As filed with the Securities and Exchange Commission on October 4, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

a.k.a. Brands Holding Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 87-0970919 |

(State or Other Jurisdiction

of Incorporation) | | (IRS Employer

Identification No.) |

| | |

100 Montgomery Street, Suite 1600

San Francisco, California | | 94104 |

| (Address of Principal Executive Offices) | | (Zip Code) |

a.k.a. Brands Holding Corp. 2021 Omnibus Incentive Plan

(Full Title of the Plan)

Ciaran Long

Interim Chief Executive Officer and Chief Financial Officer

100 Montgomery Street, Suite 2270

San Francisco, CA

(Name and address of agent for service)

(415) 295-6085

(Telephone number, including area code, of agent for service)

Copy to:

Justin R. Salon

Morrison & Foerster LLP

2100 L Street, NW Suite 900

Washington, D.C. 20037

(202) 887-1500

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | | Accelerated Filer | ¨ |

| | | | |

| Non-accelerated filer | x | | Smaller Reporting Company | ¨ |

| | | | |

| | | Emerging Growth Company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

EXPLANATORY NOTE

This Registration Statement is filed by a.k.a. Brands Holding Corp. (the “Registrant”) for the purpose of registering (i) 833,333 additional shares of the Registrant’s common stock, par value $0.001 per share (the “Common Stock”) under the a.k.a. Brands Holding Corp. 2021 Omnibus Incentive Plan (the “Plan”) as adjusted for the Reverse Stock Split (as defined below), following the amendment to the Plan that was approved by the Registrant’s stockholders at its annual meeting on May 25, 2023, (ii) 153,456 additional shares of common stock pursuant to the “evergreen” provision of the Plan, as adjusted for the Reverse Stock Split and (iii) 199,396 additional shares of common stock pursuant to the “evergreen” provision of the a.k.a. Brands Holding Corp. 2021 Employee Stock Purchase Plan (the “ESPP”), as adjusted for the Reverse Stock Split. The amendment to the Plan, among other things, increases the number of shares of Common Stock available for issuance under the Plan by 10,000,000 shares before adjusting for the Reverse Stock Split (as defined below). The “evergreen” provisions of the Plan and the ESPP provide that the maximum amount of shares of Common Stock authorized under the Plan and the ESPP shall be increased on January 1 of each year by a number equal to one percent (1%) of the total number of shares of Common Stock outstanding on December 31st of the immediately preceding calendar year. The Registrant initially registered 5,635,310 shares and 1,408,828 shares of Common Stock reserved for issuance under the Plan and the ESPP, respectively, on Form S-8 filed with the Securities and Exchange Commission (the "Commission") on September 23, 2021, however 4,900,269 shares and 1,225,067 shares were reserved under the Plan and the ESPP, respectively. The excess 735,041 shares under the Plan and the excess 183,761 shares under the ESPP are being counted against the shares that would otherwise be registered pursuant to the “evergreen” provisions of the Plan and the ESPP on this Registration Statement. On September 25, 2023, the Registrant filed a Certificate of Amendment to the Registrant’s Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, which effected a one-for-12 reverse stock split (the “Reverse Stock Split”) of the Registrant’s issued and outstanding shares of Common Stock, at 5:01 PM Eastern Time on September 29, 2023. As a result of the Reverse Stock Split, every 12 shares of Common Stock issued and outstanding were converted into one share of Common Stock. The number of shares to be awarded under the Plan and the number of additional shares available pursuant to the “evergreen” provisions are also being appropriately adjusted as a result of the Reverse Stock Split.

In accordance with General Instruction E of Form S-8, this Registration Statement hereby incorporates by reference the contents of the Registration Statement on Form S-8 (File No. 333-259753), filed by the Registrant with the Commission on September 23, 2021, relating to the Plan and the ESPP.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| | | | | | | | |

| Item 8. Exhibits. |

| | |

| Exhibit Number | | Description |

| 4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 4.4 | | |

| 4.5 | | |

| 4.6 | | |

| 5.1* | | |

| 23.1* | | |

| 23.2* | | |

| 24.1* | | |

| 107* | | |

* Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Francisco, State of California, on October 4, 2023.

| | | | | | | | |

| | a.k.a. Brands Holding Corp. |

| | | |

| By: | /s/ Ciaran Long |

| | Name: | Ciaran Long |

| | Title: | Interim Chief Executive Officer and Chief Financial Officer |

POWERS OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Ciaran Long and Kenneth C. White and each or any one of them, their true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for each of the undersigned in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement on Form S-8, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on October 4, 2023.

| | | | | | | | |

| Name | | Position |

| | |

| /s/ Ciaran Long | | Interim Chief Executive Officer and Chief Financial Officer |

| Ciaran Long | | (Principal Executive, Financial and Accounting Officer) |

| | |

| /s/ Christopher Dean | | Chair of the Board |

| Christopher Dean | | |

| | |

| /s/ Wesley Bryett | | Director |

| Wesley Bryett | | |

| | |

| /s/ Ilene Eskenazi | | Director |

| Ilene Ezkenazi | | |

| | |

| /s/ Sourav Ghosh | | Director |

| Sourav Ghosh | | |

| | |

| /s/ Matthew Hamilton | | Director |

| Matthew Hamilton | | |

| | |

| /s/ Myles McCormick | | Director |

| Myles McCormick | | |

| | | | | | | | |

| | |

| /s/ Jill Ramsey | | Chief Executive Officer and Director |

| Jill Ramsey | | |

| | |

| /s/ Kelly Thompson | | Director |

| Kelly Thompson | | |

October 4, 2023

Board of Directors

a.k.a. Brands Holding Corp.

100 Montgomery Street, Suite 1600

San Francisco, California 94104

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We are acting as counsel to a.k.a. Brands Holding Corp., a Delaware corporation (the “Company”), in connection with its registration statement on Form S-8 (the “Registration Statement”), filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), relating to the offering of up to 986,789 shares (the “Plan Shares”) of the Company’s common stock, $0.001 par value (the “Common Stock”), which shares may be issued pursuant to the Company’s 2021 Omnibus Incentive Plan, as amended by Amendment No. 1 thereto (the “Plan”), and 199,396 shares (together with the Plan Shares, the “Shares”) of Common Stock which may be issued pursuant to the Company’s 2021 Employee Stock Purchase Plan (the “ESPP,” and together with the Plan, the “Plans”).

As counsel for the Company, we have examined originals or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary for the purposes of rendering this opinion and we are familiar with the proceedings taken and proposed to be taken by the Company in connection with the authorization, issuance and sale of the Shares. In our examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals and the conformity with the originals of all documents submitted to us as copies. This opinion letter is given, and all statements herein are made, in the context of the foregoing.

This opinion letter is based as to matters of law solely on the Delaware General Corporation Law, as amended. We express no opinion herein as to any other laws, statutes, ordinances, rules, or regulations. As used herein, the term “Delaware General Corporation Law, as amended” includes the statutory provisions contained therein, all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting these laws.

Based upon, subject to and limited by the foregoing, we are of the opinion that following (i) effectiveness of the Registration Statement, (ii) issuance of the Shares pursuant to the terms of the Plans, and (iii) receipt by the Company of the consideration for the Shares specified in the applicable resolutions of the Board of Directors or a duly authorized committee thereof and the Plans, the Shares will be validly issued, fully paid and nonassessable.

This opinion letter has been prepared for use in connection with the Registration Statement. We assume no obligation to advise you of any changes in the foregoing subsequent to the effective date of the Registration Statement.

We consent to the use of this opinion as an exhibit to the Registration Statement, and we consent to the reference of our name wherever appearing in the Registration Statement and any amendments thereto. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ Morrison & Foerster LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of a.k.a. Brands Holding Corp. of our report dated March 9, 2023 relating to the financial statements, which appears in the Annual Report of a.k.a. Brands Holding Corp. on Form 10-K for the year ended December 31, 2022.

/s/ PricewaterhouseCoopers

Melbourne, Australia

October 4, 2023

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

a.k.a. Brands Holding Corp.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | | Security Class Title | | Fee Calculation Rule | | Amount Registered1 | | Proposed Maximum Offering Price Per Share | | Maximum Aggregate Offering Price | | Fee Rate | | Amount of Registration Fee |

| Equity | | Common stock, par value $0.001 per share | | Rule 457(h) | | 1,186,1852 | | $ | 4.77 | 3 | | $ | 5,658,102.45 | | | $ | 0.00014760 | | | $ | 835.14 | |

| Total Offering Amounts | | | | $ | 5,658,102.45 | | | | | $ | 835.14 | |

| Total Fee Offsets | | | | | | | | — | |

| Net Fee Due | | | | | | | | $ | 835.14 | |

1 Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of common stock which become issuable under the a.k.a. Brands Holding Corp. 2021 Omnibus Incentive Plan (the “Plan”) and the a.k.a. Brands Holding Corp. 2021 Employee Stock Purchase Agreement (the “ESPP”) by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without receipt of consideration which results in an increase in the number of a.k.a. Brands Holding Corp.’s (the “Registrant”) outstanding shares of common stock.

2 Represents (i) 833,333 additional shares of common stock, par value $0.001 per share, of the Registrant that may be issued and sold under the Plan, following the amendment to the Plan that was approved by the Registrant’s stockholders at its annual meeting on May 25, 2023; (ii) 153,456 shares of common stock that were added to the shares reserved for future issuance under the Plan pursuant to the “evergreen” provision of the Plan, (iii) 199,396 shares of common stock that were added to the shares reserved for future issuance under the ESPP pursuant to the “evergreen” provision of the ESPP; and (iv) shares of common stock that may again become available for delivery with respect to awards under the Plan pursuant to the share counting, share recycling and other terms and conditions of the Plan.

3 Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) promulgated under the Securities Act based on the average of the high and low sales prices per share of the Registrant’s common stock as reported on the New York Stock Exchange on October 3, 2023.

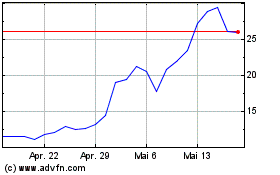

aka Brands (NYSE:AKA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

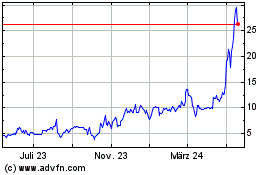

aka Brands (NYSE:AKA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024