UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23rd floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No X

Santiago, Chile, November 6, 2024 – CCU

announced today its consolidated financial and operating results1,2

for the third quarter 2024, which ended September 30,

2024.

| · | Consolidated Volumes increased

5.7% (5.5% decrease organic3). Volume performance per Operating segment was as follows: |

| o | International Business 15.1%

increase (23.5% decrease organic) |

·

Net sales were down 3.0% (6.9% decrease organic)

·

Gross profit decreased 9.4% (13.7% decrease organic)

| · | EBITDA reached CLP 70,431 million[4](CLP

71,483 million organic) a 18.4% decrease (17.2% decrease organic). The performance per Operating segment was as follows: |

| o | International Business a decrease

of 84.7% (80.6% decrease organic) |

| · | Net income reached a gain of

CLP 29,548 million (CLP 29,551 million organic) a 211.1% increase (211.1% increase organic). |

| · | Earnings per share reached

CLP 80.0 per share (CLP 80.0 per share organic). |

| |

|

|

|

|

|

|

|

|

|

| Key figures |

|

3Q24 |

3Q23 |

D % / bps |

Organic

D % / bps |

YTD24 |

YTD23 |

D % / bps |

Organic

D % / bps |

| (In ThHL or CLP million unless stated otherwise) |

|

| Volumes |

|

7,991 |

7,559 |

5.7 |

(5.5) |

22,953 |

23,805 |

(3.6) |

(7.1) |

| Net sales |

|

665,823 |

686,677 |

(3.0) |

(6.9) |

1,936,489 |

1,992,949 |

(2.8) |

(4.1) |

| Gross profit |

|

288,285 |

318,315 |

(9.4) |

(13.7) |

850,525 |

922,675 |

(7.8) |

(9.3) |

| EBIT |

|

33,629 |

51,072 |

(34.2) |

(31.4) |

124,987 |

168,245 |

(25.7) |

(24.9) |

| EBITDA |

|

70,431 |

86,344 |

(18.4) |

(17.2) |

233,316 |

268,846 |

(13.2) |

(12.8) |

| EBITDA margin % |

|

10.6 |

12.6 |

(200) bps |

(140) bps |

12.0 |

13.5 |

(144) bps |

(122) bps |

| Net income |

|

29,548 |

9,499 |

211.1 |

211.1 |

86,791 |

63,923 |

35.8 |

35.8 |

| Earnings per share (CLP) |

|

80.0 |

25.7 |

211.1 |

211.1 |

234.9 |

173.0 |

35.8 |

35.8 |

| Excluding the non-recurring effect of the sale of a portion of land in Chile in 2Q24(4) |

|

|

|

|

|

| EBIT |

|

33,629 |

51,072 |

(34.2) |

(31.4) |

96,318 |

168,245 |

(42.8) |

(41.9) |

| EBITDA |

|

70,431 |

86,344 |

(18.4) |

(17.2) |

204,647 |

268,846 |

(23.9) |

(23.5) |

| Net income |

|

29,548 |

9,499 |

211.1 |

211.1 |

65,863 |

63,923 |

3.0 |

3.0 |

1 For an explanation of the terms used in this report, please

refer to the Glossary in Additional Information and Exhibits. Figures in tables and exhibits have been rounded and may not add up exactly

to the total shown.

2 All growth or variation references in this Earnings Release

refer to 3Q24 compared to 3Q23, unless otherwise stated.

3 In 3Q24 we started consolidating “Aguas de Origen” (ADO), our water business

in Argentina. Organic figures and organic variations presented in this report exclude the effects of the consolidation.

4 Results of YTD24 include a non-recurring gain from the sale of a portion of land

in Chile in 2Q24, totalizing a gain before taxes of CLP 28,669 million, and a gain after taxes of CLP 20,928 million. At the Operating

segments level, this non-recurring effect was accounted in Others/eliminations.

| 3Q24 PRESS RELEASE |  |

| | |

In the third quarter of 2024 (3Q24), CCU moved forward to recover

profitability and financial results, which is a priority. In our main Operating segment, Chile, we posted a positive turnaround in volumes

(+1.8%), EBITDA (+13.8%) and EBITDA margin (+84 bps), mainly as the result of revenue management initiatives and costs and expenses control

efforts. In the Wine Operating segment, we kept an upward trend in EBITDA (+7.9%), mostly driven by a favorable USD and efficiencies.

On the other hand, in the International Business Operating segment, results were weaker than last year, as we faced another challenging

quarter, mostly associated with a sharp contraction in the beverage industry in Argentina. The EBITDA drop in this segment (84.7%) more

than offset the better results in the Chile and the Wine Operating segments.

Before moving into the analysis of the quarter, we would like

to mention that from 3Q24 we started consolidating “Aguas de Origen” (ADO), our water business in Argentina, of which we now

hold 50.1%. The consolidation of this business, added in 3Q24, 844 thousand hectoliters to our consolidated volumes, and a loss of CLP

1,052 million to our consolidated EBITDA. The explanations below in the paragraphs related to the consolidated and the International Business

Operating segment results, consider organic figures, this is, excluding the consolidation of ADO.

During 3Q24 organic revenues contracted 6.9%, explained by a

5.5% contraction in organic volumes and a 1.5% decrease in organic average prices in CLP. The decrease in organic volumes was mainly due

to a weakened demand in Argentina. Lower organic average prices in CLP were fully explained by Argentina, partially compensated with revenue

management efforts. Gross profit was down 13.7% organically, and as percentage of Net sales, deteriorated 342 bps organically, due to

higher cost pressures, mainly coming from the 9.6%5 and 177.3%6 depreciation of the CLP and the ARS against

the USD, respectively, impacting our USD-denominated costs. Organic MSD&A expenses contracted 10.0%, and as a percentage of Net sales

improved 130 bps organically, due to efficiencies across all operating segments. In all, organic EBITDA reached CLP 71,483 million, a

17.2% decrease, and organic EBITDA margin contracted 140 bps. Consolidated Net income reached a gain of CLP 29,548 million increasing

211.1%, driven by a better Non-operating result, particularly in Argentina.

In the Chile Operating segment top line expanded 7.0%, as a

result of 5.2% increase in average prices and 1.8% higher volumes. Average prices were boosted by revenue management efforts while volumes

expanded, changing the trend of the first half of the year. Gross profit was up 2.8% and as a percentage of Net sales decreased from 44.8%

to 43.0%, as a result of higher cost pressures, largely coming from our USD-denominated costs. On the other hand, MSD&A expenses decreased

1.7% and as a percentage of Net sales improved 302 bps, due to efficiencies, which more than offset higher USD-denominated expenses. In

all, EBITDA totalized CLP 59,880 million, a 13.8% rise and EBITDA margin grew 84 bps.

In the International Business Operating segment, which includes

Argentina, Bolivia, Paraguay and Uruguay, organic Net sales recorded a 33.3% decrease, as a consequence of a 23.5% contraction in organic

volumes and 12.8% lower organic average prices in CLP. Weaker organic volumes were mostly explained by Argentina due to a difficult context

for consumption, although we are starting to see a sequential improvement. Lower organic average prices in CLP were driven by negative

translation effects in Argentina, as prices in local currency grew. The latter was partially compensated by revenue management efforts

and positive mix effects in all the other countries. Organic Gross margin deteriorated 598 bps, as a result of cost pressures, mostly

coming from the sharp depreciation of the ARS against the USD and its impact in USD-denominated costs. Organic MSD&A expenses decreased

26.5%, and as a percentage of Net sales deteriorated 446 bps, mainly due to the lower business scale. Organic EBITDA reached CLP 5,006

million, an organic drop of 80.6%.

We would like to highlight that in October 2024, in Paraguay

we continued expanding our regional scale by entering into an association with Vierci Group, regarding the PepsiCo license for the production

and distribution of beverages as well as the distribution of snacks in this country. Consequently, Paraguay becomes the second country

where the PepsiCo license is part of CCU's brand portfolio, in addition to Chile. The Vierci Group, with 57 years of experience in various

sectors, has its headquarters in Paraguay developing its activities in Paraguay, Brazil, Chile, Bolivia, Peru, Panama, Uruguay and the

United States.

The Wine Operating segment posted a top line expansion of 3.3%,

driven by 1.9% higher volumes and 1.4% rise in prices. Volumes were boosted by the Chile domestic market, which grew 6.5%, while exports

from Chile contracted 1.2%, due to logistic difficulties in September which caused shipment delays. The better average prices were explained

by the weaker CLP and its favorable impact on export revenues, partially offset by negative mix effects. Gross profit rose 1.6% and Gross

margin decreased 66 bps. MSD&A expenses were flat, and as a percentage of Net sales decreased 102 bps due to efficiencies. In all,

EBITDA reached CLP 12,521 million, a 7.9% growth and EBITDA margin expanded 71 bps from 16.0% to 16.7%.

Regarding our main JVs and associated businesses, in Colombia,

volumes increased high-single-digit, driving better financial results. The latter, allow us to record a positive EBITDA on an accumulated

basis as of September 2024.

To conclude, in 3Q24 we showed a positive turnaround in volumes,

EBITDA and EBITDA margin in our main Operating segment, Chile and kept improving financial results in the Wine Operating segment; on the

other hand, results were weaker in the International Business Operating segment, as we faced a challenging scenario in Argentina, although

we are starting to see a sequential improvement. We will continue implementing our regional plan “HerCCUles”, with especial

focus on revenue management and efficiencies.

5 The CLP currency variation against the USD considers 2024 average of period (aop)

compared with 2023 (aop). Source Central Bank of Chile.

6 The ARS currency variation against the USD considers 2024 end of period (eop) compared

with 2023 (eop). Source Central Bank of Argentina.

| 3Q24 PRESS RELEASE |  |

| | |

|

CONSOLIDATED INCOME STATEMENT HIGHLIGHTS – THIRD QUARTER (Exhibit 1 & 3) |

The explanations below consider organic figures, this

is, excluding the consolidation of ADO, unless otherwise stated.

| · | Net sales were down 6.9% organically,

as a result of 5.5% contraction in organic consolidated volumes and a 1.5% decrease in organic average prices in CLP. The lower organic

volumes were mostly caused by a weakened demand in Argentina. By Operating segment, the performance was as follows: (i) a 1.8% increase

in the Chile Operating segment, posting a turnaround versus the first half of the year, (ii) a 1.9% expansion in the Wine Operating segment

explained by the Chile domestic market, which expanded 6.5%, while exports from Chile contracted 1.2%, due to logistic difficulties in

September which caused shipment delays, and (iii) a 23.5% organic drop in the International Business Operating segment, mainly concentrated

in Argentina. The lower organic average prices in CLP were fully driven by a 12.8% organic decrease in the International Business Operating

segment, fully explained by negative translation effects in Argentina, as prices in local currency grew, partially compensated by revenue

management efforts and positive mix effects in all the other countries. The latter was partially compensated by a 5.2% rise in the Chile

Operating segment, related to revenue management initiatives, and a 1.4% growth in the Wine Operating segment, mainly as a result of a

weaker CLP and its favorable effects on export revenues, partially compensated by negative mix effects. |

| · | Cost of sales were down 0.9% organically,

due to lower volumes partially offset by higher Cost of sales per hectoliter, which expanded 4.8% organically in CLP. The higher Cost

of sales per hectoliter was due to: (i) an 8.5% increase in the Chile Operating segment, explained by the 9.6%5 depreciation

of the CLP against the USD and its impact on USD-denominated costs, compensated by better prices in raw and packaging materials, mainly

PET and malt; (ii) a 2.3% organic drop in the International Business Operating segment, due to favorable translation effect into CLP,

as in local currency Cost of sales per hectoliter were up highly driven by the negative impact from the 177.3%6 devaluation

of the ARS against the USD in our USD-linked costs, and (iii) a 2.6% increase in the Wine Operating segment mainly due to higher USD-linked

costs and a higher cost of wine. |

| · | Gross profit reached CLP 274,646

million organic, a 13.7% organic contraction, and organic Gross margin was lower by 342 bps. |

| · | MSD&A expenses were down 10.0%

organically, and as percentage of Net sales, improved 130 bps organically, due to efficiencies across all operating segments. The breakdown

per operating segment was as follows: (i) in the Chile Operating segment, MSD&A expenses decreased 1.7%, and as a percentage of Net

sales improved 302 bps due to efficiencies that helped compensate higher USD-linked expenses, (ii) in the International Business Operating

segment MSD&A expenses in CLP were down 26.5%, nonetheless as a percentage of Net sales deteriorated 446 bps organically, the latter

due to the lower business scale in Argentina, impacting negatively fixed-expenses dilution; and (iii) in the Wine Operating segment, MSD&A

expenses were flat, and as a percentage of Net sales improved 102 bps due to efficiencies. |

| · | EBIT reached CLP 35,055 million organic,

an organic contraction of 31.4%. |

| · | EBITDA reached CLP 71,483 million

organic, contracting 17.2% organically. By Operating segment, the lower EBITDA was more than explained by the International Business Operating

segment, which posted an organic drop of 80.6% while EBITDA in the Chile and Wine Operating segments expanded 13.8% and 7.9%, respectively.

|

As the impact of the consolidation of ADO in the Non-operating

result and in Net income is not material, the explanations below consider consolidated figures, this is, including the consolidation of

ADO.

| · | Non-operating result totalized a

loss of CLP 20,069 million versus a negative result of CLP 42,638 million last year. The lower loss was explained by: (i) a better result

in Foreign currency exchange differences by CLP 29,058 million, due to a lower exposure in foreign currency liabilities in Argentina's

balance sheet, and (ii) a lower loss in Equity and income of JVs and associated by CLP 11,178 million, driven by a better result in Colombia

and non-recurring expenses in 3Q23 related with the route-to-market integration of ADO into our operation. This was partially compensated

by: (i) a higher loss in Other gains/(losses) by CLP 9,375 million, mostly caused by derivative contracts7, specifically,

forward contracts entered into to mitigate the impact of foreign exchange rate fluctuations on our foreign currency balance position;

and (ii) a higher loss by CLP 9,038 million in Net financial expenses, due to a lower level of Cash and cash equivalents and a higher

debt, both in Argentina. |

| · | Income taxes reached a positive result

of CLP 18,994 million versus a positive result of CLP 4,227 million last year. The lower taxes were mainly explained by a lower taxable

income in Argentina and positive effects in Argentina from the application of inflation for tax purposes. |

| · | Net income reached a gain of CLP

29,548 million versus a gain of CLP 9,499 million last year, explained by the effects mentioned above.

|

7 See Note 32 Other Gain/(Losses) of our Financial Statements ended in September 30,

2024.

| 3Q24 PRESS RELEASE |  |

| | |

|

CONSOLIDATED INCOME STATEMENT HIGHLIGHTS – 9 MONTHS YTD (Exhibit 2 & 4) |

The explanations below consider organic figures, this

is, excluding the consolidation of ADO, unless otherwise stated.

| · | Net sales were down 4.1% organically,

as a result of a 7.1% contraction in organic consolidated volumes, partially compensated by 3.2% increase in organic average prices in

CLP. The lower organic volumes were largely caused by the 21.1% organic contraction in the International Business Operating segment, almost

fully explained by Argentina, while Paraguay and Bolivia expanded volumes, and Uruguay decreased due to a high comparison base, explained

by an uncommon drought in 2023 which boosted packaged water consumption. The Chile Operating segment decreased 2.3%, mainly driven by

adverse weather condition during 2Q24. The Wine Operating segment expanded volume by 1.5% fully driven by exports from Chile, which expanded

3.8%, while volumes in the domestic market in Chile were flat. The higher average prices in CLP breakdowns as follows: (i) a 4.0% rise

in the Chile Operating segment, related to revenue management initiatives, partly offset by negative mix effects in the portfolio; (ii)

a 7.0% growth in the Wine Operating segment, mainly boosted by the weaker CLP and its favorable effects on export revenues, partially

compensated by a negative mixed effect, and (iii) an organic 2.1% growth in the International Business Operating segment, driven by revenue

management initiatives in all the geographies and a positive mix effect. |

| · | Cost of sales grew 0.3% organically,

as a consequence of the 8.0% organic increase in Cost of sales per hectoliter. The higher Cost of sales per hectoliter was due to: (i)

a 6.8% increase in the Chile Operating segment, explained by the 14.1%5 depreciation of the CLP against the USD and its impact

on USD-denominated costs, partially compensated by better prices in raw and packaging materials, mainly malt and PET, partially counterbalanced

by higher prices in sugar and fruit pulp; (ii) a 15.7% organic expansion in CLP in the International Business Operating segment mostly

driven by the negative impact from the 177.3%6 devaluation of the ARS against the USD in our USD-linked costs, compensated

by favorable translation effect into CLP; and (iii) a 1.4% increase in the Wine Operating segment. |

| · | Gross profit reached CLP 836,886

million organic, an 9.3% organic contraction, and organic Gross margin was lower by 249 bps. |

| · | MSD&A expenses were down 1.3%

organically, although as percentage of Net sales, deteriorated 112 bps. The breakdown per Operating segment was as follows: (i) in the

Chile Operating segment, MSD&A expenses expanded 2.2%, and as a percentage of Net sales increased 17 bps, mainly explained by lower

volumes which impacted negatively fixed-expenses dilution and larger USD-linked expenses, partially compensated by efficiencies; (ii)

in the International Business Operating segment MSD&A expenses in CLP were down 9.8% organically, nonetheless as a percentage of Net

sales increased 540 bps organically, the latter due to a lower business scale in Argentina impacting negatively fixed-expenses dilution;

(iii) in the Wine Operating segment, MSD&A expenses went up 8.7%, and as a percentage of Net sales were flat, due to efficiencies

which helped to offset higher marketing expenses related to exports which are denominated in USD. |

| · | EBIT reached CLP 126,413 million

organic. Excluding the non-recurring gain from a sale of a portion of land in Chile in 2Q24, organic EBIT totalized CLP 97,744 million,

a 41.9% organic decrease compared to last year. |

| · | EBITDA reached CLP 234,368 million

organic. Excluding the non-recurring gain from a sale of a portion of land in Chile in 2Q24, organic EBITDA totalized CLP 205,699 million,

down 23.5% organically compared to last year. By Operating segment, the lower EBITDA was explained by an 89.4% organic contraction in

the International Business Operating segment, concentrated in Argentina, and a 6.8% reduction in the Chile Operating segment. This was

partially offset by the Wine Operating segment, which increased EBITDA by 36.8%. |

As the impact of the consolidation of ADO in the Non-operating

result and in Net income is not material, the explanations below consider consolidated figures, this is, including the consolidation of

ADO.

| · | Non-operating result totalized a

loss of CLP 62,848 million versus a negative result of CLP 95,197 million. The better result was mainly explained by: (i) a lower loss

in Foreign currency exchange differences by CLP 32,037 million, due to a lower exposure in foreign currency liabilities in Argentina's

balance sheet, and (ii) a better result in Equity and income of JVs and associated by CLP 15,282 million, driven by a better financial

result in Colombia, and non-recurring expenses in 3Q23 related with the route-to-market integration of ADO into our operation. The latter

was partially offset by: (i) a higher loss by CLP 12,390 million in Net financial expenses, mainly due to lower Cash and cash equivalents

and a higher debt in Argentina, and (ii) a higher loss in Other gains/(losses) by CLP 3,241 million, mostly caused by derivative contracts7,

specifically, forward contracts entered into to mitigate the impact of foreign exchange rate fluctuations on our foreign currency balance

position. |

| · | Income taxes reached a positive result

of CLP 32,274 million versus a loss of CLP 2,426 million last year. The lower taxes were mainly explained by a lower taxable income in

Argentina and positive effects in Argentina from the application of inflation for tax purposes. |

| · | Net income reached a gain of CLP

86,791 million, expanding 35.8% versus last year. Excluding the non-recurring gain from a sale of a portion of land in Chile in 2Q24,

Net income totalized CLP 65,863 million, increasing 3.0%, explained by the effects mentioned above. |

| 3Q24 PRESS RELEASE |  |

| | |

HIGHLIGHTS BY OPERATING SEGMENTS – THIRD QUARTER |

CHILE OPERATING SEGMENT

In the Chile Operating segment top line expanded 7.0%, as

a result of 5.2% increase in average prices and 1.8% higher volumes. Average prices were boosted by revenue management efforts while volumes

expanded, changing the trend of the first half of the year. Gross profit was up 2.8% and as a percentage of Net sales decreased from 44.8%

to 43.0%, as a result of higher cost pressures, largely coming from our USD-denominated costs. On the other hand, MSD&A expenses decreased

1.7% and as a percentage of Net sales improved 302 bps, due to efficiencies, which more than offset higher USD-denominated expenses. In

all, EBITDA totalized CLP 59,880 million, a 13.8% rise and EBITDA margin grew 84 bps.

We continue making progress in our sustainability agenda.

Within Our Planet Pillar, the Water balance agenda achieved a new milestone. Along with our subsidiary Compañía Pisquera

de Chile S.A. (CPCh), we launched a “water fund” with the collaboration of local authorities targeting one of the most affected

regions of Chile by drought, Coquimbo. The goal is to boost efficiency of water use, introducing techniques such as drip irrigation, waterproofing

tanks and pipes, among others. This initiative is currently supporting 15 low-scale producers, enhancing a key activity of the region,

such as grape farming for the production of pisco.

Within Our People Pillar, we are happy to communicate the

first certification of CCU Chile as a "Top Employer" by Top Employers Institute, an achievement that reinforces CCU's commitment

to workers, the continuous development of good practices, talent acquisition, well-being, diversity and inclusion. We are committed to

continue generating work experiences to share a better life together. In addition, once again CCU obtained the first place in the beverage

sector for attracting talent in Chile, according to the 11th edition of the Merco Talento Chile ranking, one of the most renown

rankings in Chile. Finally, under the Conscious enjoyment agenda, within the same pillar, in September, a month characterized by national

holidays and celebrations in Chile, we launched our Responsible Alcohol Consumption campaign with local authorities to continue educating

about responsible alcohol consumption and safe driving.

In terms of innovations and line extensions, in the beer category

we launched Escudo Maki, a limited-edition variety produced with wild maquis collected by an agricultural cooperative in the south of

Chile. This style is designed to surprise consumers who like to explore varieties and new flavors. Our subsidiary CPCh launched “Hard

Fresh: Hard Soda”, a five degrees alcohol content ready-to-drink cocktail to respond to a growing trend of consumers, especially

younger generations, offering an option with less alcohol content, nice flavors and carry on formats. Also, in the spirits category, our

brand Mistral launched Mistral Nobel Cristalino, a crystalline pisco, as a response to a growing trend.

INTERNATIONAL BUSINESS OPERATING SEGMENT

In the International Business Operating segment, which includes

Argentina, Bolivia, Paraguay and Uruguay, organic Net sales recorded a 33.3% decrease, as a consequence of a 23.5% contraction in organic

volumes and 12.8% lower organic average prices in CLP. Weaker organic volumes were mostly explained by Argentina due to a difficult context

for consumption, although we are starting to see a sequential improvement. Lower organic average prices in CLP were driven by negative

translation effects in Argentina, as prices in local currency grew. The latter was partially compensated by revenue management efforts

and positive mix effects in all the other countries. Organic Gross margin deteriorated 598 bps, as a result of cost pressures, mostly

coming from the sharp depreciation of the ARS against the USD and its impact in USD-denominated costs. Organic MSD&A expenses decreased

26.5%, and as a percentage of Net sales deteriorated 446 bps, mainly due to the lower business scale. Altogether, organic EBITDA reached

CLP 5,006 million, an organic drop of 80.6%.

WINE OPERATING SEGMENT

The Wine Operating segment posted a top line expansion of

3.3%, driven by 1.9% higher volumes and 1.4% rise in average prices. Volumes were boosted by the Chile domestic market, which grew 6.5%,

while exports from Chile contracted 1.2%, due to logistic difficulties in September which caused shipment delays. The better average prices

were explained by the weaker CLP and its favorable impact on export revenues, partially offset by negative mix effects. Gross profit rose

1.6% and Gross margin decreased 66 bps. MSD&A expenses were flat, and as a percentage of Net sales decreased 102 bps due to efficiencies.

In all, EBITDA reached CLP 12,521 million, a 7.9% growth and EBITDA margin expanded 71 bps from 16.0% to 16.7%.

| 3Q24 PRESS RELEASE |  |

| | |

ABOUT CCU

CCU is a multi-category beverage

company with operations in Chile, Argentina, Bolivia, Colombia, Paraguay and Uruguay. CCU is one of the largest players in each one of

the beverage categories in which it participates in Chile, including beer, soft drinks, mineral and bottled water, nectar, wine and pisco,

among others. CCU is the second-largest brewer in Argentina and also participates in the cider, spirits, wine and water industries. In

Uruguay and Paraguay, the Company is present in the beer, mineral and bottled water, soft drinks, wine and nectar categories. In Bolivia,

CCU participates in the beer, water, soft drinks and malt beverage categories. In Colombia, the Company participates in the beer and in

the malt industry. The Company’s principal licensing, distribution and / or joint venture agreements include Heineken Brouwerijen

B.V., PepsiCo Inc., Seven-up International, Schweppes Holdings Limited, Société des Produits Nestlé S.A., Pernod

Ricard Chile S.A., Promarca S.A. (Watt’s), Red Bull Panamá S.A., Stokely Van Camp Inc., and Coors Brewing Company.

CORPORATE HEADQUARTERS

Vitacura 2670, 26th

floor

Santiago

Chile

STOCK TICKER

Bolsa de Comercio de Santiago:

CCU

NYSE: CCU

CAUTIONARY STATEMENT

Statements made in this press

release that relate to CCU’s future performance or financial results are forward-looking statements, which involve known and unknown

risks and uncertainties that could cause actual performance or results to materially differ. We undertake no obligation to update any

of these statements. Persons reading this press release are cautioned not to place undue reliance on these forward-looking statements.

These statements should be taken in conjunction with the additional information about risk and uncertainties set forth in CCU’s

annual report on Form 20-F filed with the US Securities and Exchange Commission and in the annual report submitted to the CMF (Chilean

Market Regulator) and available on our web page.

GLOSSARY

Operating segments

The Operating segments are defined with respect to its revenues

in the geographic areas of commercial activity:

| · | Chile: This segment commercializes Beer, Non Alcoholic

Beverages, Spirits and Cider in the Chilean market, and also includes the results of Transportes CCU Limitada, Comercial CCU S.A., Creccu

S.A., Fábrica de Envases Plásticos S.A. y La Barra S.A. |

| · | International Business: This segment commercializes

Beer, Cider, Wine, Non-Alcoholic Beverages and Spirits in Argentina, Uruguay, Paraguay and Bolivia. |

| · | Wine: This segment commercializes Wine and Sparkling

Wine, mainly in the export market reaching over 80 countries, as well as the Chilean and Argentine domestic market. |

| · | Other/Eliminations: Considers the non-allocated corporate

overhead expenses and eliminations of transactions and volumes between segments. |

| 3Q24 PRESS RELEASE |  |

| | |

ARS

Argentine peso.

CLP

Chilean peso.

Cost of sales

Formerly referred to as Cost of Goods Sold (COGS), includes

direct costs and manufacturing costs.

Earnings per Share (EPS)

Net profit divided by the weighted average number of shares

during the year.

EBIT

Earnings Before Interest and Taxes. For management purposes,

EBIT is defined as Net income before other gains (losses), net financial expenses, equity and income of joint ventures, foreign currency

exchange differences, results as per adjustment units and income taxes. EBIT is equivalent to Adjusted Operating Result used in the 20-F

Form.

EBITDA

EBITDA represents EBIT plus depreciation and amortization.

EBITDA is not an accounting measure under IFRS. When analyzing the operating performance, investors should use EBITDA in addition to,

not as an alternative for Net income, as this item is defined by IFRS. Investors should also note that CCU’s presentation of EBITDA

may not be comparable to similarly titled indicators used by other companies. EBITDA is equivalent to ORBDA (Adjusted Operating Result

Before Depreciation and Amortization), used in the 20-F Form.

Exceptional Items (EI)

Formerly referred to as Non-recurring items (NRI), Exceptional

Items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately

because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature.

Gross profit

Gross profit represents the difference between Net sales and

Cost of sales.

Gross margin

Gross profit as a percentage of Net sales.

Liquidity ratio

Total current assets / Total current liabilities

Marketing, Sales, Distribution and Administrative expenses

(MSD&A)

MSD&A includes marketing, sales, distribution and administrative

expenses.

Net Financial Debt

Total Financial Debt minus Cash & Cash Equivalents.

Net Financial Debt / EBITDA

The ratio is based on a twelve month rolling calculation for

EBITDA.

Net income

Net income attributable to the equity holders of the parent.

UF

The UF is a monetary unit indexed to the Consumer Price Index

variation in Chile.

USD

United States Dollar.

| 3Q24 PRESS RELEASE |  |

| | |

| Exhibit 1: Consolidated Income Statement (Third Quarter 2024) |

|

|

| Third Quarter |

2024 |

2023 |

Total

D % / bps |

| |

(CLP million) |

| Net sales |

665,823 |

686,677 |

(3.0) |

| Cost of sales |

(377,539) |

(368,362) |

2.5 |

| % of Net sales |

56.7 |

53.6 |

306 bps |

| Direct costs |

(287,874) |

(286,274) |

0.6 |

| Manufacturing costs |

(89,665) |

(82,088) |

9.2 |

| Gross profit |

288,285 |

318,315 |

(9.4) |

| % of Net sales |

43.3 |

46.4 |

(306) bps |

| MSD&A |

(254,461) |

(267,407) |

(4.8) |

| % of Net sales |

38.2 |

38.9 |

(72) bps |

| Other operating income/(expenses) |

(195) |

164 |

(218.9) |

| EBIT |

33,629 |

51,072 |

(34.2) |

| EBIT margin % |

5.1 |

7.4 |

(239) bps |

| Net financial expenses |

(19,853) |

(10,815) |

83.6 |

| Equity and income of JVs and associated |

(531) |

(11,709) |

(95.5) |

| Foreign currency exchange differences |

4,573 |

(24,485) |

(118.7) |

| Results as per adjustment units |

54 |

(693) |

(107.8) |

| Other gains/(losses) |

(4,312) |

5,063 |

(185.2) |

| Non-operating result |

(20,069) |

(42,638) |

(52.9) |

| Income/(loss) before taxes |

13,560 |

8,434 |

60.8 |

| Income taxes |

18,994 |

4,227 |

349.4 |

| Net income for the period |

32,554 |

12,660 |

157.1 |

| |

|

|

|

| Net income attributable to: |

|

|

|

| The equity holders of the parent |

29,548 |

9,499 |

211.1 |

| Non-controlling interest |

(3,005) |

(3,161) |

(4.9) |

| |

|

|

|

| EBITDA |

70,431 |

86,344 |

(18.4) |

| EBITDA margin % |

10.6 |

12.6 |

(200) bps |

| |

|

|

|

| OTHER INFORMATION |

|

|

|

| Number of shares |

369,502,872 |

369,502,872 |

|

| Shares per ADR |

2 |

2 |

|

| |

|

|

|

| Earnings per share (CLP) |

80.0 |

25.7 |

211.1 |

| Earnings per ADR (CLP) |

159.9 |

51.4 |

211.1 |

| |

|

|

|

| Depreciation |

36,802 |

35,272 |

4.3 |

| Capital Expenditures |

34,571 |

46,147 |

(25.1) |

| 3Q24 PRESS RELEASE |  |

| | |

| Exhibit 2: Consolidated Income Statement (Nine months ended on September 30, 2024) |

|

|

| YTD as of September |

2024 |

2023 |

Total

D % / bps |

| |

(CLP million) |

| Net sales |

1,936,489 |

1,992,949 |

(2.8) |

| Cost of sales |

(1,085,964) |

(1,070,274) |

1.5 |

| % of Net sales |

56.1 |

53.7 |

238 bps |

| Direct costs |

(831,602) |

(834,608) |

(0.4) |

| Manufacturing costs |

(254,362) |

(235,666) |

7.9 |

| Gross profit |

850,525 |

922,675 |

(7.8) |

| % of Net sales |

43.9 |

46.3 |

(238) bps |

| MSD&A |

(758,114) |

(754,300) |

0.5 |

| % of Net sales |

39.1 |

37.8 |

130 bps |

| Other operating income/(expenses) |

32,576 |

(130) |

>500 |

| EBIT |

124,987 |

168,245 |

(25.7) |

| EBIT margin % |

6.5 |

8.4 |

(199) bps |

| Net financial expenses |

(38,805) |

(26,415) |

46.9 |

| Equity and income of JVs and associated |

(6,426) |

(21,708) |

(70.4) |

| Foreign currency exchange differences |

(3,893) |

(35,929) |

(89.2) |

| Results as per adjustment units |

(5,221) |

(5,882) |

(11.2) |

| Other gains/(losses) |

(8,504) |

(5,263) |

61.6 |

| Non-operating result |

(62,848) |

(95,197) |

(34.0) |

| Income/(loss) before taxes |

62,138 |

73,048 |

(14.9) |

| Income taxes |

32,274 |

(2,426) |

>500 |

| Net income for the period |

94,412 |

70,623 |

33.7 |

| |

|

|

|

| Net income attributable to: |

|

|

|

| The equity holders of the parent |

86,791 |

63,923 |

35.8 |

| Non-controlling interest |

(7,621) |

(6,699) |

13.8 |

| |

|

|

|

| EBITDA |

233,316 |

268,846 |

(13.2) |

| EBITDA margin % |

12.0 |

13.5 |

(144) bps |

| |

|

|

|

| Excluding the non-recurring effect of the sale of a portion of land in Chile in 2Q24(4) |

|

|

|

| EBIT |

96,318 |

168,245 |

(42.8) |

| EBIT margin % |

5.0 |

8.4 |

(347) bps |

| EBITDA |

204,647 |

268,846 |

(23.9) |

| EBITDA margin % |

10.6 |

13.5 |

(292) bps |

| Net income (attributable to equity holders of the parent) |

65,863 |

63,923 |

3.0 |

| |

|

|

|

| OTHER INFORMATION |

|

|

|

| Number of shares |

369,502,872 |

369,502,872 |

|

| Shares per ADR |

2 |

2 |

|

| |

|

|

|

| Earnings per share (CLP) |

234.9 |

173.0 |

35.8 |

| Earnings per ADR (CLP) |

469.8 |

346.0 |

35.8 |

| |

|

|

|

| Depreciation |

108,329 |

100,601 |

7.7 |

| Capital Expenditures |

118,508 |

99,644 |

18.9 |

| 3Q24 PRESS RELEASE |  |

| | |

| Exhibit 3: Segment Information (Third Quarter 2024) |

| |

1. Chile Operating segment |

|

2. International Business Operating segment |

|

3. Wine Operating segment |

|

4. Other/eliminations |

|

Total |

| Third Quarter |

|

|

|

|

| (In ThHL or CLP million unless stated otherwise) |

2024 |

2023 |

YoY % |

|

2024 |

2023 |

YoY % |

Organic

YoY % |

|

2024 |

2023 |

YoY % |

|

2024 |

2023 |

YoY % |

|

2024 |

2023 |

YoY % |

Organic

YoY % |

| |

|

|

|

|

| Volumes |

5,127 |

5,039 |

1.8 |

|

2,517 |

2,187 |

15.1 |

(23.5) |

|

368 |

361 |

1.9 |

|

(21) |

(28) |

(25.3) |

|

7,991 |

7,559 |

5.7 |

(5.5) |

| Net sales |

426,414 |

398,550 |

7.0 |

|

177,834 |

227,379 |

(21.8) |

(33.3) |

|

74,774 |

72,380 |

3.3 |

|

(13,199) |

(11,631) |

13.5 |

|

665,823 |

686,677 |

(3.0) |

(6.9) |

| Net sales (CLP/HL) |

83,174 |

79,101 |

5.2 |

|

70,648 |

103,957 |

(32.0) |

(12.8) |

|

203,159 |

200,317 |

1.4 |

|

|

|

|

|

83,319 |

90,838 |

(8.3) |

(1.5) |

| Cost of sales |

(242,853) |

(219,977) |

10.4 |

|

(97,161) |

(113,270) |

(14.2) |

(25.3) |

|

(44,673) |

(42,762) |

4.5 |

|

7,149 |

7,646 |

(6.5) |

|

(377,539) |

(368,362) |

2.5 |

(0.9) |

| % of Net sales |

57.0 |

55.2 |

176 bps |

|

54.6 |

49.8 |

482 bps |

598 bps |

|

59.7 |

59.1 |

66 bps |

|

|

|

|

|

56.7 |

53.6 |

306 bps |

342 bps |

| Direct costs |

(192,168) |

(174,992) |

9.8 |

|

(68,306) |

(85,132) |

(19.8) |

(28.3) |

|

(35,157) |

(34,520) |

1.8 |

|

7,757 |

8,370 |

(7.3) |

|

(287,874) |

(286,274) |

0.6 |

(2.0) |

| Manufacturing costs |

(50,685) |

(44,985) |

12.7 |

|

(28,855) |

(28,138) |

2.6 |

(16.4) |

|

(9,517) |

(8,242) |

15.5 |

|

(607) |

(724) |

16.1 |

|

(89,665) |

(82,088) |

9.2 |

2.7 |

| Gross profit |

183,561 |

178,573 |

2.8 |

|

80,673 |

114,109 |

(29.3) |

(41.3) |

|

30,101 |

29,618 |

1.6 |

|

(6,050) |

(3,985) |

51.8 |

|

288,285 |

318,315 |

(9.4) |

(13.7) |

| % of Net sales |

43.0 |

44.8 |

(176) bps |

|

45.4 |

50.2 |

(482) bps |

(598) bps |

|

40.3 |

40.9 |

(66) bps |

|

|

|

|

|

43.3 |

46.4 |

(306) bps |

(342) bps |

| MSD&A |

(144,894) |

(147,453) |

(1.7) |

|

(86,719) |

(99,375) |

(12.7) |

(26.5) |

|

(20,966) |

(21,036) |

(0.3) |

|

(1,881) |

456 |

<(500) |

|

(254,461) |

(267,407) |

(4.8) |

(10.0) |

| % of Net sales |

34.0 |

37.0 |

(302) bps |

|

48.8 |

43.7 |

506 bps |

446 bps |

|

28.0 |

29.1 |

(102) bps |

|

|

|

|

|

38.2 |

38.9 |

(72) bps |

(130) bps |

| Other operating income/(expenses) |

714 |

271 |

163.5 |

|

(1,680) |

(101) |

<(500) |

(205.6) |

|

141 |

(153) |

(192.0) |

|

630 |

148 |

326.1 |

|

(195) |

164 |

(218.9) |

>500 |

| EBIT |

39,381 |

31,391 |

25.5 |

|

(7,726) |

14,633 |

(152.8) |

(143.1) |

|

9,275 |

8,428 |

10.0 |

|

(7,302) |

(3,380) |

116.0 |

|

33,629 |

51,072 |

(34.2) |

(31.4) |

| EBIT margin |

9.2 |

7.9 |

136 bps |

|

(4.3) |

6.4 |

(1,078) bps |

(1,059) bps |

|

12.4 |

11.6 |

76 bps |

|

|

|

|

|

5.1 |

7.4 |

(239) bps |

(196) bps |

| EBITDA |

59,880 |

52,618 |

13.8 |

|

3,954 |

25,785 |

(84.7) |

(80.6) |

|

12,521 |

11,606 |

7.9 |

|

(5,924) |

(3,666) |

(61.6) |

|

70,431 |

86,344 |

(18.4) |

(17.2) |

| EBITDA margin |

14.0 |

13.2 |

84 bps |

|

2.2 |

11.3 |

(912) bps |

(804) bps |

|

16.7 |

16.0 |

71 bps |

|

|

|

|

|

10.6 |

12.6 |

(200) bps |

(140) bps |

| 3Q24 PRESS RELEASE |  |

| | |

| Exhibit 4: Segment Information (Nine months ended on September 30, 2024) |

| |

1. Chile Operating segment |

|

2. International Business Operating segment |

|

3. Wine Operating segment |

|

4. Other/eliminations |

|

Total |

| YTD as of September |

|

|

|

|

| (In ThHL or CLP million unless stated otherwise) |

2024 |

2023 |

YoY % |

|

2024 |

2023 |

YoY % |

Organic

YoY % |

|

2024 |

2023 |

YoY % |

|

2024 |

2023 |

YoY % |

|

2024 |

2023 |

YoY % |

Organic

YoY % |

| |

|

|

|

|

| Volumes |

16,129 |

16,501 |

(2.3) |

|

5,859 |

6,360 |

(7.9) |

(21.1) |

|

1,022 |

1,007 |

1.5 |

|

(57) |

(63) |

(10.1) |

|

22,953 |

23,805 |

(3.6) |

(7.1) |

| Net sales |

1,283,967 |

1,262,745 |

1.7 |

|

483,089 |

567,277 |

(14.8) |

(19.5) |

|

205,664 |

189,396 |

8.6 |

|

(36,231) |

(26,469) |

36.9 |

|

1,936,489 |

1,992,949 |

(2.8) |

(4.1) |

| Net sales (CLP/HL) |

79,606 |

76,523 |

4.0 |

|

82,453 |

89,198 |

(7.6) |

2.1 |

|

201,295 |

188,155 |

7.0 |

|

|

|

|

|

84,368 |

83,721 |

0.8 |

3.2 |

| Cost of sales |

(716,946) |

(686,965) |

4.4 |

|

(266,762) |

(278,597) |

(4.2) |

(8.8) |

|

(124,093) |

(120,539) |

2.9 |

|

21,837 |

15,827 |

38.0 |

|

(1,085,964) |

(1,070,274) |

1.5 |

0.3 |

| % of Net sales |

55.8 |

54.4 |

144 bps |

|

55.2 |

49.1 |

611 bps |

653 bps |

|

60.3 |

63.6 |

(331) bps |

|

|

|

|

|

56.1 |

53.7 |

238 bps |

249 bps |

| Direct costs |

(575,052) |

(553,273) |

3.9 |

|

(184,529) |

(202,868) |

(9.0) |

(12.6) |

|

(95,681) |

(95,374) |

0.3 |

|

23,660 |

16,907 |

39.9 |

|

(831,602) |

(834,608) |

(0.4) |

(1.2) |

| Manufacturing costs |

(141,894) |

(133,693) |

6.1 |

|

(82,233) |

(75,729) |

8.6 |

1.6 |

|

(28,412) |

(25,165) |

12.9 |

|

(1,823) |

(1,079) |

68.8 |

|

(254,362) |

(235,666) |

7.9 |

5.7 |

| Gross profit |

567,020 |

575,780 |

(1.5) |

|

216,327 |

288,680 |

(25.1) |

(29.8) |

|

81,571 |

68,857 |

18.5 |

|

(14,394) |

(10,641) |

35.3 |

|

850,525 |

922,675 |

(7.8) |

(9.3) |

| % of Net sales |

44.2 |

45.6 |

(144) bps |

|

44.8 |

50.9 |

(611) bps |

(653) bps |

|

39.7 |

36.4 |

331 bps |

|

|

|

|

|

43.9 |

46.3 |

(238) bps |

(249) bps |

| MSD&A |

(446,605) |

(437,059) |

2.2 |

|

(244,220) |

(255,568) |

(4.4) |

(9.8) |

|

(61,735) |

(56,809) |

8.7 |

|

(5,554) |

(4,865) |

14.2 |

|

(758,114) |

(754,300) |

0.5 |

(1.3) |

| % of Net sales |

34.8 |

34.6 |

17 bps |

|

50.6 |

45.1 |

550 bps |

540 bps |

|

30.0 |

30.0 |

2 bps |

|

|

|

|

|

39.1 |

37.8 |

130 bps |

112 bps |

| Other operating income/(expenses) |

1,523 |

(590) |

358.1 |

|

(1,300) |

(19) |

<(500) |

468.3 |

|

482 |

164 |

194.7 |

|

31,871 |

315 |

>500 |

|

32,576 |

(130) |

>500 |

>500 |

| EBIT |

121,938 |

138,131 |

(11.7) |

|

(29,193) |

33,093 |

(188.2) |

(183.9) |

|

20,318 |

12,211 |

66.4 |

|

11,923 |

(15,191) |

(178.5) |

|

124,987 |

168,245 |

(25.7) |

(24.9) |

| EBIT margin |

9.5 |

10.9 |

(144) bps |

|

(6.0) |

5.8 |

(1,188) bps |

24 bps |

|

9.9 |

6.4 |

343 bps |

|

|

|

|

|

6.5 |

8.4 |

(199) bps |

(182) bps |

| EBITDA |

183,200 |

196,485 |

(6.8) |

|

5,679 |

63,468 |

(91.1) |

(89.4) |

|

29,607 |

21,645 |

36.8 |

|

14,829 |

(12,752) |

(216.3) |

|

233,316 |

268,846 |

(13.2) |

(12.8) |

| EBITDA margin |

14.3 |

15.6 |

(129) bps |

|

1.2 |

11.2 |

(1,001) bps |

(971) bps |

|

14.4 |

11.4 |

297 bps |

|

|

|

|

|

12.0 |

13.5 |

(144) bps |

(122) bps |

| Excluding the non-recurring effect of the sale of a portion of land in Chile in 2Q24(4) |

| EBIT |

121,938 |

138,131 |

(11.7) |

|

(29,193) |

33,093 |

(188.2) |

(183.9) |

|

20,318 |

12,211 |

66.4 |

|

(16,746) |

(15,191) |

(10.2) |

|

96,318 |

168,245 |

(42.8) |

(41.9) |

| EBITDA |

183,200 |

196,485 |

(6.8) |

|

5,679 |

63,468 |

(91.1) |

(89.4) |

|

29,607 |

21,645 |

36.8 |

|

(13,839) |

(12,752) |

(8.5) |

|

204,647 |

268,846 |

(23.9) |

(23.5) |

| 3Q24 PRESS RELEASE |  |

| | |

| Exhibit 5: Balance Sheet |

|

|

| |

September 30 |

December 31 |

| |

2024 |

2023 |

| |

(CLP million) |

| ASSETS |

|

|

| Cash and cash equivalents |

599,279 |

618,154 |

| Other current assets |

967,354 |

983,529 |

| Total current assets |

1,566,633 |

1,601,683 |

| |

|

|

| PP&E (net) |

1,453,173 |

1,273,988 |

| Other non current assets |

639,689 |

548,275 |

| Total non current assets |

2,092,861 |

1,822,263 |

| Total assets |

3,659,495 |

3,423,946 |

| |

|

|

| LIABILITIES |

|

|

| Short term financial debt |

186,689 |

114,294 |

| Other liabilities |

572,762 |

573,189 |

| Total current liabilities |

759,451 |

687,483 |

| |

|

|

| Long term financial debt |

1,222,845 |

1,268,308 |

| Other liabilities |

153,879 |

130,773 |

| Total non current liabilities |

1,376,724 |

1,399,081 |

| Total Liabilities |

2,136,175 |

2,086,564 |

| |

|

|

| EQUITY |

|

|

| Paid-in capital |

562,693 |

562,693 |

| Other reserves |

(78,142) |

(240,200) |

| Retained earnings |

928,702 |

895,872 |

| Total equity attributable to equity holders of the parent |

1,413,253 |

1,218,365 |

| Non - controlling interest |

110,067 |

119,018 |

| Total equity |

1,523,320 |

1,337,383 |

| Total equity and liabilities |

3,659,495 |

3,423,946 |

| |

|

|

| OTHER FINANCIAL INFORMATION |

|

|

| |

|

|

| Total Financial Debt |

1,409,534 |

1,382,602 |

| |

|

|

| Net Financial Debt |

810,255 |

764,448 |

| |

|

|

| Liquidity ratio |

2.06 |

2.33 |

| Total Financial Debt / Capitalization |

0.48 |

0.51 |

| Net Financial Debt / EBITDA |

2.36 |

2.01 |

| 3Q24 PRESS RELEASE |  |

| | |

| Exhibit 6: Summary of the Statement of Cash Flow |

|

|

| Third Quarter |

2024 |

2023 |

| |

(CLP million) |

| Cash and cash equivalents at beginning of the period |

636,539 |

591,015 |

| Net cash inflows from operating activities |

46,670 |

58,608 |

| Net cash (outflow) from investing activities |

(32,734) |

(51,157) |

| Net cash (outflow) flow from financing activities |

(22,730) |

(19,060) |

| Net (decrease) increase in cash and cash equivalents |

(8,794) |

(11,610) |

| Effects of exchange rate changes on cash and cash equivalents |

(28,466) |

47,120 |

| Increase (decrease) in cash and cash equivalents |

(37,260) |

35,510 |

| Cash and cash equivalents at end of the period |

599,279 |

626,526 |

| |

|

|

| YTD September |

2024 |

2023 |

| |

(CLP million) |

| Cash and cash equivalents at beginning of the year |

618,154 |

597,082 |

| Net cash inflows from operating activities |

133,354 |

205,681 |

| Net cash (outflow) from investing activities |

(78,008) |

(111,051) |

| Net cash (outflow) flow from financing activities |

(67,176) |

(58,930) |

| Net (decrease) increase in cash and cash equivalents |

(11,830) |

35,700 |

| Effects of exchange rate changes on cash and cash equivalents |

(7,045) |

(6,256) |

| Increase (decrease) in cash and cash equivalents |

(18,875) |

29,444 |

| Cash and cash equivalents at end of the period |

599,279 |

626,526 |

| Exhibit 7: Impact on quarterly EBITDA and EBIT from the application of IAS 29 from IFRS in accumulated results in Argentina |

| |

|

| Third Quarter |

2024 |

2023 |

| (CLP million) |

| Consolidated EBITDA |

70,431 |

86,344 |

| Impact of IAS 29 in accumulated results in Argentina |

(22) |

3,296 |

| Impact of IAS 29 in the International Business Operating segment |

(1) |

3,208 |

| Impact of IAS 29 in the Wine Operating segment |

(21) |

88 |

| Consolidated EBITDA excluding the impact of IAS 29 |

70,453 |

83,047 |

| |

|

|

| |

|

| Third Quarter |

2024 |

2023 |

| (CLP million) |

| Consolidated EBIT |

33,629 |

51,072 |

| Impact of IAS 29 in accumulated results in Argentina |

102 |

1,853 |

| Impact of IAS 29 in the International Business Operating segment |

118 |

1,835 |

| Impact of IAS 29 in the Wine Operating segment |

(16) |

18 |

| Consolidated EBIT excluding the impact of IAS 29 |

33,527 |

49,218 |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

| |

/s/ Felipe Dubernet |

| |

Chief Financial Officer |

|

|

Date: November 6, 2024

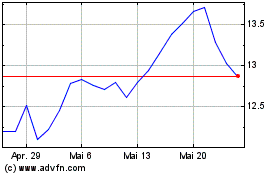

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024