As previously announced on February 16, 2024, XOMA Corporation

(“XOMA” or the “Company”; Nasdaq: XOMA) entered into a merger

agreement to acquire Kinnate Biopharma Inc. (“Kinnate”; Nasdaq:

KNTE) for (i) a base cash price per share of Kinnate common stock

of $2.3352 per share and (ii) an additional cash amount of not more

than $0.2527 per share (together with the base price, the Cash

Amount), plus one non-tradeable contingent value right (“CVR”)

representing the right to receive 85% of the net proceeds from any

out license or sale of Kinnate programs effected within one year of

closing of the merger and 100% of the net proceeds from any out

license or sale executed prior to the closing. On March 4,

2024, XOMA commenced a tender offer to acquire all outstanding

shares of Kinnate common stock (“the Offer”).

Pursuant to the terms of the Merger Agreement, based upon

Kinnate’s estimated calculation of cash, net of transaction costs,

wind-down costs and other liabilities at closing, the additional

cash amount has been determined to be the maximum $0.2527 per

share. Therefore, the Cash Amount that Kinnate stockholders

will receive in the Offer is $2.5879 per share.

Additionally, XOMA has extended the Offer’s expiration date, so

that the Offer and related withdrawal rights will expire at one

minute after 11:59 p.m. Eastern time on April 2, 2024, unless the

expiration date is further extended in accordance with the terms of

the Merger Agreement.

Stockholders who previously have tendered their shares do not

need to re-tender their shares or take any other action in response

to the determination of the additional cash amount or extension of

the Offer. As previously announced, Kinnate stockholders

holding approximately 46% of Kinnate common stock have signed

support agreements to tender their shares in the Offer prior to the

expiration date and support the merger.

The closing of the Offer is subject to certain conditions,

including the tender of Kinnate common stock representing at least

a majority of the total number of outstanding shares, the

availability of at least $120.0 million of cash, net of transaction

costs, wind-down costs, and other liabilities, at closing, and

other customary closing conditions. Promptly following the

closing of the Offer, Kinnate will merge with and into a wholly

owned subsidiary of XOMA, and all remaining shares not tendered in

the Offer, other than shares held in treasury by Kinnate or shares

owned by a stockholder who was entitled to and properly demanded

appraisal of such shares pursuant to Delaware law, will be

converted into the right to receive the same cash and CVR

consideration per share as is provided in the Offer. The

acquisition is expected to close in April 2024.

About XOMA CorporationXOMA is a biotechnology

royalty aggregator playing a distinctive role in helping biotech

companies achieve their goal of improving human health. XOMA

acquires the potential future economics associated with

pre-commercial therapeutic candidates that have been licensed to

pharmaceutical or biotechnology companies. When XOMA acquires

the future economics, the seller receives non-dilutive,

non-recourse funding they can use to advance their internal drug

candidate(s) or for general corporate purposes. The Company

has an extensive and growing portfolio of milestone and royalty

assets (asset defined as the right to receive potential future

economics associated with the advancement of an underlying

therapeutic candidate). For more information about the

Company and its portfolio, please visit www.xoma.com.

About Kinnate Biopharma Inc.Kinnate Biopharma

Inc. is a clinical-stage precision oncology company founded with a

mission to inspire hope in those battling cancer by expanding on

the promise of targeted therapies. Kinnate concentrates its

efforts on addressing known oncogenic drivers for which there are

currently no approved targeted therapies and to overcome the

limitations associated with existing cancer therapies, such as

non-responsiveness or the development of acquired and intrinsic

resistance.

Exarafenib, an investigational pan-RAF inhibitor which targets

cancers with BRAF and NRAS-driven alterations, was one of Kinnate’s

lead product candidates. Kinnate’s other lead product

candidate is an investigational FGFR inhibitor, KIN-3248, which is

designed for cancers with FGFR2 and FGFR3 alterations.

Kinnate also has early-stage programs, including a c-MET inhibitor

that targets resistant variants and a brain penetrant CDK4

selective program. For more information, visit Kinnate.com

and follow Kinnate on LinkedIn to learn about its most recent

initiatives.

Cautionary Notice Regarding Forward-Looking

StatementsThis report contains forward-looking statements

within the meaning of U.S. federal securities laws, including,

without limitation, statements regarding the anticipated timing of

and closing of the proposed Offer, Merger and related transactions

contemplated by the Merger Agreement (the “Transactions”).

The words “estimates,” “expects,” “continues,” “intends,” “plans,”

“anticipates,” “targets,” “may,” “will,” “would,” “could,”

“should,” “potential,” “goal,” and “effort”, and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Any forward-looking statements in this

report are based on management’s current expectations and beliefs

and are subject to a number of risks, uncertainties and important

factors that may cause actual events or results to differ

materially from those expressed or implied by any forward-looking

statements contained in this report, including, without limitation,

the impact of actions of other parties with respect to the

Transactions; the possibility that competing offers will be made;

the outcome of any legal proceedings that could be instituted

against the Company or Kinnate or their respective directors; the

risk that the Transactions may not be completed in a timely manner,

or at all, which may adversely affect the Company or Kinnate’s

business and the price of their respective common stock; the

failure to satisfy all of the closing conditions of the Offer and

the other transactions contemplated by the Merger Agreement; the

occurrence of any event, change or other circumstance that could

give rise to the termination of the Merger Agreement; the effect of

the announcement or pendency of the Transactions on the Company or

Kinnate’s business, and operating results; risks that the

Transactions may disrupt the Company’s current plans and business

operations; risks related to the diverting of management’s

attention from the Company’s ongoing business operations; general

economic and market conditions and the other risks identified in

the Company’s filings with the U.S. Securities and Exchange

Commission (“SEC”), including its most recent Annual Report on Form

10-K for the year ended December 31, 2022, filed with the SEC on

March 9, 2023, and subsequent filings with the SEC. Should

any risks and uncertainties develop into actual events, these

developments could have a material adverse effect on the

Transactions and/or the Company and Kinnate’s ability to

successfully complete the Transactions. The Company cautions

investors not to place undue reliance on any forward-looking

statements, which speak only as of the date they are made.

The Company disclaims any obligation to publicly update or revise

any such statements to reflect any change in expectations or in

events, conditions or circumstances on which any such statements

may be based, or that may affect the likelihood that actual results

will differ from those set forth in the forward-looking

statements. Any forward-looking statements contained in this

report represent the Company’s views only as of the date hereof and

should not be relied upon as representing its views as of any

subsequent date.

Additional Information and Where to Find ItThis

communication is for informational purposes only. It is not a

recommendation and is neither an offer to purchase nor a

solicitation of an offer to sell shares of common stock of Kinnate

or any other securities. This communication is also not a

substitute for the Offer materials that Purchaser has filed with

the SEC in connection with the Offer. On March [18], 2024,

Purchaser filed with the SEC an amended Tender Offer Statement on

Schedule TO-T (the “Amended Tender Offer Statement”) and Kinnate

filed with the SEC an amended Solicitation/Recommendation Statement

on Schedule 14D-9 (the “Amended Solicitation/Recommendation

Statement”).

KINNATE’S STOCKHOLDERS ARE URGED TO READ THE AMENDED TENDER

OFFER STATEMENT MATERIALS (INCLUDING THE AMENDED OFFER TO PURCHASE,

THE RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER

DOCUMENTS) AND THE AMENDED SOLICITATION/RECOMMENDATION STATEMENT,

BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ

CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE

OFFER.

Kinnate’s stockholders and other investors can

obtain the Amended Tender Offer Statement, the Amended

Solicitation/Recommendation Statement and other filed documents for

free at the SEC’s website at www.sec.gov. Copies of the

documents filed with the SEC by Kinnate are available free of

charge on the Investors page of Kinnate’s website, www.kinnate.com,

or by contacting Kinnate at investors@kinnate.com. In

addition, Kinnate’s stockholders may obtain free copies of the

Offer materials by contacting Morrow Sodali LLC, the information

agent for the Offer. You may call Morrow Sodali LLC toll-free

at (800) 662-5200 or email them at

KNTE@investor.morrowsodali.com. Banks and brokers may call

collect at (203) 658-9400.

| |

|

| XOMA Investor Contact |

XOMA Media Contact |

| Juliane Snowden |

Kathy Vincent |

| XOMA Corporation |

KV Consulting & Management |

| +1 646-438-9754 |

+1 310-403-8951 |

| juliane.snowden@xoma.com |

kathy@kathyvincent.com |

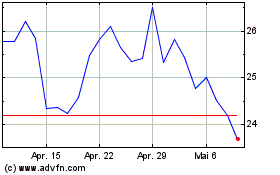

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024