Hudson Global, Inc. (Nasdaq: HSON) ("Hudson Global" or "the

Company"), a leading global total talent solutions company,

announced today financial results for the third quarter ended

September 30, 2024.

2024 Third

Quarter Summary

-

Revenue of $36.9 million decreased 6.5% from the third quarter of

2023 and 8.1% in constant currency.

-

Adjusted net revenue of $18.6 million decreased 4.0% from the third

quarter of 2023 and 5.2% in constant currency.

-

Net loss was $0.8 million, or $0.28 per diluted share, compared to

net income of $0.5 million, or $0.17 per diluted share, for the

third quarter of 2023. Adjusted net loss per diluted share

(non-GAAP measure)* was $0.13 compared to adjusted net income per

diluted share of $0.24 in the third quarter of 2023.

-

Adjusted EBITDA (non-GAAP measure)* was $0.8 million, a decrease

versus adjusted EBITDA of $2.0 million in the third quarter of

2023.

-

Under the $5 million common stock repurchase program effective

August 8, 2023, the Company repurchased $0.4 million of stock in

the third quarter of 2024. Year to date, the Company has

repurchased $2.5 million of stock under this program and a total of

$2.9 million since August 2023.

-

Total cash including restricted cash was $16.5 million at

September 30, 2024.

“Results for the third quarter of 2024 continued

to be impacted by a market-driven slowdown in hiring activity,

which we are seeing across our client base," said Jeff Eberwein,

CEO of Hudson Global. "We have taken steps to mitigate the impacts

of the current environment while also positioning ourselves for a

market recovery."

Jake Zabkowicz, Global CEO of Hudson RPO, added,

“In the third quarter of 2024, we made multiple strategic hires

with a focus on further enhancing our geographic reach and service

offerings. These individuals bring deep industry expertise to

Hudson RPO, further enhancing our global reputation and

capabilities. Our efforts are evidenced by a myriad of recognitions

we were proud to receive, including our 16th consecutive year

ranking among HRO Today magazine’s Baker’s Dozen list of top

enterprise RPO providers.”

* The Company provides non-GAAP measures as a

supplement to financial results based on accounting principles

generally accepted in the United States ("GAAP"). Constant

currency, adjusted EBITDA, EBITDA, adjusted net income or loss, and

adjusted net income or loss per diluted share are defined in the

segment tables at the end of this release and a reconciliation of

such non-GAAP measures to the most directly comparable GAAP

measures is included within such segment tables.

Regional Highlights

All rate comparisons are in constant

currency.

Americas

In the third quarter of 2024, Americas revenue

of $7.6 million increased 6% and adjusted net revenue of $6.6

million decreased 3% from the third quarter of 2023. EBITDA was

$0.4 million in the third quarter of 2024, versus a breakeven

EBITDA in the same period last year. Adjusted EBITDA was $0.6

million in the third quarter of 2024 compared to adjusted EBITDA of

$0.3 million in the same period last year.

Asia Pacific

Asia Pacific revenue of $22.6 million decreased

15% and adjusted net revenue of $7.8 million decreased 11% in the

third quarter of 2024 compared to the same period in 2023. EBITDA

was $0.3 million in the third quarter of 2024 compared to EBITDA of

$1.9 million in the same period one year ago, and adjusted EBITDA

was $0.9 million compared to adjusted EBITDA of $2.3 million in the

third quarter of 2023.

Europe, Middle East, and Africa

("EMEA")

EMEA revenue in the third quarter of 2024

increased 7% to $6.7 million and adjusted net revenue of $4.1

million increased 5% from the third quarter of 2023. EBITDA was

flat in the third quarter of 2024 compared to an EBITDA loss of

$0.3 million in the same period one year ago. Adjusted EBITDA of

$0.2 million in the third quarter of 2024 was in line with adjusted

EBITDA of $0.2 million in the third quarter of 2023.

Corporate Costs

In the third quarter of 2024, the Company's

corporate costs were $0.9 million, compared to $0.8 million in the

prior year quarter. Corporate costs in both the third quarter of

2024 and 2023 excluded non-recurring expenses of $0.1 million.

Liquidity and Capital Resources

The Company ended the third quarter of 2024 with

$16.5 million in cash, including $0.7 million in restricted cash.

The Company generated $1.3 million in cash flow from operations

during the third quarter of 2024 compared to an outflow of $0.7

million of cash flow from operations in the third quarter of

2023.

Share Repurchase Program

The Company approved a new $5 million common

stock share repurchase program, effective August 8, 2023. As of

September 30, 2024, under this program, the Company has acquired

61,224 shares in the open market for a total of $1 million. In

addition, the Company repurchased 44,250 shares in the first

quarter of 2024 and 69,567 shares in the second quarter of 2024 in

privately negotiated transactions, leaving a remaining balance of

$2.1 million available for purchase under the 2023 authorization.

The Company continues to view share repurchases as an attractive

use of capital.

NOL Carryforward

As of December 31, 2023, Hudson Global had $302

million of usable net operating losses (“NOL”) in the U.S., which

the Company considers to be a very valuable asset for its

stockholders. In order to protect the value of the NOL for all

stockholders, the Company has a rights agreement and charter

amendment in place that limit beneficial ownership of Hudson Global

common stock to 4.99%. Stockholders who wish to own more than 4.99%

of Hudson Global common stock, or who already own more than 4.99%

of Hudson Global common stock and wish to buy more, may only

acquire additional shares with the Board’s prior written

approval.

Conference Call/Webcast

The Company will conduct a conference call

today, Tuesday, November 12, 2024 at 10:00 a.m. ET to discuss this

announcement. Individuals wishing to listen can access the webcast

on the investor information section of the Company's web site at

hudsonrpo.com.

If you wish to join the conference call, please

use the dial-in information below:

- Toll-Free Dial-In Number: (833) 816-1383

- International Dial-In Number: (412) 317-0476

The archived call will be available on the

investor information section of the Company's website at

hudsonrpo.com.

About Hudson Global

Hudson Global, Inc. is a leading global total

talent solutions provider operating under the brand name Hudson

RPO. We deliver innovative, customized recruitment outsourcing and

total talent solutions to organizations worldwide. Through our

consultative approach, we develop tailored talent solutions

designed to meet our clients’ strategic growth initiatives. As a

trusted advisor, we meet our commitments, deliver quality and

value, and strive to exceed expectations.

For more information, please visit us at

hudsonrpo.com or contact us at ir@hudsonrpo.com.

Investor Relations:The Equity GroupLena Cati212 836-9611

/ lcati@equityny.com

Forward-Looking Statements

This press release contains statements that the

Company believes to be "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

Section 21E of the Securities Exchange Act of 1934, as amended, and

the Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical fact included in

this press release, including statements regarding the Company's

future financial condition, results of operations, business

operations and business prospects, are forward-looking statements.

Words such as “anticipate,” "estimate," "expect," "project,"

"intend," "plan," "predict," "believe" and similar words,

expressions and variations of these words and expressions are

intended to identify forward-looking statements. All

forward-looking statements are subject to important factors, risks,

uncertainties, and assumptions, including industry and economic

conditions that could cause actual results to differ materially

from those described in the forward-looking statements. Such

factors, risks, uncertainties and assumptions include, but are not

limited to, global economic fluctuations; the Company’s ability to

successfully achieve its strategic initiatives ; risks related to

potential acquisitions or dispositions of businesses by the

Company; the Company’s ability to operate successfully as a company

focused on its RPO business; risks related to fluctuations in the

Company’s operating results from quarter to quarter due to various

factors such as rising inflationary pressures and interest rates;

the loss of or material reduction in our business with any of the

Company’s largest customers; the ability of clients to terminate

their relationship with the Company at any time; competition in the

Company’s markets; the negative cash flows and operating losses

that may recur in the future; risks relating to how future credit

facilities may affect or restrict our operating flexibility; risks

associated with the Company’s investment strategy; risks related to

international operations, including foreign currency fluctuations,

political events, natural disasters or health crises, including the

Russia-Ukraine war, the Hamas-Israel war, and potential conflict in

the Middle East; the Company’s dependence on key management

personnel; the Company’s ability to attract and retain highly

skilled professionals, management, and advisors; the Company’s

ability to collect accounts receivable; the Company’s ability to

maintain costs at an acceptable level; the Company’s heavy reliance

on information systems and the impact of potentially losing or

failing to develop technology; risks related to providing

uninterrupted service to clients; the Company’s exposure to

employment-related claims from clients, employers and regulatory

authorities, current and former employees in connection with the

Company’s business reorganization initiatives, and limits on

related insurance coverage; the Company’s ability to utilize net

operating loss carryforwards; volatility of the Company’s stock

price; the impact of government regulations; restrictions imposed

by blocking arrangements; risks related to the use of new and

evolving technologies; and the adverse impacts of cybersecurity

threats and attacks. Additional information concerning these, and

other factors is contained in the Company's filings with the

Securities and Exchange Commission. These forward-looking

statements speak only as of the date of this document. The Company

assumes no obligation, and expressly disclaims any obligation, to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Financial Tables Follow

|

HUDSON GLOBAL, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(in thousands, except per share amounts) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

36,853 |

|

|

$ |

39,398 |

|

|

$ |

106,456 |

|

|

$ |

127,367 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Direct contracting costs and reimbursed expenses |

|

|

18,250 |

|

|

|

20,028 |

|

|

|

53,908 |

|

|

|

63,650 |

|

|

Salaries and related |

|

|

14,908 |

|

|

|

14,335 |

|

|

|

44,399 |

|

|

|

49,206 |

|

|

Office and general |

|

|

2,823 |

|

|

|

2,503 |

|

|

|

8,164 |

|

|

|

7,991 |

|

|

Marketing and promotion |

|

|

971 |

|

|

|

881 |

|

|

|

2,627 |

|

|

|

2,794 |

|

|

Depreciation and amortization |

|

|

358 |

|

|

|

374 |

|

|

|

1,042 |

|

|

|

1,076 |

|

| Total operating expenses |

|

|

37,310 |

|

|

|

38,121 |

|

|

|

110,140 |

|

|

|

124,717 |

|

|

Operating (loss) income |

|

|

(457 |

) |

|

|

1,277 |

|

|

|

(3,684 |

) |

|

|

2,650 |

|

| Non-operating income

(expense): |

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

93 |

|

|

|

90 |

|

|

|

280 |

|

|

|

284 |

|

|

Other (expense) income, net |

|

|

(184 |

) |

|

|

(404 |

) |

|

|

(318 |

) |

|

|

(321 |

) |

| (Loss) income before income

taxes |

|

|

(548 |

) |

|

|

963 |

|

|

|

(3,722 |

) |

|

|

2,613 |

|

| Provision for income

taxes |

|

|

298 |

|

|

|

430 |

|

|

|

463 |

|

|

|

1,148 |

|

| Net (loss) income |

|

$ |

(846 |

) |

|

$ |

533 |

|

|

$ |

(4,185 |

) |

|

$ |

1,465 |

|

| (Loss) earnings per

share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.28 |

) |

|

$ |

0.17 |

|

|

$ |

(1.39 |

) |

|

$ |

0.48 |

|

|

Diluted |

|

$ |

(0.28 |

) |

|

$ |

0.17 |

|

|

$ |

(1.39 |

) |

|

$ |

0.47 |

|

| Weighted-average

shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,975 |

|

|

|

3,068 |

|

|

|

3,009 |

|

|

|

3,062 |

|

|

Diluted |

|

|

2,975 |

|

|

|

3,141 |

|

|

|

3,009 |

|

|

|

3,134 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HUDSON GLOBAL, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except per share amounts) |

|

(unaudited) |

| |

|

|

|

|

| |

|

September 30,2024 |

|

December 31,2023 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

15,835 |

|

|

$ |

22,611 |

|

|

Accounts receivable, less allowance for expected credit losses of

$372 and $378, respectively |

|

|

24,475 |

|

|

|

19,710 |

|

|

Restricted cash, current |

|

|

457 |

|

|

|

354 |

|

|

Prepaid and other |

|

|

2,254 |

|

|

|

3,172 |

|

|

Total current assets |

|

|

43,021 |

|

|

|

45,847 |

|

| Property and equipment, net of

accumulated depreciation of $1,750 and $1,564, respectively |

|

|

301 |

|

|

|

421 |

|

| Operating lease right-of-use

assets |

|

|

1,272 |

|

|

|

1,431 |

|

| Goodwill |

|

|

5,771 |

|

|

|

5,749 |

|

| Intangible assets, net of

accumulated amortization of $3,646 and $2,771, respectively |

|

|

2,759 |

|

|

|

3,628 |

|

| Deferred tax assets, net |

|

|

3,634 |

|

|

|

3,360 |

|

| Restricted cash,

non-current |

|

|

201 |

|

|

|

205 |

|

| Other assets |

|

|

195 |

|

|

|

317 |

|

|

Total assets |

|

$ |

57,154 |

|

|

$ |

60,958 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

1,166 |

|

|

$ |

868 |

|

|

Accrued salaries, commissions, and benefits |

|

|

5,461 |

|

|

|

4,939 |

|

|

Accrued expenses and other current liabilities |

|

|

5,757 |

|

|

|

4,635 |

|

|

Operating lease obligations, current |

|

|

757 |

|

|

|

768 |

|

|

Total current liabilities |

|

|

13,141 |

|

|

|

11,210 |

|

| Income tax payable |

|

|

91 |

|

|

|

87 |

|

| Operating lease

obligations |

|

|

543 |

|

|

|

664 |

|

| Other liabilities |

|

|

439 |

|

|

|

443 |

|

|

Total liabilities |

|

|

14,214 |

|

|

|

12,404 |

|

| Commitments and

contingencies |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

Preferred stock, $0.001 par value, 10,000 shares authorized; none

issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 20,000 shares authorized; 4,006

and3,896 shares issued; 2,731 and 2,807 shares outstanding,

respectively |

|

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

|

493,981 |

|

|

|

493,036 |

|

|

Accumulated deficit |

|

|

(429,432 |

) |

|

|

(425,247 |

) |

|

Accumulated other comprehensive loss, net of applicable tax |

|

|

(684 |

) |

|

|

(1,290 |

) |

|

Treasury stock, 1,275 and 1,089 shares, respectively, at cost |

|

|

(20,929 |

) |

|

|

(17,949 |

) |

|

Total stockholders’ equity |

|

|

42,940 |

|

|

|

48,554 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

57,154 |

|

|

$ |

60,958 |

|

|

|

|

|

|

|

|

|

|

|

|

HUDSON GLOBAL, INC. |

|

SEGMENT ANALYSIS - QUARTER TO DATE |

|

RECONCILIATION OF ADJUSTED EBITDA |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| For The Three Months

Ended September 30, 2024 |

|

Americas |

|

Asia Pacific |

|

EMEA |

|

Corporate |

|

Total |

|

Revenue, from external customers |

|

$ |

7,578 |

|

$ |

22,560 |

|

$ |

6,715 |

|

|

$ |

— |

|

|

$ |

36,853 |

|

| Adjusted net revenue, from

external customers (1) |

|

$ |

6,634 |

|

$ |

7,847 |

|

$ |

4,122 |

|

|

$ |

— |

|

|

$ |

18,603 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

$ |

(846 |

) |

| Provision from income

taxes |

|

|

|

|

|

|

|

|

|

|

298 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

(93 |

) |

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

|

358 |

|

| EBITDA (loss) (2) |

|

$ |

351 |

|

$ |

312 |

|

$ |

42 |

|

|

$ |

(988 |

) |

|

|

(283 |

) |

| Non-operating expense

(income), including corporate administration charges |

|

|

182 |

|

|

197 |

|

|

80 |

|

|

|

(275 |

) |

|

|

184 |

|

| Stock-based compensation

expense |

|

|

67 |

|

|

109 |

|

|

40 |

|

|

|

265 |

|

|

|

481 |

|

| Non-recurring severance and

professional fees |

|

|

31 |

|

|

277 |

|

|

15 |

|

|

|

134 |

|

|

|

457 |

|

| Adjusted EBITDA (loss)

(2) |

|

$ |

631 |

|

$ |

895 |

|

$ |

177 |

|

|

$ |

(864 |

) |

|

$ |

839 |

|

| |

|

|

|

|

|

|

|

|

|

|

| For The Three Months

Ended September 30, 2023 |

|

Americas |

|

Asia Pacific |

|

EMEA |

|

Corporate |

|

Total |

| Revenue, from external

customers |

|

$ |

7,167 |

|

$ |

26,106 |

|

$ |

6,125 |

|

|

$ |

— |

|

|

$ |

39,398 |

|

| Adjusted net revenue, from

external customers (1) |

|

$ |

6,854 |

|

$ |

8,694 |

|

$ |

3,822 |

|

|

$ |

— |

|

|

$ |

19,370 |

|

| Net income |

|

|

|

|

|

|

|

|

|

$ |

533 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

|

|

430 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

(90 |

) |

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

|

374 |

|

| EBITDA (loss) (2) |

|

$ |

20 |

|

$ |

1,890 |

|

$ |

(300 |

) |

|

$ |

(363 |

) |

|

|

1,247 |

|

| Non-operating expense

(income), including corporate administration charges |

|

|

96 |

|

|

390 |

|

|

457 |

|

|

|

(539 |

) |

|

|

404 |

|

| Stock-based compensation

expense |

|

|

84 |

|

|

26 |

|

|

38 |

|

|

|

(17 |

) |

|

|

131 |

|

| Non-recurring severance and

professional fees |

|

|

— |

|

|

27 |

|

|

— |

|

|

|

82 |

|

|

|

109 |

|

| Compensation expense related

to acquisitions (3) |

|

|

113 |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

113 |

|

| Adjusted EBITDA (loss)

(2) |

|

$ |

313 |

|

$ |

2,333 |

|

$ |

195 |

|

|

$ |

(837 |

) |

|

$ |

2,004 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents Revenue less the Direct

contracting costs and reimbursed expenses caption on the Condensed

Consolidated Statements of Operations. (2) Non-GAAP earnings before

interest, income taxes, and depreciation and amortization

(“EBITDA”) and non-GAAP earnings before interest, income taxes,

depreciation and amortization, non-operating income (expense),

stock-based compensation expense, and other non-recurring severance

and professional fees (“Adjusted EBITDA”) are presented to provide

additional information about the Company's operations on a basis

consistent with the measures which the Company uses to manage its

operations and evaluate its performance. Management also uses these

measurements to evaluate capital needs and working capital

requirements. EBITDA and Adjusted EBITDA should not be considered

in isolation or as a substitute for operating income, cash flows

from operating activities, and other income or cash flow statement

data prepared in accordance with generally accepted accounting

principles or as a measure of the Company's profitability or

liquidity. Furthermore, EBITDA and Adjusted EBITDA as presented

above may not be comparable with similarly titled measures reported

by other companies.(3) Represents compensation expense payable per

the terms of acquisition agreements.

|

HUDSON GLOBAL, INC. |

|

SEGMENT ANALYSIS - YEAR TO DATE (continued) |

|

RECONCILIATION OF ADJUSTED EBITDA |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| For The Nine Months

Ended September 30, 2024 |

|

Americas |

|

Asia Pacific |

|

EMEA |

|

Corporate |

|

Total |

|

Revenue, from external customers |

|

$ |

20,544 |

|

|

$ |

66,718 |

|

|

$ |

19,194 |

|

$ |

— |

|

|

$ |

106,456 |

|

| Adjusted net revenue, from

external customers (1) |

|

$ |

18,783 |

|

|

$ |

22,020 |

|

|

$ |

11,745 |

|

$ |

— |

|

|

$ |

52,548 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

$ |

(4,185 |

) |

| Provision from income

taxes |

|

|

|

|

|

|

|

|

|

|

463 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

(280 |

) |

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

|

1,042 |

|

| EBITDA (loss) (2) |

|

$ |

(111 |

) |

|

$ |

(65 |

) |

|

$ |

459 |

|

$ |

(3,243 |

) |

|

|

(2,960 |

) |

| Non-operating expense

(income), including corporate administration charges |

|

|

325 |

|

|

|

602 |

|

|

|

168 |

|

|

(777 |

) |

|

|

318 |

|

| Stock-based compensation

expense |

|

|

166 |

|

|

|

337 |

|

|

|

144 |

|

|

399 |

|

|

|

1,046 |

|

| Non-recurring severance and

professional fees |

|

|

162 |

|

|

|

614 |

|

|

|

22 |

|

|

840 |

|

|

|

1,638 |

|

| Adjusted EBITDA (loss)

(2) |

|

$ |

542 |

|

|

$ |

1,488 |

|

|

$ |

793 |

|

$ |

(2,781 |

) |

|

$ |

42 |

|

| |

|

|

|

|

|

|

|

|

|

|

| For The Nine Months

Ended September 30, 2023 |

|

Americas |

|

Asia Pacific |

|

EMEA |

|

Corporate |

|

Total |

| Revenue, from external

customers |

|

$ |

25,008 |

|

|

$ |

81,784 |

|

|

$ |

20,575 |

|

$ |

— |

|

|

$ |

127,367 |

|

| Adjusted net revenue, from

external customers (1) |

|

$ |

24,097 |

|

|

$ |

26,734 |

|

|

$ |

12,886 |

|

$ |

— |

|

|

$ |

63,717 |

|

| Net income |

|

|

|

|

|

|

|

|

|

$ |

1,465 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

|

|

1,148 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

(284 |

) |

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

|

1,076 |

|

| EBITDA (loss) (2) |

|

$ |

(876 |

) |

|

$ |

5,455 |

|

|

$ |

995 |

|

$ |

(2,169 |

) |

|

|

3,405 |

|

| Non-operating expense

(income), including corporate administration charges |

|

|

435 |

|

|

|

994 |

|

|

|

523 |

|

|

(1,631 |

) |

|

|

321 |

|

| Stock-based compensation

expense |

|

|

341 |

|

|

|

147 |

|

|

|

166 |

|

|

333 |

|

|

|

987 |

|

| Non-recurring severance and

professional fees |

|

|

105 |

|

|

|

28 |

|

|

|

124 |

|

|

493 |

|

|

|

750 |

|

| Compensation expense related

to acquisitions (3) |

|

|

338 |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

338 |

|

| Adjusted EBITDA (loss)

(2) |

|

$ |

343 |

|

|

$ |

6,624 |

|

|

$ |

1,808 |

|

$ |

(2,974 |

) |

|

$ |

5,801 |

|

| |

|

|

|

|

|

|

|

|

|

|

(1) Represents Revenue less the Direct

contracting costs and reimbursed expenses caption on the Condensed

Consolidated Statements of Operations. (2) Non-GAAP earnings before

interest, income taxes, and depreciation and amortization

(“EBITDA”) and non-GAAP earnings before interest, income taxes,

depreciation and amortization, non-operating (income) expense,

stock-based compensation expense, and other non-recurring severance

and professional fees (“Adjusted EBITDA”) are presented to provide

additional information about the Company's operations on a basis

consistent with the measures which the Company uses to manage its

operations and evaluate its performance. Management also uses these

measurements to evaluate capital needs and working capital

requirements. EBITDA and Adjusted EBITDA should not be considered

in isolation or as a substitute for operating income, cash flows

from operating activities, and other income or cash flow statement

data prepared in accordance with generally accepted accounting

principles or as a measure of the Company's profitability or

liquidity. Furthermore, EBITDA and Adjusted EBITDA as presented

above may not be comparable with similarly titled measures reported

by other companies.(3) Represents compensation expense payable per

the terms of acquisition agreements.

|

HUDSON GLOBAL, INC.RECONCILIATION OF

CONSTANT CURRENCY MEASURES(in thousands)

(unaudited) |

|

|

The Company operates on a global basis, with the

majority of its revenue generated outside of the United States.

Accordingly, fluctuations in foreign currency exchange rates can

affect its results of operations. Constant currency information

compares financial results between periods as if exchange rates had

remained constant period-over-period. The Company defines the term

“constant currency” to mean that financial data for a previously

reported period are translated into U.S. dollars using the same

foreign currency exchange rates that were used to translate

financial data for the current period. Changes in revenue, adjusted

net revenue, selling, general and administrative expenses

("SG&A"), other non-operating income (expense), operating

income (loss) and EBITDA (loss) include the effect of changes in

foreign currency exchange rates. The Company’s management reviews

and analyzes business results in constant currency and believes

these results better represent the Company’s underlying business

trends. The Company believes that these calculations are a useful

measure, indicating the actual change in operations. There are no

significant gains or losses on foreign currency transactions

between subsidiaries. Therefore, changes in foreign currency

exchange rates generally impact only reported earnings.

| |

Three Months Ended September

30, |

| |

|

2024 |

|

|

|

2023 |

|

| |

As |

|

As |

|

Currency |

|

Constant |

| |

reported |

|

reported |

|

translation |

|

currency |

| Revenue: |

|

|

|

|

|

|

|

|

Americas |

$ |

7,578 |

|

|

$ |

7,167 |

|

|

$ |

(11 |

) |

|

$ |

7,156 |

|

|

Asia Pacific |

|

22,560 |

|

|

|

26,106 |

|

|

|

554 |

|

|

|

26,660 |

|

|

EMEA |

|

6,715 |

|

|

|

6,125 |

|

|

|

143 |

|

|

|

6,268 |

|

|

Total |

$ |

36,853 |

|

|

$ |

39,398 |

|

|

$ |

686 |

|

|

$ |

40,084 |

|

| Adjusted net revenue (1) |

|

|

|

|

|

|

|

|

Americas |

$ |

6,634 |

|

|

$ |

6,854 |

|

|

$ |

(6 |

) |

|

$ |

6,848 |

|

|

Asia Pacific |

|

7,847 |

|

|

|

8,694 |

|

|

|

168 |

|

|

|

8,862 |

|

|

EMEA |

|

4,122 |

|

|

|

3,822 |

|

|

|

92 |

|

|

|

3,914 |

|

|

Total |

$ |

18,603 |

|

|

$ |

19,370 |

|

|

$ |

254 |

|

|

$ |

19,624 |

|

| SG&A:(2) |

|

|

|

|

|

|

|

|

Americas |

$ |

6,130 |

|

|

$ |

6,859 |

|

|

$ |

(19 |

) |

|

$ |

6,840 |

|

|

Asia Pacific |

|

7,312 |

|

|

|

6,304 |

|

|

|

117 |

|

|

|

6,421 |

|

|

EMEA |

|

3,997 |

|

|

|

3,644 |

|

|

|

85 |

|

|

|

3,729 |

|

|

Corporate |

|

1,263 |

|

|

|

912 |

|

|

|

— |

|

|

|

912 |

|

|

Total |

$ |

18,702 |

|

|

$ |

17,719 |

|

|

$ |

183 |

|

|

$ |

17,902 |

|

| Operating income (loss): |

|

|

|

|

|

|

|

|

Americas |

$ |

224 |

|

|

$ |

(197 |

) |

|

$ |

— |

|

|

$ |

(197 |

) |

|

Asia Pacific |

|

466 |

|

|

|

2,228 |

|

|

|

50 |

|

|

|

2,278 |

|

|

EMEA |

|

116 |

|

|

|

150 |

|

|

|

8 |

|

|

|

158 |

|

|

Corporate |

|

(1,263 |

) |

|

|

(904 |

) |

|

|

— |

|

|

|

(904 |

) |

|

Total |

$ |

(457 |

) |

|

$ |

1,277 |

|

|

$ |

58 |

|

|

$ |

1,335 |

|

| EBITDA (loss): |

|

|

|

|

|

|

|

|

Americas |

$ |

351 |

|

|

$ |

20 |

|

|

$ |

(1 |

) |

|

$ |

19 |

|

|

Asia Pacific |

|

312 |

|

|

|

1,890 |

|

|

|

29 |

|

|

|

1,919 |

|

|

EMEA |

|

42 |

|

|

|

(300 |

) |

|

|

(4 |

) |

|

|

(304 |

) |

|

Corporate |

|

(988 |

) |

|

|

(363 |

) |

|

|

— |

|

|

|

(363 |

) |

|

Total |

$ |

(283 |

) |

|

$ |

1,247 |

|

|

$ |

24 |

|

|

$ |

1,271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents Revenue less the Direct

contracting costs and reimbursed expenses caption on the Condensed

Consolidated Statements of Operations.(2) SG&A is a measure

that management uses to evaluate the segments’ expenses and

includes salaries and related costs, office and general costs, and

marketing and promotion costs.

|

HUDSON GLOBAL INCOME PER DILUTED SHARE(in

thousands, except per share

amounts)(unaudited) |

| |

|

Adjusted |

|

Diluted Shares |

|

Per Diluted |

| For The Three Months

Ended September 30, 2024 |

|

Net Loss |

|

Outstanding |

|

Share (1) |

|

Net loss |

|

$ |

(846 |

) |

|

2,975 |

|

$ |

(0.28 |

) |

| Non-recurring severance and

professional fees (after tax) |

|

|

457 |

|

|

2,975 |

|

|

0.15 |

|

| Adjusted net loss (3) |

|

$ |

(389 |

) |

|

2,975 |

|

$ |

(0.13 |

) |

| |

|

Adjusted |

|

Diluted Shares |

|

Per Diluted |

| For The Three Months

Ended September 30, 2023 |

|

Net Income |

|

Outstanding |

|

Share (1) |

|

Net income |

|

$ |

533 |

|

3,141 |

|

$ |

0.17 |

| Non-recurring severance and

professional fees (after tax) |

|

|

109 |

|

3,141 |

|

|

0.04 |

| Compensation expense related

to acquisitions (after tax) (2) |

|

|

113 |

|

3,141 |

|

|

0.04 |

| Adjusted net income (3) |

|

$ |

755 |

|

3,141 |

|

$ |

0.24 |

| |

|

|

|

|

|

|

|

|

(1) Amounts may not sum due to rounding.

(2) Represents compensation expense payable per

the terms of the Coit acquisition, including a promissory note for

$1.35 million payable over three years, and $500k of the Company's

common stock vesting over 30 months.

(3) Adjusted net

income or loss per diluted share are Non-GAAP measures defined as

reported net income or loss and reported net income or loss per

diluted share before items such as acquisition-related costs and

non-recurring severance and professional fees after tax that are

presented to provide additional information about the Company's

operations on a basis consistent with the measures that the Company

uses to manage its operations and evaluate its performance.

Management also uses these measurements to evaluate capital needs

and working capital requirements. Adjusted net income or loss per

diluted share should not be considered in isolation or as

substitutes for net income or loss and net income or loss per share

and other income or cash flow statement data prepared in accordance

with generally accepted accounting principles or as measures of the

Company's profitability or liquidity. Further, adjusted net income

or loss and adjusted net income or loss per diluted share as

presented above may not be comparable with similarly titled

measures reported by other companies.

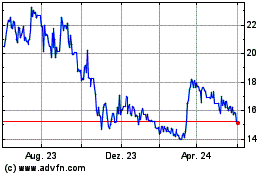

Hudson Global (NASDAQ:HSON)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

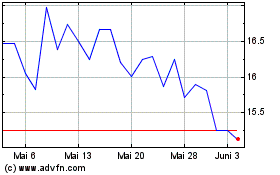

Hudson Global (NASDAQ:HSON)

Historical Stock Chart

Von Feb 2024 bis Feb 2025