0001393726false00013937262024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 28, 2024

TIPTREE INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-33549 | | 38-3754322 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 660 Steamboat Road | 2nd Floor | Greenwich | CT | | 06830 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(212) 446-1400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | TIPT | NASDAQ | Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 28, 2024, Tiptree Inc. (the “Company” or “Tiptree”) issued a press release announcing its results of operations for the quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

Included in the press release furnished as Exhibit 99.1 was an announcement that the board of directors of the Company has declared a cash dividend of $0.06 per share to Tiptree’s stockholders, with a record date of March 11, 2024 and a payment date of March 18, 2024.

On February 28, 2024, the Company posted an investor presentation dated February 2024 on the Investor Resources section of www.tiptreeinc.com. The investor presentation is furnished as Exhibit 99.2 to this Form 8-K and incorporated herein by reference. Tiptree’s website is not intended to function as a hyperlink, and the information contained on such website is not a part of this Form 8-K.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including the information contained in Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section. Furthermore, the information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including the information contained in Exhibits 99.1 and 99.2, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) List of Exhibits:

| | | | | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | TIPTREE INC. |

| | | |

| Date: | February 28, 2024 | By: | /s/ Jonathan Ilany |

| | | Name: Jonathan Ilany |

| | | Title: Chief Executive Officer |

TIPTREE ANNOUNCES FOURTH QUARTER 2023 RESULTS

Greenwich, Connecticut - February 28, 2024 - Tiptree Inc. (NASDAQ:TIPT) (“Tiptree” or the “Company”), today announced its financial results for the fourth quarter 2023.

“We are extremely pleased with our performance in the fourth quarter and full-year 2023. Our operating businesses demonstrated strong performance, resulting in an increase of revenues to $1.6 billion for the year, accompanied by an adjusted return on equity of 15.2%. Notably, Fortegra, our specialty insurance business, achieved record results, with premium and premium equivalent growth of 21%, and an adjusted return on equity of 29%. We firmly believe Fortegra is strategically positioned to maintain a trajectory of consistent top-line growth and sustained underwriting profitability over the long-term. Looking ahead, we see significant opportunities to expand our businesses and remain confident in the long-term outlook for the company”, said Tiptree’s Executive Chairman, Michael Barnes.

Financial results for the quarter and year ended December 31, 2023 and 2022 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | Year Ended December 31, | | |

| ($ in thousands, except per share information) | 2023 | | 2022 | | | 2023 | | 2022 | | |

| Total revenues | $ | 446,374 | | | $ | 369,528 | | | | $ | 1,649,031 | | | $ | 1,397,752 | | | |

| Net income (loss) attributable to common stockholders | $ | 6,871 | | | $ | 871 | | | | $ | 13,951 | | | $ | (8,274) | | | |

| Diluted earnings per share | $ | 0.15 | | | $ | 0.02 | | | | $ | 0.33 | | | $ | (0.23) | | | |

| Cash dividends paid per common share | $ | 0.05 | | | $ | 0.04 | | | | $ | 0.20 | | | $ | 0.16 | | | |

| Return on average equity | 6.8 | % | | 0.9 | % | | | 3.4 | % | | (2.1) | % | | |

| | | | | | | | | | |

Non-GAAP: (1) | | | | | | | | | | |

Adjusted net income | $ | 13,854 | | | $ | 9,684 | | | | $ | 61,917 | | | $ | 53,034 | | | |

| Adjusted return on average equity | 13.6 | % | | 9.9 | % | | | 15.2 | % | | 13.6 | % | | |

| | | | | | | | | | |

(1) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented after the impacts of non-controlling interests.

Fourth Quarter 2023 Summary

•Revenues of $446.4 million for the quarter, an increase of 20.8% from Q4'22, driven by growth in Fortegra’s specialty insurance lines. Excluding investment gains and losses, revenues increased 23.8%.

•Net income of $6.9 million compared to $0.9 million in Q4'22, driven by growth in our insurance business, partially offset by lower shipping income as a result of the sale of our vessels in 2022.

•Adjusted net income of $13.9 million increased by 43.1% from $9.7 million in Q4'22, driven by growth in our insurance operations. Annualized Adjusted return on average equity was 13.6% for the quarter, as compared to 9.9% in Q4'22.

•Declared a dividend of $0.06 per share (an increase of 20%) to stockholders of record on March 11, 2024 with a payment date of March 18, 2024.

Full Year 2023 Summary

•Revenues of $1.6 billion, an increase of 18.0% from 2022, driven by growth in Fortegra’s specialty insurance lines. Excluding investment gains and losses, revenues increased 19.3%.

•Net income of $14.0 million compared to net loss of $8.3 million in 2022, driven by growth in insurance operations and the decrease in tax expense related to the tax deconsolidation of Fortegra from $33.1 million in 2022 to $19.1 million in 2023, partially offset by lower mortgage and the sale of our vessels in 2022.

•Adjusted net income of $61.9 million increased by 16.7% from $53.0 million in 2022, driven by revenue growth in our insurance operations while maintaining a consistent combined ratio. Adjusted return on average equity was 15.2% for the year, as compared to 13.6% in 2022.

Segment Financial Highlights - Fourth Quarter 2023

Insurance (The Fortegra Group):

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | Year Ended December 31, |

| ($ in thousands) | 2023 | | 2022 | | | 2023 | | 2022 |

| Gross written premiums and premium equivalents | $ | 724,124 | | | $ | 526,557 | | | | $ | 2,747,854 | | | $ | 2,263,128 | |

| Net written premiums | $ | 384,309 | | | $ | 245,178 | | | | $ | 1,319,948 | | | $ | 1,089,390 | |

| Revenues | $ | 433,170 | | | $ | 345,408 | | | | $ | 1,593,070 | | | $ | 1,248,796 | |

| Income before taxes | $ | 44,232 | | | $ | 29,093 | | | | $ | 129,816 | | | $ | 68,150 | |

| Return on average equity | 36.9 | % | | 23.2 | % | | | 25.7 | % | | 14.6 | % |

| Combined ratio | 89.8 | % | | 89.8 | % | | | 90.3 | % | | 90.4 | % |

| | | | | | | | |

Non-GAAP: (1) | | | | | | | | |

| Adjusted net income | $ | 32,604 | | | $ | 23,939 | | | | $ | 115,705 | | | $ | 83,832 | |

| Adjusted return on average equity | 30.9 | % | | 29.3 | % | | | 29.2 | % | | 26.1 | % |

(1) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented before the impacts of non-controlling interests.

•Gross written premiums and premium equivalents grew 37.5% for the quarter and 21.4% for the year, driven by growth in specialty E&S and admitted insurance lines in the U.S. and Europe, along with benefits from a book-roll transaction with one of Fortegra’s MGA partners.

•Net written premiums were $384.3 million for the quarter, an increase of 56.7%, and $1,319.9 million for the year, an increase of 21.2%. The increases in both periods were consistent with the growth in gross written premiums and premium equivalents and increased retention on Fortegra’s whole account quota share reinsurance agreement from 30% to 40%, effective April 1, 2023.

•Record revenues increased 25.4% for the quarter and 27.6% for the year driven by premium growth in specialty E&S and admitted lines, and services businesses in the U.S. and Europe, along with growth in net investment income. Excluding the impact of investment gains and losses, revenues increased by 24.6% for the quarter and 25.9% for the year.

•The combined ratio for the quarter was 89.8%, in-line with the prior year’s period. Total year 2023 combined ratio was 90.3%, as compared to 90.4% in 2022, reflecting the consistent underwriting performance and scalability of the Company’s operating platform.

•Record income before taxes for the quarter of $44.2 million, up $15.1 million. Total year 2023 income before the taxes was $129.8 million, up $61.7 million. After-tax return on equity for the year was 25.7%, compared to 14.6% in 2022. The increases were driven by growth in underwriting and fee revenues, the consistent combined ratio and improved contributions from the investment portfolio.

•Adjusted net income for the quarter of $32.6 million, up 36.2% from Q4'22. Total year 2023 adjusted net income was $115.7 million, up 38.0% from prior year. Adjusted return on average equity for the year was 29.2%, compared to 26.1% in 2022. The increases in both periods were driven by growth in underwriting and fee income and increased net investment income.

•As of December 31, 2023, Fortegra held an outstanding balance of $130.0 million on its revolving line of credit, as compared to a balance of $46.0 million as of September 30, 2023. The increase in borrowings was primarily to fund statutory capital requirements and general corporate purposes.

•In December 2023, Fortegra entered into a commutation agreement with a partner resulting in a reduction of policy liabilities and unpaid claims of $75.6 million relating to policies written in the 2020 and 2021 treaty years.

Tiptree Capital:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| ($ in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 13,204 | | | $ | 24,120 | | | $ | 55,961 | | | $ | 148,956 | |

| Income before taxes | $ | (2,058) | | | $ | 8,459 | | | $ | (6,549) | | | $ | 32,277 | |

| Return on average equity | (3.8) | % | | 21.8 | % | | (3.6) | % | | 16.9 | % |

| | | | | | | |

Non-GAAP: (1) | | | | | | | |

| Adjusted net income | $ | (407) | | | $ | (787) | | | $ | (159) | | | $ | 8,969 | |

| Adjusted return on average equity | (0.9) | % | | (2.5) | % | | (0.1) | % | | 5.8 | % |

(1) See “—Non-GAAP Reconciliations” for a discussion of non-GAAP financial measures. Adjusted net income is presented before the impacts of non-controlling interests.

•Tiptree Capital loss before taxes was $2.1 million for the quarter, compared to income of $8.5 million in Q4’22, driven by lower mortgage revenues and the sale of vessels in 2022.

•Loss before taxes was $6.5 million for the year, down from the prior year driven by the sale of five vessels in 2022, losses on Invesque and lower mortgage revenues, partially offset by improved performance in the Company’s other investment holdings.

•Total Tiptree Capital book value was $178.1 million as of Q4’23.

Corporate:

Corporate includes expenses of the holding company for employee compensation and benefits, audit and professional fees, and public company and other expenses. For the quarter, corporate expenses were $12.1 million compared to $12.5 million in Q4'22. For the year, the corporate expenses were $40.2 million compared to $46.4 million in the prior year. The decrease was primarily driven by lower interest expense as we repaid our corporate holding company borrowings in June 2022.

Non-GAAP

Management uses Adjusted net income and Adjusted return on average equity as measurements of operating performance. Management believes these measures provide supplemental information useful to investors as they are frequently used by the financial community to analyze financial performance and comparison among companies. Management uses Adjusted net income and adjusted return on average equity as part of its capital allocation process and to assess comparative returns on invested capital. Adjusted net income represents income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, stock-based compensation, net realized and unrealized gains (losses), and intangibles amortization associated with purchase accounting, all of which is reduced for non-controlling interests. Adjusted net income and Adjusted return on average equity are presented before the impacts of non-controlling interests. Adjusted net income and Adjusted return on average equity are not measurements of financial performance or liquidity under GAAP and should not be considered as an alternative or substitute for GAAP net income. See “Non-GAAP Reconciliations” for a reconciliation of these measures to their GAAP equivalents.

Earnings Conference Call

Tiptree will host a conference call on Thursday, February 29, 2024 at 10:30 a.m. Eastern Time to discuss its Q4 2023 financial results. A copy of our investor presentation, to be used during the conference call, as well as this press release, will be available in the Investor Relations section of the Company’s website, located at www.tiptreeinc.com.

The conference call will be available via live or archived webcast at http://www.investors.tiptreeinc.com. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software. To participate in the telephone conference call, please dial 1-877-407-4018 (domestic) or 1-201-689-8471 (international). Please dial in at least five minutes prior to the start time.

A replay of the call will be available from Thursday, February 29, 2024 at 01:30 p.m. Eastern Time, until midnight Eastern on Thursday, March 7, 2024. To listen to the replay, please dial 1-844-512-2921 (domestic) or 1-412-317-6671 (international), Passcode: 13743665.

About Tiptree

Tiptree Inc. (NASDAQ: TIPT) allocates capital to select small and middle market companies with the mission of building long-term value. Established in 2007, Tiptree has a significant track record investing across a variety of industries and asset types, including the insurance, asset management, specialty finance, real estate and shipping sectors. With proprietary access and a flexible capital base, Tiptree seeks to uncover compelling investment opportunities and support management teams in unlocking the full value potential of their businesses. For more information, please visit tiptreeinc.com and follow us on LinkedIn.

Forward-Looking Statements

This release contains “forward-looking statements” which involve risks, uncertainties and contingencies, many of which are beyond the Company’s control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained in this release that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “should,” “target,” “will,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about the Company’s plans, objectives, expectations for our businesses and intentions. In addition, we make certain forward-looking statements regarding the Company’s plans to take Fortegra public. Any initial public offering by Fortegra would be subject to a variety of factors, including market conditions, and may not be consummated. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K, and as described in the Company’s other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statements.

Tiptree Inc.

Condensed Consolidated Balance Sheets

($ in thousands, except share data)

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 |

| |

| | | |

| Assets: | | | |

| Investments: | | | |

| Available for sale securities, at fair value, net of allowance for credit losses | $ | 802,609 | | | $ | 611,980 | |

| Loans, at fair value | 69,556 | | | 64,843 | |

| Equity securities | 68,308 | | | 85,776 | |

| Other investments | 111,088 | | | 73,025 | |

| Total investments | 1,051,561 | | | 835,624 | |

| Cash and cash equivalents | 468,711 | | | 538,065 | |

| Restricted cash | 23,850 | | | 12,782 | |

| Notes and accounts receivable, net | 684,608 | | | 502,311 | |

Reinsurance recoverable | 953,886 | | | 450,620 | |

Prepaid reinsurance premiums | 900,524 | | | 725,470 | |

| Deferred acquisition costs | 565,746 | | | 498,925 | |

| Goodwill | 206,155 | | | 186,608 | |

| Intangible assets, net | 118,757 | | | 117,015 | |

| Other assets | 165,515 | | | 172,143 | |

| | | |

| Total assets | $ | 5,139,313 | | | $ | 4,039,563 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Liabilities: | | | |

| Debt, net | $ | 402,411 | | | $ | 259,366 | |

| Unearned premiums | 1,695,058 | | | 1,357,436 | |

| Policy liabilities and unpaid claims | 844,848 | | | 567,193 | |

| Deferred revenue | 673,085 | | | 649,150 | |

| Reinsurance payable | 543,602 | | | 305,097 | |

| Other liabilities and accrued expenses | 403,744 | | | 367,748 | |

| | | |

| Total liabilities | $ | 4,562,748 | | | $ | 3,505,990 | |

| | | |

| Stockholders’ Equity: | | | |

| Preferred stock: $0.001 par value, 100,000,000 shares authorized, none issued or outstanding | $ | — | | | $ | — | |

| Common stock: $0.001 par value, 200,000,000 shares authorized, 36,756,187 and 36,385,299 shares issued and outstanding, respectively | 37 | | | 36 | |

| Additional paid-in capital | 382,239 | | | 382,645 | |

| Accumulated other comprehensive income (loss), net of tax | (26,073) | | | (39,429) | |

| Retained earnings | 60,663 | | | 54,113 | |

| Total Tiptree Inc. stockholders’ equity | 416,866 | | | 397,365 | |

| Non-controlling interests: | | | |

| Fortegra preferred interests | 77,679 | | | 77,679 | |

| Common interests | 82,020 | | | 58,529 | |

| Total non-controlling interests | 159,699 | | | 136,208 | |

| Total stockholders’ equity | 576,565 | | | 533,573 | |

| Total liabilities and stockholders’ equity | $ | 5,139,313 | | | $ | 4,039,563 | |

Tiptree Inc.

Condensed Consolidated Statements of Operations

($ in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Earned premiums, net | $ | 301,416 | | | $ | 242,531 | | | $ | 1,127,834 | | | $ | 904,765 | |

| Service and administrative fees | 105,678 | | | 87,837 | | | 395,969 | | | 320,720 | |

| Ceding commissions | 4,154 | | | 3,994 | | | 14,915 | | | 13,880 | |

| Net investment income | 7,061 | | | 2,055 | | | 26,674 | | | 12,219 | |

| Net realized and unrealized gains (losses) | 12,277 | | | 19,933 | | | 24,736 | | | 69,983 | |

| Other revenue | 15,788 | | | 13,178 | | | 58,903 | | | 76,185 | |

| Total revenues | 446,374 | | | 369,528 | | | 1,649,031 | | | 1,397,752 | |

| Expenses: | | | | | | | |

| Policy and contract benefits | 158,419 | | | 122,252 | | | 601,794 | | | 452,605 | |

| Commission expense | 160,140 | | | 140,251 | | | 603,033 | | | 522,686 | |

| Employee compensation and benefits | 48,231 | | | 39,730 | | | 179,075 | | | 182,657 | |

| Interest expense | 7,467 | | | 5,403 | | | 27,692 | | | 30,240 | |

| Depreciation and amortization | 5,991 | | | 5,259 | | | 23,466 | | | 22,973 | |

| Other expenses | 36,061 | | | 31,602 | | | 130,918 | | | 132,580 | |

| Total expenses | 416,309 | | | 344,497 | | | 1,565,978 | | | 1,343,741 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Income (loss) before taxes | 30,065 | | | 25,031 | | | 83,053 | | | 54,011 | |

| Less: provision (benefit) for income taxes | 13,937 | | | 18,913 | | | 43,056 | | | 50,450 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) | 16,128 | | | 6,118 | | | 39,997 | | | 3,561 | |

| | | | | | | |

| Less: net income (loss) attributable to non-controlling interests | 9,257 | | | 5,247 | | | 26,046 | | | 11,835 | |

| Net income (loss) attributable to common stockholders | $ | 6,871 | | | $ | 871 | | | $ | 13,951 | | | $ | (8,274) | |

| | | | | | | |

| Net income (loss) per common share: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic earnings per share | $ | 0.19 | | | $ | 0.02 | | | $ | 0.38 | | | $ | (0.23) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted earnings per share | $ | 0.15 | | | $ | 0.02 | | | $ | 0.33 | | | $ | (0.23) | |

| | | | | | | |

| Weighted average number of common shares: | | | | | | | |

| Basic | 36,755,768 | | | 36,330,653 | | | 36,693,204 | | | 35,531,149 | |

| Diluted | 37,744,257 | | | 37,161,862 | | | 37,619,095 | | | 35,531,149 | |

| | | | | | | |

| Dividends declared per common share | $ | 0.05 | | | $ | 0.04 | | | $ | 0.20 | | | $ | 0.16 | |

Tiptree Inc.

Non-GAAP Reconciliations (Unaudited)

Non-GAAP Financial Measures — Adjusted net income and Adjusted return on average equity

Adjusted net income is defined as income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, including merger and acquisition related expenses, stock-based compensation, net realized and unrealized gains (losses) and intangibles amortization associated with purchase accounting, all of which is reduced for non-controlling interests. The calculation of adjusted net income excludes net realized and unrealized gains (losses) that relate to investments or assets rather than business operations. Adjusted net income is presented before the impacts of non-controlling interests. Adjusted return on average equity represents adjusted net income expressed on an annualized basis as a percentage of average beginning and ending stockholders’ equity during the period. Management uses Adjusted net income and adjusted return on average equity as part of its capital allocation process and to assess comparative returns on invested capital. We believe adjusted net income provides additional clarity on the results of the Company’s underlying business operations as a whole for the periods presented by excluding distortions created by the unpredictability and volatility of realized and unrealized gains (losses). We also believe adjusted net income provides useful supplemental information to investors as it is frequently used by the financial community to analyze financial performance between periods and for comparison among companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | |

| | | Tiptree Capital | | | | | | |

| ($ in thousands) | Insurance | | Mortgage | | Other | | Corporate | | Total | | |

| Income (loss) before taxes | $ | 44,232 | | | $ | (2,391) | | | $ | 333 | | | $ | (12,109) | | | $ | 30,065 | | | |

| Less: Income tax (benefit) expense | (5,288) | | | 606 | | | (266) | | | (8,989) | | | (13,937) | | | |

Less: Net realized and unrealized gains (losses) (1) | (6,395) | | | 2,794 | | | (596) | | | — | | | (4,197) | | | |

Plus: Intangibles amortization (2) | 4,252 | | | — | | | — | | | — | | | 4,252 | | | |

| Plus: Stock-based compensation expense | 780 | | | — | | | — | | | 1,219 | | | 1,999 | | | |

Plus: Non-recurring expenses (3) | 348 | | | — | | | — | | | — | | | 348 | | | |

Plus: Non-cash fair value adjustments (4) | 842 | | | — | | | — | | | — | | | 842 | | | |

Plus: Impact of tax deconsolidation of Fortegra(5) | — | | | — | | | — | | | 8,891 | | | 8,891 | | | |

Less: Tax on adjustments (6) | (6,167) | | | (702) | | | (185) | | | (671) | | | (7,725) | | | |

Adjusted net income (before NCI) | $ | 32,604 | | | $ | 307 | | | $ | (714) | | | $ | (11,659) | | | $ | 20,538 | | | |

Less: Impact of non-controlling interests | (6,684) | | | — | | | — | | | — | | | (6,684) | | | |

Adjusted net income | $ | 25,920 | | | $ | 307 | | | $ | (714) | | | $ | (11,659) | | | $ | 13,854 | | | |

| | | | | | | | | | | |

| Adjusted net income (before NCI) | $ | 32,604 | | | $ | 307 | | | $ | (714) | | | $ | (11,659) | | | $ | 20,538 | | | |

| Average stockholders’ equity | $ | 422,327 | | | $ | 53,188 | | | $ | 128,827 | | | $ | (44,272) | | | $ | 560,070 | | | |

Adjusted return on average equity (7) | 30.9 | % | | 2.3 | % | | (2.2) | % | | NM% | | 14.7 | % | | |

| | | | | | | | | | | |

| | | |

| | | |

| | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended December 31, 2022 | | |

| ($ in thousands) | | | Tiptree Capital | | | | | | |

| Insurance | | Mortgage | | Other | | Corporate | | Total | | |

| Income (loss) before taxes | $ | 29,093 | | | $ | (2,476) | | | $ | 10,935 | | | $ | (12,521) | | | $ | 25,031 | | | |

| Less: Income tax (benefit) expense | (10,152) | | | 511 | | | (2,076) | | | (7,196) | | | (18,913) | | | |

Less: Net realized and unrealized gains (losses) (1) | (2,804) | | | 973 | | | (10,495) | | | — | | | (12,326) | | | |

Plus: Intangibles amortization (2) | 4,083 | | | — | | | — | | | — | | | 4,083 | | | |

| Plus: Stock-based compensation expense | 47 | | | — | | | (98) | | | 1,656 | | | 1,605 | | | |

Plus: Non-recurring expenses (3) | 1,813 | | | — | | | 140 | | | — | | | 1,953 | | | |

Plus: Non-cash fair value adjustments (4) | (939) | | | — | | | 1 | | | — | | | (938) | | | |

Plus: Impact of tax deconsolidation of Fortegra (5) | — | | | — | | | — | | | 9,029 | | | 9,029 | | | |

Less: Tax on adjustments (6) | 2,798 | | | (150) | | | 1,948 | | | 448 | | | 5,044 | | | |

Adjusted net income (before NCI) | $ | 23,939 | | | $ | (1,142) | | | $ | 355 | | | $ | (8,584) | | | $ | 14,568 | | | |

Less: Impact of non-controlling interests | (4,884) | | | — | | | — | | | — | | | (4,884) | | | |

Adjusted net income | $ | 19,055 | | | $ | (1,142) | | | $ | 355 | | | $ | (8,584) | | | $ | 9,684 | | | |

| | | | | | | | | | | |

| Adjusted net income (before NCI) | $ | 23,939 | | | $ | (1,142) | | | $ | 355 | | | $ | (8,584) | | | $ | 14,568 | | | |

| Average stockholders’ equity | $ | 326,431 | | | $ | 55,726 | | | $ | 70,628 | | | $ | 73,789 | | | $ | 526,574 | | | |

Adjusted return on average equity (7) | 29.3 | % | | (8.2) | % | | 2.0 | % | | NM% | | 11.1 | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Year Ended December 31, 2023 | | | |

| | | Tiptree Capital | | | | | | | |

| ($ in thousands) | Insurance | | Mortgage | | Other | | Corporate | | Total | | | |

| Income (loss) before taxes | $ | 129,816 | | | $ | (3,285) | | | $ | (3,264) | | | $ | (40,214) | | | $ | 83,053 | | | | |

| Less: Income tax (benefit) expense | (28,224) | | | 837 | | | 153 | | | (15,822) | | | (43,056) | | | | |

Less: Net realized and unrealized gains (losses) (1) | 4,207 | | | 1,861 | | | 5,289 | | | — | | | 11,357 | | | | |

Plus: Intangibles amortization (2) | 16,919 | | | — | | | — | | | — | | | 16,919 | | | | |

| Plus: Stock-based compensation expense | 2,018 | | | — | | | — | | | 6,251 | | | 8,269 | | | | |

Plus: Non-recurring expenses (3) | 2,824 | | | — | | | — | | | — | | | 2,824 | | | | |

Plus: Non-cash fair value adjustments (4) | (1,769) | | | — | | | — | | | — | | | (1,769) | | | | |

Plus: Impact of tax deconsolidation of Fortegra (5) | — | | | — | | | — | | | 19,101 | | | 19,101 | | | | |

Less: Tax on adjustments (6) | (10,086) | | | (495) | | | (1,255) | | | 797 | | | (11,039) | | | | |

Adjusted net income (before NCI) | $ | 115,705 | | | $ | (1,082) | | | $ | 923 | | | $ | (29,887) | | | $ | 85,659 | | | | |

| Less: Impact of non-controlling interests | (23,742) | | | — | | | — | | | — | | | (23,742) | | | | |

Adjusted net income | $ | 91,963 | | | $ | (1,082) | | | $ | 923 | | | $ | (29,887) | | | $ | 61,917 | | | | |

| | | | | | | | | | | | |

| Adjusted net income (before NCI) | $ | 115,705 | | | $ | (1,082) | | | $ | 923 | | | $ | (29,887) | | | $ | 85,659 | | | | |

| Average stockholders’ equity | $ | 395,661 | | | $ | 53,520 | | | $ | 100,325 | | | $ | 5,564 | | | $ | 555,070 | | | | |

Adjusted return on average equity (7) | 29.2 | % | | (2.0) | % | | 0.9 | % | | NM% | | 15.4 | % | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Year Ended December 31, 2022 |

| | | Tiptree Capital | | | | |

| ($ in thousands) | Insurance | | Mortgage | | Other | | Corporate | | Total |

| Income (loss) before taxes | $ | 68,150 | | | $ | 874 | | | $ | 31,403 | | | $ | (46,416) | | | $ | 54,011 | |

| Less: Income tax (benefit) expense | (21,251) | | | (363) | | | (5,545) | | | (23,291) | | | (50,450) | |

Less: Net realized and unrealized gains (losses) (1) | 20,347 | | | (7,003) | | | (18,788) | | | — | | | (5,444) | |

Plus: Intangibles amortization (2) | 16,229 | | | — | | | — | | | — | | | 16,229 | |

| Plus: Stock-based compensation expense | 2,423 | | | — | | | — | | | 7,093 | | | 9,516 | |

Plus: Non-recurring expenses (3) | 3,374 | | | — | | | (729) | | | 2,108 | | | 4,753 | |

Plus: Non-cash fair value adjustments (4) | (939) | | | — | | | 3,555 | | | — | | | 2,616 | |

Plus: Impact of tax deconsolidation of Fortegra (5) | 1,560 | | | — | | | — | | | 31,573 | | | 33,133 | |

Less: Tax on adjustments (6) | (6,061) | | | 1,834 | | | 3,731 | | | (467) | | | (963) | |

Adjusted net income (before NCI) | $ | 83,832 | | | $ | (4,658) | | | $ | 13,627 | | | $ | (29,400) | | | $ | 63,401 | |

| Less: Impact of non-controlling interests | (10,367) | | | — | | | — | | | — | | | (10,367) | |

| Adjusted net income | $ | 73,465 | | | $ | (4,658) | | | $ | 13,627 | | | $ | (29,400) | | | $ | 53,034 | |

| | | | | | | | | |

| Adjusted net income (before NCI) | $ | 83,832 | | | $ | (4,658) | | | $ | 13,627 | | | $ | (29,400) | | | $ | 63,401 | |

| Average stockholders’ equity | $ | 321,320 | | | $ | 57,575 | | | $ | 98,373 | | | $ | (10,390) | | | $ | 466,878 | |

Adjusted return on average equity (7) | 26.1 | % | | (8.1) | % | | 13.9 | % | | NM% | | 13.6 | % |

| | | | | |

| Notes |

| (1) | Net realized and unrealized gains (losses) added back in Adjusted net income excludes net realized and unrealized gains (losses) from the mortgage segment, those relating to our held-for-sale mortgage originator (Luxury), and unrealized gains (losses) on mortgage servicing rights. |

| (2) | Specifically associated with acquisition purchase accounting. See Note (9) Goodwill and Intangible Assets, net, of the Company’s Form 10-K for the period ended December 31, 2023. |

| (3) | For the three months and year ended December 31, 2023, included in other expenses were expenses related to banker and legal fees associated with the acquisitions of Premia and ITC. |

| (4) | For the three months and year ended December 31, 2023, non-cash fair-value adjustments represent a change in fair value of the Fortegra Additional Warrant liability which are added-back to adjusted net income. For the 2022 periods, maritime transportation depreciation and amortization was deducted as a reduction in the value of the vessel. |

| (5) | For the three months and year ended December 31, 2023, included in the adjustment is an add-back of $8.9 million and $19.1 million, respectively, related to deferred tax expense from the WP Transaction. For the three months and year ended December 31, 2022, included in the adjustment is an add-back of $9.0 million and $33.1 million, respectively, related to deferred tax expense from the WP Transaction. |

| (6) | Tax on adjustments represents the tax applied to the total non-GAAP adjustments and includes adjustments for non-recurring or discrete tax impacts. |

| (7) | Total Adjusted return on average equity, after non-controlling interests was 13.6% and 9.9% for the three months ended December 31, 2023 and 2022, respectively, based on $13.9 million and $9.7 million of Adjusted net income over $406.5 million and $392.3 million of average Tiptree Inc. stockholders’ equity, and 15.2% and 13.6% for the years ended December 31, 2023 and 2022, respectively, based on $61.9 million and $53.0 million of Adjusted net income over $407.1 million and $390.2 million of average Tiptree Inc. stockholders’ equity. |

Investor Presentation – Fourth Quarter 2023 February 2024 Financial Information for the three and twelve months ended December 31, 2023 EXHIBIT 99.2

1 Disclaimers LIMITATIONS ON THE USE OF INFORMATION This presentation has been prepared by Tiptree Inc. and its consolidated subsidiaries (“Tiptree", "the Company" or "we”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to Tiptree, its subsidiaries or any of its affiliates or any other purpose. Tiptree reports a non-controlling interest in certain operating subsidiaries that are not wholly owned. Unless otherwise noted, all information is of Tiptree on a consolidated basis before non-controlling interest. Neither Tiptree nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. These materials and any related oral statements are not all-inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Performance information is historical and is not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree's control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect,“ “intend,” “may,” “might,” "plan," “project,” “should,” "target,“ “will,” "view," “confident,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree's plans, objectives, expectations and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in Tiptree’s Annual Report on Form 10-K, and as described in the Tiptree’s other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could affect our forward-looking statements. Consequently, our actual performance could be materially different from the results described or anticipated by our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to update any forward- looking statements. MARKET AND INDUSTRY DATA Certain market data and industry data used in this presentation were obtained from reports of governmental agencies and industry publications and surveys. We believe the data from third-party sources to be reliable based upon our management’s knowledge of the industry, but have not independently verified such data and as such, make no guarantees as to its accuracy, completeness or timeliness. NOT AN OFFER OR A SOLICIATION This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with Tiptree, its subsidiaries or its affiliates. The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. NON-GAAP MEASURES In this document, we sometimes use financial measures derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). Certain of these data are considered “non-GAAP financial measures” under the SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Management's reasons for using these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are posted in the Appendix.

2 2023 Highlights Revenue $1.6 billion 18.0% vs. prior year Adjusted Net Income1 $61.9 million 16.7% vs. prior year Book Value per share1,3 $11.34 5.7% vs. 12/31/22 Net Income $14.0 million vs. prior year net loss of $(8.3) million Overall Revenues of $1.6 billion, an increase of 18% from 2022, driven by growth at Fortegra. Excluding investment gains and losses, revenues increased 19%. Net income of $14mm in 2023. Included is $19.1mm of tax expense related to tax deconsolidation of Fortegra, compared to $33.1m of tax expense in 2022. Adj. net income1 of $61.9mm, and 15.2% adj. ROAE1, driven by strong performance in insurance operations. Insurance $2.75Bn of gross written premiums and premium equivalents (GWPPE), 21% increase from prior year, driven growth in specialty E&S and admitted insurance lines. Combined ratio of 90.3% driven by consistent underwriting performance and the scalability of operating platform. Adj. net income1,2 of $115.7mm, up 38% from prior year driven by revenue growth and consistent combined ratio. Adj. return on average equity1,2 of 29.2%, compared to 26.1% in 2022. Tiptree Capital Pre-tax loss of $6.5mm driven by unrealized investment losses on Invesque. Mortgage pre-tax loss of $3.3mm, more than offset by gains on other investments. ($ in millions, all figures represent full year unless otherwise noted) 1 For a reconciliation of Non-GAAP metrics adjusted net income, adjusted return on average equity and book value per share to GAAP financials, see the Appendix. 2 Adjusted net income and adjusted return on average equity is presented before the impacts of non-controlling interests. 3 Annual total return defined as cumulative dividends paid of $0.20 per share plus change in book value per share as of December 31, 2023.

Financial Results Q4'22 Q4'23 FY’22 FY’23 $89.1 Total Revenues $369.5 $446.4 $1,397.8 $1,649.0 Net income (loss) $0.9 $6.9 $(8.3) $14.0 Diluted EPS $0.02 $0.15 $(0.23) $0.33 Adjusted net income1 $9.7 $13.9 $53.0 $61.9 Adjusted ROAE1 9.9% 13.6% 13.6% 15.2% Total shares outstanding 36.4 36.8 Book Value per share1 $10.92 $11.34 31 For a reconciliation of Non-GAAP metrics adjusted net income, adjusted return on average equity (annualized) and book value per share to GAAP financials, see the Appendix. 2 Adjusted net income for Fortegra is presented before the impacts of non-controlling interests. ($ in millions, except per share information) $20.4 $23.9 $32.6 $4.6 $(0.8) $(0.4) $(8.1) $(8.6) $(11.7) $16.9 $14.6 $20.5 Q4'21 Q4'22 Q4'23 Corporate Fortegra2 Tiptree Capital Key Highlights – Q4’23 Adjusted Net Income by business Revenues up 24%, excluding investment gains/losses • Growth in earned premiums, service fees and investment income • Improvement in investment portfolio book yield to 3.3%, from 2.7% prior year Net income of $6.9mm • Growth in insurance operations while maintaining consistent combined ratio • Unrealized investment gains partially offset by sale of vessels in 2022 • Impact of Fortegra tax deconsolidation of $9mm in Q4‘23 and Q4‘22 Adj. net income1 of $13.9mm, increased by 43% versus prior year • Continued revenue growth and consistent combined ratio at Fortegra Adj. ROAE1 of 13.6%, improvement of 3.7% versus prior year $66.8 $83.8 $115.7 $28.2 $9.0 $(31.1) $(29.4) $(29.9) $63.9 $63.4 $85.7 2021 2022 2023 $16.2 $53.0 $61.9$61.6$9.7 $13.9 Adjusted Net Income (after NCI)

Specialty Insurance Performance Highlights Q4’23

5 Fortegra – Financial Performance Highlights Record revenues of $433mm, up 25% • Product & distribution expansion to drive continued growth, while maintaining underwriting discipline • Continued investment in growth initiatives ✓ Specialty E&S and admitted lines ✓ Capital-light warranty lines ✓ European expansion Produced stable, growing results from underwriting and fees • Combined ratio consistent at 89.8% • Record underwriting & fee margin of $98mm, up 28% • 2023 Adj ROAE of 29.2%, driven by insurance and services Maintain a high-quality balance sheet, including a conservative and liquid investment portfolio Underwriting and Fee Margin1 Underwriting and Fee Revenues1 Combined Ratio 1 2 3 Summary Financials Insurance products Q4’23 Highlights & Outlook ($ in millions) Expense Ratio Loss Ratio Services Insurance 1 See the appendix for a reconciliation of Non-GAAP measures including Adjusted Net Income (before non-controlling interests), Adjusted return on average equity (annualized), underwriting and fee revenues and underwriting and fee margin. . Note: Tiptree’s ownership of Fortegra was 79.5% as of December 31, 2023 (before conversion of Fortegra preferred stock and impacts of warrants and unvested employee stock awards). Q4’22 Q4’23 FY’22 FY’23 Premiums & equivalents $526.6 $724.1 $2,263.1 $2,747.9 Net written premiums $245.2 $384.3 $1,089.4 $1,320.0 Revenue $345.4 $433.2 $1,248.8 $1,593.1 Pre-tax income (loss) $29.1 $44.2 $68.2 $129.8 Adjusted net income1 $23.9 $32.6 $83.8 $115.7 Adjusted ROAE1 29.3% 30.9% 26.1% 29.2% Combined ratio 89.8% 89.8% 90.4% 90.3% Services Insurance245 305 78 95$324 $400 Q4'22 Q4'23 49 70 27 28$76 $98 Q4'22 Q4'23 37.8% 39.6% 38.7% 36.0% 13.3% 14.2% 89.8% 89.8% Q4'22 Q4'23 Acquisition ratio

Investment Portfolio Cash & Equivalents 31% Government & Agency 33% Corporate Bonds 19% Muni & ABS 6% Equities 2% Other Alternatives 9% Cash & Equivalents 34% Government & Agency 38% AA 6% A 13% BBB 7% $1,191mm 6 Asset Allocation Liquid and Highly-Rated Fixed Income Portfolio ($ in millions) 1,057 1,191 97 136 $1,154 $1,327 2022 2023 Other investments Fixed Income & Cash $1,327mm ◼ 2.5 year duration ◼ AA, S&P rating 3.3%2.7%Book yield Q4’22 Q4’23 FY’22 FY’23 Net investment income – P&L $2.1 $7.1 $12.2 $26.7 Cash and cash equivalent interest income $1.8 $3.2 $2.5 $11.0 Net realized and unrealized gains (losses) – P&L $2.8 $6.4 $(20.3) $(4.2) Unrealized gains (losses) on AFS Securities – OCI $1.3 $23.0 $(55.2) $19.0 Return Metrics (Pre-tax, before NCI)

Fortegra – A Highly Profitable and Growing Specialty Insurer $32.8 $43.4 $66.8 $83.8 $115.7 2019 2020 2021 2022 2023 7 ($ in millions) Gross Written Premiums & Equivalents1 Underwriting & Fee Revenues and Margin2 Adjusted Net Income2 1,015 1171 1,601 1,889 2,386 75 258 335 374 362 $1,090 $1,430 $1,936 $2,263 $2,748 2019 2020 2021 2022 2023 Combined Ratio Adj. ROAE%2 Adj. Net Income Loss Ratio Expense Ratio Insurance Services 1 Gross written premiums and premium equivalents represent total gross written premiums from insurance policies and warranty service contracts issued during a reporting period. 2 See the appendix for a reconciliation of Non-GAAP measures including Adjusted Net Income (before non-controlling interests), Adjusted return on average equity (annualized), underwriting and fee revenues and underwriting and fee margin. 12% U/W & Fee Revenues 26% U/W & Fee Margin 29%22%15% $145 $176 $244 $279 $355 2019 2020 2021 2022 2023 $594 $654 $932 $1,200 $1,500 2019 2020 2021 2022 2023 28.7% 36.2% 35.1% 37.7% 40.1% 47.0% 36.9% 38.7% 39.0% 36.2% 16.6% 17.9% 16.5% 13.7% 14.0% 92.3% 91.0% 90.3% 90.4% 90.3% 2019 2020 2021 2022 2023 Acquisition Ratio

Performance Highlights Q4’23

57.6 7.1 54.7 52.3 13.0 41.3 4.2 77.4 $129.6 $178.1 2022 2023 Financial drivers Pre-tax income (loss) Q4’22 Q4’23 FY’22 FY’23 Mortgage $(2.5) $(2.4) $0.9 $(3.3) Senior living (Invesque) (3.1) (2.2) (16.0) (9.3) Maritime transportation 13.3 (2.8) 49.8 (4.5) Other 0.8 5.3 (2.4) 10.6 Total $8.5 $(2.1) $32.3 $(6.5) 9 Tiptree Capital – Financial Performance Highlights Mortgage: • Mortgage origination volumes of $877mm, down 23% from PY • Pre-tax contributions below PY from volume decline and negative FV adjustment on MSR asset; gain on sale margins consistent at 4.7% • MSR asset of $41mm Cash & U.S Government Securities: • Invested in U.S. Government and money market funds Equities: • 2023 unrealized loss of $3.5mm, compared to PY loss of $9.3m – both periods driven by losses on Invesque Maritime transportation: • 2022 included one-time gains from sale of five vessels Capital Allocation 2023 Highlights ($ in millions) Mortgage Maritime transportation and other Equity Securities Cash and U.S. Government Securities

01 Summary & Outlook

11 ❑ Maintain trajectory of consistent top-line growth and sustained underwriting profitability over the long-term in our insurance business ❑ Continue to look for opportunities to allocate capital for long-term value creation ❑ Remain disciplined and patient as we navigate today’s economic, political and financial environment Summary & Outlook ($ in millions) ✓ Strong operating performance from our businesses – Fortegra continues to deliver record financial and operating performance – Increasing yields on investment portfolio 2023 Highlights Looking Ahead

Appendix Non-GAAP Reconciliations • Insurance underwriting and fee revenue • Insurance underwriting and fee margin • Book Value per share • Adjusted net income

Non-GAAP Reconciliations 13 Adjusted Net Income We define adjusted net income as income before taxes, less provision (benefit) for income taxes, and excluding the after-tax impact of various expenses that we consider to be unique and non-recurring in nature, including merger and acquisition related expenses, stock-based compensation, net realized and unrealized gains (losses) and intangibles amortization associated with purchase accounting, all of which is reduced for non- controlling interests. The calculation of adjusted net income excludes net realized and unrealized gains (losses) that relate to investments or assets rather than business operations. Adjusted net income should not be viewed as a substitute for income before taxes calculated in accordance with GAAP, and other companies may define adjusted net income differently. Adjusted net income (before NCI) is presented before the impacts of non-controlling interests. We present adjustments for amortization associated with acquired intangible assets. The intangible assets were recorded as part of purchase accounting in connection with Tiptree’s acquisition of Fortegra Financial in 2014, Defend in 2019, and Smart AutoCare and Sky Auto in 2020, ITC in 2022 and Premia in 2023. The intangible assets acquired contribute to overall revenue generation, and the respective purchase accounting adjustments will continue to occur in future periods until such intangible assets are fully amortized in accordance with the respective amortization periods required by GAAP. We define adjusted return on average equity as adjusted net income expressed on an annualized basis as a percentage of average beginning and ending stockholder’s equity during the period. We use adjusted return on average equity as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance. Adjusted return on average equity should not be viewed as a substitute for return on average equity calculated in accordance with GAAP, and other companies may define adjusted return on average equity differently. Book value per share Management believes the use of book value per share provides supplemental information useful to investors as it is frequently used by the financial community to analyze company growth on a relative per share basis. Insurance – Underwriting and Fee Revenues We generally manage our exposure to the underwriting risk we assume using both reinsurance (e.g., quota share and excess of loss) and retrospective commission agreements with our partners (e.g., commissions paid are adjusted based on the actual underlying losses incurred), which mitigate our risk. Period-over-period comparisons of revenues and expenses are often impacted by the Producer Owned Reinsurance Company (PORCs) and distribution partners’ choice as to whether to retain risk, specifically service and administration fees and ceding commissions, both components of revenue, and policy and contract benefits and commissions paid to our partners and reinsurers. Generally, when losses are incurred, the risk which is retained by our partners and reinsurers is reflected in a reduction in commissions paid. In order to better explain to investors the underwriting performance of the Company’s programs and the respective retentions between the Company and its agents and reinsurance partners, we use non-GAAP metrics of underwriting and fee revenues and underwriting and fee margin. We define underwriting and fee revenues as total revenues excluding net investment income, net realized gains (losses) and net unrealized gains (losses), ceding fees, ceding commissions and cash and cash equivalent interest income as reported in other income. Underwriting and fee revenues represents revenues generated by our underwriting and fee-based operations and allows us to evaluate our underwriting performance without regard to investment income. We use this metric as we believe it gives our management and other users of our financial information useful insight into our underlying business performance. Underwriting and fee revenues should not be viewed as a substitute for total revenues calculated in accordance with GAAP, and other companies may define underwriting and fee revenues differently. Insurance - Underwriting and Fee Margin We define underwriting and fee margin as income before taxes, excluding net investment income, net realized gains (losses), net unrealized gains (losses), cash and cash equivalent interest income, employee compensation and benefits, other expenses, interest expense and depreciation and amortization. Underwriting and fee margin represents the underwriting performance of our underwriting and fee-based programs. As such, underwriting and fee margin excludes general administrative expenses, interest expense, depreciation and amortization and other corporate expenses as those expenses support the vertically integrated business model and not any individual component of our business mix. We use this metric as we believe it gives our management and other users of our financial information useful insight into the specific performance of our underlying underwriting and fee programs. Underwriting and fee income should not be viewed as a substitute for income before taxes calculated in accordance with GAAP, and other companies may define underwriting and fee margin differently.

14 Non-GAAP Reconciliations – Underwriting & Fee Revenues & Margin ($ in thousands, except per share information) 2023 2022 2023 2022 2021 2020 2019 Total Revenues 433,170$ 345,408$ 1,593,070$ 1,248,796$ 984,130$ 691,061$ 635,085$ Less: Net investment income (7,061) (2,055) (26,674) (12,219) (17,896) (9,916) (8,667) Less: Net realized and unrealized gains (losses) (6,395) (2,804) 4,207 20,347 2,006 11,944 (6,896) Less: Ceding fees (12,015) (11,134) (44,628) (40,154) (24,183) (17,834) (14,331) Less: Ceding commissions (4,154) (3,994) (14,915) (13,880) (11,784) (21,101) (9,608) Less: Cash and cash equivalent interest income (3,210) (1,768) (11,037) (2,505) (55) (211) (1,123) Underwriting and fee revenues - Non GAAP 400,335$ 323,653$ 1,500,023$ 1,200,385$ 932,218$ 653,943$ 594,460$ 2023 2022 2023 2022 2021 2020 2019 Income (loss) before income taxes 44,232$ 29,093$ 129,816$ 68,150$ 69,857$ 26,948$ 37,030$ Less: Net investment income (7,061) (2,055) (26,674) (12,219) (17,896) (9,916) (8,667) Less: Net realized and unrealized gains (losses) (6,395) (2,804) 4,207 20,347 2,006 11,944 (6,896) Less: Money market interest income (3,210) (1,768) (11,037) (2,505) (55) (211) (1,123) Plus: Depreciation and amortization 5,470 4,854 21,425 18,551 17,223 10,835 9,105 Plus: Interest expense 6,915 4,888 25,836 20,054 17,576 15,487 14,766 Plus: Employee compensation and benefits 31,049 23,759 114,341 87,918 76,552 65,089 49,789 Plus: Other expenses 26,945 20,311 96,825 78,832 79,227 55,594 50,657 Underwriting and fee margin 97,945$ 76,278$ 354,739$ 279,128$ 244,490$ 175,770$ 144,661$ 2023 2022 Total stockholders’ equity 576,565$ 533,573$ Less: Non-controlling interests (159,699) (136,208) Total stockholders’ equity, net of non-controlling interests 416,866$ 397,365$ Total common shares outstanding 36,756 36,385 Book value per share 11.34$ 10.92$ Three Months Ended December 31, Year Ended December 31, Year Ended December 31, As of December 31, Three Months Ended December 31,

15 Non-GAAP Reconciliations – Adjusted Net Income The footnotes below correspond to the tables above, under “—Adjusted Net Income - Non-GAAP and “—Adjusted Return on Average Equity - Non-GAAP” (annualized). Adjusted net income is presented before the impacts of non-controlling interests. Tiptree’s subsidiary ownership percentage as of December 31, 2023 was Fortegra 79.5%, Tiptree Marine 100%, Reliance (Mortgage) 100%. (1) Net realized and unrealized gains (losses) added back in Adjusted net income excludes net realized and unrealized gains (losses) from the mortgage segment, those relating to our held-for-sale mortgage originator (Luxury), and unrealized gains (losses) on mortgage servicing rights. (2) Specifically associated with acquisition purchase accounting. See Note (9) Goodwill and Intangible Assets, net. (3) Included in other expenses were expenses related to banker and legal fees associated with the acquisitions of Premia and ITC. (4) Non-cash fair-value adjustments represent a change in fair value of the Fortegra Additional Warrant liability which are added-back to adjusted net income. For the 2022 periods, maritime transportation depreciation and amortization was deducted as a reduction in the value of the vessel. (5) For the three and twelve months ended December 31, 2023, included in the adjustment is an add-back of $8.9 million and $19.1 million, respectively, related to deferred tax expense from the WP Transaction. For the three and twelve months ended December 31, 2022, included in the adjustment is an add-back of $9.0 million and $33.1 million, respectively, related to deferred tax expense from the WP Transaction. (6) Tax on adjustments represents the tax applied to the total non-GAAP adjustments and includes adjustments for non-recurring or discrete tax impacts. (7) Total adjusted return on average equity, after non- controlling interests was 13.6% and 9.9% for the three months ended December 31, 2023 and 2022, respectively, based on $13.9 million and $9.7 million of Adjusted net income over $406.5 million and $392.3 million of average Tiptree Inc. stockholders’ equity, and 15.2% and 13.6% for the years ended December 31, 2023 and 2022, respectively, based on $61.9 million and $53.0 million of Adjusted net income over $407.1 million and $390.2 million of average Tiptree Inc. stockholders’ equity. ($ in thousands) Insurance Mortgage Other Corporate Total Insurance Mortgage Other Corporate Total Income (loss) before taxes 44,232$ (2,391)$ 333$ (12,109)$ 30,065$ 29,093$ (2,476)$ 10,935$ (12,521)$ 25,031$ Less: Income tax (benefit) expense (5,288) 606 (266) (8,989) (13,937) (10,152) 511 (2,076) (7,196) (18,913) Less: Net realized and unrealized gains (losses) (1) (6,395) 2,794 (596) - (4,197) (2,804) 973 (10,495) - (12,326) Plus: Intangibles amortization (2) 4,252 - - - 4,252 4,083 - - - 4,083 Plus: Stock-based compensation expense 780 - - 1,219 1,999 47 - (98) 1,656 1,605 Plus: Non-recurring expenses (3) 348 - - - 348 1,813 - 140 - 1,953 Plus: Non-cash fair value adjustments (4) 842 - - - 842 (939) - 1 - (938) Plus: Impact of tax deconsolidation of Fortegra (5) - - - 8,891 8,891 - - - 9,029 9,029 Less: Tax on adjustments (6) (6,167) (702) (185) (671) (7,725) 2,798 (150) 1,948 448 5,044 Adjusted net income (before NCI) 32,604$ 307$ (714)$ (11,659)$ 20,538$ 23,939$ (1,142)$ 355$ (8,584)$ 14,568$ Less: Impact of non-controlling interests (6,684) - - - (6,684) (4,884) - - - (4,884) Adjusted net income 25,920$ 307$ (714)$ (11,659)$ 13,854$ 19,055$ (1,142)$ 355$ (8,584)$ 9,684$ Average stockholders’ equity 422,327$ 53,188$ 128,827$ (44,272)$ 560,070$ 326,431$ 55,726$ 70,628$ 73,789$ 526,574$ Adjusted return on average equity (7) 30.9% 2.3% (2.2)% NM% 14.7% 29.3% (8.2)% 2.0% NM% 11.1% ($ in thousands) Insurance Mortgage Other Corporate Total Insurance Mortgage Other Corporate Total Income (loss) before taxes 129,816$ (3,285)$ (3,264)$ (40,214)$ 83,053$ 68,150$ 874$ 31,403$ (46,416)$ 54,011$ Less: Income tax (benefit) expense (28,224) 837 153 (15,822) (43,056) (21,251) (363) (5,545) (23,291) (50,450) Less: Net realized and unrealized gains (losses) (1) 4,207 1,861 5,289 - 11,357 20,347 (7,003) (18,788) - (5,444) Plus: Intangibles amortization (2) 16,919 - - - 16,919 16,229 - - - 16,229 Plus: Stock-based compensation expense 2,018 - - 6,251 8,269 2,423 - - 7,093 9,516 Plus: Non-recurring expenses (3) 2,824 - - - 2,824 3,374 - (729) 2,108 4,753 Plus: Non-cash fair value adjustments (4) (1,769) - - - (1,769) (939) - 3,555 - 2,616 Plus: Impact of tax deconsolidation of Fortegra (5) - - - 19,101 19,101 1,560 - - 31,573 33,133 Less: Tax on adjustments (6) (10,086) (495) (1,255) 797 (11,039) (6,061) 1,834 3,731 (467) (963) Adjusted net income (before NCI) 115,705$ (1,082)$ 923$ (29,887)$ 85,659$ 83,832$ (4,658)$ 13,627$ (29,400)$ 63,401$ Less: Impact of non-controlling interests (23,742) - - - (23,742) (10,367) - - - (10,367) Adjusted net income 91,963$ (1,082)$ 923$ (29,887)$ 61,917$ 73,465$ (4,658)$ 13,627$ (29,400)$ 53,034$ Average stockholders’ equity 395,661$ 53,520$ 100,325$ 5,564$ 555,070$ 321,320$ 57,575$ 98,373$ (10,390)$ 466,878$ Adjusted return on average equity (7) 29.2% (2.0)% 0.9% NM% 15.4% 26.1% (8.1)% 13.9% NM% 13.6% Year Ended December 31, 2022 Tiptree Capital Tiptree Capital Three Months Ended December 31, 2022 Tiptree Capital Three Months Ended December 31, 2023 Tiptree Capital Year Ended December 31, 2023

TiptreeInc. ir@tiptreeinc.com

v3.24.0.1

Cover Page

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

TIPTREE INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-33549

|

| Entity Tax Identification Number |

38-3754322

|

| Entity Address, Address Line One |

660 Steamboat Road

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

Greenwich

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06830

|

| City Area Code |

212

|

| Local Phone Number |

446-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Listing, Par Value Per Share |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TIPT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001393726

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

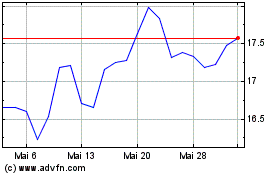

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024