UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23rd floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No X

NOTICE OF MATERIAL EVENT

(Santiago, Chile, November 3rd,

2020) – Compañía Cervecerías Unidas S.A. ("CCU") reported as a material event (the “Material

Event”) the following:

One)

Description of the Transaction

On

November 2, 2020, Fábrica de Envases Plásticos S.A. (“Plasco”), a subsidiary of CCU, and Envases CMF

S.A. (“CMF”, together with “Plasco”, the “Parties”), executed a Memorandum of Understanding

(“MoU”) which establishes the preliminary terms of an investment agreement and a shareholders agreement to be subscribed

by the Parties, regarding the design, construction and operation of a facility capable to process (recycle) PET resin, through

a new company to be organized in Chile (the “Company”), owned in equal parts (50/50) by the Parties (the “Transaction”).

Each

Party shall undertake to purchase from the Company a certain amount of recycled PET (“rPET”). In addition, the MoU

provides that part of the plant's production capacity will be offered to third parties, not related to the Parties, under the same

conditions as those applicable to the Parties.

The

closing of the Transaction is subject to the fulfillment of certain suspensive conditions, customary for this type of agreement,

among which is obtaining the consents of authorities required under applicable legislation.

Each

of the Parties, Plasco and CMF, shall undertake to contribute to the Company, either through a capital increase or debt, as agreed

by the Parties, the amount of USD 12,000,000 (twelve million US dollars).

Two)

Status of the Transaction

The

Parties will notify the Fiscalía Nacional Económica (local antitrust authority), within the next few days, of the

execution of the MoU, pursuant to Title IV of Decree Law 211 and other applicable regulations.

Three)

Timeframe to execute the Transaction

The

Parties expect that on or before June 30, 2021, the suspensive conditions to which the Transaction is subject to will be fulfilled,

and the final documents will be executed.

Four)

Impacts of the Transactions on CCU´s financial results

It

was taken into consideration, among others, that the Transaction will allow or facilitate compliance with current legislation,

such as Law 20,920 that establishes the Framework for Waste Management, the Extended Responsibility of the Producer and Promotion

of Recycling, and those eventually applicable in the future in relation to the use of rPET.

In

addition, the Transaction is part of the “Planet Dimension”, one of the three pillars of CCU's Sustainability Management

Model, and more specifically the objective of Circular Economy, which aims for our containers and packaging to be made with recycled

material.

As

of today, it is not possible for us to determine the potential effect of the Transaction on CCU´s financial statements and,

as a joint venture, CCU will not consolidate the financial results of the Company.

CCU

is a multi-category beverage company with operations in Chile, Argentina, Bolivia, Colombia, Paraguay and Uruguay. CCU is one

of the largest players in each one of the beverage categories in which it participates in Chile, including beer, soft drinks,

mineral and bottled water, nectar, wine and pisco, among others. CCU is the second-largest brewer in Argentina and also participates

in the cider, spirits and wine industries. In Uruguay and Paraguay, the Company is present in the beer, mineral and bottled water,

soft drinks and nectar categories. In Bolivia, CCU participates in the beer, water, soft drinks and malt beverage categories.

In Colombia, the Company participates in the beer and in the malt industry. The Company’s principal licensing, distribution

and / or joint venture agreements include Heineken Brouwerijen B.V., PepsiCo Inc., Seven-up International, Schweppes Holdings

Limited, Société des Produits Nestlé S.A., Pernod Ricard Chile S.A., Promarca S.A. (Watt’s) and Coors

Brewing Company.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

|

|

|

/s/ Felipe Dubernet

|

|

|

Chief Financial Officer

|

|

|

|

Date: Novemver 3, 2020

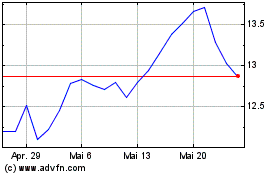

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024