false000152986400015298642023-10-042023-10-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 04, 2023 |

ENOVA INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-35503 |

45-3190813 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

175 West Jackson Boulevard |

|

Chicago, Illinois |

|

60604 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 568-4200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.00001 par value per share |

|

ENVA |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 26, 2023, Enova International, Inc., a Delaware corporation (the “Company”), commenced a solicitation of consents (the “Consent Solicitation”) pursuant to the terms and conditions of a Consent Solicitation Statement, dated September 26, 2023 (the “Consent Solicitation Statement”) from holders of its outstanding 8.500% Senior Notes due 2025 (the “Notes”) to amend the Indenture, dated as of September 19, 2018, among the Company, the guarantors party thereto and Computershare Trust Company, N.A., as trustee (the “Trustee”), governing the Notes (as amended, supplemented or otherwise modified from time to time, the “Indenture”). The purpose of the Consent Solicitation is to approve an amendment (the “Proposed Amendment”) to the restricted payments covenant in the Indenture in order to increase the Company’s ability to make restricted payments in connection with share repurchases and for other corporate purposes. The Proposed Amendment would amend the Indenture to provide the Company with additional restricted payments capacity in an amount which does not exceed $200.0 million; so long as, immediately after giving pro forma effect to the making of such restricted payment, the Debt to Tangible Common Equity Ratio of the Company does not exceed 4.5 to 1.0. Debt is balance sheet reported long-term debt (including the current portion thereof). Tangible Common Equity is balance sheet reported total common stockholders’ equity less goodwill and intangible assets. The terms and conditions of the Consent Solicitation are described in detail in the Consent Solicitation Statement.

In connection with the Consent Solicitation, the consents of the holders of more than 50% of the aggregate principal amount of the Notes outstanding were received as of 5:00 p.m., New York City time, on October 3, 2023 (the “Expiration Time”). Accordingly, on October 4, 2023, the Company, the guarantors party thereto and the Trustee entered into a supplemental indenture to the Indenture (the “Supplemental Indenture”) to effect the Proposed Amendment, which Supplemental Indenture is now effective. Upon the cash payment by the Company of $15.00 per $1,000 principal amount of Notes in respect of which such Consents were validly delivered (and not validly revoked) prior to the Expiration Time, the Proposed Amendment will become operative. The Company intends to settle the Consent Solicitation promptly upon satisfaction or waiver of the conditions to the completion of the Consent Solicitation.

Item 7.01 Regulation FD Disclosure.

On October 4, 2023, the Company issued a press release announcing that it had completed the Consent Solicitation. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Current Report on Form 8-K under Item 7.01 and set forth in the attached Exhibit 99.1 is deemed to be “furnished” solely pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished as part of this Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Enova International, Inc. |

|

|

|

|

Date: |

October 4, 2023 |

By: |

/s/ Sean Rahilly |

|

|

|

Sean Rahilly

General Counsel and Secretary |

Exhibit 99.1

Enova Announces Successful Consent Solicitation for Senior Notes due 2025

CHICAGO, October 4, 2023/PRNewswire/-- Enova International, Inc. (NYSE: ENVA) (the “Company”), a leading financial technology company powered by machine learning and world-class analytics, today announced that it has successfully completed its previously announced consent solicitation (the “Consent Solicitation”) pursuant to terms and conditions of a Consent Solicitation Statement, dated September 26, 2023 (the “Consent Solicitation Statement”) to approve an amendment (the “Proposed Amendment”) to the indenture (the “Indenture”) governing its outstanding 8.500% Senior Notes due 2025 (the “Notes”) in order to increase the Company’s ability to make restricted payments in connection with share repurchases and for other corporate purposes.

Accordingly, the Company entered into the supplement to the Indenture, which is now effective. Upon the cash payment by the Company of $15.00 per $1,000 principal amount of Notes in respect of which such Consents were validly delivered (and not validly revoked) prior to the Expiration Time, the Proposed Amendment will become operative. The Company intends to settle the Consent Solicitation promptly.

“We are pleased our 2025 senior noteholders have provided us additional flexibility to increase capital returns to our shareholders. Over the last several years, we’ve built a strong balance sheet, meaningfully improved our financial risk profile and consistently demonstrated the ability to deliver strong financial results,” said David Fisher, CEO of Enova.

This news release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy the Notes or any other securities. The Consent Solicitation Statement does not constitute a solicitation of consents in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such solicitation under applicable securities laws.

Investor Relations Contact:

Lindsay Savarese

(212) 331-8417

IR@enova.com

About Enova

Enova International (NYSE: ENVA) is a leading financial services company with powerful online lending that serves small businesses and consumers who are underserved by traditional banks. Through its world-class analytics and machine learning algorithms, Enova has provided more than 8.6 million customers with over $51 billion in loans and financing. You can learn more about the company and its portfolio of businesses at www.enova.com.

Cautionary Statement Regarding Forward Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical facts are forward looking statements. These forward-looking statements reflect the current view of management and are subject to various risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those indicated by such forward-looking statements because of various risks and uncertainties, including, without limitation, those risks and uncertainties indicated in Enova’s filings with the Securities and Exchange Commission (“SEC”), including its annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These risks and uncertainties are beyond the ability of Enova to control, and, in many cases, Enova cannot predict all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. When used in this release, the words “believes,” “estimates,” “plans,” “expects,” “anticipates” and similar expressions or variations as they relate to Enova or its management are intended to identify forward-looking statements. Enova cautions you not to put undue reliance on these statements. Enova disclaims any intention or obligation to update or revise any forward-looking statements after the date of this release.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

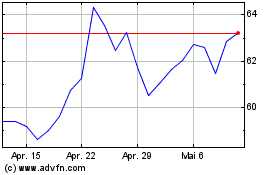

Enova (NYSE:ENVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Enova (NYSE:ENVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024