Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405

01 März 2024 - 10:15PM

Edgar (US Regulatory)

| | |

| SEC File Number |

| 001-34766 |

| CUSIP Number |

| 42315705 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 12b-25

______________

NOTIFICATION OF LATE FILING

(Check One): ☒ Form 10-K ☐ Form 20-F ☐ Form 11-K ☐ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR

For Period Ended: December 31, 2023

☐ Transition Report on Form 10-K

☐Transition Report on Form 20-F

☐Transition Report on Form 11-K

☐Transition Report on Form 10-Q

For the Transition Period Ended: ____________________________

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates: n/a

| | | | | | | | | | | |

| PART I - REGISTRANT INFORMATION |

| | | |

| | ARMOUR Residential REIT, Inc. | |

| | (Full Name of Registrant) | |

| | | |

| | N/A | |

| | (Former Name if Applicable) | |

| | | |

| | 3001 Ocean Drive, Suite 201 | |

| | (Address of Principal Executive Office (Street and Number)) | |

| | | |

| | Vero Beach, Florida 32963 | |

| | City, State and Zip Code | |

| | | | | | | | | | | |

| PART II - RULES 12b-25(b) AND (c) |

| If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate) |

| ☒ | (a) | The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K, Form N-CEN or Form NCSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due day; and |

| (c) | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

ARMOUR Residential REIT, Inc. (“ARMOUR” or the “Company”) is filing this Notification of Late Filing on Form 12b-25 with respect to its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Form 10-K”). The independent members of the Board of Directors of the Company have formed a special committee (the “Special Committee”) comprised of certain of the independent directors, which Special Committee has commenced an internal investigation to review issues raised internally at the Company in late January 2024. The issues generally relate, among other things, to (a) the appropriateness of reporting Distributable Earnings and Net Interest Margin, which are non-GAAP financial measures, in earnings releases and the Company’s public filings with the Securities and Exchange Commission (the “SEC”) and the methods of calculating such measures; (b) the Company’s considerations with respect to reviewing and evaluating its external manager, ARMOUR Capital Management LP and (c) certain of the internal controls over financial reporting and disclosure controls and procedures of the Company. The Special Committee, which promptly began its work in early February 2024, has engaged outside counsel to assist in the process and ARMOUR’s independent registered public accounting firm has been notified of the investigation, which remains ongoing.

As stated below, the Company does not anticipate any material changes to financial information previously disclosed or released by the Company. In the meantime, the day-to-day operations of the Company and its broker-dealer affiliate, BUCKLER Securities, LLC (“BUCKLER”), are expected to continue uninterrupted during the Special Committee’s review. In this regard, the Company’s $200.0 million secured demand note commitment to BUCKLER will remain in place and continue to provide capital for BUCKLER.

Given the time required by the Special Committee and its advisors to properly complete their review of these matters, the Company is unable to file its Form 10-K within the prescribed time period. The Company fully supports the efforts of the Special Committee to complete its work and intends to file the Form 10-K within the 15-day grace period ending March 15, 2024.

In any event, the Company does not expect the results of the Special Committee’s investigation to materially impact its previously announced preliminary unaudited results for the fourth quarter of 2023 or financial condition as of December 31, 2023, the preliminary unaudited results set forth below in Attachment A or the veracity of its previously issued financial statements.

Safe Harbor

This filing includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Additional information concerning these and other risk factors are contained in the Company’s most recent filings with the SEC. All subsequent written and oral forward-looking statements concerning the Company are expressly qualified in their entirety by the cautionary statements above. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

The condensed statement of operations for the year ended December 31, 2023 set forth below in Attachment A is preliminary, is not a comprehensive statement of financial results for the fiscal year, and is provided prior to completion of all internal and external review and audit procedures and, therefore, may be subject to adjustments. Actual results may vary from these estimates, and the variations may be material. Among the factors that could cause or contribute to material differences between the Company’s actual results and expectations indicated by the forward-looking statements are risks and uncertainties that include, but are not limited to, changes to the Company’s financial results for the year ended December 31, 2023 due to the completion of financial closing procedures, final adjustments and other developments that may arise between now and the time that the Company’s financial statements for the fiscal year are finalized and publicly released and other risks and uncertainties described above and in the Company’s filings with the SEC.

| | | | | | | | | | | |

| PART IV - OTHER INFORMATION |

| | | |

| (1) | Name and telephone number of person to contact in regard to this notification. |

| | | |

| Scott J. Ulm | 772 | 617-4340 |

| (Name) | (Area Code) | (Telephone Number) |

| | | |

| (2) | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) been filed? If the answer is no, identify report(s). ☒ Yes ☐ No |

| | | |

| (3) | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No |

| If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. |

See Attachment A hereto which is incorporated herein by reference.

ARMOUR Residential REIT, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 1, 2024

ARMOUR RESIDENTIAL REIT, INC.

| | | | | |

| By: | By: /s/ Scott J. Ulm |

| Name: | Scott J. Ulm |

| Title: | Co-Chief Executive Officer |

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

Attachment A

In its press release issued on February 14, 2024, furnished as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated February 14, 2024, the Company reported certain preliminary unaudited results for the fourth quarter 2023 and financial condition as of December 31, 2023. Below are preliminary unaudited results for the 2023 full fiscal year that the Company anticipates releasing in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Such results differ from results for the 2022 fiscal year as set forth below.

| | | | | | | | | | | | | | | | | |

| Condensed Statements of Operations (Unaudited) | | For the Years Ended | |

| | December 31, 2023 | | December 31, 2022 | Percentage Increase (Decrease) |

| | ($ in thousands except,

share and per share) | |

| Interest Income | | $ | 552,903 | | | $ | 228,432 | | 142 | % |

| Interest expense | | (525,794) | | | (120,768) | | 335 | % |

| Net Interest Income | | $ | 27,109 | | | $ | 107,664 | | (75) | % |

| | | | | |

| Realized gain (loss) on sale of available for sale Agency Securities (reclassified from Other comprehensive loss) | | (7,471) | | | (7,452) | | — | % |

| Impairment losses on available for sale Agency Securities | | — | | | (4,183) | | (100) | % |

| Loss on Agency Securities, trading | | (52,665) | | | (946,666) | | (94) | % |

| Loss on U.S. Treasury Securities | | (43,093) | | | (152,268) | | (72) | % |

| Gain on derivatives, net | | 51,748 | | | 810,808 | | (94) | % |

| Total Other Loss | | $ | (51,481) | | | $ | (299,761) | | (83) | % |

| | | | | |

| Compensation | | 4,944 | | | 5,485 | | (10) | % |

| Other Operating | | 7,019 | | | 6,374 | | 10 | % |

| Management fees | | 38,188 | | | 33,774 | | 13 | % |

| Management fees waived | | (6,600) | | | (7,800) | | (15) | % |

| Total Expenses | | $ | 43,551 | | | $ | 37,833 | | 15 | % |

| | | | | |

| Net Loss | | $ | (67,923) | | | $ | (229,930) | | (70) | % |

| Dividends on preferred stock | | (11,982) | | | (11,982) | | — | % |

| Net Loss related to common stockholders | | $ | (79,905) | | | $ | (241,912) | | (67) | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |

| Net Loss per share related to common stockholders: | | | | | |

| Basic | | $ | (1.86) | | | $ | (10.25) | | (82) | % |

| Diluted | | $ | (1.86) | | | $ | (10.25) | | (82) | % |

| Dividends declared per common share | | $ | 5.00 | | | $ | 6.00 | | (17) | % |

| Weighted average common shares outstanding: | | | | | |

| Basic | | 43,054,450 | | | 23,593,600 | | 82 | % |

| Diluted | | 43,054,450 | | | 23,593,539 | | 82 | % |

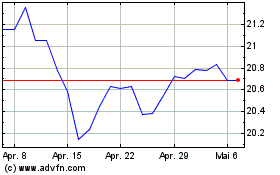

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

Von Apr 2023 bis Apr 2024