0000937556false00009375562024-01-102024-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2024

MASIMO CORPORATION

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DE | | 001-33642 | | 33-0368882 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| 52 Discovery | | Irvine, | | CA | | | | | 92618 |

| (Address of Principal Executive Offices) | | | | | (Zip Code) |

| | | | | | (949) | 297-7000 | | | |

Registrant’s telephone number, including area code: |

Not Applicable |

(Former name or former address, if changed since last report) |

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities Registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | MASI | | The Nasdaq Stock Market LLC |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On January 10, 2024, Masimo Corporation (the “Company”) issued a press release announcing select preliminary financial results for the fourth quarter and full-year ended December 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report. The preliminary financial information presented in this press release is based on the Company’s current expectations and may be adjusted as a result of, among other things, completion of customary annual audit procedures. The Company’s management plans to discuss the Company’s complete fourth quarter and full-year 2023 financial results after the market closes on Tuesday, February 27, 2024.

In accordance with General Instructions B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

In connection with the Company’s participation at the 42nd Annual J.P. Morgan Healthcare Conference on January 10, 2024, the Company’s Chief Financial Officer, will review select preliminary financial results for the fourth quarter and full-year 2023 and estimates for its full-year 2024 financial guidance.

In addition, the Company is making available to investors supplemental financial information for fiscal 2017, 2018, 2019, 2020, 2021, 2022 and the first, second and third quarter of fiscal 2022 and 2023 pursuant to the materials furnished as Exhibit 99.2 to this Current Report, as well as a discussion of non-GAAP measures, adjustments and definitions pursuant to the materials furnished as Exhibit 99.3 to this Current Report.

In accordance with General Instructions B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) The following items are filed as exhibits to the Current Report on Form 8-K.

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Masimo Corporation has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | MASIMO CORPORATION |

| | | | | |

| Date: January 10, 2024 | | | | By: | | /s/ MICAH YOUNG |

| | | | | | Micah Young |

| | | | | | Executive Vice President & Chief Financial Officer |

| | | | | | (Principal Financial Officer) |

Exhibit 99.1

Masimo Announces Select Preliminary 2023 Financial Results and 2024 Guidance

Complete fourth quarter and full-year 2023 financial results will be announced on Tuesday, February 27, 2024

Irvine, California, January 10, 2024 - Masimo Corporation (Nasdaq: MASI) today announced select preliminary financial results for the fourth quarter and full-year ended December 30, 2023 and provided estimates for its full-year 2024 guidance.

Preliminary Fourth Quarter 2023 Financial Results:

| | | | | | | | | | | | | | | |

| | | | | | | |

| • | | Consolidated revenue of $541 million to $551 million; | | | | |

| • | | Healthcare revenue of $336 million to $341 million; and | | | | |

| • | | Non-healthcare revenue of $205 million to $210 million. | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Preliminary Full-Year 2023 Financial Results:

| | | | | | | | | | | | | | | |

| | | | | | | |

| • | | Consolidated revenue of $2,041 million to $2,051 million; | | | | |

| • | | Healthcare revenue of $1,272 million to $1,277 million; and | | | | |

| • | | Non-healthcare revenue of $769 million to $774 million. | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The preliminary financial information presented in this press release is based on Masimo’s current expectations and may be adjusted as a result of, among other things, completion of customary annual audit procedures. Management plans to discuss Masimo’s complete fourth quarter and full-year 2023 financial results after the market closes on Tuesday, February 27, 2024.

Full-Year 2024 Guidance:

| | | | | | | | | | | | | | | |

| | | | | | | |

| • | | Consolidated revenue of $2,045 million to $2,165 million; | | | | |

| • | | Healthcare revenue of $1,345 million to $1,385 million; | | | | |

| • | | Non-healthcare revenue of $700 million to $780 million; | | | | |

| • | | GAAP earnings per diluted share of $1.91 to $2.08; | | | | |

| • | | Non-GAAP earnings per diluted share of $3.00 to $3.15 (prior definition); and | | | | |

| • | | Non-GAAP earnings per diluted share of $3.44 to $3.60 (updated definition). | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Effective fiscal year 2024, we are updating our non-GAAP financial measures to exclude the impact of all expenses related to our litigation against Apple. Masimo had previously only excluded the expenses related to the U.S. International Trade Commission litigation against Apple. Masimo believes all of the Apple litigation expenses are unique in nature and not indicative of the Company’s on-going operating performance and is therefore excluding them from its non-GAAP financial measures. The Company has included a reconciliation of its non-GAAP financial measures under both the updated and prior definitions to assist investors in making comparisons of period-to-period operating results.

| | | | | | | | | | | | | | | | | | | | |

| | Full-Year 2024 Guidance |

| | | | (Updated Definition) | | (Prior Definition) |

| (in millions, except earnings per diluted share) | | GAAP | | Non-GAAP | | Non-GAAP |

| Consolidated revenue | | $2,045 to $2,165 | | $2,045 to $2,165 | | $2,045 to $2,165 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Healthcare revenue | | $1,345 to $1,385 | | $1,345 to $1,385 | | $1,345 to $1,385 |

| Non-healthcare revenue | | $700 to $780 | | $700 to $780 | | $700 to $780 |

| Consolidated operating income | | $198 to $214 | | $307 to $322 | | $275 to $290 |

| Consolidated earnings per diluted share | | $1.91 to $2.08 | | $3.44 to $3.60 | | $3.00 to $3.15 |

| | | | | | |

| | | | | | |

Supplementary Non-GAAP Financial Information

For additional non-GAAP financial details, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information.

Non-GAAP Financial Measures

The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non-GAAP financial measures presented exclude the items described below. Management uses these non-GAAP financial measures internally for its operating and budgeting purposes, and believes that adjustments for these items assist investors in making comparisons of period-to-period operating results. Furthermore, management believes that the excluded items are not indicative of the Company’s on-going operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP.

Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies.

The Company has presented the following non-GAAP measures to assist investors in understanding the Company’s net operating results on an on-going basis: (i) constant currency revenue growth %, (ii) non-GAAP net income, (iii) non-GAAP (net income) earnings per diluted share and (iv) non-GAAP operating income/margin. These non-GAAP financial measures may also assist investors in making comparisons of the Company’s operating results with those of other companies. Management believes constant currency revenue growth, non-GAAP operating income/margin, non-GAAP net income and non-GAAP earnings per diluted share are important measures in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business.

The non-GAAP financial measures reflect adjustments for the following items:

Constant currency revenue adjustments

Some of our sales agreements with foreign customers provide for payment in currencies other than the U.S. Dollar. These foreign currency revenues, when converted into U.S. Dollars, can vary significantly from period-to-period depending on the average and quarter-end exchange rates during a respective period. We believe that comparing these foreign currency denominated revenues by holding the exchange rates constant with the prior year period is useful to management and investors in evaluating our revenue growth rates on a period-to-period basis. We anticipate that fluctuations in foreign exchange rates and the related constant currency adjustments for calculation of our revenue growth rate will continue to occur in future periods.

Acquired tangible asset amortization

These transactions represent amortization expense in connection with business or assets acquisitions associated with acquired tangible assets and asset valuation step-ups.

Acquired intangible asset amortization

These transactions represent amortization expense in connection with business or assets acquisitions associated with acquired intangible assets including, but not limited to customer relationships, intellectual property, trade names and non-competition agreements.

Acquisition, integration and related costs

These transactions represent gains, losses, and other related costs associated with acquisitions, integrations, investments, divestitures, assets impairments, and in-process research and development.

Business transition and related costs

These transactions represent gains, losses, and other related costs associated with business transition plans. These items may include but are not limited to severance, relocation, consulting, leasehold exit costs, asset impairment, and other related costs to rationalize our operational footprint and optimize business results.

Litigation related expenses and settlements (prior definition)

These transactions represent gains, losses, and other related costs associated with certain litigation matters, which can vary in their characteristics, frequency and significance to our operating results.

Litigation related expenses and settlements (updated definition)

We have been engaged in various legal proceedings against Apple since January 2020, including various proceedings in the federal courts, various proceedings in the U.S. Patent and Trademark Office (the “PTO proceedings”), and a proceeding in the U.S. International Trade Commission (the “ITC proceeding”). Although we previously excluded only expenses relating to the ITC proceeding from the definition of “Litigation related expenses and settlements”, beginning with the first quarter of 2024, we have revised the definition of “Litigation related expenses and settlements” to exclude not only expenses relating to the ITC proceeding, but also all other Apple litigation expenses, including those relating to the federal court proceedings and the PTO proceedings. We believe all of the Apple litigation expenses are unique in nature and not indicative of the Company’s on-going operating performance, and this updated definition will provide more useful information to investors by facilitating period-to-period comparisons of our financial performance that otherwise may be obscured by the significant fluctuations in Apple-related litigation expenses.

Other adjustments

In the event there are gains, losses and other adjustments which impact period-to-period comparability and do not represent the underlying ongoing results of the business, the Company may choose to exclude these from non-GAAP earnings.

Financing related adjustments

The Company may enter into various financial arrangements whereby costs are incurred and certain instrument features are valued and expensed accordingly but are not necessarily indicative of the on-going cash flow generation of the Company and therefore excludes these costs from non-GAAP earnings. For GAAP earnings per diluted share purposes, the Company cannot reflect the anti-dilutive impact, if applicable, in its diluted shares calculations. However, the Company believes that reflecting the anti-dilutive impact of these instruments in non-GAAP earnings per diluted share provides management and investors with useful information in evaluating the financial performance of the Company on a per share basis.

Realized and unrealized gains or losses

These transactions represent gains, losses, and other related costs associated with foreign currency denominated transactions and investments. Changes in the underlying currency rates relative to the U.S. Dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Unrealized and realized gains and losses on investments may impact the Company’s reported results of operations for a period. These items are highly variable, difficult to predict and outside the control of those responsible for the underlying operations of the business. Other items also included here are mark-to-market gains and losses of derivative contracts that are not designated as hedging instruments or the ineffective portions of cash flow hedges.

Tax impact of non-GAAP adjustments

In order to reflect the tax effected impact of the non-GAAP adjustments, the Company will adjust the non-GAAP earnings by the approximate tax impact of these adjustments.

Excess tax benefits from stock-based compensation expense

GAAP requires that excess tax benefits recognized on stock-based compensation expense be reflected in our provision for income taxes rather than paid-in capital. As these excess tax benefits may be highly variable from period-to-period, the Company may choose to exclude these tax benefits from non-GAAP earnings to facilitate comparability between periods and with peers.

| | | | | | | | | | | | | | | | | |

RECONCILIATION OF GAAP TO NON-GAAP CONSOLIDATED OPERATING INCOME(1): |

| (in millions) | | Full-Year 2024

Guidance(2) | | Full-Year 2023

Guidance(3) |

| GAAP Operating Income | | $198 to $214 | | $ 138 to $152 |

| Non GAAP Adjustments: | | | | |

| Acquired tangible asset amortization | | 6 | | 6 |

| Acquired intangible asset amortization | | 37 | | 38 |

| Acquisition, integration and related costs | | 7 | | 20 |

| Business transition and related costs | | 12 | | 4 |

| Litigation related expenses and settlements | | 14 | | 45 |

| Other adjustments | | — | | | 4 |

| | | | |

| Non-GAAP Operating Income (prior definition) | | $275 to $290 | | $256 to $270 |

| Litigation related expenses and settlements(4) | | 32 | | 38 |

| Non-GAAP Operating Income (updated definition) | | $307 to $322 | | $294 to $308 |

__________________

(1) May not foot due to rounding.

(2) Guidance provided January 10, 2024.

(3) Guidance provided on November 7, 2023.

(4) Adjustments to conform to the new updated non-GAAP definition which excludes all Apple-related litigation expenses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME AND NET INCOME PER DILUTED SHARE(1): |

| | | Full-Year 2024 Guidance(2) | | Full-Year 2023 Guidance(3) |

| (in thousands, except per share amounts) | | $ | | Per Diluted Share | | $ | | Per Diluted Share |

| | | | | | | | |

| | | | | | | | |

| GAAP net income | | $105 to $115 | | $1.91 to $2.08 | | $72 to $83 | | $1.34 to $1.54 |

| Non-GAAP adjustments: | | | | | | | | |

| | | | | | | | | |

| Acquired tangible asset amortization | | 6 | | | 0.12 | | | 6 | | | 0.12 | |

| Acquired intangible asset amortization | | 37 | | | 0.68 | | | 38 | | | 0.70 | |

| Acquisition, integration and related costs | | 7 | | | 0.12 | | | 20 | | | 0.36 | |

| Business transition and related costs | | 12 | | | 0.22 | | | 4 | | | 0.08 | |

| Litigation related expenses and settlements | | 14 | | | 0.24 | | | 45 | | | 0.83 | |

| Other adjustments | | — | | | — | | | 4 | | | 0.07 | |

| Realized and unrealized gains or losses | | — | | | — | | | (7) | | | (0.12) | |

| Financing related adjustments | | 2 | | | 0.03 | | | 2 | | | 0.03 | |

| Tax impact of non-GAAP adjustments | | (16) to (17) | | (0.30) to (0.31) | | (27) | | | (0.50) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Excess tax benefits from stock-based compensation | | (2) | | | (0.03) | | | (4) | | | (0.07) | |

| | | | | | | | | |

| Non-GAAP net income (prior definition) | $165 to $174 | | $3.00 to $3.15 | | $155 to $165 | | $2.85 to $3.05 |

| Litigation related expenses and settlements(4) | | 32 | | 0.58 | | | 38 | | 0.71 | |

| Tax impact of non-GAAP adjustments | | (8) | | | (0.14) | | | (9) | | | (0.17) | |

| Non-GAAP net income (updated definition) | $189 to $198 | | $3.44 to $3.60 | | $184 to $195 | | $3.39 to $3.59 |

| Weighted average shares outstanding - diluted | | | | 55.1 | | | | | 54.2 | |

__________________

(1) May not foot due to rounding.

(2) Guidance provided January 10, 2024.

(3) Guidance provided on November 7, 2023.

(4) Adjustments to conform to the new updated non-GAAP definition which excludes all Apple-related litigation expenses.

Conference Call:

The conference call to review Masimo’s complete fourth quarter and full-year 2023 financial results will begin at 1:30 p.m. PT (4:30 p.m. ET) on Tuesday, February 27, 2024 and will be hosted by Joe Kiani, Chairman and Chief Executive Officer, and Micah Young, Executive Vice President and Chief Financial Officer. A live webcast of the conference call will be available online from the investor relations page of the Company’s corporate website at www.masimo.com.

To register for the conference call and receive the dial-in number, please use the link below. Upon registering, each participant will be provided with call details and a registrant ID number.

Conference Call Registration Link:

https://conferencingportals.com/event/nUSpRIEm

A replay of the webcast and conference call will be available shortly after the conclusion of the call and will be archived on the Company’s website.

About Masimo

Masimo (Nasdaq: MASI) is a global technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight iconic audio brands, including Bowers & Wilkins®, Denon®, Marantz®, and Polk Audio®. Our mission is to improve life, improve patient outcomes; and reduce the cost of care. Masimo SET® Measure-through Motion and Low Perfusion™ pulse oximetry, introduced in 1995, has been shown in over 100 independent and objective studies to outperform other pulse oximetry technologies. Masimo SET® has also been shown to help clinicians reduce severe retinopathy of prematurity in neonates, improve CCHD screening in newborns, and, when used for continuous monitoring with Masimo Patient SafetyNet™ in post-surgical wards, reduce rapid response team activations, ICU transfers, and costs. Masimo SET® is estimated to be used on more than 200 million patients in leading hospitals and other healthcare settings around the world, and is the primary pulse oximetry at 9 of the top 10 hospitals as ranked in the 2022-23 U.S. News and World Report Best Hospitals Honor Roll. In 2005, Masimo introduced rainbow® Pulse CO-Oximetry technology, allowing noninvasive and continuous monitoring of blood constituents that previously could only be measured invasively and intermittently, including total hemoglobin (SpHb®), oxygen content (SpOC™), carboxyhemoglobin (SpCO®), methemoglobin (SpMet®), Pleth Variability Index (Pvi®), RPVi™ (rainbow® Pvi), and Oxygen Reserve Index (Ori™). In 2013, Masimo introduced the Root® Patient Monitoring and Connectivity Platform, built from the ground up to be as flexible and expandable as possible to facilitate the addition of other Masimo and third-party monitoring technologies; key Masimo additions include Next Generation SedLine® Brain Function Monitoring, O3® Regional Oximetry, and ISA™ Capnography with NomoLine® sampling lines. Masimo’s family of continuous and spot-check monitoring Pulse CO-Oximeters® includes devices designed for use in a variety of clinical and non-clinical scenarios, including tetherless, wearable technology, such as Radius-7®, Radius-PPG® and Radius VSM™, portable devices like Rad-67®, fingertip pulse oximeters like MightySat® Rx, and devices available for use both in the hospital and at home, such as Rad-97®. Masimo hospital and home automation and connectivity solutions are centered around Root and the Masimo Hospital Automation™ platform, and include Iris® Gateway, iSirona™, Patient SafetyNet, Replica®, Halo ION, UniView®, UniView :60™, and Masimo SafetyNet™. Masimo’s growing portfolio of health and wellness solutions include Radius T™ and the Masimo W1™ watch, Stork™, Opioid Halo™, Bridge™, and PerL™. Additional information about Masimo and its products may be found at www.masimo.com. Published clinical studies on Masimo products can be found at www.masimo.com/evidence/featured-studies/feature/.

RPVi has not received FDA 510(k) clearance and are not available for sale in the United States. The use of the trademark Patient SafetyNet is under license from University HealthSystem Consortium.

Forward-Looking Statements

All statements other than statements of historical facts included in this press release that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including our expectations regarding our updated fourth-quarter and full-year 2023 preliminary financial results and full-year 2024 guidance, including consolidated revenue, healthcare revenue, non-healthcare revenue, consolidated operating income and consolidated GAAP and non-GAAP earnings per diluted share. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include, but are not limited to, those related to: completion of customary annual audit procedures for our 2023 financial statements; our dependence on Masimo SET® and Masimo rainbow SET™ products and technologies for substantially all of our revenue; any failure in protecting our intellectual property exposure to competitors’ assertions of intellectual property claims; the highly competitive nature of the markets in which we sell our products and technologies; any failure to continue developing innovative products and technologies; our ability to successfully integrate Sound United’s brands into our business; our ability to address and expand into new markets; the lack of acceptance of any of our current or future products and technologies; obtaining regulatory approval of our current and future products and technologies; the risk that the implementation of our international realignment will not continue to produce anticipated operational and financial benefits, including a continued lower effective tax rate; the loss of our customers; the failure to retain and recruit senior management; product liability claims exposure; a failure to obtain expected returns from the amount of intangible assets we have recorded; the maintenance of our brand; the amount and type of equity awards that we may grant to employees and service providers in the future; our ongoing litigation and related matters; and other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

# # #

| | | | | | | | |

| Investor Contact: Eli Kammerman | | Media Contact: Evan Lamb |

| (949) 297-7077 | | (949) 396-3376 |

| ekammerman@masimo.com | | elamb@masimo.com |

Masimo, SET, Signal Extraction Technology, Improving Patient Outcome and Reducing Cost of Care... by Taking Noninvasive Monitoring to New Sites and Applications, rainbow, SpHb, SpOC, SpCO, SpMet, PVI and ORI are trademarks or registered trademarks of Masimo Corporation.

1 GAAP to Non-GAAP Reconciliations January 10, 2024 CONFIDENTIAL

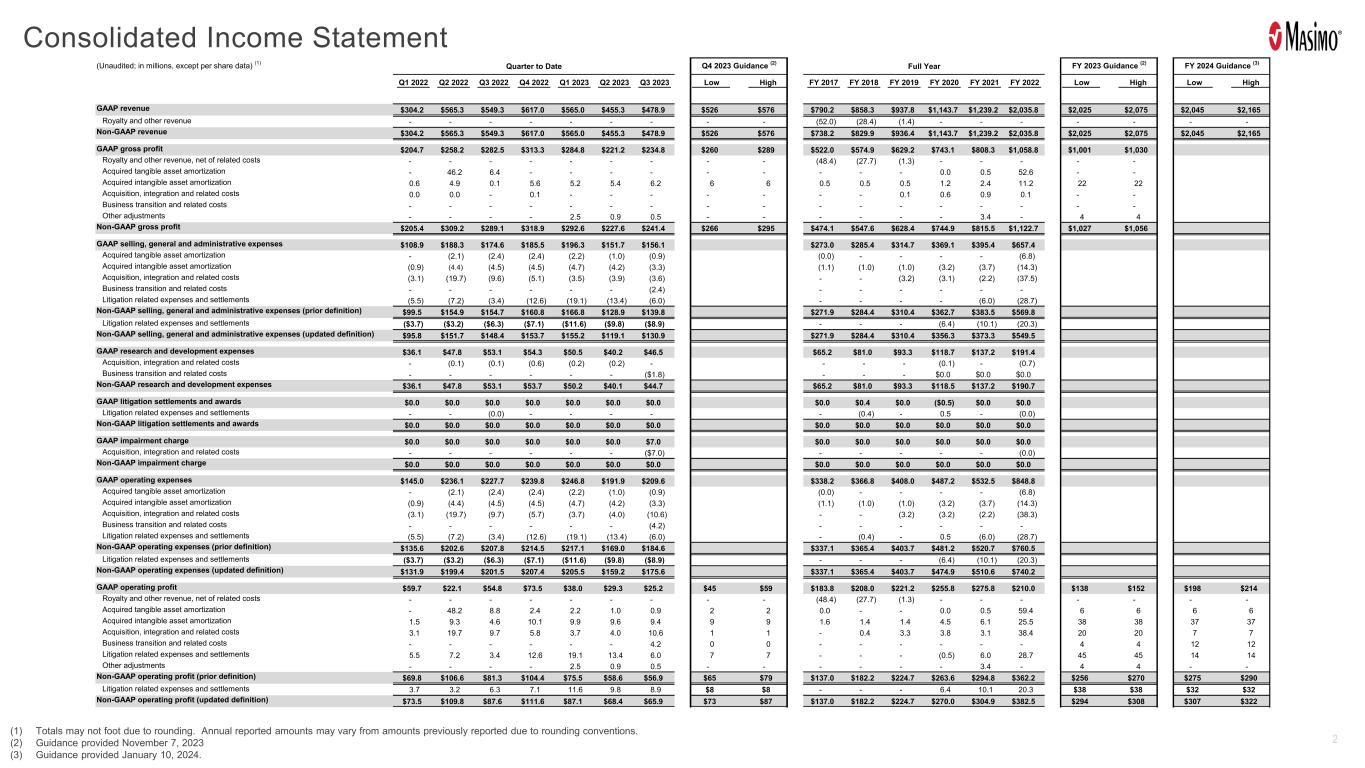

2 Consolidated Income Statement (1) Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conventions. (2) Guidance provided November 7, 2023 (3) Guidance provided January 10, 2024. (Unaudited; in millions, except per share data) (1) Quarter to Date Q4 2023 Guidance (2) Full Year FY 2023 Guidance (2) FY 2024 Guidance (3) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Low High FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 Low High Low High GAAP revenue $304.2 $565.3 $549.3 $617.0 $565.0 $455.3 $478.9 $526 $576 $790.2 $858.3 $937.8 $1,143.7 $1,239.2 $2,035.8 $2,025 $2,075 $2,045 $2,165 Royalty and other revenue - - - - - - - - - (52.0) (28.4) (1.4) - - - - - - - Non-GAAP revenue $304.2 $565.3 $549.3 $617.0 $565.0 $455.3 $478.9 $526 $576 $738.2 $829.9 $936.4 $1,143.7 $1,239.2 $2,035.8 $2,025 $2,075 $2,045 $2,165 GAAP gross profit $204.7 $258.2 $282.5 $313.3 $284.8 $221.2 $234.8 $260 $289 $522.0 $574.9 $629.2 $743.1 $808.3 $1,058.8 $1,001 $1,030 Royalty and other revenue, net of related costs - - - - - - - - - (48.4) (27.7) (1.3) - - - - - Acquired tangible asset amortization - 46.2 6.4 - - - - - - - - - 0.0 0.5 52.6 - - Acquired intangible asset amortization 0.6 4.9 0.1 5.6 5.2 5.4 6.2 6 6 0.5 0.5 0.5 1.2 2.4 11.2 22 22 Acquisition, integration and related costs 0.0 0.0 - 0.1 - - - - - - - 0.1 0.6 0.9 0.1 - - Business transition and related costs - - - - - - - - - - - - - - - - - Other adjustments - - - - 2.5 0.9 0.5 - - - - - - 3.4 - 4 4 Non-GAAP gross profit $205.4 $309.2 $289.1 $318.9 $292.6 $227.6 $241.4 $266 $295 $474.1 $547.6 $628.4 $744.9 $815.5 $1,122.7 $1,027 $1,056 GAAP selling, general and administrative expenses $108.9 $188.3 $174.6 $185.5 $196.3 $151.7 $156.1 $273.0 $285.4 $314.7 $369.1 $395.4 $657.4 Acquired tangible asset amortization - (2.1) (2.4) (2.4) (2.2) (1.0) (0.9) (0.0) - - - - (6.8) Acquired intangible asset amortization (0.9) (4.4) (4.5) (4.5) (4.7) (4.2) (3.3) (1.1) (1.0) (1.0) (3.2) (3.7) (14.3) Acquisition, integration and related costs (3.1) (19.7) (9.6) (5.1) (3.5) (3.9) (3.6) - - (3.2) (3.1) (2.2) (37.5) Business transition and related costs - - - - - - (2.4) - - - - - - Litigation related expenses and settlements (5.5) (7.2) (3.4) (12.6) (19.1) (13.4) (6.0) - - - - (6.0) (28.7) Non-GAAP selling, general and administrative expenses (prior definition) $99.5 $154.9 $154.7 $160.8 $166.8 $128.9 $139.8 $271.9 $284.4 $310.4 $362.7 $383.5 $569.8 Litigation related expenses and settlements ($3.7) ($3.2) ($6.3) ($7.1) ($11.6) ($9.8) ($8.9) - - - (6.4) (10.1) (20.3) Non-GAAP selling, general and administrative expenses (updated definition) $95.8 $151.7 $148.4 $153.7 $155.2 $119.1 $130.9 $271.9 $284.4 $310.4 $356.3 $373.3 $549.5 GAAP research and development expenses $36.1 $47.8 $53.1 $54.3 $50.5 $40.2 $46.5 $65.2 $81.0 $93.3 $118.7 $137.2 $191.4 Acquisition, integration and related costs - (0.1) (0.1) (0.6) (0.2) (0.2) - - - - (0.1) - (0.7) Business transition and related costs - - - - - - ($1.8) - - - $0.0 $0.0 $0.0 Non-GAAP research and development expenses $36.1 $47.8 $53.1 $53.7 $50.2 $40.1 $44.7 $65.2 $81.0 $93.3 $118.5 $137.2 $190.7 GAAP litigation settlements and awards $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.4 $0.0 ($0.5) $0.0 $0.0 Litigation related expenses and settlements - - (0.0) - - - - - (0.4) - 0.5 - (0.0) Non-GAAP litigation settlements and awards $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 GAAP impairment charge $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $7.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Acquisition, integration and related costs - - - - - - ($7.0) - - - - - (0.0) Non-GAAP impairment charge $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 GAAP operating expenses $145.0 $236.1 $227.7 $239.8 $246.8 $191.9 $209.6 $338.2 $366.8 $408.0 $487.2 $532.5 $848.8 Acquired tangible asset amortization - (2.1) (2.4) (2.4) (2.2) (1.0) (0.9) (0.0) - - - - (6.8) Acquired intangible asset amortization (0.9) (4.4) (4.5) (4.5) (4.7) (4.2) (3.3) (1.1) (1.0) (1.0) (3.2) (3.7) (14.3) Acquisition, integration and related costs (3.1) (19.7) (9.7) (5.7) (3.7) (4.0) (10.6) - - (3.2) (3.2) (2.2) (38.3) Business transition and related costs - - - - - - (4.2) - - - - - - Litigation related expenses and settlements (5.5) (7.2) (3.4) (12.6) (19.1) (13.4) (6.0) - (0.4) - 0.5 (6.0) (28.7) Non-GAAP operating expenses (prior definition) $135.6 $202.6 $207.8 $214.5 $217.1 $169.0 $184.6 $337.1 $365.4 $403.7 $481.2 $520.7 $760.5 Litigation related expenses and settlements ($3.7) ($3.2) ($6.3) ($7.1) ($11.6) ($9.8) ($8.9) - - - (6.4) (10.1) (20.3) Non-GAAP operating expenses (updated definition) $131.9 $199.4 $201.5 $207.4 $205.5 $159.2 $175.6 $337.1 $365.4 $403.7 $474.9 $510.6 $740.2 GAAP operating profit $59.7 $22.1 $54.8 $73.5 $38.0 $29.3 $25.2 $45 $59 $183.8 $208.0 $221.2 $255.8 $275.8 $210.0 $138 $152 $198 $214 Royalty and other revenue, net of related costs - - - - - - - - - (48.4) (27.7) (1.3) - - - - - - - Acquired tangible asset amortization - 48.2 8.8 2.4 2.2 1.0 0.9 2 2 0.0 - - 0.0 0.5 59.4 6 6 6 6 Acquired intangible asset amortization 1.5 9.3 4.6 10.1 9.9 9.6 9.4 9 9 1.6 1.4 1.4 4.5 6.1 25.5 38 38 37 37 Acquisition, integration and related costs 3.1 19.7 9.7 5.8 3.7 4.0 10.6 1 1 - 0.4 3.3 3.8 3.1 38.4 20 20 7 7 Business transition and related costs - - - - - - 4.2 0 0 - - - - - - 4 4 12 12 Litigation related expenses and settlements 5.5 7.2 3.4 12.6 19.1 13.4 6.0 7 7 - - - (0.5) 6.0 28.7 45 45 14 14 Other adjustments - - - - 2.5 0.9 0.5 - - - - - - 3.4 - 4 4 - - Non-GAAP operating profit (prior definition) $69.8 $106.6 $81.3 $104.4 $75.5 $58.6 $56.9 $65 $79 $137.0 $182.2 $224.7 $263.6 $294.8 $362.2 $256 $270 $275 $290 Litigation related expenses and settlements 3.7 3.2 6.3 7.1 11.6 9.8 8.9 $8 $8 - - - 6.4 10.1 20.3 $38 $38 $32 $32 Non-GAAP operating profit (updated definition) $73.5 $109.8 $87.6 $111.6 $87.1 $68.4 $65.9 $73 $87 $137.0 $182.2 $224.7 $270.0 $304.9 $382.5 $294 $308 $307 $322

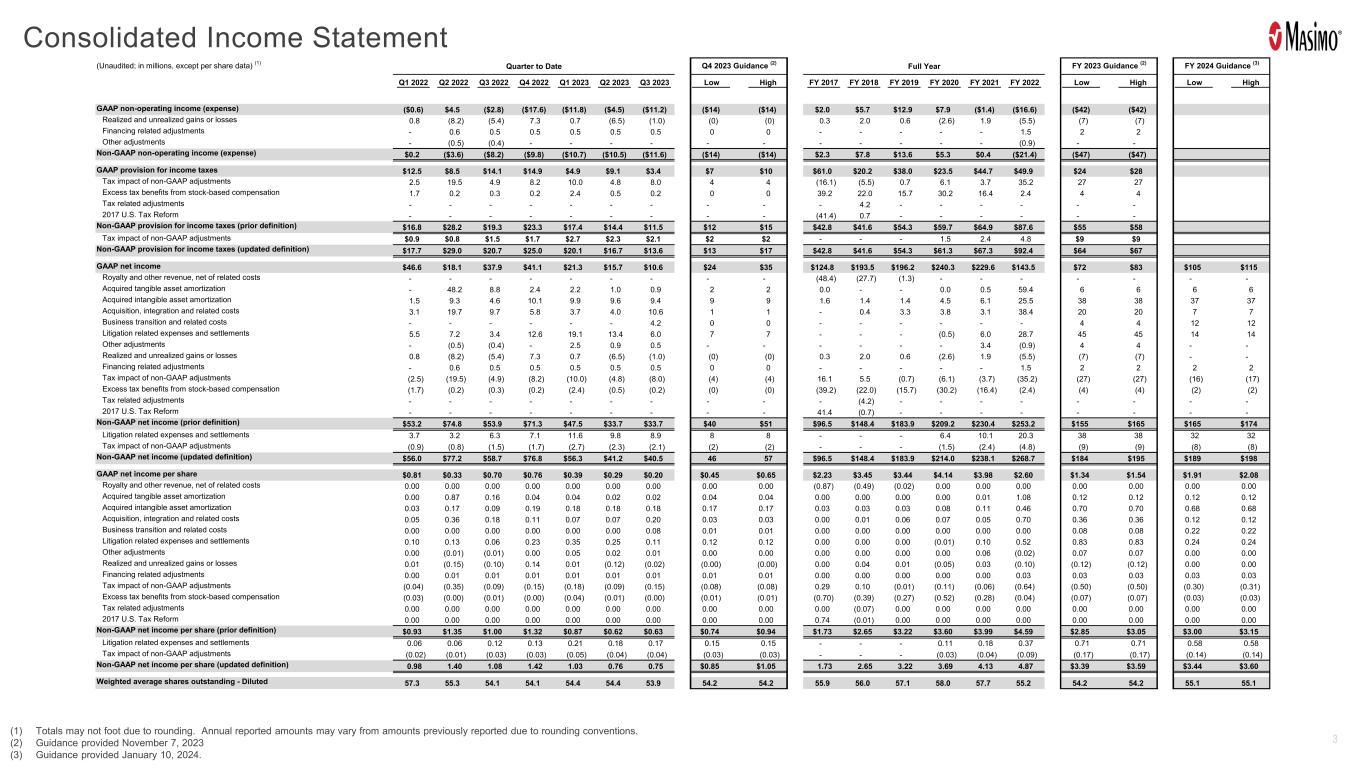

3 Consolidated Income Statement (1) Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conventions. (2) Guidance provided November 7, 2023 (3) Guidance provided January 10, 2024. (Unaudited; in millions, except per share data) (1) Quarter to Date Q4 2023 Guidance (2) Full Year FY 2023 Guidance (2) FY 2024 Guidance (3) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Low High FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 Low High Low High GAAP non-operating income (expense) ($0.6) $4.5 ($2.8) ($17.6) ($11.8) ($4.5) ($11.2) ($14) ($14) $2.0 $5.7 $12.9 $7.9 ($1.4) ($16.6) ($42) ($42) Realized and unrealized gains or losses 0.8 (8.2) (5.4) 7.3 0.7 (6.5) (1.0) (0) (0) 0.3 2.0 0.6 (2.6) 1.9 (5.5) (7) (7) Financing related adjustments - 0.6 0.5 0.5 0.5 0.5 0.5 0 0 - - - - - 1.5 2 2 Other adjustments - (0.5) (0.4) - - - - - - - - - - - (0.9) - - Non-GAAP non-operating income (expense) $0.2 ($3.6) ($8.2) ($9.8) ($10.7) ($10.5) ($11.6) ($14) ($14) $2.3 $7.8 $13.6 $5.3 $0.4 ($21.4) ($47) ($47) GAAP provision for income taxes $12.5 $8.5 $14.1 $14.9 $4.9 $9.1 $3.4 $7 $10 $61.0 $20.2 $38.0 $23.5 $44.7 $49.9 $24 $28 Tax impact of non-GAAP adjustments 2.5 19.5 4.9 8.2 10.0 4.8 8.0 4 4 (16.1) (5.5) 0.7 6.1 3.7 35.2 27 27 Excess tax benefits from stock-based compensation 1.7 0.2 0.3 0.2 2.4 0.5 0.2 0 0 39.2 22.0 15.7 30.2 16.4 2.4 4 4 Tax related adjustments - - - - - - - - - - 4.2 - - - - - - 2017 U.S. Tax Reform - - - - - - - - - (41.4) 0.7 - - - - - - Non-GAAP provision for income taxes (prior definition) $16.8 $28.2 $19.3 $23.3 $17.4 $14.4 $11.5 $12 $15 $42.8 $41.6 $54.3 $59.7 $64.9 $87.6 $55 $58 Tax impact of non-GAAP adjustments $0.9 $0.8 $1.5 $1.7 $2.7 $2.3 $2.1 $2 $2 - - - 1.5 2.4 4.8 $9 $9 Non-GAAP provision for income taxes (updated definition) $17.7 $29.0 $20.7 $25.0 $20.1 $16.7 $13.6 $13 $17 $42.8 $41.6 $54.3 $61.3 $67.3 $92.4 $64 $67 GAAP net income $46.6 $18.1 $37.9 $41.1 $21.3 $15.7 $10.6 $24 $35 $124.8 $193.5 $196.2 $240.3 $229.6 $143.5 $72 $83 $105 $115 Royalty and other revenue, net of related costs - - - - - - - - - (48.4) (27.7) (1.3) - - - - - - - Acquired tangible asset amortization - 48.2 8.8 2.4 2.2 1.0 0.9 2 2 0.0 - - 0.0 0.5 59.4 6 6 6 6 Acquired intangible asset amortization 1.5 9.3 4.6 10.1 9.9 9.6 9.4 9 9 1.6 1.4 1.4 4.5 6.1 25.5 38 38 37 37 Acquisition, integration and related costs 3.1 19.7 9.7 5.8 3.7 4.0 10.6 1 1 - 0.4 3.3 3.8 3.1 38.4 20 20 7 7 Business transition and related costs - - - - - - 4.2 0 0 - - - - - - 4 4 12 12 Litigation related expenses and settlements 5.5 7.2 3.4 12.6 19.1 13.4 6.0 7 7 - - - (0.5) 6.0 28.7 45 45 14 14 Other adjustments - (0.5) (0.4) - 2.5 0.9 0.5 - - - - - - 3.4 (0.9) 4 4 - - Realized and unrealized gains or losses 0.8 (8.2) (5.4) 7.3 0.7 (6.5) (1.0) (0) (0) 0.3 2.0 0.6 (2.6) 1.9 (5.5) (7) (7) - - Financing related adjustments - 0.6 0.5 0.5 0.5 0.5 0.5 0 0 - - - - - 1.5 2 2 2 2 Tax impact of non-GAAP adjustments (2.5) (19.5) (4.9) (8.2) (10.0) (4.8) (8.0) (4) (4) 16.1 5.5 (0.7) (6.1) (3.7) (35.2) (27) (27) (16) (17) Excess tax benefits from stock-based compensation (1.7) (0.2) (0.3) (0.2) (2.4) (0.5) (0.2) (0) (0) (39.2) (22.0) (15.7) (30.2) (16.4) (2.4) (4) (4) (2) (2) Tax related adjustments - - - - - - - - - - (4.2) - - - - - - - - 2017 U.S. Tax Reform - - - - - - - - - 41.4 (0.7) - - - - - - - - Non-GAAP net income (prior definition) $53.2 $74.8 $53.9 $71.3 $47.5 $33.7 $33.7 $40 $51 $96.5 $148.4 $183.9 $209.2 $230.4 $253.2 $155 $165 $165 $174 Litigation related expenses and settlements 3.7 3.2 6.3 7.1 11.6 9.8 8.9 8 8 - - - 6.4 10.1 20.3 38 38 32 32 Tax impact of non-GAAP adjustments (0.9) (0.8) (1.5) (1.7) (2.7) (2.3) (2.1) (2) (2) - - - (1.5) (2.4) (4.8) (9) (9) (8) (8) Non-GAAP net income (updated definition) $56.0 $77.2 $58.7 $76.8 $56.3 $41.2 $40.5 46 57 $96.5 $148.4 $183.9 $214.0 $238.1 $268.7 $184 $195 $189 $198 GAAP net income per share $0.81 $0.33 $0.70 $0.76 $0.39 $0.29 $0.20 $0.45 $0.65 $2.23 $3.45 $3.44 $4.14 $3.98 $2.60 $1.34 $1.54 $1.91 $2.08 Royalty and other revenue, net of related costs 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (0.87) (0.49) (0.02) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Acquired tangible asset amortization 0.00 0.87 0.16 0.04 0.04 0.02 0.02 0.04 0.04 0.00 0.00 0.00 0.00 0.01 1.08 0.12 0.12 0.12 0.12 Acquired intangible asset amortization 0.03 0.17 0.09 0.19 0.18 0.18 0.18 0.17 0.17 0.03 0.03 0.03 0.08 0.11 0.46 0.70 0.70 0.68 0.68 Acquisition, integration and related costs 0.05 0.36 0.18 0.11 0.07 0.07 0.20 0.03 0.03 0.00 0.01 0.06 0.07 0.05 0.70 0.36 0.36 0.12 0.12 Business transition and related costs 0.00 0.00 0.00 0.00 0.00 0.00 0.08 0.01 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.08 0.08 0.22 0.22 Litigation related expenses and settlements 0.10 0.13 0.06 0.23 0.35 0.25 0.11 0.12 0.12 0.00 0.00 0.00 (0.01) 0.10 0.52 0.83 0.83 0.24 0.24 Other adjustments 0.00 (0.01) (0.01) 0.00 0.05 0.02 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.06 (0.02) 0.07 0.07 0.00 0.00 Realized and unrealized gains or losses 0.01 (0.15) (0.10) 0.14 0.01 (0.12) (0.02) (0.00) (0.00) 0.00 0.04 0.01 (0.05) 0.03 (0.10) (0.12) (0.12) 0.00 0.00 Financing related adjustments 0.00 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.00 0.00 0.00 0.00 0.00 0.03 0.03 0.03 0.03 0.03 Tax impact of non-GAAP adjustments (0.04) (0.35) (0.09) (0.15) (0.18) (0.09) (0.15) (0.08) (0.08) 0.29 0.10 (0.01) (0.11) (0.06) (0.64) (0.50) (0.50) (0.30) (0.31) Excess tax benefits from stock-based compensation (0.03) (0.00) (0.01) (0.00) (0.04) (0.01) (0.00) (0.01) (0.01) (0.70) (0.39) (0.27) (0.52) (0.28) (0.04) (0.07) (0.07) (0.03) (0.03) Tax related adjustments 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (0.07) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2017 U.S. Tax Reform 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.74 (0.01) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Non-GAAP net income per share (prior definition) $0.93 $1.35 $1.00 $1.32 $0.87 $0.62 $0.63 $0.74 $0.94 $1.73 $2.65 $3.22 $3.60 $3.99 $4.59 $2.85 $3.05 $3.00 $3.15 Litigation related expenses and settlements 0.06 0.06 0.12 0.13 0.21 0.18 0.17 0.15 0.15 - - - 0.11 0.18 0.37 0.71 0.71 0.58 0.58 Tax impact of non-GAAP adjustments (0.02) (0.01) (0.03) (0.03) (0.05) (0.04) (0.04) (0.03) (0.03) - - - (0.03) (0.04) (0.09) (0.17) (0.17) (0.14) (0.14) Non-GAAP net income per share (updated definition) 0.98 1.40 1.08 1.42 1.03 0.76 0.75 $0.85 $1.05 1.73 2.65 3.22 3.69 4.13 4.87 $3.39 $3.59 $3.44 $3.60 Weighted average shares outstanding - Diluted 57.3 55.3 54.1 54.1 54.4 54.4 53.9 54.2 54.2 55.9 56.0 57.1 58.0 57.7 55.2 54.2 54.2 55.1 55.1

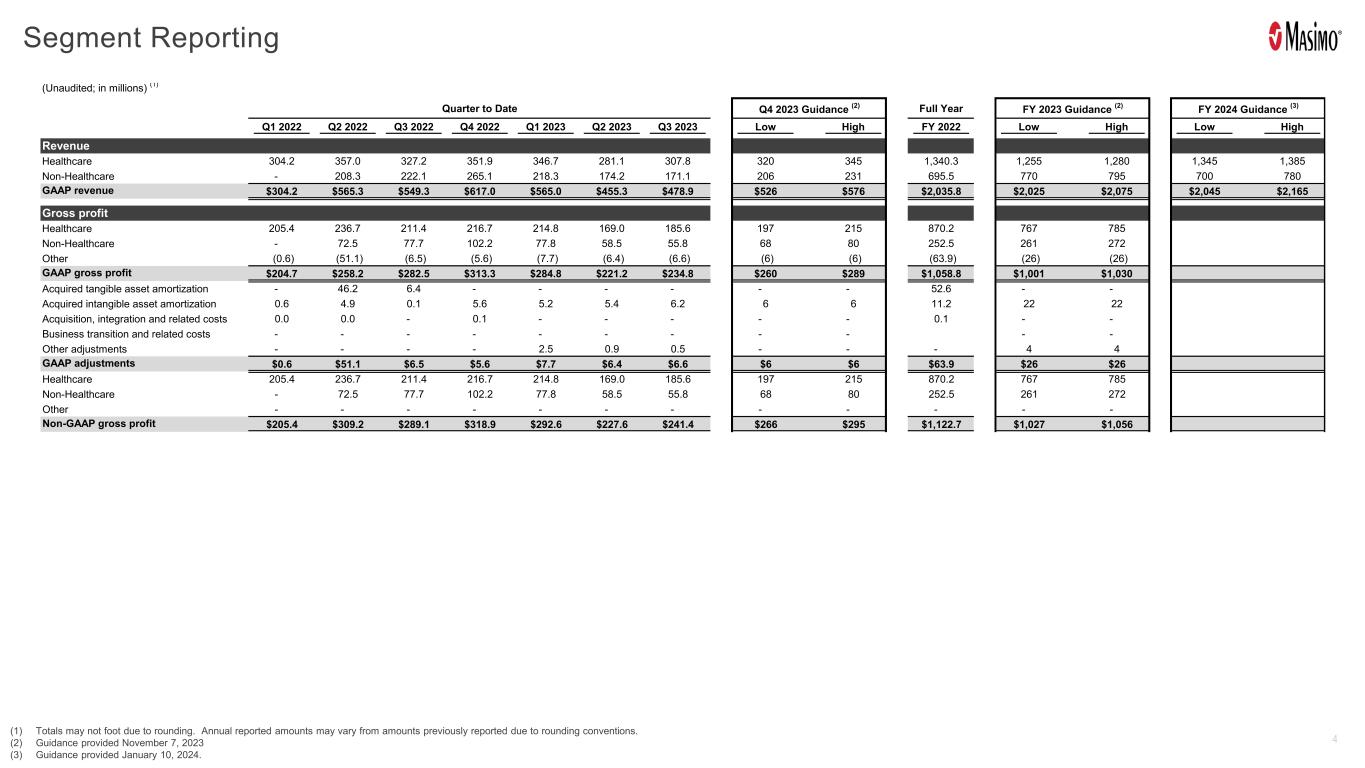

4 Segment Reporting (1) Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conventions. (2) Guidance provided November 7, 2023 (3) Guidance provided January 10, 2024. (Unaudited; in millions) (1) Quarter to Date Q4 2023 Guidance (2) Full Year FY 2023 Guidance (2) FY 2024 Guidance (3) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Low High FY 2022 Low High Low High Revenue Healthcare 304.2 357.0 327.2 351.9 346.7 281.1 307.8 320 345 1,340.3 1,255 1,280 1,345 1,385 Non-Healthcare - 208.3 222.1 265.1 218.3 174.2 171.1 206 231 695.5 770 795 700 780 GAAP revenue $304.2 $565.3 $549.3 $617.0 $565.0 $455.3 $478.9 $526 $576 $2,035.8 $2,025 $2,075 $2,045 $2,165 Gross profit Healthcare 205.4 236.7 211.4 216.7 214.8 169.0 185.6 197 215 870.2 767 785 Non-Healthcare - 72.5 77.7 102.2 77.8 58.5 55.8 68 80 252.5 261 272 Other (0.6) (51.1) (6.5) (5.6) (7.7) (6.4) (6.6) (6) (6) (63.9) (26) (26) GAAP gross profit $204.7 $258.2 $282.5 $313.3 $284.8 $221.2 $234.8 $260 $289 $1,058.8 $1,001 $1,030 Acquired tangible asset amortization - 46.2 6.4 - - - - - - 52.6 - - Acquired intangible asset amortization 0.6 4.9 0.1 5.6 5.2 5.4 6.2 6 6 11.2 22 22 Acquisition, integration and related costs 0.0 0.0 - 0.1 - - - - - 0.1 - - Business transition and related costs - - - - - - - - - - - Other adjustments - - - - 2.5 0.9 0.5 - - - 4 4 GAAP adjustments $0.6 $51.1 $6.5 $5.6 $7.7 $6.4 $6.6 $6 $6 $63.9 $26 $26 Healthcare 205.4 236.7 211.4 216.7 214.8 169.0 185.6 197 215 870.2 767 785 Non-Healthcare - 72.5 77.7 102.2 77.8 58.5 55.8 68 80 252.5 261 272 Other - - - - - - - - - - - - Non-GAAP gross profit $205.4 $309.2 $289.1 $318.9 $292.6 $227.6 $241.4 $266 $295 $1,122.7 $1,027 $1,056

© 2019 Masimo Non-GAAP Measures, Adjustments and Definitions Updated January 10, 2024

© 2019 Masimo Forward-Looking Statements Masimo Corporation (“Masimo”, “MASI”, or the “Company”) cautions you that statements included in this presentation that are not a description of historical facts are forward-looking statements that involve risks, uncertainties, assumptions and other factors which, if they do not materialize or prove correct, could cause the Company’s results to differ materially and adversely from historical results or those expressed or implied by such forward-looking statements. Further information on Masimo’s disclaimer and forward-looking statements and the potential risks and uncertainties that could cause actual results to differ materially are more fully described in the Company’s press releases and periodic filings with the Securities and Exchange Commission.

© 2019 Masimo The Company uses certain non-GAAP financial measures such as constant currency revenue growth, non- GAAP gross profit/margin percentage, non-GAAP SG&A expense percentage, non-GAAP R&D expense percentage, non-GAAP operating income/margin percentage, non-GAAP provision for income taxes/tax rate, non-GAAP net income, non-GAAP net income per diluted share, adjusted EBITDA and adjusted free cash flow. These non-GAAP financial measures may include certain adjustments related to the following items: > Constant currency revenue adjustments > Acquisition, integration and related costs > Acquired tangible asset amortization > Acquired intangible asset amortization > Litigation related expenses and settlements (prior definition) > Litigation related expenses and settlements (updated definition) > Business transition and related costs > Realized and unrealized gains or losses > Financing related adjustments > Tax impact of non-GAAP adjustments > Tax events > Excess tax benefits from stock-based compensation expense > Other adjustments Non-GAAP Measures & Adjustments

© 2019 Masimo Non-GAAP Measures & Adjustments (continued) The Company also uses non-GAAP liquidity measures such as adjusted free cash flow, which excludes certain cash items related to the foregoing that may impact period-to-period comparability, and adjusted EBITDA, which excludes non-cash stock-based compensation expense. The Company uses these non-GAAP financial measures to enable it to further and more consistently analyze the period-to-period financial performance and liquidity of its core business operations, which are generally designated as “non-GAAP” measures herein. Management believes that providing investors with these non-GAAP financial measures gives investors additional information to enable them to assess, in the same way management assesses, the Company’s current and future core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs and expenditures associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. Reconciliations of the non-GAAP financial measures to the nearest comparable GAAP financial measures can be found on the Investor Relations section of the Company’s website.

© 2019 Masimo Non-GAAP Definitions > Constant currency revenue adjustments ▪ Some of our sales agreements with foreign customers provide for payment in currencies other than the U.S. Dollar. These foreign currency revenues, when converted into U.S. Dollars, can vary significantly from period-to-period depending on the average and quarter-end exchange rates during a respective period. We believe that comparing these foreign currency denominated revenues by holding the exchange rates constant with the prior year period is useful to management and investors in evaluating our revenue growth rates on a period-to-period basis. We anticipate that fluctuations in foreign exchange rates and the related constant currency adjustments for calculation of our revenue growth rate will continue to occur in future periods. > Acquisition, integration and related costs ▪ These transactions represent gains, losses, and other related costs associated with acquisitions, integrations, investments, divestitures, assets impairments, and in-process research and development. > Acquired tangible asset amortization ▪ These transactions represent amortization expense in connection with business or assets acquisitions associated with acquired tangible assets and asset valuation step-ups. > Acquired intangible asset amortization ▪ These transactions represent amortization expense in connection with business or assets acquisitions associated with acquired intangible assets including, but not limited to customer relationships, intellectual property, trade names and non- competition agreements.

© 2019 Masimo Non-GAAP Definitions (continued) > Litigation related expenses and settlements (prior definition) ▪ These transactions represent gains, losses, and other related costs associated with certain litigation matters, which can vary in their characteristics, frequency and significance to our operating results. > Litigation related expenses and settlements (updated definition) ■ We have been engaged in various legal proceedings against Apple since January 2020, including various proceedings in the federal courts, various proceedings in the U.S. Patent and Trademark Office (the “PTO proceedings”), and a proceeding in the U.S. International Trade Commission (the “ITC proceeding”). Although we previously excluded only expenses relating to the ITC proceeding from the definition of “Litigation related expenses and settlements”, beginning with the first quarter of 2024, we have revised the definition of “Litigation related expenses and settlements” to exclude not only expenses relating to the ITC proceeding, but also all other Apple litigation expenses, including those relating to the federal court proceedings and the PTO proceedings. We believe all of the Apple litigation expenses are unique in nature and not indicative of the Company’s on-going operating performance, and this updated definition will provide more useful information to investors by facilitating period-to-period comparisons of our financial performance that otherwise may be obscured by the significant fluctuations in Apple-related litigation expenses. > Business transition and related costs ▪ These transactions represent gains, losses, and other related costs associated with business transition plans. These items may include but are not limited to severance, relocation, consulting, leasehold exit costs, asset impairment, and other related costs to rationalize our operational footprint and optimize business results.

© 2019 Masimo Non-GAAP Definitions (continued) > Realized and unrealized gains or losses ▪ These transactions represent gains, losses, and other related costs associated with foreign currency denominated transactions and investments. Changes in the underlying currency rates relative to the U.S. Dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Unrealized and realized gains and losses on investments may impact the Company’s reported results of operations for a period. These items are highly variable, difficult to predict and outside the control of those responsible for the underlying operations of the business. Other items also included here are mark-to-market gains and losses of derivative contracts that are not designated as hedging instruments or the ineffective portions of cash flow hedges. > Financing related adjustments ▪ The Company may enter into various financial arrangements whereby costs are incurred and certain instrument features are valued and expensed accordingly but are not necessarily indicative of the on-going cash flow generation of the Company and therefore excludes these costs from non-GAAP earnings. For GAAP earnings per diluted share purposes, the Company cannot reflect the anti-dilutive impact, if applicable, in its diluted shares calculations. However, the Company believes that reflecting the anti-dilutive impact of these instruments in non-GAAP earnings per diluted share provides management and investors with useful information in evaluating the financial performance of the Company on a per share basis. > Tax impact of non-GAAP adjustments ▪ In order to reflect the tax effected impact of the non-GAAP adjustments, the Company will adjust the non-GAAP earnings by the approximate tax impact of these adjustments.

© 2019 Masimo Non-GAAP Definitions (continued) > Tax events ▪ This represents certain tax events that impact period over period comparability and do not represent the underlying ongoing results of the core operations. The Company may choose to exclude these tax events from non-GAAP earnings. > Excess tax benefits from stock-based compensation expense ▪ GAAP requires that excess tax benefits recognized on stock-based compensation expense be reflected in our provision for income taxes rather than paid-in capital. As these excess tax benefits may be highly variable from period-to-period, the Company may choose to exclude these tax benefits from non-GAAP earnings to facilitate comparability between periods and with peers. > Adjusted free cash flow ▪ Represents free cash flow (cash flow from operations less cash used in the purchase of property, plant and equipment) adjusted for the impact of cash receipts or payments relating to certain previously described non-GAAP adjustments, which may impact period-to-period comparability. > Adjusted EBITDA ▪ Represents earnings before non-operating income/expense, taxes, depreciation and amortization, as adjusted for the applicable non-GAAP adjustments previously described, and further excluding non-cash stock-based compensation expense. > Other adjustments ▪ In the event there are gains, losses and other adjustments which impact period-to-period comparability and do not represent the underlying ongoing results of the business, the Company may choose to exclude these from non-GAAP earnings.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Masimo (NASDAQ:MASI)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Masimo (NASDAQ:MASI)

Historical Stock Chart

Von Mai 2023 bis Mai 2024