MIDDLEFIELD BANC CORP false 0000836147 0000836147 2023-08-07 2023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2023

MIDDLEFIELD BANC CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ohio |

|

001-36613 |

|

34-1585111 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

I.D. No.) |

|

| 15985 East High Street, Middlefield, Ohio 44062 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (440) 632-1666

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, no par value |

|

MBCN |

|

The NASDAQ Stock Market, LLC (NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Other Events.

Middlefield Banc Corp. (NASDAQ: MBCN) intends to use the materials furnished herewith in one or more meetings with investors/analysts during the third quarter of 2023.

The information in this current Report on Form 8-K is being furnished under item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01(d) Exhibits

The following exhibit is furnished as Regulation FD Disclosure to this Current Report on Form 8-K.

(a) Exhibits.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

| MIDDLEFIELD BANC CORP. |

|

|

| By: |

|

/s/ James R. Heslop, II |

|

|

James R. Heslop, II |

|

|

Chief Executive Officer |

|

| Date: August 7, 2023 |

Middlefield Banc Corp. 2023

Second Quarter Investor Presentation (Nasdaq: MBCN) Exhibit 99.1

Forward Looking Statements This

presentation contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Middlefield Banc Corp.’s plans, strategies, objectives,

expectations, intentions, financial condition and results of operations. These forward-looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other

factors that could cause the actual results to differ materially from those contemplated by the statements. The significant risks and uncertainties related to Middlefield Banc Corp. of which management is aware are discussed in detail in the

periodic reports that Middlefield Banc Corp. files with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” section of its Annual Report on Form 10-K and its Quarterly Report on Form 10-Q.

Investors are urged to review Middlefield Banc Corp.’s periodic reports, which are available at no charge through the SEC’s website at www.sec.gov and through Middlefield Banc Corp.’s website at www.middlefieldbank.bank on the

“Investor Relations” page. Middlefield Banc Corp. assumes no obligation to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation.

www.middlefieldbank.bank

Middlefield Banc Corp. Middlefield

Banc Corp. (Nasdaq: MBCN) Providing financial services throughout Central, Western and Northeast Ohio Profitably serving its communities, customers, employees, and shareholders by its commitment to quality, safety and soundness, and maximizing

shareholder value www.middlefieldbank.bank

www.middlefieldbank.bank Middlefield:

A Community Bank That is Safe, Strong and Committed Highlights Strategic Strengths People: Experienced leadership team Strong bench of management talent Management succession with Ron Zimmerly (President) and Mike Ranttila (CFO) Communities: Serving

attractive Ohio banking markets Located in three of the top five Ohio counties ranked by median household income Optimally positioned between rural (funding) and metropolitan (lending) communities Customers: Balanced mix of retail and commercial

customers Geauga County in Northeast Ohio is home to the world’s 4th largest Amish population Community Banking Values and Focus: Providing superior and responsive financial services since 1901 Committed to quality, safety and soundness Local

decision making and community investment creates competitive advantage Financial Strength: Profitable throughout the economic cycle and never reported a loss AOCI impact is minimal Above peer ROAA, NIM, and Equity/Assets, and Tangible Equity/Assets*

Legacy of returning capital back to shareholders $582.9 million of maximum borrowing capacity at the FHLB at June 30, 2023 21 Branches 120+ Years of service 3 Strong and compelling Ohio markets #1 Community Bank in core NE Ohio and Liberty markets

4.30% 2023 first half net interest margin * Please see Reconciliation of Non-GAAP Measures on slide 25

Only independent community bank with

exposure to Central, Western and Northeast Ohio Markets Branches located in counties that have above average median household income, median value of owner-occupied housing, and employment rates www.middlefieldbank.bank Compelling Ohio Banking

Franchise Middlefield locations

www.middlefieldbank.bank Historic

Growth Underway in The Columbus Region Franklin Pickaway Union Madison Delaware Morrow Licking Fairfield Logan Marion The 10-county area in Central Ohio is home to over 2.2 million people and 16 Fortune 1000 company headquarters. The Columbus region

is the 14th largest metropolis in the U.S. According to https://columbusregion.com/meet-the-region Sources:(1) Betsy Liska Goldstein, “Intel on Intel” https://www.youtube.com/watch?v=9MO0wPg4CYw (2)

https://www.cleveland19.com/2022/09/09/intels-investment-ohio-could-have-100-billion-impact/ (3) https://columbusregion.com/meet-the-region/demographics/ Historic economic development is underway across Central Ohio including recently announced

projects(1) from Intel ($100 Billion), Amazon ($8.0 Billion), Honda ($4.5 Billion), and Nationwide Children’s Hospital ($3.3 Billion). Intel’s project alone is the largest single private-sector investment in Ohio’s history.

Intel’s initial $20 billion investment into two new factories in Licking County could grow to as much as $100 billion by the time the buildout is complete, creating one of the largest semiconductor manufacturing sites in the world. The first

phase of the project is expected to create 3,000 Intel jobs and 7,000 construction jobs(2). The Columbus Region has experienced robust growth. From 2010 to 2020, the population of the city alone increased at a growth rate of more than 12%, which is

substantially higher than the 2.1% average for the rest of the Midwest. The Columbus Region is expected to expand to 3 million people by 2050(3). Every job at Intel is expected to create 13 more jobs in other industries, creating a total of 39,000

jobs in Central Ohio(1). The Middlefield Banking Company has a strong and established presence throughout Central and Western Ohio. With 10 locations throughout Central and Western Ohio, The Middlefield Banking Company is one of the largest

independent community banks in the region making it well positioned to support the rapidly expanding financial needs of its surrounding communities.

www.middlefieldbank.bank History of

Creating Value for Shareholders Total Shareholder Return Value Drivers $100 invested in Middlefield Banc Corp. since 2011, has achieved a total return of $446 compared to $235 for the KBW Regional Bank Index, and $243 for the Nasdaq Bank Index.

Middlefield has outperformed the KBW Regional Bank Index and the Nasdaq Bank Index by 89.5% and 83.3%, respectively over this period. Never reported an annual loss Compelling dividend yield Capital allocation strategy focused on Acquisitions, Share

buybacks and Dividends Long-term earnings and asset growth Management focused on long-term value creation

www.middlefieldbank.bank Well

Positioned for Any Economic Cycle At June 30, 2023, Middlefield’s allowance for credit losses to nonperforming loans was 289.36%, while the allowance for credit losses to total loans was 1.46%. Strong Allowance Well Capitalized Limited

Nonperforming Loans Conservative Lending Culture Focused on fair pricing, no national or sub-prime lending, lending within market area, and participation loans with banks that have similar credit quality standards and cultures. Equity to assets of

11.26% at June 30, 2023, compared to 9.91% at June 30, 2022. Middlefield did not take TARP, remained profitable and saw annual net charge-offs peak at only $2.5 million for the year ended December 31, 2011. Overall asset quality remains strong, with

$7.1 million in nonperforming loans at June 30, 2023, or 0.50% of total loans. 2008 – 2010 Great Financial Crisis Middlefield is focused on balancing stable loan growth with excellent asset quality. This approach has served the Bank well

throughout its 120+ year history and difficult economic periods, including the 2008 – 2010 great financial crisis

www.middlefieldbank.bank Strong

Deposit Base and Net Interest Margin Overview Deposit Trends (in thousands) Net Loans to Deposit Ratio Net Interest Margin Stable capital levels supported by local deposit base Core deposit funding base supplemented by $59.1 million in cash and cash

equivalents, and $167.2 million in investment securities at June 30, 2023 Uninsured deposits to total assets were approximately 20%, and approximately 25% of total deposits at June 30, 2023

www.middlefieldbank.bank Excellent

Asset Quality and Diverse CRE Composition Overview (at June 30, 2023) CRE Portfolio Composition (at June 30, 2023) Nonperforming Assets to Total Assets Net Charge-Offs (Recoveries) to Average Loans Secured loans are subject to loan-to-value

requirements based on collateral types CRE as a percent of the total loan portfolio was 44.9% Balanced and diverse CRE portfolio CRE office credit exposure represented 5.2% of the Company's total loan portfolio, with a weighted average loan-to-value

of approximately 53% and an average loan of $1.2 million. Allowance for credit losses/nonperforming loans was 289.36%

www.middlefieldbank.bank Strong

Asset Quality: 2006 – 2023 NPA and NCO Summary Conservative underwriting philosophy “Quick to downgrade, slow to upgrade” credit philosophy mitigates loss exposure From 2006 to 2023, NCOs have averaged 10.8% of stated NPAs *NPAs

exclude TDRs

www.middlefieldbank.bank Successful

Acquisition Strategy: Total Assets Have Grown at a 13.5% CAGR Since 2016 The January 2017 Liberty Bank, N.A. acquisition extended Middlefield’s reach in Northeast Ohio and into Cuyahoga and Summit Counties The December 2022 Liberty Bancshares,

Inc. acquisition extended Middlefield’s reach in Western and Central Ohio and into Hardin and Logan Counties

www.middlefieldbank.bank Returning

Capital to Shareholders Annual Dividend Cumulative Shares Repurchased Middlefield has a history of returning excess capital to shareholders. The Company has increased its regular dividend payment in four of the last six years and paid three special

dividends over this period. During the first half of 2023, Middlefield repurchased 164,221 shares at an average of $27.44 per share and have 293,910 shares remaining under the current repurchase program. 2018 included a $0.025 per share special

dividend 2021 included a $0.04 per share special dividend 2022 included a $0.10 per share special dividend * Annualized Special cash dividend Regular cash dividend $0.81

www.middlefieldbank.bank “I

put together an aggressive growth strategy for my business Exscape Designs. The need for a local relationship-based approach made clear sense. In my experience over the years with Middlefield Bank we have been able to achieve a lot of growth

together. With Middlefield you're not just numbers, it's the relationship and community that matters to them.” “Ease Logistics was looking for a small community bank to help us grow our business. We needed a credit line to support our

40% growth. Middlefield bank was able to step up and provide us the working capital we needed, and the process was seamless. When Ease Logistics needed a mortgage for their new headquarters in Dublin, Middlefield Bank was there. We love the staff

too!” “It has been a pleasure to do business with Middlefield Bank for these past 20 years. When all of the other local major banks turned away from the business, Middlefield Bank welcomed it with open arms. This relationship started

with trust and that trust is the foundation in which we continue to use Middlefield for all of our banking needs.” Strategy Dependent on Customers and Communities Local Strong Committed

www.middlefieldbank.bank Fully

automated Digital Account Opening (DAO) solution provides our customers a modern, flexible approach to opening accounts. New digital insurance agency platform. Offers a full-service insurance agency solution to our retail and commercial customers.

Provides simple, seamless access to competitive options. New fraud prevention platform for checks and ACH transactions. Platform empowers customers with the ability to customize actionable alerts and accept or reject suspicious ACH and checks

in real-time. Adding Digital Tools and Services to Improve Our Customer Experience and Enhance Our Relationships Digital Account Opening Digital Insurance Agency Digital Fraud Prevention

www.middlefieldbank.bank Loans

Supported by Local Decision Making and Individual Service Middlefield’s markets have seen significant industry consolidation in the past ten years. In most cases, large national and regional banks cannot deliver the same level of community

service that Middlefield can offer customers Highlights Residential Real Estate Loans(1) Commercial Loans(2) (3) (2) In millions, commercial loans are C&I plus commercial real estate loans (3) Orange bars reflect PPP loan balance >30 Local

Lenders 1 Highly Productive LPO 8.9% Commercial Loan 2017 - 2022 CAGR 5.1% Consumer Loan 2017 – 2022 CAGR (1) In millions, includes consumer installment loans

www.middlefieldbank.bank Controlled

Balance Sheet Growth Highlights Total Deposits (in millions) Loans (in millions) Introduced new products to attract more deposits and drive noninterest income At June 30, 2023, Middlefield had a net loan-to-deposit ratio of 97.0%, $59.1 million in

cash and cash equivalents, and $167.2 million in investment securities Strong capital levels, robust liquidity, diverse loan and deposit portfolios, and borrowing capacity of $582.9 million at the FHLB Continuing to enhance delivery in both personal

and commercial channels

Supplemental Financial Data

(Nasdaq: MBCN)

Annual Financial Summary

www.middlefieldbank.bank (1) Per share data adjusted for 2-for-1 stock split on November 8, 2019 Dollars in thousands 2022 2021 2020 2019 2018 2017 Net interest income $ 50,177 $ 48,140 $ 43,388 $ 41,385 $ 40,448 $ 37,348 Provision for loan

losses 0 700 9,840 890 840 1,045 Noninterest income 6,746 7,249 5,990 4,841 3,728 4,859 Noninterest expense 38,030 31,991 29,788 30,033 28,743 27,485 Income before income taxes 18,893 22,698 9,750 15,303 14,593 13,677 Income taxes 3,220 4,065 1,401

2,592 2,162 4,222 Net income $ 15,673 $ 18,633 $ 8,349 $ 12,711 $ 12,431 $ 9,455 Net interest margin 4.08% 3.78% 3.54% 3.68% 3.77% 3.82% Total assets $1,687,682 $1,331,006 $1,391,979 $1,182,475 $1,248,398 $1,106,336 Loans outstanding, net $1,338,434

$ 967,349 $1,090,626 $ 977,490 $ 984,681 $ 916,023 Deposits $1,402,019 $1,166,610 $1,225,200 $1,020,843 $1,016,067 $ 878,194 Equity capital $ 197,691 $ 145,335 $ 143,810 $ 137,775 $ 128,290 $ 119,863 Earnings per share - diluted(1) $ 2.60 $ 3.01 $

1.31 $ 1.96 $ 1.92 $ 1.56 Cash dividend (per share)(1) $ 0.81 $ 0.69 $ 0.60 $ 0.57 $ 0.59 $ 0.54 Dividend pay-out ratio 35.03% 22.76% 45.92% 28.99% 30.40% 35.52% Return on average assets 1.17% 1.36% 0.64% 1.05% 1.09% 0.88% Return on average equity

11.25% 12.74% 5.87% 9.35% 9.94% 8.52% Return on average tangible common equity 12.95% 14.38% 6.66% 10.72% 11.57% 10.15%

Excellent Asset Quality and Capital

Levels www.middlefieldbank.bank Strong reserve coverage provides flexibility in managing potential losses with reduced impact on net income For the Three Months Ended June 30, March 31, December 31, September 30, June 30, Asset quality data 2023

2023 2022 2022 2022 (Dollar amounts in thousands, unaudited) Nonperforming loans (1) $ 7,116 $ 6,882 $ 2,111 $ 3,692 $ 4,670 Other real estate owned 5,792 5,792 5,821 6,792 6,792 Nonperforming assets $ 12,908 $ 12,674 $ 7,932 $ 10,484 $ 11,462

Allowance for credit losses $ 20,591 $ 20,162 $ 14,438 $ 14,532 $ 14,550 Allowance for credit losses/total loans 1.46% 1.46% 1.07% 1.46% 1.49% Net charge-offs (recoveries): Quarter-to-date $ 111 $ (8) $ 94 $ 18 $ (58) Year-to-date 103 (8) (96) (190)

(208) Net charge-offs (recoveries) to average loans, annualized: Quarter-to-date 0.03% 0.00% 0.03% 0.01% -0.02% Year-to-date 0.01% 0.00% -0.01% -0.02% -0.04% Nonperforming loans/total loans 0.50% 0.50% 0.16% 0.37% 0.48% Allowance for credit

losses/nonperforming loans 289.36% 292.97% 683.94% 393.61% 311.56% Nonperforming assets/total assets 0.74% 0.73% 0.47% 0.78% 0.89% (1) Nonperforming loans exclude troubled debt restructurings that are performing in accordance with their terms over a

prescribed period of time.

Reconciliation of Non-GAAP Measures

www.middlefieldbank.bank This presentation includes disclosure of Middlefield Banc Corp.’s tangible book value per share and return on average tangible equity, which are financial measures not prepared in accordance with generally accepted

accounting principles in the United States (GAAP). A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes or includes amounts that are required to be

disclosed by GAAP. Middlefield Banc Corp. believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the underlying operational results and trends and Middlefield Banc Corp.’s

marketplace performance. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the numbers prepared in accordance with GAAP. Reconciliation of Common Stockholders' Equity to Tangible Common

Equity For the Three Months Ended (Dollar amounts in thousands, unaudited) June 30, March 31, December 31, September 30, June 30, 2023 2023 2022 2022 2022 Stockholders' Equity $ 197,227 $ 195,165 $ 197,691 $ 122,855 $ 128,220 Less Goodwill and other

intangibles 43,368 39,171 39,436 16,242 16,320 Tangible Common Equity $ 153,859 $ 155,994 $ 158,255 $ 106,613 $ 111,900 Shares outstanding 8,088,793 8,088,793 8,245,235 5,767,803 5,810,351 Tangible book value per share $ 19.02 $ 19.29 $ 19.19 $

18.48 $ 19.26 Reconciliation of Average Equity to Return on Average Tangible Common Equity For the Three Months Ended For the Six Months Ended June 30, March 31, December 31, September 30, June 30, June 30, June 30, 2023 2023 2022 2022 2022 2023

2022 Average Stockholders' Equity $ 214,161 $ 194,814 $ 148,616 $ 130,263 $ 133,377 $ 208,930 $ 139,003 Less Average Goodwill and other intangibles 40,522 39,300 23,731 16,280 16,357 39,911 16,396 Average Tangible Common Equity $ 173,639 $ 155,514 $

124,885 $ 113,983 $ 117,020 $ 169,019 $ 122,607 Net income $ 5,092 $ 4,897 $ 4,896 $ 3,502 $ 4,249 $ 9,989 $ 7,922 Return on average tangible common equity (annualized) 11.76% 12.77% 11.13% 14.79% 14.02% 11.92% 13.03%

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

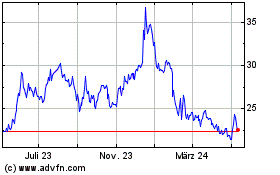

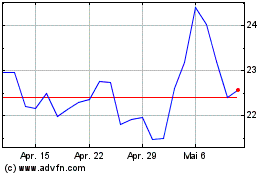

Middlefield Banc (NASDAQ:MBCN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Middlefield Banc (NASDAQ:MBCN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024