Facility increases equity Permian crude

processing capacity, bolstering American energy value chain

Chevron U.S.A., Inc. (CUSA), a wholly owned subsidiary of

Chevron Corporation (NYSE: CVX), has completed a retrofit of its

refinery in Pasadena, Texas, which is expected to increase product

flexibility and expand the processing capacity of lighter crudes by

nearly 15 percent to 125,000 barrels per day.

Chevron acquired the Pasadena Refinery in 2019 with the

strategic intent to expand its Gulf Coast refining system. This

project is expected to allow the company to process more equity

crude from the Permian Basin, supply more products to customers in

the U.S. Gulf Coast and realize synergies with the company’s

Pascagoula refinery.

The Light Tight Oil (LTO) Project aims to enhance facility

reliability and safety and will ultimately result in an increase in

the supply of refined products domestically. The refinery will also

begin producing jet fuel and exporting gas oil.

“The Pasadena Refinery is on a journey to maximize value for

Chevron and the community it serves by driving progress in safety

and reliability,” said Chevron Manufacturing President Chris

Cavote. “This refinery now firmly integrates our upstream and

downstream businesses as we aim to optimize the value chain.”

Planning for the LTO Project began in 2019 with work beginning

in early 2020.

“I’m extremely proud of our employee and contractor workforce,

which logged over 4 million hours to complete this complex project

in an operating refinery. Our safety program reinforced the focus

on working safely throughout the project,” said Refinery General

Manager Tifanie Steele. “We are investing in the refinery to help

it be successful in the long-term, which we hope will support

continuing positive economic impact to our community.”

The phased start-up of the asset is expected to last through Q1

of 2025 as project team members work to confirm all plants are

operating as planned and products are developed to

specification.

About Chevron

Chevron (NYSE: CVX) is one of the world’s leading integrated

energy companies. We believe affordable, reliable and ever-cleaner

energy is essential to enabling human progress. Chevron produces

crude oil and natural gas; manufactures transportation fuels,

lubricants, petrochemicals and additives; and develops technologies

that enhance our business and the industry. We aim to grow our oil

and gas business, lower the carbon intensity of our operations and

grow lower carbon businesses in renewable fuels, carbon capture and

offsets, hydrogen and other emerging technologies. More information

about Chevron is available at www.chevron.com.

NOTICE

As used in this news release, the term “Chevron” and such terms

as “the company,” “the corporation,” “our,” “we,” “us” and “its”

may refer to Chevron Corporation, one or more of its consolidated

subsidiaries, or to all of them taken as a whole. All of these

terms are used for convenience only and are not intended as a

precise description of any of the separate companies, each of which

manages its own affairs. Structural cost reductions describe

decreases in operating expenses from operational efficiencies,

divestments, and other cost saving measures that are expected to be

sustainable compared with 2024 levels.

Please visit Chevron’s website and Investor Relations page at

www.chevron.com and www.chevron.com/investors, LinkedIn:

www.linkedin.com/company/chevron, X: @Chevron, Facebook:

www.facebook.com/chevron, and Instagram: www.instagram.com/chevron,

where Chevron often discloses important information about the

company, its business, and its results of operations.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995

This news release contains forward-looking statements relating

to Chevron’s operations and lower carbon strategy that are based on

management’s current expectations, estimates, and projections about

the petroleum, chemicals, and other energy-related industries.

Words or phrases such as “anticipates,” “expects,” “intends,”

“plans,” “targets,” “advances,” “commits,” “drives,” “aims,”

“forecasts,” “projects,” “believes,” “approaches,” “seeks,”

“schedules,” “estimates,” “positions,” “pursues,” “progress,”

“may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,”

“trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,”

“strategies,” “opportunities,” “poised,” “potential,” “ambitions,”

“aspires” and similar expressions, and variations or negatives of

these words, are intended to identify such forward-looking

statements, but not all forward-looking statements include such

words. These statements are not guarantees of future performance

and are subject to numerous risks, uncertainties and other factors,

many of which are beyond the company’s control and are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements. The reader should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this report. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements are:

changing crude oil and natural gas prices and demand for the

company’s products, and production curtailments due to market

conditions; crude oil production quotas or other actions that might

be imposed by the Organization of Petroleum Exporting Countries and

other producing countries; technological advancements; changes to

government policies in the countries in which the company operates;

public health crises, such as pandemics and epidemics, and any

related government policies and actions; disruptions in the

company’s global supply chain, including supply chain constraints

and escalation of the cost of goods and services; changing

economic, regulatory and political environments in the various

countries in which the company operates; general domestic and

international economic, market and political conditions, including

the military conflict between Russia and Ukraine, the conflict in

Israel and the global response to these hostilities; changing

refining, marketing and chemicals margins; the company’s ability to

realize anticipated cost savings and efficiencies associated with

enterprise structural cost reduction initiatives; the potential for

gains and losses from asset dispositions or impairments; the

possibility that future charges related to enterprise structural

cost reduction initiatives, impairments and other obligations may

be greater or different than anticipated, including as a result of

unexpected or changed facts, circumstances and assumptions; actions

of competitors or regulators; timing of exploration expenses;

timing of crude oil liftings; the competitiveness of

alternate-energy sources or product substitutes; development of

large carbon capture and offset markets; the results of operations

and financial condition of the company’s suppliers, vendors,

partners and equity affiliates; the inability or failure of the

company’s joint-venture partners to fund their share of operations

and development activities; the potential failure to achieve

expected net production from existing and future crude oil and

natural gas development projects; potential delays in the

development, construction or start-up of planned projects; the

potential disruption or interruption of the company’s operations

due to war, accidents, political events, civil unrest, severe

weather, cyber threats, terrorist acts, or other natural or human

causes beyond the company’s control; the potential liability for

remedial actions or assessments under existing or future

environmental regulations and litigation; significant operational,

investment or product changes undertaken or required by existing or

future environmental statutes and regulations, including

international agreements and national or regional legislation and

regulatory measures related to greenhouse gas emissions and climate

change; the potential liability resulting from pending or future

litigation; the risk that regulatory approvals and clearances

related to the Hess Corporation (Hess) transaction are not obtained

or are obtained subject to conditions that are not anticipated by

the company and Hess; potential delays in consummating the Hess

transaction, including as a result of the ongoing arbitration

proceedings regarding preemptive rights in the Stabroek Block joint

operating agreement; risks that such ongoing arbitration is not

satisfactorily resolved and the potential transaction fails to be

consummated; uncertainties as to whether the potential transaction,

if consummated, will achieve its anticipated economic benefits,

including as a result of risks associated with third party

contracts containing material consent, anti-assignment, transfer or

other provisions that may be related to the potential transaction

that are not waived or otherwise satisfactorily resolved; the

company’s ability to integrate Hess’ operations in a successful

manner and in the expected time period; the possibility that any of

the anticipated benefits and projected synergies of the potential

transaction will not be realized or will not be realized within the

expected time period; the company’s future acquisitions or

dispositions of assets or shares or the delay or failure of such

transactions to close based on required closing conditions;

government mandated sales, divestitures, recapitalizations, taxes

and tax audits, tariffs, sanctions, changes in fiscal terms or

restrictions on scope of company operations; foreign currency

movements compared with the U.S. dollar; higher inflation and

related impacts; material reductions in corporate liquidity and

access to debt markets; changes to the company’s capital allocation

strategies; the effects of changed accounting rules under generally

accepted accounting principles promulgated by rule-setting bodies;

the company’s ability to identify and mitigate the risks and

hazards inherent in operating in the global energy industry; and

the factors set forth under the heading “Risk Factors” on pages 20

through 26 of the company’s 2023 Annual Report on Form 10-K and in

subsequent filings with the U.S. Securities and Exchange

Commission. Other unpredictable or unknown factors not discussed in

this report could also have material adverse effects on

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210415151/en/

For media inquiries contact: Allison Cook

ACook@chevron.com

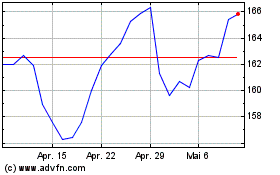

Chevron (NYSE:CVX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

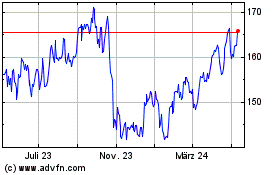

Chevron (NYSE:CVX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024