0001062231

false

0001062231

2023-06-28

2023-06-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

June 28, 2023

AMERICAN AXLE & MANUFACTURING HOLDINGS,

INC.

(Exact Name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| |

| |

| 1-14303 |

38-3161171 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| One Dauch Drive, Detroit, Michigan |

48211-1198 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| |

|

| (313) 758-2000 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| |

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

AXL |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| |

|

|

|

|

|

| Emerging growth company |

☐ |

| |

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

| |

Item 1.01. |

Entry into a Material Definitive Agreement |

On June 28, 2023, American Axle & Manufacturing

Holdings, Inc. (“Holdings”) and American Axle & Manufacturing, Inc., a wholly owned subsidiary of Holdings (“AAM”),

entered into the First Amendment (the “First Amendment”) among AAM, as borrower, Holdings, each financial institution

party thereto as a lender and JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”), amending

the Amended and Restated Credit Agreement, dated as of March 11, 2022 (the “Amended and Restated Credit Agreement”),

among AAM, as borrower, Holdings, each financial institution party thereto from time to time as a lender, and the Administrative Agent.

For the period from June 28, 2023 through the earlier

of (i) the date on which Holdings and AAM deliver to the Administrative Agent its Form 10-Q for the fiscal quarter ending June 30, 2024

and (ii) the date on which Holdings and AAM provide to the Administrative Agent documentation certifying certain matters pursuant to the

First Amendment (the “Amendment Period”), the First Amendment, among other things: (a) increased the maximum levels

of the total net leverage ratio covenant during the Amendment Period; (b) reduced the minimum levels of the cash interest expense coverage

ratio covenant during the Amendment Period; (c) modified certain categories of the applicable margin (determined based on the total net

leverage ratio of Holdings) for the duration of the Amendment Period with respect to interest rates under the term loan A facility under

the Amended and Restated Credit Agreement (the “Term Loan A Facility”) and interest rates under the revolving credit facility

under the Amended and Restated Credit Agreement (the “Revolving Credit Facility”); and (d) modified certain covenants restricting

the ability of Holdings, AAM and certain subsidiaries of Holdings to create, incur, assume or permit to exist certain additional indebtedness

and liens and to make or agree to pay or make certain restricted payments, voluntary payments and distributions.

AAM also agreed to prepay the Term Loan A Facility

in an aggregate principal amount of $16,250,000 upon closing on June 28, 2023.

The terms of the term loan B facility under the Amended

and Restated Credit Agreement, including the maturity dates, interest rates and applicable margins with respect to such interest rates,

remain unchanged.

A copy of the First Amendment is included as Exhibit

10.1 hereto and is incorporated by reference herein. The foregoing description of the First Amendment does not purport to be complete

and is qualified in its entirety by reference to the full text of the agreement.

| |

Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information in Item 1.01 of this Current Report is incorporated by

reference into this Item 2.03.

| |

Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

| Exhibit No. |

|

Description |

| 10.1 |

|

First Amendment to the Amended and Restated Credit Agreement, dated as of June 28, 2023, among American Axle & Manufacturing Holdings, Inc., American Axle & Manufacturing, Inc., certain subsidiaries of American Axle & Manufacturing Holdings, Inc. identified therein, each financial institution party thereto as a lender and JPMorgan Chase Bank, N.A., as Administrative Agent. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

|

|

| Date: |

June 29, 2023 |

By: |

/s/ Christopher J. May |

|

| |

|

|

Christopher J. May |

|

| |

|

|

Executive Vice President & Chief Financial Officer |

|

Exhibit 10.1

EXECUTION VERSION

FIRST AMENDMENT dated

as of June 28, 2023 (this “Amendment”), to the AMENDED AND RESTATED CREDIT AGREEMENT dated as of March 11, 2022 (as

amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Credit Agreement”, and

as further amended hereby, the “Credit Agreement”; capitalized terms used and not defined herein shall have the meanings

assigned to such terms in the Credit Agreement), among AMERICAN AXLE & MANUFACTURING, INC., a Delaware corporation (the “Borrower”),

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC., a Delaware corporation (the “Parent”), the LENDERS party thereto

and JPMORGAN CHASE BANK, N.A., as Administrative Agent (the “Administrative Agent”).

WHEREAS, the Borrower has

requested that certain provisions of the Existing Credit Agreement be amended as set forth herein; and

WHEREAS, the Lenders party

hereto, constituting a Majority in Interest of the Tranche A Term Lenders and a Majority in Interest of the Revolving Lenders, are willing

to consent to such amendments to the Existing Credit Agreement on the terms and subject to the conditions set forth herein.

NOW, THEREFORE, in consideration

of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged,

and subject to the conditions set forth herein, the parties hereto hereby agree as follows:

SECTION 1. Rules of Interpretation.

The rules of interpretation set forth in Section 1.03 of the Credit Agreement are hereby incorporated by reference herein, mutatis

mutandis.

SECTION 2. Amendments

to the Credit Agreement.

(a) Section 1.01 of the Existing

Credit Agreement is hereby amended by inserting the following defined terms in the appropriate alphabetical order therein:

“Applicable

Cash Interest Expense Coverage Ratio” means, for any date, the Cash Interest Expense Coverage Ratio applicable pursuant to Section

6.11 with respect to the period of four consecutive fiscal quarters of the Parent most recently ended on or prior to such date.

“First Amendment

Effective Date” means June 28, 2023, which was the First Amendment Effective Date under (and as defined in) the First Amendment

relating to this Agreement, among the Borrower, the Parent, the Administrative Agent and the Lenders party thereto.

[[6108061]]

“First Amendment

Period” means the period commencing on the First Amendment Effective Date and ending on the earlier to occur of the First Amendment

Period Termination Date and the date on which the Parent shall have delivered to the Administrative Agent the financial statements as

of and for the fiscal quarter of the Parent ending June 30, 2024 pursuant to Section 5.01(b), together with the related certificate pursuant

to Section 5.01(c).

“First Amendment

Period Termination Date” means the date, if any, on which the Parent shall have delivered a First Amendment Period Termination

Notice to the Administrative Agent.

“First Amendment

Period Termination Notice” means a certificate of a Financial Officer of the Parent delivered together with the financial statements

and certificate required to be delivered pursuant to Section 5.01(a) or (b) and Section 5.01(c), respectively, with respect to any fiscal

quarter or fiscal year ending on or prior to March 31, 2024, certifying that as of the last day of such period, the Parent is in compliance

with the applicable Unamended Total Net Leverage Ratio and Unamended Cash Interest Expense Coverage Ratio contained in Section 6.10 and

Section 6.11 (with such compliance being demonstrated in the calculations set forth in the certificate delivered concurrently pursuant

to Section 5.01(c)) and notifying the Administrative Agent that effective as of the date of such certificate, the First Amendment Period

is terminated.

“Unamended Total

Net Leverage Ratio” has the meaning assigned to such term in Section 6.10.

(b) The definition of “Applicable

Rate” set forth in Section 1.01 of the Existing Credit Agreement is hereby amended by inserting the following proviso immediately

before the semicolon at the end of paragraph (b) thereof:

“; provided,

further, that at all times during the First Amendment Period (and only during such Period), the Applicable Rate set forth below

in Category 2 shall be increased by 0.25% per annum”

(c) The definition of “Applicable

Rate” set forth in Section 1.01 of the Existing Credit Agreement is hereby further amended by inserting the following proviso immediately

before the semicolon at the end of paragraph (c) thereof:

“; provided,

further, that at all times during the First Amendment Period (and only during such Period), the Applicable Rate set forth below

in Category 2 (other than as set forth under the caption “Commitment Fee Rate”) shall be increased by 0.25% per annum”

(d) Section 2.27 of the Existing

Credit Agreement is hereby amended by replacing the words “the eighteen-month anniversary of the Closing Date” therein with

“June 30, 2024”.

(e) Section 6.10 of the Existing

Credit Agreement is hereby amended and restated in its entirety to read as follows:

SECTION 6.10. Total

Net Leverage Ratio. For the benefit of the Revolving Lenders, the Issuing Banks and the Tranche A Term Lenders only (and the Administrative

Agent on their behalf), the Parent will not permit the Total Net Leverage Ratio as of the end of any fiscal quarter set forth below to

exceed the ratio set forth below with respect to such fiscal quarter:

| |

Period |

Total Net Leverage Ratio |

| |

April 1, 2022, through June 30, 2022 |

5.00 to 1.00 |

| |

July 1, 2022 through September 30, 2022 |

4.75 to 1.00 |

| |

October 1, 2022, through June 30, 2024 |

4.50 to 1.00 |

| |

July 1, 2024 through December 31, 2024 |

4.25 to 1.00 |

| |

January 1, 2025, through March 31, 2025 |

4.00 to 1.00 |

| |

April 1, 2025, through September 30, 2025 |

3.75 to 1.00 |

| |

October 1, 2025 and thereafter |

3.50 to 1.00 |

provided, however,

that the Total Net Leverage Ratio level set forth above may, at the election of the Borrower and upon written notice to the Administrative

Agent prior to the consummation of a Qualified Permitted Acquisition, be increased by 0.50:1.00 in connection with a Permitted Acquisition

with aggregate cash consideration (including assumed Indebtedness) paid in connection therewith in excess of $350,000,000 (each such Permitted

Acquisition, a “Qualified Permitted Acquisition”), with a 0.50:1.0 step-down (returning the required Total Net Leverage

Ratio to the then otherwise required ratio) for the first four fiscal quarter period ending after the date that is six (6) months after

such Permitted Acquisition; provided further that, (w) in any event, the maximum Total Net Leverage Ratio for any period of four

fiscal quarters shall not be increased to be greater than 4.50:1.00, (x) the Total Net Leverage Ratio levels shall not be increased pursuant

to the foregoing proviso on more than two occasions after the Closing Date, (y) following any increase in the Total Net Leverage Ratio

level pursuant to the foregoing proviso, no subsequent increase in the Total Net Leverage Ratio level pursuant to the foregoing proviso

may be made until after the required Total Net Leverage Ratio has been at the applicable level set forth above (without giving effect

to any increase pursuant to the foregoing proviso) for at least two full consecutive fiscal quarters and (z) any such increase of the

Total Net Leverage Ratio levels pursuant to this Section 6.10 shall apply only with respect to the calculation of the Total Net Leverage

Ratio for purposes of determining compliance with this Section 6.10 and for purposes of any Qualified Permitted Acquisition Pro Forma

Calculation (it being understood that the Total Net Leverage Ratio applicable under the Qualified Permitted Acquisition Pro Forma Calculation

shall in any event be no greater than the Total Net Leverage Ratio as increased pursuant to the foregoing proviso under this Section 6.10).

Notwithstanding the

foregoing, if, with respect to any fiscal quarter of the Parent ending during the First Amendment Period, the Parent shall have delivered

to the Administrative Agent a First Amendment Period Termination Notice, then, with respect to the fiscal quarter in respect of which

such notice was delivered and each subsequent fiscal quarter of the Parent, the ratios set forth in the table above shall not apply and

the applicable maximum Total Net Leverage Ratio shall instead be the ratio set forth below with respect to such fiscal quarter (the “Unamended

Total Net Leverage Ratio”):

| |

Period

|

Total Net Leverage Ratio |

| |

April 1, 2023, through September 30, 2023 |

4.25 to 1.00 |

| |

October 1, 2023, through December 31, 2023 |

4.00 to 1.00 |

| |

January 1, 2024, through March 31, 2024 |

3.75 to 1.00 |

| |

April 1, 2024 and thereafter |

3.50 to 1.00 |

(f) Section 6.11 of the Existing

Credit Agreement is hereby amended and restated in its entirety to read as follows:

SECTION 6.11. Cash

Interest Expense Coverage Ratio. For the benefit of the Revolving Lenders, the Issuing Banks and the Tranche A Term Lenders only (and

the Administrative Agent on their behalf), the Parent will not permit the Cash Interest Expense Coverage Ratio as of the last day of any

period of four consecutive fiscal quarters ending during the dates set forth below to be less than the ratio set forth below with respect

to such period:

| |

Period End Date |

Cash Interest Expense Coverage Ratio |

| |

Closing Date through June 30, 2023 |

3.00 to 1.00 |

| |

July 1, 2023, through June 30, 2024 |

2.75 to 1.00 |

| |

July 1, 2024 and thereafter |

3.00 to 1.00 |

Notwithstanding the

foregoing, if, with respect to any period of four consecutive fiscal quarters of the Parent ending during the First Amendment Period,

the Parent shall have delivered to the Administrative Agent a First Amendment Period Termination Notice, then, with respect to such period

and each subsequent period of four consecutive fiscal quarters of the Parent, the ratios set forth in the table above shall not apply

and the Parent will not permit the Cash Interest Expense Coverage Ratio as of the last day of each period of four consecutive fiscal quarters

be less than 3.00 to 1.00 (the “Unamended Cash Interest Expense Coverage Ratio”).

SECTION 3. Covenants.

Each of the Borrower and the Parent covenants and agrees for the benefit of the Revolving Lenders, the Issuing Banks and the Tranche A

Term Lenders only (and the Administrative Agent on their behalf) that, during the First Amendment Period:

(a) the Borrower shall not

incur any Incremental Extensions of Credit or any Alternative Incremental Facility Debt that is secured by the Collateral on a pari passu

basis with the Loan Document Obligations;

(b) the Parent shall not

designate any Restricted Subsidiary as an Unrestricted Subsidiary, unless (i) immediately before and after such designation, no Event

of Default shall have occurred and be continuing or would immediately result from such designation (including as a result of the covenants

contained in this Section 3) and (ii) immediately after giving effect to such designation, (x) the Total Net Leverage Ratio, calculated

on a Pro Forma Basis as of the last day of the most recently ended fiscal quarter of the Parent, shall not exceed the Applicable Total

Net Leverage Ratio and (y) the Cash Interest Expense Coverage Ratio, calculated on a Pro Forma Basis as of the last day of the most recently

ended fiscal quarter of the Parent, shall not exceed the Applicable Cash Interest Coverage Ratio;

(c) neither the Parent nor

the Borrower shall, or shall permit any other Restricted Subsidiary to, assume or permit to exist Indebtedness otherwise permitted by

Section 6.01(a)(vi)(A) of the Existing Credit Agreement, unless (i) such Indebtedness exists at the time such Person becomes a Restricted

Subsidiary (or is so merged or consolidated) or such assets are acquired and is not created in contemplation of or in connection with

such Person becoming a Restricted Subsidiary (or such merger or consolidation) or such assets being acquired and (ii) immediately after

giving effect to the assumption of such Indebtedness, the Total Net Leverage Ratio, calculated on a Pro Forma Basis as of the last day

of the most recently ended fiscal quarter of the Parent, shall not exceed the Applicable Total Net Leverage Ratio and (y) the Cash Interest

Expense Coverage Ratio, calculated on a Pro Forma Basis as of the last day of the most recently ended fiscal quarter of the Parent, shall

not exceed the Applicable Cash Interest Coverage Ratio;

(d) neither the Parent nor

the Borrower shall permit to exist Indebtedness of Foreign Subsidiaries otherwise permitted by Section 6.01(a)(vii) of the Existing

Credit Agreement in an aggregate principal amount (other than Indebtedness owing by a Foreign Subsidiary to another Foreign Subsidiary)

exceeding $350,000,000;

(e) neither the Parent nor

the Borrower shall permit to exist any Ratio Debt incurred by any Restricted Subsidiary that is not a Loan Party;

(f) neither the Parent nor

the Borrower shall, or shall permit any other Restricted Subsidiary to, create, incur, assume or permit to exist any Lien on any property

or asset now owned or hereafter acquired by it, which Lien is otherwise permitted by Section 6.02(f) of the Existing Credit Agreement,

except any (i) Lien on any property or asset of any Foreign Subsidiary in an aggregate amount at any time outstanding not exceeding $350,000,000

and (ii) other Lien on any property or asset of any Foreign Subsidiary; provided that

(A) in respect

of this sub-clause (ii), such Lien secures Indebtedness or other obligations of such Foreign Subsidiary that is not Guaranteed by any

Loan Party and (B) with respect to Indebtedness such Indebtedness is permitted by Section 6.01 of the Existing Credit Agreement

and clauses (c), (d), (e) and (f) of this Section 3;

(g) neither the Parent nor

the Borrower shall, or shall permit any Restricted Subsidiary to, (i) declare or make, or agree to pay or make, directly or indirectly,

any Restricted Payment, or incur any obligation (contingent or otherwise) to make any Restricted Payment, that is otherwise permitted

by Sections 6.07(a)(vii) or (a)(viii) of the Existing Credit Agreement or (ii) agree to pay or make, directly or indirectly,

any voluntary payment or other distribution (whether in cash, securities or other property) of or in respect of any Junior Debt, or any

payment or other distribution (whether in cash, securities or other property), including any sinking fund or similar deposit, on account

of the repayment, repurchase, redemption, retirement, acquisition, cancellation or termination of any Junior Debt, that is otherwise permitted

by Sections 6.07(b)(iii) through (b)(v) of the Existing Credit Agreement; and

(h) neither the Parent nor

the Borrower shall, or shall permit any Restricted Subsidiary to, make or agree to pay or make, directly or indirectly, any voluntary

payment or other distribution (whether in cash, securities or other property) of or in respect of any of the Borrower’s senior unsecured

notes other than the Senior Notes described in clause (c) of the definition thereof set forth in the Existing Credit Agreement (collectively,

the “Senior Unsecured Notes”), or any payment or other distribution (whether in cash, securities or other property),

including any sinking fund or similar deposit, on account of the repayment, repurchase, redemption, retirement, acquisition, cancellation

or termination of any of the Senior Unsecured Notes, except (i) any refinancing of Senior Unsecured Notes with Permitted Refinancing Indebtedness

and (ii) regularly scheduled payments of principal or interest in respect thereof.

SECTION 4. Additional

Agreements. The Borrower agrees for the benefit of the Revolving Lenders, the Issuing Banks and the Tranche A Term Lenders only (and

the Administrative Agent on their behalf) that, within 10 Business Days following the First Amendment Effective Date, the Borrower shall

make a prepayment pursuant to Section 2.11(a) of the Credit Agreement of Tranche A Term Loans in an aggregate principal amount equal to

$16,250,000.00 (it being understood and agreed that such prepayments shall be applied to reduce the amortization payments in respect of

the Tranche A Term Loans pursuant to Section 2.10(a)(i) of the Credit Agreement commencing with the payment in respect of the fiscal quarter

ending September 30, 2023 in direct order thereof, and for all other purposes of the Credit Agreement shall be deemed to have been paid

as an amortization payment pursuant to Section 2.10(a)(i), and not Section 2.11(a), of the Credit Agreement). Each Lender party hereto

hereby waives any right to compensation pursuant to Section 2.16 of the Credit Agreement in connection with such prepayment.

SECTION 5. Representations

and Warranties. The Borrower represents and warrants to the Administrative Agent and to each of the Lenders that:

(a) This Amendment and the

transactions contemplated hereby are within the corporate powers of each of the Borrower and the Parent and have been duly authorized

by all necessary corporate and, if required, stockholder action.

(b) This Amendment has been

duly executed and delivered by each of the Borrower and the Parent and constitutes a legal, valid and binding obligation of such Loan

Party, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws

affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding

in equity or at law.

SECTION 6. Effectiveness.

This Amendment shall become effective as of the date first above written (the “First Amendment Effective Date”) when:

(a) the Administrative Agent

shall have received counterparts of this Amendment, duly executed and delivered on behalf of (i) the Borrower, (ii) the Parent, (iii)

each other Loan Party and (iv) Lenders constituting a Majority in Interest of the Tranche A Term Lenders and a Majority in Interest of

the Revolving Lenders, or as to any of the foregoing parties, advice reasonably satisfactory to the Administrative Agent that each of

the foregoing parties has executed a counterpart of this Amendment;

(b) each of the representations

and warranties set forth in Section 5 hereof shall be true and correct as of the First Amendment Effective Date;

(c) The representations and

warranties of each Loan Party set forth in the Loan Documents shall be true and correct in all material respects (or, in the case of representations

and warranties qualified as to materiality, in all respects) on and as of the First Amendment Effective Date, except to the extent any

such representation and warranty expressly relates to a prior date, in which case such representation and warranty shall be true and correct

in all material respects (or in all respects, as applicable) as of such earlier date;

(d) At the time of and immediately

after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing;

(e) the Administrative Agent

shall have received a certificate of a Responsible Officer of the Borrower confirming compliance with the conditions set forth in paragraphs

(b), (c) and (d) of this Section 6; and

(f) the Administrative Agent

shall have received payment of all fees and expenses required to be paid or reimbursed by the Borrower under or in connection with this

Amendment, including those fees and expenses set forth in Section 11 hereof, to the extent such fees and expenses are invoiced at least

one Business Day prior to the proposed First Amendment Effective Date.

SECTION 7. Reaffirmation.

Each of the Borrower, the Parent and each other Loan Party hereby (a) reaffirms its obligations under the Credit Agreement and each other

Loan Document to which it is a party, in each case as modified by this Amendment, (b) reaffirms all Liens on the Collateral which have

been granted by it in favor of the Collateral Agent (for the benefit of the Secured Parties) pursuant to the Loan Documents and (c) acknowledges

and agrees that the guarantees of the Loan Parties contained in the Guarantee Agreement and the grants of security interests by the Loan

Parties contained in the Collateral Agreement and the other Security Documents are, and shall remain, in full force and effect in respect

of, and to secure, the Secured Obligations.

SECTION 8. Credit Agreement.

Except as expressly set forth herein, this Amendment (a) shall not by implication or otherwise limit, impair, constitute a waiver

of or otherwise affect the rights and remedies of the Lenders, the Administrative Agent, the Borrower or any other Loan Party under the

Credit Agreement or any other Loan Document and (b) shall not alter, modify, amend or in any way affect any of the terms, conditions,

obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document, all of which are ratified and affirmed

in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle the Borrower or any other Loan

Party to any future consent to, or waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants

or agreements contained in the Credit Agreement or any other Loan Document in similar or different circumstances. After the First Amendment

Effective Date, any reference in the Loan Documents to the Credit Agreement shall mean the Credit Agreement as modified hereby. This Amendment

shall constitute a “Loan Document” for all purposes of the Credit Agreement and the other Loan Documents and, for the avoidance

of doubt, any breach of this Amendment by the Borrower or the Parent shall constitute an Event of Default.

SECTION 9. Applicable

Law; Waiver of Jury Trial.

(a) THIS AMENDMENT AND

ANY CLAIM, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO

THIS AMENDMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF

NEW YORK.

(b) EACH PARTY HERETO

HEREBY AGREES AS SET FORTH IN SECTION 9.10 OF THE CREDIT AGREEMENT AS IF SUCH SECTION WERE SET FORTH IN FULL HEREIN.

SECTION 10. Counterparts;

Amendment; Effectiveness.

(a) This Amendment may be

executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original, but

all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment

by facsimile transmission or other electronic imaging shall be effective as delivery of an original executed counterpart of this Amendment.

This Amendment may not be amended nor may any provision hereof be waived except pursuant to a writing signed by the Borrower, the Administrative

Agent and the Lenders party hereto.

(b) The words “execution”,

“signed”, “signature”, “delivery” and words of like import in or relating to any document to be signed

in connection with this Amendment and the transactions contemplated hereby shall be deemed to include any electronic sound, symbol or

process attached to, or associated with, a contract or other record and adopted by a Person with the intent to sign, authenticate or accept

such contract or record (each, an “Electronic Signature”), and deliveries or the keeping of records in electronic form,

each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof

or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including

the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act or any

other similar State laws based on the Uniform Electronic Transactions Act; provided that nothing herein shall require the Administrative

Agent to accept electronic signatures in any form or format without its prior written consent. Without limiting the generality of the

foregoing, the Borrower (i) agrees that, for all purposes, including in connection with any workout, restructuring, enforcement of remedies,

bankruptcy proceedings or litigation among the Administrative Agent, the Lenders and the Loan Parties, electronic images of this Amendment

(including with respect to any signature pages hereto) shall have the same legal effect, validity and enforceability as any paper original,

and (ii) waives any argument, defense or right to contest the validity or enforceability of this Amendment based solely on the lack of

paper original copies of this Amendment, including with respect to any signature pages hereto.

SECTION 11. Fees and Expenses.

(a) The Borrower hereby agrees

to pay to the Administrative Agent on the First Amendment Effective Date, for the account of each Tranche A Term Lender and Revolving

Lender that shall have executed and irrevocably delivered to the Administrative Agent an executed signature page to this Amendment, an

amendment fee equal to 0.125% of the sum of such Lender’s outstanding Tranche A Term Loans and outstanding Revolving Commitment

(whether used or unused) on the First Amendment Effective Date (after giving effect to any prepayment of the Tranche A Term Loans on the

First Amendment Effective Date).

(b) The Borrower agrees to

reimburse the Administrative Agent for its reasonable out-of-pocket expenses in connection with this Amendment to the extent required

under Section 9.03 of the Credit Agreement.

SECTION 12. Headings. Section

headings used herein are for convenience of reference only, are not part of this Amendment and are not to affect the construction of,

or to be taken into consideration in interpreting, this Amendment.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first written above.

| |

|

AMERICAN AXLE & MANUFACTURING, INC.

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

|

| |

|

By |

| |

|

|

/s/ Shannon J. Curry |

| |

|

|

Name: Shannon J. Curry |

| |

|

|

Title: Vice President & Treasurer

|

[Signature Page to First

Amendment]

Solely with respect to the provisions

of Section 6 hereof:

| |

AMERICAN AXLE & MANUFACTURING

HOLDINGS, INC.

|

| |

AMERICAN AXLE & MANUFACTURING,INC. |

| |

AAM CASTING CORP. |

| |

AAM INTERNATIONAL HOLDINGS, INC. |

| |

AAM POWDER METAL COMPONENTS, INC. |

| |

ACCUGEAR, INC. |

| |

ASP GREDE INTERMEDIATE HOLDINGS LLC |

| |

ASP HHI HOLDINGS, INC. |

| |

AUBURN HILLS MANUFACTURING, INC. |

| |

COLFOR MANUFACTURING, INC. |

| |

HHI FORMTECH, LLC |

| |

IMPACT FORGE GROUP, LLC |

| |

JERNBERG INDUSTRIES, LLC |

| |

MD INVESTORS CORPORATION |

| |

METALDYNE M&A BLUFFTON, LLC |

| |

METALDYNE PERFORMANCE GROUP INC. |

| |

METALDYNE POWERTRAIN COMPONENTS, INC. |

| |

METALDYNE SINTERED RIDGWAY, LLC |

| |

METALDYNE SINTERFORGED PRODUCTS, LLC |

| |

MSP INDUSTRIES CORPORATION |

| |

OXFORD FORGE, INC. |

| |

PUNCHCRAFT MACHINING AND TOOLING, LLC |

| |

TEKFOR, INC. |

| |

By |

|

| |

|

/s/ Shannon J. Curry |

|

| |

|

Name: Shannon J. Curry |

|

| |

|

Title: Vice President & Treasurer

|

|

[Signature Page to First

Amendment]

| |

JPMORGAN CHASE BANK, N.A., individually and as Administrative Agent |

|

| |

By |

|

| |

|

/s/ Joon Hur |

|

| |

|

Name: Joon Hur |

|

| |

|

Title: Executive Director |

|

[Signature Page to First

Amendment]

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution: BARCLAYS BANK PLC

| |

by |

/s/ Charlene Saldanha |

| |

|

Name: Charlene Saldanha |

| |

|

Title: Vice President |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution: Bank of Montreal, Chicago

Branch

| |

by |

/s/ Andrew Berryman |

| |

|

Name: Andrew Berryman |

| |

|

Title: Director |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution: BANK

OF AMERICA, N.A.

| |

by |

/s/ Brian Lukehart |

| |

|

Name: Brian Lukehart |

| |

|

Title: Managing Director |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution:

Citibank, N.A.

| |

by |

/s/ Andrew Padovano |

| |

|

Name: Andrew Padovano |

| |

|

Title: Vice President |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution: MIZUHO BANK, LTD.

| |

by |

/s/ Donna DeMagistris |

| |

|

Name: Donna DeMagistris |

| |

|

Title: Executive Director |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution: Royal

Bank of Canada

| |

by |

/s/ Benjamin Lennon |

| |

|

Name: Benjamin Lennon |

| |

|

Title: Authorized Signatory |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of lnstitution: PNC BANK, NATIONAL ASSOCIATION

| |

by |

/s/ Scott Neiderheide |

| |

|

Name: Scott Neiderheide |

| |

|

Title: Senior Vice President |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

| Name of Institution: |

U.S. Bank National Association |

| |

by |

/s/ Jeffery S. Johnson |

| |

|

Name: Jeffery S. Johnson |

| |

|

Title: SVP |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of lnstitution:

Citizens Bank, National Association

| |

by |

/s/ Kelly M. Hamrick |

| |

|

Name: Kelly M. Hamrick |

| |

|

Title: Senior Vice President |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution:

The Huntington National Bank

| |

by |

/s/ Scott Lyman |

| |

|

Name: Scott Lyman |

| |

|

Title: Assistant Vice President |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of lnstitution: FIFTH

THIRD BANK, NATIONAL ASSOCIATION

| |

by |

/s/ Will Batchelor |

| |

|

Name: Will Batchelor |

| |

|

Title: Vice President |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution: HSBC BANK USA, NATIONAL

ASSOCIATION

| |

by |

/s/ Casey Klepsch |

| |

|

Name: Casey Klepsch |

| |

|

Title: Senior Vice President |

| |

SIGNATURE PAGE TO THE FIRST AMENDMENT DATED AS OF THE DATE FIRST WRITTEN ABOVE, RELATING TO THE AMERICAN AXLE & MANUFACTURING, INC. AMENDED AND RESTATED CREDIT AGREEMENT |

Name of Institution:

KeyBank National Association

| |

by |

/s/ Eric W. Domin |

| |

|

Name: Eric W. Domin |

| |

|

Title: SVP |

| |

|

|

| |

|

|

| |

|

For any institution requiring a second signature line: |

| |

|

|

| |

by |

|

| |

|

Name: |

| |

|

Title: |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

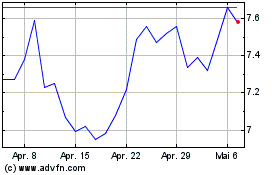

American Axle and Manufa... (NYSE:AXL)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

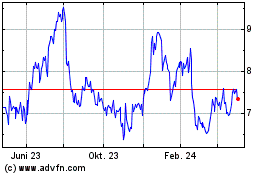

American Axle and Manufa... (NYSE:AXL)

Historical Stock Chart

Von Mai 2023 bis Mai 2024