Rigetti Computing, Inc. (Nasdaq: RGTI) (“Rigetti” or the

“Company”), a pioneer in full-stack quantum-classical computing,

today announced its financial results for the third quarter ended

September 30, 2024 and business updates, including updates to its

technology roadmap.

Third Quarter 2024 Financial Highlights

- Total revenues for the three months ended September 30, 2024

were $2.4 million

- Total operating expenses for the three months ended September

30, 2024 were $18.6 million

- Operating loss for the three months ended September 30, 2024

was $17.3 million

- Net loss for the three months ended September 30, 2024 was

$14.8 million

- As of September 30, 2024 cash, cash equivalents and

available-for-sale securities totaled $92.6 million

Technology Updates

Roadmap updateThe Company plans to introduce a

new modular system architecture in 2025. By mid-year 2025, the

Company expects to release a 36-qubit system based on four 9-qubit

chips tiled together with a targeted 99.5% median 2-qubit fidelity.

By the end of 2025, the Company expects to release a system with

over 100 qubits with a targeted 99.5% median 2-qubit fidelity.

Rigetti plans to develop the 336-qubit Lyra™ system thereafter.

Rigetti remains on track to develop and deploy its anticipated

84-qubit Ankaa™-3 system with the goal of achieving a 99+% median

2-qubit gate fidelity by the end of 2024.

We believe superconducting qubits have many advantages,

including that they are fabricated using well-established

semiconductor design and manufacturing techniques. Superconducting

qubits also perform faster gate operations than other qubit

modalities. Rigetti’s system gate speeds consistently achieve an

active duration of 60-8ns, which is four orders of magnitude faster

than other modalities such as ion traps and pure atoms. System

speed is an important factor to enable hybrid computing with

current CPUs/GPUs.

“After spending years optimizing the performance of our larger

scale 84-qubit Ankaa™ chips and honing our multi-chip scaling

technology, we are manufacturing 9-qubit chips at 99.4% 2-qubit

median fidelity, and in Q3 of this year we demonstrated tiling of

9-qubit chips without deterioration in performance,” says Dr.

Subodh Kulkarni, Rigetti CEO. “We believe the anticipated 4-chip

36-qubit system will be the most ambitious multi-chip QPU

architecture in the market, and a significant milestone for the

company and the quantum computing industry. Our approach to

scalability, mirroring multi-chip architectures for advanced

applications with CMOS, is supported by our recently announced

Alternating-Bias Assisted Annealing (ABAA) technique for precisely

targeted qubit frequencies. ABAA allows us to consistently

manufacture high performance QPUs with the frequency precision

necessary for high fidelities. The combination of our ABAA

technique and a multi-chip architecture is the cornerstone of our

scaling strategy as we move into developing higher qubit count

systems.”

Demonstrating real-time and low-latency QEC with

superconducting qubitsQuantum error correction (QEC) will

be essential to achieve the accuracy needed for quantum computers

to realize their full potential. Together with Riverlane, Rigetti

is working to advance our understanding of how to build fault

tolerant quantum computers using QEC technology.

Rigetti’s recent paper with Riverlane, “Demonstrating real-time

and low-latency quantum error correction with superconducting

qubits,” demonstrates how integrating Riverlane’s quantum error

decoder into the control system of Rigetti’s 84-qubit Ankaa-2

system enabled the achievement of real-time, low-latency quantum

error correction, a critical process for developing fault tolerant

quantum computers.

Novera QPU co-located at Israeli Quantum Computing

Center

Rigetti believes that its 9-qubit Novera™ QPU is ideal for

experimentation across a variety of research areas including qubit

characterization and hybrid quantum algorithms. Rigetti is excited

to share that a Novera QPU has been co-located at the Israeli

Quantum Computing Center (IQCC) with Quantum Machines’ OPX1000

control system and NVIDIA’s Grace-Hopper superchip servers, which

was made available to partners for research and experimentation.

The set-up was recently leveraged for a reinforcement learning

project, which was presented at IEEE Quantum Week 2024 in

September. The demonstration entailed optimizing single qubit

operations on the Novera QPU, and is an exciting use case for using

a Novera QPU for quantum machine learning development.

Novel chip fabrication process for scalable, high

performing QPUsWe believe quantum computers capable of

addressing real-world problems will require hundreds to thousands

of high performing qubits. Because qubits are sensitive to noise

and other external factors, an important factor for scaling to

higher qubit count systems is improving control over the materials,

design, and environment of qubits. In August 2024, Rigetti

introduced a novel chip fabrication technique, ABAA, that allows

for qubit frequencies to be precisely targeted prior to a chip

being packaged. The technique entails applying a series of low,

alternating voltages at room temperature to the junctions that form

the qubit. Unlike more complicated solutions that address the

problem of tuning frequency, which often require laser trimming of

the chip, ABAA is a simple and scalable process.

The Company found that leveraging ABAA enables improved

execution of 2-qubit gates and a reduction in defects, which both

contribute to higher fidelity.

The Company is leveraging the ABAA technique to fabricate chips

for the Novera QPU and the upcoming Ankaa-3 system.

Business Updates

NQCC opens landmark facility that includes fully

operational Rigetti QPU The National Quantum Computing

Centre (NQCC) officially opened the doors of its landmark facility

on Harwell Campus on October 25, 2024.

The facility will support world-class quantum computing research

and provide state-of-the-art laboratories for designing, building

and testing quantum computers. The state-of-the-art facility

includes a fully operational 24-qubit Ankaa-class system that will

be made available to NQCC researchers for testing, benchmarking,

and exploratory applications development.

Conference Call and WebcastRigetti will host a

conference call later today, November 12, 2024, at 8:30 a.m. ET, or

5:30 a.m. PT, to discuss its third quarter 2024 financial

results.

You can listen to a live audio webcast of the conference call at

https://edge.media-server.com/mmc/p/aoxe8j5p/ or the “Events &

Presentations” section of the Company’s Investor Relations website

at https://investors.rigetti.com/. A replay of the conference call

will be available at the same locations following the conclusion of

the call for one year.

To participate in the live call, you must register using the

following link:

https://register.vevent.com/register/BI66e8b07255734ee49c6d5daf2166b220.

Once registered, you will receive dial-in numbers and a unique PIN

number. When you dial in, you will input your PIN and be routed

into the call. If you register and forget your PIN, or lose the

registration confirmation email, simply re-register to receive a

new PIN.

About RigettiRigetti is a pioneer in full-stack

quantum computing. The Company has operated quantum computers over

the cloud since 2017 and serves global enterprise, government, and

research clients through its Rigetti Quantum Cloud Services

platform. The Company’s proprietary quantum-classical

infrastructure provides high performance integration with public

and private clouds for practical quantum computing. Rigetti has

developed the industry’s first multi-chip quantum processor for

scalable quantum computing systems. The Company designs and

manufactures its chips in-house at Fab-1, the industry’s first

dedicated and integrated quantum device manufacturing facility.

Learn more at www.rigetti.com.

ContactsRigetti Computing Investor

Contact:IR@Rigetti.com

Rigetti Computing Media Contact:press@rigetti.com

Cautionary Language Concerning Forward-Looking

StatementsCertain statements in this communication may be

considered “forward-looking statements” within the meaning of the

federal securities laws, including statements with respect to the

Company’s expectations with respect to its future success and

performance, including expectations with respect to the Company’s

future revenues and the timing, availability and impact of

government programs relating to quantum information science;

expectations related to the Company’s ability to achieve milestones

including the development, performance and deployment of new

systems with the anticipated timing and features or at all;

expectations that the ABAA technique will allow the Company to

manufacture high performance QPUs with the frequency precision

necessary for high fidelities; expectations with respect to future

sales or leases of the Novera QPU, customer adoption of the Ankaa-2

and Ankaa-3 systems and Novera QPU; expectations with respect to

scaling to create larger qubit systems without sacrificing gate

performance using the Company’s modular chip architecture,

including expectations with respect to the Company’s anticipated

systems; expectations with respect to the Company’s partners and

customers and the quantum computing plans and activities thereof;

and expectations with respect to the anticipated stages of quantum

technology maturation, including the Company’s ability to develop a

quantum computer that is able to solve practical, operationally

relevant problems significantly better, faster, or cheaper than a

current classical solution and achieve quantum advantage on the

anticipated timing or at all; expectations with respect to the

quantum computing industry and related industries. These

forward-looking statements are based upon estimates and assumptions

that, while considered reasonable by the Company and its

management, are inherently uncertain. Factors that may cause actual

results to differ materially from current expectations include, but

are not limited to: the Company’s ability to achieve milestones,

technological advancements, including with respect to its

technology roadmap, help unlock quantum computing, and develop

practical applications; the ability of the Company to obtain

government contracts successfully and in a timely manner and the

availability of government funding; the potential of quantum

computing; the ability of the Company to expand its QPU sales and

the Novera QPU Partnership Program; the success of the Company’s

partnerships and collaborations; the Company’s ability to

accelerate its development of multiple generations of quantum

processors; the outcome of any legal proceedings that may be

instituted against the Company or others; the ability to maintain

relationships with customers and suppliers and attract and retain

management and key employees; costs related to operating as a

public company; changes in applicable laws or regulations; the

possibility that the Company may be adversely affected by other

economic, business, or competitive factors; the Company’s estimates

of expenses and profitability; the evolution of the markets in

which the Company competes; the ability of the Company to implement

its strategic initiatives, expansion plans and continue to innovate

its existing services; the expected use of proceeds from the

Company’s past and future financings or other capital; the

sufficiency of the Company’s cash resources; unfavorable conditions

in the Company’s industry, the global economy or global supply

chain, including financial and credit market fluctuations and

uncertainty, rising inflation and interest rates, disruptions in

banking systems, increased costs, international trade relations,

political turmoil, natural catastrophes, warfare (such as the

ongoing military conflict between Russia and Ukraine and related

sanctions and the state of war between Israel, Hamas and Hezbollah

and related threat of a larger conflict), and terrorist attacks;

the Company’s ability to maintain compliance with the continued

listing standards of the Nasdaq Capital Market; and other risks and

uncertainties set forth in the section entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 and Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024, and other documents filed by the Company from

time to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and the Company

assumes no obligation and does not intend to update or revise these

forward-looking statements other than as required by applicable

law. The Company does not give any assurance that it will achieve

its expectations.

|

RIGETTI COMPUTING, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(in thousands, except

number of shares and par value)(unaudited) |

| |

|

|

September 30, |

|

December 31, |

| |

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

20,286 |

|

|

$ |

21,392 |

|

|

Available-for-sale investments |

|

72,294 |

|

|

|

78,537 |

|

|

Accounts receivable |

|

6,384 |

|

|

|

5,029 |

|

|

Prepaid expenses and other current assets |

|

4,902 |

|

|

|

2,709 |

|

|

Total current assets |

|

103,866 |

|

|

|

107,667 |

|

| Property

and equipment, net |

|

44,837 |

|

|

|

44,483 |

|

|

Operating lease right-of-use assets |

|

8,369 |

|

|

|

7,634 |

|

| Other

assets |

|

178 |

|

|

|

129 |

|

|

Total assets |

$ |

157,250 |

|

|

$ |

159,913 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

1,604 |

|

|

$ |

5,772 |

|

|

Accrued expenses and other current liabilities |

|

5,581 |

|

|

|

8,563 |

|

|

Deferred revenue |

|

886 |

|

|

|

343 |

|

|

Current portion of debt |

|

11,247 |

|

|

|

12,164 |

|

|

Current portion of operating lease liabilities |

|

2,142 |

|

|

|

2,210 |

|

|

Total current liabilities |

|

21,460 |

|

|

|

29,052 |

|

| Debt,

less current portion |

|

2,061 |

|

|

|

9,894 |

|

|

Operating lease liabilities, less current portion |

|

7,040 |

|

|

|

6,297 |

|

|

Derivative warrant liabilities |

|

2,210 |

|

|

|

2,927 |

|

| Earn-out

liabilities |

|

1,641 |

|

|

|

2,155 |

|

|

Total liabilities |

|

34,412 |

|

|

|

50,325 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, par value $0.0001 per share, 10,000,000 shares

authorized, none outstanding |

|

— |

|

|

|

— |

|

| Common

stock, par value $0.0001 per share, 1,000,000,000 shares

authorized, 191,958,045 shares issued and outstanding at September

30, 2024 and 147,066,336 shares issued and outstanding at

December 31, 2023 |

|

19 |

|

|

|

14 |

|

|

Additional paid-in capital |

|

524,351 |

|

|

|

463,089 |

|

|

Accumulated other comprehensive income |

|

254 |

|

|

|

244 |

|

|

Accumulated deficit |

|

(401,786 |

) |

|

|

(353,759 |

) |

|

Total stockholders’ equity |

|

122,838 |

|

|

|

109,588 |

|

|

Total liabilities and stockholders’ equity |

$ |

157,250 |

|

|

$ |

159,913 |

|

|

|

|

RIGETTI COMPUTING, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands,

except per share data)(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

$ |

2,378 |

|

|

$ |

3,105 |

|

|

$ |

8,516 |

|

|

$ |

8,632 |

|

| Cost of revenue |

|

1,174 |

|

|

|

834 |

|

|

|

3,822 |

|

|

|

1,940 |

|

| Total gross profit |

|

1,204 |

|

|

|

2,271 |

|

|

|

4,694 |

|

|

|

6,692 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

12,752 |

|

|

|

13,056 |

|

|

|

36,093 |

|

|

|

39,981 |

|

|

Selling, general and administrative |

|

5,798 |

|

|

|

6,047 |

|

|

|

18,617 |

|

|

|

20,808 |

|

|

Restructuring |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

991 |

|

|

Total operating expenses |

|

18,550 |

|

|

|

19,103 |

|

|

|

54,710 |

|

|

|

61,780 |

|

|

Loss from operations |

|

(17,346 |

) |

|

|

(16,832 |

) |

|

|

(50,016 |

) |

|

|

(55,088 |

) |

| Other income (expense), net |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

(733 |

) |

|

|

(1,473 |

) |

|

|

(2,809 |

) |

|

|

(4,511 |

) |

| Interest income |

|

1,226 |

|

|

|

1,263 |

|

|

|

3,567 |

|

|

|

3,746 |

|

| Change in fair value of

derivative warrant liabilities |

|

1,200 |

|

|

|

(3,442 |

) |

|

|

717 |

|

|

|

(4,320 |

) |

| Change in fair value of earn-out

liabilities |

|

820 |

|

|

|

(1,731 |

) |

|

|

514 |

|

|

|

(2,362 |

) |

| Total other income (expense),

net |

|

2,513 |

|

|

|

(5,383 |

) |

|

|

1,989 |

|

|

|

(7,447 |

) |

|

Net loss before provision for income taxes |

|

(14,833 |

) |

|

|

(22,215 |

) |

|

|

(48,027 |

) |

|

|

(62,535 |

) |

| Provision for income taxes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net loss |

$ |

(14,833 |

) |

|

$ |

(22,215 |

) |

|

$ |

(48,027 |

) |

|

$ |

(62,535 |

) |

|

Net loss per share attributable to common stockholders – basic

and diluted |

$ |

(0.08 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.48 |

) |

| Weighted average shares used in

computing net loss per share attributable to common

stockholders – basic and diluted |

|

188,389 |

|

|

|

133,866 |

|

|

|

170,665 |

|

|

|

129,173 |

|

| |

|

RIGETTI COMPUTING INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW(in

thousands)(Unaudited) |

| |

|

| |

Nine Months Ended September 30, |

| |

2024 |

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

Net loss |

$ |

(48,027 |

) |

|

$ |

(62,535 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

5,155 |

|

|

|

6,381 |

|

|

Stock-based compensation |

|

9,705 |

|

|

|

8,727 |

|

|

Change in fair value of earn-out liabilities |

|

(514 |

) |

|

|

2,362 |

|

|

Change in fair value of derivative warrant liabilities |

|

(717 |

) |

|

|

4,320 |

|

|

Change in fair value of forward contract |

|

— |

|

|

|

2,229 |

|

|

Impairment of deferred offering costs |

|

— |

|

|

|

836 |

|

|

Accretion of available-for-sale securities |

|

(2,752 |

) |

|

|

(2,310 |

) |

|

Amortization of debt issuance costs, commitment fees and accretion

of debt end-of-term liabilities |

|

741 |

|

|

|

1,100 |

|

|

Non-cash lease expense |

|

1,533 |

|

|

|

1,288 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(1,355 |

) |

|

|

3,239 |

|

|

Prepaid expenses, other current assets and other assets |

|

(1,955 |

) |

|

|

(1,027 |

) |

|

Deferred revenue |

|

543 |

|

|

|

(489 |

) |

|

Accounts payable |

|

(808 |

) |

|

|

(212 |

) |

|

Accrued expenses and operating lease liabilities |

|

(3,632 |

) |

|

|

(2,067 |

) |

| Net cash used in operating

activities |

|

(42,083 |

) |

|

|

(38,158 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

(9,816 |

) |

|

|

(7,511 |

) |

|

Purchases of available-for-sale securities |

|

(98,451 |

) |

|

|

(79,047 |

) |

|

Maturities of available-for-sale securities |

|

107,499 |

|

|

|

98,082 |

|

| Net cash (used in) provided by

investing activities |

|

(768 |

) |

|

|

11,524 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

Payments of principal of notes payable |

|

(9,491 |

) |

|

|

(5,405 |

) |

|

Proceeds from sale of common stock from sales through Common Stock

Purchase Agreement |

|

12,838 |

|

|

|

15,051 |

|

|

Proceeds from sale of common stock from sales through At-The-Market

(ATM) Offering |

|

38,831 |

|

|

|

— |

|

|

Payments of offering costs |

|

(476 |

) |

|

|

(107 |

) |

|

Proceeds from issuance of common stock upon exercise of stock

options and warrants |

|

83 |

|

|

|

1,002 |

|

| Net cash provided by financing

activities |

|

41,785 |

|

|

|

10,541 |

|

| Effects of exchange rate

changes on cash and cash equivalents |

|

(40 |

) |

|

|

(38 |

) |

| Net decrease in cash and cash

equivalents |

|

(1,106 |

) |

|

|

(16,131 |

) |

| Cash and cash equivalents –

beginning of period |

|

21,392 |

|

|

|

57,888 |

|

| Cash and cash equivalents –

end of period |

$ |

20,286 |

|

|

$ |

41,757 |

|

| Supplemental

disclosures of other cash flow information: |

|

|

|

|

|

|

Cash paid for interest |

$ |

2,057 |

|

|

$ |

3,299 |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

Capitalization of deferred costs to equity upon share issuance |

|

190 |

|

|

|

13 |

|

|

Purchases of property and equipment recorded in accounts

payable |

|

252 |

|

|

|

394 |

|

|

Purchases of property and equipment recorded in accrued

expenses |

|

76 |

|

|

|

605 |

|

|

Non-cash addition to operating lease right-of-use assets and lease

liability |

|

2,268 |

|

|

|

— |

|

|

Unrealized Gain on short term investments |

|

54 |

|

|

|

273 |

|

|

|

|

|

|

|

|

|

|

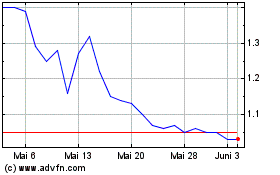

Rigetti Computing (NASDAQ:RGTI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Rigetti Computing (NASDAQ:RGTI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024