false

0001534525

0001534525

2024-10-21

2024-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed with the Securities and Exchange Commission

on October 21, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

XENETIC BIOSCIENCES, INC.

(Exact name of registrant as

specified in its charter)

| Nevada |

|

45-2952962 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

945 Concord Street

Framingham, Massachusetts 01701

(781) 778-7720

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

James F. Parslow

Interim Chief Executive Officer and Chief Financial

Officer

Xenetic Biosciences, Inc.

945 Concord Street

Framingham, Massachusetts 01701

(781) 778-7720

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With a copy to:

Danielle C. Price

Holland & Knight LLP

701 Brickell Avenue, Suite 3300

Miami, Florida 33131

Phone: (305) 349-2259

Facsimile: (305) 789-7799

Approximate date of commencement

of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the

registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section

8(a), may determine.

The information in this

prospectus is not complete and may be changed. We may not sell the securities until the Registration Statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy

these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED OCTOBER 21, 2024

PROSPECTUS

Xenetic Biosciences, Inc.

$50,000,000

Common Stock

Preferred Stock

Warrants

Units

Rights

Depositary Shares

Debt Securities

We may offer, issue and sell, from time to time,

shares of our common stock, preferred stock, warrants, units, rights, depositary shares and debt securities which may consist of debentures,

notes, or other types of debt, in one or more offerings with an aggregate offering price not to exceed $50,000,000. We will provide specific

terms of each offering and issuance of these securities, such as when we sell the securities, the amounts of securities we will sell and

the prices and other terms on which we will sell them, in supplements to this prospectus. We may offer and sell these securities to or

through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. You should read this

prospectus and any supplement carefully before you decide to invest. This prospectus may not be used to consummate sales of these securities

unless it is accompanied by a prospectus supplement.

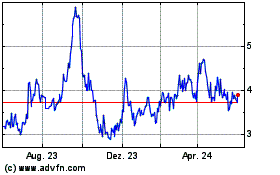

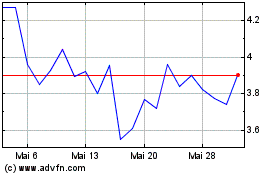

Our common stock is listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “XBIO”. As of September 30, 2024, the aggregate market value of our outstanding

common stock held by non-affiliates, or public float, was approximately $5.6 million based on 1,303,696 shares of outstanding common stock

held by non-affiliates, at a price of $4.32 per share, which was the last reported sale price of our common stock on Nasdaq on September

30, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the shelf securities in a public primary offering

with a value exceeding more than one-third of the aggregate market value of our voting and non-voting common equity held by non-affiliates

in any 12-month period as long as the aggregate market value of our outstanding voting and non-voting common equity held by non-affiliates

is less than $75 million.

Our principal office is located at 945 Concord

Street, Framingham, Massachusetts 01701. Our telephone number is (781) 778-7720.

Investing in our securities involves risks.

You should carefully consider the information referred to under the heading “Risk Factors”

on page 4 of this prospectus before you invest.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED THAT THIS PROSPECTUS IS TRUTHFUL OR

COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is

, 2024

TABLE OF CONTENTS

You should rely only on the information contained in this document

or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only

be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration

process. Under this shelf registration process, we may sell the securities described in this prospectus in one or more offerings with

an aggregate offering price not to exceed $50,000,000. This prospectus provides you with a general description of the securities we may

offer. Each time we offer to sell securities, we will provide a supplement to this prospectus that will contain specific information about

the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. It is important

for you to consider the information contained in this prospectus and any prospectus supplement together with additional information described

under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

You should rely only on the information incorporated

by reference or set forth in this prospectus or the applicable prospectus supplement. We have not authorized anyone else to provide you

with additional or different information. You should not assume that the information in this prospectus, the applicable prospectus supplement

or any other offering material is accurate as of any date other than the dates on the front of those documents.

Our logo and some of our trademarks and tradenames

are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of others. Solely

for convenience, trademarks, tradenames and service marks referred to in this prospectus may appear without the ®, ™ and SM

symbols. References to our trademarks, tradenames and service marks are not intended to indicate in any way that we will not assert to

the fullest extent under applicable law our rights or the rights of the applicable licensor, nor that respective owners to other intellectual

property rights will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display

of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by any other companies.

Since our patents are either held by us or our wholly-owned subsidiaries, we will not distinguish between patents held by us or our subsidiaries

in this prospectus.

References in this prospectus to “we,”

“us,” “our,” “Xenetic” or the “Company” are to Xenetic Biosciences, Inc. and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, any prospectus supplement and

the other documents we have filed with the SEC that are incorporated by reference herein contain forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities

Act of 1933, as amended. All statements contained in this prospectus other than statements of historical fact, including statements regarding

our future results of operations and financial position, our business strategy and plans, future revenues, projected costs, prospects

and our objectives for future operations, are forward-looking statements. These forward-looking statements include, but are not limited

to, statements concerning: anticipated effects of geopolitical events, including the conflicts in the Ukraine and the Middle East and

associated sanctions imposed by the U.S. and other countries in response; our plans to develop our proposed drug candidates; our expectations

regarding the nature, timing and extent of clinical trials and proposed clinical trials; our expectations regarding the timing for proposed

submissions of regulatory filings; our expectations regarding the nature, timing and extent of collaboration arrangements; the expected

results pursuant to collaboration arrangements, including the receipts of future payments that may arise pursuant to collaboration arrangements;

the outcome of our plans to obtain regulatory approval of our drug candidates; the outcome of our plans for the commercialization of our

drug candidates; our plans to address certain markets, engage third party manufacturers, and evaluate additional drug candidates for subsequent

commercial development along with the likelihood and extent of competition to our drug candidates; our plans to advance innovative immune-oncology

technologies addressing hard to treat oncology indications; expectations regarding our Deoxyribonuclease (“DNase”) platform,

such as regarding the DNase platform being in development for the treatment of solid tumors and being aimed at improving outcomes of existing

treatments, including immunotherapies, by targeting neutrophil extracellular traps (“NETs”); our expectations to focus our

efforts and resources on advancing the DNase platform into the clinic as an adjunctive therapy for pancreatic carcinoma and locally advanced

or metastatic solid tumors; and our expectations regarding our PolyXen® platform, including concerning our plans to leverage the platform.

In some cases, these statements may be identified

by terminology such as “may,” “will,” “would,” “could,” “should,” “expect,”

“plan,” “anticipate,” “believe,” “estimate,” “seek,” “approximately,”

“intend,” “predict,” “potential,” “projects,” or “continue,” or the negative

of such terms and other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements

contained herein are reasonable, we cannot guarantee future results, the levels of activity, performance or achievements. These statements

involve known and unknown risks and uncertainties that may cause our or our industry's results, levels of activity, performance or achievements

to be materially different from those expressed or implied by forward-looking statement.

This prospectus should be read together with

our financial statements and related notes thereto incorporated by reference in this prospectus. The forward-looking statements made herein

are based on our current expectations, involve a number of risks and uncertainties and should not be considered as guarantees of future

performance. This prospectus, any prospectus supplement and the other documents we have filed with the SEC that are incorporated by reference

herein contain trend analysis and other forward-looking statements. Any statements that are not statements of historical facts are forward-looking

statements.

You should carefully consider these risks before

you make an investment decision with respect to our securities, along with the following factors that could cause actual results to differ

materially from our forward-looking statements:

| · | uncertainty of the expected financial performance of the Company; |

| · | failure to realize the anticipated potential of the DNase or PolyXen technologies; |

| · | our ability to implement our business strategy; |

| · | our failure to maintain compliance with the continued listing requirements of Nasdaq; |

| · | our need to raise additional working capital in the future for the purpose of further developing our

pipeline and to continue as a going concern; |

| · | our ability to finance our business; |

| · | our ability to successfully execute, manage and integrate key acquisitions and mergers; |

| · | product development and commercialization risks, including our ability to successfully develop the DNase

technology; |

| · | the impact of adverse safety outcomes and clinical trial results for our therapies; |

| · | our ability to secure and maintain a manufacturer for our technologies; |

| · | the impact of new therapies and new uses of existing therapies on the competitive environment; |

| · | our ability to successfully commercialize our current and future drug candidates; |

| · | our ability to achieve milestone and other payments associated with our current and future co-development

collaborations and strategic arrangements; |

| · | our reliance on consultants, advisors, vendors and business partners to conduct work on our behalf; |

| · | the impact of new technologies on our drug candidates and our competition; |

| · | changes in laws or regulations of governmental agencies; |

| · | interruptions or cancellation of existing contracts; |

| · | impact of competitive products and pricing; |

| · | product demand and market acceptance and risks; |

| · | the presence of competitors with greater financial resources; |

| · | continued availability of supplies or materials used in manufacturing at the current prices; |

| · | the ability of management to execute plans and motivate personnel in the execution of those plans; |

| · | our ability to attract and retain key personnel; |

| · | costs, diversion and other adverse effects of the actions of activist shareholders; |

| · | adverse publicity related to our products or the Company itself; |

| · | adverse claims relating to our intellectual property; |

| · | the adoption of new, or changes in, accounting principles; |

| · | the costs inherent with complying with statutes and regulations applicable to public reporting companies,

such as the Sarbanes-Oxley Act of 2002; |

| · | other new lines of business that we may enter in the future; |

| · | general economic and business conditions, as well as inflationary trends and financial market instability

or disruptions to the banking system due to bank failures; |

| · | the impact of natural disasters or public health emergencies, such as the COVID-19 global pandemic,

and geopolitical events, such as the Russian invasion of Ukraine and conflict in the Middle East, and related sanctions and other economic

disruptions or concerns, on our financial condition and results of operations; and |

| · | other factors set forth in the Risk Factors section of our Annual Report on Form 10-K and in subsequent

filings with the Securities and Exchange Commission (“SEC”). |

These factors are not necessarily all of the important

factors that could cause actual results to differ materially from those expressed in the forward-looking statements in this prospectus.

Other unknown or unpredictable factors also could have material adverse effects on our future results, including, but not limited to,

those discussed in the section titled “Risk Factors.” The forward-looking statements in this prospectus are made only as of

the date of this prospectus, and we do not undertake any obligation to publicly update any forward-looking statements to reflect subsequent

events or circumstances. We intend that all forward-looking statements be subject to the safe-harbor provisions of the Private Securities

Litigation Reform Act of 1995.

PROSPECTUS SUMMARY

This summary highlights selected information and does not contain

all the information that is important to you. You should carefully read this prospectus, including the “Risk Factors” section

and the consolidated financial statements and related notes included in this prospectus or incorporated by reference into this prospectus,

any applicable prospectus supplement and the documents to which we have referred to in the “Incorporation of Certain Documents

by Reference” section below for information about us and our financial statements.

Overview

We are a biopharmaceutical company focused on advancing

innovative immune-oncology technologies addressing hard to treat cancers. Our proprietary DNase platform is designed to improve outcomes

of existing treatments, including immunotherapies, by targeting NETs, which have been implicated in cancer progression and resistance

to cancer treatments. We are currently focused on advancing our systemic DNase program into the clinic as an adjunctive therapy for pancreatic

carcinoma and locally advanced or metastatic solid tumors.

Additionally, we have partnered with biotechnology

and pharmaceutical companies to develop our proprietary drug delivery platform, PolyXen, and receive royalty payments under an exclusive

license arrangement in the field of blood coagulation disorders. PolyXen is an enabling platform technology for protein and peptide drug

delivery. It uses the biological polymer polysialic acid (“PSA”) to prolong the drug's half-life and potentially improve the

stability of therapeutic peptides and proteins.

We incorporate our patented and proprietary technologies

into drug candidates currently under development with biotechnology and pharmaceutical industry collaborators to create what we believe

will be the next-generation biologic drugs with improved pharmacological properties over existing therapeutics. Our drug candidates have

resulted from our research activities or that of our collaborators and are in the development stage. As a result, we continue to commit

a significant amount of our resources to our research and development activities and anticipate continuing to do so for the near future.

To date, none of our drug candidates have received regulatory marketing authorization or approval in the U.S. by the Food and Drug Administration

(“FDA”) nor in any other countries or territories by any applicable agencies. As noted above, we are receiving ongoing royalties

pursuant to a license of our PolyXen technology to an industry partner.

Although we hold a broad patent portfolio, the

focus of our internal efforts in 2023 and 2024 was on the licensing and advancement of our DNase platform.

Corporate Information

We were incorporated under the laws of the State

of Nevada in August 2011. Our corporate headquarters and operation facilities are located at 945 Concord Street, Framingham, Massachusetts

01701. Our telephone number is (781) 778-7720. We maintain a website at www.xeneticbio.com. Our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports are available, free of charge, on or through our

website as soon as practicable after we electronically file such forms, or furnish them to, the SEC. The SEC maintains an Internet website

located at www.sec.gov that contains the information we file or furnish electronically with the SEC.

The Offering

Under this prospectus, we may offer and sell to

the public in one or more series or issuances of common stock, preferred stock, depository shares, debt securities, warrants, units and

rights with an aggregate offering price not to exceed $50,000,000.

RISK FACTORS

Investing in our securities involves risks. You

should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10-K,

as amended, and in any subsequent public filings with the SEC, including our Quarterly Reports on Form 10-Q (which descriptions are incorporated

by reference herein), as well as the other information contained or incorporated by reference in this prospectus or in any prospectus

supplement hereto before making a decision to invest in our securities. See “Where You Can Find More Information”

and “Incorporation of Certain Documents by Reference” below.

USE OF PROCEEDS

Unless otherwise indicated in an accompanying prospectus

supplement, we intend to use all the net proceeds from the sale of the securities offered by this prospectus and any related prospectus

supplement for general corporate purposes in accordance with our objectives and strategies described in our most recent Annual Report

on Form 10-K, as amended, and other filings with the SEC, which may include:

| |

· |

acquisitions of assets and businesses; |

| |

|

|

| |

· |

funding of ongoing development programs and clinical trials; |

| |

|

|

| |

· |

repayment of indebtedness outstanding at that time; and |

| |

|

|

| |

· |

general working capital. |

Any specific allocation of the net proceeds of

an offering of securities to a specific purpose will be determined at the time of such offering and will be described in the related supplement

to this prospectus.

DESCRIPTION OF CAPITAL STOCK

The following is a summary of the rights and preferences of our

capital stock. While we believe that the following description covers the material terms of our capital stock, the description may not

contain all of the information that is important to you. We encourage you to read carefully this entire prospectus, any future related

prospectus supplement and certificates of designation relating to the securities, as applicable, our articles of incorporation, as amended

(the “charter”) and amended and restated bylaws (the “bylaws”) and the other documents we refer to for a more

complete understanding of our capital stock. Copies of our charter and bylaws are incorporated by reference as exhibits to the registration

statement of which this prospectus is a part. See “Where You Can Find More Information” and

“Incorporation of Certain Documents by Reference.”

General

Our charter provides that we may issue up to 10,000,000

shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share, 1,000,000 of

which are designated as Series A Preferred Stock, 2,500,000 of which are designated as Series B Preferred Stock, and 6,500,000 of which

shares of preferred stock are undesignated. Under Nevada law, stockholders are not generally liable for our debts or obligations.

Shares of Common Stock

Voting Rights

Our common stock is entitled to one vote per share

on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided

in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will

possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election

of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented

by proxy, subject to any voting rights granted to holders of any preferred stock. Our stockholders do not have cumulative voting rights

in the election of directors. Holders of our common stock representing 50% of our capital stock issued, outstanding and entitled to vote,

represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a

majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment

to our charter.

Dividends

Subject to the preferential rights of any other

class or series of shares of stock created from time to time by our board of directors from time to time, the holders of shares of our

common stock will be entitled to such cash dividends, non-cumulative, as may be declared from time to time by our board of directors from

funds available therefore. We will not pay any dividends on shares of common stock (other than dividends in the form of common stock)

unless and until such time as we pay dividends on our preferred stock on an as-converted basis.

Liquidation

Subject to the preferential rights of any other

class or series of shares of stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the

holders of shares of our common stock will be entitled to share ratably in the assets of the Company available for distribution to such

holders.

Rights and Preferences

In the event of any merger or consolidation with

or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other

securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares

of stock and other securities and property (including cash). Holders of our common stock have no pre-emptive, conversion, subscription

or other rights and there are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges

of the holders of our common stock are subject to and may be adversely affected by the rights of the holders of shares of any series of

our preferred stock that we may designate in the future.

Fully Paid and Nonassessable

All of our outstanding shares

of common stock are duly authorized, validly issued, fully paid and nonassessable.

Shares of Preferred Stock

The following description sets forth general terms

and provisions of the preferred stock to which any prospectus supplement may relate. The statements below describing the preferred stock

are in all respects subject to and qualified in their entirety by reference to our charter, bylaws, and any certificate of designation,

designating terms of a series of preferred stock. The outstanding shares of our preferred stock have been validly issued, fully paid,

and non-assessable. Because our board of directors has the power to establish the preferences, powers and rights of each series of preferred

stock, our board of directors may afford the holders of any series of preferred stock preferences, powers and rights, voting or otherwise,

senior to the rights of our common stockholders. The issuance of our preferred stock could adversely affect the voting power of holders

of common stock and the likelihood that such holders will receive dividend payments and payments upon a liquidation. In addition, the

issuance of preferred stock could have the effect of delaying, deferring or preventing a change of control of the Company or other corporate

action.

The rights, preferences, privileges and restrictions

of our outstanding series of preferred stock are, and of each additional series of preferred stock, when and if issued in the future will

be, fixed by the certificate of designation relating to the series. A prospectus supplement, relating to each series, will specify the

terms of the preferred stock, as follows:

| |

· |

the title and stated value of the preferred stock; |

| |

|

|

| |

· |

the voting rights of the preferred stock, if applicable; |

| |

|

|

| |

· |

the preemptive rights of the preferred stock, if applicable; |

| |

|

|

| |

· |

the restrictions on alienability of the preferred stock, if applicable; |

| |

|

|

| |

· |

the number of shares offered, the liquidation preference per share and the offering price of the shares; |

| |

|

|

| |

· |

liability to further calls or assessment of the preferred stock, if applicable; |

| |

|

|

| |

· |

the dividend rate(s), period(s) and payment date(s) or method(s) of calculation applicable to the preferred stock; |

| |

· |

the date from which dividends on the preferred stock will accumulate, if applicable; |

| |

|

|

| |

· |

the procedures for any auction and remarketing for the preferred stock, if any; |

| |

|

|

| |

· |

the provision for a sinking fund, if any, for the preferred stock; |

| |

|

|

| |

· |

the provision for and any restriction on redemption, if applicable, of the preferred stock; |

| |

|

|

| |

· |

the provision for and any restriction on repurchase, if applicable, of the preferred stock; |

| |

|

|

| |

· |

any listing of the preferred stock on any securities exchange; |

| |

|

|

| |

· |

the terms and provisions, if any, upon which the preferred stock will be convertible into common stock, including the conversion price (or manner of calculation) and conversion period; |

| |

|

|

| |

· |

the terms under which the rights of the preferred stock may be modified, if applicable; |

| |

|

|

| |

· |

any other specific terms, preferences, rights, limitations or restrictions of the preferred stock; |

| |

|

|

| |

· |

a discussion of certain material federal income tax considerations applicable to the preferred stock; |

| |

|

|

| |

· |

the relative ranking and preferences of the preferred stock as to dividend rights and rights upon the liquidation, dissolution or winding-up of our affairs; |

| |

|

|

| |

· |

any limitation on issuance of any series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights upon the liquidation, dissolution or winding-up of our affairs; and |

| |

|

|

| |

· |

any limitations on direct or beneficial ownership and restrictions on transfer of the preferred stock. |

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock and preferred stock is Empire Stock Transfer, Inc.

Restrictions on Transfer

Transfers of shares of capital stock of the Company

shall be made only (i) by entering upon the stock-transfer books of the Company or (ii) by transfer agents designated to transfer shares

of capital stock of the Company.

Anti-takeover Effects of Certain Provisions of Nevada Law and of

Our Charter and Bylaws

Our charter and bylaws and the Nevada Revised Statutes

(the “NRS”) contain provisions that may delay, defer or prevent a change in control or other transaction that might involve

a premium price for shares of our common stock or otherwise be in the best interests of our stockholders, including business combination

provisions, the ability of our board of directors to authorize undesignated preferred stock, supermajority vote requirements and advance

notice requirements for director nominations and stockholder proposals. Likewise, if the provision in the bylaws opting out of the business

combination provisions of the NRS were rescinded or if we were to opt in, these provisions of the NRS could have similar anti-takeover

effects. See “Nevada Business Combinations Statute” and “Control Share Acquisitions” below.

These provisions are expected to discourage coercive

takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of

us to first negotiate with our board of directors. We believe that the benefits of increased protection of our potential ability to negotiate

with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging these

proposals because negotiation of these proposals could result in an improvement of their terms.

Blank Check Authorization

The NRS permits, if authorized by the Company’s

articles of incorporation, as amended, the issuance of blank check preferred stock with preferences, limitations and relative rights determined

by a corporation’s board of directors without stockholder approval. The Company’s articles of incorporation, as amended, currently

authorizes the issuance of blank check preferred stock, of which 6,500,000 preferred shares are available for future issuance in one or

more series to be issued from time to time.

No Right to Cumulative Voting

Pursuant to our bylaws, each of our directors is

elected by holders of our common stock entitled to vote and called to serve until the next annual meeting of stockholders when his or

her successor is duly elected and qualified. Holders of shares of common stock have no right to cumulative voting in the election of directors.

Consequently, at each annual meeting of stockholders, the holders of a plurality of the shares of common stock entitled to vote are able

to elect all of our directors. Holders of our preferred stock do not have voting rights, except that holders of our Series B Preferred

Stock have certain voting rights under limited circumstances.

Removal of Directors

Our bylaws and charter provide that the number

of directors we have may be established by our board of directors but may not be less than 1, nor more than 15. Our bylaws provide that

any vacancy may be filled only by a majority of the remaining directors. Any individual appointed to fill such a vacancy will serve until

the next annual meeting of stockholders when a successor is duly elected and qualified. Our bylaws further provide that a director may

be removed for cause and only by the affirmative vote of the holders of shares entitled to cast at least two thirds of all the votes of

common stockholders entitled to be cast generally in the election of directors. This provision, when coupled with the power of our board

of directors to fill vacancies on the board of directors, precludes stockholders from (1) removing incumbent directors except upon a substantial

affirmative vote and (2) filling the vacancies created by such removal with their own nominees.

Nevada Business Combinations Statute

The “business combination” provisions

of Sections 78.411 to 78.444, inclusive, of the NRS, generally prohibit a Nevada corporation with at least 200 stockholders from engaging

in various “combination” transactions with any interested stockholder for a period of two years after the date of the transaction

in which the person became an interested stockholder, unless the corporation’s board of directors approves the transaction by which

the stockholder becomes an interested stockholder in advance, or the proposed combination in advance of the stockholder becoming an interested

stockholder. The proposed combination may be approved after the stockholder becomes an interested stockholder with preapproval by the

board of directors and a vote at a special or annual meeting of stockholders holding at least 60 percent of the voting power not owned

by the interested stockholder or its affiliates or associates. A “combination” is generally defined to include mergers or

consolidations or any sale, lease exchange, mortgage, pledge, transfer, or other disposition, in one transaction or a series of transactions,

with an “interested stockholder” (a) having an aggregate market value equal to 5% or more of the aggregate market value of

the assets of the corporation, (b) having an aggregate market value equal to 5% or more of the aggregate market value of all outstanding

shares of the corporation, or (c) representing 10% or more of the earning power or net income of the corporation. In general, an “interested

stockholder” is any person who, together with affiliates and associates, beneficially owns (or within two years, did own) 10% or

more of a corporation’s voting stock. After the two-year moratorium period, additional stockholder approvals or fair value requirements

must be met by the interested stockholder up to four years after the stockholder became an interested stockholder.

The statute could be used to prohibit or delay

mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire our Company even though such

a transaction may offer our stockholders the opportunity to sell their stock at a price above the prevailing market price. Our charter

states that we have elected not to be governed by the “business combination” provisions, therefore such provisions currently

do not apply to us.

Control Share Acquisitions

The “control share” provisions of Sections

78.378 to 78.3793, inclusive, of the NRS apply to Nevada corporations with at least 200 stockholders, including at least 100 stockholders

of record who are Nevada residents, and that conduct business directly or indirectly in Nevada, including through an affiliated corporation.

The control share statute prohibits an acquirer, under certain circumstances, from voting its shares of a target corporation’s stock

after crossing certain ownership threshold percentages, unless the acquirer obtains approval of the target corporation’s disinterested

stockholders. The statute specifies three thresholds: one-fifth or more but less than one-third, one-third but less than a majority, and

a majority or more, of the outstanding voting power. Generally, once an acquirer crosses one of the above thresholds, those shares in

an offer or acquisition and acquired within 90 days thereof become “control shares” and such control shares are deprived of

the right to vote until disinterested stockholders restore the right. These provisions also provide that if control shares are accorded

full voting rights and the acquiring person has acquired a majority or more of all voting power, all other stockholders who do not vote

in favor of authorizing voting rights to the control shares are entitled to demand payment for the fair value of their shares in accordance

with statutory procedures established for dissenters’ rights.

A corporation may elect to not be governed by,

or “opt out” of, the control share provisions by making an election in its articles of incorporation or bylaws, provided that

the opt-out election must be in place on the 10th day following the date an acquiring person has acquired a controlling interest, that

is, crossing any of the three thresholds described above. We have not opted out of the control share statutes, and will be subject to

these statutes if we are an “issuing corporation” as defined in such statutes. As we currently have fewer than 100 stockholders

of record who are residents of Nevada, we do not believe that we are an “issuing corporation” as defined by the control share

statutes.

The effect of the Nevada control share statutes

is that the acquiring person, and those acting in association with the acquiring person, will obtain only such voting rights in the control

shares as are conferred by a resolution of the stockholders at an annual or special meeting. The Nevada control share law, if applicable,

could have the effect of discouraging takeovers of our Company.

Meetings of Stockholders

Pursuant to our bylaws, a meeting of our stockholders

for the election of directors and the transaction of any business will be held annually on a date and at the time set by our board of

directors. In addition, the board of directors is authorized, with the approval of a majority of the entire board of directors, to call

a special meeting of our stockholders.

Amendment to Our Charter and Bylaws

Pursuant to the NRS, our charter may be amended

with the approval of the board of directors or the affirmative vote of a majority of the stockholders entitled to vote. In furtherance

and not in limitation of the powers conferred by the NRS and our charter, our bylaws expressly authorize our board of directors to adopt,

amend and repeal the bylaws. This authority is subject to the power of our stockholders to adopt, amend or repeal the bylaws upon the

affirmative vote of the holders of at least two-thirds of the voting power of the issued and outstanding stock entitled to vote generally

in the election of directors, voting together as a single class, in addition to the affirmative vote of the holders of any class or series

of the shares of capital stock of the Company as may be required by law, our charter, our bylaws or our preferred stock.

Dissolution

Pursuant to the NRS, our dissolution must be approved

by the board of directors along with the affirmative

vote of the holders of not less than a majority of all of the shares

entitled to cast a vote on the matter.

Advance Notice of Director Nominations and New

Business

Our bylaws provide that, with respect to an annual

meeting of stockholders, nominations of individuals for election to the board of directors and the proposal of other business to be considered

by stockholders may be made only (1) pursuant to our notice of the meeting, (2) by or at the direction of our board of directors or (3)

by a stockholder who was a stockholder of record at the time of giving his notice who is entitled to vote at the meeting on the election

of directors or on the proposal of other business, as the case may be, and has complied with the advance notice provisions set forth in

our bylaws.

With respect to special meetings of stockholders,

only the business specified in our notice of meeting may be brought before the meeting. Nominations of individuals for election to our

board of directors may be made only (1) by or at the direction of our board of directors or (2) provided that the board of directors has

determined that directors will be elected at such meeting, by a stockholder who was a stockholder of record at the time of giving his

notice and who is entitled to vote at the meeting and has complied with the advance notice provisions set forth in our bylaws.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of common

stock, preferred stock or debt securities in one or more series, from time to time. We may issue warrants independently or together with

common stock, preferred stock and/or debt securities, and the warrants may be attached to or separate from those securities.

The warrants issued, if any, will be evidenced

by warrant certificates issued under one or more warrant agreements, which are contracts between us and an agent for the holders of the

warrants. The prospectus supplements relating to any warrants being offered pursuant to this prospectus and any applicable prospectus

supplements will contain the specific terms of the warrants, as well as the complete warrant agreements and warrant certificates that

contain the terms of the warrants. Forms of warrant agreements and warrant certificates containing the terms of the warrants being offered

will be incorporated by reference into the registration statement of which this prospectus is a part from reports we file with the SEC.

DESCRIPTION OF UNITS

As specified in the applicable prospectus supplement,

we may issue units consisting of one or more shares of common stock, shares of preferred stock, depositary shares, warrants, or any combination

of such securities.

DESCRIPTION OF RIGHTS

The following description summarizes only the general

features of the rights that we may offer from time to time under this prospectus. The specific terms of a series of rights will be described

in the applicable prospectus supplement relating to that series of rights along with any general provisions applicable to that series

of rights. We may issue rights to our stockholders to purchase shares of our common stock and/or any of the other securities offered hereby.

In connection with any offering of rights, each series of rights may be issued under a separate rights agreement to be entered into between

us and a bank or trust company, as rights agent. The following description of the rights and any description of the rights in a prospectus

supplement may not be complete and is subject to, and qualified in its entirety by reference to, the underlying rights agreement, which

we will file with the SEC at or prior to the time of the sale of the rights. You should refer to, and read this summary together with,

the rights agreement and the applicable prospectus supplement to review the terms of a particular series of rights. You can obtain copies

of any form of rights agreement or other agreement pursuant to which the rights are issued by following the directions described under

the caption “Where You Can Find More Information.” The applicable prospectus supplement relating to any rights will

describe the terms of the offered rights, including, where applicable, the following:

| |

· |

the date for determining the persons entitled to participate in the rights distribution; |

| |

|

|

| |

· |

the exercise price for the rights; |

| |

|

|

| |

· |

the aggregate number or amount of underlying securities purchasable upon exercise of the rights; |

| |

|

|

| |

· |

the extent to which the rights are transferable; |

| |

|

|

| |

· |

the date on which the right to exercise the rights will commence and the date on which the rights will expire; |

| |

|

|

| |

· |

the extent to which the rights include an over-subscription privilege with respect to unsubscribed securities; |

| |

|

|

| |

· |

anti-dilution provisions of the rights, if any; and |

| |

|

|

| |

· |

any other material terms of the rights, including terms, procedures and limitations relating to the distribution, exchange and exercise of the rights. |

Holders may exercise rights as described in the

applicable prospectus supplement. Upon receipt of payment and the rights certificate properly completed and duly executed at the corporate

trust office of the rights agent or any other office indicated in the prospectus supplement, we will, as soon as practicable, forward

the securities purchasable upon exercise of the rights. If less than all of the rights issued in any rights offering are exercised, we

may offer any unsubscribed securities directly to persons other than existing stockholders, to or through agents, underwriters or dealers

or through a combination of such methods, including pursuant to standby underwriting arrangements, as described in the applicable prospectus

supplement.

DESCRIPTION OF DEPOSITARY SHARES

General

We may issue depositary shares, each of which would

represent a fractional interest of a share of a particular series of preferred stock. We will deposit shares of preferred stock represented

by depositary shares under a separate deposit agreement among the Company, a preferred stock depositary and the holders of the depositary

shares. Subject to the terms of the deposit agreement, each owner of a depositary share will possess, in proportion to the fractional

interest of a share of preferred stock represented by the depositary share, all the rights and preferences of the preferred stock represented

by the depositary shares. Depositary receipts will evidence the depositary shares issued pursuant to the deposit agreement. Immediately

after the Company issues and delivers preferred stock to a preferred stock depositary, the preferred stock depositary will issue the depositary

receipts.

Dividends and Other Distributions

The depositary will distribute all cash dividends

on the preferred stock to the record holders of the depositary shares. Holders of depositary shares generally must file proofs, certificates

and other information and pay charges and expenses of the depositary in connection with distributions. If a distribution on the preferred

stock is other than in cash and it is feasible for the depositary to distribute the property it receives, the depositary will distribute

the property to the record holders of the depositary shares. If such a distribution is not feasible, the depositary, with our approval,

may sell the property and distribute the net proceeds from the sale to the holders of the depositary shares.

Withdrawal of Stock

Unless we have previously called the underlying

preferred stock for redemption or the holder of the depositary shares has converted such shares, a holder of depositary shares may surrender

them at the corporate trust office of the depositary in exchange for whole or fractional shares of the underlying preferred stock together

with any money or other property represented by the depositary shares. Once a holder has exchanged the depositary shares, the holder may

not redeposit the preferred stock and receive depositary shares again. If a depositary receipt presented for exchange into preferred stock

represents more shares of preferred stock than the number to be withdrawn, the depositary will deliver a new depositary receipt for the

excess number of depositary shares.

Redemption of Depositary Shares

Whenever we redeem shares of preferred stock held

by a depositary, the depositary will redeem the corresponding amount of depositary shares with funds it receives from us for the preferred

stock. The depositary will notify the record holders of the depositary shares to be redeemed not less than 30 days nor more than 60 days

before the date fixed for redemption at the holders’ addresses appearing in the depositary’s books. The redemption price per

depositary share will be equal to the applicable fraction of the redemption price and any other amounts payable with respect to the preferred

stock. If we intend to redeem less than all of the underlying preferred stock, we and the depositary will select the depositary shares

to be redeemed on as nearly a pro rata basis as practicable without creating fractional depositary shares or by any other equitable method

determined by us.

On the redemption date:

| |

· |

all dividends relating to the shares of preferred stock called for redemption will cease to accrue; |

| |

|

|

| |

· |

we and the depositary will no longer deem the depositary shares called for redemption to be outstanding; and |

| |

|

|

| |

· |

all rights of the holders of the depositary shares called for redemption will cease, except the right to receive any money payable upon the redemption and any money or other property to which the holders of the depositary shares are entitled upon redemption. |

Voting of the Preferred Stock

When a depositary receives notice regarding a meeting

at which the holders of the underlying preferred stock have the right to vote, it will mail that information to the holders of the depositary

shares. Each record holder of depositary shares on the record date may then instruct the depositary to exercise its voting rights for

the amount of preferred stock represented by that holder’s depositary shares. The depositary will vote in accordance with these

instructions. The depositary will abstain from voting to the extent it does not receive specific instructions from the holders of depositary

shares. A depositary will not be responsible for any failure to carry out any instruction to vote, or for the manner or effect of any

vote, as long as any action or non-action is in good faith and does not result from negligence or willful misconduct of the depositary.

Liquidation Preference

In the event of our liquidation, dissolution or

winding up, a holder of depositary shares will receive the fraction of the liquidation preference accorded each share of underlying preferred

stock represented by the depositary share, in the event such underlying preferred stock is entitled to any such liquidation preference.

Conversion of Preferred Stock

Depositary shares will not themselves be convertible

into common stock or any other securities or property of the Company. However, if the underlying preferred stock is convertible, holders

of depositary shares may surrender them to the depositary with written instructions to convert the preferred stock represented by their

depositary shares into whole shares of common stock, other shares of our preferred stock or other shares of stock, as applicable. Upon

receipt of these instructions and any amounts payable in connection with a conversion, we will convert the preferred stock using the same

procedures as those provided for delivery of preferred stock. If a holder of depositary shares converts only part of its depositary shares,

the depositary will issue a new depositary receipt for any depositary shares not converted. We will not issue fractional shares of common

stock upon conversion. If a conversion will result in the issuance of a fractional share, we will pay an amount in cash equal to the value

of the fractional interest based upon the closing price of the common stock on the last business day prior to the conversion.

Amendment and Termination of a Deposit Agreement

The Company and the depositary may amend any form

of depositary receipt evidencing depositary shares and any provision of a deposit agreement. However, unless the existing holders of at

least two-thirds of the applicable depositary shares then outstanding have approved the amendment, we and the depositary may not make

any amendment that:

| |

· |

would materially and adversely alter the rights of the holders of depositary shares; or |

| |

|

|

| |

· |

would be materially and adversely inconsistent with the rights granted to the holders of the underlying preferred stock. |

Subject to exceptions in the deposit agreement

and except in order to comply with applicable law, no amendment may impair the right of any holders of depositary shares to surrender

their depositary shares with instructions to deliver the underlying preferred stock and all money and other property represented by the

depositary shares. Every holder of outstanding depositary shares at the time any amendment becomes effective who continues to hold the

depositary shares will be deemed to consent and agree to the amendment and to be bound by the amended deposit agreement.

We may terminate a deposit agreement upon not less

than 30 days prior written notice to the depositary if a majority of each series of preferred stock affected by the termination consents

to the termination.

In addition, a deposit agreement will automatically

terminate if:

| |

· |

we have redeemed all underlying preferred stock subject to the agreement; |

| |

|

|

| |

· |

a final distribution of the underlying preferred stock in connection with any liquidation, dissolution or winding up has occurred, and the depositary has distributed the distribution to the holders of the depositary shares; or |

| |

|

|

| |

· |

each share of the underlying preferred stock has been converted into other capital stock of the Company not represented by depositary shares. |

Expenses of a Preferred Stock Depositary

We will pay all transfer and other taxes and governmental

charges and expenses arising in connection with a deposit agreement. In addition, we will generally pay the fees and expenses of a depositary

in connection with the performance of its duties. However, holders of depositary shares will pay the fees and expenses of a depositary

for any duties requested by the holders that the deposit agreement does not expressly require the depositary to perform.

Resignation and Removal of Depositary

A depositary may resign at any time by delivering

to us notice of its election to resign. We may also remove a depositary at any time. Any resignation or removal will take effect upon

the appointment of a successor depositary. We will appoint a successor depositary within 60 days after delivery of the notice of resignation

or removal. The successor must be a bank or trust company with its principal office in the U.S. and have a combined capital and surplus

of at least $50 million.

Miscellaneous

The depositary will forward to the holders of depositary

shares any reports and communications from us with respect to the underlying preferred stock. Neither the depositary nor the Company will

be liable if any law or any circumstances beyond their control prevent or delay them from performing their obligations under a deposit

agreement. The obligations of the Company and a depositary under a deposit agreement will be limited to performing their duties in good

faith and without negligence in regard to voting of preferred stock, gross negligence or willful misconduct. Neither the Company nor a

depositary must prosecute or defend any legal proceeding with respect to any depositary shares or the underlying preferred stock unless

they are furnished with satisfactory indemnity.

The Company and any depositary may rely on the

written advice of counsel or accountants, or information provided by persons presenting shares of preferred stock for deposit, holders

of depositary shares or other persons they believe in good faith to be competent, and on documents they believe in good faith to be genuine

and signed by a proper party. In the event a depositary receives conflicting claims, requests or instructions from us and any holders

of depositary shares, the depositary will be entitled to act on the claims, requests or instructions received from us.

Depositary

The prospectus supplement will identify the depositary

for the depositary shares.

Listing of the Depositary Shares

The applicable prospectus supplement will specify

whether or not the depositary shares will be listed on any securities exchange.

DESCRIPTION OF DEBT SECURITIES

General

The following description of the terms of our senior

debt securities and subordinated debt securities (together, referred to as the “debt securities”), sets forth certain general

terms and provisions of the debt securities to which any prospectus supplement may relate. Unless otherwise noted, the general terms and

provisions of our debt securities discussed below apply to both our senior debt securities and our subordinated debt securities. Our debt

securities may be issued from time to time in one or more series. The particular terms of any series of debt securities and the extent

to which the general provisions may apply to a particular series of debt securities will be described in the prospectus supplement relating

to that series.

The senior debt securities will be issued under

an indenture (the “senior indenture”) between us and a Senior Indenture trustee (the “Senior Indenture Trustee”).

The subordinated debt securities will be issued under an indenture (the “subordinated indenture” and, together with the senior

indenture, the “indentures”) between us and a Subordinated Indenture trustee (the “Subordinated Indenture Trustee”).

The Senior Indenture Trustee and the Subordinated Indenture Trustee are both referred to, individually, as the “trustee”.

The senior debt securities will constitute our unsecured and unsubordinated obligations and the subordinated debt securities will constitute

our unsecured and subordinated obligations. A detailed description of the subordination provisions is provided below under the caption

“- Ranking and Subordination - Subordination.” In general, however, if we declare bankruptcy, holders of the senior

debt securities will be paid in full before the holders of subordinated debt securities will receive anything.

The statements set forth below are brief summaries

of certain provisions contained in the indentures, which summaries do not purport to be complete and are qualified in their entirety by

reference to the forms of indentures, which are filed as exhibits to the registration statement of which this prospectus forms a part.

Terms used herein that are otherwise not defined shall have the meanings given to them in the indentures. Such defined terms shall be

incorporated herein by reference.

The indentures will not limit the amount of debt

securities that may be issued under the applicable indenture, and debt securities may be issued under the applicable indenture up to the

aggregate principal amount that may be authorized from time to time by us. Any such limit applicable to a particular series will be specified

in the prospectus supplement relating to that series.

The prospectus supplement relating to any series

of debt securities in respect of which this prospectus is being delivered will contain the following terms, among others, as applicable,

for each such series of debt securities:

| |

· |

the designation and issue date of the debt securities; |

| |

|

|

| |

· |

the date or dates on which the principal amount of the debt securities is payable; |

| |

|

|

| |

· |

the rate or rates (or manner of calculation thereof), if any, per annum at which the debt securities will bear interest, if any, the date or dates from which interest will accrue and the interest payment date or dates for the debt securities; |

| |

|

|

| |

· |

any limit upon the aggregate principal amount of the debt securities which may be authenticated and delivered under the applicable indenture; |

| |

|

|

| |

· |

the period or periods within which, the redemption price or prices or the repayment price or prices, as the case may be, at which, and the terms and conditions upon which, the debt securities may be redeemed at the Company’s option or the option of the holder of such debt securities; |

| |

|

|

| |

· |

the obligation, if any, of the Company to purchase the debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder of such debt securities and the period or periods within which, the price or prices at which and the terms and conditions upon which such debt securities will be purchased, in whole or in part, pursuant to such obligation; |

| |

|

|

| |

· |

if other than denominations of $1,000 and any integral multiple thereof, the denominations in which the debt securities will be issuable; |

| |

· |

provisions, if any, with regard to the conversion or exchange of the debt securities, at the option of the holders of such debt securities or the Company, as the case may be, for or into new securities of a different series, common stock or other securities; |

| |

|

|

| |

· |

if other than U.S. dollars, the currency or currencies or units based on or related to currencies in which the debt securities will be denominated and in which payments of principal of, and any premium and interest on, such debt securities shall or may be payable; |

| |

|

|

| |

· |

if the principal of (and premium, if any) or interest, if any, on the debt securities are to be payable, at the election of the Company or a holder of such debt securities, in a currency (including a composite currency) other than that in which such debt securities are stated to be payable, the period or periods within which, and the terms and conditions upon which, such election may be made; |

| |

|

|

| |

· |

if the amount of payments of principal of (and premium, if any) or interest, if any, on the debt securities may be determined with reference to an index based on a currency (including a composite currency) other than that in which such debt securities are stated to be payable, the manner in which such amounts shall be determined; |

| |

|

|

| |

· |

provisions, if any, related to the exchange of the debt securities, at the option of the holders of such debt securities, for other securities of the same series of the same aggregate principal amount or of a different authorized series or different authorized denomination or denominations, or both; |

| |

|

|

| |

· |

the portion of the principal amount of the debt securities, if other than the principal amount thereof, which shall be payable upon declaration of acceleration of the maturity thereof as more fully described under the section “Events of Default, Notice and Waiver” below; |

| |

|

|

| |

· |

whether the debt securities will be issued in the form of global securities and, if so, the identity of the depositary with respect to such global securities; |

| |

|

|

| |

· |

if the debt securities will be guaranteed, the terms and conditions of such guarantees and provisions for the accession of the guarantors to certain obligations under the applicable indenture; |

| |

|

|

| |

· |

with respect to subordinated debt securities only, the amendment or modification of the subordination provisions in the subordinated indenture with respect to the debt securities; and |

| |

|

|

| |

· |

any other specific terms. |

We may issue debt securities of any series at various

times and we may reopen any series for further issuances from time to time without notice to existing holders of securities of that series.

Some of the debt securities may be issued as original

issue discount debt securities. Original issue discount debt securities bear no interest or bear interest at below-market rates. These

are sold at a discount below their stated principal amount. If we issue these securities, the prospectus supplement relating to such series

of debt securities will describe any special tax, accounting or other information which we think is important. We encourage you to consult

with your own tax and financial advisors on these important matters.

Unless we specify otherwise in the applicable

prospectus supplement relating to such series of debt securities, the covenants contained in the indentures will not provide special protection

to holders of debt securities if we enter into a highly leveraged transaction, recapitalization or restructuring.

Unless otherwise set forth in the prospectus supplement

relating to such series of debt securities, interest on outstanding debt securities will be paid to holders of record on the date that

is 15 days prior to the date such interest is to be paid or, if not a business day, the next preceding business day. Unless otherwise

specified in the prospectus supplement, debt securities will be issued in fully registered form only. Unless otherwise specified in the

prospectus supplement, the principal amount of the debt securities will be payable at the corporate trust office of the trustee in New

York, New York. The debt securities may be presented for transfer or exchange at such office unless otherwise specified in the prospectus

supplement, subject to the limitations provided in the applicable indenture, without any service charge, but we may require payment of

a sum sufficient to cover any tax or other governmental charges payable in connection therewith.

Ranking and Subordination

General

The subordinated debt securities and the related

guarantees will effectively rank junior in right of payment to any of our or the guarantors’ current and future secured obligations

to the extent of the value of the assets securing such obligations. The debt securities and the guarantees will be effectively subordinated

to all existing and future liabilities, including indebtedness and trade payables, of our non-guarantor subsidiaries. Unless otherwise

set forth in the prospectus supplement relating to such series of debt securities, the indentures will not limit the amount of unsecured

indebtedness or other liabilities that can be incurred by our non-guarantor subsidiaries.

Ranking of Debt Securities

The senior debt securities described in this prospectus

will be unsecured, senior obligations of the Company and will rank equally with the Company’s other unsecured and unsubordinated

obligations. Any guarantees of the senior debt securities will be unsecured and senior obligations of each of the guarantors, and will

rank equally with all other unsecured and unsubordinated obligations of such guarantors. The subordinated debt securities will be unsecured,

subordinated obligations and any guarantees of the subordinated debt securities will be unsecured and subordinated obligations of each

of the guarantors.

Subordination

If issued, the indebtedness evidenced by the subordinated

debt securities will be subordinate to the prior payment in full of all our Senior Indebtedness (as defined below). During the continuance

beyond any applicable grace period of any default in the payment of principal, premium, interest or any other payment due on any of our

Senior Indebtedness, we may not make any payment of principal of, or premium, if any, or interest on the subordinated debt securities.

In addition, upon any payment or distribution of our assets upon any dissolution, winding up, liquidation or reorganization, the payment

of the principal of, or premium, if any, and interest on the subordinated debt securities will be subordinated to the extent provided

in the subordinated indenture in right of payment to the prior payment in full of all our Senior Indebtedness. Because of this subordination,

if we dissolve or otherwise liquidate, holders of our subordinated debt securities may receive less, ratably, than holders of our Senior

Indebtedness. The subordination provisions do not prevent the occurrence of an event of default under the subordinated indenture.

The subordination provisions also apply in the

same way to any guarantor with respect to the Senior Indebtedness of such guarantor.

The term “Senior Indebtedness” of a

person means with respect to such person the principal of, premium, if any, interest on, and any other payment due pursuant to any of

the following, whether outstanding on the date of the subordinated indenture or incurred by that person in the future:

| |

· |

all of the indebtedness of that person for borrowed money, including any indebtedness secured by a mortgage or other lien which is (1) given to secure all or part of the purchase price of property subject to the mortgage or lien, whether given to the vendor of that property or to another lender, or (2) existing on property at the time that person acquires it; |

| |

|

|

| |

· |

all of the indebtedness of that person evidenced by notes, debentures, bonds or other similar instruments sold by that person for money; |

| |

|

|

| |

· |

all of the lease obligations which are capitalized on the books of that person in accordance with generally accepted accounting principles; |

| |

|

|

| |

· |

all indebtedness of others of the kinds described in the first two bullet points above and all lease obligations of others of the kind described in the third bullet point above, in each case, that the person, in any manner, assumes or guarantees or that the person in effect guarantees through an agreement to purchase, whether that agreement is contingent or otherwise; and |

| |

|

|

| |

· |

all renewals, extensions or refunds of indebtedness of the kinds described in the first, second or fourth bullet point above and all renewals or extensions of leases of the kinds described in the third or fourth bullet point above; unless, in the case of any particular indebtedness, lease, renewal, extension or refunding, the instrument or lease creating or evidencing it or the assumption or guarantee relating to it expressly provides that such indebtedness, lease, renewal, extension or refunding is not superior in right of payment to the subordinated debt securities. Our senior debt securities, and any unsubordinated guarantee obligations of ours or any guarantor to which we and the guarantors are a party, including the guarantors’ guarantees of our debt securities and other indebtedness for borrowed money, constitute Senior Indebtedness for purposes of the subordinated indenture. |

Consolidation, Merger, Conveyance or Transfer on Certain Terms

Except as described in the applicable prospectus

supplement relating to such debt securities, we will not consolidate with or merge into any other entity or convey or transfer our properties

and assets substantially as an entirety to any entity, unless:

| |

(1) |

the entity formed by such consolidation or into which we are merged or the entity that acquires by conveyance or transfer our properties and assets substantially as an entirety shall be organized and existing under the laws of the U.S. or any state or the District of Columbia, and will expressly assume, by supplemental indenture, executed and delivered to the trustee, in form reasonably satisfactory to the trustee, the due and punctual payment of the principal of (and premium, if any) and interest on all the debt securities and the performance of every covenant of the applicable indenture (as supplemented from time to time) on our part to be performed or observed; |

| |

|

|

| |

(2) |