8/3/20230000945764false00009457642023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 3, 2023

DENBURY INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-12935 | | 20-0467835 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 5851 Legacy Circle | | | | | | | |

| Plano, | Texas | | | | 75024 | | | (972) | 673-2000 |

| (Address of principal executive offices) | | | (Zip code) | | | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☑ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $.001 per share | | DEN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 – Results of Operations and Financial Condition

On August 3, 2023, Denbury Inc. issued a press release announcing its 2023 second quarter financial and operating results. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Item 2.02 and in Exhibit 99.1 hereto shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission (unless otherwise specifically provided therein), whether or not filed under the Securities Act of 1933, as amended, or the 1934 Act, regardless of any general incorporation language in any such document.

Item 9.01 – Financial Statements and Exhibits

(d)Exhibits.

The following exhibit is furnished in accordance with the provisions of Item 601 of Regulation S-K:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1* | | |

| 104 | | The cover page has been formatted in Inline XBRL.

|

* Included herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Denbury Inc. (Registrant) |

| Date: August 3, 2023 | By: | /s/ James S. Matthews |

| | | James S. Matthews |

| | | Executive Vice President, Chief Administrative Officer,

General Counsel and Secretary |

News Release

News Release

Denbury Reports Second Quarter 2023 Financial and Operational Results

PLANO, Texas – August 3, 2023 – Denbury Inc. (NYSE: DEN) (“Denbury” or the “Company”) today released its second quarter 2023 results. As a result of the Company’s pending merger with Exxon Mobil Corporation (“ExxonMobil”), Denbury will not be hosting a webcast / conference call, which had previously been scheduled to take place tomorrow, August 4, nor posting supplemental materials regarding its quarterly results or future outlook.

| | | | | | | | | | | |

| | | |

| KEY 2Q HIGHLIGHTS | |

| | | |

| • | Second quarter 2023 net cash provided by operating activities totaled $142 million, and adjusted cash flows from operations(1) totaled $129 million. | |

| | | |

| • | Capital expenditures, excluding capitalized interest, totaled $132 million, and equity investments totaled $12 million. Total debt at the end of the second quarter was $85 million. | |

| | | |

| • | Net income(2) for the quarter was $67 million, or $1.25 per diluted share, and adjusted net income(1)(2) was $57 million, or $1.06 per diluted share. | |

| | | |

| • | Commenced Enhanced Oil Recovery (“EOR”) production at the Cedar Creek Anticline (“CCA”) tertiary project, with second quarter tertiary production at CCA averaging 574 Bbl/d. | |

| | | |

| • | Added four dedicated CO2 sequestration sites to the Company’s portfolio, including one in Texas, two in Louisiana, and one in Wyoming. In addition, executed agreement to transport and sequester 1 million metric tons of CO2 per year for a blue methanol project in Louisiana. | |

| | | |

(1) A non-GAAP measure. See accompanying schedules that reconcile GAAP to non-GAAP measures along with a statement indicating why the Company believes the non-GAAP measures provide useful information for investors.

(2) Calculated using weighted average diluted shares outstanding of 54.0 million for the quarter ended June 30, 2023.

CEO Comment

| | | | | |

| Chris Kendall, Denbury’s President and CEO, commented, “I am extremely proud of our team and our accomplishments through the first half of the year. During the second quarter, we commenced initial tertiary production at our flagship CCA CO2 EOR project and early results from the flood are encouraging. We also continued to advance our CCUS business, adding four new storage sites and an additional contract for transportation and storage. On July 13th, we announced an agreement to combine with ExxonMobil, and we expect to close the transaction in the fourth quarter of this year, subject to stockholder and regulatory approvals. We look forward to bringing our assets and expertise together to accelerate the development of the CCUS industry.” |

Oil & Gas Operations Results

| | | | | | | | | | | |

| 2Q 2023 | 1Q 2023 | 2Q 2022 |

| Sales volumes (BOE/d) | 46,982 | 47,655 | 46,561 |

| Avg. oil price, including hedges ($ per Bbl) | $73.83 | $75.36 | $77.63 |

Blue oil (% oil volumes using industrial CO2) | 29% | 30% | 28% |

Industrial CO2 injected (million metric tons) | 1.09 | 1.14 | 1.19 |

Industrial CO2 injected (% total CO2 used in EOR operations) | 43% | 40% | 41% |

| Oil & gas development capital ($ 000s) | $103,395 | $99,791 | $86,290 |

Approximately 54% of second quarter sales volumes were from the Company’s Gulf Coast assets, with the remaining 46% from the Rocky Mountain region. As compared to the first quarter of the year, Gulf Coast production was lower by 4%, driven primarily by a planned facility turnaround at Delhi and lower crude inventory sales at Tinsley, as expected. Rocky Mountain region sales volumes were slightly higher than in the first quarter of the year, driven by initial tertiary production and higher non-tertiary production at CCA, which more than offset unexpected facility downtime at Bell Creek.

The Company’s average oil price differential per barrel of oil (“Bbl”) in the second quarter of 2023 was $1.14 below the West Texas Intermediate (“WTI”) average, a modest improvement from the $1.28

below the WTI average in the first quarter of 2023, driven by Gulf Coast region realizations. Second quarter 2023 commodity hedging receipts totaled $5 million, or $1.24 per Bbl.

Lease operating expenses (“LOE”) in second quarter 2023 totaled $130 million, or $30.48 per barrel of oil equivalent (“BOE”). As compared to the first quarter of the year, higher per unit labor, workover and other costs offset reduced power and utilities expenses. CO2 costs, as part of LOE, were also modestly higher than in the first quarter as the Company began recording a portion of the CO2 injection at CCA as LOE rather than as capital expenditures following EOR production startup. General and administrative expenses totaled nearly $27 million, higher than first quarter levels driven primarily by employee-related costs, including salaries, bonus accrual, and stock compensation expense related to annual equity grants. Depletion, depreciation, and amortization was $50 million, or $11.63 per BOE for the quarter, higher than first quarter levels as the Company commenced the recording of proved reserves associated with the CCA CO2 EOR project.

Nearly half of second quarter 2023 oil & gas development capital expenditures were spent on the CCA CO2 EOR project, primarily focused on the construction of CO2 recycle facilities and well conversions from secondary to tertiary production. Also in the Rocky Mountain region, capital expenditures included multiple CO2 flood expansion projects, including drilling activity in the Beaver Creek and Grieve fields. Second quarter capital spend in the Gulf Coast region included the completion of well conversions at the Soso Rodessa Phase 2 EOR development, a heat exchanger project at Delhi, and various other small development projects.

Denbury ended the second quarter with $85 million borrowed on the Company’s bank credit facility, up $56 million from the end of 2022. Financial liquidity as of June 30, 2023 was $655 million, including cash on hand and borrowing capacity under the Company’s credit facility.

Cedar Creek Anticline EOR Development

Tertiary production response at CCA initiated in April 2023, following commissioning of the first CO2 recycle facility at the end of the first quarter. Second quarter EOR production averaged 574 barrels of oil per day, which includes both incremental response from the CO2 flood and production associated with the waterflood in responding units. A second CO2 recycle facility was commissioned in June 2023, and two additional CO2 recycle facilities are currently being constructed and are anticipated to be commissioned in the fourth quarter of 2023. CCA EOR production is anticipated to continue to increase throughout the remainder of 2023 and through 2024.

Asset Divestment

On June 30, 2023, the Company closed on a transaction whereby it exchanged its 49% non-operated interest in the West Yellow Creek field in Mississippi for a term overriding royalty interest in the field (7% for the first eight years and 3.4% for the next five years). The Company also amended its CO2 sales

contract as part of the transaction to continue selling CO2 to the West Yellow Creek field operator for a fee. Average production from the West Yellow Creek field was 443 Bbl/d for Denbury in the second quarter of 2023.

Carbon Capture, Utilization, and Storage (“CCUS”) Results

| | | | | | | | | | | |

| 2Q 2023 | 1Q 2023 | 2Q 2022 |

Announced CO2 transport and/or storage offtake (cumulative million metric tons per year) | 23 | 22 | 7 |

Secured CO2 sequestration capacity (cumulative million metric tons) | 2,020 | 2,065 | 1,500 |

Class VI CO2 injection permit applications submitted (cumulative) | 9 | 3 | - |

| Stratigraphic test wells drilled | - | 1 | - |

| CCUS capital expenditures ($ 000s) | $28,390 | $19,688 | $2,951 |

During the second quarter, Denbury executed an agreement with SunGas Renewables Inc. (“SunGas”) to provide CO2 transportation and storage services associated with SunGas’ low-carbon methanol facility to be constructed in Pineville, Louisiana. SunGas’ project is planned to commence operation in 2027 with an estimated one million metric tons per year of associated CO2.

Second quarter 2023 capital expenditures for CCUS primarily represented costs associated with dedicated CO2 sequestration sites, including lease acquisition bonus, seismic imaging, and land and legal costs. The Company expanded its sequestration portfolio by four sites, including one in Texas, two in Louisiana, and one in Wyoming. The Texas and Louisiana additions, which were previously announced, bring the Company’s Gulf Coast dedicated sequestration portfolio to a total of nine sites and nearly two billion metric tons of CO2 storage potential. In Wyoming, the Company finalized a definitive agreement for the rights to develop a dedicated CO2 sequestration site on approximately 19,000 acres in Campbell County, directly underneath the Company’s Greencore CO2 Pipeline. Denbury estimates potential CO2 sequestration capacity of the site to be 40 million metric tons, bringing total sequestration capacity for Denbury in the Rocky Mountain region to 80 million metric tons of CO2 from two sites.

During the second quarter of 2023, the Company submitted an application to the U.S. Environmental Protection Agency (“EPA”) for six Class VI well permits for the Company’s Leo CO2 sequestration site in Mississippi. Subsequent to quarter-end, the Company submitted an additional application to the EPA for six Class VI injection well permits associated with the Draco CO2 sequestration site in Louisiana, bringing the Company’s total number of submitted Class VI injection permits to 15.

In April 2023, based on the achievement of certain project milestones, the Company invested its remaining $10 million commitment for a total $20 million equity investment into Clean Hydrogen Works, the development company of a blue hydrogen/ammonia project planned in Louisiana.

Outlook

As a result of the Company’s pending merger with ExxonMobil, Denbury’s prior guidance should no longer be relied upon. Denbury will not be providing or updating quarterly or full-year guidance in this or future earnings releases or in quarterly supplemental materials that previously had accompanied quarterly releases. Information regarding known or expected trends may be addressed in Denbury’s or ExxonMobil’s future filings with the Securities and Exchange Commission (“SEC”).

About Denbury

Denbury is an independent energy company with operations and assets focused on Carbon Capture, Utilization, and Storage (“CCUS”) and Enhanced Oil Recovery (“EOR”) in the Gulf Coast and Rocky Mountain regions. For over two decades, the Company has maintained a unique strategic focus on utilizing CO2 in its EOR operations and since 2012 has also been active in CCUS through the injection of captured industrial-sourced CO2. The Company currently injects over four million tons of captured industrial-sourced CO2 annually, with an objective to fully offset its Scope 1, 2, and 3 CO2 emissions by 2030, primarily through increasing the amount of captured industrial-sourced CO2 used in its operations. For more information about Denbury, visit www.denbury.com.

Follow Denbury on X and LinkedIn.

Important Information about the Transaction and Where to Find It

In connection with the proposed transaction between Exxon Mobil Corporation (“ExxonMobil”) and Denbury Inc. (“Denbury”), ExxonMobil and Denbury will file relevant materials with the SEC, including a registration statement on Form S-4 filed by ExxonMobil that will include a proxy statement of Denbury that also constitutes a prospectus of ExxonMobil. A definitive proxy statement/prospectus will be mailed to stockholders of Denbury. This communication is not a substitute for the registration statement, proxy statement or prospectus or any other document that ExxonMobil or Denbury (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EXXONMOBIL AND DENBURY ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing important information about ExxonMobil or Denbury, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by ExxonMobil will be available free of charge on ExxonMobil’s internet website at www.exxonmobil.com under the tab “investors” and then under the tab “SEC Filings” or by contacting ExxonMobil’s Investor Relations Department at investor.relations@exxonmobil.com. Copies of the documents filed with the SEC by Denbury will be available free of charge on Denbury’s website at denbury.com under the tab “Investors” and then under the tab “Financial Information” and then under the tab “SEC Filings” or by contacting Denbury’s Investor Relations Department at IR@denbury.com. The information included on, or accessible through, ExxonMobil’s or Denbury’s website is not incorporated by reference into this communication.

Participants in the Solicitation

ExxonMobil, Denbury, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Denbury is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 18, 2023, and in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 23, 2023. Information about the directors and executive officers of ExxonMobil is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, and in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 22, 2023. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans,

estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of ExxonMobil and Denbury, that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the proposed transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required on anticipated terms and Denbury stockholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the merger, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the ability of ExxonMobil and Denbury to integrate the business successfully and to achieve anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be instituted against ExxonMobil, Denbury or their respective directors; the risk that disruptions from the proposed transaction will harm ExxonMobil’s or Denbury’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger; rating agency actions and ExxonMobil and Denbury’s ability to access short- and long-term debt markets on a timely and affordable basis; legislative, regulatory and economic developments, including regulatory implementation of the Inflation Reduction Act, timely and attractive permitting for carbon capture and storage by applicable federal and state regulators, and other regulatory actions targeting public companies in the oil and gas industry and changes in local, national, or international laws, regulations, and policies affecting ExxonMobil and Denbury including with respect to the environment; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the merger that could affect ExxonMobil’s and/or Denbury’s financial performance and operating results; certain restrictions during the pendency of the merger that may impact Denbury’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against ExxonMobil or Denbury, and other political or security disturbances; dilution caused by ExxonMobil’s issuance of additional shares of its common stock in connection with the proposed transaction; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in policy and consumer support for emission-reduction products and technology; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; global or regional changes in the supply and demand for oil, natural gas, petrochemicals, and feedstocks and other market or economic conditions that impact demand, prices and differentials, including reservoir performance; changes in technical or operating conditions, including unforeseen technical difficulties; those risks described in Item 1A of ExxonMobil’s Annual Report on Form 10-K, filed with the SEC on February 22, 2023, and subsequent reports on Forms 10-Q and 8-K, as well as under the heading “Factors Affecting Future Results” on the Investors page of ExxonMobil’s website at www.exxonmobil.com (information included on or accessible through ExxonMobil’s website is not incorporated by reference into this communication); those risks described in Item 1A of Denbury’s Annual Report on Form 10-K, filed with the SEC on February 23, 2023, and subsequent reports on Forms 10-Q and 8-K; and those risks that will be described in the registration statement on Form S-4 and accompanying prospectus available from the sources indicated above. References to resources or other quantities of oil or natural gas may include amounts that ExxonMobil or Denbury believe will ultimately be produced, but that are not yet classified as “proved reserves” under SEC definitions. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors

presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Neither ExxonMobil nor Denbury assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on ExxonMobil’s or Denbury’s website should be deemed to constitute an update or re-affirmation of these statements as of any future date.

# # #

This press release, other than historical information, contains forward-looking statements that involve risks and uncertainties detailed in the Company’s filings with the Securities and Exchange Commission, including Denbury’s 2022 Annual Report on Form 10-K. These risks and uncertainties are incorporated by this reference as though fully set forth herein. These statements are based on financial and market, engineering, geological and operating assumptions that management believes are reasonable based on currently available information; however, management’s assumptions and the Company’s future performance are both subject to a wide range of risks, and there is no assurance that these goals and projections can or will be met. Actual results may vary materially. In addition, any forward-looking statements represent the Company’s estimates only as of today and should not be relied upon as representing its estimates as of any future date. Denbury assumes no obligation to update its forward-looking statements.

DENBURY IR CONTACTS

Brad Whitmarsh, 972.673.2020, brad.whitmarsh@denbury.com

Beth Palmer, 972.673.2554, beth.palmer@denbury.com

Financial and Statistical Data Tables and Reconciliation Schedules

The following tables include selected unaudited financial and operational information for the comparative three and six-month periods ended June 30, 2023 and 2022, in order to assist investors in understanding the comparability of the Company’s financial and operational results for the applicable periods. All sales volumes and dollars are expressed on a net revenue interest basis with gas volumes converted to equivalent barrels at 6:1.

Denbury Inc. Consolidated Statements of Operations (Unaudited)

The following information is based on GAAP. Additional required disclosures will be included in the Company’s periodic reports:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| In thousands, except per-share data | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues and other income | | | | | | | | |

| Oil sales | | $ | 301,543 | | | $ | 446,592 | | | $ | 614,115 | | | $ | 827,834 | |

| Natural gas sales | | 1,403 | | | 5,378 | | | 3,320 | | | 9,047 | |

CO2 sales and transportation fees | | 11,164 | | | 12,610 | | | 21,850 | | | 26,032 | |

| Oil marketing revenues | | 13,983 | | | 16,786 | | | 28,531 | | | 30,062 | |

| Other income | | 890 | | | 790 | | | 2,185 | | | 1,040 | |

| Total revenues and other income | | 328,983 | | | 482,156 | | | 670,001 | | | 894,015 | |

| Expenses | | | | | | | | |

| Lease operating expenses | | 130,291 | | | 124,351 | | | 259,465 | | | 242,179 | |

| Transportation and marketing expenses | | 5,159 | | | 4,802 | | | 10,548 | | | 9,447 | |

CO2 operating and discovery expenses | | 1,597 | | | 1,681 | | | 2,793 | | | 4,498 | |

| Taxes other than income | | 26,937 | | | 36,317 | | | 55,975 | | | 67,698 | |

| Oil marketing purchases | | 13,922 | | | 15,027 | | | 28,390 | | | 28,067 | |

| General and administrative expenses | | 26,895 | | | 19,235 | | | 49,872 | | | 37,927 | |

Interest, net of amounts capitalized of $2,259, $975, $3,952 and $2,133, respectively | | 825 | | | 1,526 | | | 1,752 | | | 2,183 | |

| Depletion, depreciation, and amortization | | 49,767 | | | 35,400 | | | 91,799 | | | 70,745 | |

| Commodity derivatives (income) expense | | (19,677) | | | 56,854 | | | (42,800) | | | 249,573 | |

| | | | | | | | |

| | | | | | | | |

| Other expenses | | 3,990 | | | 6,621 | | | 5,481 | | | 8,733 | |

| Total expenses | | 239,706 | | | 301,814 | | | 463,275 | | | 721,050 | |

| Income before income taxes | | 89,277 | | | 180,342 | | | 206,726 | | | 172,965 | |

| Income tax provision | | | | | | | | |

| Current income taxes | | 857 | | | 2,912 | | | 3,195 | | | 2,351 | |

| Deferred income taxes | | 21,139 | | | 21,936 | | | 47,051 | | | 15,992 | |

| Net income | | $ | 67,281 | | | $ | 155,494 | | | $ | 156,480 | | | $ | 154,622 | |

| | | | | | | | |

| Net income per common share | | | | | | | | |

| Basic | | $ | 1.30 | | | $ | 3.00 | | | $ | 3.03 | | | $ | 2.99 | |

| Diluted | | $ | 1.25 | | | $ | 2.83 | | | $ | 2.90 | | | $ | 2.81 | |

| | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | 51,817 | | | 51,757 | | | 51,661 | | | 51,680 | |

| Diluted | | 53,999 | | | 54,886 | | | 53,882 | | | 54,931 | |

Denbury Inc. Consolidated Statements of Cash Flows (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| In thousands | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities | | | | | | | | |

| Net income | | $ | 67,281 | | | $ | 155,494 | | | $ | 156,480 | | | $ | 154,622 | |

| Adjustments to reconcile net income to cash flows from operating activities | | | | | | | | |

| Depletion, depreciation, and amortization | | 49,767 | | | 35,400 | | | 91,799 | | | 70,745 | |

| | | | | | | | |

| Deferred income taxes | | 21,139 | | | 21,936 | | | 47,051 | | | 15,992 | |

| Stock-based compensation | | 6,548 | | | 4,104 | | | 11,486 | | | 7,075 | |

| Commodity derivatives (income) expense | | (19,677) | | | 56,854 | | | (42,800) | | | 249,573 | |

| Receipt (payment) on settlements of commodity derivatives | | 5,157 | | | (127,959) | | | 7,222 | | | (221,016) | |

| | | | | | | | |

| Debt issuance costs and discounts | | 532 | | | 1,249 | | | 1,063 | | | 1,934 | |

| | | | | | | | |

| Other, net | | (2,218) | | | (1,888) | | | (4,176) | | | (3,155) | |

| Changes in assets and liabilities, net of effects from acquisitions | | | | | | | | |

| Accrued production receivable | | 12,062 | | | (12,991) | | | 12,855 | | | (85,786) | |

| Trade and other receivables | | 7,970 | | | (13,427) | | | 5,545 | | | (11,783) | |

| Other current and long-term assets | | (4,821) | | | (12,364) | | | (315) | | | (12,175) | |

| Accounts payable and accrued liabilities | | 16,624 | | | 40,600 | | | (25,623) | | | 52,010 | |

| Oil and natural gas production payable | | (7,053) | | | 9,981 | | | (9,914) | | | 33,329 | |

| Asset retirement obligations and other liabilities | | (10,820) | | | (7,024) | | | (19,660) | | | (11,257) | |

| Net cash provided by operating activities | | 142,491 | | | 149,965 | | | 231,013 | | | 240,108 | |

| | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Oil and natural gas capital expenditures | | (105,636) | | | (80,815) | | | (210,418) | | | (139,522) | |

| CCUS storage sites and related capital expenditures | | (34,644) | | | (2,858) | | | (49,289) | | | (17,758) | |

| Acquisitions of oil and natural gas properties | | (7) | | | (374) | | | (42) | | | (374) | |

| Pipelines and plants capital expenditures | | (668) | | | (5,060) | | | (1,291) | | | (20,264) | |

| Net proceeds from sales of oil and natural gas properties and equipment | | — | | | 137 | | | — | | | 237 | |

| Equity investments | | (11,926) | | | — | | | (19,034) | | | — | |

| Other | | (7,752) | | | (4,127) | | | (13,631) | | | (5,623) | |

| Net cash used in investing activities | | (160,633) | | | (93,097) | | | (293,705) | | | (183,304) | |

| | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

| Bank repayments | | (546,000) | | | (250,000) | | | (865,000) | | | (524,000) | |

| Bank borrowings | | 563,000 | | | 215,000 | | | 921,000 | | | 489,000 | |

| | | | | | | | |

| | | | | | | | |

| Common stock repurchase program | | — | | | (23,374) | | | — | | | (23,374) | |

| | | | | | | | |

| Other | | 2,129 | | | 1,680 | | | 7,748 | | | (1,388) | |

| Net cash provided by (used in) financing activities | | 19,129 | | | (56,694) | | | 63,748 | | | (59,762) | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | | 987 | | | 174 | | | 1,056 | | | (2,958) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 47,949 | | | 47,212 | | | 47,880 | | | 50,344 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 48,936 | | | $ | 47,386 | | | $ | 48,936 | | | $ | 47,386 | |

Denbury Inc. Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| | |

| In thousands, except par value and share data | | June 30, 2023 | | Dec. 31, 2022 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 531 | | | $ | 521 | |

| Accrued production receivable | | 131,422 | | | 144,277 | |

| Trade and other receivables, net | | 21,800 | | | 27,343 | |

| Derivative assets | | 36,809 | | | 15,517 | |

| Prepaids | | 20,117 | | | 18,572 | |

| Total current assets | | 210,679 | | | 206,230 | |

| Property and equipment | | | | |

| Oil and natural gas properties (using full cost accounting) | | | | |

| Proved properties | | 1,751,158 | | | 1,414,779 | |

| Unevaluated properties | | 114,320 | | | 240,435 | |

CO2 properties | | 193,432 | | | 190,985 | |

| Pipelines | | 219,748 | | | 220,125 | |

| CCUS storage sites and related assets | | 114,190 | | | 64,971 | |

| Other property and equipment | | 115,086 | | | 107,133 | |

| Less: accumulated depletion, depreciation, amortization and impairment | | (382,591) | | | (306,743) | |

| Net property and equipment | | 2,125,343 | | | 1,931,685 | |

| Operating lease right-of-use assets | | 19,425 | | | 18,017 | |

| Derivative assets | | 1,269 | | | — | |

| | | | |

| Intangible assets, net | | 74,571 | | | 79,128 | |

| Restricted cash for future asset retirement obligations | | 48,405 | | | 47,359 | |

| Other assets | | 61,927 | | | 45,080 | |

| Total assets | | $ | 2,541,619 | | | $ | 2,327,499 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | $ | 221,173 | | | $ | 248,800 | |

| Oil and gas production payable | | 70,455 | | | 80,368 | |

| Derivative liabilities | | — | | | 13,018 | |

| | | | |

| Operating lease liabilities | | 5,098 | | | 4,676 | |

| Total current liabilities | | 296,726 | | | 346,862 | |

| Long-term liabilities | | | | |

| Long-term debt, net of current portion | | 85,153 | | | 29,000 | |

| Asset retirement obligations | | 312,372 | | | 315,942 | |

| | | | |

| Deferred tax liabilities, net | | 118,171 | | | 71,120 | |

| Operating lease liabilities | | 16,075 | | | 15,431 | |

| Other liabilities | | 12,969 | | | 16,527 | |

| Total long-term liabilities | | 544,740 | | | 448,020 | |

| Commitments and contingencies | | | | |

| Stockholders’ equity | | | | |

Preferred stock, $0.001 par value, 50,000,000 shares authorized, none issued and outstanding | | — | | | — | |

Common stock, $0.001 par value, 250,000,000 shares authorized; 50,473,001 and 49,814,874 shares issued, respectively | | 50 | | | 50 | |

| Paid-in capital in excess of par | | 1,058,119 | | | 1,047,063 | |

| Retained earnings | | 641,984 | | | 485,504 | |

| | | | |

Total stockholders’ equity | | 1,700,153 | | | 1,532,617 | |

| Total liabilities and stockholders’ equity | | $ | 2,541,619 | | | $ | 2,327,499 | |

Denbury Inc. Operating Highlights (Unaudited)

All sales volumes and dollars are expressed on a net revenue interest basis with gas volumes converted to equivalent barrels at 6:1.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | | | | | Six Months Ended |

| | June 30, | | | | | | | | June 30, |

| | 2023 | | 2022 | | | | | | | | | | 2023 | | 2022 |

| Average daily sales (BOE/d) | | | | | | | | | | | | | | | | |

| Tertiary | | | | | | | | | | | | | | | | |

| Gulf Coast region | | 22,041 | | | 22,205 | | | | | | | | | | | 22,580 | | | 22,608 | |

| Rocky Mountain region | | 10,241 | | | 9,186 | | | | | | | | | | | 10,332 | | | 9,203 | |

| Total tertiary sales | | 32,282 | | | 31,391 | | | | | | | | | | | 32,912 | | | 31,811 | |

| | | | | | | | | | | | | | | | |

| Non-tertiary | | | | | | | | | | | | | | | | |

| Gulf Coast region | | 3,506 | | | 3,566 | | | | | | | | | | | 3,453 | | | 3,598 | |

| Rocky Mountain region | | 11,194 | | | 11,604 | | | | | | | | | | | 10,952 | | | 11,333 | |

| Total non-tertiary sales | | 14,700 | | | 15,170 | | | | | | | | | | | 14,405 | | | 14,931 | |

| | | | | | | | | | | | | | | | |

| Total Company | | | | | | | | | | | | | | | | |

| Oil (Bbls/d) | | 45,648 | | | 45,104 | | | | | | | | | | | 46,016 | | | 45,284 | |

| Natural gas (Mcf/d) | | 8,004 | | | 8,741 | | | | | | | | | | | 7,803 | | | 8,747 | |

| BOE/d (6:1) | | 46,982 | | | 46,561 | | | | | | | | | | | 47,317 | | | 46,742 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Unit sales price (excluding derivative settlements) | | | | | | | | | | | | | | | | |

| Gulf Coast region | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | 72.81 | | | $ | 108.87 | | | | | | | | | | | $ | 73.85 | | | $ | 100.94 | |

| Natural gas (per mcf) | | 2.01 | | | 7.49 | | | | | | | | | | | 2.40 | | | 6.03 | |

| | | | | | | | | | | | | | | | |

| Rocky Mountain region | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | 72.32 | | | $ | 108.72 | | | | | | | | | | | $ | 73.58 | | | $ | 101.07 | |

| Natural gas (per mcf) | | 1.90 | | | 6.36 | | | | | | | | | | | 2.33 | | | 5.53 | |

| | | | | | | | | | | | | | | | |

| Total Company | | | | | | | | | | | | | | | | |

Oil (per Bbl)(1) | | $ | 72.59 | | | $ | 108.81 | | | | | | | | | | | $ | 73.73 | | | $ | 101.00 | |

| Natural gas (per mcf) | | 1.93 | | | 6.76 | | | | | | | | | | | 2.35 | | | 5.71 | |

| BOE (6:1) | | 70.86 | | | 106.67 | | | | | | | | | | | 72.09 | | | 98.92 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX differentials | | | | | | | | | | | | | | | | |

| Gulf Coast region | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | (0.92) | | | $ | 0.16 | | | | | | | | | | | $ | (1.08) | | | $ | (0.72) | |

| Natural gas (per mcf) | | (0.30) | | | 0.02 | | | | | | | | | | | (0.15) | | | 0.01 | |

| | | | | | | | | | | | | | | | |

| Rocky Mountain region | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | (1.41) | | | $ | 0.01 | | | | | | | | | | | $ | (1.35) | | | $ | (0.59) | |

| Natural gas (per mcf) | | (0.42) | | | (1.12) | | | | | | | | | | | (0.22) | | | (0.49) | |

| | | | | | | | | | | | | | | | |

| Total Company | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | (1.14) | | | $ | 0.09 | | | | | | | | | | | $ | (1.20) | | | $ | (0.67) | |

| Natural gas (per mcf) | | (0.39) | | | (0.71) | | | | | | | | | | | (0.20) | | | (0.31) | |

(1)Total Company realized oil prices including derivative settlements were $73.83 per Bbl and $77.63 per Bbl during the three months ended June 30, 2023 and 2022, respectively, and $74.60 per Bbl and $74.03 per Bbl during the six months ended June 30, 2023 and 2022, respectively.

Denbury Inc. Supplemental Non-GAAP Financial Measures (Unaudited)

Reconciliation of net income (GAAP measure) to adjusted net income (non-GAAP measure)

Adjusted net income is a non-GAAP measure provided as a supplement to present an alternative net income measure which excludes expense and income items (and their related tax effects) not directly related to the Company’s ongoing operations. Management believes that adjusted net income may be helpful to investors by eliminating the impact of noncash and/or special items not indicative of the Company’s performance from period to period, and is widely used by the investment community, while also being used by management, in evaluating the comparability of the Company’s ongoing operational results and trends. Adjusted net income should not be considered in isolation, as a substitute for, or more meaningful than, net income or any other measure reported in accordance with GAAP, but rather to provide additional information useful in evaluating the Company’s operational trends and performance.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Quarter Ended |

| | June 30, 2023 | | June 30, 2022 |

| In thousands, except per-share data | | Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) |

| Net income (GAAP measure) | | $ | 67,281 | | | $ | 1.25 | | | $ | 155,494 | | | $ | 2.83 | |

| Adjustments to reconcile to adjusted net income (non-GAAP measure) | | | | | | | | |

Noncash fair value gains on commodity derivatives(2) | | (14,520) | | | (0.27) | | | (71,105) | | | (1.30) | |

| Merger expense | | 1,138 | | | 0.02 | | | — | | | — | |

| Insurance reimbursements | | — | | | — | | | (6,692) | | | (0.12) | |

Delta pipeline incident costs (included in other expenses)(3) | | — | | | — | | | 3,867 | | | 0.07 | |

| | | | | | | | |

| Litigation expense | | — | | | — | | | 1,444 | | | 0.03 | |

| | | | | | | | |

Noncash fair value adjustment - contingent consideration(4) | | — | | | — | | | (12) | | | — | |

| | | | | | | | |

Estimated income taxes on above adjustments to net income and other discrete tax items(5) | | 3,292 | | | 0.06 | | | 10,005 | | | 0.18 | |

| Adjusted net income (non-GAAP measure) | | $ | 57,191 | | | $ | 1.06 | | | $ | 93,001 | | | $ | 1.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended | | Six Months Ended |

| | June 30, 2023 | | June 30, 2022 |

| In thousands, except per-share data | | Amount | | Per Diluted Share(1) | | Amount | | Per Diluted Share(1) |

| Net income (GAAP measure) | | $ | 156,480 | | | $ | 2.90 | | | $ | 154,622 | | | $ | 2.81 | |

| Adjustments to reconcile to adjusted net income (non-GAAP measure) | | | | | | | | |

Noncash fair value losses (gains) on commodity derivatives(2) | | (35,578) | | | (0.66) | | | 28,557 | | | 0.52 | |

| Merger expense | | 1,138 | | | 0.02 | | | — | | | — | |

| Delhi Field insurance reimbursements | | — | | | — | | | (6,692) | | | (0.12) | |

Delta pipeline incident costs (included in other expenses)(3) | | (999) | | | (0.02) | | | 3,867 | | | 0.07 | |

| | | | | | | | |

| Litigation expense | | — | | | — | | | 1,444 | | | 0.03 | |

| | | | | | | | |

| Accelerated depreciation | | 1,117 | | | 0.02 | | | — | | | — | |

| | | | | | | | |

Noncash fair value adjustment - contingent consideration(4) | | — | | | — | | | 173 | | | — | |

Estimated income taxes on above adjustments to net income and other discrete tax items(5) | | 8,339 | | | 0.16 | | | 4,152 | | | 0.08 | |

| Adjusted net income (non-GAAP measure) | | $ | 130,497 | | | $ | 2.42 | | | $ | 186,123 | | | $ | 3.39 | |

(1)Includes the impact of potentially dilutive securities including nonvested restricted stock, restricted stock units, performance stock units, shares to be issued under the employee stock purchase plan and warrants.

(2)The net change between periods of the fair market values of open commodity derivative positions, excluding the impact of settlements on commodity derivatives during the period.

(3)Represents an accrual in 2022 of a preliminarily assessed civil penalty proposed in May 2022 by the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration related to the Company’s February 2020 Delta-Tinsley pipeline incident and in 2023, represents a true-up to actual adjustment based on finalization of the assessed penalty.

(4)Expense related to the change in fair value of the contingent consideration payments related to the Company’s March 2021 Wind River Basin CO2 EOR field acquisition.

(5)Represents the estimated income tax impacts on pre-tax adjustments to net income, which rate incorporates discrete tax adjustments. During the three and six months ended June 30, 2022, discrete tax adjustments primarily represented the release of the valuation allowance on certain of the Company’s federal and state deferred tax assets totaling $18.8 million and $24.7 million, respectively.

Denbury Inc. Supplemental Non-GAAP Financial Measures (Unaudited)

Reconciliation of net income (GAAP measure) to Adjusted EBITDAX (non-GAAP measure)

Adjusted EBITDAX is a non-GAAP measure which management uses and excludes certain items that are included in net income, the most directly comparable GAAP financial measure. Items excluded include interest, income taxes, depletion, depreciation, and amortization, and items that the Company believes affect the comparability of operating results such as items whose timing and/or amount cannot be reasonably estimated or are nonrecurring. Management believes Adjusted EBITDAX may be helpful to investors in order to assess the Company’s operating performance as compared to that of other companies in the industry, without regard to financing methods, capital structure or historical costs basis. It is also commonly used by third parties to assess leverage and the Company’s ability to incur and service debt and fund capital expenditures. Adjusted EBITDAX should not be considered in isolation, as a substitute for, or more meaningful than, net income, cash flow from operations, or any other measure reported in accordance with GAAP. The Company’s Adjusted EBITDAX may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDAX, EBITDAX or EBITDA in the same manner. The following table presents a reconciliation of the Company’s net income to Adjusted EBITDAX.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Quarter Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (GAAP measure) | | $ | 67,281 | | | $ | 155,494 | | | $ | 156,480 | | | $ | 154,622 | |

| Adjustments to reconcile to Adjusted EBITDAX | | | | | | | | |

| Interest expense | | 825 | | | 1,526 | | | 1,752 | | | 2,183 | |

| Income tax expense | | 21,996 | | | 24,848 | | | 50,246 | | | 18,343 | |

| Depletion, depreciation, and amortization | | 49,767 | | | 35,400 | | | 91,799 | | | 70,745 | |

| Noncash fair value losses (gains) on commodity derivatives | | (14,520) | | | (71,105) | | | (35,578) | | | 28,557 | |

| Stock-based compensation | | 6,548 | | | 4,104 | | | 11,486 | | | 7,075 | |

| | | | | | | | |

| | | | | | | | |

| Noncash, non-recurring and other | | 292 | | | 4,137 | | | (1,664) | | | 3,726 | |

| Adjusted EBITDAX (non-GAAP measure) | | $ | 132,189 | | | $ | 154,404 | | | $ | 274,521 | | | $ | 285,251 | |

Denbury Inc. Supplemental Non-GAAP Financial Measures (Unaudited)

Reconciliation of cash flows from operations (GAAP measure) to adjusted cash flows from operations (non-GAAP measure) and free cash flow (non-GAAP measure)

Adjusted cash flows from operations is a non-GAAP measure that represents cash flows provided by operations before changes in assets and liabilities, as summarized from the Company’s Unaudited Condensed Consolidated Statements of Cash Flows. Adjusted cash flows from operations measures the cash flows earned or incurred from operating activities without regard to the collection or payment of associated receivables or payables. Free cash flow is a non-GAAP measure that represents adjusted cash flows from operations less oil and gas development expenditures, CCUS storage sites and related capital expenditures and capitalized interest, but before acquisitions, ARO and equity method investments. Management believes that it is important to consider these additional measures, along with cash flows from operations, as it believes the non-GAAP measures can often be a better way to discuss changes in operating trends in its business caused by changes in sales volumes, prices, operating costs and related factors, without regard to whether the earned or incurred item was collected or paid during that period. Adjusted cash flows from operations and free cash flow are not measures of financial performance under GAAP and should not be considered as alternatives to cash flows from operations, investing, or financing activities, nor as a liquidity measure or indicator of cash flows.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Quarter Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operations (GAAP measure) | | $ | 142,491 | | | $ | 149,965 | | | $ | 231,013 | | | $ | 240,108 | |

| Net change in assets and liabilities relating to operations | | (13,962) | | | (4,775) | | | 37,112 | | | 35,662 | |

| Adjusted cash flows from operations (non-GAAP measure) | | 128,529 | | | 145,190 | | | 268,125 | | | 275,770 | |

| | | | | | | | |

| Oil & gas development capital expenditures | | (103,395) | | | (86,290) | | | (203,186) | | | (143,896) | |

| CCUS storage sites and related capital expenditures | | (28,390) | | | (2,951) | | | (48,078) | | | (23,900) | |

| Capitalized interest | | (2,259) | | | (975) | | | (3,952) | | | (2,133) | |

| Free cash flow (deficit) (non-GAAP measure) | | $ | (5,515) | | | $ | 54,974 | | | $ | 12,909 | | | $ | 105,841 | |

Denbury Inc. Capital Expenditure Summary (Unaudited)(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | | | June 30, |

| In thousands | | 2023 | | 2022 | | | | 2023 | | 2022 |

Capital expenditure summary(1) | | | | | | | | | | |

CCA EOR field expenditures(2) | | $ | 47,737 | | | $ | 21,483 | | | | | $ | 87,775 | | | $ | 39,205 | |

CCA CO2 pipelines | | 442 | | | (950) | | | | | 965 | | | 1,241 | |

| CCA tertiary development | | 48,179 | | | 20,533 | | | | | 88,740 | | | 40,446 | |

| Non-CCA tertiary and non-tertiary fields | | 43,895 | | | 57,074 | | | | | 92,988 | | | 86,437 | |

CO2 sources and other CO2 pipelines | | 1,743 | | | 1,380 | | | | | 3,306 | | | 2,110 | |

Capitalized internal costs(3) | | 9,578 | | | 7,303 | | | | | 18,152 | | | 14,903 | |

| Oil & gas development capital expenditures | | 103,395 | | | 86,290 | | | | | 203,186 | | | 143,896 | |

| CCUS storage sites and related capital expenditures | | 28,390 | | | 2,951 | | | | | 48,078 | | | 23,900 | |

| Oil and gas and CCUS development capital expenditures | | 131,785 | | | 89,241 | | | | | 251,264 | | | 167,796 | |

| Capitalized interest | | 2,259 | | | 975 | | | | | 3,952 | | | 2,133 | |

| Acquisitions of oil and natural gas properties | | 7 | | | 3 | | | | | 42 | | | 374 | |

Equity investments(4) | | 11,926 | | | — | | | | | 19,034 | | | — | |

| Total capital expenditures | | $ | 145,977 | | | $ | 90,219 | | | | | $ | 274,292 | | | $ | 170,303 | |

(1)Capital expenditures in this summary are presented on an as-incurred basis (including accruals) and are $10.4 million and $9.3 million lower than the capital expenditures in the Unaudited Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2023 and June 30, 2022, respectively, and are $9.5 million lower and $0.6 million higher for the three months ended June 20, 2023 and June 30, 2022, respectively, which are presented on a cash basis.

(2)Includes pre-production CO2 costs associated with the CCA EOR development project totaling $4.1 million and $9.3 million during the three and six months ended June 30, 2023, respectively, and $8.0 million and $10.8 million during the three and six months ended June 30, 2022.

(3)Includes capitalized internal acquisition, exploration and development costs and pre-production tertiary startup costs, excluding CCA.

(4)Mainly represents investments made in carbon capture technology companies during the second quarter of 2023 including a $10 million equity investment in Clean Hydrogen Works and $1.5 million equity investment in Libra CO2 Storage Solutions, LLC, and investments made during the first quarter of 2023 of $2 million in Aqualung Carbon Capture AS, as well as a $5 million investment in ION Clean Energy, Inc.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

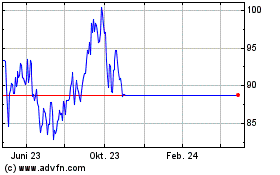

Denbury (NYSE:DEN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Denbury (NYSE:DEN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024