Kyiv, New York, Dubai and Philadelphia, 13

January 2025: VEON Ltd. (Nasdaq: VEON), a global digital

operator (“VEON” or, together with its subsidiaries, the “Group”),

and Cohen Circle Acquisition Corp. I (“Cohen Circle”), a special

purpose acquisition company (Nasdaq: CCIRU), today announced the

signing of a letter of intent (“LOI”) to enter into a business

combination with the aim of indirectly listing Kyivstar, VEON’s

digital operator in Ukraine, on the Nasdaq Stock Market LLC

(“Nasdaq”) in the United States.

Completion of this transaction would make

Kyivstar the first purely Ukrainian investment opportunity to be

publicly listed on a U.S. stock exchange, enabling U.S. and other

international investors to participate more directly in Kyivstar’s

growth and the broader recovery of the Ukrainian economy.

Kyivstar is Ukraine’s leading digital operator,

with the country’s largest mobile and fixed-line connectivity

businesses that serve nearly 24 million connectivity customers.

Kyivstar’s portfolio of digital services includes the digital

healthcare platform Helsi with a registered user base of 28 million

and the entertainment streaming platform, Kyivstar TV. Kyivstar is

a leading provider of enterprise services in Ukraine, supporting

Ukrainian businesses with cloud, cybersecurity and AI solutions, a

growing player in the software development landscape of Ukraine via

Kyivstar Tech, and a preferred partner for international technology

companies, having most recently signed a groundbreaking agreement

with Starlink to bring direct-to-cell satellite connectivity to

Ukraine to enhance the resilience of communication.

“We are proud to be opening American and global

markets for Ukraine with Kyivstar's benchmark Nasdaq listing. As

Ukraine's largest private investor, this milestone amplifies our

'Invest in Ukraine NOW!' campaign, showcasing the country’s growth

potential and offering American investors direct access to its

future economic opportunities,” said Augie K Fabela II, Chairman

and Founder of VEON.

“The agreement that we have reached with Cohen

Circle is a significant step in

VEON’s ambition of crystallizing value

for our investors,

including through the listings of our key

assets where relevant. It also underscores our commitment to

rebuilding Ukraine through investments. We are excited to see

investor interest in Kyivstar’s growth story and the appreciation

of Ukraine’s potential. We are determined to work diligently

towards the successful completion of this process, which will make

Kyivstar a unique U.S.-listed opportunity for international

investors while also highlighting the overall investment case for

Ukraine,” said Kaan Terzioglu, VEON Group CEO.

“Kyivstar possesses all of the qualities we look

for as a merger partner - strong business fundamentals, excellent

management and opportunities for outsized growth. We couldn’t

be more excited than to partner with VEON and provide investors

with a compelling opportunity to invest in the economic development

of Ukraine,” said Betsy Cohen, Chairman and CEO of Cohen Circle

Acquisition Corp. I.

The LOI will enable VEON and Cohen Circle to

explore a business combination between VEON Holdings B.V. (“VEON

Holdings”) and Cohen Circle with the aim of indirectly listing

Kyivstar, a wholly owned subsidiary of VEON Holdings, on Nasdaq

(the “Business Combination”). VEON will continue to hold a majority

stake in such publicly listed entity. The parties expect to

announce additional details regarding the Business Combination upon

the execution of a definitive agreement, which is anticipated to

take place by the second quarter of 2025.

As part of the preparation for the Business

Combination, VEON will undertake a pre-transaction reorganization

of VEON Holdings (the “Reorganization”). This Reorganization will

be consummated through a Dutch legal demerger, as a result of which

VEON Holdings, which will remain domiciled in the Netherlands, will

hold only Kyivstar and its subsidiaries and certain other select

assets and liabilities. A newly incorporated entity will hold

VEON’s other core operating subsidiaries and assets.

VEON has commenced the process of this demerger

by filing the demerger proposal and accompanying documents with the

Dutch Chamber of Commerce today. The Reorganization is expected to

be completed by March 2025. Further information on the demerger

process can be found on the Company’s website:

https://www.veon.com/investors

To facilitate the aforementioned actions, VEON

Holdings today also launches a consent solicitation to obtain

consent from the holders of its bonds maturing in 2027 (ISIN: Reg

S: XS2824764521/ Rule 144A: XS2824766146) (the “2027 Notes”).

The consent solicitation is being made on the

terms and subject to the conditions contained in the consent

solicitation memorandum dated 13 January 2025 (the “Consent

Solicitation Memorandum”). A copy of the Consent Solicitation

Memorandum (subject to distribution restrictions) can be obtained

from the tabulation agent (Kroll Issuer Services Limited). ICBC and

Jefferies will be acting as Solicitation Agents on the consent.

About VEONVEON is a Nasdaq-listed digital

operator headquartered in the Dubai International Financial Center

that provides converged connectivity and digital services to nearly

160 million customers. Operating across six countries that are

home to more than 7% of the world’s population, VEON is

transforming lives through technology-driven services that empower

individuals and drive economic growth. For more information

visit: www.veon.com

About Cohen CircleCohen Circle is a

special purpose acquisition company sponsored by Cohen Circle, LLC

and formed for the purpose of entering into a merger, capital stock

exchange, asset acquisition, stock purchase, reorganization or

similar business combination with one or more technology and/or

financial services businesses. Cohen Circle is listed on the NASDAQ

under the symbol “CCIRU.”

No Offer or SolicitationThis press

release shall not constitute a solicitation of a proxy, consent, or

authorization with respect to any securities or in respect of the

proposed Business Combination. This press release does not

constitute an offer to sell or the solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any

states or jurisdictions in which such offer, solicitation, or sale

would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Forward-Looking Statements

This release contains “forward-looking

statements”, as the phrase is defined in Section 27A of the U.S.

Securities Act of 1933, as amended, and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended. All statements

contained in this press release that do not relate to matters of

historical fact should be considered forward-looking statements,

including, without limitation, statements relating to, among other

things, the proposed transactions, including the execution and

timing of entering into a definitive agreement in connection with

the Business Combination and the Reorganization, and the expected

timing of completing the proposed transactions, the expectation

that Kyivstar will be the first purely Ukrainian investment

opportunity to be publicly listed on a U.S. stock exchange, the

expected impact of the proposed Business Combination, including

investor interest in Kyivstar and Ukraine, the intended outcome of

the consent solicitation process and the future structure of the

Group. These statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause VEON’s or the Special Purpose

Acquisition Company’s actual results, performance or achievements

to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements

in this press release, including, but not limited to, the

occurrence of any event, change or other circumstances that could

give rise to the termination of the Business Combination (including

before any definitive agreement in connection with the Business

Combination is entered into); the outcome of any legal proceedings

that may be instituted against VEON Ltd., any of its subsidiaries

or others following the announcement of the Business Combination;

the inability to complete the Business Combination due to the

failure to obtain the necessary board and shareholder approvals or

to satisfy other conditions to closing; changes to the proposed

structure of the Business Combination or the contemplated

reorganization that may be required or appropriate as a result of

applicable laws or regulations; the ability to meet stock exchange

listing standards following the entry into a definitive agreement

for the Business Combination or a consummation of the Business

Combination; the risk that the Business Combination disrupts

current plans and operations of VEON Ltd. as a result of the

announcement and consummation of the Business Combination; the

ability to recognize the anticipated benefits of the Business

Combination, which may be affected by, among other things,

competition, the ability of the combined company to grow, retain

its management and key employees; costs related to the Business

Combination; changes in applicable laws or regulations; and other

risks and uncertainties expected to be set forth in subsequent

filings in the event of the entry into a definitive agreement for

the Business Combination, including a proxy statement and or

prospectus relating to the Business Combination expected to be

filed by the Special Purpose Acquisition Company and/or a

newly-formed holding company of Kyivstar in the event of the entry

into a definitive agreement for the Business Combination.

Forward-looking statements are inherently subject to risks and

uncertainties, many of which VEON cannot predict with accuracy and

some of which VEON might not even anticipate. The forward-looking

statements contained in this release speak only as of the date of

this release. VEON does not undertake to publicly update, except as

required by U.S. federal securities laws, any forward-looking

statement to reflect events or circumstances after such dates or to

reflect the occurrence of unanticipated events.

No assurances can be made that the parties will

successfully negotiate and enter into a definitive agreement in

respect of the Business Combination, or that the Business

Combination will be consummated on the terms or timeframe currently

contemplated, or at all. The Business Combination is subject to the

execution of a definitive agreement, board approval of each of VEON

and Cohen Circle, approval of Cohen Circle’s shareholders,

regulatory approvals, and other customary conditions to

closing.

Contact Information

VEON Hande Asik Group Director of

Communication & Strategy pr@veon.com

Faisal Ghori Group Director of Investor

Relationsir@veon.com

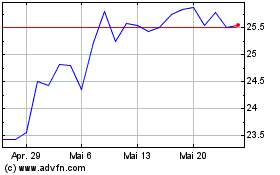

VEON (NASDAQ:VEON)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

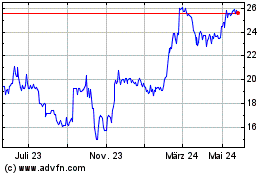

VEON (NASDAQ:VEON)

Historical Stock Chart

Von Jan 2024 bis Jan 2025