0001679688false00016796882024-01-102024-01-100001679688us-gaap:CommonClassAMemberexch:XNYS2024-01-102024-01-100001679688us-gaap:SeriesHPreferredStockMemberexch:XNYS2024-01-102024-01-100001679688dbrg:SeriesIPreferredStockMemberexch:XNYS2024-01-102024-01-100001679688dbrg:SeriesJPreferredStockMemberexch:XNYS2024-01-102024-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2024

| | | | | | | | |

| DIGITALBRIDGE GROUP, INC. | |

| (Exact Name of Registrant as Specified in Its Charter) | |

| | | | | | | | | | | | | | |

| Maryland | | 001-37980 | | 46-4591526 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

750 Park of Commerce Drive, Suite 210

Boca Raton, Florida 33487

(Address of Principal Executive Offices, Including Zip Code)

(561) 544-7475

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.01 par value | | DBRG | | New York Stock Exchange |

| Preferred Stock, 7.125% Series H Cumulative Redeemable, $0.01 par value | | DBRG.PRH | | New York Stock Exchange |

| Preferred Stock, 7.15% Series I Cumulative Redeemable, $0.01 par value | | DBRG.PRI | | New York Stock Exchange |

| Preferred Stock, 7.125% Series J Cumulative Redeemable, $0.01 par value | | DBRG.PRJ | | New York Stock Exchange |

| | | | | | | | | | | |

| | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | |

| Emerging growth company | ☐ | |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |

On January 10, 2024, DigitalBridge Group, Inc. (the "Company") announced that following the execution of a series of agreements, including the conversion of certain earnout payments to investors in Vantage SDC (Stabilized Data Centers) to equity interests in Vantage SDC and the modification of certain governance rights of Vantage SDC in connection therewith on December 31, 2023, DigitalBridge no longer holds a controlling financial interest in Vantage SDC and will deconsolidate Vantage SDC effective December 31, 2023. Vantage SDC was the sole remaining asset in the Company’s Operating segment, which will be discontinued, with investment management as DigitalBridge’s sole line of business as of December 31, 2023. The Company’s equity investment in Vantage SDC, representing a 12.8% ownership interest (diluted from 13.1% as part of this transaction and excluding interests held by limited partners in vehicles managed and consolidated by the Company) will be carried under Investments on the Company’s balance sheet.

A copy of the Company’s press release announcing the deconsolidation is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being filed with this Current Report on Form 8-K.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Date: | January 10, 2024 | DIGITALBRIDGE GROUP, INC. | | | | |

| | | | | | | | |

| | | By: | /s/ Jacky Wu | | | | |

| | | | Jacky Wu | | | | |

| | | | Executive Vice President and Chief Financial Officer | | | | |

DigitalBridge Completes Deconsolidation of Vantage SDC

Finalizes Corporate Transition to Pure-Play Alternative Asset Manager

Dedicated to Digital Infrastructure

Achieves Key 2023 Simplification Initiative Including

De-Leveraging of Balance Sheet

BOCA RATON, Fla.--(BUSINESS WIRE)—January 10, 2024-- DigitalBridge Group, Inc. (NYSE: DBRG) (“DigitalBridge” or the “Company”) today announced that following the execution of a series of agreements, including the conversion of certain earnout payments to investors in Vantage SDC (Stabilized Data Centers) to equity interests in Vantage SDC and the modification of certain governance rights of Vantage SDC in connection therewith on December 31, 2023, DigitalBridge no longer holds a controlling financial interest in Vantage SDC and will deconsolidate Vantage SDC effective December 31, 2023.

Marc Ganzi, CEO of DigitalBridge, said, “I am pleased to report that today we are a pure-play alternative asset manager, fully aligned with our investment partners to drive long-term returns powered by the secular demand for digital infrastructure and our history of building value in the sector. With the deconsolidation of Vantage SDC, we achieved a key 2023 objective, simplifying our business profile and reporting structure, while continuing to maintain financial exposure to Vantage SDC’s high-quality data center assets serving key power-constrained North American markets.”

Vantage SDC was the sole remaining asset in the Company’s Operating segment, which will be discontinued, with investment management as DigitalBridge’s sole line of business as of December 31, 2023. The Company’s equity investment in Vantage SDC, representing a 12.8% ownership interest (diluted from 13.1% as part of this transaction and excluding interests held by limited partners in vehicles managed and consolidated by the Company) will be carried under Investments on the Company’s balance sheet.

Vantage SDC is a portfolio of 13 hyperscale data centers serving 4 North American markets and is managed and operated by Vantage Data Centers.

About DigitalBridge

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure. With a heritage of over 25 years investing in and operating businesses across the digital ecosystem including cell towers, data centers, fiber, small cells and edge infrastructure, the DigitalBridge team manages $75 billion of digital infrastructure assets on behalf of its limited partners and shareholders. Headquartered in Boca Raton, Florida, DigitalBridge has key offices in New York, Los Angeles, London, Luxembourg and Singapore. For more information, visit: www.digitalbridge.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include changes to the level of

demand for digital infrastructure, anticipated changes in our financial reporting following the deconsolidation of Vantage SDC and other risks and uncertainties, including those detailed in DigitalBridge’s Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, and its other reports filed from time to time with the U.S. Securities and Exchange Commission. All forward-looking statements reflect DigitalBridge’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. DigitalBridge cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this press release. DigitalBridge is under no duty to update any of these forward-looking statements after the date of this press release, nor to conform prior statements to actual results or revised expectations, and DigitalBridge does not intend to do so.

INVESTOR RELATIONS

Severin White

Managing Director, Head of Investor Relations

+1 212.547.2777

severin.white@digitalbridge.com

PRESS & MEDIA

Joele Frank, Wilkinson Brimmer Katcher for DigitalBridge

Jon Keehner / Sarah Salky

+1 212.355.4449

dbrg-jf@joelefrank.com

v3.23.4

Document and Entity Information Document

|

Jan. 10, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 10, 2024

|

| Entity Registrant Name |

DIGITALBRIDGE GROUP, INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-37980

|

| Entity Tax Identification Number |

46-4591526

|

| Entity Address, Address Line One |

750 Park of Commerce Drive

|

| Entity Address, Address Line Two |

Suite 210

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

561

|

| Local Phone Number |

544-7475

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001679688

|

| Amendment Flag |

false

|

| New York Stock Exchange | Common Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value

|

| Trading Symbol |

DBRG

|

| Security Exchange Name |

NYSE

|

| New York Stock Exchange | Series H Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.125% Series H Cumulative Redeemable, $0.01 par value

|

| Trading Symbol |

DBRG.PRH

|

| Security Exchange Name |

NYSE

|

| New York Stock Exchange | Series I Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.15% Series I Cumulative Redeemable, $0.01 par value

|

| Trading Symbol |

DBRG.PRI

|

| Security Exchange Name |

NYSE

|

| New York Stock Exchange | Series J Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.125% Series J Cumulative Redeemable, $0.01 par value

|

| Trading Symbol |

DBRG.PRJ

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dbrg_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dbrg_SeriesJPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

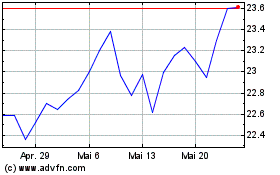

DigitalBridge (NYSE:DBRG-J)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

DigitalBridge (NYSE:DBRG-J)

Historical Stock Chart

Von Mai 2023 bis Mai 2024