Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

08 November 2024 - 11:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

/s/ Alfonso Camilo Barco |

|

| |

|

Name: |

Alfonso Camilo Barco |

|

| |

|

Title: |

Chief

Financial Officer |

|

Date: November 8,

2024

Fitch Ratings maintains Ecopetrol's overall credit rating at

BB+ and stable outlook.

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) (the “Company”

or “Ecopetrol”) informs that Fitch Ratings reported on November 6, 2024, that it has maintained the global credit rating

of the Company at BB+ with a stable outlook. Additionally, the agency has downgraded the Standalone Credit Profile (“SCP”)

from ‘bbb’ to ‘bbb-’ and affirmed the national long-term and short-term ratings of Ecopetrol

at ‘AAA (col)’ with a Stable Outlook and ‘F1+(col)’, respectively.

Fitch noted that the global rating of ‘BB+’ reflects

the stable operational condition of the Company as the leading producer of oil and gas in Colombia, as well as its significant energy

transmission business in Colombia and other Latin American countries through its subsidiary Interconexión Eléctrica

S.A. E.S.P -ISA. The agency indicated Ecopetrol’s strategic importance and ability to maintain a solid financial profile. is expected

to

The SCPCwere by the agencyrobustness fromevaluation

of the aforementioned factors and the other considerations contained in the report support an individual rating that is within Investment

Grade and at a level above the Company’s overall rating.

The assessment of the aforementioned factors and other

considerations contained in the report supports an SCP that remains within the Investment Grade range and above the Company’s global

rating.

The complete report issued by the agency on November

6, 2024, can be consulted at the following link:

https://www.fitchratings.com/research/corporate-finance/fitch-affirms-ecopetrol-foreign-local-currency-idrs-at-bb-outlook-stable-06-11-2024

Bogota D.C., November 8, 2024

-----------------------------------------

Ecopetrol is the largest company

in Colombia and one of the main integrated energy companies in the American continent, with more than 19,000 employees. In Colombia, it

is responsible for more than 60% of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems, and

it holds leading positions in the petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares, the

company participates in energy transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway

concession. At the international level, Ecopetrol has a stake in strategic basins in the American continent, with Drilling and Exploration

operations in the United States (Permian basin and the Gulf of Mexico), Brazil, and, through ISA and its subsidiaries, Ecopetrol holds

leading positions in the power transmission business in Brazil, Chile, Peru, and Bolivia, road concessions in Chile, and the telecommunications

sector.

For more information, please contact:

Head of Capital Markets (a)

Lina María Contreras Mora

Email: investors@ecopetrol.com.co

Head of Corporate Communications

Marcela Ulloa

Email: marcela.ulloa@ecopetrol.com.co

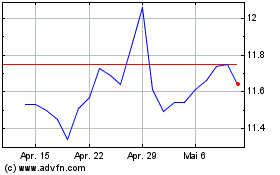

Ecopetrol (NYSE:EC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

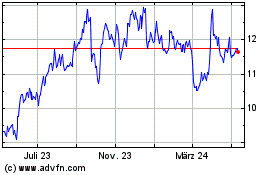

Ecopetrol (NYSE:EC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024