Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

10 Januar 2022 - 10:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2022

Commission File Number: 001-31909

ASPEN INSURANCE HOLDINGS LIMITED

(Translation of registrant’s name into English)

141 Front Street

Hamilton HM 19

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ¨ No ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ¨ No ý

On January 10, 2022, Aspen Insurance Holdings Limited and certain of its subsidiaries (“Aspen”) entered into an Amended and Restated Reinsurance Agreement with a subsidiary of Enstar Group Limited (the “Agreement”), which amends and restates the Adverse Development Cover Agreement, dated as of March 2, 2020 (the “Original Agreement”), previously entered into between the parties. Under the terms of the Agreement, Enstar’s subsidiary will reinsure net losses incurred on or prior to December 31, 2019 on Aspen’s diverse mix of property, liability and specialty lines across the U.S., U.K. and other jurisdictions (the “Subject Business”) having net loss reserves of $3.12 billion as of September 30, 2021. The Agreement provides for a limit of $3.57 billion in consideration for a premium of $3.16 billion. The amount of net loss reserves ceded, as well as the premium and limit amounts provided under the Agreement, will be adjusted for claims paid between October 1, 2021 and the closing date of the transaction. The premium includes $770.0 million of premium previously paid with respect to reserves ceded under the Original Agreement, which will continue to be held in trust accounts to secure the Enstar subsidiary’s obligations under the Agreement. The incremental new premium will initially be held in funds withheld accounts maintained by Aspen but will be released to the trust accounts maintained by the Enstar subsidiary no later than September 30, 2025. The funds withheld by Aspen will be credited with interest at an annual rate of 1.75% plus, for periods after October 1, 2022, an additional amount equal to 50% of the amount by which the total return on the investments and cash and cash equivalents of Aspen Insurance Holdings Limited and its subsidiaries exceeds 1.75%. Under the Agreement, the Enstar subsidiary will assume claims control of the Subject Business upon closing and entrance into an administrative services agreement.

The Agreement includes customary representations and warranties, indemnification obligations, covenants and termination rights of the parties. Completion of the transaction is subject to regulatory approvals and satisfaction of various other closing conditions. The transaction is expected to close in the first half of 2022. If the transaction cannot be completed, the Original Agreement would remain in effect.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASPEN INSURANCE HOLDINGS LIMITED

|

|

|

|

|

|

|

Dated: January 10, 2022

|

|

|

|

By:

|

|

/s/ Christopher Coleman

|

|

|

|

|

|

Name:

|

|

Christopher Coleman

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

Aspen Insurance (NYSE:AHL-C)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

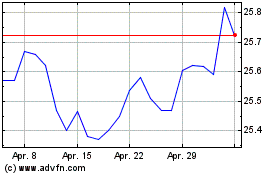

Aspen Insurance (NYSE:AHL-C)

Historical Stock Chart

Von Jan 2024 bis Jan 2025