $8.18 per share. There were no share

repurchases during the third quarter.

Dividend

On September 30, 2024, the Company paid a quarterly dividend of

$0.035 per share or unit, as applicable, for the third quarter of

2024 to holders of the Company’s Class A common stock (NYSE: ESRT)

and Class B common stock and to holders of the Series ES, Series

250 and Series 60 partnership units (NYSE Arca: ESBA, FISK and

OGCP, respectively) and Series PR partnership units of Empire State

Realty OP, L.P., the Company’s operating partnership (the

“Operating Partnership”).

On September 30, 2024, the Company paid a quarterly preferred

dividend of $0.15 per unit for the third quarter of 2024 to holders

of the Operating Partnership’s Series 2014 private perpetual

preferred units and a preferred dividend of $0.175 per unit for the

third quarter of 2024 to holders of the Operating Partnership’s

Series 2019 private perpetual preferred units.

2024 Earnings Outlook

The Company provides 2024 guidance and key assumptions, as

summarized in the table below. The Company’s guidance does not

include the impact of any significant future lease termination fee

income or any unannounced acquisition, disposition or other capital

markets activity.

Key Assumptions

2024 Updated Guidance

(Oct 2024)

2024 Prior

Guidance

(July 2024)

Comments Earnings

Core FFO Per Fully Diluted Share

$0.92 to $0.94

$0.90 to $0.94

• 2024 includes $0.04 from multifamily assets

Commercial

Property Drivers

Commercial Occupancy at year-end

88% to 89%

87% to 89%

SS Property Cash NOI (excluding lease termination fees)

3% to 4%

0% to 3%

• Assumes positive revenue growth • Assumes ~8% y/y increase in

operating expenses and real estate taxes inclusive of planned

additional R&M work, partially offset by higher tenant expense

reimbursements

Observatory Drivers

Observatory NOI

$96M to $100M

$94M to $102M

• Reflects average quarterly expenses of ~$9M

Low High

Net Income (Loss) Attributable to Common Stockholders and the

Operating Partnership

$0.27

$0.29

Add: Impairment Charge

0.00

0.00

Real Estate Depreciation & Amortization

0.67

0.67

Less: Preferred Unit Distributions

0.02

0.02

Gain on Disposal of Real Estate, net

0.04

0.04

FFO Attributable to Common Stockholders and the Operating

Partnership

$0.88

$0.90

Add: Amortization of Below Market Ground Lease

0.03

0.03

Interest Expense Associated with Property in Receivership

0.01

0.01

Loss on Early Extinguishment of Debt

0.00

0.00

Core FFO Attributable to Common Stockholders and the Operating

Partnership

$0.92

$0.94

The estimates set forth above may be subject to fluctuations as

a result of several factors, including continued impacts of changes

in the use of office space and remote work on our business and our

market, our ability to complete planned capital improvements in

line with budget, costs of integration of completed acquisitions,

costs associated with future acquisitions or other transactions,

straight-line rent adjustments and the amortization of above and

below-market leases. There can be no assurance that the Company’s

actual results will not differ materially from the estimates set

forth above.

Investor Presentation Update

The Company has posted on the “Investors” section of ESRT’s

website the latest investor presentation, which contains additional

information on its businesses, financial condition and results of

operations.

Webcast and Conference Call Details

Empire State Realty Trust, Inc. will host a webcast and

conference call, open to the general public, on Tuesday, October

22, 2024 at 12:00 pm Eastern time.

The webcast will be accessible on the “Investors” section of

ESRT’s website. To listen to the live webcast, go to the site at

least five minutes prior to the scheduled start time in order to

register and download and install any necessary audio software. The

conference call can also be accessed by dialing 1-877-407-3982 for

domestic callers or 1-201-493-6780 for international callers.

Starting shortly after the call until October 29, 2024, a replay

of the webcast will be available on the Company’s website, and a

dial-in replay will be available by dialing 1-844-512-2921 for

domestic callers or 1-412-317-6671 for international callers. The

passcode for this dial-in replay is 13741463.

The Supplemental Report and Investor Presentation are additional

components of the quarterly earnings announcement and are now

available on the “Investors” section of ESRT’s website.

The Company uses, and intends to continue to use, the

“Investors” page of its website, which can be found at

www.esrtreit.com, as a means to disclose material nonpublic

information and to comply with its disclosure obligations under

Regulation FD, including, without limitation, through the posting

of investor presentations that may include material nonpublic

information. Accordingly, investors should monitor the “Investors”

page, in addition to following our press releases, SEC filings,

public conference calls, presentations and webcasts. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of modernized, amenitized,

and well-located office, retail, and multifamily assets. ESRT’s

flagship Empire State Building, the “World's Most Famous Building,”

features its iconic Observatory that was declared the #1 Attraction

in the World – and the #1 Attraction in the U.S. for the third

consecutive year – in Tripadvisor’s 2024 Travelers’ Choice Awards:

Best of the Best Things to Do. The Company is the recognized leader

in energy efficiency and indoor environmental quality. As of

September 30, 2024, ESRT’s portfolio is comprised of approximately

7.8 million rentable square feet of office space, 0.7 million

rentable square feet of retail space and 732 residential units.

More information about Empire State Realty Trust can be found at

esrtreit.com and by following ESRT on Facebook, Instagram, TikTok,

X, and LinkedIn.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We intend

these forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and are including this

statement for purposes of complying with those safe harbor

provisions. You can identify forward-looking statements by the use

of forward-looking terminology such as “aims," "anticipates,"

"approximately," "believes," "contemplates," "continues,"

"estimates," "expects," "forecasts," "hope," "intends," "may,"

"plans," "seeks," "should," "thinks," "will," "would" or the

negative of these words and phrases or similar words or phrases.

For the avoidance of doubt, any projection, guidance, or similar

estimation about the future or future results, performance or

achievements is a forward-looking statement.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond our control, and you should not rely on them as

predictions of future events. Forward-looking statements depend on

assumptions, data or methods which may be incorrect or imprecise,

and we may not be able to realize them. We do not guarantee that

the transactions and events described will happen as described (or

that they will happen at all).

Many important factors could cause our actual results,

performance, achievements, and future events to differ materially

from those set forth, implied, anticipated, expected, projected,

assumed or contemplated in our forward-looking statements,

including, among other things: (i) economic, market, political and

social impact of, and uncertainty relating to, any catastrophic

events, including pandemics, epidemics or other outbreaks of

disease, climate-related risks such as natural disasters and

extreme weather events, terrorism and other armed hostilities, as

well as cybersecurity threats and technology disruptions; (ii) a

failure of conditions or performance regarding any event or

transaction described herein; (iii) resolution of legal proceedings

involving the Company; (iv) reduced demand for office, multifamily

or retail space, including as a result of the changes in the use of

office space and remote work; (v) changes in our business strategy;

(vi) a decline in Observatory visitors due to changes in domestic

or international tourism, including due to health crises,

geopolitical events, currency exchange rates, and/or competition

from other observatories; (vii) defaults on, early terminations of,

or non-renewal of, leases by tenants; (viii) increases in the

Company’s borrowing costs as a result of changes in interest rates

and other factors; (ix) declining real estate valuations and

impairment charges; (x) termination of our ground leases; (xi)

limitations on our ability to pay down, refinance, restructure or

extend our indebtedness or borrow additional funds; (xii) decreased

rental rates or increased vacancy rates; (xiii) difficulties in

executing capital projects or development projects successfully or

on the anticipated timeline or budget; (xiv) difficulties in

identifying and completing acquisitions; (xv) impact of changes in

governmental regulations, tax laws and rates and similar matters;

(xvi) our failure to qualify as a REIT; (xvii) incurrence of

taxable capital gain on disposition of an asset due to failure of

compliance with a 1031 exchange program; (xviii) our disclosure

controls and internal control over financial reporting, including

any material weakness; and (xix) failure to achieve sustainability

metrics and goals, including as a result of tenant collaboration,

and impact of governmental regulation on our sustainability

efforts. For a further discussion of these and other factors that

could impact the company's future results, performance, or

transactions, see the section entitled “Risk Factors” of our annual

report on Form 10-K for the year ended December 31, 2023 and of our

quarterly report on Form 10-Q for the quarter ended June 30, 2024

and any additional factors that may be contained in any filing we

make with the SEC.

While forward-looking statements reflect the Company's good

faith beliefs, they do not guarantee future performance. Any

forward-looking statement contained in this press release speaks

only as of the date on which it was made, and we assume no

obligation to update or revise publicly any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events, or other changes

after the date of this press release, except as required by

applicable law. Prospective investors should not place undue

reliance on any forward-looking statements, which are based only on

information currently available to the Company (or to third parties

making the forward-looking statements).

Empire Start Realty Trust,

Inc.

Condensed Consolidated

Statements of Operations

(unaudited and amounts in

thousands, except per share data)

Three Months Ended September

30,

2024

2023

Revenues

Rental revenue

$

153,117

$

151,458

Observatory revenue

39,382

37,562

Lease termination fees

4,771

—

Third-party management and other fees

271

268

Other revenue and fees

2,058

2,238

Total revenues

199,599

191,526

Operating expenses

Property operating expenses

45,954

42,817

Ground rent expenses

2,331

2,331

General and administrative expenses

18,372

16,012

Observatory expenses

9,715

9,471

Real estate taxes

31,982

32,014

Depreciation and amortization

45,899

46,624

Total operating expenses

154,253

149,269

Total operating income

45,346

42,257

Other income (expense):

Interest income

6,960

4,462

Interest expense

(27,408

)

(25,382

)

Interest expense associated with property

in receivership

(1,922

)

—

Gain on disposition of properties

1,262

—

Income before income taxes

24,238

21,337

Income tax expense

(1,442

)

(1,409

)

Net income

22,796

19,928

Net (income) loss attributable to

non-controlling interests:

Non-controlling interest in the Operating

Partnership

(8,205

)

(7,207

)

Non-controlling interests in other

partnerships

—

(111

)

Preferred unit distributions

(1,050

)

(1,050

)

Net income attributable to common

stockholders

$

13,541

$

11,560

Total weighted average shares

Basic

164,880

161,851

Diluted

269,613

266,073

Earnings per share attributable to

common stockholders

Basic

$

0.08

$

0.07

Diluted

$

0.08

$

0.07

Empire Start Realty Trust,

Inc.

Condensed Consolidated

Statements of Operations

(unaudited and amounts in

thousands, except per share data)

Nine Months Ended September

30,

2024

2023

Revenues

Rental revenue

$

459,469

$

446,152

Observatory revenue

98,102

93,149

Lease termination fees

4,771

—

Third-party management and other fees

912

1,076

Other revenue and fees

7,067

6,313

Total revenues

570,321

546,690

Operating expenses

Property operating expenses

132,530

124,380

Ground rent expenses

6,994

6,994

General and administrative expenses

52,364

47,795

Observatory expenses

27,104

25,983

Real estate taxes

96,106

95,292

Depreciation and amortization

139,453

140,312

Total operating expenses

454,551

440,756

Total operating income

115,770

105,934

Other income (expense):

Interest income

16,230

10,396

Interest expense

(77,859

)

(76,091

)

Interest expense associated with property

in receivership

(2,550

)

—

Loss on early extinguishment of debt

(553

)

—

Gain on disposition of properties

12,065

29,261

Income before income taxes

63,103

69,500

Income tax expense

(1,537

)

(923

)

Net income

61,566

68,577

Net (income) loss attributable to

non-controlling interests:

Non-controlling interest in the Operating

Partnership

(22,138

)

(25,424

)

Non-controlling interests in other

partnerships

(4

)

(69

)

Preferred unit distributions

(3,151

)

(3,151

)

Net income attributable to common

stockholders

$

36,273

$

39,933

Total weighted average shares

Basic

164,453

160,799

Diluted

268,608

265,269

Earnings per share attributable to

common stockholders

Basic

$

0.22

$

0.25

Diluted

$

0.22

$

0.25

Empire State Realty Trust,

Inc.

Reconciliation of Net Income

to Funds From Operations (“FFO”),

Modified Funds From Operations

(“Modified FFO”) and Core Funds From Operations (“Core

FFO”)

(unaudited and amounts in

thousands, except per share data)

Three Months Ended September

30,

2024

2023

Net income

$

22,796

$

19,928

Non-controlling interests in other

partnerships

—

(111

)

Preferred unit distributions

(1,050

)

(1,050

)

Real estate depreciation and

amortization

44,871

45,174

Gain on disposition of properties

(1,262

)

—

FFO attributable to common stockholders

and Operating Partnership units

65,355

63,941

Amortization of below-market ground

leases

1,958

1,957

Modified FFO attributable to common

stockholders and Operating Partnership units

67,313

65,898

Interest expense associated with property

in receivership

1,922

—

Core FFO attributable to common

stockholders and Operating Partnership units

$

69,235

$

65,898

Total weighted average shares and

Operating Partnership units

Basic

264,787

262,756

Diluted

269,613

266,073

FFO per share

Basic

$

0.25

$

0.24

Diluted

$

0.24

$

0.24

Modified FFO per share

Basic

$

0.25

$

0.25

Diluted

$

0.25

$

0.25

Core FFO per share

Basic

$

0.26

$

0.25

Diluted

$

0.26

$

0.25

Empire State Realty Trust,

Inc.

Reconciliation of Net Income

to Funds From Operations (“FFO”),

Modified Funds From Operations

(“Modified FFO”) and Core Funds From Operations (“Core

FFO”)

(unaudited and amounts in

thousands, except per share data)

Nine Months Ended September

30,

2024

2023

Net income

$

61,566

$

68,577

Non-controlling interests in other

partnerships

(4

)

(69

)

Preferred unit distributions

(3,151

)

(3,151

)

Real estate depreciation and

amortization

136,126

136,085

Gain on disposition of properties

(12,065

)

(29,261

)

FFO attributable to common stockholders

and Operating Partnership units

182,472

172,181

Amortization of below-market ground

leases

5,874

5,873

Modified FFO attributable to common

stockholders and Operating Partnership units

188,346

178,054

Interest expense associated with property

in receivership

2,550

—

Loss on early extinguishment of debt

553

—

Core FFO attributable to common

stockholders and Operating Partnership units

$

191,449

$

178,054

Total weighted average shares and

Operating Partnership units

Basic

264,675

263,379

Diluted

268,608

265,269

FFO per share

Basic

$

0.69

$

0.65

Diluted

$

0.68

$

0.65

Modified FFO per share

Basic

$

0.71

$

0.68

Diluted

$

0.70

$

0.67

Core FFO per share

Basic

$

0.72

$

0.68

Diluted

$

0.71

$

0.67

Empire State Realty Trust,

Inc.

Condensed Consolidated Balance

Sheets

(unaudited and amounts in

thousands)

September 30, 2024

December 31, 2023

Assets

Commercial real estate properties, at

cost

$

3,667,687

$

3,655,192

Less: accumulated depreciation

(1,241,454

)

(1,250,062

)

Commercial real estate properties, net

2,426,233

2,405,130

Contract asset2

168,687

—

Cash and cash equivalents

421,896

346,620

Restricted cash

48,023

60,336

Tenant and other receivables

34,068

39,836

Deferred rent receivables

244,448

255,628

Prepaid expenses and other assets

81,758

98,167

Deferred costs, net

176,720

172,457

Acquired below market ground leases,

net

315,368

321,241

Right of use assets

28,257

28,439

Goodwill

491,479

491,479

Total assets

$

4,436,937

$

4,219,333

Liabilities and equity

Mortgage notes payable, net

$

692,989

$

877,388

Senior unsecured notes, net

1,196,911

973,872

Unsecured term loan facility, net

268,655

389,286

Unsecured revolving credit facility

120,000

—

Debt associated with property in

receivership

177,667

—

Accrued interest associated with property

in receivership

3,511

—

Accounts payable and accrued expenses

81,443

99,756

Acquired below market leases, net

14,702

13,750

Ground lease liabilities

28,257

28,439

Deferred revenue and other liabilities

70,766

70,298

Tenants’ security deposits

24,715

35,499

Total liabilities

2,679,616

2,488,288

Total equity

1,757,321

1,731,045

Total liabilities and equity

$

4,436,937

$

4,219,333

2 This contract asset represents the

amount of obligation we expect to be released upon the final

resolution of the foreclosure process on First Stamford Place.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021615883/en/

Investors and Media

Empire State Realty Trust Investor Relations (212) 850-2678

IR@esrtreit.com

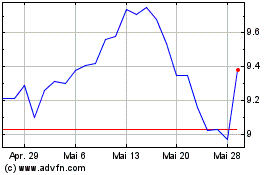

Empire State Realty (NYSE:ESRT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

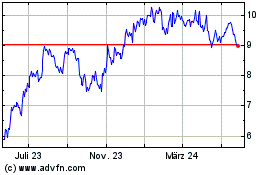

Empire State Realty (NYSE:ESRT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024