0001393726false00013937262024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 29, 2024

TIPTREE INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-33549 | | 38-3754322 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 660 Steamboat Road | 2nd Floor | Greenwich | CT | | 06830 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(212) 446-1400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | TIPT | NASDAQ | Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

Fortegra Announces Launch of Initial Public Offering

On January 29, 2024, The Fortegra Group, Inc. (“Fortegra”), a multinational specialty insurer and subsidiary of Tiptree Inc. (“Tiptree”), announced the launch of Fortegra’s initial public offering (the “IPO”). Fortegra has filed a registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”) to offer 18,000,000 shares of its common stock to the public. Fortegra also intends to grant the underwriters a 30-day option to purchase up to an additional 2,700,000 shares of common stock from Fortegra.

The price range for the initial public offering is expected to be between $15.00 and $18.00 per share. Fortegra has applied to list its common stock on the New York Stock Exchange under the ticker symbol “TFG.” Fortegra intends to use the net proceeds it receives from the offering to execute its growth strategy and for working capital and general corporate purposes.

Goldman Sachs & Co. LLC, J.P. Morgan and Jefferies are acting as joint lead bookrunning managers for the proposed offering. Barclays is acting as joint bookrunning manager for the proposed offering. JMP Securities, A Citizens Company, Keefe, Bruyette & Woods, A Stifel Company, Piper Sandler, Raymond James, Fifth Third Securities and Independence Point Securities are acting as co-managers for the proposed offering. The proposed offering will be made only by means of a prospectus.

Copies of the preliminary prospectus relating to the proposed offering may be obtained for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, copies of the preliminary prospectus may be obtained from Goldman Sachs & Co. LLC, Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526, facsimile at (212) 902-9316 or by email at Prospectus-ny@ny.email.gs.com; J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at (866) 803-9204 or by email at prospectuseq_fi@jpmorganchase.com; Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by telephone at (877) 821-7388 or by email at Prospectus_Department@Jefferies.com; and Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, by telephone at (888) 603-5847 or by email at barclaysprospectus@broadridge.com.

Recent Developments

In connection with the IPO, Tiptree is announcing certain preliminary estimated unaudited consolidated financial results of Fortegra for the three months and year ended December 31, 2023. While Fortegra’s final audited consolidated financial statements for the three months and year ended December 31, 2023 are not yet available, based on the information currently available, Fortegra preliminarily estimates the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in thousands) | Three Months Ended December 31, | | Year Ended December 31, | |

| 2023 | | 2022 | | 2023 | | 2022 | |

Gross written premiums and premium equivalents(1) | $ | 724,124 | | | $ | 526,557 | | | $ | 2,747,854 | | | $ | 2,263,128 | | |

Net written premiums | $ | 384,309 | | | $ | 245,178 | | | $ | 1,319,948 | | | $ | 1,089,390 | | |

Revenues | $ | 433,170 | | | $ | 345,408 | | | $ | 1,593,070 | | | $ | 1,248,796 | | |

Net income | $ | 38,842 | | | $ | 19,456 | | | $ | 101,348 | | | $ | 46,424 | | |

Adjusted net income(2) | $ | 32,604 | | | $ | 23,939 | | | $ | 115,705 | | | $ | 83,832 | | |

Return on average equity | 36.9 | % | | 23.2 | % | | 25.7 | % | | 14.6 | % | |

Adjusted return on average equity(2) | 30.9 | % | | 29.3 | % | | 29.2 | % | | 26.1 | % | |

Combined ratio | 89.8 | % | | 89.8 | % | | 90.3 | % | | 90.4 | % | |

(1) The total gross written premiums and premium equivalents of $2,747.9 million and $2,263.1 million for the years ended December 31, 2023, and 2022, respectively, were comprised of gross written premiums of $1,896.5 million and $1,515.1 million, plus assumed premiums of $489.1 million and $374.3 million, plus gross service and administrative fee additions of $362.3 million and $373.7 million.

(2) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented before the impacts of non-controlling interests.

•Gross written premiums and premium equivalents were $724.1 million for the three months ended December 31, 2023, an increase of 37.5% compared to $526.6 million in the prior year period. For the year ended December 31, 2023, gross

written premiums and premium equivalents were $2,747.9 million, an increase of 21.4% compared to $2,263.1 million in 2022. The increases in both periods were driven by growth in specialty E&S and admitted insurance lines in the U.S. and Europe along with benefits from a book-roll transaction with one of Fortegra’s MGA partners.

•Net written premiums were $384.3 million for the three months ended December 31, 2023, an increase of 56.7%, and $1,319.9 million for the year ended December 31, 2023, an increase of 21.2%. The increases in both periods were consistent with the growth in gross written premiums and premium equivalents and increased retention on Fortegra’s whole account quota share reinsurance agreement from 30% to 40%, effective April 1, 2023.

•Total revenues increased 25.4% to $433.2 million for three months ended December 31, 2023, compared to the prior year period, and 27.6% to $1,593.1 million for the year ended December 31, 2023, compared to 2022, driven by premium growth in specialty E&S and admitted insurance lines and services businesses in the U.S. and Europe, along with growth in net investment income.

•The combined ratio for the three months and year ended December 31, 2023, was 89.8% and 90.3%, compared to 89.8% and 90.4% in the respective prior year periods. The loss ratio for the three months and year ended December 31, 2023, was 39.6% and 40.1%, compared to 37.8% and 37.7% for the respective prior year periods. For both periods, the loss ratio increases were driven by a shift in business mix towards commercial lines and continued increases in repair and labor costs on vehicle service contracts. The acquisition ratio for the three months and year ended December 31, 2023, was 36.0% and 36.2%, compared to 38.7% and 39.0% for the respective prior year periods. The decrease in the acquisition ratio was driven by the shift in business mix toward commercial lines and impacts from sliding scale commission structures. The operating expense ratio for the three months and year ended December 31, 2023, was 14.2% and 14.0%, as compared to 13.3% and 13.7% for the respective prior year periods. The increase in operating expense ratio was the result of continued investment in data science, European platform expansion, and to support continued growth in the U.S. insurance business.

•Net income for the three months ended December 31, 2023, was $38.8 million, an increase of $19.4 million compared to the prior year period. For the year ended December 31, 2023, net income was $101.3 million, an increase of $54.9 million compared to 2022. Return on equity for the year ended December 31, 2023, was 25.7%, compared to 14.6% in 2022. The increases in both periods were driven by growth in underwriting and fee revenues, the consistent combined ratio and improved contributions from the investment portfolio.

•Adjusted net income for three months ended December 31, 2023, was $32.6 million, an increase of 36.2% from the prior year period. Adjusted net income for the year ended December 31, 2023, was $115.7 million, an increase of 38.0% from 2022. Adjusted return on average equity was 29.2% for the year ended December 31, 2023, compared to 26.1% in 2022. The increases in both periods were driven by growth in underwriting and fee income and increased net investment income.

•Total stockholder’s equity was $452.6 million as of December 31, 2023, compared to $338.7 million as of December 31, 2022, with the increase driven by net income during the year as well as an improvement in the accumulated other comprehensive loss position, which was $31.1 million as of December 31, 2023, compared to $52.7 million as of December 31, 2022.

•As of December 31, 2023, Fortegra held an outstanding balance of $130.0 million on its revolving line of credit, as compared to a balance of $46.0 million as of September 30, 2023. The increase in borrowings was primarily to fund statutory capital requirements and general corporate purposes.

•During the three months ended December 31, 2023, Fortegra entered into a commutation agreement with a partner resulting in a reduction of policy liabilities and unpaid claims of $75.6 million relating to policies written in the 2020 and 2021 treaty years.

The preliminary financial information above is unaudited and there can be no assurance that it will not vary from Fortegra’s actual financial results as of and for the three months and year ended December 31, 2023. The preliminary financial information above reflects estimates based only on preliminary information available to Fortegra as of the date of this Current Report on Form 8-K, has not been subject to our normal quarterly closing procedures and adjustments, which may be material, and is not a comprehensive statement of Fortegra’s financial results for the three months and year ended December 31, 2023, nor has Fortegra completed all of our internal control procedures as of the date of this filing. Accordingly, actual results may differ materially from those described above and you should not place undue reliance on these preliminary estimates, nor should they be viewed as a substitute for full financial statements as of and for the three months and year ended December 31, 2023, prepared in accordance with GAAP. The preliminary financial information above has been prepared by, and is the responsibility of, Fortegra’s management. Tiptree and Fortegra’s independent registered public accounting firm has not audited,

reviewed, compiled or performed any procedures with respect to the preliminary financial information, nor have any other independent accountants, and does not express an opinion or any other form of assurance with respect thereto.

Non-GAAP Reconciliations

In addition to GAAP results, we also use the non-GAAP financial measures adjusted net income and adjusted return on average equity as measures of operating performance and to determine incentive compensation for the Fortegra’s executive officers. Management believes these measures provide supplemental information useful to investors as they are frequently used by the financial community to analyze financial performance and to compare specialty insurance companies. Adjusted net income and adjusted return on average equity are not measurements of financial performance or liquidity under GAAP and should not be considered as an alternative or substitute for earned premiums, net income or any other measure derived in accordance with GAAP.

Adjusted Net Income — Non-GAAP

We define adjusted net income as income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, including merger and acquisition related expenses, stock-based compensation, net realized gains (losses), net unrealized gains (losses) and intangibles amortization associated with purchase accounting. The calculation of adjusted net income excludes net realized and unrealized gains (losses) that relate to investments or assets rather than business operations. We use adjusted net income as an internal operating performance measure and to determine incentive compensation for our executive officers. We believe adjusted net income provides useful supplemental information to investors as it is frequently used by the financial community to analyze financial performance between periods and for comparison among companies. Adjusted net income should not be viewed as a substitute for income before taxes calculated in accordance with GAAP, and other companies may define adjusted net income differently. We present adjustments for amortization associated with acquired intangible assets. The intangible assets were recorded as part of purchase accounting in connection with Tiptree’s acquisition of Fortegra Financial Corporation in 2014, Defend Insurance Group in 2019, Smart AutoCare and Sky Auto in 2020, ITC Compliance GRP Limited (“ITC”) in 2021, and Premia Solutions Limited (“Premia”) in 2022. The intangible assets acquired contribute to overall revenue generation, and the respective purchase accounting adjustments will continue to occur in future periods until such intangible assets are fully amortized in accordance with the respective amortization periods required by GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

($ in thousands) | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 (Unaudited) | | 2022 | | 2023 (Unaudited) | | 2022 |

Income before taxes | $ | 44,233 | | | $ | 29,093 | | | $ | 129,816 | | | $ | 68,150 | |

Less: Income tax (benefit) expense | (5,288) | | | (10,152) | | | (28,224) | | | (21,251) | |

Less: Net realized and unrealized gains (losses) | (6,395) | | | (2,804) | | | 4,207 | | | 20,347 | |

Plus: Intangibles amortization(1) | 4,252 | | | 4,083 | | | 16,919 | | | 16,229 | |

Plus: Stock-based compensation expense | 780 | | | 47 | | | 2,018 | | | 2,423 | |

Plus: Non-recurring expenses(2) | 348 | | | 1,813 | | | 2,824 | | | 3,374 | |

Plus: Non-cash fair value adjustments(3) | 842 | | | (939) | | | (1,769) | | | (939) | |

Less: Tax on adjustments and non-recurring taxes (4) | (6,168) | | | 2,798 | | | (10,086) | | | (4,501) | |

Adjusted net income | $ | 32,604 | | | $ | 23,939 | | | $ | 115,705 | | | $ | 83,832 | |

_______________

(1) Specifically associated with acquisition purchase accounting. See the insurance segment in Note (8) Goodwill and Intangible Assets, net, of Tiptree’s Form 10-Q for the period ended September 30, 2023 and Tiptree’s Form 10-K for the period ended December 31, 2022.

(2) For the three months and year ended December 31, 2023, and 2022, included in other expenses were expenses related to banker and legal fees for the acquisition of Premia and ITC.

(3) For the three months and year ended December 31, 2023, and 2022, non-cash fair-value adjustments represent a change in fair value of the Fortegra Additional Warrant liability which are added-back to adjusted net income.

(4) Tax on adjustments represents the tax applied to the total non-GAAP adjustments and includes adjustments for non-recurring or discrete tax impacts.

Adjusted Return on Average Equity — Non-GAAP

We define adjusted return on average equity as adjusted net income expressed on an annualized basis as a percentage of Fortegra’s average beginning and ending member’s / stockholders’ equity during the period. See “—Adjusted Net Income—Non GAAP” above. We use adjusted return on average equity as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance. Adjusted return on average equity should not be viewed as a

substitute for return on average equity calculated in accordance with GAAP, and other companies may define adjusted return on average equity differently.

| | | | | | | | | | | | | | | | | | | | | | | |

($ in thousands) | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 (Unaudited) | | 2022 | | 2023 (Unaudited) | | 2022 |

Adjusted net income(1) | $ | 32,604 | | | $ | 23,939 | | | $ | 115,705 | | | $ | 83,832 | |

Average member’s / stockholders’ equity | $ | 422,327 | | | $ | 326,431 | | | $ | 395,661 | | | $ | 321,320 | |

Adjusted return on average equity | 30.9 | % | | 29.3 | % | | 29.2 | % | | 26.1 | % |

______________

(1) See “—Adjusted Net Income—Non GAAP” above.

The information in this Item 2.02 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by Tiptree under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities.

CAUTIONARY LANGUAGE CONCERNING FORWARD-LOOKING STATEMENTS

This release contains “forward-looking statements” which involve risks, uncertainties and contingencies, many of which are beyond Tiptree’s control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained in this release that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “should,” “target,” “will,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree’s plans, objectives, expectations and intentions. Such forward-looking statements also include, but are not limited to, statements relating to the proposed initial public offering, including the size of such offering, the price range, the plan to list on the New York Stock Exchange and the expected use of proceeds from the offering. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in Fortegra’s Registration Statement on Form S-1 and Tiptree’s Annual Report on Form 10-K, and as described in Tiptree’s other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statements.

This Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy securities and shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, any securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On January 29, 2024, Fortegra, a multinational specialty insurer and subsidiary of Tiptree, announced that it has launched its proposed IPO. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information contained in the website in the press release attached as Exhibit 99.1 hereto is not a part of this current report on Form 8-K. The information contained in this Item 7.01, including the information contained in the press release attached as Exhibit 99.1 hereto, is being “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The press release attached as Exhibit 99.1 hereto is being issued pursuant to Rule 134 under the Securities Act, and is neither an offer to sell nor a solicitation of an offer to buy securities and shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, any securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) List of Exhibits:

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | TIPTREE INC. |

| | | |

| Date: | January 29, 2024 | By: | /s/ Jonathan Ilany |

| | | Name: Jonathan Ilany |

| | | Title: Chief Executive Officer |

EXHIBIT 99.1

Fortegra Announces Launch of Initial Public Offering

JACKSONVILLE, FL. January 29, 2024. The Fortegra Group, Inc. (“Fortegra” or the “Company”), a multinational specialty insurer and subsidiary of Tiptree Inc. (NASDAQ: TIPT), today announced the launch of Fortegra’s initial public offering. Fortegra has filed a registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”) to offer 18,000,000 shares of its common stock to the public. Fortegra also intends to grant the underwriters a 30-day option to purchase up to an additional 2,700,000 shares of common stock from the Company.

The price range for the initial public offering is expected to be between $15.00 and $18.00 per share. Fortegra has applied to list its common stock on the New York Stock Exchange under the ticker symbol “TFG.”

The Company intends to use the net proceeds it receives from the offering to execute its growth strategy and for working capital and general corporate purposes.

Goldman Sachs & Co. LLC, J.P. Morgan and Jefferies are acting as joint lead bookrunning managers for the proposed offering. Barclays is acting as joint bookrunning manager for the proposed offering. JMP Securities, A Citizens Company, Keefe, Bruyette & Woods, A Stifel Company, Piper Sandler, Raymond James, Fifth Third Securities and Independence Point Securities are acting as co-managers for the proposed offering. The proposed offering will be made only by means of a prospectus.

Copies of the preliminary prospectus relating to the proposed offering may be obtained for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, copies of the preliminary prospectus may be obtained from Goldman Sachs & Co. LLC, Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526, facsimile at (212) 902-9316 or by email at Prospectus-ny@ny.email.gs.com; J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by telephone at (866) 803-9204 or by email at prospectuseq_fi@jpmorganchase.com; Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by telephone at (877) 821-7388 or by email at Prospectus_Department@Jefferies.com; and Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, by telephone at (888) 603-5847 or by email at barclaysprospectus@broadridge.com.

A registration statement on Form S-1 relating to the proposed offering has been filed with the SEC but has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective.

This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended. The proposed offering is subject to market conditions, and there can be no assurance as to whether or when the proposed offering may be completed, or as to the actual size or terms of the proposed offering.

About Fortegra

For more than 45 years, Fortegra, via its subsidiaries, has underwritten risk management solutions that help people and businesses succeed in the face of uncertainty. As a multinational specialty insurer whose insurance subsidiaries have an A.M. Best Financial Strength Rating of A- (Excellent), we offer a diverse set of admitted and excess and surplus lines insurance products and warranty solutions.

Note on Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of securities laws and involve risks, uncertainties and contingencies, many of which are beyond Fortegra’s control, that may cause

actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained in this release that are not clearly historical in nature are forward-looking, and the words “proposed” and “expect” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements relating to the proposed initial public offering, including the size of such offering, the price range, the plan to list on the New York Stock Exchange and the expected use of proceeds from the offering. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to uncertainties related to market conditions and the SEC’s review process, and other factors relating to Fortegra’s business described in the section entitled “Risk Factors” in the prospectus included in the registration statement, in the form last filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statements.

Media

Edelman Smithfield for Fortegra

fortegra@edelmansmithfield.com

Investor Relations

ir@fortegra.com

v3.24.0.1

Cover Page

|

Jan. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2024

|

| Entity Registrant Name |

TIPTREE INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-33549

|

| Entity Tax Identification Number |

38-3754322

|

| Entity Address, Address Line One |

660 Steamboat Road

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

Greenwich

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06830

|

| City Area Code |

212

|

| Local Phone Number |

446-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Listing, Par Value Per Share |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TIPT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001393726

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

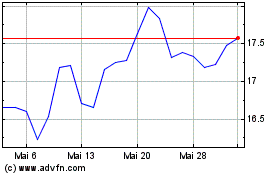

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024