Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

12 Februar 2024 - 11:14PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration No. 333-276975

$2,000,000,000

AMERICAN EXPRESS COMPANY

$1,700,000,000

5.098% Fixed-to-Floating Rate Notes due February 16, 2028

$300,000,000

Floating Rate Notes due February 16, 2028

Terms and Conditions Applicable to all Notes

| Issuer: |

American Express Company |

| Expected Ratings(1): |

A2/BBB+/A (Stable/Stable/Stable) (Moody’s/S&P/Fitch) |

| Ranking: |

Senior Unsecured |

| Trade Date: |

February 12, 2024 |

| Settlement Date: |

February 16, 2024 (T+4). Pursuant to Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on any date prior to two business days before delivery will be required, by virtue of the fact that the Notes are initially expected to settle in T+4, to specify alternative settlement arrangements to prevent a failed settlement. |

| Total Net Proceeds to American Express Company: |

$1,995,000,000 (before expenses) |

| Use of Proceeds: |

The issuer intends to use the net proceeds from this offering for general corporate purposes. |

| Listing: |

The Notes will not be listed on any exchange. |

| Minimum Denominations/Multiples: |

Minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| Joint Book-Running Managers: |

RBC Capital Markets, LLC

BofA Securities, Inc.

Mizuho Securities USA LLC

|

| Co-Managers: |

BNP Paribas Securities Corp.

Lloyds Securities Inc.

Mischler Financial Group, Inc.

SG Americas Securities, LLC |

| Junior Co-Managers: |

Drexel Hamilton, LLC

Siebert Williams Shank & Co., LLC

|

| Risk Factors: |

Investing in the Notes involves risks. You should carefully consider the information under “Risk Factors” beginning on page 3 of the base prospectus (as defined below) and in the issuer’s Annual Report on Form 10-K for the year ended December 31, 2023 and the other information incorporated by reference in the base prospectus. |

Terms

and Conditions Applicable to the 5.098% Fixed-to-Floating Rate Notes due February 16, 2028

| |

|

| Maturity Date: |

February 16, 2028 |

| |

|

| Par Amount: |

$1,700,000,000 |

| |

|

| Benchmark Treasury: |

UST

4.125% due February 15, 2027

|

| |

|

| Benchmark Treasury Price and Yield: |

99-21; 4.248% |

| |

|

| Re-offer Spread to Benchmark: |

+85 bps |

| |

|

| Re-offer Yield: |

5.098% |

| |

|

| Interest Rates: |

The Notes will bear interest (i) during the Fixed Rate Period at a fixed rate per annum equal to 5.098%, and (ii) during the Floating Rate Period at a floating rate per annum equal to Compounded SOFR (determined in accordance with the provisions set forth in the base prospectus) plus 1.000%. |

| |

|

| Fixed Rate Period: |

From, and including, the Settlement Date to, but excluding, February 16, 2027 |

| |

|

| Floating Rate Period: |

From, and including, February 16, 2027 to, but excluding, the Maturity Date |

| |

|

| Public Offering Price: |

100.000% |

| |

|

| Underwriters’ Discount: |

0.250% |

| |

|

| Net Proceeds to American Express Company: |

$1,695,750,000 (before expenses) |

| |

|

| Interest Payment Dates: |

(i) With respect to the Fixed Rate Period, February 16 and August 16 of each year, beginning August 16, 2024 and ending on February 16, 2027, and (ii) with respect to the Floating Rate Period, February 16, May 16, August 16 and November 16, beginning May 16, 2027 and ending on the Maturity Date. |

| |

|

| Interest Periods: |

Semi-annually in arrears during the Fixed Rate Period and quarterly in arrears during the Floating Rate Period. |

| |

|

| Floating Rate Interest Determination Dates: |

Two U.S. Government Securities Business Days preceding each Floating Rate Interest Payment Date (or in the final Floating Rate Interest Period, preceding the Maturity Date, or in the case of the redemption of any Notes, preceding the Redemption Date). |

| |

|

| Business Day Convention |

Fixed Rate Period: Following Unadjusted Business Day Convention

Floating Rate Period: Modified Following Adjusted Business Day Convention,

except Following Unadjusted Business Day Convention for the Maturity Date and any Redemption Date. |

| |

|

| Day Count: |

Fixed Rate Period: 30 / 360

Floating Rate Period: Actual / 360 |

| |

|

| Optional Redemption: |

(i) In whole but not in part on February 16, 2027 or (ii) in whole or in part during the 31-day period prior to the Maturity Date, in each case at a redemption price equal to the principal amount of the Notes being redeemed, together with any accrued and unpaid interest thereon to, but excluding, the date fixed for redemption. |

| |

|

| CUSIP: |

025816 DP1 |

| |

|

| ISIN: |

US025816DP17 |

Terms

and Conditions Applicable to the Floating Rate Notes due February 16, 2028

| Maturity Date: |

February 16, 2028 |

| Par Amount: |

$300,000,000 |

| Base Rate: |

Compounded SOFR (as determined in accordance with the provisions set forth in the base prospectus). |

| Spread: |

+100 bps |

| Public Offering Price: |

100.000% |

| Underwriters’ Discount: |

0.250% |

| Net Proceeds to American Express Company: |

$299,250,000 (before expenses) |

| Interest Payment Dates: |

February 16, May 16, August 16 and November 16 of each year, beginning May 16, 2024. |

| Interest Periods: |

Quarterly. The initial period will be the period from, and including the Settlement Date to, but excluding, May 16, 2024, the initial Interest Payment Date. The subsequent interest periods will be the periods from, and including the applicable Interest Payment Date to, but excluding, the next Interest Payment Date or the Maturity Date, as applicable. |

| Interest Determination Dates: |

Two U.S. Government Securities Business Days preceding each Interest Payment Date (or in the final Interest Period, preceding the Maturity Date, or in the case of the redemption of any Notes, preceding the Redemption Date). |

| Business Day Convention |

Modified Following Adjusted Business Day Convention, except Following Unadjusted Business Day Convention for the Maturity Date and any Redemption Date. |

| Day Count: |

Actual / 360 |

| Optional Redemption: |

(i) In whole but not in part on February 16, 2027 or (ii) in whole or in part during the 31-day period prior to the Maturity Date, in each case at a redemption price equal to the principal amount of the Notes being redeemed, together with any accrued and unpaid interest thereon to, but excluding, the date fixed for redemption. |

| CUSIP: |

025816 DQ9 |

| ISIN: |

US025816DQ99 |

(1)

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating agencies base

their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate.

The rating of the Notes should be evaluated independently from similar ratings of other securities. A credit rating of a security is

not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any

time by the assigning rating agency.

The

issuer has filed a registration statement (including a base prospectus (the “base prospectus”) dated February 9, 2024) with

the SEC for the offering to which this communication relates. Capitalized terms used but not defined herein have the meanings ascribed

to them in the base prospectus. Before you invest, you should read the base prospectus and other documents the issuer has filed with the

SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you

the base prospectus if you request it by calling RBC Capital Markets, LLC at 1-866-375-6829, BofA Securities, Inc. at 1-800-294-1322

and Mizuho Securities USA LLC at 1-866-271-7403.

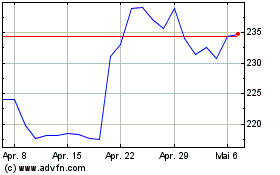

American Express (NYSE:AXP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

American Express (NYSE:AXP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024