UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. __)*

Bright Scholar Education Holdings Limited

(Name of Issuer)

Class A Ordinary Shares, par value $0.00001

per share

Class B Ordinary Shares, par value $0.00001

per share

(Title of Class of Securities)

109199208**

(CUSIP Number)

Excellence Education Investment Limited

Telephone: + 86 757 2666 2233

No.1, Country Garden Road

Beijiao Town, Shunde District

Foshan, Guangdong 528300

The People’s Republic of China

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 18, 2024

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to

be sent.

| * | The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

| ** | CUSIP number 109199208 has been assigned

to the American Depositary Shares (“ADSs”) of the issuer, which are quoted on the New York Stock Exchange under the

symbol “BEDU.” Each ADS represents four Class A Ordinary Shares of the issuer. No CUSIP number has been assigned to Ordinary

Shares of the issuer. |

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 109199208

| 1 |

NAME OF REPORTING PERSONS

Excellence Education Investment Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

72,590,000 Class B Ordinary Shares(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

72,590,000 Class B Ordinary Shares(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

72,590,000 Class B Ordinary Shares(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (See Instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

61.0% of the Class B Ordinary Shares(2)

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| (1) | Excellence

Education Investment Limited has shared voting and dispositive power over the Issuer’s 72,590,000 Class B Ordinary Shares directly

held by it. |

| (2) | The

percentage of the Class A Ordinary Shares beneficially owned by Excellence Education Investment Limited is calculated on an as-converted

basis based on 31,314,817 Class A ordinary shares and 87,590,000 Class B ordinary shares outstanding as of November 30, 2023, assuming

conversion of all Class B Ordinary Shares into Class A Ordinary Shares. |

CUSIP No. 109199208

| 1 |

NAME OF REPORTING PERSONS

Ultimate Wise Group Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

451,559 Class A Ordinary Shares(1)

15,000,000 Class B Ordinary Shares(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

451,559 Class A Ordinary Shares(1)

15,000,000 Class B Ordinary Shares(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

451,559 Class A Ordinary Shares(1)

15,000,000 Class B Ordinary Shares(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (See Instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.0%(2)

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| (1) | Ultimate Wise Group

Limited has shared voting and dispositive power over the Issuer’s 451,559 Class A Ordinary Shares and 15,000,000 Class B Ordinary

Shares directly held by it. |

| (2) | The

percentage of the Class A Ordinary Shares beneficially owned by Ultimate Wise Group Limited is calculated on an as-converted basis based

on 31,314,817 Class A ordinary shares and 87,590,000 Class B ordinary shares outstanding as of November 30, 2023, assuming conversion

of all Class B Ordinary Shares into Class A Ordinary Shares. |

CUSIP No. 109199208

| 1 |

NAME OF REPORTING PERSONS

Noble Pride Global Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (See Instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

74.0%(2)

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| (1) |

Noble Pride Global Limited has shared voting and dispositive power over the Issuer’s 451,559 Class A Ordinary Shares and 15,000,000 Class B Ordinary Shares directly held by Ultimate Wise Group Limited and 72,590,000 Class B Ordinary Shares directly held by Excellence Education Investment Limited, both of which are its wholly owned subsidiaries. |

| (2) |

The percentage of the Class A Ordinary Shares beneficially owned by Noble Pride Global Limited is calculated on an as-converted basis based on 31,314,817 Class A ordinary shares and 87,590,000 Class B ordinary shares outstanding as of November 30, 2023, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares. |

CUSIP No. 109199208

| 1 |

NAME OF REPORTING PERSONS

Yeung Family Trust V |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Jersey |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (See Instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

74.0%(2)

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

| (1) |

TMF Trust (HK) Limited, in its capacity as the trustee of Yeung Family

Trust V, is the sole shareholder of Noble Pride Global Limited. Therefore, Yeung Family Trust V has shared voting and dispositive power over the Issuer’s 451,559 Class A Ordinary Shares and 15,000,000 Class B Ordinary Shares directly held by Ultimate Wise Group Limited and 72,590,000 Class B Ordinary Shares directly held by Excellence Education Investment Limited, both of which are wholly owned subsidiaries of Noble Pride Global Limited. |

| (2) |

The percentage of the Class A Ordinary Shares beneficially owned by Yeung Family Trust V is calculated on an as-converted basis based on 31,314,817 Class A ordinary shares and 87,590,000 Class B ordinary shares outstanding as of November 30, 2023, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares. |

CUSIP No. 109199208

| 1 |

NAME OF REPORTING PERSONS

TMF Trust (HK) Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See Instructions)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Hong Kong |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

451,559 Class A Ordinary Shares(1)

87,590,000 Class B Ordinary Shares(1)

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (See Instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

74.0%(2)

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| (1) |

TMF Trust (HK) Limited, in its capacity as the trustee of Yeung Family

Trust V, is the sole shareholder of Noble Pride Global Limited, and therefore is deemed to have shared voting and dispositive power over the Issuer’s 451,559 Class A Ordinary Shares and 15,000,000 Class B Ordinary Shares directly held by Ultimate Wise Group Limited and 72,590,000 Class B Ordinary Shares directly held by Excellence Education Investment Limited. Both of Ultimate Wise Group Limited and Excellence Education Investment Limited are wholly owned subsidiaries of Noble Pride Global Limited. |

| (2) |

The percentage of the Class A Ordinary Shares beneficially owned by TMF Trust (HK) Limited is calculated on an as-converted basis based on 31,314,817 Class A ordinary shares and 87,590,000 Class B ordinary shares outstanding as of November 30, 2023, assuming conversion of all Class B Ordinary Shares into Class A Ordinary Shares. |

Item 1. Security and Issuer.

This statement on Schedule 13D (this “Schedule

13D”) relates to Class A ordinary shares, par value $0.00001 per share (the “Class A Ordinary Shares”)

and Class B ordinary shares, par value $0.00001 per share (the “Class B Ordinary Shares”) of Bright Scholar

Education Holdings Limited, a Cayman Islands exempted company (the “Issuer”). The address of the principal executive

offices of the Issuer is No.1, Country Garden Road, Beijiao Town, Shunde District, Foshan, Guangdong 528300, China.

The Issuer’s American depositary shares

(the “ADSs”), each representing four Class A Ordinary Share, are listed on the New York Stock Exchange under the symbol

“BEDU.” As used in this Schedule 13D, the term “Ordinary Shares” includes Class A Ordinary Shares and Class

B Ordinary Shares.

Item 2. Identity and Background.

This Schedule is being jointly filed by the following

persons pursuant to Rule 13d-1(k) promulgated under the Securities Exchange Act of 1934, as amended:

| |

1) |

Excellence Education Investment Limited (“Excellence Education”), a company incorporated and existing under the laws of the British Virgin Islands, with its registered address at Commerce House, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British Virgin Islands, and its principal business in investment holding; |

| |

2) |

Ultimate Wise Group Limited (“Ultimate Wise”), a company incorporated and existing under the laws of the British Virgin Islands, with its registered address at Trident Chambers, P.O. Box 146, Road Town, Tortola, British Virgin Islands, and its principal business in investment holding; |

| |

3) |

Noble Pride Global Limited (“Noble Pride”), a company incorporated and existing under the laws of the British Virgin Islands, with its registered address at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands, and its principal business in investment holding; |

| |

4) |

Yeung

Family Trust V, an irrevocable discretionary trust established under the laws of Jersey, with its trustee’s business address

at 31/F, Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong and principal business in investment holding; and |

| |

5) |

TMF Trust (HK) Limited (“TMF Trust”), a company incorporated and existing under the laws of Hong Kong, with its principal business address at 31/F, Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong, and its principal business in trustee services. |

Excellence Education, Ultimate Wise, Noble Pride,

Yeung Family Trust V and TMF Trust are collectively referred to as “Reporting Persons.”

The name, business address, present principal

occupation or employment and citizenship of the directors, executive officers and control persons of the Reporting Persons as of the date

hereof is set forth on Schedule A.

Ultimate Wise and Excellence Education are the

record holders of the Ordinary Shares reported on this Schedule 13D. Noble Pride is the sole shareholder of each of Ultimate Wise and

Excellence Education. TMF Trust, in its capacity as the trustee of Yeung Family Trust V,

is the sole shareholder of Noble Pride.

None of the Reporting Persons and, to the best

of their knowledge, the persons listed on Schedule A hereto, has, during the last five years, been

(i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of

a judicial or administrative body of competent jurisdiction or subject to any judgment, decree or final order finding any violation of

federal or state securities laws or enjoining future violations of, or prohibiting or mandating activities subject to, such laws.

The Reporting Persons previously reported their

beneficial ownership in the Issuer’s Ordinary Shares on Schedule 13D filed with the U.S. Securities and Exchange Commission (the

“Commission”) on December 31, 2018, as amended and supplemented by the Amendment No. 1 filed with the Commission on

January 15, 2019, the Amendment No. 2 filed with the Commission on February 19, 2019, the Amendment No.3 filed with the Commission on

May 2, 2022, and the Amendment No. 4 filed with the Commission on January 3, 2023.

Item 3. Source and Amount of Funds or Other Consideration.

On December 19, 2018, Ms. Meirong Yang, by way

of gift, transferred 100 ordinary shares of par value US$0.0001 each in the capital stock of Excellence Education, which represents the

entire issued share capital of Excellence Education, to Noble Pride, a company directly and wholly owned by Yeung Family Trust V.

On December 19, 2018, Ms. Huiyan Yang, by way

of gift, transferred one ordinary share of par value US$1.00 each in the capital stock of Ultimate Wise, which represents its entire issued

share capital stock, to Noble Pride, a company directly and wholly owned by Yeung Family Trust V.

On January 8, 2019, Concrete Win Limited, for nil consideration, transferred

451,559 Class A Ordinary Shares of the Issuer to Ultimate Wise, a company directly and wholly owned by Noble Pride.

Item 4. Purpose of Transaction.

Yeung Family Trust V was established for succession

planning purposes. Ms. Meirong Yang and Ms. Huiyan Yang, a relative of hers, are the joint settlors of Yeung Family Trust V. Prior to

July 18, 2024, Ms. Meirong Yang and Ms. Huiyan Yang were also the members of the two-person investment committee of Yeung Family

Trust V.

On July 18, 2024, to the composition of the investment

committee of Yeung Family Trust V was restructured. Ms. Huiyan Yang resigned from the committee, and Mr. Hongru Zhou and Mr. Ruolei Niu

were appointed as new members. The investment committee currently consists of three members: Ms. Meirong Yang, Mr. Hongru Zhou, and Mr.

Ruolei Niu. Each member has one vote on the investment committee. The investment committee retains the sole power to vote the Ordinary

Shares beneficially owned by Yeung Family Trust V or direct the trustee of Yeung Family Trust V to vote such shares.

The Reporting Persons acquired the Ordinary Shares

reported herein for investment purposes. The Reporting Persons may, from time to time, make additional purchases of Ordinary Shares or

ADSs either in the open market or in privately-negotiated transactions, depending upon the Reporting Persons’ evaluation of the

Issuer’s business, prospects and financial condition, the market for the Ordinary Shares and the ADSs, other opportunities available

to the Reporting Persons, general economic conditions, stock market conditions and other factors. Depending upon the factors noted above,

the Reporting Persons may also decide to hold or dispose of all or part of their investments in Ordinary Shares and/or enter into derivative

transactions with institutional counterparties with respect to the Issuer’s securities, including the Ordinary Shares and the ADSs.

Except as set forth in this Item 4 or Item 6 below,

the Reporting Persons have no present plans or proposals that relate to or that would result in any of the actions specified in clauses

(a) through (j) of Item 4 of Schedule 13D of the Act.

Item 5. Interest in Securities of the Issuer

(a) See Items 11 and 13 of the cover pages to

this Schedule for the aggregate number and percentage of Ordinary Shares that are beneficially owned by each Reporting Person as of the

date hereof.

(b) See Items 7 through 10 of the cover pages

to this Schedule for the number of Ordinary Shares that are beneficially owned by each Reporting Person as of the date hereof as to which

there is sole or shared power to vote or direct the vote, and sole or shared power to dispose or direct the disposition.

(c) Except as set forth herein, to the knowledge

of the Reporting Persons with respect to the persons named in response to Item 5(a), none of the persons named in response to Item 5(a)

has effected any transactions in the Ordinary Shares during the past 60 days.

(d) No person other than the Reporting Persons

is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, any securities

owned by any of the Reporting Persons.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The information set forth in or incorporated

by reference in Items 3, 4 and 5 of this Schedule 13D is incorporated by reference into this Item 6.

Item

7. Material to be Filed as Exhibits.

SIGNATURE

After reasonable inquiry and to the

best of its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Date: July 31, 2024

| |

EXCELLENCE EDUCATION INVESTMENT LIMITED |

| |

|

| |

By: |

/s/ Meirong Yang |

| |

Name: |

Meirong Yang |

| |

Title: |

Director |

| |

|

|

| |

ULTIMATE WISE GROUP LIMITED |

| |

|

| |

By: |

/s/ Huiyan Yang |

| |

Name: |

Huiyan Yang |

| |

Title: |

Director |

| |

|

|

| |

NOBLE PRIDE GLOBAL LIMITED |

| |

|

| |

By: |

/s/ YEU Chi Fai |

| |

Name: |

YEU Chi Fai |

| |

Title: |

Authorized Signatory of S.B. Vanwall Ltd., the Sole Director of Noble Pride Global Limited |

| |

|

|

| |

YEUNG FAMILY TRUST V |

| |

|

| |

By: |

/s/ YEU Chi Fai, HUI Wai Ling |

| |

Name: |

YEU Chi Fai, HUI Wai Ling |

| |

Title: |

Authorized Signatories of TMF Trust (HK) Limited, the trustee of Yeung Family Trust V |

| |

|

|

| |

TMF TRUST (HK) LIMITED |

| |

|

| |

By: |

/s/ YEU Chi Fai, HUI Wai Ling |

| |

Name: |

YEU Chi Fai, HUI Wai Ling |

| |

Title: |

Authorized Signatories |

SCHEDULE A

Excellence Education Investment Limited

Director |

|

Business

Address |

|

Present

Principal Employment |

|

Citizenship |

| Meirong Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Director of Excellence Education Investment Limited |

|

PRC |

| Junchun Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Director of Excellence Education Investment Limited and director of Ultimate Wise Group Limited |

|

Macau |

Ultimate Wise Group Limited

| |

|

|

|

|

|

|

Director |

|

Business

Address |

|

Present

Principal Employment |

|

Citizenship |

| Huiyan

Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Chairman and executive

director of Country Garden Holdings Company Limited; chairman and non-executive director of Country Garden Services Holdings Company

Limited |

|

Hong Kong |

| Junchun

Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Director of Excellence Education Investment Limited and director of Ultimate Wise Group Limited |

|

Macau |

Noble Pride Global Limited

| |

|

|

|

|

|

|

|

Director |

|

Business Address |

|

Present Principal Employment |

|

Citizenship |

| S.B. Vanwall Ltd. |

|

31/F., Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong |

|

Director of Noble Pride Global Limited |

|

British Virgin Islands |

Yeung Family Trust V

| |

|

|

|

|

|

|

Joint Settlor |

|

Business

Address |

|

Present

Principal Employment |

|

Citizenship |

| Huiyan Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Chairman and executive

director of Country Garden Holdings Company Limited; chairman and non-executive director of Country Garden Services Holdings Company

Limited |

|

Hong Kong |

| Meirong Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Director of Excellence Education Investment Limited |

|

PRC |

Member of Investment Committee |

|

Business

Address |

|

Present

Principal Employment |

|

Citizenship |

| Meirong Yang |

|

No.1, Country Garden Road,

Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Director of Excellence Education Investment Limited |

|

PRC |

| Hongru Zhou |

|

c/o Bright Scholar Education

Holdings Limited, No.1, Country Garden Road, Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Chairperson of the Board

of Director and Chief Executive Officer of Bright Scholar Education Holdings Limited |

|

PRC |

| Ruolei Niu |

|

c/o Bright Scholar Education

Holdings Limited, No.1, Country Garden Road, Beijiao Town, Shunde District, Foshan, Guangdong 528300, China |

|

Chief Financial Officer of Bright Scholar Education Holdings Limited |

|

Hong Kong |

TMF Trust (HK) Limited

| |

|

|

|

|

|

|

|

Directors |

|

Business Address |

|

Present Principal Employment |

|

Citizenship |

| CHAN Ki |

|

c/o TMF Trust (HK) Limited, 31/F., Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong |

|

Director of TMF Trust (HK) Limited |

|

Hong Kong |

| |

|

|

|

|

CHOA Kin Wai

|

|

c/o TMF Trust (HK) Limited, 31/F., Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong |

|

Director of TMF Trust (HK) Limited |

|

Hong Kong |

| |

|

|

|

|

CHOW Tsz Kwan

|

|

c/o TMF Trust (HK) Limited, 31/F., Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong |

|

Director of TMF Trust (HK) Limited |

|

Hong Kong |

| |

|

|

|

|

|

|

|

Arno WIEDIJK

|

|

c/o TMF Trust (HK) Limited, 31/F., Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong |

|

Director of TMF Trust (HK) Limited |

|

Nederlandse |

| |

|

|

|

|

|

|

| Wiebe WIJNIA |

|

c/o TMF Trust (HK) Limited, 31/F., Tower Two, Times Square, 1 Matheson Street, Causeway Bay, Hong Kong |

|

Director of TMF Trust (HK) Limited |

|

Nederlandse |

12

Exhibit 99.1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) promulgated under the Securities Exchange

Act of 1934, as amended, the undersigned hereby agree to the joint filing with all other Reporting Persons (as such term is defined in

the Schedule 13D referred to below) on behalf of each of them of a statement on Schedule 13D (including amendments thereto) with respect

to the Class A ordinary shares (including the Class A ordinary shares represented by ADSs), par value of $0.00001 per share, and Class

B ordinary shares, par value of $0.00001 per share, of Bright Scholar Education Holdings Limited, a Cayman Islands company, and that this

Agreement may be included as an Exhibit to such joint filing. This Agreement may be executed in any number of counterparts, all of which

taken together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the undersigned hereby execute this Agreement as

of July 26, 2024.

[Signature page to follow]

| EXCELLENCE EDUCATION INVESTMENT LIMITED |

|

| |

|

|

| By: |

/s/ Meirong Yang |

|

| Name: |

Meirong Yang |

|

| Title: |

Director |

|

| |

|

|

| ULTIMATE WISE GROUP LIMITED |

|

| |

|

|

| By: |

/s/ Huiyan Yang |

|

| Name: |

Huiyan Yang |

|

| Title: |

Director |

|

| |

|

|

| NOBLE PRIDE GLOBAL LIMITED |

|

| |

|

|

| By: |

/s/ YEU Chi Fai |

|

| Name: |

YEU Chi Fai |

|

| Title: |

Authorized Signatory of S.B. Vanwall Ltd., the Sole Director of Noble Pride Global Limited |

|

| |

|

|

| YEUNG FAMILY TRUST V |

|

| |

|

|

| By: |

/s/ YEU Chi Fai, HUI Wai Ling |

|

| Name: |

YEU Chi Fai, HUI Wai Ling |

|

| Title: |

Authorized Signatories of TMF Trust (HK) Limited, the trustee of Yeung Family Trust V |

|

| |

|

|

| TMF TRUST (HK) LIMITED |

|

| |

|

|

| By: |

/s/ YEU Chi Fai, HUI Wai Ling |

|

| Name: |

YEU Chi Fai, HUI Wai Ling |

|

| Title: |

Authorized Signatories |

|

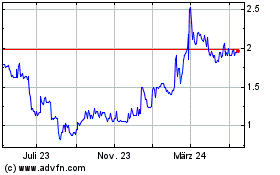

Bright Scholar Education (NYSE:BEDU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

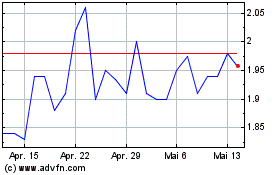

Bright Scholar Education (NYSE:BEDU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024