false000145586300014558632023-08-282023-08-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 28, 2023

Americold Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Maryland | 001-34723 | 93-0295215 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 10 Glenlake Parkway, | South Tower, Suite 600 | |

|

| Atlanta, | Georgia | | 30328 |

(Address of principal executive offices) | | (Zip Code) |

(678) 441-1400

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | COLD | | New York Stock Exchange |

Item 5.02 — Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 28, 2023, Americold Realty Trust, Inc. (the “Company”) announced the appointment of Bryan Verbarendse as Executive Vice President & Chief Operating Officer – North America.

Mr. Verbarendse, age 50, has more than 31 years of experience in retail and wholesale grocery supply chain. Prior to joining the Company, he served as Senior Vice President of Distribution and Replenishment for Albertson’s. He has also served as Group Vice President of Distribution at Albertson’s and held General Manager roles at Albertson’s and SUPERVALU.

In connection with Mr. Verbarendse’s appointment as Executive Vice President & Chief Operating Officer – North America, the Company provided an offer letter, dated as of July 24, 2023 (the “Verbarendse Offer Letter”), which provides Mr. Verbarendse the following key compensation and benefits:

•an annual base salary of $450,000, which will be reviewed on an annual basis;

•annual incentive compensation opportunity for meeting stated performance goals targeted at 75% of base salary, which will be reviewed on an annual basis;

•a one-time grant of time-based Operating Partnership Profits Units with a value of $750,000, which will vest in two installments: 75% on the first anniversary of the grant date and 25% on the second anniversary of the grant date;

•a one-time bonus of $250,000 to be paid in two installments and subject to reimbursement in the event Mr. Verbarendse leaves the Company or is terminated for Cause within one year of his start date;

•eligibility to participate in the Americold Realty Trust 2017 Equity Incentive Plan (the “Incentive Plan”) in such amounts and at such times as the Compensation Committee of the Board shall determine at its sole discretion;

•participation in the Company’s retirement, health and welfare, vacation and other benefit programs.

•

Mr. Verbarendse will also participate in the Executive Severance Benefits Plan, which is filed as Exhibit 10.2 to the Current Report on Form 8-K filed by the Company on February 24, 2022 and incorporated by reference in this Item 5.02.

Mr. Verbarendse’s employment with the Company will be “at will.” There are no family relationships between Mr. Verbarendse and any Company director or executive officer, and no arrangements or understandings between Mr. Verbarendse and any other person pursuant to which he was selected as an officer. Mr. Verbarendse is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

The foregoing summary of the Verbarendse Offer Letter is not complete and is subject to, qualified in its entirety by, and should be read in conjunction with, the full text of the Verbarendse Offer Letter, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| |

| | Bryan Verbarendse Offer Letter |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 28, 2023

| | | | | | | | |

| Americold Realty Trust, Inc. |

| | |

| By: | /s/ Marc J. Smernoff |

| | Name: Marc J. Smernoff |

| | Title: Chief Financial Officer and Executive Vice President |

| | |

Exhibit 10.1

July 24, 2023

Bryan Verbarendse

Delivered via email

Dear Bryan,

It is my pleasure to submit to you this employment offer with Americold. We believe you bring the breadth and depth of experience that will support solid growth for our company. Based on your position within our company, the following offer provisions should be attractive and can be summarized within these points:

The position being offered is Executive Vice President & Chief Operating Officer-North America, effective on August 28, 2023.

You will report to our Chief Executive Officer, George Chappelle and be based out of your home office in Idaho until such time you relocate to Atlanta, GA on a date mutually agreed to by you and the Company. Your relocation will be facilitated through the Company’s relocation policy, which will be provided to you separately.

The annual base salary for this position is $450,000.00, which on a bi-weekly basis is $17,307.69.

The annual incentive compensation opportunity for meeting stated performance goals is targeted at 75% of your base salary effective the month in which you start and paid in accordance with the terms of the Annual Incentive Plan (“AIP”).

You will be eligible to participate in the Americold Realty Trust 2017 Equity Incentive Plan (the “Plan”) in such amounts and at such times as the Compensation Committee of the Board of Directors shall determine at its sole discretion. All awards will be subject to the terms and conditions of the Plan. Subject to the final approval of the Compensation Committee and Board of Directors, the terms of the Plan and associated grant documentation, it is anticipated:

oOn your start date, you would receive a one-time Restricted Stock Unit grant with a value of $750,000, which will vest in two installments: 75% on the first anniversary from the grant date, and 25% on the second anniversary from the grant date.

oIt is anticipated that your 2024 annual grant, which includes a combination of time-based and performance Restricted Stock Units, will have a target value of $750,000, subject to the final approval of the Compensation Committee and Board of Directors.

A one-time lump sum bonus will be provided in the amount of $250,000, minus applicable taxes and deductions, to be paid in two installments. The first installment of $100,000 will be paid on the first feasible pay date 30-days after your start date. The second installment of $150,000 will be paid when the Company pays their annual bonuses, which is anticipated to be in early April of 2024. Should you voluntarily leave the company or are terminated for Cause within one year of your start date, you will be responsible for reimbursing the Company in full for said payment.

You will be provided with a competitive benefit plan which includes paid medical/dental/vision for you and your dependents through our Executive Health program. Additionally, we offer life insurance, disability, 401(k) and other benefits. Your healthcare benefits coverage will be effective the first (1st) day of the month following your start date.

You will be eligible for 25 days Paid Time Off per calendar year on a prorated basis in accordance with the company’s policy, as well as 7 paid holidays and 2 floating holidays.

Additional details such as notice to leave the Company and any other termination provisions will be found in our Executive Severance Benefits Plan, which will be provided to you separately.

The Company reserves the right to modify benefits and offerings due to plan amendments. This offer and your continued employment are contingent on you passing our pre-employment drug screen, background verifications, receiving favorable references and presenting timely and valid documentation as required by the Immigration Reform

10 Glenlake Parkway | Suite 600, South Tower | Atlanta, GA 30328 | USA | p. +1.678.441.1400 | f. +1.678.441.6824 | www.americold.com

and Control Act to ensure you are authorized to work in the United States. In addition, you will need to complete our conflict of interest questionnaire and apply for the required SEC codes.

Please note that Americold is an “at will” employer. You have the right to review this job offer with anyone you choose, at your cost. This offer shall remain open until April 27th, 2023.

Bryan, all of us are excited about the opportunities ahead and the contributions we see you making with our company. We are convinced you will add significant value to the success of Americold. The team looks forward to making your transition to your new position within the Americold family as smooth as possible.

With best regards,

Samantha Charleston

Samantha “Sam” Charleston

EVP & Chief Human Resources Officer

cc: George Chappelle, Lisa Chasey

| | | | | | | | | | | |

Please sign below to confirm your understanding and acceptance of the above terms and conditions of the employment offer.

|

| Signature: | /s/ Bryan Verbane | Date: | 7/24/21023 |

10 Glenlake Parkway | Suite 600, South Tower | Atlanta, GA 30328 | USA | p. +1.678.441.1400 | f. +1.678.441.6824 | www.americold.com

Cover Page Document

|

Aug. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 28, 2023

|

| Entity Registrant Name |

Americold Realty Trust, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34723

|

| Entity Tax Identification Number |

93-0295215

|

| Entity Address, Address Line One |

10 Glenlake Parkway,

|

| Entity Address, Address Line Two |

South Tower, Suite 600

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

678

|

| Local Phone Number |

441-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

COLD

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001455863

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

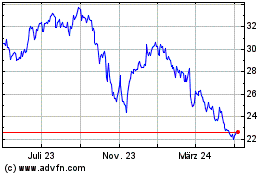

Americold Realty (NYSE:COLD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Americold Realty (NYSE:COLD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024