false

0001600983

0001600983

2024-03-01

2024-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 1, 2024

Knightscope, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41248 |

|

46-2482575 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1070 Terra Bella Avenue

Mountain View, California 94043

(Address of principal executive offices)(Zip

Code)

Registrant’s telephone number, including

area code: (650) 924-1025

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 per share |

|

KSCP |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 |

Regulation FD Disclosure. |

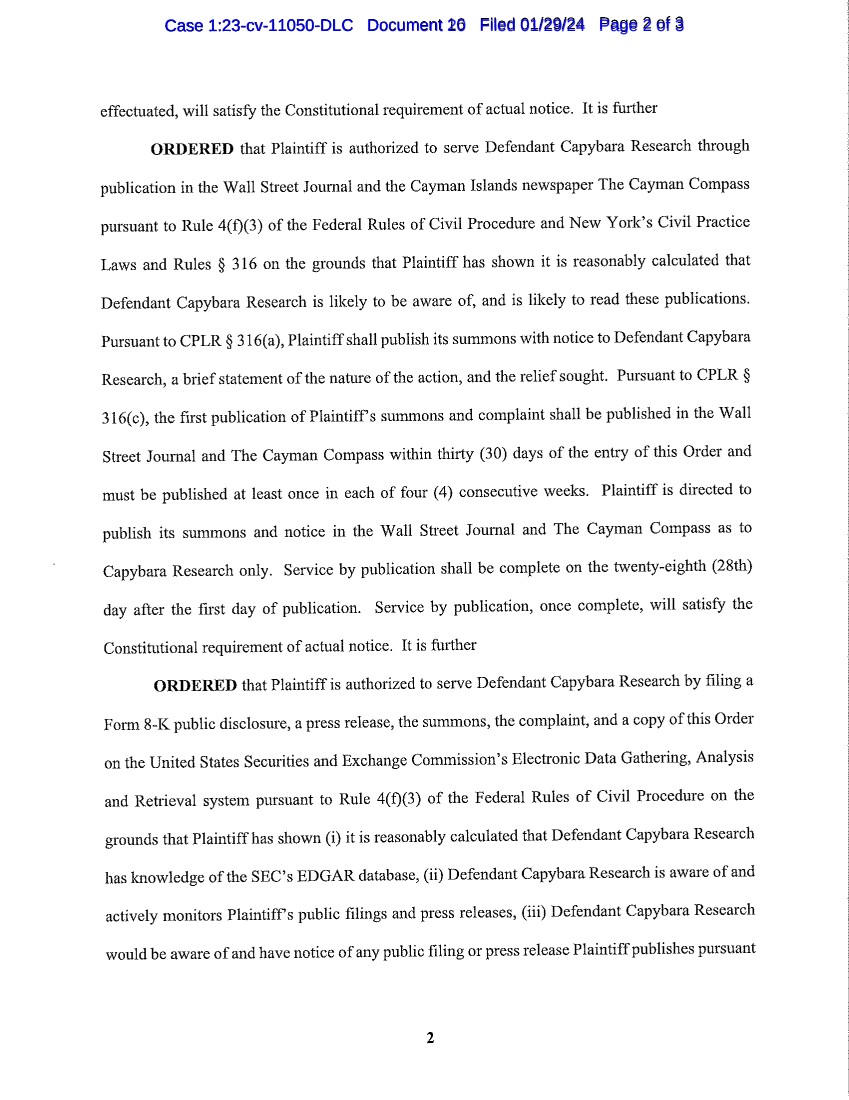

On January 29, 2024, The Honorable Denise L. Cote in the United

States District Court for the Southern District of New York entered an Order, ECF 29 (the “Order”), in the matter of Knightscope, Inc.

(the “Company”) v. Capybara Research et. al., Case No. 1:23-cv-11050-DLC (the “Capybara Action”), permitting

the Company to serve its summons and complaint upon Defendant Capybara Research by filing this Current Report on Form 8-K and publishing

the press release, attached hereto as Exhibit 99.1. Pursuant to the Order, the filing of this Current Report on Form 8-K, the

summons attached hereto as Exhibit 99.2, the complaint attached hereto as Exhibit 99.3, and the Order attached hereto as Exhibit 99.4,

shall provide the constitutional requirement of actual notice of the Capybara Action to Capybara Research pursuant to Rule 4(f)(3) of

the Federal Rules of Civil Procedure.

The information in this Item 7.01, including the information contained

in Exhibits 99.1, 99.2, 99.3, and 99.4 of this Current Report on Form 8-K, is in each case furnished herewith and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities under that section, nor shall any of the foregoing be deemed incorporated by reference in any

filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general

incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

The following Exhibits 99.1, 99.2, 99.3, and 99.4 each relates to Item

7.01 and shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

knightscope, INC. |

| |

|

|

| Date: March 1, 2024 |

|

By: |

/s/ William Santana Li |

| |

|

Name: |

William Santana Li |

| |

|

Title: |

Chief Executive Officer and President |

Exhibit 99.1

Knightscope News

Release

March 1, 2024 6:30 AM ET

Litigation Update - Knightscope

Authorized to Serve Notice of Action

Against Capybara Research by Public Disclosure and Press Release Pursuant to Court Order

MOUNTAIN VIEW, Calif.,

March 1, 2024 -- On December 20, 2023, Knightscope, Inc. [Nasdaq:

KSCP] (“Knightscope” or the “Company”) filed a federal lawsuit in the United States District Court for the Southern

District of New York, Knightscope, Inc. v. Capybara Research et. al., Case No. 1:23-cv-11050-DLC (the “Action”)

against Capybara Research, Igor Appelboom (“Appelboom,” and together with Capybara Research, the “Capybara Defendants”),

and Accretive Capital LLC d/b/a Benzinga. Capybara Research is a short selling research firm that writes and publishes what the Company

believes are malicious and defamatory articles – known as “short seller reports” – devised to negatively impact

the share prices of publicly traded companies in which Capybara Research and its owner, Appelboom, hold a short position.

The Action alleges that the Capybara Defendants take

short positions in publicly traded companies and release fraudulent, disparaging reports in order to drive the company’s stock price

down for their own financial benefit. In July and August of 2023, the Capybara Defendants posted to X (f/k/a Twitter)

links to two alleged defamatory “short reports” (hereinafter, the “Capybara Reports”) on Capybara Research’s

website disparaging the Company for the purpose of driving down the Company’s share price. Indeed, Capybara Research admits in the

Capybara Reports that it “hold[s] a short position in shares of $KSCP....” As alleged in the Action, the Company believes

that the Capybara Reports are a direct cause of the subsequent drop in market price of KSCP stock.

On January 25, 2024, the Company, through its

counsel at The Basile Law Firm P.C., filed an ex parte motion for alternative service pursuant to Fed. R. Civ. P. 4(f)(3). On January 29,

2024, The Honorable Denise L. Cote granted the Company’s motion, in part, authorizing the Company to serve defendant Capybara Research

notice of the Action through this press release and Form 8-K filed on the Securities and Exchange Commission’s EDGAR database.

Pursuant to the Order of The Honorable Denise L. Cote

in the United States District Court for the Southern District of New York, entered on January 29, 2024 (ECF 29), in the matter of Knightscope, Inc.

v. Capybara Research et. al., Case No. 1:23-cv-11050-DLC, this press release, the Current Report on Form 8-K filed on March 1,

2024, and the exhibits thereto containing the Summons, Complaint, and the Court Order, hereby provide the constitutional requirement of

actual notice of the Action to Defendant Capybara Research in accordance with Rule 4(f)(3) of the Federal Rules of Civil

Procedure.

About Knightscope

Knightscope

builds cutting-edge technologies to improve public safety, and our long-term ambition is to make the United States of America the safest

country in the world. Learn more about us and book a discovery call or demonstration today at www.knightscope.com/discover

Forward-Looking Statements

This press release may contain “forward-looking

statements” about Knightscope’s future expectations, plans, outlook, projections and prospects. Such forward-looking statements

can be identified by the use of words such as “should,” “may,” “intends,” “anticipates,”

“believes,” “estimates,” “projects,” “forecasts,” “expects,” “plans,”

“proposes” and similar expressions. Forward-looking statements contained in this press release and other communications include,

but are not limited to, statements about the Company’s goals, profitability, growth, prospects, and the Company’s intention

to litigate the allegations in the Action, including that the Capybara Defendants have made fraudulent, disparaging reports in order to

drive the Company’s stock price down for their own financial benefit, and the ultimate outcome of such litigation. Although Knightscope

believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of

risks, uncertainties and other important factors that could cause actual results to differ materially from such forward-looking statements.

These risks and uncertainties include, among other things, the Company’s ability to successfully litigate its allegations. Readers

are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading

“Risk Factors” in Knightscope’s Annual Report on Form 10-K for the year ended December 31, 2022. Forward-looking

statements speak only as of the date of the document in which they are contained, and Knightscope does not undertake any duty to update

any forward-looking statements, except as may be required by law.

Public Relations:

Stacy Stephens

Knightscope, Inc.

(650) 924-1025

# #

#

Exhibit 99.2

| AO 440 (Rev. 06/12) Summons in a Civil Action

UNITED STATES DISTRICT COURT

for the

__________ District of __________

)

)

)

)

)

)

)

)

)

)

)

)

Plaintiff(s)

v. Civil Action No.

Defendant(s)

SUMMONS IN A CIVIL ACTION

To: (Defendant’s name and address)

A lawsuit has been filed against you.

Within 21 days after service of this summons on you (not counting the day you received it) — or 60 days if you

are the United States or a United States agency, or an officer or employee of the United States described in Fed. R. Civ.

P. 12 (a)(2) or (3) — you must serve on the plaintiff an answer to the attached complaint or a motion under Rule 12 of

the Federal Rules of Civil Procedure. The answer or motion must be served on the plaintiff or plaintiff’s attorney,

whose name and address are:

If you fail to respond, judgment by default will be entered against you for the relief demanded in the complaint.

You also must file your answer or motion with the court.

CLERK OF COURT

Date:

Signature of Clerk or Deputy Clerk

Southern District of New York

KNIGHTSCOPE, INC.

1:23-cv-11050

CAPYBARA RESEARCH, IGOR APPELBOOM and

ACCRETIVE CAPITAL LLC d/b/a BENZINGA

Capybara Research

Unknown Address

Waleed Amer, Esq.

The Basile Law Firm P.C.

390 N. Broadway, Suite 140

Jericho, New York 11753

Case 1:23-cv-11050-DLC Document 21 Filed 01/31/24 Page 1 of 2

2/1/2024 /s/ P. Canales

Case 1:23-cv-11050-DLC Document 22 Filed 02/01/24 Page 1 of 2 |

| AO 440 (Rev. 06/12) Summons in a Civil Action (Page 2)

Civil Action No.

PROOF OF SERVICE

(This section should not be filed with the court unless required by Fed. R. Civ. P. 4 (l))

This summons for (name of individual and title, if any)

was received by me on (date) .

’ I personally served the summons on the individual at (place)

on (date) ; or

’ I left the summons at the individual’s residence or usual place of abode with (name)

, a person of suitable age and discretion who resides there,

on (date) , and mailed a copy to the individual’s last known address; or

’ I served the summons on (name of individual) , who is

designated by law to accept service of process on behalf of (name of organization)

on (date) ; or

’ I returned the summons unexecuted because ; or

’ Other (specify):

..

My fees are $ for travel and $ for services, for a total of $ .

I declare under penalty of perjury that this information is true.

Date:

Server’s signature

Printed name and title

Server’s address

Additional information regarding attempted service, etc:

1:23-cv-11050

0.00

Case 1:23-cv-11050-DLC Document 21 Filed 01/31/24 Page 2 of 2 Case 1:23-cv-11050-DLC Document 22 Filed 02/01/24 Page 2 of 2 |

Exhibit 99.3

| 1

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

KNIGHTSCOPE, INC.,

Plaintiff,

v.

CAPYBARA RESEARCH, IGOR

APPELBOOM, and ACCRETIVE

CAPITAL LLC d/b/a BENZINGA,

Defendants.

CIVIL ACTION NO. _____________

COMPLAINT

Plaintiff Knightscope, Inc. (“KSCP,” “Knightscope” or “Plaintiff”), by and through their

undersigned counsel, respectfully states as follows for its Complaint against Defendants Capybara

Research (“Capybara Research” or “Capybara”), Igor Appelboom (“Appelboom,” together with

Capybara Research, the “Capybara Defendants”) and Accretive Capital LLC d/b/a Benzinga

(“Benzinga,” together with the Capybara Defendants, “Defendants”).

THE PARTIES

1. Plaintiff Knightscope, Inc. is a Delaware corporation with its principal place of

business and headquarters located at 1070 Terra Bella Avenue, Mountain View, California 94043.

2. Defendant Capybara Research is a short selling research firm with an unknown

principal place of business.

3. Defendant Igor Appelboom is an individual who resides in the country of Brazil at

Av Antonio Gil Veloso 2232, Es, Vila Velha, Brazil 29101-738.

4. Appelboom is the owner and operator of Capybara Research and the author and

publisher of the Capybara Research Report.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 1 of 19 |

| 2

5. Defendant Accretive Capital LLC d/b/a Benzinga owns and operates a financial

news website.1

Benzinga is headquartered in Detroit, Michigan at One Campus Martius, Suite

200, Detroit, Michigan 48226.

JURISDICTION AND VENUE

6. This Court has subject matter jurisdiction over this case pursuant to 28 U.S.C. §

1331 because Plaintiff is asserting a claim under the Securities Exchange Act of 1934.

7. This Court has supplemental jurisdiction over Plaintiff’s state law claim for tortious

interference with prospective business expectancy pursuant to 28 U.S.C. § 1367, as the claims

arise out of the same “common nucleus of operative facts” as Plaintiff’s claim under the Securities

Exchange Act of 1934.

8. This Court has personal jurisdiction over the out-of-state Defendant Benzinga

pursuant to CPLR § 302(a)(3)(ii) because: (i) outside of the State of New York, Benzinga tortiously

interfered with Plaintiff’s business expectancy causing financial damages to Plaintiff in the State

of New York; (ii) Benzinga reasonably should have expected its tortious acts would cause Plaintiff

to suffer financial and reputational consequences; and (iii) Benzinga derives substantial revenue

through interstate channels by providing services through its website to securities investors within

the State of New York, including the authoring and publishing of articles related to companies

publicly traded on the New York Stock Exchange, NASDAQ Stock Market and Over-The-Counter

Markets.

9. Venue is proper in this Court under 28 U.S.C. § 1391(b)(2) because a substantial

part of the events giving rise to the claims occurred in this District.

1 The URL for Benzinga’s website is https://www.benzinga.com/.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 2 of 19 |

| 3

FACTUAL BACKGROUND

10. Knightscope is a publicly traded corporation incorporated in Delaware and

headquartered in California. Knightscope’s stock can be purchased and sold on the NASDAQ

Stock Market, a stock exchange based in New York, NY, under the ticker symbol KSCP.

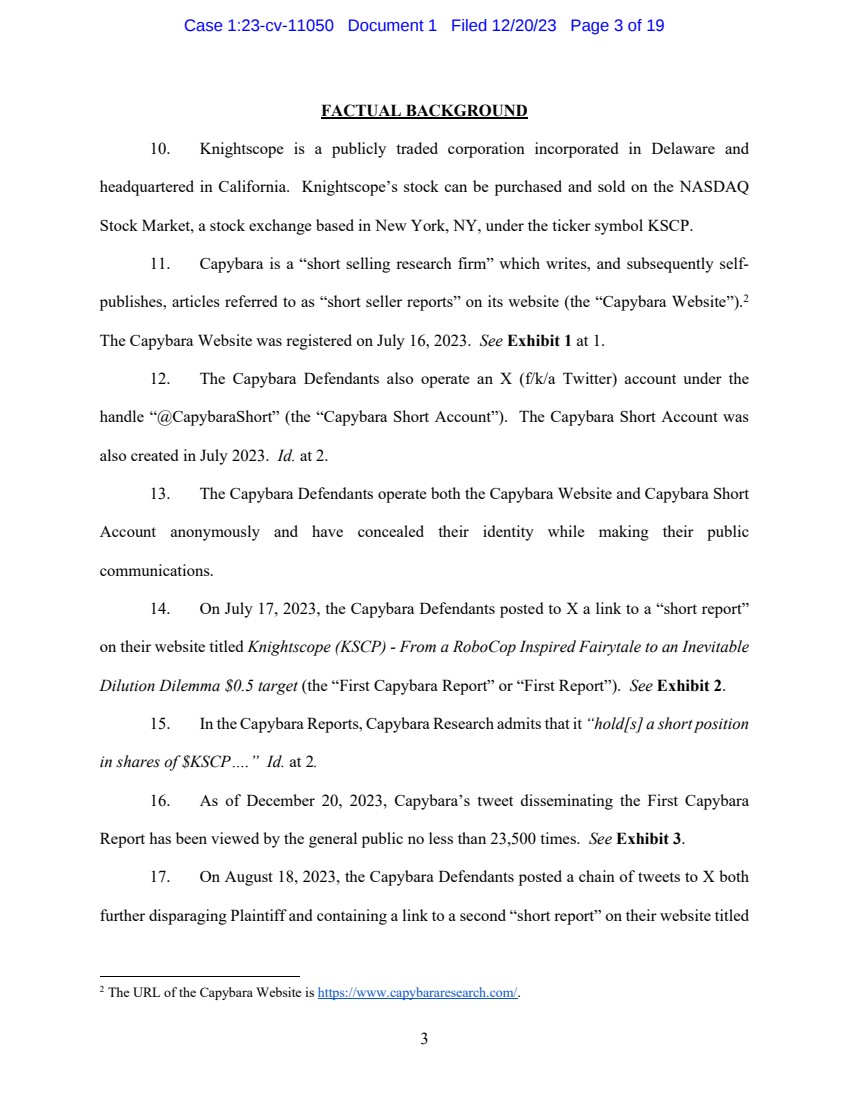

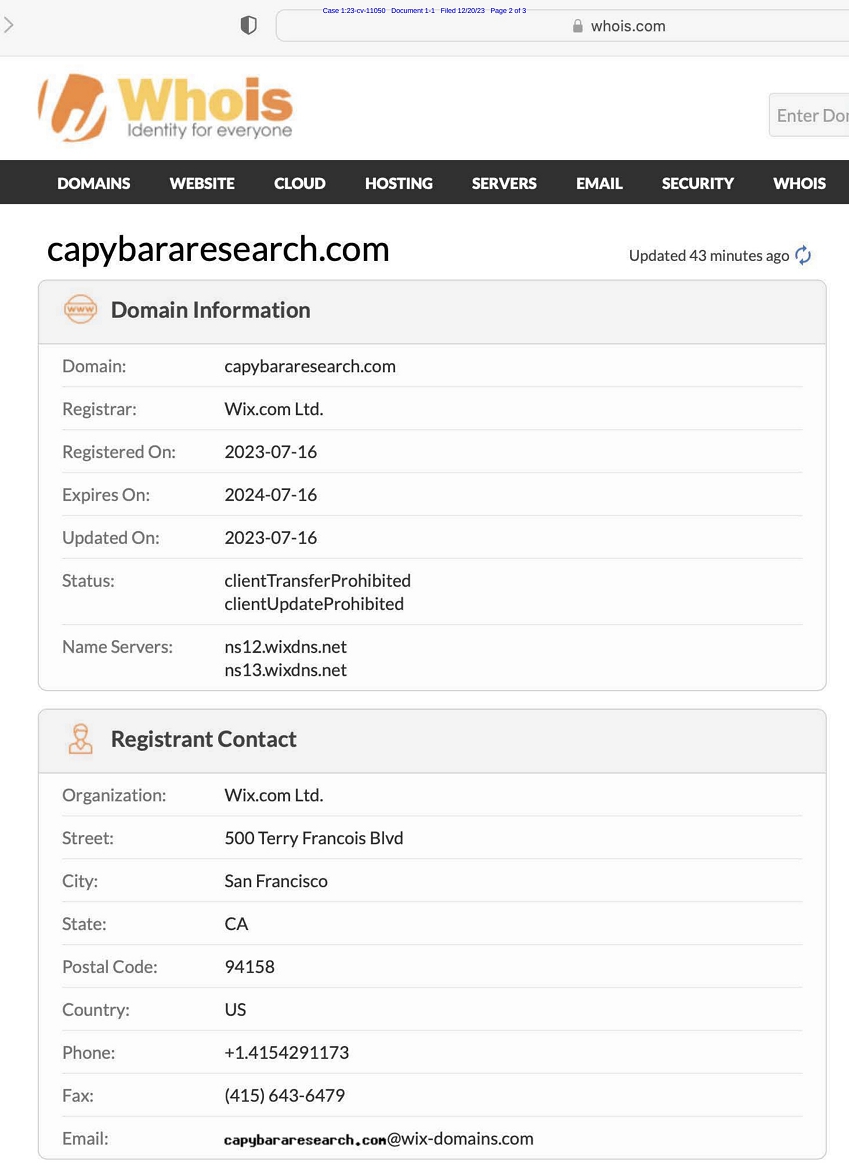

11. Capybara is a “short selling research firm” which writes, and subsequently self-publishes, articles referred to as “short seller reports” on its website (the “Capybara Website”).2

The Capybara Website was registered on July 16, 2023. See Exhibit 1 at 1.

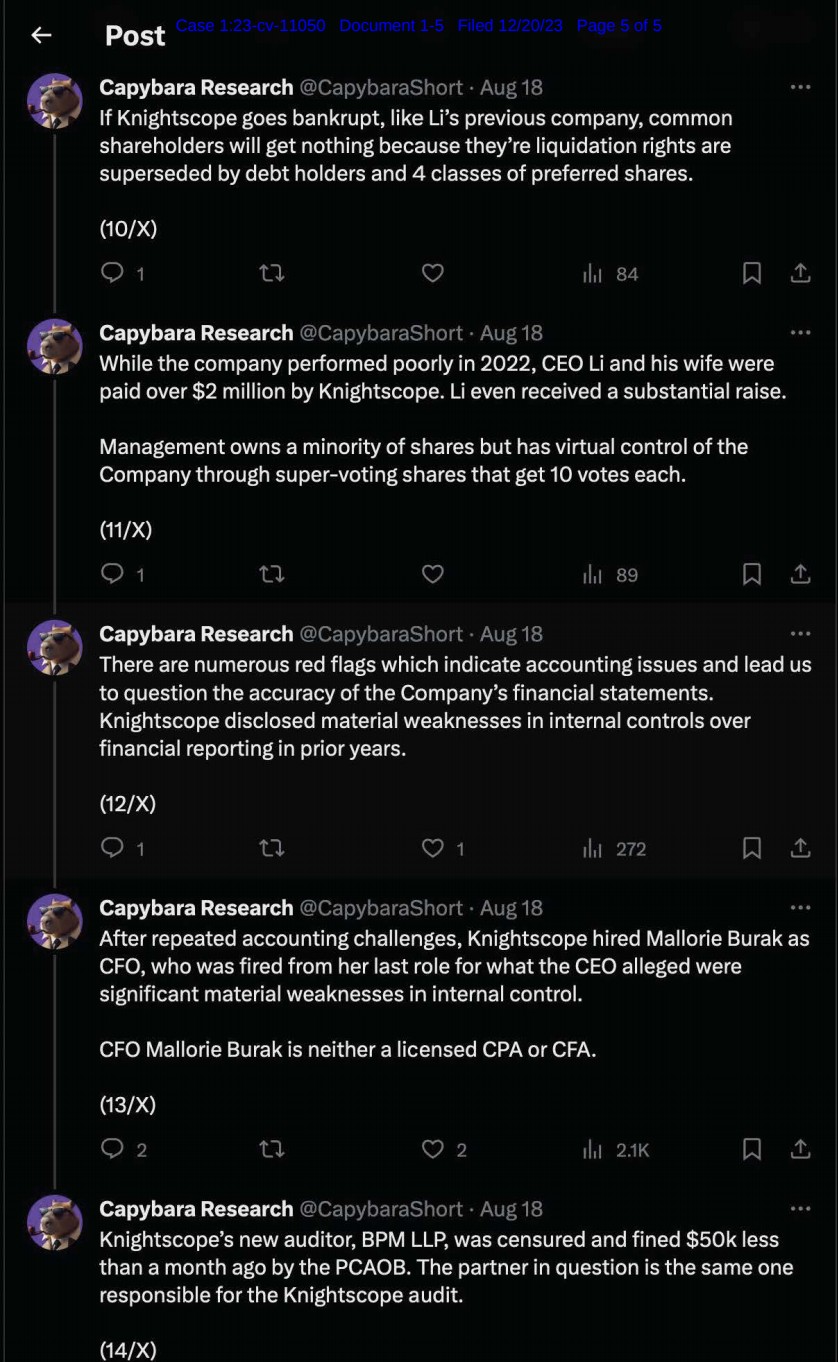

12. The Capybara Defendants also operate an X (f/k/a Twitter) account under the

handle “@CapybaraShort” (the “Capybara Short Account”). The Capybara Short Account was

also created in July 2023. Id. at 2.

13. The Capybara Defendants operate both the Capybara Website and Capybara Short

Account anonymously and have concealed their identity while making their public

communications.

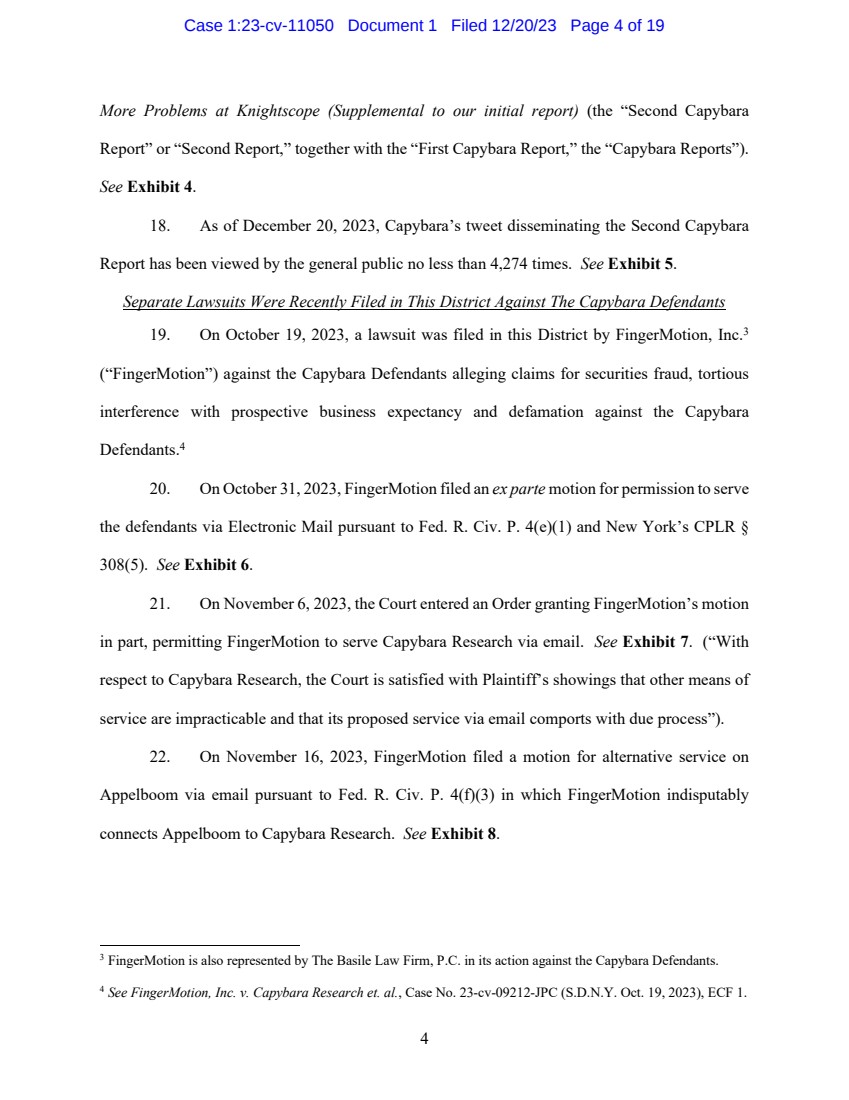

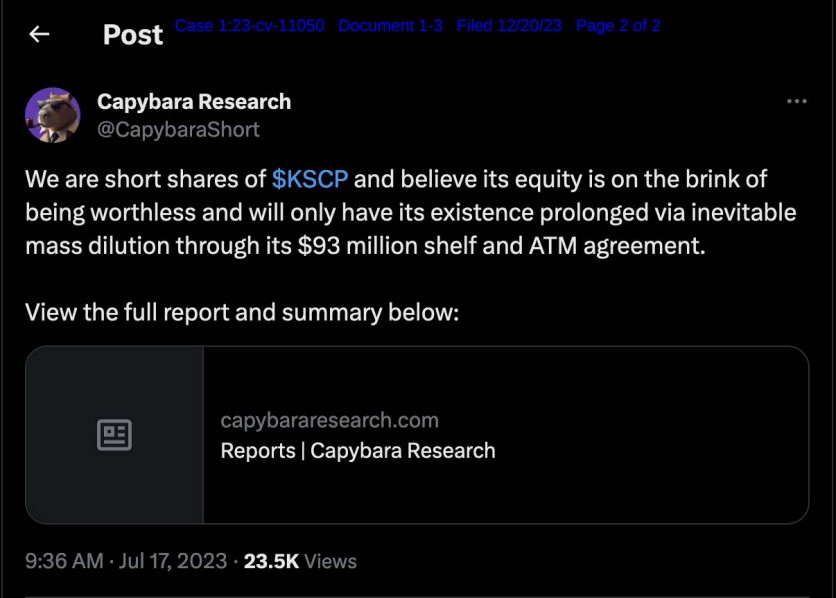

14. On July 17, 2023, the Capybara Defendants posted to X a link to a “short report”

on their website titled Knightscope (KSCP) - From a RoboCop Inspired Fairytale to an Inevitable

Dilution Dilemma $0.5 target (the “First Capybara Report” or “First Report”). See Exhibit 2.

15. In the Capybara Reports, Capybara Research admits that it “hold[s] a short position

in shares of $KSCP….” Id. at 2.

16. As of December 20, 2023, Capybara’s tweet disseminating the First Capybara

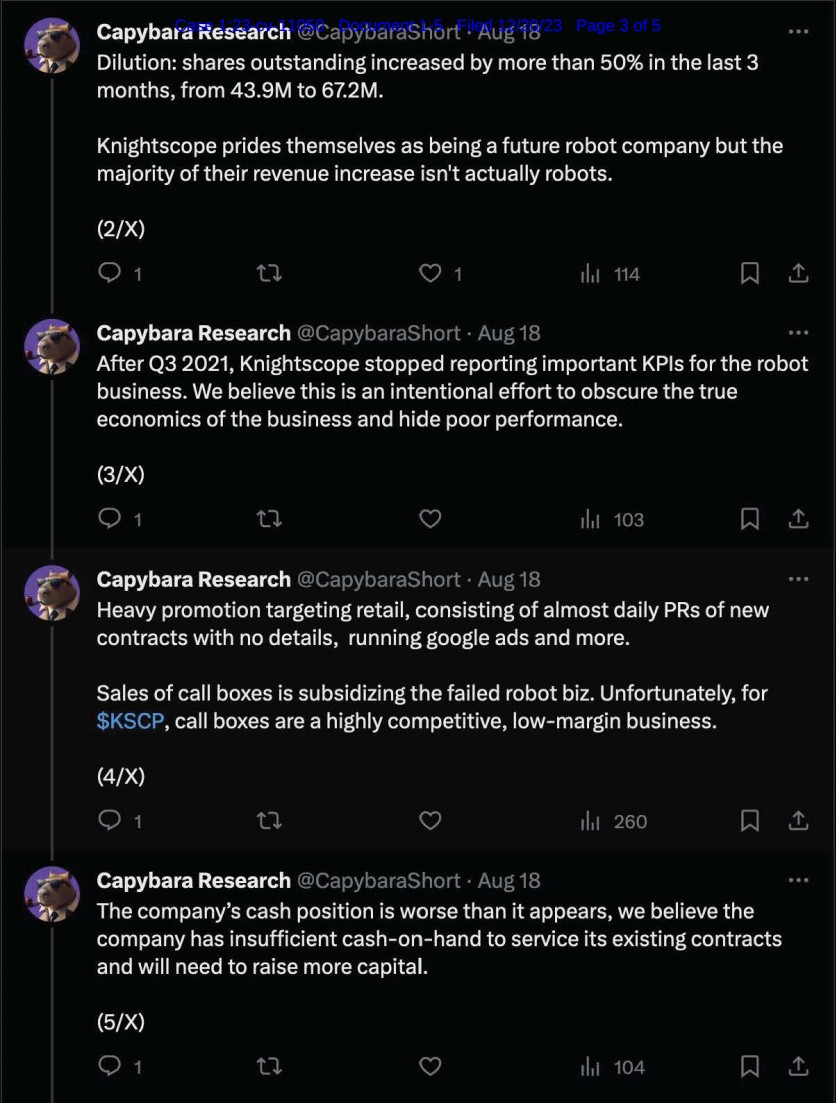

Report has been viewed by the general public no less than 23,500 times. See Exhibit 3.

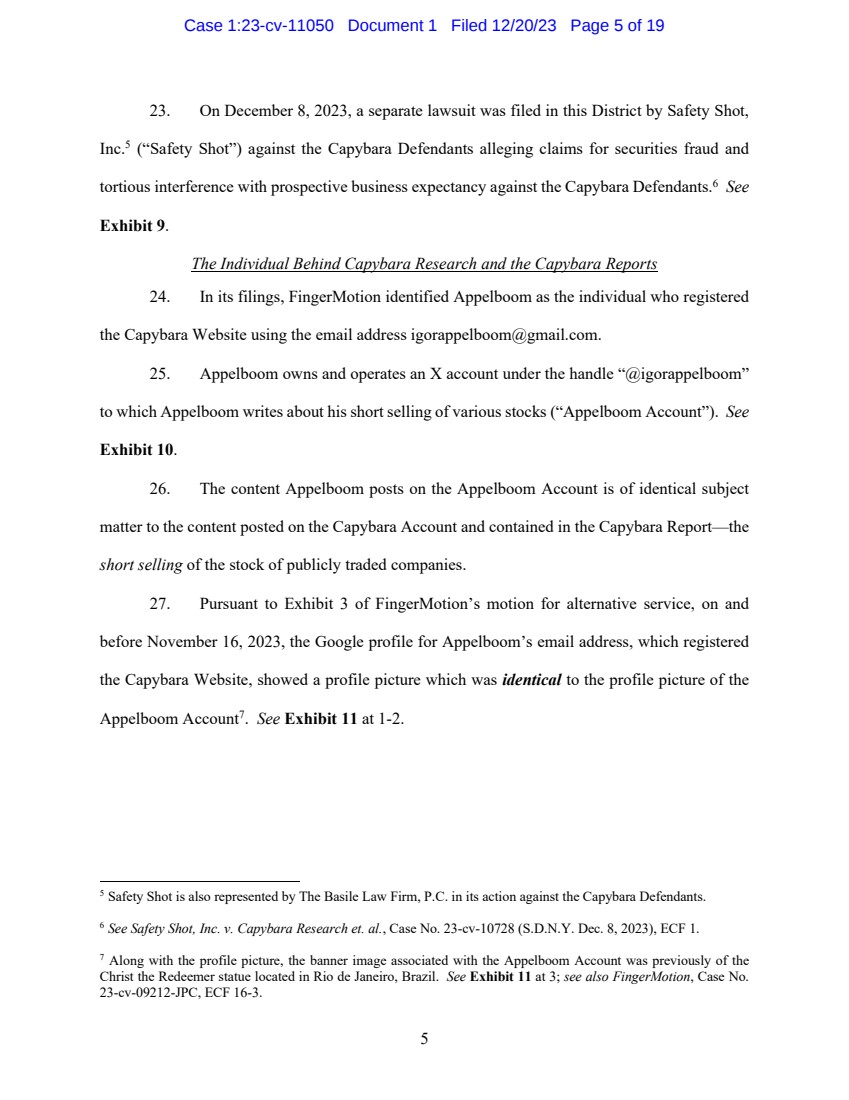

17. On August 18, 2023, the Capybara Defendants posted a chain of tweets to X both

further disparaging Plaintiff and containing a link to a second “short report” on their website titled

2 The URL of the Capybara Website is https://www.capybararesearch.com/.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 3 of 19 |

| 4

More Problems at Knightscope (Supplemental to our initial report) (the “Second Capybara

Report” or “Second Report,” together with the “First Capybara Report,” the “Capybara Reports”).

See Exhibit 4.

18. As of December 20, 2023, Capybara’s tweet disseminating the Second Capybara

Report has been viewed by the general public no less than 4,274 times. See Exhibit 5.

Separate Lawsuits Were Recently Filed in This District Against The Capybara Defendants

19. On October 19, 2023, a lawsuit was filed in this District by FingerMotion, Inc.3

(“FingerMotion”) against the Capybara Defendants alleging claims for securities fraud, tortious

interference with prospective business expectancy and defamation against the Capybara

Defendants.4

20. On October 31, 2023, FingerMotion filed an ex parte motion for permission to serve

the defendants via Electronic Mail pursuant to Fed. R. Civ. P. 4(e)(1) and New York’s CPLR §

308(5). See Exhibit 6.

21. On November 6, 2023, the Court entered an Order granting FingerMotion’s motion

in part, permitting FingerMotion to serve Capybara Research via email. See Exhibit 7. (“With

respect to Capybara Research, the Court is satisfied with Plaintiff’s showings that other means of

service are impracticable and that its proposed service via email comports with due process”).

22. On November 16, 2023, FingerMotion filed a motion for alternative service on

Appelboom via email pursuant to Fed. R. Civ. P. 4(f)(3) in which FingerMotion indisputably

connects Appelboom to Capybara Research. See Exhibit 8.

3 FingerMotion is also represented by The Basile Law Firm, P.C. in its action against the Capybara Defendants.

4 See FingerMotion, Inc. v. Capybara Research et. al., Case No. 23-cv-09212-JPC (S.D.N.Y. Oct. 19, 2023), ECF 1.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 4 of 19 |

| 5

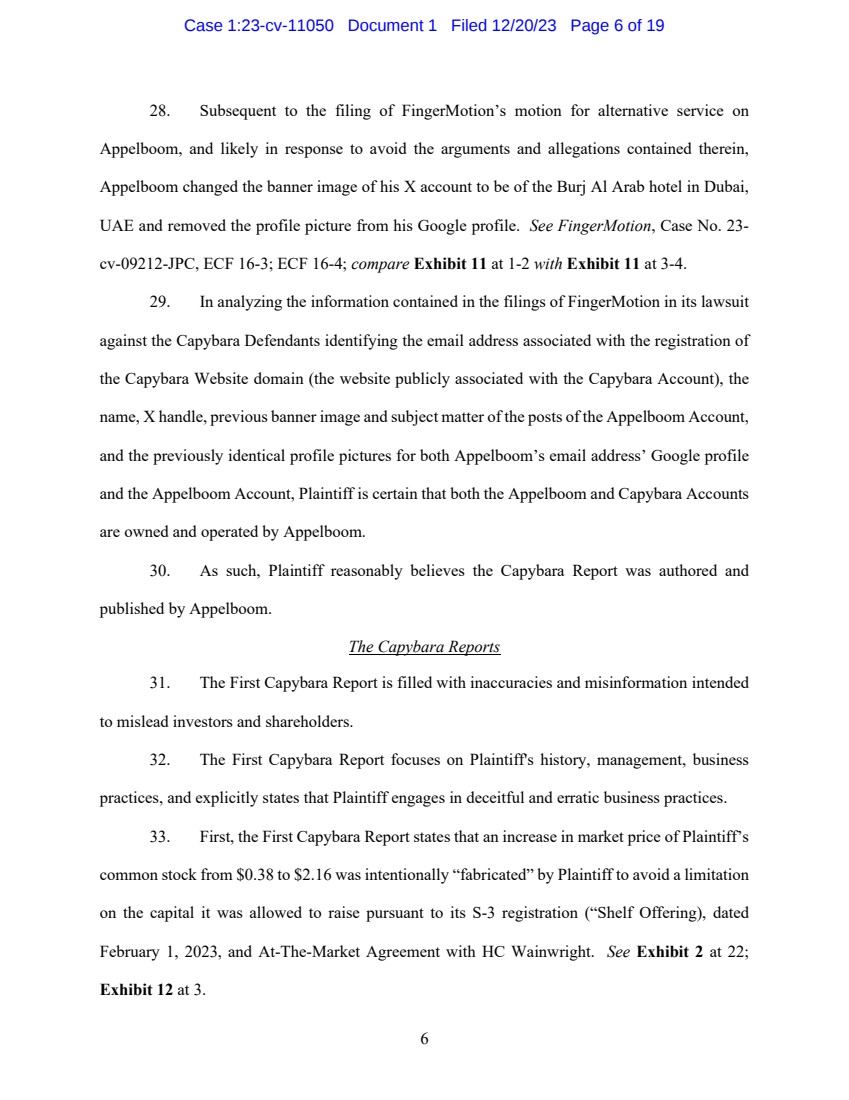

23. On December 8, 2023, a separate lawsuit was filed in this District by Safety Shot,

Inc.5 (“Safety Shot”) against the Capybara Defendants alleging claims for securities fraud and

tortious interference with prospective business expectancy against the Capybara Defendants.6 See

Exhibit 9.

The Individual Behind Capybara Research and the Capybara Reports

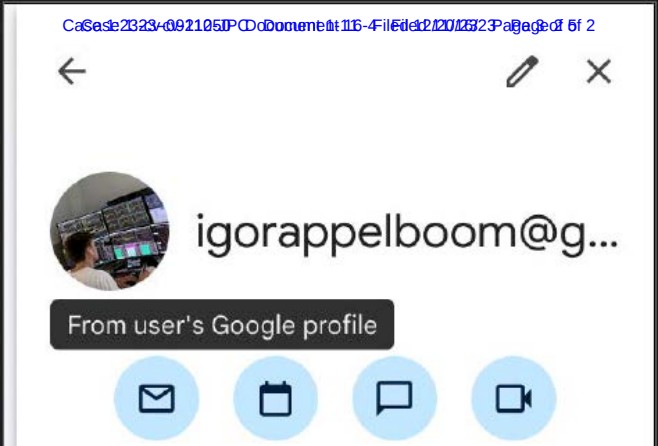

24. In its filings, FingerMotion identified Appelboom as the individual who registered

the Capybara Website using the email address igorappelboom@gmail.com.

25. Appelboom owns and operates an X account under the handle “@igorappelboom”

to which Appelboom writes about his short selling of various stocks (“Appelboom Account”). See

Exhibit 10.

26. The content Appelboom posts on the Appelboom Account is of identical subject

matter to the content posted on the Capybara Account and contained in the Capybara Report—the

short selling of the stock of publicly traded companies.

27. Pursuant to Exhibit 3 of FingerMotion’s motion for alternative service, on and

before November 16, 2023, the Google profile for Appelboom’s email address, which registered

the Capybara Website, showed a profile picture which was identical to the profile picture of the

Appelboom Account7

.. See Exhibit 11 at 1-2.

5 Safety Shot is also represented by The Basile Law Firm, P.C. in its action against the Capybara Defendants.

6 See Safety Shot, Inc. v. Capybara Research et. al., Case No. 23-cv-10728 (S.D.N.Y. Dec. 8, 2023), ECF 1.

7 Along with the profile picture, the banner image associated with the Appelboom Account was previously of the

Christ the Redeemer statue located in Rio de Janeiro, Brazil. See Exhibit 11 at 3; see also FingerMotion, Case No.

23-cv-09212-JPC, ECF 16-3.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 5 of 19 |

| 6

28. Subsequent to the filing of FingerMotion’s motion for alternative service on

Appelboom, and likely in response to avoid the arguments and allegations contained therein,

Appelboom changed the banner image of his X account to be of the Burj Al Arab hotel in Dubai,

UAE and removed the profile picture from his Google profile. See FingerMotion, Case No. 23-

cv-09212-JPC, ECF 16-3; ECF 16-4; compare Exhibit 11 at 1-2 with Exhibit 11 at 3-4.

29. In analyzing the information contained in the filings of FingerMotion in its lawsuit

against the Capybara Defendants identifying the email address associated with the registration of

the Capybara Website domain (the website publicly associated with the Capybara Account), the

name, X handle, previous banner image and subject matter of the posts of the Appelboom Account,

and the previously identical profile pictures for both Appelboom’s email address’ Google profile

and the Appelboom Account, Plaintiff is certain that both the Appelboom and Capybara Accounts

are owned and operated by Appelboom.

30. As such, Plaintiff reasonably believes the Capybara Report was authored and

published by Appelboom.

The Capybara Reports

31. The First Capybara Report is filled with inaccuracies and misinformation intended

to mislead investors and shareholders.

32. The First Capybara Report focuses on Plaintiff's history, management, business

practices, and explicitly states that Plaintiff engages in deceitful and erratic business practices.

33. First, the First Capybara Report states that an increase in market price of Plaintiff’s

common stock from $0.38 to $2.16 was intentionally “fabricated” by Plaintiff to avoid a limitation

on the capital it was allowed to raise pursuant to its S-3 registration (“Shelf Offering), dated

February 1, 2023, and At-The-Market Agreement with HC Wainwright. See Exhibit 2 at 22;

Exhibit 12 at 3.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 6 of 19 |

| 7

34. Second, the First Capybara Report states Chief Executive Officer of Knightscope

William Li, and by extension Plaintiff, raises capital by “exploit[ing] unsuspecting investors by

heavily promoting [its] stock[],” and that there was “a clear agenda in play to promote the stock.”

See Exhibit 2 at 3.

35. Third, the First Capybara Report unambiguously states that either Plaintiff’s

“equity will crater as extensive dilution is inevitable” or “it is likely that the company will file for

bankruptcy.” See Exhibit 2 at 1.

36. The Second Capybara Report expands upon the inaccuracies contained in the First

Capybara Report and facilitates additional misinformation aimed at additional damage to

Plaintiff’s share price, business and reputation including stating Plaintiff is intentionally

“obscur[ing] the true economics of the business and hid[ing] poor performance.” See Exhibit 4 at

1.

Benzinga Facilitates Further Dissemination of the First Capybara Report

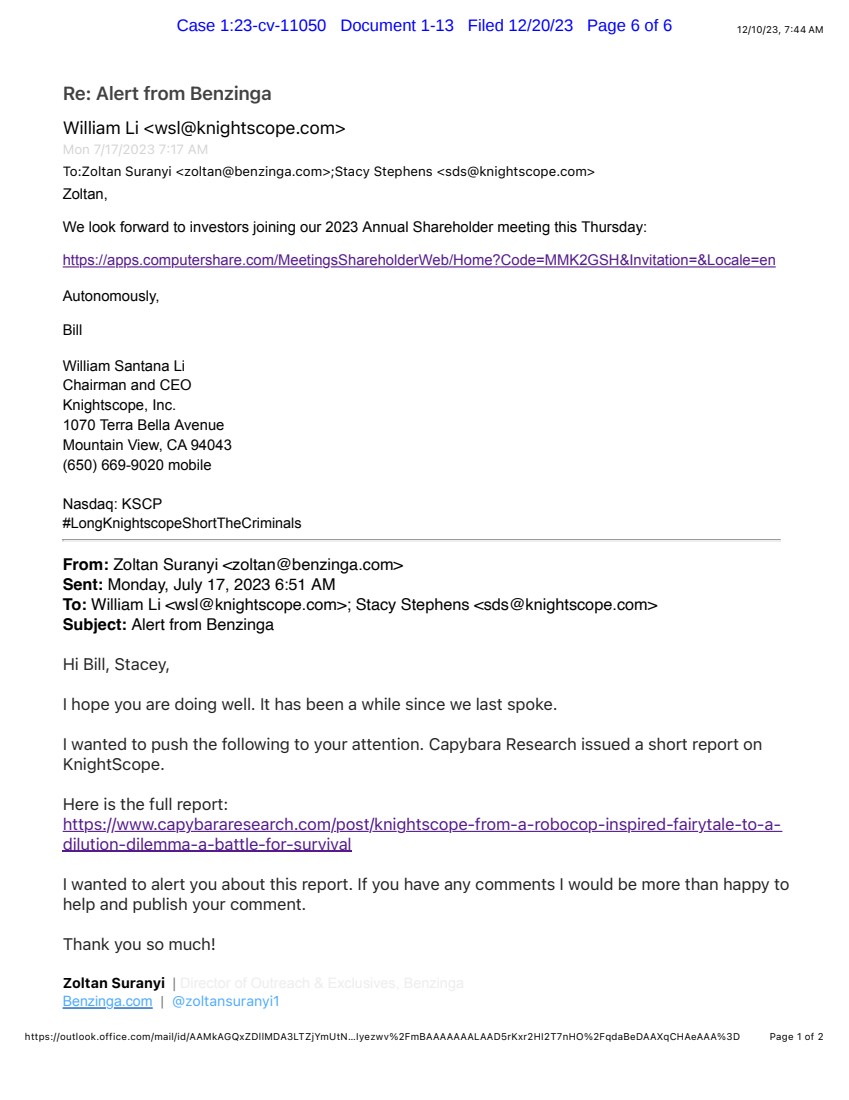

37. On July 17, 2023, Benzinga also posted two articles on its website entitled

Watching Knightscope; Capybara Research Releases Short Report On Co Titled “Knightscope -

From A RoboCop Inspired Fairytale To An Inevitable Dilution Dilemma $0.5 Target” and

Knightscope Shares Tumble on Short Report: The Details, both of which spread the defamatory

First Capybara Report to Benzinga subscribers and users of various brokerage services (the

“Benzinga Articles”). See Exhibit 13.

38. The Benzinga Articles contained a link to the First Capybara Report on the

Capybara Website, indicating the authors’ intent for readers to click the link to read the content of

the defamatory article. Id.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 7 of 19 |

| 8

39. Prior to the publication of the Benzinga Articles, a director at Benzinga reached

out to William Li for a comment on the First Capybara Report. See id. at 5. Despite being aware

of the content of the First Capybara Report, Benzinga proceeded to publish the Benzinga Articles.

40. The Benzinga Articles sparked fervent online discussion, as well as additional

discussion of the First Capybara Report, on X, facilitating further dissemination of the defamatory

First Report and causing additional interference with Plaintiff’s prospective business expectancy

and share value.

41. To date, the Benzinga Articles remain unretracted on its website and are available

for any Benzinga subscriber to view.8

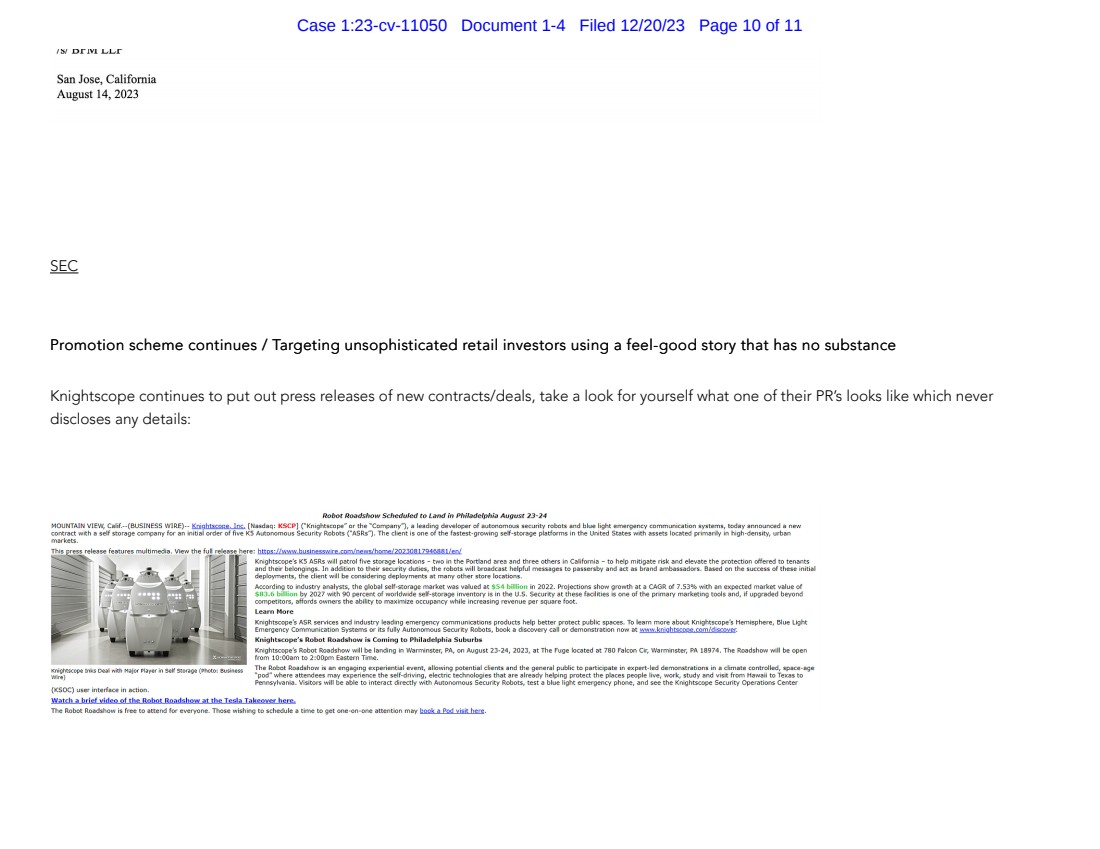

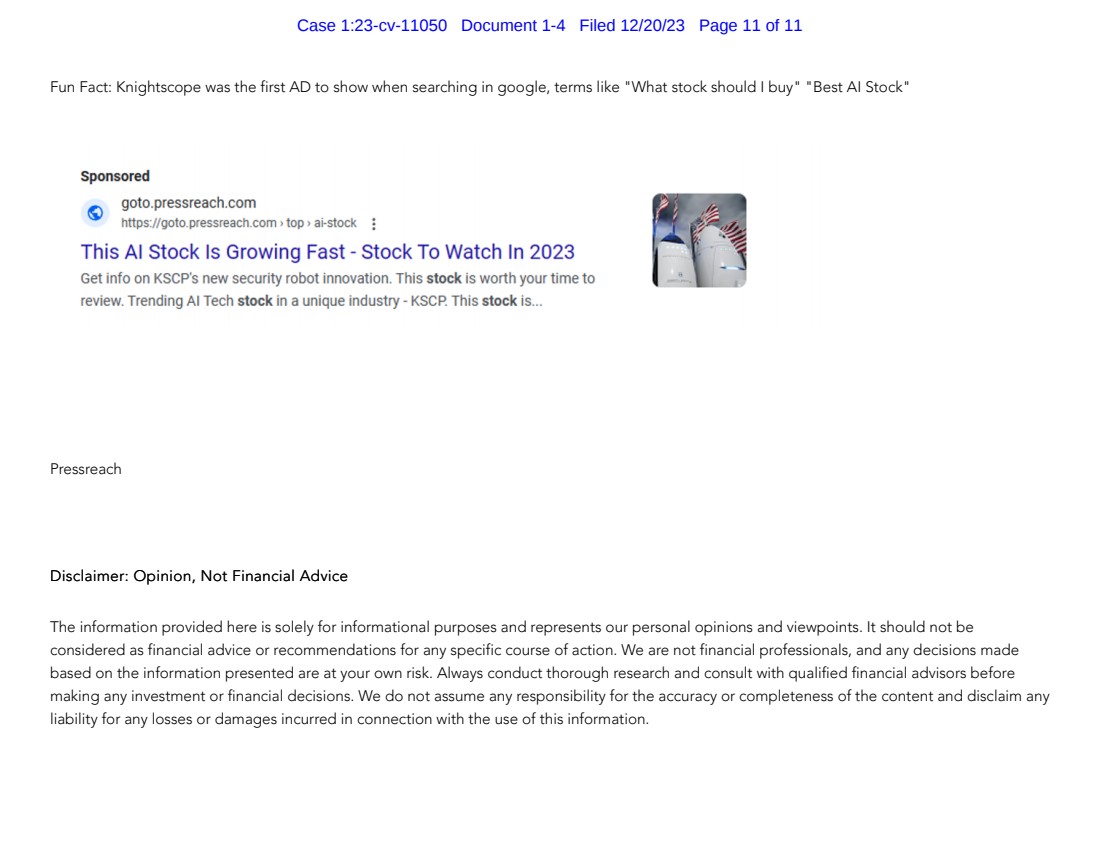

Knightscope, Inc.’s Promotional Practices

42. The First Capybara Report states William Li, and by extension Plaintiff, raises

capital by “exploit[ing] unsuspecting investors by heavily promoting [its] stock[],” and that there

was “a clear agenda in play to promote the stock.” See Exhibit 2 at 3, 22.

43. The First Capybara Report further states that “Knightscope is known for its constant

stock promotion” through the use of third parties such as the Stock Day Podcast, a company that

Capybara Research alleges “receive[s] $ in exchange for promoting … mostly OTCs and shady

businesses” and alleging Plaintiff “spend[s] more money and time on promoting their stock, vs

anything else” by including a screenshot of various press releases and announcements by Plaintiff

between May 16 and August 14, 2023. See id. at 27-31.

8 Happy Mohamed, Watching Knightscope; Capybara Research Releases Short Report On Co Titled “Knightscope -

From A RoboCop Inspired Fairytale To An Inevitable Dilution Dilemma $0.5 Target” (July 17, 2023), available at

https://www.benzinga.com/news/23/07/33249134/watching-knightscope-capybara-research-releases-short-report-on-co-titled-knightscope-from-a-robocop (last accessed December 20, 2023). See also Knightscope Shares Tumble

on Short Report: The Details (July 17, 2023), available at

https://www.benzinga.com/news/23/07/33253122/knightscope-shares-tumble-on-short-report-the-details (last

accessed December 20, 2023).

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 8 of 19 |

| 9

44. While Plaintiff does engage in the employment of third parties for advertising and

utilizes press releases to promote its business, none of Plaintiff's means of self-promotion are

outside normal practices of promotion or advertising, as the First Capybara Report suggests.

45. The First Capybara Report does not explain how Li, and by extension Plaintiff,

“exploit[s] unsuspecting investors” and, instead, only sought to mislead the public, tarnish

Plaintiff’s reputation and depress Plaintiff’s share price so that Capybara Research can financially

benefit from its disclosed short position in Knightscope.

46. Plaintiff, like every other public company, generates interest in its stock, but does

not entice individuals to invest without a comprehensive understanding of fundamentals and risks,

as the First Capybara Report suggests.

47. Being a public company, Plaintiff publicly files its quarterly and annual reports

with the Securities and Exchange Commission.

48. The reports are available to the public and contain Plaintiff’s financial reports, risks,

analysis, and ongoing litigation for investors and potential investors to read, understand, and

appreciate.

Knightscope, Inc.’s Valuation and Effect on Dilution

49. Plaintiff’s market capitalization on July 14, 2023, the trading day before the First

Capybara Report was published, was over $166,966,700.9 See Exhibit 4 at 4.

50. On February 1, 2023, Plaintiff filed its Form S-3 in connection with its Shelf

Offering, which contained two prospectuses: (i) the issuance and sale of up to $100,000,000 in the

aggregate in KSCP common stock; and (ii) an At-The-Market Agreement with HC Wainwright

9 Market Capitalization = (Outstanding Shares * Market Price) = (75,380,000 * $2.215) = $166,966,700.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 9 of 19 |

| 10

where up to $20,000,000 of KSCP common stock may be issued and sold through HC Wainwright,

acting as KSCP’s sales agent. See Exhibit 12 at 3.

51. The First Capybara Report unambiguously states that, as a result of both the Shelf

Offering and At-The-Market Agreement, either Plaintiff’s “equity will crater as extensive dilution

is inevitable” or “it is likely that the company will file for bankruptcy.” See Exhibit 2 at 1.

52. The existence of both the Shelf Offering and the At-The-Market Agreement does

not necessarily mean that KSCP stock dilution is inevitable, nor does it mean that it will have a

negative effect on the value of KSCP’s stock, as the Capybara Report claims. Rather, the Shelf

Offering and the At-The-Market Agreement would cause an increase in the interest of prospective

and current investors to purchase KSCP common stock, which would result in the newly-issued

KSCP stock being purchased on the market. As a result of the newly-issued stock being purchased,

there would be minimal to no stock dilution, as any newly-issued stock may be purchased by

current shareholders.

53. Further, as the Capybara Reports concede, both the Shelf Offering and the At-The-Market Agreement allow KSCP to issue KSCP common shares directly to the open market as a

means to raise cash, which would benefit KSCP as a whole. Both the Shelf Offering and the At-The-Market Agreement allow Plaintiff to gain financing and working capital to fund its intended

business plans which, in turn, will raise the value and result in the reverse dilution of the KSCP

common stock.

54. Due to the effect of the Capybara Reports on the market price of KSCP stock to

date, both the Shelf Offering and At-The-Market Agreement have become inherently less valuable

and more dilutive. As a result of a 68.39% drop in the market price of KSCP stock, KSCP must

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 10 of 19 |

| 11

now sell 68.39% more shares of its stock in its Shelf Offering and At-The-Market Agreement to

raise the same amount of capital.

55. As such, both the Capybara Report and the subsequent short selling of KSCP shares

account for the decline in KSCP common stock, not Plaintiff’s announcement of the Shelf Offering

or the At-The-Market Agreement.

The Effect of the Capybara Reports on Knightscope, Inc.’s Market Value

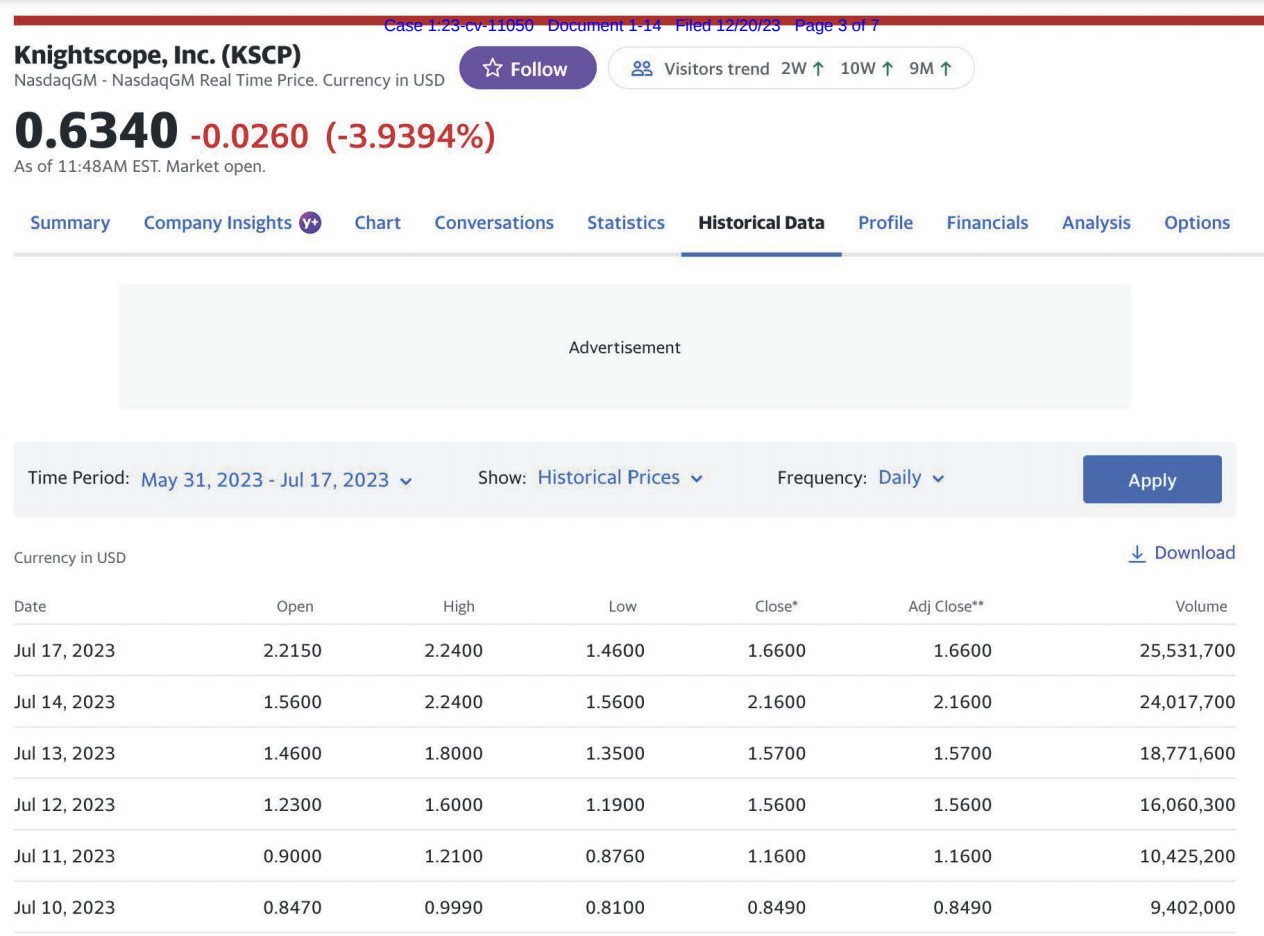

56. Exactly one week before the First Capybara Report was released, on Monday, July

10, 2023, KSCP’s share price increased from $0.847 per share to $2.16 per share at the close of

the market on Friday, July 14, 2023. See Exhibit 14 at 2.

57. On July 17, 2023, the date Capybara released the First Capybara Report, KSCP

opened with a market price of $2.215 per share and closed with a market price of $1.66 per share,

a staggering 28.64% decrease. Id.

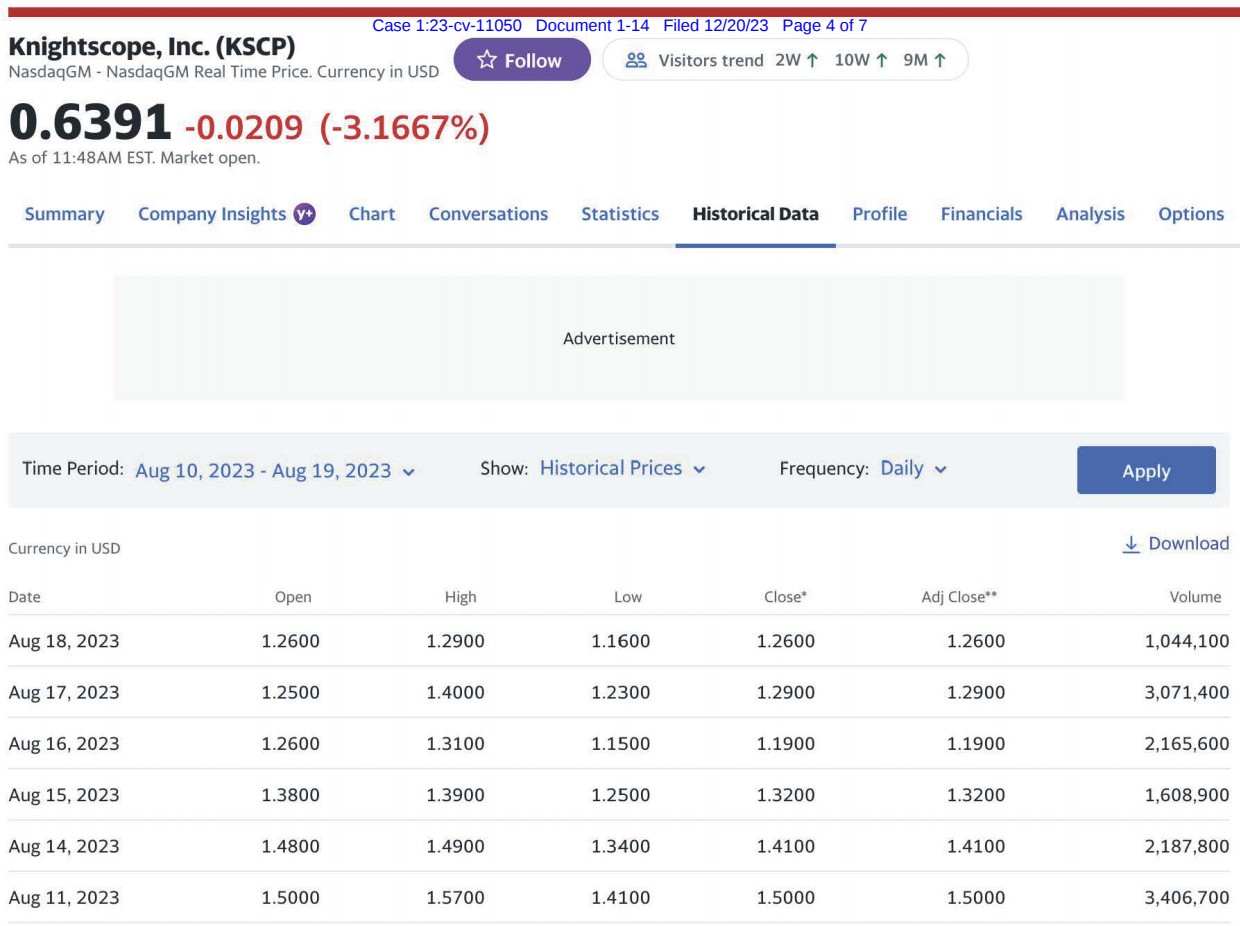

58. During the week prior to the Second Capybara Report’s release, from Friday,

August 11, 2023, KSCP’s share price continued to decrease from $1.50 per share to $1.29 per

share at the close of the market on Friday, July 17, 2023. See id. at 3.

59. On August 18, 2023, the date the Second Capybara Report released, KSCP’s market

price decreased to $1.26 per share. Id.

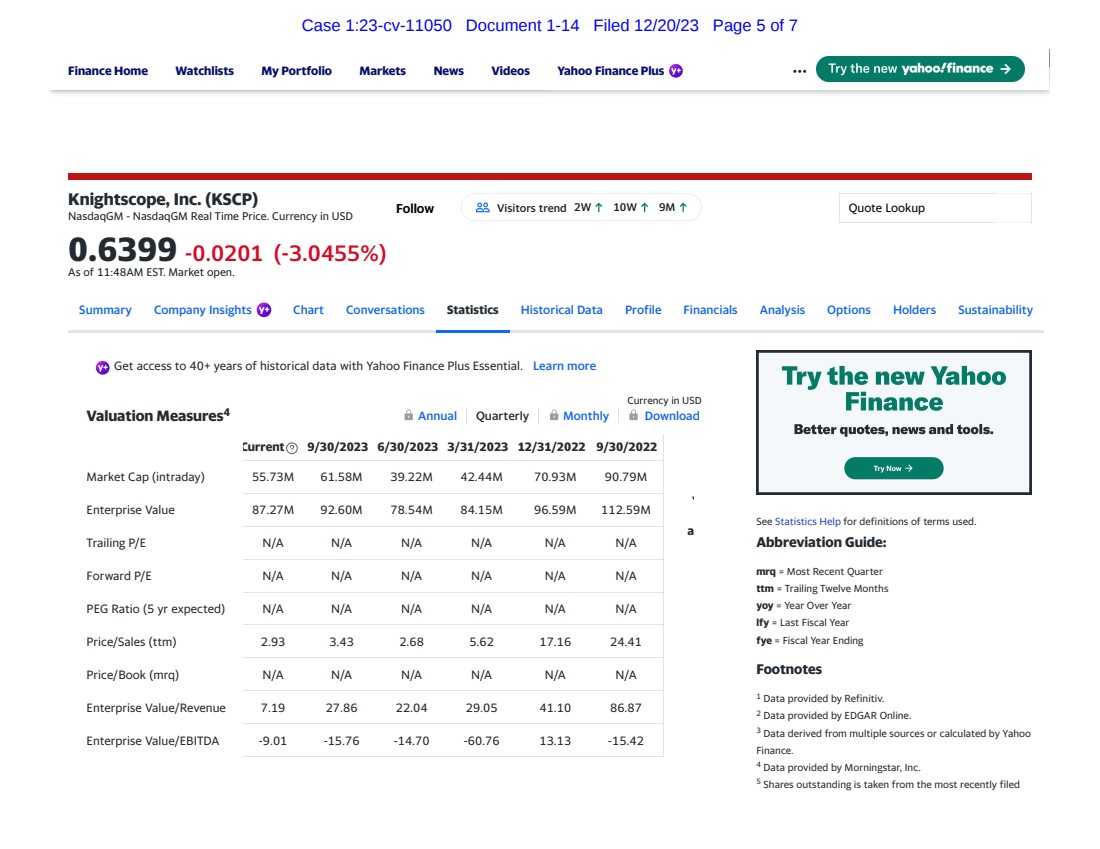

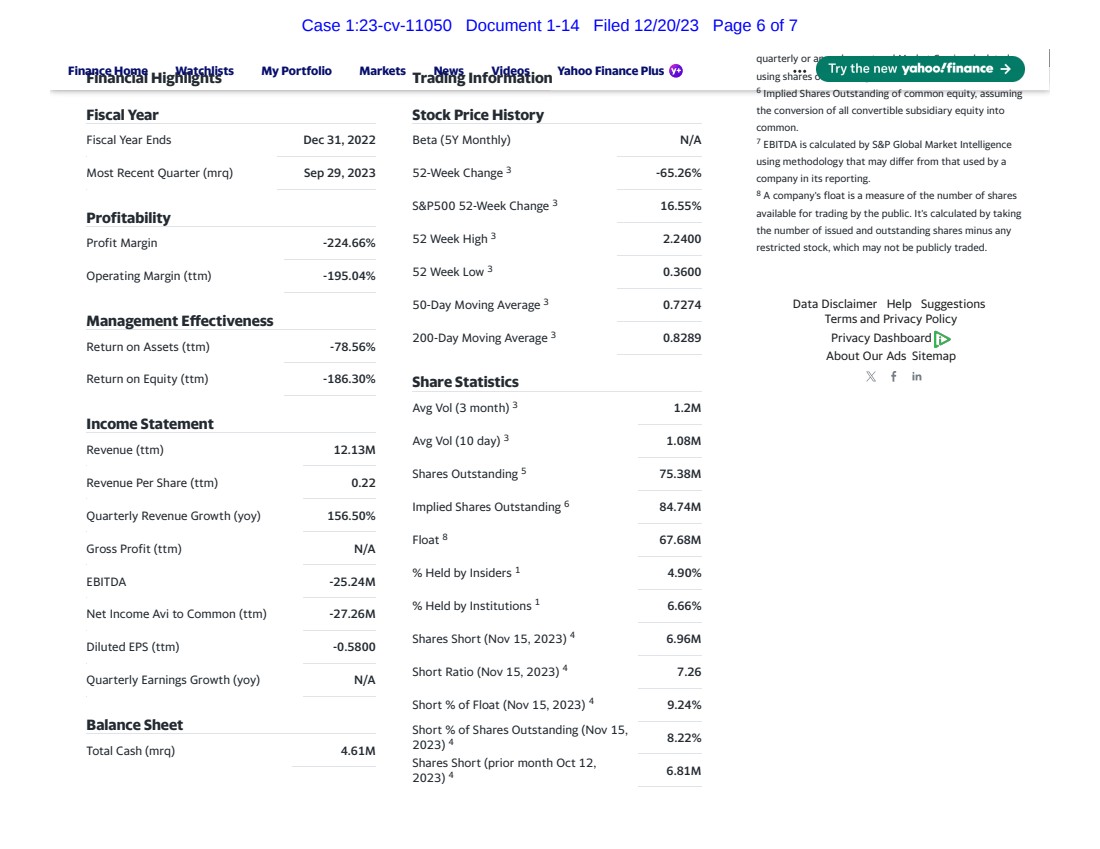

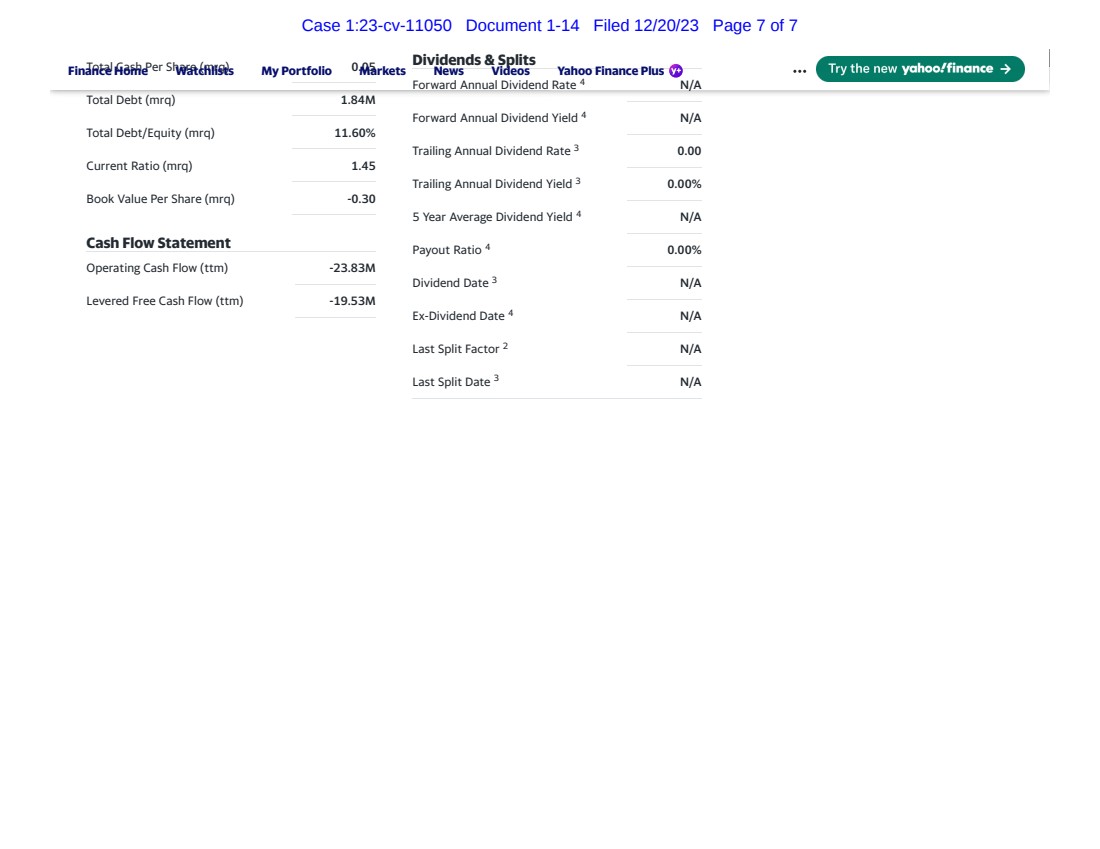

60. KSCP has 75.38 million shares outstanding.10 As a result of the drop in market

price since July 17, 2023, the market capitalization11 of KSCP dropped from $166,966,70012 to

10 See Yahoo Finance, Knightscope, Inc. Share Statistics (last accessed December 20, 2023),

https://finance.yahoo.com/quote/KSCP/key-statistics?p=KSCP.

11 Market capitalization refers to the total dollar market value of a company’s outstanding shares of stock or what the

public market determines a company is worth.

12 Market Capitalization = (Outstanding Shares * Market Price) = (75,380,000 * $2.215) = $166,966,700.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 11 of 19 |

| 12

$97,240,200,13 a difference of $71,987,900. To date, KSCP stock has not traded at the same value

that the stock opened at on July 17, 2023, $2.215 per share.14 By extension, to date, Plaintiff’s

market capitalization also has not rebounded to pre-July 17, 2023 levels.

61. Further, as a result of the Capybara Reports, short volume in KSCP rose

significantly. On July 10, 2023, one week before the First Capybara Report was released, the short

volume was approximately 3,569,113 shares shorted. On July 17, 2023, the short volume was

approximately 8,096,563 shares shorted, more than 2.27 times the amount shorted a week earlier.15

The Capybara Reports Interfered with Knightscope, Inc.’s Natural Business Expectations

62. Plaintiff expected and anticipated natural volatility in the market value of its

common shares on July 17, 2023, the date that the First Capybara Report was published and made

available online to the public.

63. Plaintiff, and its shareholders, never expected the market value of its common stock

to decline by 28.64% on July 17, 2023 as a result of the release of the First Capybara Report and

by 68.39% to date.

64. Plaintiff, and its shareholders, expected only legitimate and natural market forces

to impact the value of KSCP stock.

65. The Capybara Reports were external, non-natural forces that impacted the market

value of KSCP common stock.

13 Market Capitalization = (Outstanding Shares * Market Price) = (75,380,000 * $1.26) = $94,978,800.

14 According to Yahoo Finance’s Historical Data, KSCP’s market price was $0.64 per share at the close of the trading

day on November 30, 2023. See Yahoo Finance, Knightscope, Inc. Historical Data (last accessed December 20, 2023),

https://finance.yahoo.com/quote/KSCP/history?p=KSCP.

15 Information gathered from FINRA, Daily Short Sale Volume Files (last accessed December 20, 2023),

https://www.finra.org/finra-data/browse-catalog/short-sale-volume-data.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 12 of 19 |

| 13

66. Plaintiff did not anticipate the Capybara Reports to be released, and certainly did

not anticipate the Capybara Reports to contain any falsities, half-truths, and misleading statements

that would negatively impact the value of its common stock and prospective business relations.

67. Upon information and belief, the Capybara Defendants knew and intended for the

Capybara Reports to result in the decline in market value of KSCP common stock.

68. Upon information and belief, it was foreseeable to the Capybara Defendants that

the Capybara Reports would result in a decrease in market value of KSCP common stock.

69. Upon information and belief, the Capybara Defendants knew that the Capybara

Reports would harm Plaintiff’s reputation, and therefore, negatively impact Plaintiff’s prospective

business relations.

70. But for the Capybara Reports, the market value of KSCP common stock would not

have aggressively declined on and after July 17, 2023.

71. Additionally, but for the Capybara Reports, the daily short volume of KSCP

common stock would not have been as substantial.

The Capybara Defendants Knowingly Published False and Misleading Information in the

Capybara Reports

72. The Capybara Defendants defamed Plaintiff by providing false information in the

Capybara Reports about Plaintiff’s business practices to the general public resulting in damages to

Plaintiff’s stock price, market capitalization, and reputation.

73. The Capybara Defendants’ defamatory statements were published in writing for the

public to view. Specifically, the Capybara Reports are libel per se because the Capybara Reports

state false facts that tend to injure Plaintiff concerning its business, trade, and profession.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 13 of 19 |

| 14

74. The Capybara Defendants acted with actual malice or a reckless disregard for the

truth because the Capybara Defendants knew that the statements contained within the Capybara

Reports were false at the time of publishing, yet still proceeded to publish the Capybara Reports.

75. As of December 20, 2023, Capybara’s tweets disseminating the Capybara Reports

have been viewed by the general public no less than 27,774 times combined.

76. To this day, the Capybara Reports are still available for the public to view and read

on both the Capybara Website and X.

77. Plaintiff is not a public figure.

78. As a result of the Capybara Defendants’ false statements and misleading

information in the Capybara Reports, the market value of KSCP stock has sharply declined,

injuring Plaintiff and its shareholders, as well as injuring Plaintiff’s reputation, business, trade, and

profession.

FIRST CAUSE OF ACTION

Securities Fraud Against the Capybara Defendants

79. Plaintiff repeats, reiterates, and re-alleges each and every allegation of the

paragraphs as though fully set forth herein.

80. “It shall be unlawful for any person, directly or indirectly, by the use of the mails

or any means or instrumentality of interstate commerce, or of any facility of any national securities

exchange, or for any member of a national securities exchange to effect, alone or with one or more

other persons, a manipulative short sale of any security.” 15 U.S.C. § 78i(d).

81. “It shall be unlawful for any person, directly or indirectly, by the use of any means

or instrumentality of interstate commerce or of the mails, or of any facility of any national

securities exchange—[t]o effect a short sale, or to use or employ any stop-loss order in connection

with the purchase or sale, of any security other than a government security, in contravention of

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 14 of 19 |

| 15

such rules and regulations as the Commission may prescribe as necessary or appropriate in the

public interest or for the protection of investors.” 15 U.S.C. § 78j(a)(1).

82. The Capybara Defendants made public communications in an effort to manipulate

the general investing public into selling their KSCP shares or into opening short positions in order

to capitalize on a drop in share price. This is confirmed by a disclosure in the First Capybara

Report which states “[w]e hold a short position in shares of $KSCP….” See Exhibit 2 at 2;

Exhibit 5 at 2.

83. The Capybara Defendants acted intentionally to drive down the price of KSCP

common stock in a manipulative fashion. Because it held a short position, the Capybara

Defendants would financially benefit from a decline in Plaintiff’s stock price.

84. The foregoing facts give rise to a strong inference that the Capybara Defendants

acted with intentionality and recklessness as to how their public communication and the Capybara

Reports would spread across social media and motivate investors to react by creating short selling

downward pressure on KSCP’s market price. KSCP’s market price has not rebounded to pre-July

17, 2023 levels as the short selling of KSCP stock has increased dramatically. These short sales

are directly caused by the Capybara Reports.

85. Plaintiff’s share value, business opportunities and shareholders’ long positions—

which relied on an efficient market free of manipulation—were artificially manipulated to

Plaintiff’s detriment, thereby causing Plaintiff damages in an amount to be proven at trial.

86. As a result, Plaintiff is further entitled to an award of attorney’s fees and costs

pursuant to 15 U.S.C. § 78u-4(c), to the extent the Capybara Defendants interpose defenses in

violation of Fed. R. Civ. P. 11(b).

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 15 of 19 |

| 16

SECOND CAUSE OF ACTION

Tortious Interference with Prospective Business Expectancy

Against the Capybara Defendants and Benzinga

87. Plaintiff repeats, reiterates, and re-alleges each and every allegation of the

paragraphs as though fully set forth herein.

88. Plaintiff has and had a valid business expectation that its common stock will only

be subject to normal, marketplace, and general business risks of investment.

89. The Capybara Defendants’ conduct was wrongful, because it involved illegal stock

market manipulation in violation of federal securities laws quoted above.

90. The Capybara Defendants knew that Plaintiff, as well as holders of KSCP common

stock, had an expectation that pure market forces, not false and manipulative public statements,

would impact the value of their investments and equity.

91. The Capybara Defendants intentionally and directly caused a deluge of short selling

trades, putting down pressure on Plaintiff’s stock price.

92. The Capybara Defendants’ conduct disrupted Plaintiff’s expectations of only

legitimate market forces impacting the value of its stock.

93. Benzinga’s supplementary dissemination of the Capybara Reports caused

additional third-parties, including investors, to short Plaintiff’s common stock, directly causing

additional downward pressure on Plaintiff’s share price.

94. Plaintiff had a valid business expectation that it would be able to sell its shares of

common stock at a higher price or would be able to realize an increased market price.

95. Plaintiff suffered damages as a result of the tortious interference in its business

expectancy as a result of Defendants’ actions.

96. Accordingly, Plaintiff is entitled to damages in an amount to be determined at trial.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 16 of 19 |

| 17

THIRD CAUSE OF ACTION

Defamation Against the Capybara Defendants and Benzinga

97. Plaintiff repeats, reiterates, and re-alleges each and every allegation of the

paragraphs as though fully set forth herein.

98. The Capybara Defendants made malicious and knowingly false assertions of

fact—not opinions—tending to harm the reputation, prospects for success and profitability, the

legal legitimacy, and character of Plaintiff.

99. The assertions of fact constitute libel, and more specifically, libel per se.

100. The Capybara Defendants have caused damage to Plaintiff in a direct and proximate

fashion for which demonstrable damages have been sustained, as particularly shown by the KSCP

market fluctuations and stock prices.

101. The Capybara Defendants acted with reckless disregard as to the truth or falsity of

their assertions.

102. There is no public figure, public official, or public comment immunity or qualified

immunity for the defamatory statements made by the Capybara Defendants.

103. Upon information and belief, the Capybara Defendants sought to or actually did

enrich themselves by injuring Plaintiff’s reputation for the Capybara Defendants’ own financial

gain or reputational enhancement.

104. The Capybara Defendants’ conduct is over the level of reprehensibility so as to

justify the imposition of exemplary and punitive damages in an amount of a proportion to the

actual damages thereby caused.

105. Further, in the Benzinga Articles, Benzinga re-published a link to the defamatory

First Capybara Report on its website, effectively republishing the First Capybara Report and

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 17 of 19 |

| 18

expanding the audience beyond X users who were aware of the links posted on the Capybara

Account. See Exhibit 13.

106. Any article authored and published by Benzinga is available on its own website for

Benzinga subscribers to view.

107. Further, when Benzinga articles are published to its website, they are also displayed

as news articles on investor’s brokerage accounts.

108. The Benzinga Articles sparked fervent online discussion, as well as renewed

discussion of the First Capybara Report on X, facilitating further dissemination of the defamatory

First Capybara Report, causing additional damage to Plaintiff’s share price and reputation.

109. To date, the Benzinga Articles remain unretracted on its website and are available

for any Benzinga subscriber to view.

110. Accordingly, Plaintiff is entitled to damages in an amount to be determined at trial.

111. Plaintiff hereby demands a trial by jury and declines to waive the same.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff seeks a Verdict and Judgment against Defendants as follows:

A. Awarding Plaintiff compensatory, special, incidental and punitive damages, in an

amount to be determined at trial, plus post-judgment interest at the legal rate from the date of the

verdict until paid in full;

B. Awarding attorneys’ fees and costs to the extent available under 15 U.S.C. § 78u-4(c), together with post-judgment interest at the legal rate from the date of judgment until paid in

full;

C. Issuing an order directing the Capybara Defendants to publicly retract the Capybara

Report in writing;

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 18 of 19 |

| 19

D. Issuing an injunction preventing the Capybara Defendants from communicating

about Plaintiff on any social media website or posting articles about Plaintiff on its website, except

for a public written retraction of the Capybara Report;

E. Issuing an order directing Benzinga to remove and publicly retract the Benzinga

Articles republishing the First Capybara Report, in writing; and

F. Awarding such other just and/or equitable relief as this Court deems necessary.

DATED: December 20, 2023 Respectfully submitted,

THE BASILE LAW FIRM P.C.

/s/ Waleed Amer

Waleed Amer, Esq.

Mark R. Basile, Esq.

390 N. Broadway, Ste. 140

Jericho, NY 11753

Tel.: (516) 455-1500

Fax: (631) 498-0748

Email: waleed@thebasilelawfirm.com

mark@thebasilelawfirm.com

Attorneys for Plaintiff Knightscope, Inc.

Case 1:23-cv-11050 Document 1 Filed 12/20/23 Page 19 of 19 |

| Exhibit 1

Case 1:23-cv-11050 Document 1-1 Filed 12/20/23 Page 1 of 3 |

| > ()

• 01S

Identity for everyone

DOMAINS WEBSITE CLOUD HOSTING

capybararesearch.com

w Domain Information

Domain:

Registrar:

Registered On:

Expires On:

Updated On:

Status:

Name Servers:

capybararesearch.com

Wix.com Ltd.

2023-07-16

2024-07-16

2023-07-16

clientTransferProhibited

clientUpdateProhibited

ns 12.wixd ns.net

ns 13.wixd ns.net

£ Registrant Contact

Organization:

Street:

City:

State:

Postal Code:

Country:

Phone:

Fax:

Wix.com Ltd.

500 Terry Francois Blvd

San Francisco

CA

94158

us

+1.4154291173

(415) 643-6479

SERVERS

Email: capybarar-esearch.con@wix-domains.com

i whois.com

Enter Dor

EMAIL SECURITY WHOIS

Updated 43 minutes ago ¢

Case 1:23-cv-11050 Document 1-1 Filed 12/20/23 Page 2 of 3 |

| f- Capybara Research

39 posts

Case 1:23-cv-11050 Document 1-1 Filed 12/20/23 Page 3 of 3 |

| Exhibit 2

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 1 of 32 |

| Capybara Research Jul 16 14 min read

Knightscope (KSCP) - From a RoboCop Inspired Fairytale to an Inevitable

Dilution Dilemma $0.5 target

Updated: Jul 17

Disclosure: We hold a short position in shares of $KSCP and firmly believe that its equity will crater as extensive dilution is inevitable. Otherwise, it is

likely that the company will file for bankruptcy.

• Knightscope claims their robots “fight crime” but in reality, are more like “roombas” with cameras.

• Knightscope is negative on cash and needs to dilute

• Has an active $93m shelf (+ ATM) from which it can issue shares

• As of 7/14/23 it is no longer subject to Baby Shelf Rule (can dilute full $93m now)

• Funds its operations through toxic dilution and crowdfunding

• Revenues have flatlined for the last few years

f

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 2 of 32 |

| Summary

Introduction

Pre-IPO Financing

The K5 Robot (flagship)

What are Knightscope's customers/ saying?

Financials

Truth on their Revenues/Growth

Cash Position

Dilution (ability to raise cash)

Summary of ATM Usage + Insider Sells

Management

CEO William Santana Li and his disastrous track record.

Stock Promotion + Marketing Spend

Summary

Knightscope ($KSCP), is a self-proclaimed American security camera and robotics company established in 2013 which builds Autonomous Security

• Revenues have flatlined for the last few years

• Despite $10s of millions in marketing

• And $10s of millions in R&D

• Cash burn continues to increase, and the promise of profitability is nowhere near

• Founder and CEO has a track record of failed ventures, but an amazing ability to continuously raise capital

• Knightscope’s services are heavily disliked, and customers aren’t satisfied with their services

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 3 of 32 |

| Robots (ASR’s). Since its establishment, it has managed to capture attention with its laughable attempts at innovation with “security” robots that

resemble rejected Star Wars characters. The company parades itself as a solution for surveillance, but a closer look reveals a company that is more

smoke and mirrors than actual substance. In this report, we will dissect Knightscope's impending dilution, highlighting its consistent lack of

profitability, inability to scale, ineffective robotic technology, lack of customer satisfaction and the threat of delisting from Nasdaq.

As of Friday, the company is no longer under the “Baby Shelf” rule (which limits dilution via Shelf Registration), and is now able to utilize the $100m

shelf to its full capacity. As is outlined in the “Financial” section, it will become clear how necessary it is for Knightscope to dilute stock in order to

raise capital. Also highlighted is the company's consistent usage of its “At-The-Market '' agreement with HC Wainwright (known for facilitating

share dilution for questionable small-cap companies with a history of cash burn, and lack of shareholder value creation), that ultimately led to a -75%

move with only a few shares issued (annotated chart later in the document) .

We believe there is a clear agenda in play, with the stock running from $0.38 to $2.16 within a short time frame on no substantial news, and that the

company's shares will experience a significant decline with or without dilution.

Introduction

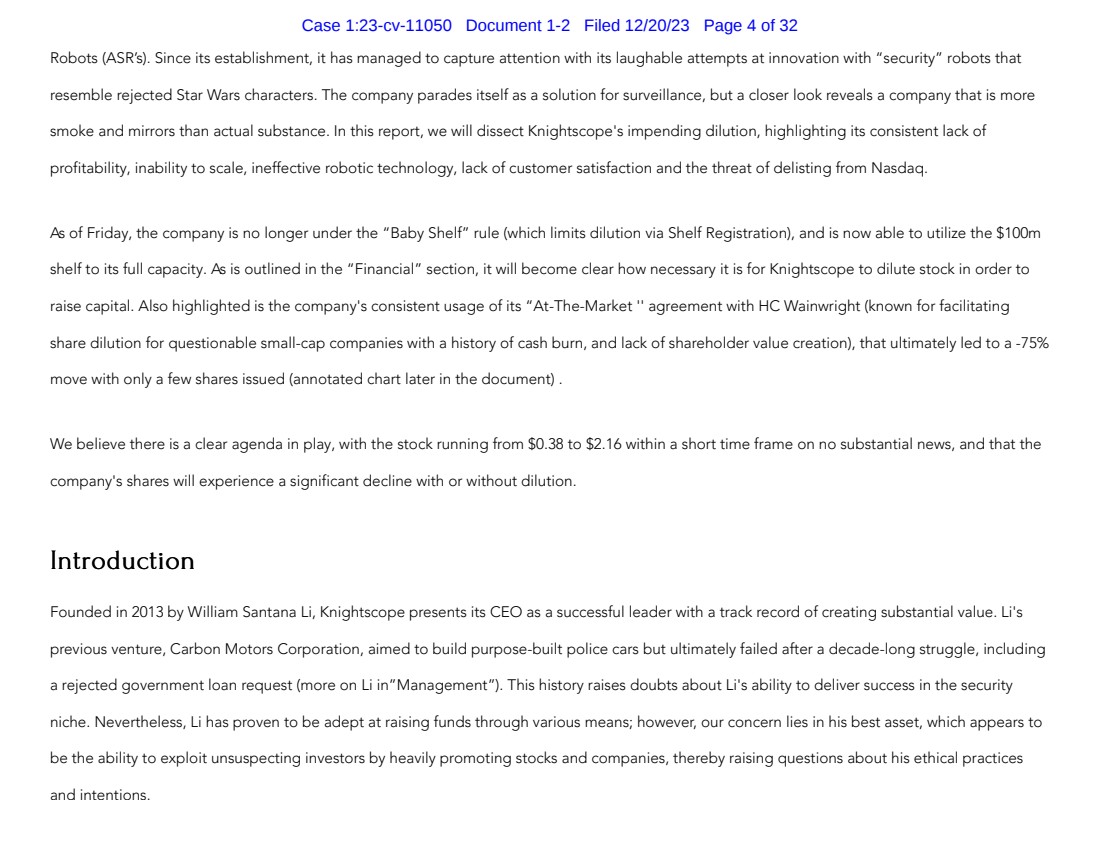

Founded in 2013 by William Santana Li, Knightscope presents its CEO as a successful leader with a track record of creating substantial value. Li's

previous venture, Carbon Motors Corporation, aimed to build purpose-built police cars but ultimately failed after a decade-long struggle, including

a rejected government loan request (more on Li in”Management”). This history raises doubts about Li's ability to deliver success in the security

niche. Nevertheless, Li has proven to be adept at raising funds through various means; however, our concern lies in his best asset, which appears to

be the ability to exploit unsuspecting investors by heavily promoting stocks and companies, thereby raising questions about his ethical practices

and intentions.

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 4 of 32 |

| and intentions.

Knightscope stoops to a remarkably low level by shamelessly leveraging tragedies such as the "Sandy Hook" shootings, the "Boston bombings,"

and the 9/11 attacks as a means to promote their company. This exploitative tactic demonstrates a disturbing lack of moral integrity, as they

attempt to capitalize on these horrific events while conveniently concealing the fact that their product, a "roomba" with a camera as we like to call

it, would offer little to no actual effectiveness in preventing or addressing such incidents. Later we go over what the community as well as customers

actually think about them.

Pre-IPO Financing

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 5 of 32 |

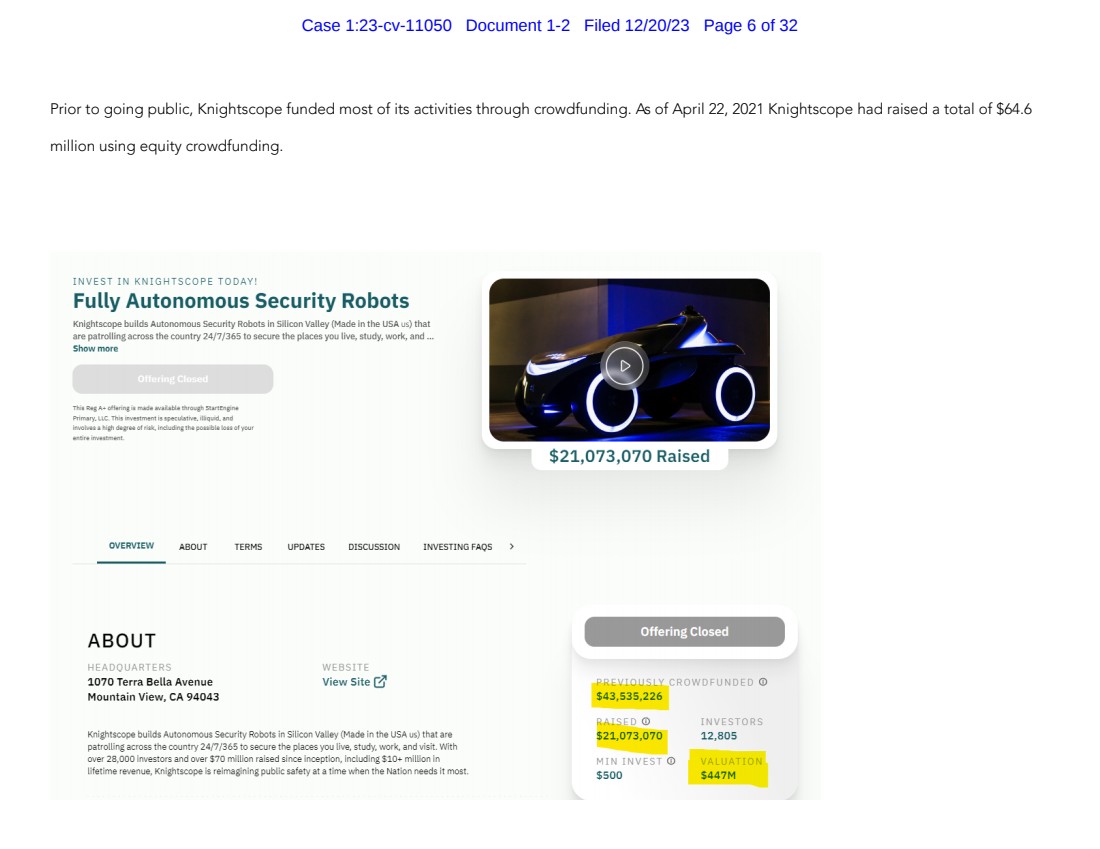

| Prior to going public, Knightscope funded most of its activities through crowdfunding. As of April 22, 2021 Knightscope had raised a total of $64.6

million using equity crowdfunding.

INVEST IN KNIGHTSCOPE TODAY!

Fully Autonomous Security Robots

Knightscope builds Autonomous Security Robots in Silicon Valley (Made in the USA us) that

are patrolling across the country 24/7/365 to secure the places you live, study, work, and ...

Show more

Thu Reg A• offHing is made: available through 5tartEn.giM

Primary. LLC. Th19 inve:Jtment i!I speculative, ilUqu~. and

invotvH a high de.gree of ri.!lk. including the ~!ii ble loss of your

entire investment.

OVERVIEW ABOUT

ABOUT

HEADQUARTERS

1070 Terra Bella Avenue

Mountain View, CA 94043

TERMS UPDATES DISCUSSION

WEBSITE

View Site B'

INVESTING FAQS

Knightscope builds Autonomous Security Robots in Silicon Valley (Made in the USA us) that are

patrolling across the coun ry 24/7 /365 to secure ihe places you live, study; work, and visit. With

over 28,000 investors and over $70 million raised since inception, including S10,. mituon in

Ii etime revenue, Knightscope is reimagining public safety a a time when he Nation needs it mos .

Offering Closed

CROWDFUNDED 0

D0

$21,073,070

MIN INVEST 0

$500 $447M

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 6 of 32 |

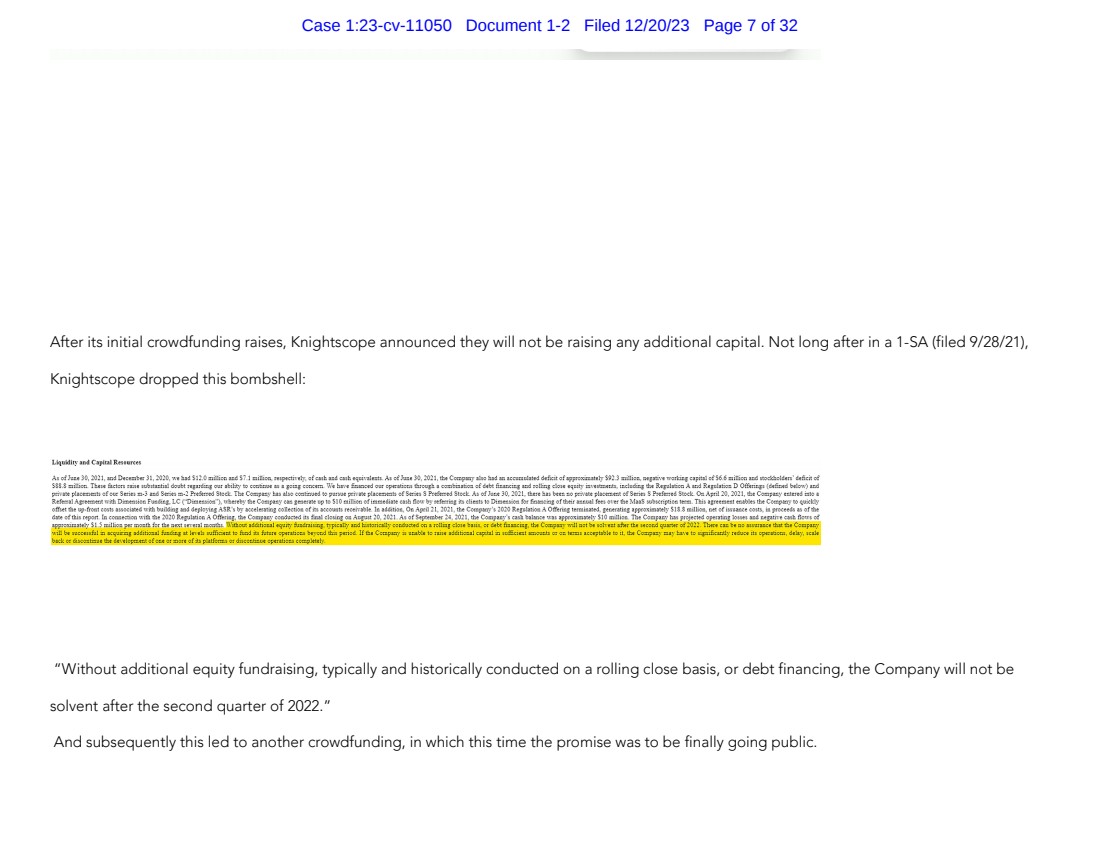

| After its initial crowdfunding raises, Knightscope announced they will not be raising any additional capital. Not long after in a 1-SA (filed 9/28/21),

Knightscope dropped this bombshell:

“Without additional equity fundraising, typically and historically conducted on a rolling close basis, or debt financing, the Company will not be

solvent after the second quarter of 2022.”

And subsequently this led to another crowdfunding, in which this time the promise was to be finally going public.

Liquidity and Capi1al Rtsourtu

As of font 30, 2021, and Dtctmbff 31, 2020, wt had Sll.O million and S7.1 million, resptctinly, of cash and cash tquinltnts. As of Jun, 30, 2021, tht Company also had ar. accumulated deficit of approximately S92.3 million, nt!atin working capital ofS6.6 million and stod:holdm' deficit of

SSS.S million. Thu, facton raise substantial doubt regirding our ability to continue as a ioing concern. ''e ha·.-, financed our Opr."ations throu!h a combination of debt financing and rollin! close eq1,ity investments, includin! tht Re,!Ulation A and Re!lJlation D Offerings (defined below) and

prit·att plactmtnts of our Seriu m-3 and Series m-2 Preferred Stoel:. The Company has aho continued to punue pri·att placements ofSeriu S Preferred Stoc:k. As of June 30, 2021, there has been no private placemt:1t ofStriu S Preferred Stock. On April 20, 2021, the Company entered into a

ReferralA!reement with Dime:1sion F1:.r.din!, LC ("Dioeruion''), whereby the Compa:ty c.art !enerate up to SIO million of immediate cash flow by rdttrin! its clients to Dimtt.sio:1 for Manc:i.11,! of their annual feu onr the MuS subKrip1io:1 term. This a!rteme:1t ettablu the Company to quickly

offsei the up-front costs USO(:iated with building and deployingASR's by accelerating collection of its aeeounu reeti''able. In addition, On April 21, 2021, the Company's 2020RegulationA Offering terminated, generating approximately S18.S million, Jltl ofiuuanee eosu, in Pf'OCttds u of the

datt of this rtpon. In connection with tht 2020 Regulation.- Offering, tht Company conducted its (ma.I closing on Augu.st 20, 2021. As of September 24, 2021, tht Compan)"'s cash balance wu approximately SIO million. Tht Company hu Pf'Ojtcttd o~rating louts and ntgati·t c.uh flows of

approximattl;:_Sl.S million ~r month for the ntxt se,·,ral months, ''ithout add1t10nal equity fur.dramr.g. typ1cally .llld h1stonca!ly cor.ducttd on a rolhng clou bam. or dtbt fir.a:1cmg, tht Company nil not bt solnnt after tl:.t second quantr of :::o:::::: Thtrt can bt no auuranct that tht Company

,nil be succenful m a,qu1rmr addu:onal fundm1! at ltHls 1uftie:tn1 to fund 1u fuiu:t ope:auons beyond thu ptnod If tht Company is unable to rant addmonal cap:1.1! :r. 1uffic1tnt amount~ o: on ttn::is acceptable 10 11. 1h, Company may ha,.-, to st1!nd'icantly rtd1.1ce m opt:a110ns, delay, seal,

back or daconun1.1e L~t dtalopmelll of o:it or more oftt~ platforms or d1~co1mnue optra1:on1 complt!tly

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 7 of 32 |

| A cursory review of Knightscope's 1-SA filings reveals a pattern of statements akin to the one mentioned above (including the recent 10-K), where it

becomes apparent with minimal due diligence that the company heavily relies on continuous funding. They often assert having sufficient capital,

only to subsequently declare the need for further funding, perpetuating a seemingly endless cycle. This raises concerns about the company's

transparency, financial stability, and their ability to provide accurate and reliable information to investors.

Upon its Nasdaq debut, Knightscope concluded its Regulation A Offering on January 26, 2022, successfully issuing 2,236,619 shares of Class A

common stock and generating approximately $19.5 million in net proceeds.

Public crowdfundings are often viewed negatively due to their inherent drawbacks. Generally, there is heightened risk associated with early-stage

ventures, liquidity concerns, lack of regulatory oversight and inadequate investor protections.

This article provides a good overview on the problems with crowdfunding equity.

Nanalyze

During the concluding crowdfunding campaign, Li drew comparisons between Knightscope's aspiration to go public and the trajectory of

companies like $FUV that followed the same path. There is no issue in that, until you see what happened to $FUV’s stock price, which has

experienced a staggering 99% decline from it's all-time high.

Another company which went public after raising funds in a similar fashion was $AMV (current ticker $NXU, is also down 99% from its ATH).

Ah !oO srn11e, to whet Acr1rnoto

did l hey uwd Reg A• 10 hove

on IPO I bcl1C'Y<'

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 8 of 32 |

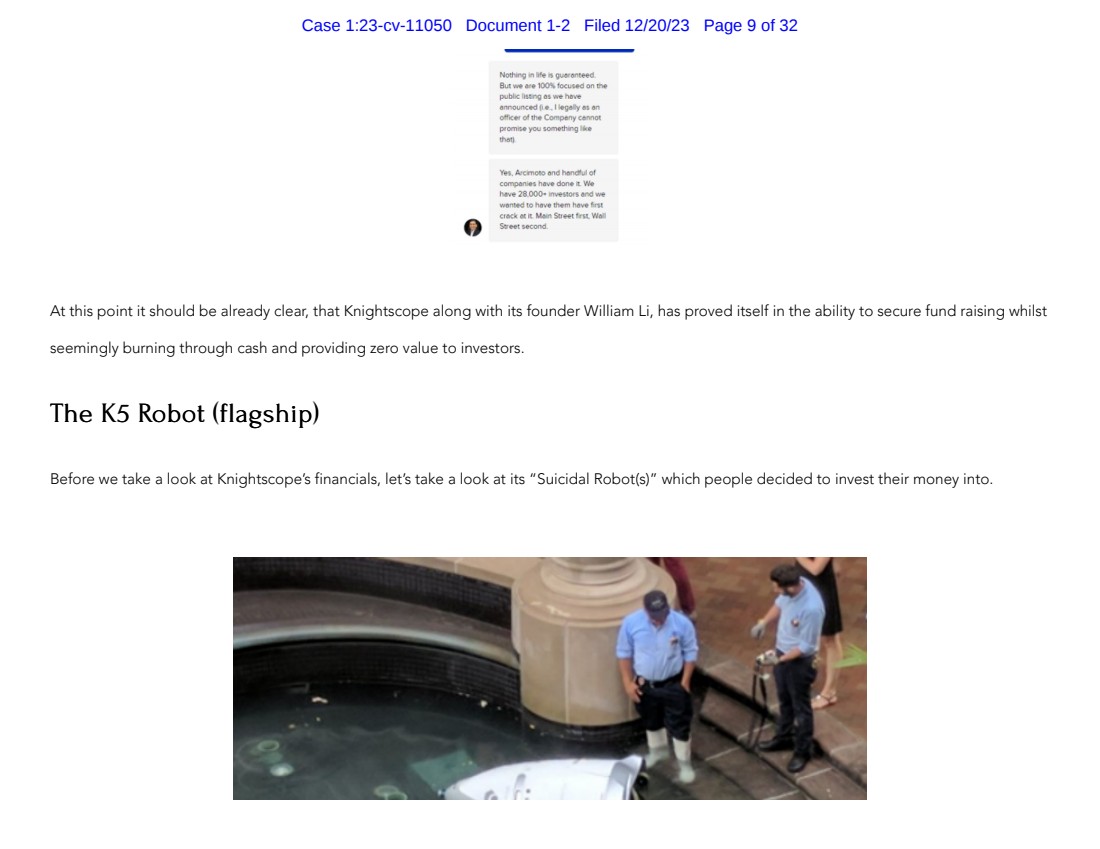

| At this point it should be already clear, that Knightscope along with its founder William Li, has proved itself in the ability to secure fund raising whilst

seemingly burning through cash and providing zero value to investors.

The K5 Robot (flagship)

Before we take a look at Knightscope’s financials, let’s take a look at its “Suicidal Robot(s)” which people decided to invest their money into.

NOU'llr'lig lr"I 'e IS QUP' teed

But w. a•• 1004. ocused on

pt.,bhc Ii ng as we have

onnounced (1 • I 01 or,

o 1CeroflheCom~unno<

Pfom1se you somethwig e

th~U

YH. A.~cimoto ond hdndf of

CfOc.k ot I M

Street second

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 9 of 32 |

| According to the Bureau of Labor and Statistics, a security guard’s job is to “guard, patrol, or monitor premises to prevent theft, violence, or

infractions of rules”

We will mainly be looking at its flagship robot, the K5. A 300 lb+ hunk of metal, which appears to be a knock-off copy of R2D2 that doesn’t even

have a functioning arm. So yes, throwing a blanket over K5 would render it useless.

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 10 of 32 |

| In simple terms, the Knightscope robot is highly ineffective, with a maximum speed of 3 mph that falls short of even a six-year-old's running pace. Its

primary purpose seems to be limited to monitoring, making it questionable to spend $1200 per week (at a cost of $7 per hour) on a malfunctioning

robot that not only ignores people in distress but has also been known to run over a toddler's foot in past incidents, even at such slow speeds. Such

occurrences raise serious concerns about the safety and reliability of the robot, making its use both impractical and potentially harmful. The cost

outweighs the benefits, making it an impractical and unreliable investment.

In a specific incident at a local park (Huntington), when a fight broke out, the Knightscope robot failed to respond appropriately. When a woman

attempted to utilize the robot's emergency alert button, it persistently instructed her to "step out of the way." As the altercation continued, the

robot carried on rolling down the sidewalk, playing a whimsical tune from its speakers, and sporadically reminding bystanders to "please keep the

park clean." This lack of responsiveness and misplaced behavior raises serious doubts about the robot's effectiveness in handling real-time

emergencies and its ability to fulfill its intended security functions.

Subsequently, it was discovered that the emergency calls made by the woman during the park fight were actually directed to Knightscope's

headquarters. This revelation suggests that the primary objective of the robot was not to address security concerns but rather to intermittently

remind park visitors to "please keep the park clean." This revelation further reinforces the notion that the robot's focus and capabilities are far from

being aligned with effective security measures, raising doubts about its true purpose and usefulness in critical situations.

NBC

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 11 of 32 |

| Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 12 of 32 |

| Our favorite incident was when the Knightscope robot faced off against a "drunk man" and ended up being overpowered and tipped over. This

episode makes their "Robots Winning Against Crime," statement almost comical.

CNET

A further incident occurred at a shopping mall in 2016, where the 300 lb+ K5 robot collided and ran over a 16-month-old toddler and continued

operating without immediate intervention. This raises concerns about Knightscope's ability to ensure basic safety protocols. This incident proves

that Knightscope’s robots, can't even follow "Asimov's first law of robotics," which prioritizes the protection of human life above anything else.

As competition in the robotics industry grows, and with advancements in AI, the achievement of full autonomy becomes more accessible, posing

challenges for Knightscope and the competition it may face.

The mother of the toddler involved in the incident commented, "The robot hit my son's head, and he fell down facing the floor, but the robot didn't

stop, it just kept moving forward." The parents of the toddler also stated that the robot ran over his right foot, causing swelling, and he suffered a

scrape on his leg. The intensity of the toddler's crying following was reported by witnesses as a concern for the robot's potential to cause distress

rather than prevent.

It is common to see videos like this on Youtube when searching for videos on Knightscope, clearly showcasing its best asset is to entertain children's

attention and irritate anyone passing by with its annoying and loud sounds.

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 13 of 32 |

| What are Knightscopes customers/ saying?

Well as one might imagine with a $7 per hour malfunctioning robot, many of them aren’t happy and not renewing contracts, lets take a look at a

few.

Trinity Metro - Fort Worth

Take Trinity Metro, who began a pilot test for the K5 Robot, Sundance in May of 2020 to patrol the Fort Worth Central Station lobby area. As is with

many customers who introduce Knightscope’s services it is done so in addition to “existing physical security staff patrols, providing video

surveillance capabilities in the regions that had limited use of cameras”.

These were the costs per month of each of Knightscopes Services.

K-5 Robot (1): $6,500

SCOT Towers (2): $2,190

each ROSA Devices (5): $730 each

The monthly leasing costs were a whopping $14,530 per month, for basically glorified cameras. And, “another pertinent fact is “that Sundance” has

damaged the floor at Fort Worth Central Station, which requires repairs costing nearly $75,000.00.”

As one might expect, Trinity Metro decided to end the pilot for all Knightscope services.

Trinity Metro

Hayward

The city of Hayward dispatched its robot in a city parking garage in 2018, the following year, a man attacked and knocked over the robot, and no

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 14 of 32 |

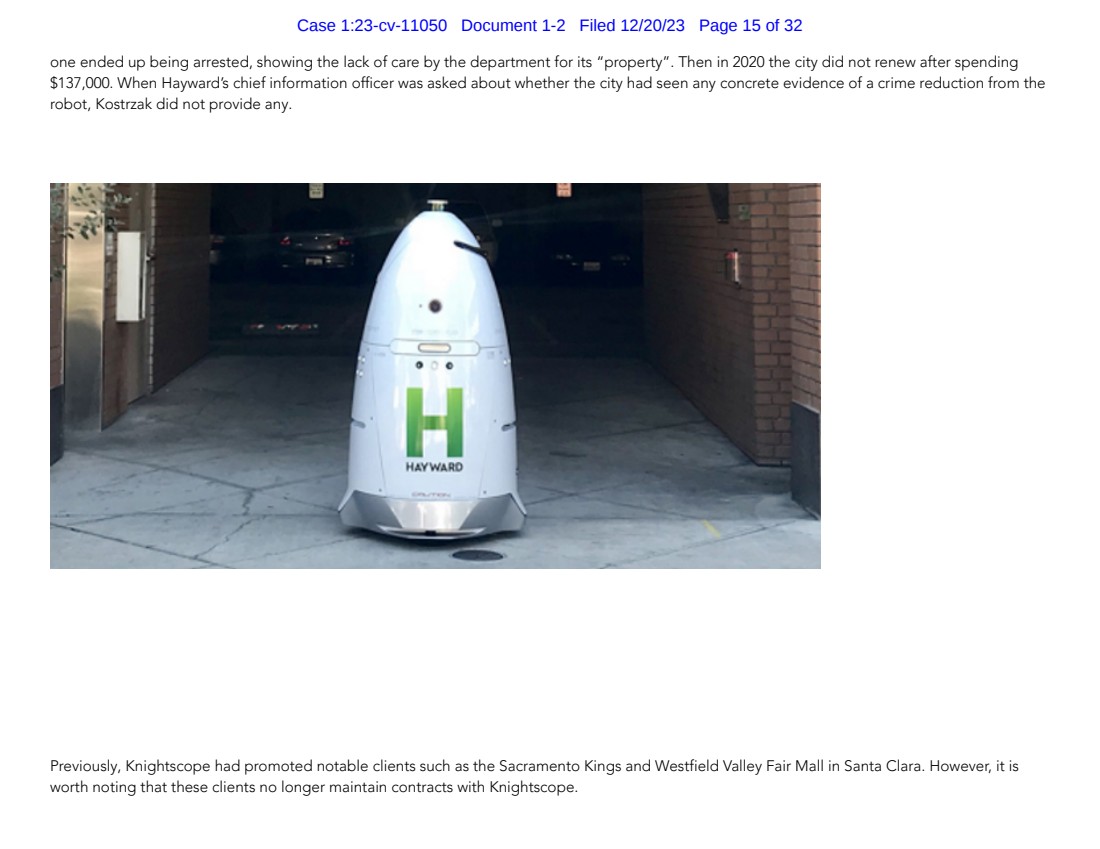

| one ended up being arrested, showing the lack of care by the department for its “property”. Then in 2020 the city did not renew after spending

$137,000. When Hayward’s chief information officer was asked about whether the city had seen any concrete evidence of a crime reduction from the

robot, Kostrzak did not provide any.

Previously, Knightscope had promoted notable clients such as the Sacramento Kings and Westfield Valley Fair Mall in Santa Clara. However, it is

worth noting that these clients no longer maintain contracts with Knightscope.

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 15 of 32 |

| PG&E

PG&E, a California utility company who recently pleaded guilty to 84 wildfire deaths, employed Knightscope’s robots, but that too, didn’t go too

well. With the robot roaming along the sidewalks, being a nuisance to pedestrians, bystanders, locals etc.

A bartender who worked close by said, “It’s creepy. No one likes this. Just — no one likes this,” Emily, a 25-year-old bartender at The Homestead,

located across from PG&E’s property.

Another local resident living near PG&E’s land, said that the robots were “especially troubling,” because “the robot annoys the hell out of anyone

trying to do as much as just stand here,” and moreover, “We can hear the annoying sound that the robot makes all day long, including when we’re

trying to sleep at night.”

Well, those locals would be happy to hear that recently PG&E decided not to continue with the security robot experiment as a PG&E spokesperson

said they “will not be continuing with plans to deploy the unit at our Folsom location."

zdnet

Here is a demonstration of the exact robot in question from the PG&E location, from the quotes above: Youtube

•••

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 16 of 32 |

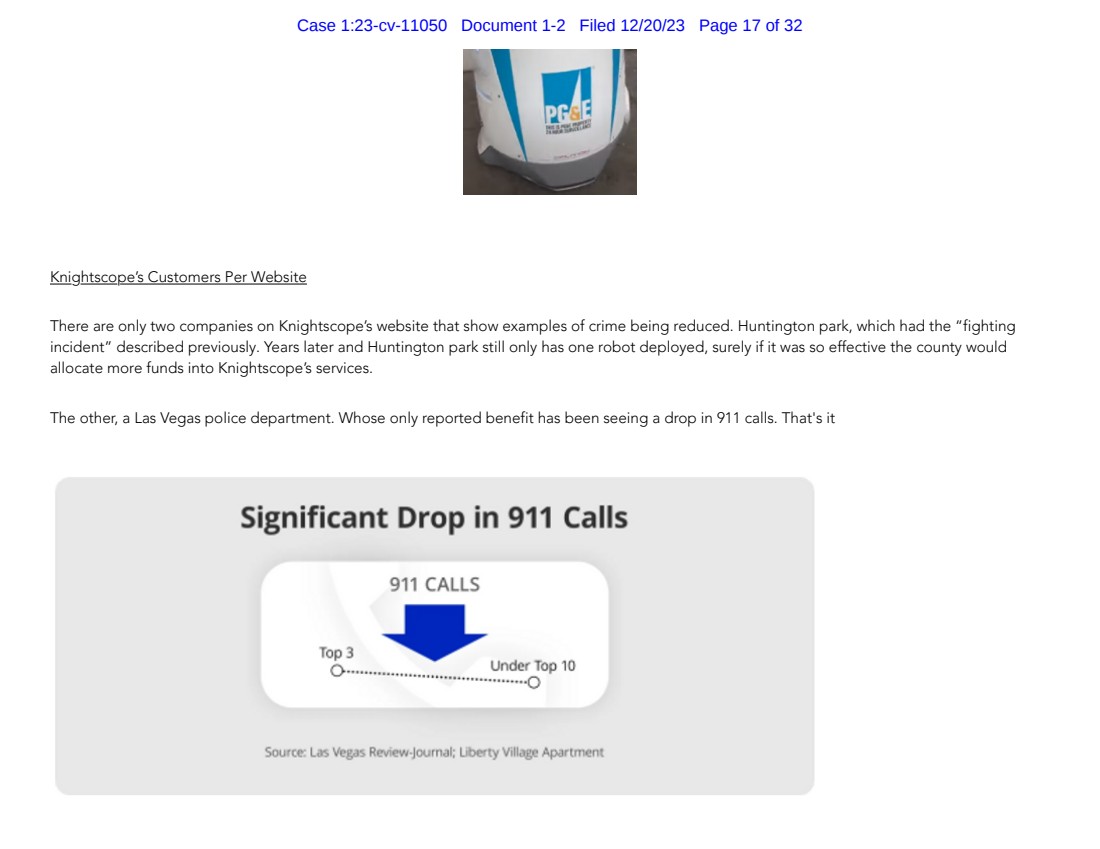

| Knightscope’s Customers Per Website

There are only two companies on Knightscope’s website that show examples of crime being reduced. Huntington park, which had the “fighting

incident” described previously. Years later and Huntington park still only has one robot deployed, surely if it was so effective the county would

allocate more funds into Knightscope’s services.

The other, a Las Vegas police department. Whose only reported benefit has been seeing a drop in 911 calls. That's it

----------

Signif·cant Drop in 911 Calls

9 1 CALLS

op

.......................... Und 0 op 10 ... ······· ....... .

R ·JOU r l;

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 17 of 32 |

| Knightscope Crime

Financials

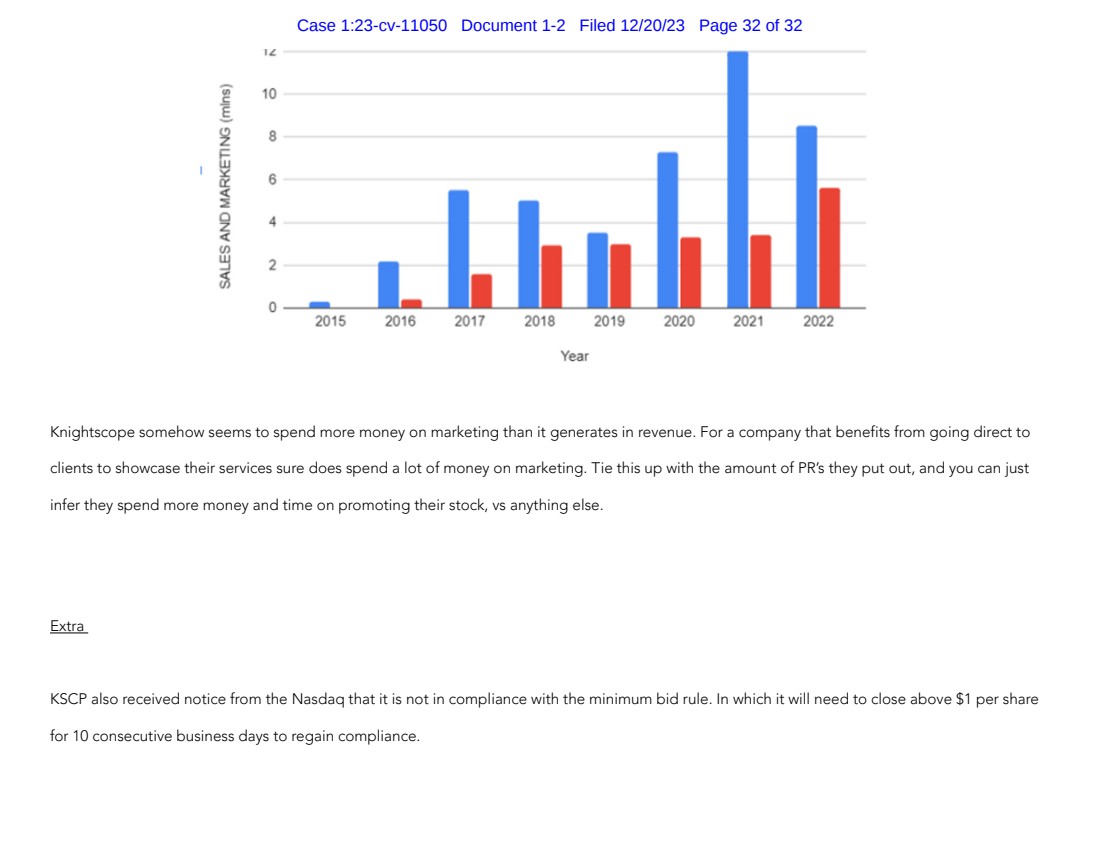

Kngihtscope charges monthly revenues for their ASR’s ranging from $3000 to $8500 per month. And since 2015 have been receiving paid orders.

And for the first 2 years revenue grew quickly, but until the IPO stage revenue pretty much flatlined, even with the tens of millions of $ they spent

which they received through financing, and all of their investments into R&D. It is now 10 years after its founding, and they just figured out how to

“detect gunshot sounds,” something we believe the human ear can do as well, one really wonders what truly happens to all this R&D spend. Since

2020, its spend on R&D has been on average around 137% of its annual revenue.

Truth on their Revenues/Growth

-- ----------

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 18 of 32 |

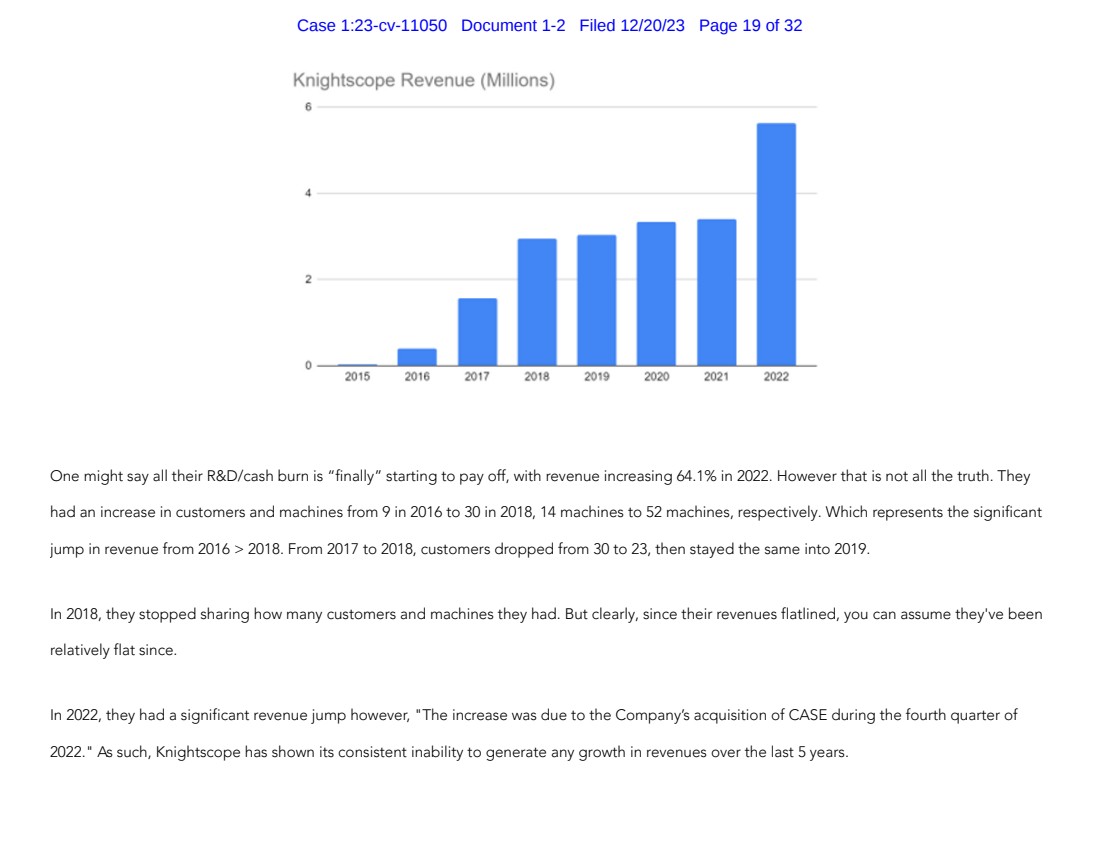

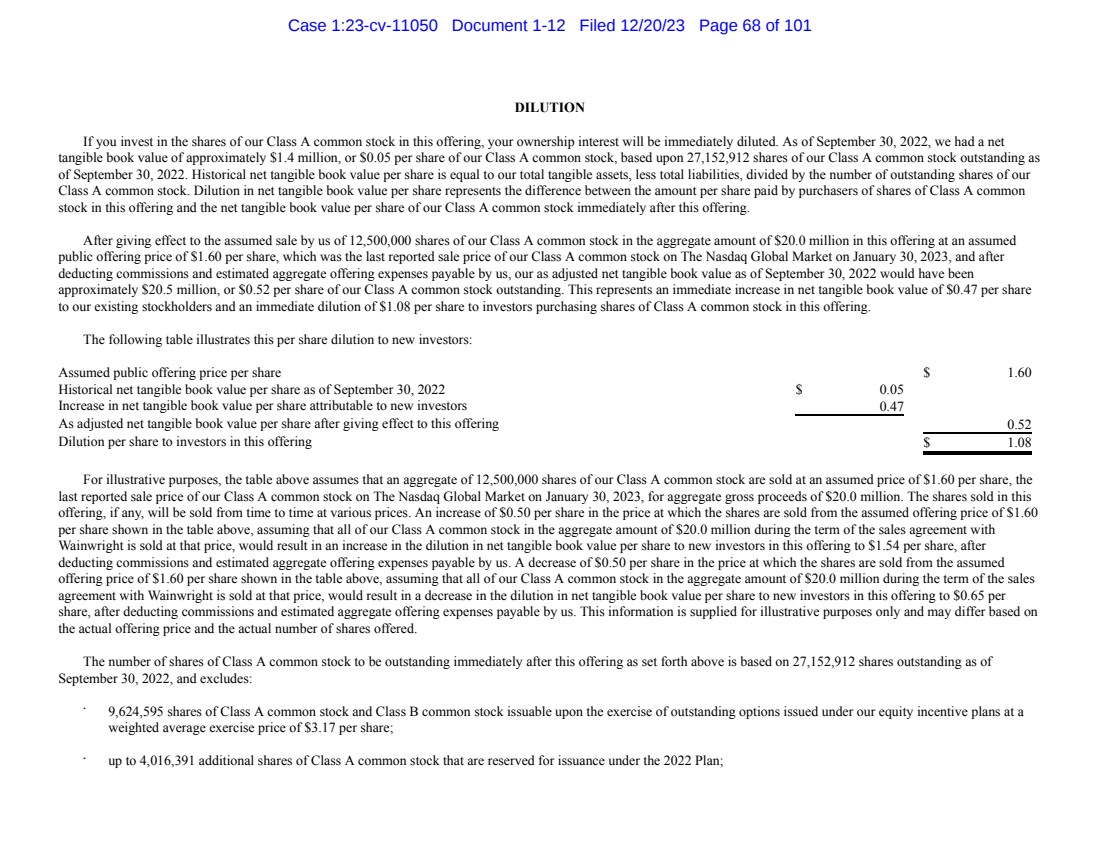

| One might say all their R&D/cash burn is “finally” starting to pay off, with revenue increasing 64.1% in 2022. However that is not all the truth. They

had an increase in customers and machines from 9 in 2016 to 30 in 2018, 14 machines to 52 machines, respectively. Which represents the significant

jump in revenue from 2016 > 2018. From 2017 to 2018, customers dropped from 30 to 23, then stayed the same into 2019.

In 2018, they stopped sharing how many customers and machines they had. But clearly, since their revenues flatlined, you can assume they've been

relatively flat since.

In 2022, they had a significant revenue jump however, "The increase was due to the Company’s acquisition of CASE during the fourth quarter of

2022." As such, Knightscope has shown its consistent inability to generate any growth in revenues over the last 5 years.

Knightscope Revenue ( illions)

6

4

2

0----

2015

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 19 of 32 |

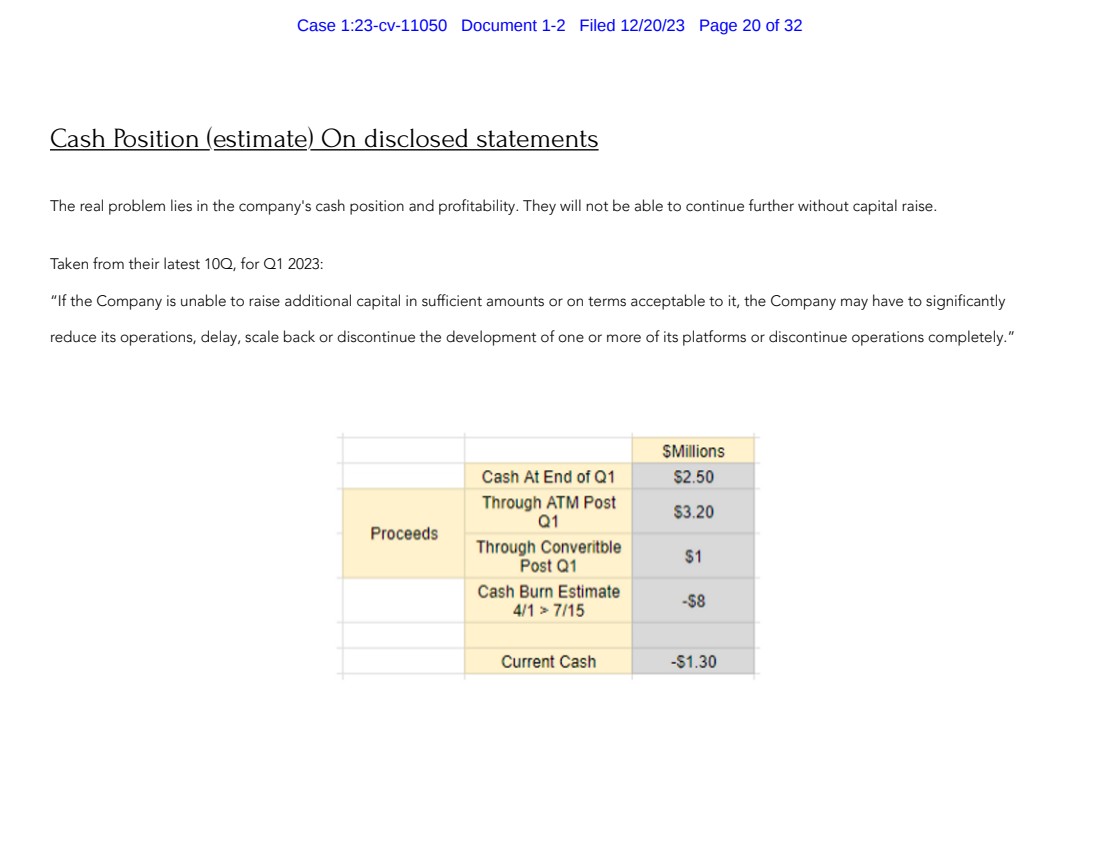

| Cash Position (estimate) On disclosed statements

The real problem lies in the company's cash position and profitability. They will not be able to continue further without capital raise.

Taken from their latest 10Q, for Q1 2023:

“If the Company is unable to raise additional capital in sufficient amounts or on terms acceptable to it, the Company may have to significantly

reduce its operations, delay, scale back or discontinue the development of one or more of its platforms or discontinue operations completely.”

Pro eeds

Cas A End of 01

T rough AT Post

01

Tl ro gl Con

Posto

Cash Bur Esti a e

/1 115

Curre t Cash

illi ns

2.50

..20

1

- 8

- .30

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 20 of 32 |

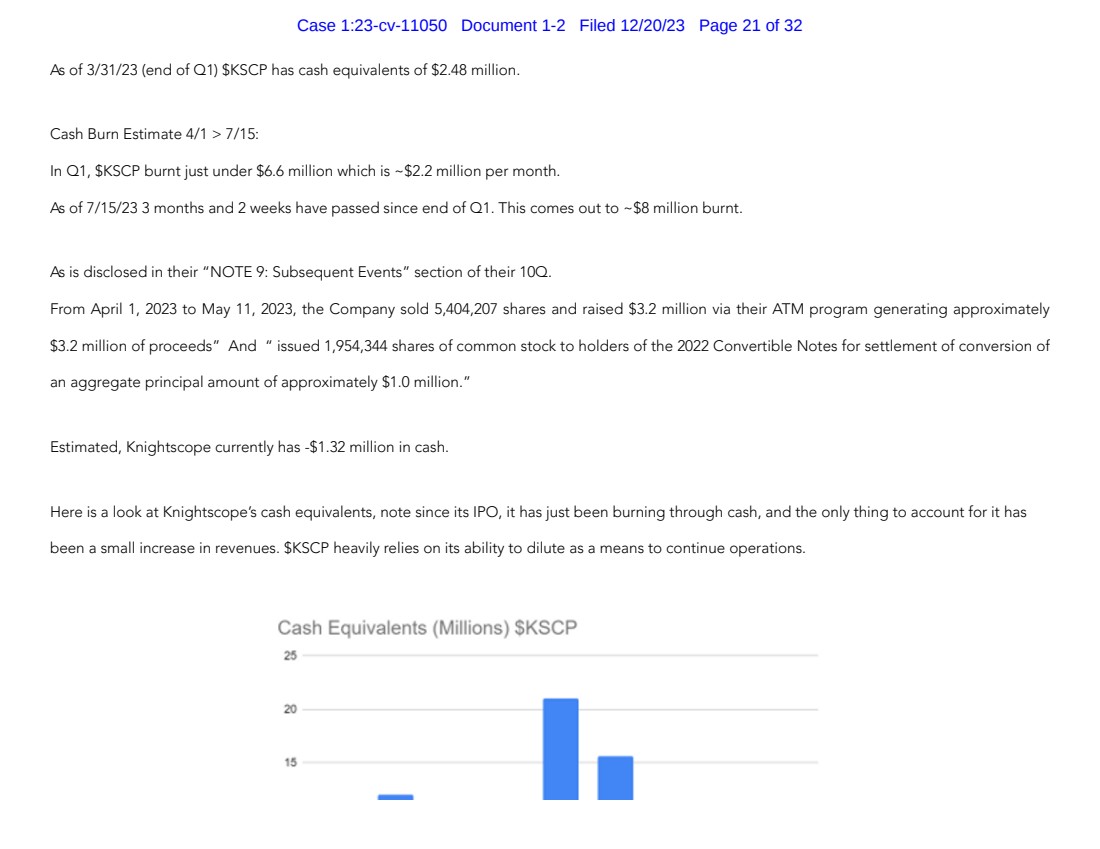

| As of 3/31/23 (end of Q1) $KSCP has cash equivalents of $2.48 million.

Cash Burn Estimate 4/1 > 7/15:

In Q1, $KSCP burnt just under $6.6 million which is ~$2.2 million per month.

As of 7/15/23 3 months and 2 weeks have passed since end of Q1. This comes out to ~$8 million burnt.

As is disclosed in their “NOTE 9: Subsequent Events” section of their 10Q.

From April 1, 2023 to May 11, 2023, the Company sold 5,404,207 shares and raised $3.2 million via their ATM program generating approximately

$3.2 million of proceeds” And “ issued 1,954,344 shares of common stock to holders of the 2022 Convertible Notes for settlement of conversion of

an aggregate principal amount of approximately $1.0 million.”

Estimated, Knightscope currently has -$1.32 million in cash.

Here is a look at Knightscope’s cash equivalents, note since its IPO, it has just been burning through cash, and the only thing to account for it has

been a small increase in revenues. $KSCP heavily relies on its ability to dilute as a means to continue operations.

Cash Equivalents (Millions) SKSCP

25

20

-

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 21 of 32 |

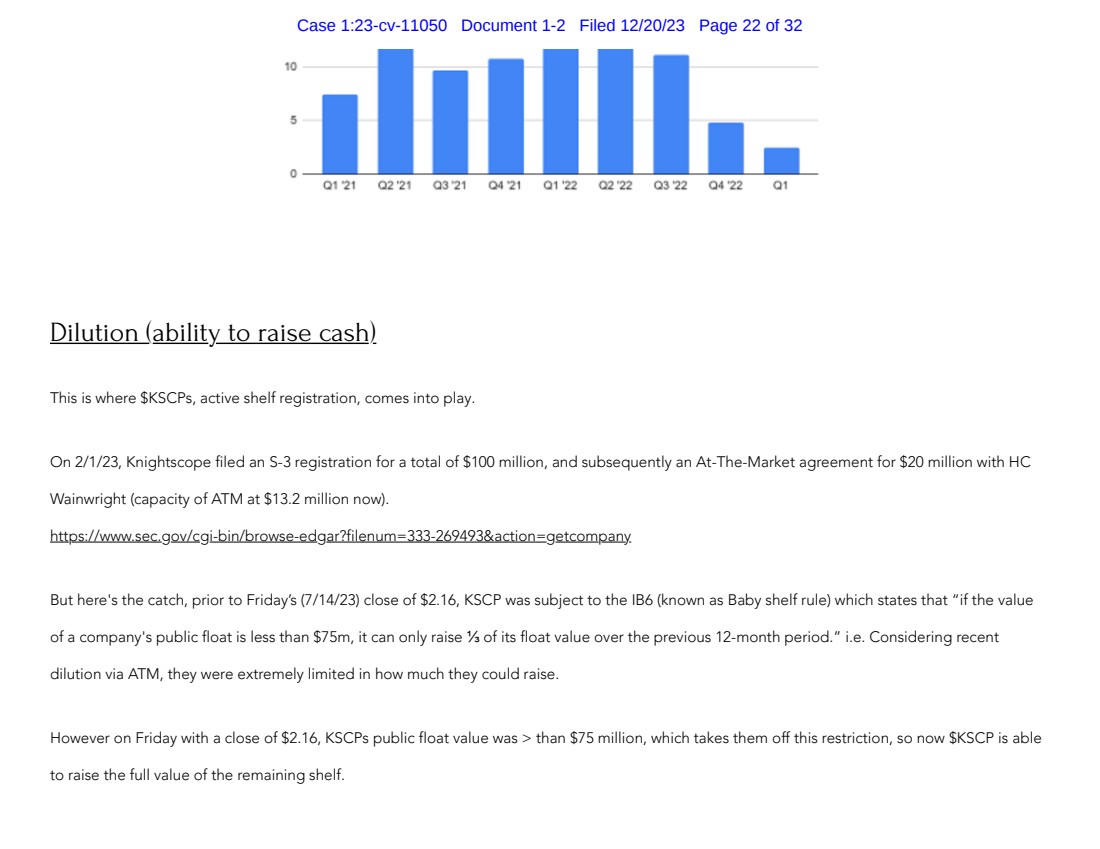

| Dilution (ability to raise cash)

This is where $KSCPs, active shelf registration, comes into play.

On 2/1/23, Knightscope filed an S-3 registration for a total of $100 million, and subsequently an At-The-Market agreement for $20 million with HC

Wainwright (capacity of ATM at $13.2 million now).

https://www.sec.gov/cgi-bin/browse-edgar?filenum=333-269493&action=getcompany

But here's the catch, prior to Friday’s (7/14/23) close of $2.16, KSCP was subject to the IB6 (known as Baby shelf rule) which states that “if the value

of a company's public float is less than $75m, it can only raise ⅓ of its float value over the previous 12-month period.” i.e. Considering recent

dilution via ATM, they were extremely limited in how much they could raise.

However on Friday with a close of $2.16, KSCPs public float value was > than $75 million, which takes them off this restriction, so now $KSCP is able

to raise the full value of the remaining shelf.

0

0

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 22 of 32 |

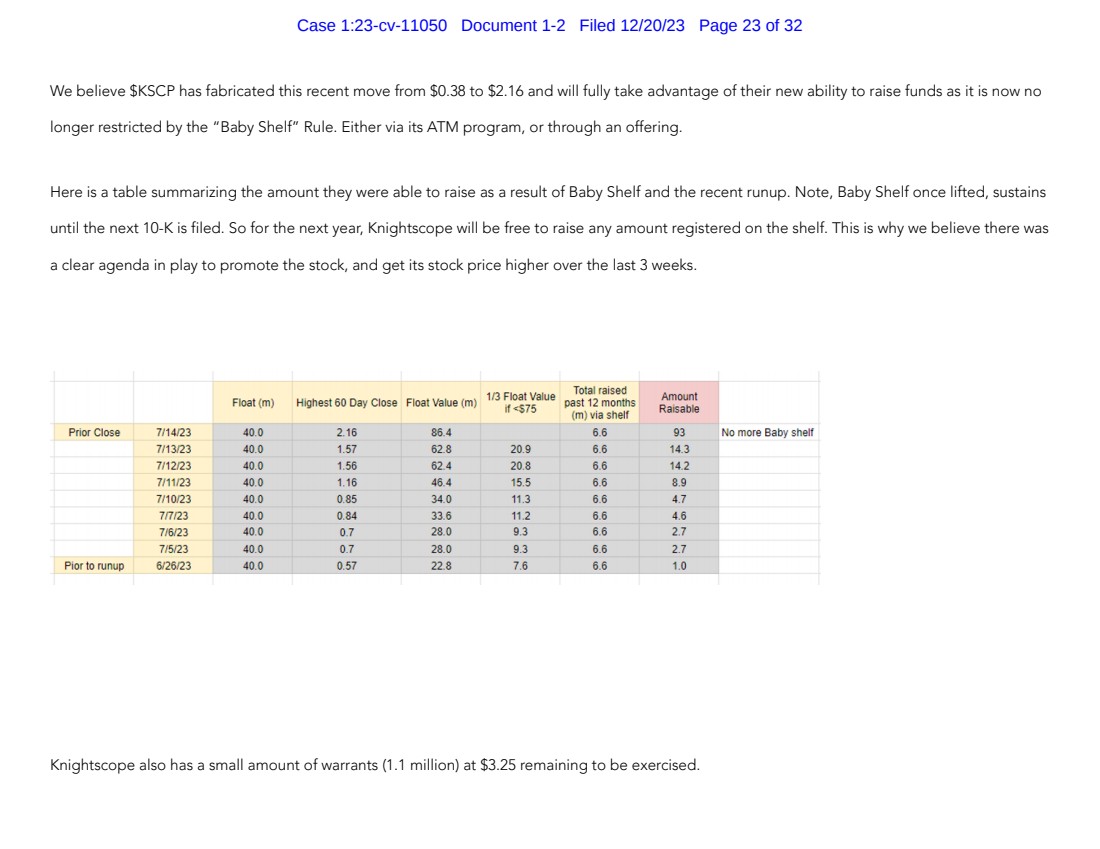

| We believe $KSCP has fabricated this recent move from $0.38 to $2.16 and will fully take advantage of their new ability to raise funds as it is now no

longer restricted by the “Baby Shelf” Rule. Either via its ATM program, or through an offering.

Here is a table summarizing the amount they were able to raise as a result of Baby Shelf and the recent runup. Note, Baby Shelf once lifted, sustains

until the next 10-K is filed. So for the next year, Knightscope will be free to raise any amount registered on the shelf. This is why we believe there was

a clear agenda in play to promote the stock, and get its stock price higher over the last 3 weeks.

Knightscope also has a small amount of warrants (1.1 million) at $3.25 remaining to be exercised.

1/3 Float Value Total raIBed Amount Float (m) Highest 60 Day Close Floa Value (m) if <S75 past 12 months Raisab e (m) via shelf

Prior Close 7/14123 40.0 2.16 86.4 6.6 93 No more Baby shelf

7/13123 40.0 1.57 62.8 20.9 6.6 14.3

7/12123 40.0 1.56 62.4 20.8 6.6 14.2

7/11/23 40.0 1.16 46.4 15.5 6.6 8.9

7/10123 40.0 0.85 34.0 11.3 6.6 4.7

7f7/23 40.0 0.84 33.6 11.2 6.6 4.6

7(6123 40.0 0.7 28.0 9.3 6.6 2.7

7(5123 40.0 0.7 28.0 9.3 6.6 2.7

Pior to runup 6/26123 40.0 0.57 22.8 7.6 6.6 1.0

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 23 of 32 |

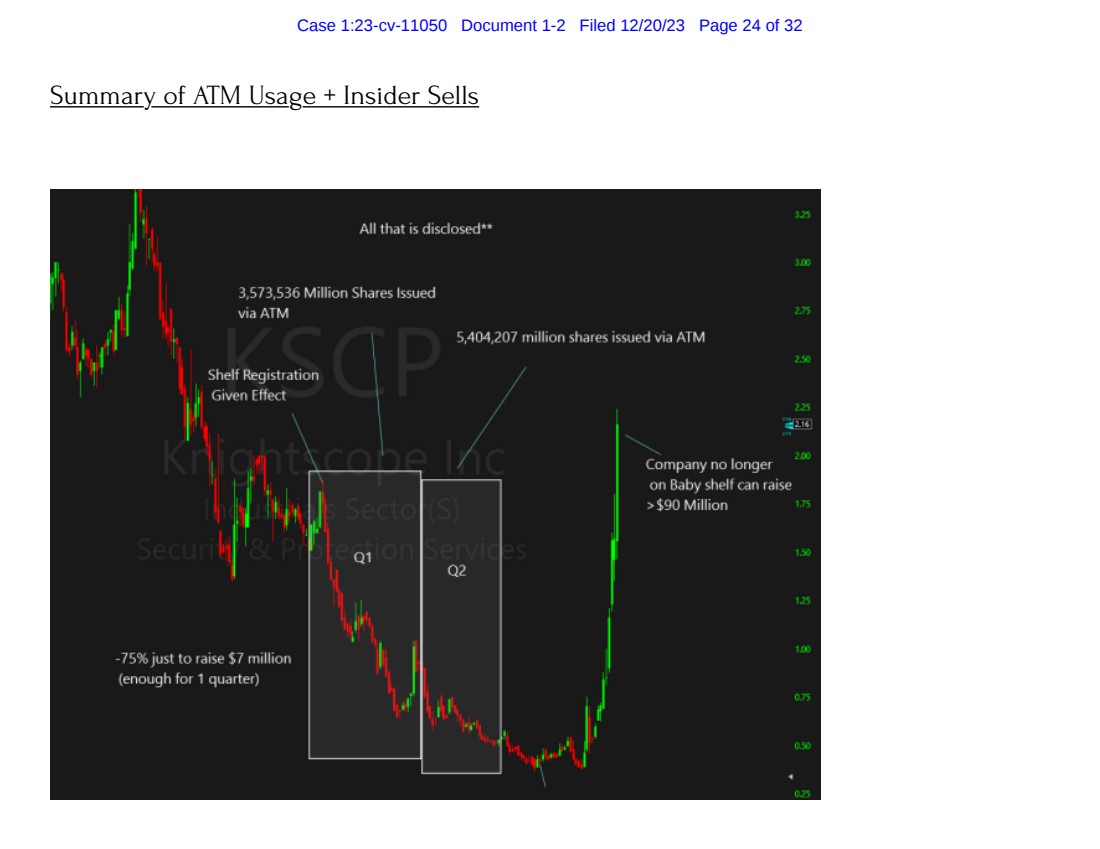

| Summary of ATM Usage + Insider Sells

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 24 of 32 |

| Just during Q1 which is when the Shelf/ATM was filed, Knightscope “issued 3,573,536 shares of Class A Common Stock under the at-the-market

offering program for net proceeds of approximately $3.4 million, net of brokerage and placement fees of approximately $0.1 million.”

Also. “From April 1, 2023 to May 11, 2023, the Company sold 5,404,207 shares of Class A Common Stock, generating approximately $3.2 million of

proceeds, net of commissions and other issuance costs, under the Company’s at-the-market offering program”

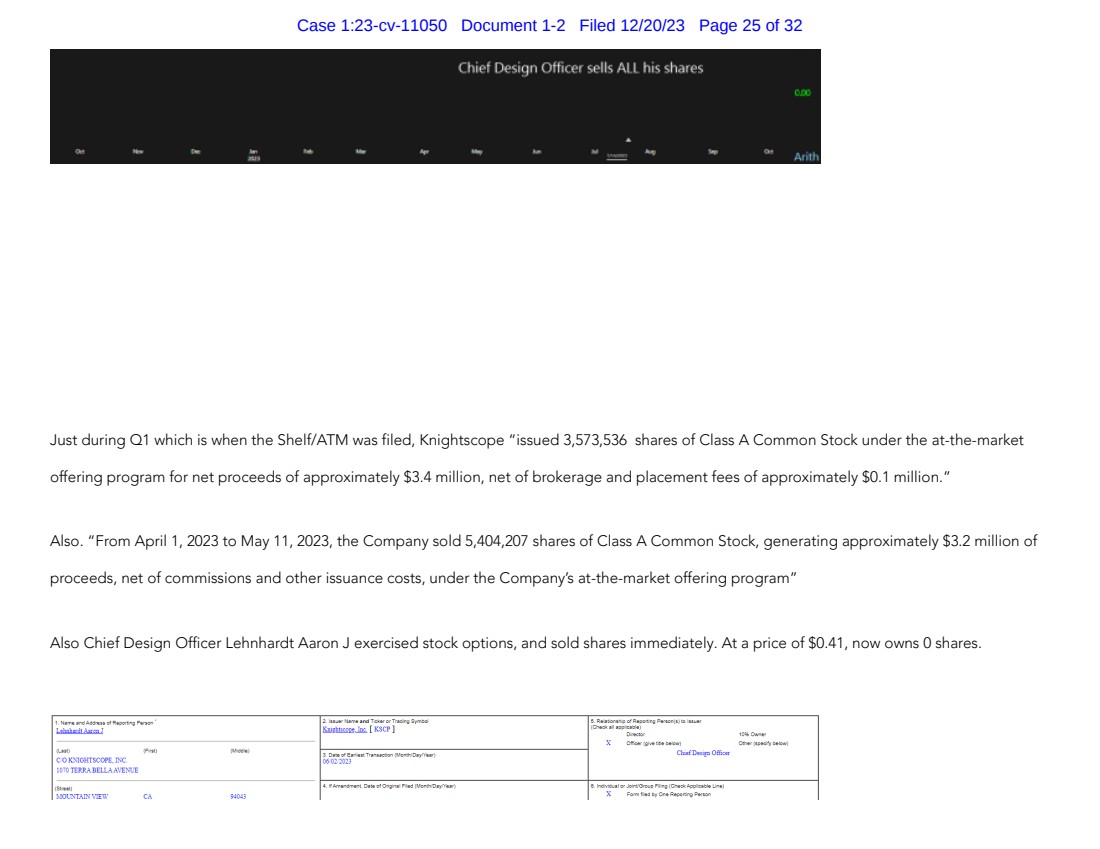

Also Chief Design Officer Lehnhardt Aaron J exercised stock options, and sold shares immediately. At a price of $0.41, now owns 0 shares.

I Namt! and AddrHI of RepOl'tlng Person •

L@hnhardt Aaron J

(L:ut)

CO K..'-lGHTSCOPE, J:C.

1070TERRABELLAAVE~1JE

(Street)

MOUNTAIN VIEi''

(Fi~t)

CA 94043

2. 1111.Jttr Namt! and TIC:ker or Trading Symbol

Kli!gli!KfflJfil. [ KSCP]

3 Oat• of E.lrtiut TranHciion (Month/Day/Year)

0M2202J

4 If Amendment. 01.1e of Original Filed (MonW01.yfYur)

X Ol!ie.r(givetitlebelow)

Chi!!:fD!!:.!ign Offiw

e lndividul.1 « Joint/Group F~u,g (Cheek Applicl.ble Lin.•)

X Fonn filed by One Repolting Person

10'lio.,,m.r

Omer(1peel'ybelow)

Case 1:23-cv-11050 Document 1-2 Filed 12/20/23 Page 25 of 32 |

| Management

Board

There are 4 board members:

BoD has NO relevant experience:

• William Santana Li: Robotics

• Linda Keene Solomon: Consulting and government sales

• Patricia L Watkins: Sales and marketing

• Patricia Howell: Operations

• No law enforcement experience

• No criminal justice experience

• No community safety experience

(City) (Zip)

1. TitieotSecurity(lnstr.3)