United-Guardian Reports Second Quarter Financial Results

11 August 2023 - 3:00PM

United-Guardian, Inc. (NASDAQ:UG) announced today the financial

results for the second quarter and first half of 2023. Sales for

the six-month period ended June 30th decreased from $7,518,535 in

2022 to $5,220,623 in 2023. Net income decreased from $1,544,789

($0.34 per share) to $1,217,175 ($0.26 per share). Second quarter

sales decreased from $3,626,177 to $2,650,299, with net income

decreasing from $633,324 ($0.14 per share) to $461,094 ($0.10 per

share).

Donna Vigilante, President of United-Guardian,

stated, “The sales decrease for both the second quarter and the

first six months of 2023 was primarily due to a decrease in sales

of our cosmetic ingredients, which was partially offset by an

increase in sales of Renacidin®, the Company’s principal

pharmaceutical product, which increased by 7%. The distributor

responsible for marketing our Lubrajel® line of cosmetic

ingredients in China experienced decreased demand due to increased

competition in China from lower-priced competitive products,

especially those from Asian producers, along with slow post-COVID

economic recovery in China. In addition, customers are maintaining

lower inventory levels and changing to just-in-time inventory

management, which negatively impacted our sales. We are evaluating

various options to increase our sales both in China and in other

markets, and are continuing to work closely with our marketing

partners to develop new strategies to remain competitive while

growing our market share. We are hopeful that these efforts, along

with China’s re-opening progress, will result in an increase in

sales going forward.”

United-Guardian is a manufacturer of cosmetic

ingredients, pharmaceuticals, and medical lubricants.

| |

Contact: |

Donna

Vigilante |

| |

|

(631) 273-0900 |

| |

|

dvigilante@u-g.com |

NOTE: This press release contains both

historical and "forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements about the company’s expectations or beliefs concerning

future events, such as financial performance, business prospects,

and similar matters, are being made in reliance upon the “safe

harbor” provisions of that Act. Such statements are subject to a

variety of factors that could cause our actual results or

performance to differ materially from the anticipated results or

performance expressed or implied by such forward-looking

statements. For further information about the risks and

uncertainties that may affect the company’s business please refer

to the company's reports and filings with the Securities and

Exchange Commission.

Financial Results for the

Three and Six Months Ended June 30, 2023

and 2022

STATEMENTS OF INCOME

(unaudited)

| |

|

THREE MONTHS ENDED JUNE 30, |

|

SIX MONTHS ENDED JUNE 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

sales |

$ |

2,650,299 |

|

$ |

3,626,177 |

|

$ |

5,220,623 |

|

$ |

7,518,535 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

1,429,407 |

|

|

1,693,753 |

|

|

2,523,002 |

|

|

3,403,870 |

|

|

Operating expenses |

|

574,093 |

|

|

620,229 |

|

|

1,092,039 |

|

|

1,166,978 |

|

|

Research and development expense |

|

128,729 |

|

|

112,266 |

|

|

255,688 |

|

|

243,932 |

|

|

Total costs and expenses |

|

2,132,229 |

|

|

2,426,248 |

|

|

3,870,729 |

|

|

4,814,780 |

|

|

Income from operations |

|

518,070 |

|

|

1,199,929 |

|

|

1,349,894 |

|

|

2,703,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

54,950 |

|

|

58,860 |

|

|

102,582 |

|

|

99,410 |

|

|

Net gain (loss) gain on marketable securities |

|

7,479 |

|

|

(460,278 |

) |

|

80,180 |

|

|

(853,938 |

) |

|

Total other income (expense) |

|

62,429 |

|

|

(401,418 |

) |

|

182,762 |

|

|

(754,528 |

) |

|

Income before

provision for income taxes |

|

580,499 |

|

|

798,511 |

|

|

1,532,656 |

|

|

1,949,227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

119,405 |

|

|

165,187 |

|

|

315,481 |

|

|

404,438 |

|

|

Net income |

$ |

461,094 |

|

$ |

633,324 |

|

$ |

1,217,175 |

|

$ |

1,544,789 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

(basic and diluted) |

$ |

0.10 |

|

$ |

0.14 |

|

$ |

0.26 |

|

$ |

0.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

(basic and diluted) |

|

4,594,319 |

|

|

4,594,319 |

|

|

4,594,319 |

|

|

4,594,319 |

|

Additional financial information can be found on the company’s

web site at www.u-g.com.

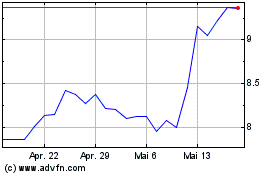

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

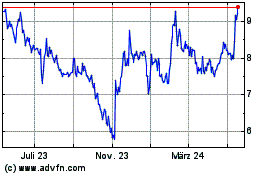

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024