SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2021

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

NOTICE TO SHAREHOLDERS

CENTRAIS ELÉTRICAS

BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9

PUBLIC COMPANY

Centrais Elétricas Brasileiras S/A (“Company”

or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O & XELT.B) hereby informs its shareholders

and the market in general that it was approved at the 61st Eletrobras Annual General Meeting, held on April 27, 2021 (“General

Meeting”), the proposal for the payment of Dividends contained in the Management Proposal, in the amount of BRL 1,507,138,670.20

(one billion, five hundred and seven million, center and thirty-eight thousand, six hundred and seventy reais and twenty cents) to the

Company’s shareholders holders of class “A” and “B” preferred shares and common shares, as provided for

in the Company's Bylaws (“Dividends”).

The total amount of Dividends to be paid to shareholders

holding preferred shares of classes “A” and “B” issued by the Company is BLR 290,771,849.42 (two hundred and ninety

million, seven hundred and seventy-one thousand, eight hundred and forty-nine reais and forty-two cents), equivalent to BRL 1.03814345290052

per preferred share, on the base date of December 31, 2020.

The total amount of Dividends to be paid to the holders

of common shares issued by the Company is BRL 1,216,366,820.78 (one billion, two hundred and sixteen million, three hundred and sixtysix

thousand, eight hundred and twenty reais and seventy-eight cents) equivalent to BRL 0.94376677536411 per share class, in the base-date

December 31, 2020.

Considering that the annual obligation established in paragraphs

1 and 2 of article 10 of the Bylaws was fully met, in 2021, with the payment of dividends made on February 19, 2021, the criterion for

the distribution of dividends approved herein, and to be paid until December 31, 2021, observed the provisions of paragraphs 3 and 4 of

article 10 of the Bylaws, which establish that, after the “A” and “B” preferred shares are guaranteed, the minimum

dividends provided for in the Bylaws, as occurred with the payment mentioned above in February 2021, each preferred share "A"

and "B" will be entitled to receive dividends, for each preferred share, at least 10% greater than those attributed to each

common share

The amounts of Dividends approved by the 61st Annual Shareholders'

Meeting will be updated based on the positive variation of the SELIC rate, pro rata temporis, from January 1, 2021 until the date of the

effective payment, which may be made until December 31, 2021, as decided by the shareholders meeting at the General Meeting, in compliance

with article 205, paragraph 3, of Federal Law No. 6,404 of December 15, 1976, as amended.

The updated amounts per share of the respective Dividends

will be disclosed by the Company in due course upon payment, and it is certain that the shareholders of the Company holding class “A”

and “B” preferred shares and shares will be entitled to receive the dividends common shares, included in the shareholding

base of April 27, 2021, date of its resolution, and, as of April 28, 2021, inclusive, the preferred shares of classes “A”

and “B” and the common shares, of issued by the Company will be traded “ex” right to these Dividends.

This document may contain estimates and forecasts

that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future

events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange

Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

|

Declared Dividend Amounts

|

|

Class of Shares

|

Data Base 12.31.2020

|

Data Base

04.27.2021*

|

|

PNA

|

1.03814345290052

|

1.04499918616052

|

|

PNB

|

1.03814345290052

|

1.04499918616052

|

|

ON

|

0.94376677536411

|

0.94999926014593

|

*Dividend values, by class, of 12/31/2020,

updated by the Selic rate, up to 4/27/2021.

For shareholders with shares held by the B3 S.A. –

Brasil, Bolsa, Balcão (“B3”), the amounts will be paid to the “B3”, which will pass along them to the shareholders,

through the custody agents. The payment to the order shareholders will be made through current account credit, according the registration

data of the respective shareholders, with Banco Bradesco S.A., bookkeeping agent of the Company. The shareholders whose records are out

of date, should go to a Bradesco Bank branch to update the registration data and receive the dividends.

Rio de Janeiro, April 27, 2021

Elvira Cavalcanti Presta

CEO (Interim) and CFO and Investor Relations Officer

This document may contain estimates and forecasts

that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future

events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange

Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: April 27, 2021

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

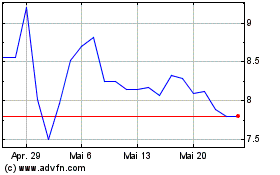

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

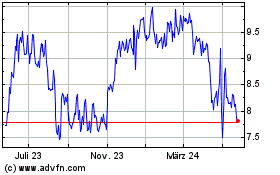

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024