Filed by AltC Acquisition Corp.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: AltC Acquisition Corp.

Commission File No. 001-40583

Date: August 28, 2023

Oklo and Centrus Energy Sign Memorandum of Understanding

for Fuel, Components, and Power Procurement to Support the Deployment of Advanced Fission Technologies in Southern Ohio

PIKETON, Ohio. – Oklo Inc. (“Oklo”) and Centrus Energy

Corp. (“Centrus”) (NYSE American: LEU) today announced a new Memorandum of Understanding (“MOU”) between the two

companies to support the deployment of Oklo’s advanced fission powerhouses and advanced nuclear fuel production in Southern Ohio,

making the region a critical hub for the future of the U.S. nuclear industry. Oklo and Centrus have been partners since 2021 when the

companies signed a Letter of Intent to cooperate in the development of a High-Assay, Low-Enriched Uranium (“HALEU”) fuel facility.

With this new MOU, Oklo and Centrus plan to enter into a broad range of collaboration programs supporting the development and operation

of Oklo’s Aurora powerhouses including supply of HALEU produced by Centrus at its Piketon, Ohio, facility. Centrus also intends

to buy clean, reliable, and affordable energy from Oklo’s planned Ohio plants to power its HALEU Production Facility.

The parties intend to enter into one or more definitive agreements

relating to the following collaborative activities addressed in the MOU:

| · | Oklo would purchase HALEU from the production facility Centrus is planning to build in Piketon, Ohio, the only such facility licensed

by the U.S. Nuclear Regulatory Commission to produce HALEU. |

| · | Centrus would purchase electricity from the Aurora powerhouses that Oklo is planning to build in Piketon. These two power plants are

designed to power thousands of homes and businesses in addition to the HALEU production facility; similarly, the HALEU production plant

is designed to be scaled up to support hundreds of reactors. |

| · | Centrus would manufacture components for Oklo’s Aurora powerhouse at Centrus’ advanced manufacturing facility in Oak Ridge,

Tennessee, as well as manufacturing capacity at the American Centrifuge Plant in Piketon, Ohio, where HALEU production will take place. |

| · | Centrus and Oklo would work together to establish and license the capabilities necessary to deconvert HALEU from uranium hexafluoride

to uranium metal and fabricate fuel assemblies for Oklo’s Aurora powerhouses. |

Oklo is playing a leading role in catalyzing the commercialization

of advanced nuclear technologies. The company has secured a site use permit from the Department of Energy (“DOE”) and a fuel

award from Idaho National Laboratory for its first commercial power plant deployment in Idaho. Oklo has a partnership with Southern Ohio

Diversification Initiative at the DOE Piketon Site for its second and third commercial plants.

“Our wide-ranging landmark partnership with Centrus is expected

to span fuel production, manufacturing, and power off-take, exemplifying the early market interest in our scalable power plants and differentiated

business model, involving selling power, not power plants. This important collaboration is expected to facilitate several elements of

our strategy to meet the growing demand for our powerhouses that stems from our pipeline of customer engagements across various industries,”

said Dr. Jacob DeWitte, Co-founder and CEO of Oklo.

“We see tremendous potential in a strategic partnership between

Centrus and Oklo to advance the next generation of carbon-free nuclear energy,” said Centrus President and CEO Daniel B. Poneman.

“It has always been clear that establishing a domestic HALEU supply chain requires a public-private partnership. We are excited

to see strong support from industry leaders like Oklo as well as growing bipartisan support in Congress and the Administration for robust

investment in domestic uranium enrichment.”

“I am excited about the powerful enabling

effect between Oklo and Centrus in providing abundant, inexpensive energy with advanced fission. This partnership will represent an important

step in lowering the cost of energy by establishing a critical domestic fuel supply infrastructure,” said Sam Altman, CEO of AltC

Acquisition Corp. (“AltC”) and Chairman of Oklo. Oklo recently announced a definitive business combination agreement with

AltC. Upon closing of the business combination, the combined company will operate as Oklo and is expected to be listed on the New York

Stock Exchange under the ticker “OKLO.”

At the American Centrifuge Plant in Piketon, Ohio,

Centrus has constructed the first U.S. HALEU production facility licensed by the U.S. Nuclear Regulatory Commission and expects to begin

production of HALEU by the end of 2023 as part of the company’s contract with the DOE. With sufficient funding and offtake commitments,

Centrus could expand the facility to meet the full range of commercial and national security requirements for enriched uranium, including

the production of Low-Enriched Uranium as well as HALEU.

About Oklo Inc.: Oklo is developing fast fission power plants

to provide clean, reliable, and affordable energy at scale. Oklo received a site use permit from the U.S. Department of Energy, was

awarded fuel material from Idaho National Laboratory, submitted the first advanced fission custom combined license application to the

NRC, and is developing advanced fuel recycling technologies in collaboration with the U.S. Department of Energy and U.S. national laboratories.

On July 11, 2023, Oklo and AltC Acquisition

Corp. (“AltC”) (NYSE: ALCC) announced that they have entered into a definitive business combination agreement that upon closing

would result in the combined company to be listed on the New York Stock Exchange under the ticker symbol “OKLO.”

About Centrus Energy:

Centrus Energy is a trusted supplier of nuclear fuel and services for

the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources

– helping them meet the growing need for clean, affordable, carbon-free electricity. Since 1998, the Company has provided its utility

customers with more than 1,750 reactor years of fuel, which is equivalent to 7 billion tons of coal. With world-class technical and engineering

capabilities, Centrus is also advancing the next generation of centrifuge technologies so that America can restore its domestic uranium

enrichment capability in the future. Find out more at www.centrusenergy.com.

Forward Looking Statements:

This news release contains “forward-looking statements”

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act

of 1995. In this context, forward-looking statements mean statements related to future events, which may impact our expected future business

and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”,

“believes”, “will”, “should”, “could”, “would” or “may” and other

words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding expectations for the

collaborative programs memorialized in the Memorandum of Understanding announced herein, including with respect to the supply of HALEU

to Oklo and any of the other components of the collaboration, statements regarding the consummation of any definitive agreement between

Oklo and Centrus, including with respect to Centrus’ purchase of electricity from Oklo, the deployment and capabilities of Oklo’s

powerhouses in southern Ohio, statements regarding Oklo’s expected market opportunity and pricing for the electricity generated

by its powerhouses and the consummation of the proposed business combination between Oklo and AltC. These forward-looking statements are

based on information available to us as of the date of this news release and represent management’s current views and assumptions.

Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties

and other factors, which may be beyond our control.

For Centrus Energy Corp., particular risks and uncertainties that

could cause Centrus’ actual future results to differ materially from those expressed in the forward-looking statements relating

to Centrus include but are not limited to the following which are, and will be, exacerbated by the COVID-19 pandemic and subsequent variants,

and any worsening of the global business and economic environment as a result; risks related to the success of each of the collaboration

programs announced herein; risks that Oklo is unable or unwilling to proceed with the collaboration programs announced herein; the risk

that Oklo and Centrus do not ever enter into any definitive agreements relating to the collaboration programs announced herein; risks

related to whether or when government funding or demand for HALEU for government or commercial uses will materialize; risks related to

(i) Centrus’ ability to perform and absorb costs under Centrus’ agreement with the DOE to deploy and operate a cascade of

centrifuges to demonstrate production of HALEU for advanced reactors (the “HALEU Operations Contract”), (ii) Centrus’

ability to obtain contracts and funding to be able to continue operations and (iii) Centrus’ ability to obtain and/or perform under

other agreements; risks related to uncertainty regarding Centrus’ ability to commercially deploy a competitive enrichment technology;

risks related to the fact that Centrus faces significant competition from major producers who may be less cost sensitive or are wholly

or partially government owned; risks related to the impact of government regulation and policies including by the DOE and the U.S. Nuclear

Regulatory Commission; and other risks and uncertainties discussed in this news release and Centrus’ filings with the SEC. Readers

are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this news release. These

factors may not constitute all factors that could cause actual results to differ from those discussed in any forward-looking statement.

Accordingly, forward-looking statements should not be relied upon as a predictor of actual results. Readers are urged to carefully review

and consider the various disclosures made in this news release and in Centrus’ other filings with the SEC, including its Annual

report on Form 10-K for the year ended December 31, 2022, and its other filings with the SEC that attempt to advise interested parties

of the risks and factors that may affect its business. Centrus does not undertake to update its forward-looking statements to reflect

events or circumstances that may arise after the date of this news release, except as required by law.

For Oklo, particular risks and uncertainties that could cause Oklo’s

actual future results to differ materially from those expressed in the forward-looking statements relating to Oklo include but are not

limited to, risks related to the deployment of Oklo’s powerhouses, including those that affect the success of each of the collaboration

programs announced herein; the risks that Centrus is the future is unable or unwilling to proceed with the collaboration programs announced

herein; the risk that Oklo and Centrus do not ever enter into any definitive agreements relating to the purchase and sale of electricity

or for any of the other acitivities noted in the release; the risk that Oklo is pursuing an emerging market, with no commercial project

operating, regulatory uncertainties; the potential need for financing to construct plants, market, financial, political and legal conditions;

the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that the approval

of the shareholders of AltC or Oklo is not obtained the effects of competition; changes in applicable laws or regulations; the outcome

of any government and regulatory proceedings, investigations and inquiries; each case, under the heading “Risk Factors,” and

other documents filed, or to be filed, with the SEC by AltC, including the registration statement on Form S-4 that AltC intends to file.

If any of these risks materialize or Oklo’s assumptions prove incorrect, actual results could differ materially from the results

implied by the forward-looking statements relating to Oklo. There may be additional risks that Oklo does not presently know or that Oklo

currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect Oklo’s expectations, plans or forecasts of future events and views as of the date

of this communication. Oklo anticipate that subsequent events and developments will cause Oklo’s assessments to change. However,

while Oklo may elect to update these forward- looking statements at some point in the future, Oklo specifically disclaim any obligation

to do so. These forward-looking statements should not be relied upon as representing Oklo’s assessments as of any date subsequent

to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information About the Oklo and AltC Business Combination

and Where to Find It

The proposed business combination will be submitted to shareholders

of AltC for their consideration. AltC intends to file a registration statement on Form S-4 (the “Registration Statement”)

with the SEC, which will include preliminary and definitive proxy statements to be distributed to AltC’s shareholders in connection

with AltC’s solicitation for proxies for the vote by AltC’s shareholders in connection with the proposed business combination

and other matters to be described in the Registration Statement, as well as the prospectus relating to the offer of the securities to

be issued to Oklo’s shareholders in connection with the completion of the proposed business combination. After the Registration

Statement has been filed and declared effective, AltC will mail a definitive proxy statement/prospectus/consent solicitation statement

and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination. AltC’s

shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus/consent solicitation

statement and any amendments thereto and, once available, the definitive proxy statement/prospectus/consent solicitation statement, in

connection with AltC’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things,

the proposed business combination, as well as other documents filed with the SEC by AltC in connection with the proposed business combination,

as these documents will contain important information about AltC, Oklo and the proposed business combination. Shareholders may obtain

a copy of the preliminary or definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents

filed by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC

Acquisition Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

AltC, Oklo and certain of their respective directors, executive officers

and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from AltC’s

shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed

participants in the solicitation of AltC’s shareholders in connection with the proposed business combination will be set forth in

AltC’s proxy statement/prospectus/consent solicitation statement when it is filed with the SEC. You can find more information about

AltC’s directors and executive officers in AltC’s final prospectus filed with the SEC on July 7, 2021 and in the Annual Reports

filed by AltC with the SEC on Form 10-K. Additional information regarding the participants in the proxy solicitation and a description

of their direct and indirect interests will be included in the proxy statement/prospectus/consent solicitation statement when it becomes

available. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus/consent solicitation

statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents

from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus, an advertisement or a public

offering of the securities described herein in the United States or any other jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. INVESTMENT

IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON

OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

Media Contact for Oklo:

Bonita Chester, Director of Communications and Media at media@oklo.com

Christina Stenson / Michael Landau

Gladstone Place Partners

(212) 230-5930

Investor Contact

Caldwell Bailey / Eduardo Royes

ICR, Inc.

OkloIR@icrinc.com

Investor Contact for Oklo:

Caldwell Bailey / Eduardo Royes, ICR Inc., OkloIR@icrinc.com

Centrus Contacts:

Investors: Dan Leistikow at LeistikowD@centrusenergy.com

Media: Lindsey Geisler at GeislerLR@centrusenergy.com

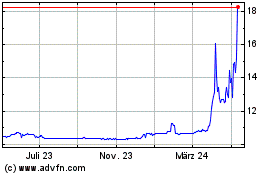

AltC Acquisition (NYSE:ALCC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

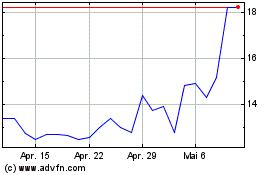

AltC Acquisition (NYSE:ALCC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024