Plug Power Announces Key Strategic Milestones and Continued Margin Improvement in Third Quarter 2024

12 November 2024 - 1:00PM

Plug Power Inc. (NASDAQ: PLUG), a global leader in comprehensive

hydrogen solutions for the green hydrogen economy, today announced

further progress on its strategic and operational initiatives and

path to profitability in the third quarter of 2024. These

developments underscore the Company's commitment to advancing the

hydrogen economy and solidifying its market and financial position

in the industry.

Financial Highlights

-

Q3 Financial Performance: Plug reported revenue of

$173.7 million in Q3 2024, representing an inflection in

electrolyzer deployments, continued expansion of its internally

produced hydrogen network, and increased leverage on its

manufacturing footprint.

-

Operating Cash Flows: Improved 31%

Quarter-Over-Quarter (QoQ) reflecting improvement in margins,

working capital efficiency, and leverage of existing inventory.

Plug expects to continue to see improvements as revenues increase

in the fourth quarter, allowing for further leverage on inventory

and fixed manufacturing costs.

-

Gross Margin Loss: Decreased 37% QoQ. This was

driven by multiple revenue streams, equipment improving 42%,

service improving 776%, Power Purchase Agreements (PPA) improving

13%, and fuel improving 9%.

-

Net Loss: Plug recorded an Earnings-Per-Share loss

of $0.25 for Q3 2024, compared to $0.36 for Q2 2024. The Company

recorded a net loss of $211.2 million in Q3 2024, compared to

$262.3 million in Q2 2024. This net loss included strategic

investments, new product deployments, and market dynamics. This net

loss also included ~$70.5 million of non-cash charges such as

depreciation and amortization, stock-based compensation, provision

for common stock warrants, inventory adjustments, and impairment

charges.

Operational and Strategic

Highlights

-

Electrolyzer Deployment and Revenue Inflection:

Plug reported an inflection point for revenue in Q3 2024 with

electrolyzer sales increasing 285% QoQ with contribution from 5MW

(megawatt) system sales being recognized and additional revenue

recognized from a large-scale order being deployed. In Q3 2024, the

Company announced an order for 25 MW from bp and Iberdola’s joint

venture at the Castellon refinery project in Spain. This quarter

marks a major milestone for Plug’s electrolyzer business as it

scales and is a significant inflection point for the industry

overall, with Q4 2024 expected to see significant deployments

continue. This positions the product platform for growth in 2025

and beyond.

-

Leveraging Plug’s Hydrogen Production Network:

Hydrogen fuel margins continue to improve as the Company

effectively leverages its internal network of hydrogen plants.

Planned downtime and maintenance at its Georgia and Tennessee

facilities in Q3 2024 limited margin contribution but is expected

to improve with higher utilization in Q4 2024. Additionally, our

Joint Venture hydrogen plant with Olin Corporation in Louisiana is

progressing and is currently in the process of commissioning, with

liquid production expected to ramp up to nameplate capacity during

Q1 2025.

-

Basic Engineer and Design Package (BEDP)

Contracts: To date, Plug has grown to over 8 GW

(gigawatts) in global BEDP contracts, which includes further

progress in Q3 2024 to a binding framework agreement to provide

Allied Green Ammonia (AGA) with 3 GW of electrolyzer capacity for

its ammonia plant in Australia. Plug and AGA are in the final

stages of completing purchase agreements, expected to be finalized

in the coming months. Progress with BEDP customers has continued

globally, and anticipated finalization of the 45V tax credit in the

U.S. is expected to support acceleration in BEDP work and project

FIDs in coming quarters.

-

Continued Momentum in Material Handling: This

quarter Plug saw additional benefits of price increases implemented

during Q2 2024, primarily in its fuel and service business, with

additional pricing benefits expected from PPAs in Q4 2024.

Alongside this progress, Plug expanded its material handling

portfolio by partnering with Carreras Grupo Logistico to establish

Spain’s first hydrogen-powered logistics site. Plug plans to

deliver a complete green hydrogen ecosystem to this site, including

hydrogen fuel cells, a 1 MW electrolyzer, and a hydrogen refueling

station, marking a key milestone in advancing hydrogen adoption in

European logistics.

-

Groundbreaking 8 MW Stationary Hydrogen Fuel Cell System

for Energy Vault: Plug Power has completed the

installation of an 8 MW hydrogen fuel cell system, designed and

integrated by Energy Vault, for a first-of-its-kind hybrid

microgrid in California. Combining battery storage with green

hydrogen, this system will deliver reliable power during wildfires

and emergencies, setting a new benchmark for clean, resilient

energy solutions in the U.S.

-

Department of Energy (DOE) Support: Plug continues

to progress with the DOE loan, which aims to support the expansion

of its green hydrogen initiatives and infrastructure for up to six

hydrogen sites. Additionally, the Company was awarded a $10 million

DOE grant to lead the development of advanced hydrogen refueling

stations in Washington State in Q3 2024.

-

Revenue Outlook: Plug anticipates its 2024 revenue

to range between $700 million and $800 million, driven by a

pipeline of orders in the electrolyzer, cryogenic, and material

handling businesses in the second half of 2024. Despite the speed

and development of the hydrogen economy continuing to impact

hydrogen equipment deployments, the mid-term and long-term outlook

remains positive.

CEO Statement

Plug Power CEO Andy Marsh stated: “Plug Power's

performance this quarter underscores our commitment to building a

sustainable and profitable hydrogen future. Our progress in

electrolyzer deployments, advancements in hydrogen production, and

expansion into new markets reflect our team's dedication to leading

the build out of the hydrogen economy.”

2024 Plug symposium

Plug will host its 6th annual symposium on

November 13th at its headquarters in Slingerlands, N.Y. The event

will bring together Plug leadership and industry experts to

showcase groundbreaking projects that are reshaping the hydrogen

industry and to present innovative solutions for the future.

We invite all stakeholders to join us virtually

for this important industry event. Register now at:

https://event.on24.com/wcc/r/4709318/2EB78C1AF5AAF63684C7F1DF68A30983?partnerref=EarningsPR

Conference Call

Plug Power has a scheduled conference call today, November 12,

at 8:30 AM ET to review the Company’s results for the third quarter

of 2024. Interested parties are invited to listen to the conference

call by calling 877-407-9221 / +1 201-689-8597

The webcast can be accessed at:

https://event.webcasts.com/starthere.jsp?ei=1692922&tp_key=d012114e58

A playback of the call will be available online for a period

following the event.

About Plug Power

Plug is building an end-to-end green hydrogen ecosystem, from

production, storage, and delivery to energy generation, to help its

customers meet their business goals and decarbonize the economy. In

creating the first commercially viable market for hydrogen fuel

cell technology, the Company has deployed more than 69,000 fuel

cell systems and over 250 fueling stations, more than anyone else

in the world, and is the largest buyer of liquid hydrogen.

With plans to operate a green hydrogen highway across North

America and Europe, Plug built a state-of-the-art Gigafactory to

produce electrolyzers and fuel cells and is developing multiple

green hydrogen production plants for commercial operation. Plug

delivers its green hydrogen solutions directly to its customers and

through joint venture partners into multiple environments,

including material handling, e-mobility, power generation, and

industrial applications.

For more information, visit www.plugpower.com.

Plug Power Safe Harbor Statement

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve significant risks and uncertainties about Plug Power

Inc. (“Plug”), including but not limited to statements about Plug’s

expectations regarding its revenue in Q4 2024 and its ability to

leverage inventory and fixed manufacturing costs; Plug’s

expectations regarding its electrolyzer business, including

deployments in Q4 2024 and growth in 2025 and beyond; Plug’s

expectations that planned downtime and maintenance at its Georgia

and Tennessee facilities will improve with higher utilization in Q4

2024; Plug’s expectation that its Joint Venture hydrogen plant with

Olin Corporation in Louisiana will ramp up to nameplate capacity

during Q1 2025; Plug’s expectation that it will finalize purchase

agreements with Allied Green Ammonia in the coming months; Plug’s

anticipation that finalization of the 45V tax credit in the U.S.

will support acceleration in BEDP work and project FIDs in coming

quarters; Plug’s expectations that there will be additional impacts

from price increases from power purchase agreements in Q4 2024;

Plug’s plans to deliver a complete green hydrogen ecosystem

Carreras Grupo Logistico; Plug’s belief that its hydrogen fuel cell

system for Energy Vault will deliver reliable power during

wildfires and emergencies; Plug’s expectation with respect to its

conditional commitment loan guarantee from the United States

Department of Energy (DOE); Plug’s anticipation that its 2024

revenue will range between $700 million and $800 million and Plug’s

belief that the mid-term and long-term outlook for the hydrogen

economy in the United States remains positive.

You are cautioned that such statements should not be read as a

guarantee of future performance or results as such statements are

subject to risks and uncertainties. Actual performance or results

may differ materially from those expressed in these statements as a

result of various factors, including, but not limited to, the

following: the risk that our ability to achieve our business

objectives and to continue to meet our obligations is dependent

upon our ability to maintain a certain level of liquidity, which

will depend in part on our ability to manage our cash flows; the

risk that the funding of our loan guarantee from the Department of

Energy may be delayed and the risk that we may not be able to

satisfy all of the technical, legal, environmental or financial

conditions acceptable to the DOE to receive the loan guarantee; the

risk that we may continue to incur losses and might never achieve

or maintain profitability; the risk that we may not realize the

anticipated benefits and actual savings in connection with the

restructuring; the risk that we may not be able to raise additional

capital to fund our operations and such capital may not be

available to us on favorable terms or at all; the risk that we may

not be able to expand our business or manage our future growth

effectively; the risk that we may not be able to maintain an

effective system of internal control over financial reporting; the

risk that global economic uncertainty, including inflationary

pressures, fluctuating interest rates, currency fluctuations, and

supply chain disruptions, may adversely affect our operating

results; the risk that we may not be able to obtain from our

hydrogen suppliers a sufficient supply of hydrogen at competitive

prices or the risk that we may not be able to produce hydrogen

internally at competitive prices; the risk that delays in or not

completing our product and project development goals may adversely

affect our revenue and profitability; the risk that our estimated

future revenue may not be indicative of actual future revenue or

profitability; the risk of elimination, reduction of, or changes in

qualifying criteria for government subsidies and economic

incentives for alternative energy products, including the Inflation

Reduction Act and our qualification to utilize the PTC; and the

risk that we may not be able to manufacture and market products on

a profitable and large-scale commercial basis. For a further

description of the risks and uncertainties that could cause actual

results to differ from those expressed in these forward-looking

statements, as well as risks relating to the business of Plug in

general, see Plug’s public filings with the Securities and Exchange

Commission, including the “Risk Factors” section of Plug’s Annual

Report on Form 10-K for the year ended December 31, 2023,

the Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2024 and June 30, 2024, as well as any

subsequent filings. Readers are cautioned not to place undue

reliance on these forward-looking statements. The forward-looking

statements are made as of the date hereof and are based on current

expectations, estimates, forecasts and projections as well as the

beliefs and assumptions of management. We disclaim any obligation

to update forward-looking statements except as may be required by

law.

Media Contact: Fatimah Nouilati Plug Power Inc.

Email: PlugPR@plugpower.com

| Plug Power

Inc. and Subsidiaries |

|

| Condensed

Consolidated Balance Sheets |

|

| (In

thousands, except share and per share amounts) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

September

30, |

|

December

31, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

93,940 |

|

|

$ |

135,033 |

|

|

|

|

Restricted cash |

|

— |

216,772 |

|

|

— |

216,552 |

|

|

|

|

Accounts receivable, net of allowance of $7,340 as of September 30,

2024 and $8,798 as of December 31, 2023 |

|

|

167,222 |

|

|

|

243,811 |

|

|

|

|

Inventory, net |

|

|

885,764 |

|

|

|

961,253 |

|

|

|

|

Contract assets |

|

|

145,499 |

|

|

|

126,248 |

|

|

|

|

Prepaid expenses and other current assets |

|

|

124,824 |

|

|

|

104,068 |

|

|

|

|

Total current assets |

|

— |

1,634,021 |

|

|

— |

1,786,965 |

|

|

|

| |

|

|

|

|

|

|

|

|

| Restricted

cash |

|

$ |

689,483 |

|

|

$ |

817,559 |

|

|

|

| Property,

plant, and equipment, net |

|

|

1,534,056 |

|

|

— |

1,436,177 |

|

|

|

| Right of use

assets related to finance leases, net |

|

|

52,947 |

|

|

|

57,281 |

|

|

|

| Right of use

assets related to operating leases, net |

|

— |

361,009 |

|

|

|

399,969 |

|

|

|

| Equipment

related to power purchase agreements and fuel delivered to

customers, net |

|

— |

142,238 |

|

|

— |

111,261 |

|

|

|

| Contract

assets |

|

— |

30,333 |

|

|

— |

29,741 |

|

|

|

| Intangible

assets, net |

|

— |

175,006 |

|

|

|

188,886 |

|

|

|

| Investments

in non-consolidated entities and non-marketable equity

securities |

|

— |

92,767 |

|

|

— |

63,783 |

|

|

|

| Other

assets |

|

|

13,014 |

|

|

|

11,116 |

|

|

|

|

Total assets |

|

$ |

4,724,874 |

|

|

$ |

4,902,738 |

|

|

|

| |

|

— |

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

207,224 |

|

|

$ |

257,828 |

|

|

|

|

Accrued expenses |

|

— |

107,402 |

|

|

|

200,544 |

|

|

|

|

Deferred revenue and other contract liabilities |

|

— |

132,345 |

|

|

|

204,139 |

|

|

|

|

Operating lease liabilities |

|

|

66,973 |

|

|

|

63,691 |

|

|

|

|

Finance lease liabilities |

|

|

10,822 |

|

|

|

9,441 |

|

|

|

|

Finance obligations |

|

|

83,305 |

|

|

|

84,031 |

|

|

|

|

Current portion of convertible senior notes, net |

|

— |

58,163 |

|

|

— |

— |

|

|

|

|

Current portion of long-term debt |

|

— |

3,232 |

|

|

— |

2,716 |

|

|

|

|

Contingent consideration, loss accrual for service contracts, and

other current liabilities |

|

— |

117,479 |

|

|

— |

142,410 |

|

|

|

|

Total current liabilities |

|

— |

786,945 |

|

|

— |

964,800 |

|

|

|

|

|

|

— |

|

|

— |

|

|

|

| Deferred

revenue and other contract liabilities |

|

$ |

59,529 |

|

|

$ |

84,163 |

|

|

|

| Operating

lease liabilities |

|

|

249,191 |

|

|

|

292,002 |

|

|

|

| Finance

lease liabilities |

|

— |

27,134 |

|

|

|

36,133 |

|

|

|

| Finance

obligations |

|

|

278,250 |

|

|

|

284,363 |

|

|

|

| Convertible

senior notes, net |

|

— |

149,214 |

|

|

— |

195,264 |

|

|

|

| Long-term

debt |

|

— |

2,341 |

|

|

— |

1,209 |

|

|

|

| Contingent

consideration, loss accrual for service contracts, and other

liabilities |

|

|

142,937 |

|

|

|

146,679 |

|

|

|

|

Total liabilities |

|

— |

1,695,541 |

|

|

— |

2,004,613 |

|

|

|

| |

|

— |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock, $.01 par value per share; 1,500,000,000 shares

authorized; Issued (including shares in treasury): 900,281,573 as

of September 30, 2024 and 625,305,025 as of December 31, 2023 |

|

$ |

9,003 |

|

|

$ |

6,254 |

|

|

|

|

Additional paid-in capital |

|

— |

8,388,930 |

|

|

|

7,494,685 |

|

|

|

|

Accumulated other comprehensive loss |

|

— |

(1,634 |

) |

|

|

(6,802 |

) |

|

|

|

Accumulated deficit |

|

|

(5,259,021 |

) |

|

|

(4,489,744 |

) |

|

|

|

Less common stock in treasury: 19,831,594 as of September 30, 2024

and 19,169,366 as of December 31, 2023 |

|

|

(107,945 |

) |

|

|

(106,268 |

) |

|

|

|

Total stockholders’ equity |

|

|

3,029,333 |

|

|

|

2,898,125 |

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

4,724,874 |

|

|

$ |

4,902,738 |

|

|

|

| |

|

|

|

|

|

|

|

|

| Plug Power

Inc. and Subsidiaries |

| Condensed

Consolidated Statements of Operations |

| (In

thousands, except share and per share amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months

ended |

Nine months

ended |

|

| |

|

|

September

30, |

September

30, |

|

| |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| Net

revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of equipment, related infrastructure and other |

|

|

$ |

107,141 |

|

|

$ |

145,130 |

|

|

$ |

252,224 |

|

|

$ |

543,510 |

|

|

|

Services performed on fuel cell systems and related

infrastructure |

|

|

|

14,148 |

|

|

|

9,290 |

|

|

|

40,205 |

|

|

|

27,088 |

|

|

|

Power purchase agreements |

|

|

|

20,459 |

|

|

|

20,068 |

|

|

|

58,437 |

|

|

|

44,135 |

|

|

|

Fuel delivered to customers and related equipment |

|

|

|

29,791 |

|

|

|

19,371 |

|

|

|

77,964 |

|

|

|

47,391 |

|

|

|

Other |

|

|

|

2,191 |

|

|

|

4,852 |

|

|

|

8,514 |

|

|

|

7,055 |

|

|

|

Net revenue |

|

|

$ |

173,730 |

|

|

$ |

198,711 |

|

|

$ |

437,344 |

|

|

$ |

669,179 |

|

|

| Cost of

revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of equipment, related infrastructure and other |

|

|

|

149,912 |

|

|

|

158,989 |

|

|

|

414,948 |

|

|

|

504,717 |

|

|

|

Services performed on fuel cell systems and related

infrastructure |

|

|

|

9,086 |

|

|

|

17,916 |

|

|

|

35,773 |

|

|

|

53,586 |

|

|

|

Provision for loss contracts related to service |

|

|

|

6,036 |

|

|

|

41,581 |

|

|

|

38,265 |

|

|

|

55,801 |

|

|

|

Power purchase agreements |

|

|

|

51,782 |

|

|

|

56,981 |

|

|

|

161,322 |

|

|

|

157,773 |

|

|

|

Fuel delivered to customers and related equipment |

|

|

|

55,538 |

|

|

|

59,012 |

|

|

|

172,428 |

|

|

|

177,963 |

|

|

|

Other |

|

|

|

1,401 |

|

|

|

2,197 |

|

|

|

4,963 |

|

|

|

4,843 |

|

|

|

Total cost of revenue |

|

|

$ |

273,755 |

|

|

$ |

336,676 |

|

|

$ |

827,699 |

|

|

$ |

954,683 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

loss |

|

|

$ |

(100,025 |

) |

|

$ |

(137,965 |

) |

|

$ |

(390,355 |

) |

|

$ |

(285,504 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

19,712 |

|

|

|

27,651 |

|

|

|

63,932 |

|

|

|

83,437 |

|

|

|

Selling, general and administrative |

|

|

|

91,586 |

|

|

|

105,451 |

|

|

|

254,689 |

|

|

|

310,621 |

|

|

|

Restructuring |

|

|

|

514 |

|

|

|

— |

|

|

|

8,154 |

|

|

|

— |

|

|

|

Impairment |

|

|

|

4,185 |

|

|

|

665 |

|

|

|

8,406 |

|

|

|

11,734 |

|

|

|

Change in fair value of contingent consideration |

|

|

|

146 |

|

|

|

2,239 |

|

|

|

(5,286 |

) |

|

|

26,316 |

|

|

|

Total operating expenses |

|

|

$ |

116,143 |

|

|

$ |

136,006 |

|

|

$ |

329,895 |

|

|

$ |

432,108 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

|

|

(216,168 |

) |

|

|

(273,971 |

) |

|

|

(720,250 |

) |

|

|

(717,612 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

7,423 |

|

|

|

10,369 |

|

|

|

24,495 |

|

|

|

44,392 |

|

|

|

Interest expense |

|

|

|

(9,148 |

) |

|

|

(11,802 |

) |

|

|

(29,984 |

) |

|

|

(33,717 |

) |

|

|

Other income/(expense), net |

|

|

|

15,510 |

|

|

|

4,987 |

|

|

|

(566 |

) |

|

|

(4,866 |

) |

|

|

Realized gain on investments, net |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

263 |

|

|

|

Other-than-temporary impairment of available-for-sale

securities |

|

|

|

— |

|

|

|

(10,831 |

) |

|

|

— |

|

|

|

(10,831 |

) |

|

|

Change in fair value of equity securities |

|

|

|

— |

|

|

|

70 |

|

|

|

— |

|

|

|

8,987 |

|

|

|

Loss on equity method investments |

|

|

|

(8,690 |

) |

|

|

(7,030 |

) |

|

|

(29,043 |

) |

|

|

(19,970 |

) |

|

|

Loss on extinguishment of convertible senior notes |

|

|

|

— |

|

|

|

— |

|

|

|

(14,047 |

) |

|

|

— |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before

income taxes |

|

|

$ |

(211,073 |

) |

|

$ |

(288,208 |

) |

|

$ |

(769,395 |

) |

|

$ |

(733,354 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (expense)/benefit |

|

|

|

(95 |

) |

|

|

4,729 |

|

|

|

118 |

|

|

|

6,916 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

|

$ |

(211,168 |

) |

|

$ |

(283,479 |

) |

|

$ |

(769,277 |

) |

|

$ |

(726,438 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

$ |

(0.25 |

) |

|

$ |

(0.47 |

) |

|

$ |

(1.03 |

) |

|

$ |

(1.22 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of common stock outstanding |

|

|

|

858,442,951 |

|

|

|

599,465,146 |

|

|

|

745,827,431 |

|

|

|

593,417,595 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Plug Power

Inc. and Subsidiaries |

|

| Condensed

Consolidated Statements of Cash Flows |

|

| (In

thousands) |

|

|

(Unaudited) |

|

|

|

|

Nine months

ended September 30, |

| |

|

2024 |

|

|

2023 |

|

|

|

Operating activities |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(769,277 |

) |

|

$ |

(726,438 |

) |

|

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

Depreciation of long-lived assets |

|

|

51,639 |

|

|

|

37,810 |

|

|

|

Amortization of intangible assets |

|

|

14,194 |

|

|

|

14,158 |

|

|

|

Lower of cost or net realizable value inventory adjustment and

provision for excess and obsolete inventory |

|

|

67,768 |

|

|

|

33,889 |

|

|

|

Stock-based compensation |

|

|

64,120 |

|

|

|

129,074 |

|

|

|

Loss on extinguishment of convertible senior notes |

|

|

14,047 |

|

|

|

- |

|

|

|

(Recoveries)/provision for losses on accounts receivable |

|

|

(1,458 |

) |

|

|

948 |

|

|

|

Amortization of (premium)/discount of debt issuance costs on

convertible senior notes and long-term debt |

|

|

(1,731 |

) |

|

|

1,699 |

|

|

|

Provision for common stock warrants |

|

|

16,294 |

|

|

|

12,737 |

|

|

|

Deferred income tax benefit |

|

|

(118 |

) |

|

|

(621 |

) |

|

|

Impairment |

|

|

8,406 |

|

|

|

11,734 |

|

|

|

(Recovery)/loss on service contracts |

|

|

(558 |

) |

|

|

35,893 |

|

|

|

Loss on sale of long-lived assets |

|

|

2,519 |

|

|

|

- |

|

|

|

Fair value adjustment to contingent consideration |

|

|

(5,286 |

) |

|

|

26,316 |

|

|

|

Net realized gain on investments |

|

|

- |

|

|

|

(263 |

) |

|

|

Other-than-temporary impairment of available-for-sale

securities |

|

|

- |

|

|

|

10,831 |

|

|

|

Accretion of premium on available-for-sale securities |

|

|

- |

|

|

|

(5,144 |

) |

|

|

Lease origination costs |

|

|

(3,508 |

) |

|

|

(7,665 |

) |

|

|

Change in fair value for equity securities |

|

|

- |

|

|

|

(8,987 |

) |

|

|

Loss on equity method investments |

|

|

29,043 |

|

|

|

19,970 |

|

|

|

Change in fair value of derivative financial instruments |

|

|

100 |

|

|

|

- |

|

|

| Changes in

operating assets and liabilities that provide/(use) cash: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

78,047 |

|

|

|

(34,685 |

) |

|

|

Inventory |

|

|

30,868 |

|

|

|

(411,737 |

) |

|

|

Contract assets |

|

|

(14,849 |

) |

|

|

(39,040 |

) |

|

|

Prepaid expenses and other assets |

|

|

(42,835 |

) |

|

|

(6,423 |

) |

|

|

Accounts payable, accrued expenses, and other liabilities |

|

|

(29,183 |

) |

|

|

21,221 |

|

|

|

Payments of contingent consideration |

|

|

(9,216 |

) |

|

|

(2,895 |

) |

|

|

Deferred revenue and other contract liabilities |

|

|

(96,428 |

) |

|

|

23,699 |

|

|

|

Net cash used in operating activities |

|

$ |

(597,402 |

) |

|

$ |

(863,919 |

) |

|

|

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(253,148 |

) |

|

|

(484,030 |

) |

|

|

Purchases of equipment related to power purchase agreements and

equipment related to fuel delivered to customers |

|

|

(41,513 |

) |

|

|

(26,094 |

) |

|

|

Proceeds from maturities of available-for-sale securities |

|

|

- |

|

|

|

961,160 |

|

|

|

Proceeds from sales of equity securities |

|

|

- |

|

- |

|

76,263 |

|

|

|

Proceeds from sale of long-lived assets |

|

|

500 |

|

|

|

- |

|

|

|

Cash paid for non-consolidated entities and non-marketable equity

securities |

|

|

(64,368 |

) |

|

|

(66,811 |

) |

|

|

Net cash (used in)/provided by investing activities |

|

$ |

(358,529 |

) |

|

$ |

460,488 |

|

|

| |

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

|

|

Payments of contingent consideration |

|

|

(1,841 |

) |

|

|

(10,105 |

) |

|

|

Proceeds from public and private offerings, net of transaction

costs |

|

|

793,249 |

|

|

|

- |

|

|

|

Payments of tax withholding on behalf of employees for net stock

settlement of stock-based compensation |

|

|

(1,677 |

) |

|

|

(7,922 |

) |

|

|

Proceeds from exercise of stock options |

|

|

96 |

|

|

|

1,313 |

|

|

|

Principal payments on long-term debt |

|

|

(726 |

) |

|

|

(5,710 |

) |

|

|

Proceeds from finance obligations |

|

|

54,416 |

|

|

|

90,265 |

|

|

|

Principal repayments of finance obligations and finance leases |

|

|

(64,342 |

) |

|

|

(53,394 |

) |

|

|

Net cash provided by financing activities |

|

$ |

779,175 |

|

|

$ |

14,447 |

|

|

|

Effect of exchange rate changes on cash |

|

|

7,807 |

|

|

|

2,130 |

|

|

|

Decrease in cash and cash equivalents |

|

|

(41,093 |

) |

|

|

(579,821 |

) |

|

|

(Decrease)/increase in restricted cash |

|

|

(127,856 |

) |

|

|

192,967 |

|

|

|

Cash, cash equivalents, and restricted cash beginning of

period |

|

|

1,169,144 |

|

|

|

1,549,344 |

|

|

|

Cash, cash equivalents, and restricted cash end of

period |

|

$ |

1,000,195 |

|

|

$ |

1,162,490 |

|

|

| |

|

|

|

|

|

|

|

Plug Power (NASDAQ:PLUG)

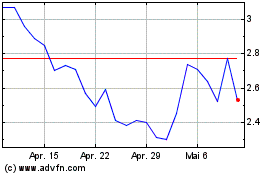

Historical Stock Chart

Von Okt 2024 bis Nov 2024

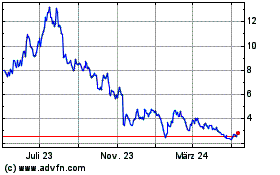

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

Von Nov 2023 bis Nov 2024