false

0001093691

0001093691

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 13, 2024

Plug Power Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-34392 |

|

22-3672377 |

| (State

or other jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation) |

|

Number) |

|

Identification

No.) |

| |

|

|

|

|

125 Vista Boulevard,

Slingerlands, New York |

|

12159 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone

number, including area code: (518)

782-7700

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which

registered |

| Common

Stock, par value $0.01 per share |

|

PLUG |

|

The

Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On November 13, 2024, Plug Power Inc., a Delaware corporation (the

“Company”), announced that Sanjay K. Shrestha has been appointed to serve as the Company’s President, effective November

13, 2024. Following the appointment of Mr. Shrestha, Andrew J. Marsh will continue to serve as the Company’s Chief Executive Officer

and as a director.

Mr. Shrestha joined the Company as Chief Strategy Officer and Executive

Vice President in April 2019, and was appointed as General Manager, Energy Solutions in January 2021. Prior to joining the Company, from

2015 to 2019, Mr. Shrestha served as both the Chief Investment Officer of Sky Solar Holdings, which owns and operates solar projects in

Japan, Europe and the Americas, and President of Sky Capital America, which owns and operats solar projects in North and South America.

From 2013 to 2015, he led the renewables investment banking effort at FBR Capital Markets (now known as B. Riley Financial, Inc.). Prior

to joining FBR Capital Markets, Mr. Shrestha was the global head of renewables research coverage at Lazard Capital Markets and worked

at First Albany Capital, where he built the firm’s renewables and industrial research practice. Mr. Shrestha serves as an independent

director on the board of directors of Fusemachines, an artificial intelligence talent and education solutions company. In addition, Mr.

Shrestha currently serves on the boards of directors of AccionaPlug S.L., which is the Company’s joint venture with Acciona Generación

Renovable, S.A., and Hidrogenii, which is the Company’s joint venture with Niloco Hydrogen Holdings LLC, a wholly-owned subsidiary

of Olin Corporation. Mr. Shrestha received a Bachelor of Science and an honorary doctorate degree in 2022 from The College of Saint Rose.

In connection with his new role, Mr. Shrestha will be entitled

to an increase in annual base salary to $500,000. There is no arrangement or understanding between either Mr. Shrestha and any other person

pursuant to which he was appointed as President. There are no family relationships between Mr. Shrestha and any of the Company’s

directors, executive officers or persons nominated or chosen by the Company to become a director or executive officer. Mr. Shrestha is

not a participant in, nor is he to be a participant in, any related-person transaction or proposed related-person transaction required

to be disclosed by Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended, in connection with his appointment.

| Item 7.01 | Regulation FD Disclosure |

As previously disclosed, the Company will host its 2024 Plug Symposium

at its Vista manufacturing facility in Slingerlands, New York starting at 9:00 a.m. Eastern Time on November 13, 2024. During the symposium,

certain of the Company’s officers will provide highlights of the Company’s business, including its applications, and certain

of the Company’s officers and outside guest speakers will provide an overview of the hydrogen economy and the state of the industry.

A copy of the presentation that will be used at the symposium is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K

and incorporated herein by reference. A recording of the webcast will be available on the Company's website for a period of time following

the call.

In connection with the foregoing, the Company issued a press release.

A copy of the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The information included in this Item 7.01, Exhibit 99.1 and

Exhibit 99.2 of this Current Report on Form 8-K is not deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor

shall this item, Exhibit 99.1 or Exhibit 99.2 be incorporated by reference into the Company’s filings under the Securities Act

of 1933, as amended (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in

such future filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Plug Power Inc. |

| |

|

|

| Date: November 13, 2024 |

By: |

/s/ Paul Middleton |

| |

Name: |

Paul Middleton |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

| Copyright 2024, Plug Power Inc.

Symposium 2024:

Plug Doing Real Things

Andy Marsh, CEO

November 13, 2024 |

| 2

Safe Harbor |

| Customers Infrastructure 3

Plug is Uniquely Positioned to Capture the Market |

| 4

Plug is Uniquely Positioned to Support the Full Ecosystem |

| 5

Plug is Uniquely Positioned with the

Right People & Experience |

| 6

It has been tough, but the

capabilities are here for the future. |

| 7

INFLECTION POINT: New Platforms have been Nurtured to Fruition

Investments and buildout over last few years is poised for growth and leverage

Produce: Transport: Store & Dispense: Use: |

| 8

-140%

-120%

-100%

-80%

-60%

-40%

-20%

0%

-$400

-$350

-$300

-$250

-$200

-$150

-$100

-$50

$0

Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Forecast Q4'24

Operating Cash Flows and GM% Trends

Operating Cash Flow GM%

2024 was a Consolidation Year Q4’23 – Q2’24:

Pivotal period

where Plug

initiated several

optimization

initiatives in

response to

market dynamics,

marking a

significant

infection point.

Million |

| 9

2024 Key Milestones:

Expanded Hydrogen Production:

Commissioned 15 TPD GA plant, enhanced 10 TPD TN plant

Record Electrolyzer Deployments:

Installations across 5 continents, including 100MW electrolyzer for Galp and

a 25 MW system for bp and Iberdrola in Spain

Customer Milestones:

Delivered initial green hydrogen shipments to major customers Walmart,

Amazon, and Home Depot; commissioned high power stationary sites in US

Technological Innovation:

Released next-gen PEM electrolyzers and mobile refuler station, designed for

rapid deployment to support hydrogen-powered fleet vehicles

Strategic Partnerships:

Key collaborations - bp, Iberdrola, and Allied Green Ammonia- to expand

hydrogen infrastructure across multiple continents |

| Plug Power has received the orders for the

H2 infrastructure at 2 BMW locations

and is looking forward to further cooperation

with BMW in order to jointly expand Germany

as a hydrogen location and to promote the

topic of hydrogen in intralogistics. |

| 11

North America’s First Green

Hydrogen Plant Online in GA

Green Hydrogen Production: Produces 15

TPD of liquid hydrogen, powering ~15,000

forklifts daily

US’s Largest PEM Electrolyzer Deployment:

Plant operates with eight 5 MW PEM

electrolyzers for zero-carbon production

First Hydrogen Deliveries: Delivered via Plug’s

cryogenic trailers, serving Southeast customers

efficiently |

| 12

Record Electrolyzer Deployments

Across 5 Continents

Lhyfe,

France

Hiringa,

New Zealand

Infinium,

Texas |

| 13

8 MW of Hydrogen Fuel Cells for Energy Vault’s

microgrid backup system for PG&E and

Calistoga, CA

First of its Kind Microgrid: Reduces grid

reliance, supporting sustainable and resilient

energy for critical infrastructure.

Reliable Power for Homes: Supporting home

energy resilience during California wildfire

season without relying on polluting diesel

generators.

Stationary Power:

Energy Vault Deployment |

| 14

Government and Policy

• US Tax Incentives

• PTC

• Net Zero/ITC

• DOE Loan Program

• Tariffs

• Government

Grants

• European Policy |

| 15

BIG GOAL

Achieve Dominance in

Building Out the Global

Hydrogen Ecosystem

Photo: Plug LA Hydrogen Plant |

| Photography courtesy of Nasdaq, Inc. 16

Sanjay Shrestha,

President, Plug |

| Copyright 2024, Plug Power Inc.

Laser Focused on 2025:

Setting the Stage

for the next 5 Years

Sanjay Shrestha, President |

| 19

Laser focused on 2025 • Transformational Year • Exiting 2025 with positive GM

run rates

Setting the stage for

sustainable growth over the

next five years • EBITDAS Positive 2H 2026

Operating Income Positive

exiting 2027

Overall Profitability Exiting 2028

Executive Summary:

Path to 2030 |

| 20

2025 Key Priorities

Top Priority: Revenue Growth and Bookings

Cost Down Initiatives 1

Application SWAT Team goals:

- Improve fuel cell stack life & reliability

- Improve product & service margin

- Impact starting in Q125

2 Drive Further Margin Expansion

Electrolyzer SWAT Team goals:

- Reduce stack and system costs

- Impact starting in Q1 2025

Improve Fuel Margin 3

Hydrogen Fuel SWAT Team goals:

- Drive network efficiency

- Third party sales

- Manage IGC purchases

- Evaluate network storage

4 Multiple Other Initiatives |

| 21

Drive sales and profitable

growth

Continuous improvement

in margin throughout the

year & exiting 2025 with

positive gross margin

Setting the state for

sustainable growth over

the next five years

Laser Focused on 2025

2025 Target

Range

Revenue $850 – $950M

Gross Margin (20%) – (5%) |

| 22

Strategic Priorities:

Exiting 2026:

EBITDAS

Positive

Exiting 2027:

Operating

Income Positive

Exiting 2028:

Overall

Profitability

Outlook for 2025 to 2030:

Leverage Effort from 2025

1. Drive ~30% CAGR in Energy business.

• Growth driven by ELX and Cryo

2. Focused effort on growing Applications at ~30% CAGR

• Expanding middle market, reaccelerate growth with

pedestal customers

3. Continued enhancements:

• Fuel cell and ELX stack & system cost, life/reliability

• H2 plant and infrastructure network optimization

• Manufacturing excellence

4. Drive efficiencies to refine plant design & cost profile

5. Strong collaboration between Plug Cryogenics (PCT)

and Applications on storage & fueling offerings |

| 23

Energy Business

Only global player to support the entire hydrogen ecosystem

Produce: Transport: Store: Dispense: |

| 24

Energy Business to Grow

~30% CAGR from 2025 to 2030

Key Drivers:

Revenue growth largely driven by ELX and

cryogenic business

• Electrolyzer business is driven by converting BEDP

pipeline into bookings and backlog (>8GW)

• Cryogenics business is driven by strategic non-hydrogen business with growth acceleration from

hydrogen product line

• Executing on ELX stack/system improvements to

drive margin coupled with volume leverage

• Multiple initiatives underway to drive margin and

profitability in fuel business

0%

5%

10%

15%

20%

25%

30%

35%

$0

$500

$1,000

$1,500

$2,000

$2,500

2025 2026 2027 2028 2029 2030

Energy 2025-2030

Energy Revenue Energy Gross Profit Energy Gross Margin

Million |

| 25

Electrolyzers: BEDP Detail & 2024-2025 Order Intake

>1 GW Order Intake Opportunity in 2025

BEDP Detail 2024-2025 5MW Order Intake

2024-2025 10MW Order Intake

FID Date MWs

Q2 2024 25

Q4 2024 50

Q4 2024 80

Q1 2025 200

Q1 2025 400

Q1 2025 500

Q1 2025 500

Q2 2025 1,000

Q2 2025 500

Q2 2025 250

Q3 2025 200

Q3 2025 110

Q3 2025 200

Q3 2025 100

Q3 2025 280

Q4 2025 3,000

Q4 2025 320

Q4 2025 200

Grand Total 8,075

Product Units

5 MW 1

5 MW 6

5 MW 3

5 MW 5

5 MW 12

5 MW 2

5 MW 1

5 MW 10

Grand Total 40

Product Units

10 MW 2

10 MW 5

10 MW 100

10 MW 10

10 MW 8

10 MW 20

10 MW 5

Grand Total 150 |

| 26

Liquefaction & Cryogenic Pipeline

Liquefier Opportunities

Scope Booking $ Est .Timing

1 x 15 TPD $31M Q4 ’24 / Q1 ’25

1 x 12 TPD $32M Q1 ‘25

1 x 30 TPD $45M Q2' 25

1 x 15 TPD $35M Q2 ‘25

1 x 15 TPD $35M Q4 ‘25

1 x 30 TPD $45M Q4 ‘25

1 x 30 TPD $46M On-hold

Energy Transition Opportunities

Scope Booking $ Est .Timing

Renewable Diesel

Project $50-60M Q4 ’24 / Q1 ’25

Cryogenics Opportunities

LH2 Equipment

Category Sales Funnel Total Pipeline Value

Refuelers $135M $76M

LH2 Transports &

Storage Tanks $289M $25M

Total Value $424M $101M

Non LH2

Equipment

Non LH2

Transports &

Storage Tanks

$93M $75M

Non LH2 Special

Projects $83M $50M

Service & Repair $14M $10M

Total Value $190M $135M |

| 27

Hydrogen Plant Update: LA and TX

LA: Commissioning underway

• Construction ~99% complete across the plant

• Electrical components beginning to be energized

Picture: Commercial Liquid Production in LA expected in Q1 2025

TX: Long lead-time items already ordered

• Detail engineering to further optimize cost

• Focused on closing DOE loan |

| 28

Enterprise / Facility Sales Opportunity

H2 Generation Cryo H2 Delivery + Storage

Electrolyzers Liquefiers On-road Tankers Stationary Tanks

H2 Liquefaction Molecule Supply

OR

Plug is the only company that offers this turnkey solution

Total equipment sales opportunity more

than doubles with this approach!

Typical 30 TPD Facility:

• 80MW ELX = $50M

• 30 TPD liquefier = $50M

• 480k gal cryogenic storage = $6-8M

• 14 LH2 trailers = $20M

Total equipment

sales opportunity

~$130M in revenue

and ~$25-30M+ in

margin per facility |

| 29

Plug’s Broad Fuel Cell Application Portfolio Enables Hydrogen Sales

Store & Dispense: Use:

Material Handling

Fuel Cell Power

Large Scale Stationary

Fuel Cell Power |

| 30

Applications to grow ~30%

CAGR from 2025 to 2030

Key Drivers:

• Drive material handling growth leveraging

replacement cycle coupled with middle-market expansion

• Strategic stationary product testing,

demonstrations, and deployments with

datacenter hyper-scalers with favorable

pricing (MSFT, AMZN, Meta)

• Strategically planning H2 network to

support new stationary deployments

• Enhancements in stack/system reliability

and cost

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

-$200

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2025 2026 2027 2028 2029 2030

Applications 2025-2030

Applications Revenue Applications Gross Profit

Applications Gross Margin

Million |

| 31

Plug’s integrated

business model

creates a

classic flywheel

effect accelerating

growth and

profitability.

Energy

Applications |

| 32

2026 - 2030 Revenue and Gross Margin Targets

0%

5%

10%

15%

20%

25%

30%

35%

0

200

400

600

800

1000

1200

1400

2026 2027 2028 2029 2030

PLUG 2026-2030 Margin

0

500

1000

1500

2000

2500

3000

3500

4000

2026 2027 2028 2029 2030

PLUG 2026-2030 Revenue

Million

Million |

| Copyright 2024, Plug Power Inc.

Operational

Excellence

Dean C. Fullerton, COO

November 13, 2024 |

| 35

Career History

United Parcel Service – 14 years

• Started loading package cars at 3:30 am while at University

• Entered UPS Management Program

• Industrial Engineering Manager

Tompkins Associates, Supply Chain Consulting – 8 years

• Project Manager

• Principal/Director

The Gap – 2 years

• Sr. Director, Engineering and Maintenance for North America

Amazon – 14 years

• Sr. Manager, Director, Vice President – Global Engineering Services

Plug Power

• Chief Operating Officer |

| 36

My Tenets and Principles

DELIVERY

RESULTS

BIAS FOR

ACTION

CUSTOMER

OBSESSION

HAVE

BACKBONE,

DISAGREE

AND

COMMIT

BEING

RIGHT A LOT

THINK BIG

HIRE AND

DEVELOP

THE BEST

INSIST ON

HIGHEST

STANDARDS

FRUGALITY

OWNERSHIP

INVENT

AND

SIMPLIFY

LEARN AND

BE CURIOUS

DIVE DEEP EARN TRUST |

| 37

Customer Obsession

:

Deliver on time for ELX, Fuel Cells, Hydrogen,

and provide service/maintenance above

contractual commitments.

Improve Product Quality

:

..

Reduce Costs (30% Target):

Deliver all projects with a high level of quality,

under budget, with reduce service costs, and a

focus on efficiency.

Reorganizational Structure:

Establish Project Manager roles and defined

escalation paths. Established a PMO to identify

all outstanding items across projects,

initiatives and DOE approval.

SWAT Teams for Reliability: Increase Sales for Hydrogen

and ELX

:

Enhance delivery speed, product quality,

reduce costs, and increase customer satisfaction.

Deliver reliable, high

-quality projects and

execute ELX and Fuel Cell SWAT team

initiatives.

A Laser Focus on 2025

Established two work streams (SWAT

Teams), to focus on immediately improving

reliability and reducing costs |

| 38

Vista Headquarters, Slingerlands, NY

Plug Gigafactory, Rochester, NY

Global

Fabricators

and

Integrators

• Corpus Cristi,

TX

• Cohoes, NY • Houston, TX • Dubai, UAE • Vietnam • Netherlands

How is Plug Unique?

Our Global Plug

Operational Facilities!

Plug Cryo, Houston, TX

Plug Power ELX, Netherlands

Plug Engineering, India |

| Copyright 2024, Plug Power Inc.

Financial

Roadmap

November 13, 2024

Paul Middleton, CFO |

| 41

Build out has

established

the platform

to accelerate

growth.

Hydrogen Ecosystem Solutions Provider

Only global player to support the entire ecosystem |

| 42

Strong

Differentiated

Platform

Broad Foundation of Technologies

Deep Relationships

New Investments

Strong Cost Discipline |

| 43

INFLECTION POINT: New Platforms have been Nurtured to Fruition

Investments and buildout over last few years is poised for growth and leverage

Produce: Transport: Store & Dispense: Use: |

| 44

Electrolyzer Stationary Power On-Road

Green Hydrogen Material Handling

2025 Outlook

Revenue: ~$850M to $950M

Gross Margin: (20%) to (5%) |

| 45

Target

Business

Model:

>30% Average Sales

Growth

>35% Gross Margin

~13% OPEX Leverage

>22% Operating Income

Strategic Plan

Update: Path

to 2030

Laser focused on 2025 as

Transformational Year

• Exiting 2025 with positive GM run

rates

• Set the stage for next five years

EBITDAS Positive 2H 2026

Operating Income positive exiting

2027

Overall Profitability Exiting 2028

Driving Financial

Targets Through:

Continued Innovation

Vertical Integration

Mfg Capacity & OPEX Leverage

Supply Chain Leverage

Policy |

| 46

2026 - 2030 Revenue and Gross Margin Targets

0%

5%

10%

15%

20%

25%

30%

35%

0

200

400

600

800

1000

1200

1400

2026 2027 2028 2029 2030

PLUG 2026-2030 Margin

0

500

1000

1500

2000

2500

3000

3500

4000

2026 2027 2028 2029 2030

PLUG 2026-2030 Revenue

Million

Million |

| 47

Debt & Project

Capital Solutions

Corporate Debt

Solutions

Project Finance

Project Equity

Partners

DOE Loan Program |

Exhibit 99.2

Plug Power Hosts 2024 Plug Symposium

With

the theme "Plug Doing Real Things," the event highlights how Plug is laying the groundwork for the next five years

Plug

targets ~30% CAGR for Energy and Applications businesses from 2025 to 2030 and appoints Sanjay Shrestha new President

SLINGERLANDS,

N.Y., Nov. 13, 2024 — Plug Power Inc. (NASDAQ: PLUG), a global leader in hydrogen

solutions for the green hydrogen economy, is hosting its sixth annual Plug Symposium at the Company’s Vista headquarters and manufacturing

facility in Slingerlands, N.Y. With the theme “Plug Doing Real Things,” this year’s event underscores Plug’s role

in driving the global green hydrogen economy, showcasing its comprehensive portfolio of deployed solutions worldwide. In addition,

the Plug executive team will lay the groundwork for growth over the next five years.

This event features presentations

from CEO Andy Marsh and other top executives, as well as panel discussions that underscore Plug's role in the worldwide green hydrogen

economy spanning policy, energy, applications, and technology.

2024 Milestones:

| · | Expanded Hydrogen Production: Commissioned a 15 TPD (ton per day) hydrogen plant in Georgia and

upgraded a 10 TPD facility in Tennessee, strengthening Plug’s leadership in U.S. green hydrogen production. |

| · | Record Electrolyzer Deployments: Deployed electrolyzers on five continents, including a 100 MW

(megawatt) system for Galp. |

| · | Major Customer Deliveries: Delivered initial liquid green hydrogen supplies to Walmart, Amazon,

and Home Depot, and launched stationary power sites across the U.S. |

| · | Technological Advancements: Launched next-gen PEM (proton exchange membrane) electrolyzers and

a mobile refueler, enabling rapid hydrogen deployment for fleet vehicles. |

| · | Strategic Global Partnerships: Formed key alliances with bp, Iberdrola, and Allied Green Ammonia

to expand hydrogen infrastructure worldwide. |

"As trailblazers

in the new category of green hydrogen, we recognize innovation often comes with challenges. However, we have diligently built a strong

foundation in both infrastructure and applications to not only meet these challenges but also to exceed the demands of our customers for

a cost-effective, versatile, and low-carbon energy solution. Our commitment to innovation is unwavering, and we are tirelessly working

to lead the charge in the global transition to sustainable energy," said Andy Marsh, CEO of Plug.

2025 and Beyond:

As Plug looks toward

2025, the Company remains laser-focused on several key priorities to drive sustainable growth and profitability.

| · | Plug’s Energy Business: Targeting ~30% CAGR from 2025 to 2030, with revenue growth expected to be

largely driven by its electrolyzer and cryogenic solutions. |

| · | Plug’s Applications Business: Targeting ~30% CAGR from 2025

to 2030 by expanding middle market opportunities in Material Handling, reaccelerating growth with pedestal customers, and driving sales

of the Company’s large-scale stationary product. |

| · | Plug’s Technology Roadmap: Targeting product improvements in performance, efficiency, and cost by

focusing on research, development and design that impacts the commercial strategy and economical viability of the products and supports

customers’ use of the products. |

| · | Plug’s Approach to Policy: Navigating the shifting domestic and global political landscape that

is creating both challenges and opportunities for businesses in the clean energy sector and leveraging hydrogen’s unique position

in the U.S. political environment with historically bipartisan support for its role in creating jobs, promoting manufacturing competitiveness,

and contributing to energy and national security to drive policy changes that are beneficial to the hydrogen industry. |

Appointment of New

President:

The Company is excited

to announce that effective today Sanjay Shrestha, formerly the Company’s Chief Strategy Officer and General Manager, Energy Solutions,

will assume the position of President while Andy Marsh will retain the position of CEO. As General

Manager, Sanjay broadened the company’s product portfolio and expanded the Energy business to offer end-to-end solutions including

electrolyzer, liquifier, and cryogenic businesses, while successfully overseeing the build-out of the Company’s hydrogen production

plants. In his new role as President, Sanjay will be responsible for the strategic execution of Plug’s business priorities

to establish a clear path to profitability with major emphasis on delivering on the Company’s targets for 2025. His leadership will

focus on driving growth and expanding value for both customers and shareholders as Plug continues its momentum leading the green hydrogen

economy.

"At Plug, we're

not merely dreaming of a sustainable future, we're actively building it," said Sanjay Shrestha, President of Plug. "As I take

on this new responsibility, I'm profoundly appreciative of the confidence vested in me to guide the strategic implementation of our path

to profitability and delivering on our 2025 objectives. Our Symposium epitomizes Plug’s dedication to transforming strategy into

tangible, impactful outcomes that generate value for our investors while propelling development of a green hydrogen economy. I extend

my gratitude to our team, partners, and investors for their unwavering support as we collectively strive to realize this vision."

Financial Outlook:

Plug provides a financial

outlook for 2025 and sets the stage for the next five years, as follows:

| · | 2025 Revenue: ~$850M to $950M |

| · | 2025 Gross Margin: (20%) to (5%) |

| · | 2030 Target Revenue: ~$3.75B |

| · | 2030 Target Gross Margin: >30% |

Join the 2024 Plug

Symposium:

We invite all

stakeholders to join us virtually for this important industry event. Register now at: https://event.on24.com/wcc/r/4709318/2EB78C1AF5AAF63684C7F1DF68A30983?partnerref=EarningsPR

A playback

of the call will be available online for a period of time following the event.

About Plug Power

Plug

is building an end-to-end green hydrogen ecosystem, from production, storage, and delivery to energy generation, to help its customers

meet their business goals and decarbonize the economy. In creating the first commercially viable market for hydrogen fuel cell technology,

the Company has deployed more than 69,000 fuel cell systems and over 250 fueling stations, more than anyone else in the world, and is

the largest buyer of liquid hydrogen.

With

plans to operate a green hydrogen highway across North America and Europe, Plug built a state-of-the-art Gigafactory to produce electrolyzers

and fuel cells and is developing multiple green hydrogen production plants for commercial operation. Plug delivers its green hydrogen

solutions directly to its customers and through joint venture partners into multiple environments, including material handling, e-mobility,

power generation, and industrial applications.

For more information, visit www.plugpower.com.

Plug Power Safe Harbor Statement

This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks and uncertainties

about Plug Power Inc. (“Plug”), including but not limited to statements about Plug’s financial outlook, including revenue

and gross margin projections for 2025 and 2030; Plug’s belief that it will achieve its target growth over the next five years; Plug’s

ability to execute on its key priorities, including achieving target CAGR for certain of its businesses, and its belief that several key

priorities will drive sustainable growth and profitability; Plug’s expectations regarding leadership change and the successful execution

of Plug’s business priorities to establish a path to profitability and deliver on Plug’s targets for 2025.

You are cautioned that such statements

should not be read as a guarantee of future performance or results as such statements are subject to risks and uncertainties. Actual

performance or results may differ materially from those expressed in these statements as a result of various factors, including, but

not limited to, the following: the risk that our ability to achieve our business objectives and to continue to meet our obligations

is dependent upon our ability to maintain a certain level of liquidity, which will depend in part on our ability to manage our cash

flows; the risk that the funding of our loan guarantee from the Department of Energy may be delayed and the risk that we may not be

able to satisfy all of the technical, legal, environmental or financial conditions acceptable to the DOE to receive the loan

guarantee; the risk that we may continue to incur losses and might never achieve or maintain profitability; the risk that we may not

realize the anticipated benefits and actual savings in connection with the restructuring; the risk that we may not be able to raise

additional capital to fund our operations and such capital may not be available to us on favorable terms or at all; the risk that we

may not be able to expand our business or manage our future growth effectively; the risk that we may not be able to maintain an

effective system of internal control over financial reporting; the risk that global economic uncertainty, including inflationary

pressures, fluctuating interest rates, currency fluctuations, and supply chain disruptions, may adversely affect our operating

results; the risk that we may not be able to obtain from our hydrogen suppliers a sufficient supply of hydrogen at competitive

prices or the risk that we may not be able to produce hydrogen internally at competitive prices; the risk that delays in or not

completing our product and project development goals may adversely affect our revenue and profitability; the risk that our estimated

future revenue may not be indicative of actual future revenue or profitability; the risk of elimination, reduction of, or changes in

qualifying criteria for government subsidies and economic incentives for alternative energy products, including the Inflation

Reduction Act and our qualification to utilize the PTC; and the risk that we may not be able to manufacture and market products on a

profitable and large-scale commercial basis. For a further description of the risks and uncertainties that could cause actual

results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Plug in

general, see Plug’s public filings with the Securities and Exchange Commission, including the “Risk Factors”

section of Plug’s Annual Report on Form 10-K for the year ended December 31, 2023, the Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2024, and June 30, 2024 and September 30, 2024, as well as any subsequent filings. Readers are cautioned

not to place undue reliance on these forward-looking statements. In addition, financial estimates, forecasts and projections are

based on assumptions and analyses made by management based on its experience and perception of historical trends, current conditions

and expected future developments, as well as other factors it believes are appropriate under the circumstances. There is no

assurance that such estimates, forecasts or projections will be realized. Information provided in this press release is solely as of

the date hereof and may change or be modified at any time without notice. We disclaim any obligation to update forward-looking

statements except as may be required by law.

Media Contact:

Fatimah Nouilati

Email: PlugPR@plugpower.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

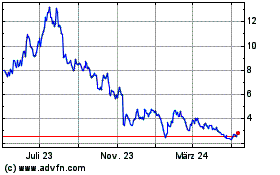

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

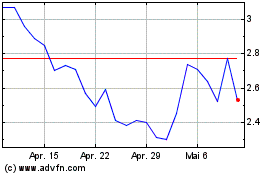

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024